What is the Data Center Power Management Market Size?

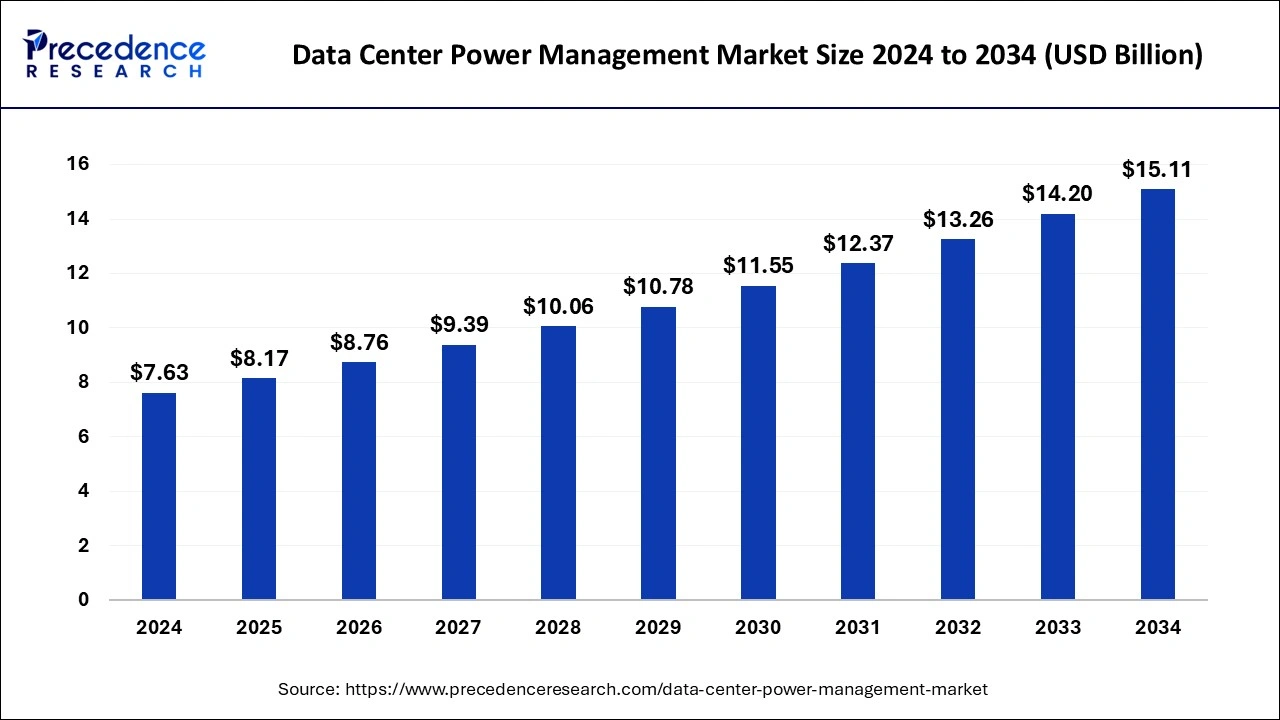

The global data center power management market size is calculated at USD 8.17 billion in 2025 and is predicted to increase from USD 8.76 billion in 2026 to approximately USD 16.04 billion by 2035, expanding at a CAGR of 6.98% from 2026 to 2035.The data center power management market is expanding rapidly due to increasing demand for data processing, ongoing technological advancements, and the rising focus on energy efficiency. Furthermore, the rising demand for cloud computing and the increasing digitization contribute to market growth.

Data Center Power Management Market Key Takeaways

- The global data center power management market was valued at USD 7.63 billion in 2025.

- It is projected to reach USD 16.04 billion by 2035.

- The data center power management market is expected to grow at a CAGR of 6.98% from 2026 to 2035.

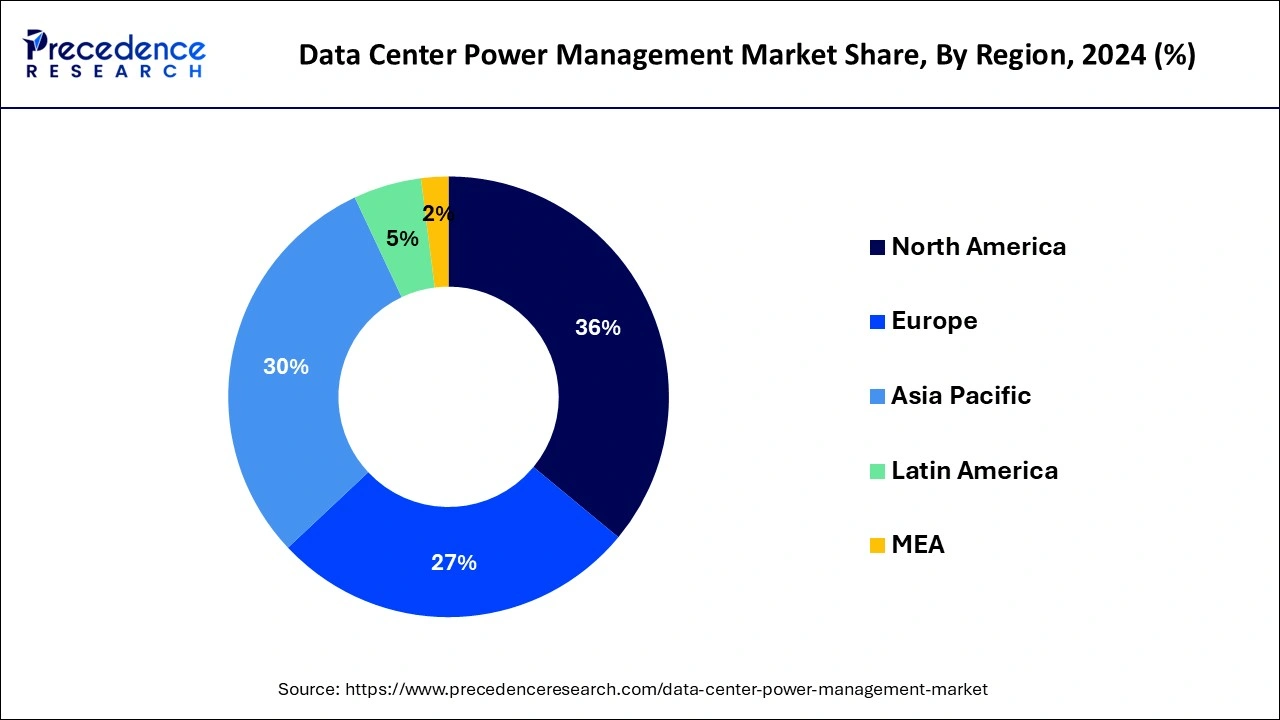

- North America contributed 36% of market share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By component, the solution segment held the largest market share in 2025.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

- By application, the IT & telecom segment has contributed the major market share in 2025.

- By application, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

- By solution, the UPS segment generated the largest market share in 2025.

- By solution, the busway segment is expected to expand at the fastest CAGR over the projected period.

- By service, the design and consulting segment has contributed to the major market share in 2025.

- By service, the support & maintenance segment is expected to expand at the fastest CAGR over the projected period.

What is Meant by Data Center Power Management Market?

The data center power management market offers strategies and technologies used to efficiently control and distribute electricity within data center facilities. It involves ensuring that the power supply meets the demands of the various equipment and systems housed in the data center while also prioritizing energy efficiency and reliability. This includes tasks such as monitoring power usage, regulating voltage levels, implementing backup power systems like uninterruptible power supplies (UPS), and optimizing cooling systems to maintain ideal operating conditions. Effective power management helps prevent downtime, protects sensitive equipment from power fluctuations, and reduces energy consumption and associated costs. It plays a crucial role in ensuring the continuous operation of data centers, which are essential for storing, processing, and accessing vast amounts of digital information in today's interconnected world.

Impact of AI on the Data Center Power Management Market

Artificial intelligence (AI) significantly impacts the market in several ways. Firstly, AI algorithms are integrated into data centers to enhance efficiency and optimize power consumption. These algorithms analyze data and understand power usage patterns, which allows data centers to manage their energy consumption better. Secondly, machine learning algorithms are increasingly being used to make data center operations more efficient. These algorithms forecast future power needs, enabling data centers to allocate energy resources effectively. They also optimize cooling systems, increasing efficiency.

Data Center Power Management Market Outlook

- Industry Growth Overview: This growth is driven by the rise of cloud computing, AI, and a global target on energy efficiency and sustainability. The huge increase in global data traffic, driven by AI, cloud services, 5G networks, and even the Internet of Things (IoT), necessitates more data centers and, thus, robust power management solutions.

- Major Investors: Major investors in the data center power management market involve tech giants (AWS, Google, Microsoft) building hyperscale DCs, infrastructure funds (KKR, Stonepeak, Blackstone) funding development, and even core technology manufacturers such as Schneider Electric, ABB, Eaton, and Vertiv, who dominate the solutions space, all driven by AI/cloud expansion and demanding efficiency/sustainability.

What are the Growth Factors in the Data Center Power Management Market?

- Growth of Data-Intensive Applications: The increasing number of data centers across the world due to cloud computing and digital services enhances the demand for effective power control systems to manage the growing demand.

- Rising Energy Costs: Energy costs are a major part of total expenditure, the data center operators are looking to minimize power usage and increase power utilization efficiency.

- Sustainability and Environmental Concerns: Growing awareness about climate change and the environment along with the rising impacts of data centers is moving operators to invest in energy-efficient power management solutions to reduce carbon markers as per sustainability objectives and enable market growth.

- Application of Edge Computing: Edge computing which demands low latency computing and real-time analytics has given rise to the use of decentralized IT which in turn has led to the requirement of this power management.

- Regulations and Standards: Various governments and regulatory agencies are setting higher requirements concerning energy consumption and ecological impact. Adherence to these regulations like ENERGY STAR certification and certifications by Leadership in Energy and Environmental Design (LEED) means the adoption of efficient power management solutions in data centers, which in turn fosters market expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.98% |

| Market Size in 2025 | USD 8.17Billion |

| Market Size in 2026 | USD 8.76 Billion |

| Market Size by 2035 | USD 16.04 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Data Center Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Escalating energy costs driving the need for optimization

Escalating energy costs are a significant driver in boosting the demand for data center power management solutions. As energy expenses continue to rise, data center operators face mounting pressure to optimize their power consumption to reduce operational costs. By implementing efficient power management strategies and technologies, such as intelligent cooling systems and energy-efficient UPS systems, data centers can minimize their energy usage without compromising on performance or reliability.

This heightened focus on optimization not only helps data centers cut down on their electricity bills but also aligns with broader sustainability goals. Many businesses are increasingly concerned about their environmental impact and are actively seeking ways to reduce their carbon footprint. As a result, the demand for energy-efficient power management solutions in data centers is surging, with operators looking to invest in technologies that can help them achieve both cost savings and environmental sustainability. In essence, the need to mitigate escalating energy costs is driving a strong demand for data center power management solutions that offer efficiency, reliability, and sustainability.

Restraint

Security concerns related to IoT devices

Security concerns related to IoT devices serve as a significant restraint in the data center power management market. With the proliferation of IoT devices in data centers, there is an increased risk of cyberattacks and breaches, posing threats to the integrity and reliability of power management systems. Many IoT devices lack robust security features, making them vulnerable to hacking and unauthorized access, which can potentially disrupt critical power management functions. These security concerns deter data center operators from fully embracing IoT-based power management solutions, as they prioritize safeguarding their infrastructure against potential cyber threats. Without adequate security measures in place, the adoption of IoT devices for power management purposes remains limited, hindering the market demand for data center power management solutions.

As a result, industry stakeholders must address these security challenges by implementing robust cybersecurity protocols and enhancing the resilience of IoT devices to mitigate risks and foster greater trust and confidence in adopting IoT-enabled power management technologies.

Opportunity

Increasing demand for colocation and hyperscale data centers

The increasing demand for colocation and hyperscale data centers presents significant opportunities in the market for data center power management. Colocation facilities, where multiple tenants share data center space and resources, require efficient power management solutions to meet the diverse needs of different clients while optimizing energy usage and costs. As more businesses opt for colocation services to outsource their IT infrastructure, there is a growing need for power management systems that can accommodate varying workloads and scalability requirements.

Similarly, hyperscale data centers, which are massive facilities operated by technology giants to support cloud computing and digital services, demand advanced power management technologies to handle substantial power loads efficiently. These facilities require robust solutions for power distribution, backup power, and energy efficiency to ensure uninterrupted operations and support the rapid growth of digital services. As the demand for colocation and hyperscale data centers continues to rise, the market for data center power management is poised for growth, offering opportunities for innovation and expansion in delivering tailored solutions to meet the evolving needs of these facilities.

Segment Insights

Component Insights

The solution segment held the highest market share of 65% in 2025. In the data center power management market, the solution segment comprises various components aimed at optimizing power distribution, monitoring, and backup within data center facilities. This includes uninterruptible power supply (UPS) systems, power distribution units (PDUs), energy storage solutions, and intelligent power management software. Trends in this segment focus on the integration of advanced technologies such as artificial intelligence and predictive analytics to enhance energy efficiency, reliability, and resilience of data center power infrastructures, meeting the evolving demands of modern data centers.

The service segment is anticipated to witness rapid growth at a significant CAGR of 8.2% during the projected period. In the data center power management market, the service segment encompasses various offerings provided by vendors to support the deployment, maintenance, and optimization of power management solutions within data centers. This includes services such as consulting, installation, integration, training, and ongoing support. A key trend in this segment involves the increasing demand for managed services, where vendors offer outsourced management of power infrastructure to help data center operators reduce operational complexity and focus on their core business activities.

Solution Insight

The UPS segment has contributed the biggest market share in 2025. Several technologies are utilized to regulate the flow of power to the data centers and to protect critical information technology resources such as the UPS. Moreover, portable UPS systems have found applications in services, for example, High-Performance Computing, SaaS services, Streaming Media, and Online Gaming and this has helped to drive the segment.

The busway segment is anticipated to witness rapid growth over the projected period. Data-center busways are wiring systems that distribute electrical power to server racks in data center applications. The increase in the use of big data, real-time information, artificial intelligence, machine learning, and much more has called for robust computing systems. These systems provide a reliable method of conveying power to all racks and cabinets while at the same time keeping losses very low and the possibility of failure. Datacenter busways are significant in meeting the requirements of complex computational applications in a data center space by providing seamless service.

Service Insights

The design and consulting segment has contributed the biggest market share in 2025. Consulting services and designing services can assist the end users in making efficient ways and achieving energy-saving measures by using efficient equipment, overhauling the cooling systems, and applying intelligent power management. Data center power management and design consulting includes the ability to plan and design the power of a data center and the management of the infrastructure. These are the power supply systems, cooling systems, and other forms of backups that may be required.

The support & maintenance segment is anticipated to witness rapid growth over the projected period. This growth is also creating a demand for effective maintenance and support solutions for the enhanced operation of data center power supplies. Data centers contain sophisticated power distribution, UPS, PDUs, and cooling systems. Maintaining these systems in their peak efficiency and effectiveness is another thing that needs expertise and support. Thus, the market requires many support and maintenance services.

Application Insights

The IT & telecom segment has held the biggest market share in 2025. In the data center power management market, the IT & telecom segment primarily encompasses power management solutions tailored for information technology (IT) infrastructure and telecommunications networks. This includes uninterruptible power supply (UPS) systems, power distribution units (PDUs), and energy-efficient cooling solutions designed to support the critical operations of IT equipment and telecommunications hardware. Recent trends in this segment include the adoption of energy-efficient technologies, the integration of smart monitoring and control systems, and the deployment of modular power management solutions to enhance flexibility and scalability.

The healthcare segment is anticipated to witness rapid growth over the projected period. In the healthcare segment, data center power management involves ensuring reliable and efficient power supply to support critical medical applications, electronic health records (EHRs), and diagnostic imaging systems. Trends in this sector include the adoption of energy-efficient UPS systems and cooling solutions to minimize downtime and maintain data integrity. Additionally, there's a growing focus on implementing intelligent monitoring and analytics tools to optimize power usage, enhance system reliability, and ensure compliance with stringent regulatory requirements.

Regional Insights

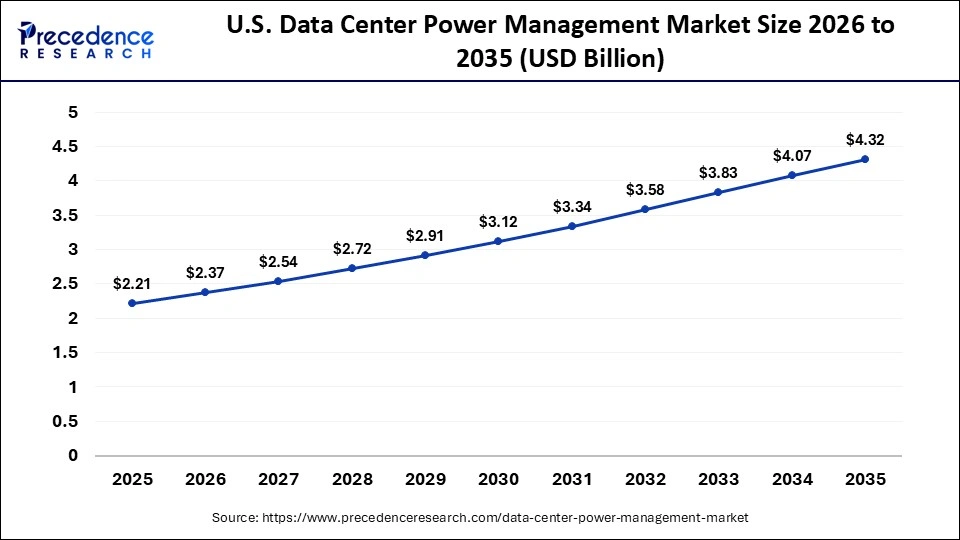

The U.S. data center power management market size is exhibited at USD 2.21 billion in 2025 and is projected to be worth around USD 4.32 billion by 2035, growing at a CAGR of 6.93% from 2026 to 2035.

North America has contributed more than 36% of market share in 2025. Firstly, the region boasts a robust infrastructure for data centers, driven by the presence of numerous technology companies and cloud service providers. Secondly, North America has high levels of digitalization across various sectors, leading to increased demand for data center services. Additionally, the region prioritizes technological advancements and investments in energy-efficient solutions, contributing to the dominance of North America in the market for data center power management.

U.S. Data Center Power Management Market Trends

The U.S. data center power management market is growing, driven by cloud computing, AI, and hyperscale expansion, with trends targeting on extreme power density, AI-driven optimization, modular/busway systems, advanced cooling, integrating renewables, and also high-voltage DC solutions, all while grappling with massive power need increases and rising grid strain.

Asia-Pacific is witnessing rapid growth in the data center power management market due to several factors.Firstly, the region is experiencing significant digital transformation, leading to an increased demand for data center infrastructure. Additionally, rising internet penetration and expanding cloud services drive the need for efficient power management solutions. Moreover, governments are promoting sustainable energy practices, further fueling the adoption of energy-efficient power management technologies. With these combined forces, the Asia-Pacific region emerges as a key player in the global data center power management market, experiencing substantial growth and opportunities.

China Data Center Power Management Market Analysis

China's market is booming, driven by massive cloud/AI need, 5G, and also strict green mandates, shifting towards renewables, DC power, and smart systems (UPS, analytics) for efficiency, despite high expense and regulations in Tier 1 cities, with remarkable growth anticipated in AI workloads and DC power solutions.

Meanwhile, Europe is experiencing notable growth in the data center power management market due to several factors. Firstly, increasing digitization across various industries drives the demand for data center services, necessitating efficient power management solutions. Additionally, stringent regulations regarding energy efficiency and environmental sustainability push data center operators to invest in advanced power management technologies. Moreover, the rise of edge computing and cloud services fuels the expansion of data center infrastructure, further driving the demand for power management solutions to ensure reliability, efficiency, and compliance.

UK Data Center Power Management Market Trends

The UK market is booming, driven by cloud growth, AI, and sustainability, with key trends including growing AI rack densities, increased target on grid-interactive or renewable power, retrofitting older sites for high density, along with locating new DCs outside London for power, all under UK government fund for green energy and critical infrastructure.

Data Center Power Management Market Companies

- Schneider Electric SE: Schneider Electric provides comprehensive data center power management, which includes hardware (APC NetShelter racks, Galaxy UPS, intelligent PDUs), EcoStruxure software for hybrid cooling, monitoring/optimization, modular designs, alongside services for AI readiness and sustainability, aiming on efficiency, reliability, and even digitalization from edge to large-scale facilities.

- ABB Ltd: ABB Ltd. provides a comprehensive portfolio of software, hardware, and services for the data center power management market, focusing on energy efficiency, reliability, speed of deployment, and also scalability.

- Eaton Corporation: Eaton Corporation provides a comprehensive portfolio of few solutions for the data center power management market, including hardware products for power protection and distribution, and also a full software suite for monitoring and optimization, as well as a range of expert services.

Other Major Key Players

- Vertiv Group Corp

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- General Electric Company

- Legrand SA

- Raritan Inc.

- Cyber Power Systems (USA), Inc.

- Tripp Lite

- Socomec Group

- Vertiv Co.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

Announcement by Industry Leader

- In November 2024, Delta released a new product, the SMART PDU I-Type power management unit. This innovative 1U DC distribution equipment offers great benefits to telecom network operators, tower companies, data center designers, and infrastructure engineers. The SMART PDU I-Type optimizes power distribution while significantly reducing operational costs, making it an ideal solution for modern, space-constrained telecom and data center environments. Andreas Grewing, Vice President of Telecom Power Solutions at Delta Electronics EMEA region, stated that the SMART PDU I-Type combines compact design with intelligent, programmable breakers and remote control capabilities. These superior features deliver substantial space and operational cost savings while providing precise power monitoring for better energy efficiency.

Recent Developments

- In March 2024, Eaton announced the launch of an innovative new modular data center solution in North America for organizations seeking to rapidly meet the growing requirements for edge computing, machine learning and AI. Eaton's SmartRack modular data center combines racks, cooling, and service enclosures to withstand up to 150kW of equipment load.

Segments Covered in the Report

By Component

- Solution

- Service

By solutionsÂ

- PDU

- UPS

- Busway

- Others

By servicesÂ

- Design & Consulting

- Integration & deployment

- Support & maintenance

By Application

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- Manufacturing

- IT & telecom

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting