Data Center Substation Market Size and Forecast 2025 to 2034

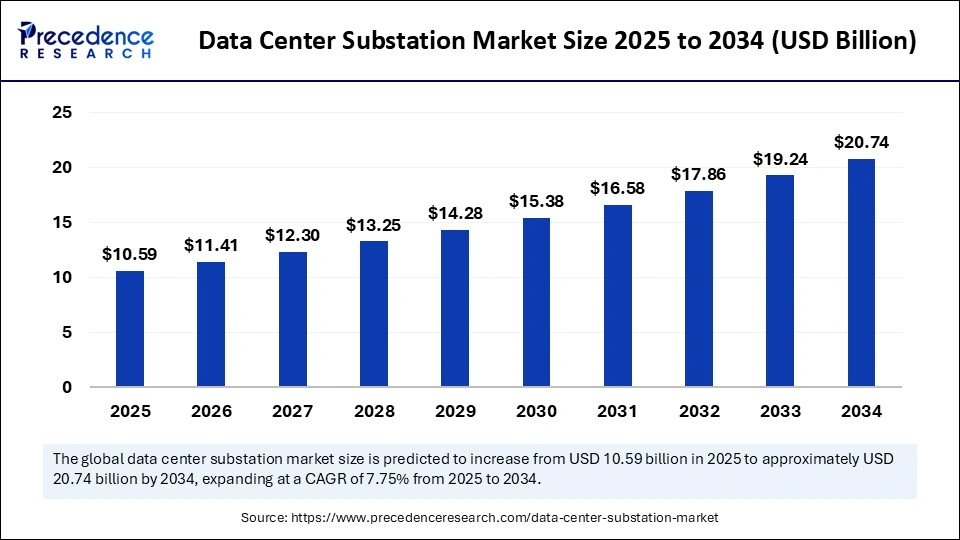

The global data center substation market size accounted for USD 9.83 billion in 2024 and is predicted to increase from USD 10.59 billion in 2025 to approximately USD 20.74 billion by 2034, expanding at a CAGR of 7.75% from 2025 to 2034. The increasing integration of various technologies like IoT, 5G, and AI/ML, along with big data by several enterprises, creates a huge demand for continuous power supply, rapid adoption of cloud computing, and innovation in technologies for substations operation are fueling the market's growth globally.

Data Center Substation Market Key Takeaways

- In terms of revenue, the global data center substation market was valued at USD 9.83 billion in 2024.

- It is projected to reach USD 20.74 billion by 2034.

- The market is expected to grow at a CAGR of 7.75% from 2025 to 2034.

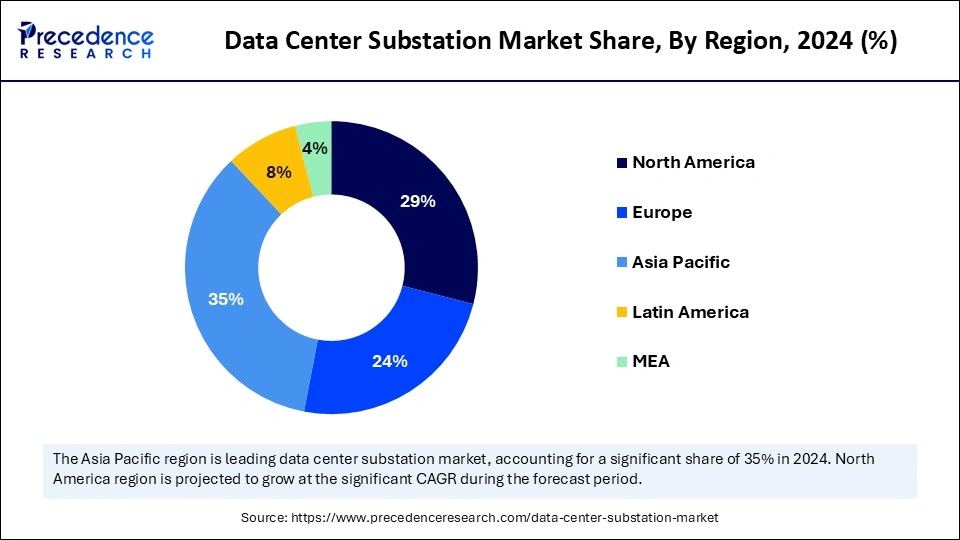

- Asia Pacific held the largest data center substation market share of 35% in 2024.

- The Middle East & Africa is expected to witness the fastest CAGR during the foreseeable period.

- By product type, the power transformers segment held the biggest market share of 35% in 2024.

- By product type, the switchgear segment is expected to witness the fastest CAGR during the foreseeable period.

- By voltage level, the medium voltage (MV) segment captured the highest market share of 50% in 2024.

- By voltage level, the low voltage (LV) segment is expected to witness the fastest CAGR during the foreseeable period.

- By cooling medium, the mineral oil-filled segment accounted for the significant market share of 60% in 2024.

- By cooling medium, the ester/synthetic fluid filled segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the hyperscale data centers segment contributed the maximum market share of 40% in 2024.

- By end user, the edge/micro data centers segment is expected to witness the fastest CAGR during the foreseeable period.

- By deployment type, the Greenfield new build segment generated major market share of 55% in 2024.

- By deployment type, the brownfield upgrades & expansions segment is expected to witness the fastest CAGR during the foreseeable period.

Market Overview

The data center substation market encompasses equipment and systems designed to transform, switch, protect, monitor, and distribute high-voltage power within or adjacent to data center facilities, ensuring a reliable and efficient electricity supply.

How is AI Transforming the Data Center Substation Market?

The integration of artificial intelligence into data center substation offers various benefits to streamline its workflow and enhance results by leveraging fine-tuned AI systems. In a recent survey, nearly 57% of data center owners agreed to integrate AI for their daily tasks at data centers. This shows a 20% increase from last year. Operators can use predictive analytics to make real-time decisions for data center cooling systems, which is crucial to maintain. For example, Google has implemented an AI system for its cooling systems, which minimizes total maintenance costs up to 40%. IT infrastructure drawbacks can also be solved by AI to improve power usage effectively. Thus, many data centers have already included AI to enhance workload management and allocation efficiently to use hardware and networking. This reduces downtime and offers continuous services to consumers.

What Are the Key Trends in the Data Center Substation Market?

- High-density compute: With the increasing demand for high-power computing due to the expansion of AI and 5G networks, data centers are shifting towards modular, highly scalable designs and incorporating high-voltage substations that can provide seamless power supply to various racks in the data center. The growing demand for edge data centers needs high-capacity and resilient substations to effectively perform complex operations for a better energy supply.

- Shift to the digital substations: Another significant driving factor for the expansion of the data center substation market is an increasing shift to adopt digital substations instead of their physical infrastructure, which is energy and resource-intensive, thus adding extra costs to it. A global shift is occurring to adopt fiber optic ethernet instead of copper wiring to accelerate communication speed with capacity transfer over long distances. It minimizes maintenance costs while supporting advanced data management and control that is crucial to support new-age data centers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.74 Billion |

| Market Size in 2025 | USD 10.59 Billion |

| Market Size in 2024 | USD 9.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.75% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Voltage Level, Cooling Medium, End-user Data Center Type, Deployment Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased use of cloud computing

A significant driving factor for the growth of the data center substation market is the increasing use of cloud computing by various businesses, which requires robust support for data processing. Cloud computing and data centers are highly intertwined, as data centers act as a pillar that allows cloud services to function effectively. To deliver streamlined consumer services, both facilities are complementing and embracing each other, which accelerates the adoption of the datacenter substation, as high power requirement is a prime factor that drives data centers uninterruptedly. The data center offers the necessary infrastructure that supports cloud services and enables users to access and use applications and data, irrespective of geographical location, which is highly anticipated for businesses and consumers as well.

Restraint

Resource-intensive and environmental concerns

Despite huge demand, the data center substations are facing some constraints, such as high energy consumption and resource exploitation, which lead to environmental issues that directly affect the market's growth on a basic level. Extensive use of water for cooling methods of data center substation can affect local resources and may cause water and air pollution if not disposed of properly. Data centers are harmful to the climate due to their GHG emission, which adds carbon footprints. It's over dependency on fossil fuels is a major concern that needs to be resolved early. However, researchers are collaborating with institutes and leading players to get rid of these issues, which may create hope for market growth further.

Opportunity

Substation technology with innovation

A prominent opportunity that the data center substations market holds is technology innovation for substations, which includes automation through AI/ML models, increased efficiency by leveraging advanced hardware with robust grid capability. Advanced sensors can offer real-time monitoring for grid operators, which helps detect anomalies before they are completely damaged and make informed decisions to repair them. Advances in switchgear further create lucrative opportunities for markets to stabilize by improving safety and new levels of performance. Industrial Internet of Things devices offer convenience to remotely control activities of the data center substation, further expanding the market's reach.

Product Type Insights

Why do power transformers dominate the data center substation market?

The power transformers segment held the largest market due to increasing power demand for data centers in terms of electricity to power their services. Foundational devices such as transformers have seen a surge. Data centers cannot tolerate power cuts during peak periods or operations due to their critical role in offering assigned data transmission to consumers. Thus, power transformers are essential for stepping down high-voltage transmission power to an optimum level that can be easily distributed within data centers.

The switchgear segment is expected to witness the fastest CAGR during the foreseeable period. Data centers require a continuous power supply, which makes switchgear critical for the protection of systems to ensure that ongoing operation can be done effectively while offering constant energy. Factors like exponential growth in the digital sector, need for high reliability along with energy efficiency, further expand the market's growth.

Voltage Level Insights

How is the medium voltage beneficial to the growth of the data center substation market?

The medium voltage (MV) segment held the largest market share of 50% in 2024. Medium voltage substations are beneficial for stepping down high voltages to optimum levels that can be distributed to the data center racks while ensuring a reliable and constant power supply to support critical applications. Hyperscale data centers require huge power to operate, and they are large consumers of medium to high-voltage power. Also, medium voltage ensures to deliver of power to the data centers and their equipment.

The low voltage (LV) segment is expected to witness the fastest CAGR during the foreseeable period. The increasing adoption of digital substations, along with cutting-edge technologies like AI and IoT, for enhanced operations, where low voltage is essential. The increasing demand for cloud computing, big data analytics, and other digital services has fueled the establishment of data centers where low voltages in substations are required.

The Cooling Medium Insights

What is the utilization of mineral oil in the data center substation market?

The mineral oil-filled segment held the largest market share of 60% in 2024. Mineral oil is inexpensive compared to available materials, and it is a practical option for large-scale enterprises, as it is easily available everywhere in nature. The oil offers benefits like electrical insulation between devices and a medium that is used for heat transfer, making it essential to prevent overheating and damage that leads to prolonged downtime, which is not reasonable for data centers. Also, it has a long history of effective cooling methods in high-density workloads, as it provides thermal stability effectively.

The ester/synthetic fluid-filled segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Easter fluids are eco-friendly in nature and offer less risk than traditional mineral oils while aligning with sustainability goals. The responsible disposal is seen as a crucial factor due to the increasing demand for green energy and to avoid toxins that can harm the environment. Also, both natural and synthetic esters offer excellent thermal and oxidative stability, which offers longer fluid life along with more reliable equipment operations.

End User Insights

Why do hyperscale data centers require a robust substation?

The hyperscale data centers segment held the largest market share of 40% in 2024. A substantial power support is required for hyperscale data centers to operate their huge IT ecosystem, such as storage, servers, and other essential networking components. Hyperscale facilities are crucial for processing Complex AI workloads like learning and training AI models, which require a high-density computing environment. Also, leading tech giants and cloud providers are substantially investing in building hyperscale data centers with their individual substations to reduce power outages and provide better services to consumers.

The edge/micro data centers segment is expected to witness the fastest CAGR during the foreseeable period. The segment's growth is driven by a couple of factors, like the expansion of IoT devices and, requirement for ultra-low latency, specifically for real-time applications. Edge and micro data centers can process data effectively near its source and thus minimize redundancy and enable quicker response.

Deployment Type Insights

What factors support greenfield build as the preferred deployment in the data center substation market?

The Greenfield new build segment held the largest market share of 55% in 2024. Green field build-to-project can be customized as per requirement, as they start from empty land and enable designs to fulfill enterprises' needs, such as advanced IT infrastructure, energy-efficient systems with robust security. Also, greenfield sites offer the integration of renewable energy sources like solar and wind with advanced power systems to meet stringent regulations for environmental concerns.

The brownfield upgrades & expansions segment is expected to witness the fastest CAGR during the foreseeable period. The segment's growth is attributed to the explosive growth of data and AI capabilities, which require cost-effective expansion with established facilities, with quicker deployment.

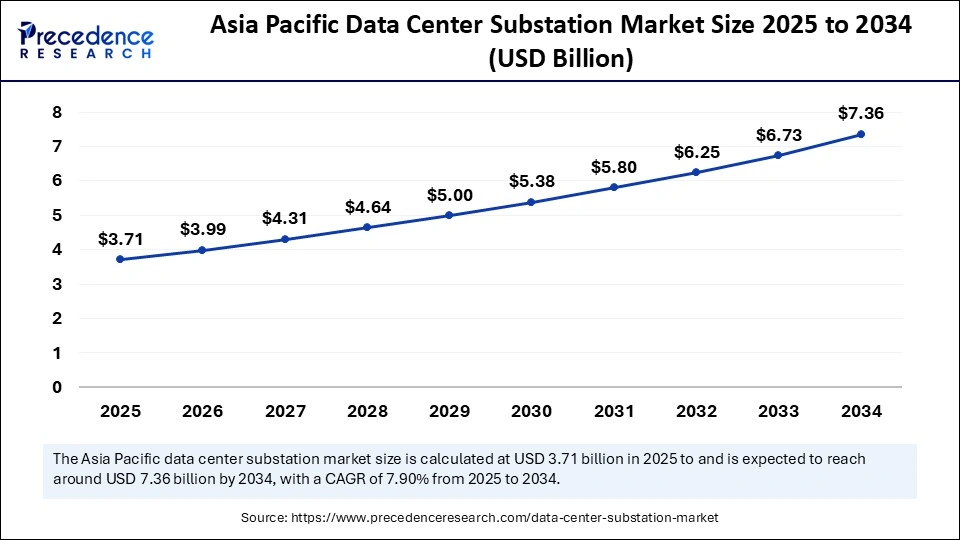

Asia Pacific Data Center Substation Market Size and Growth 2025 to 2034

The Asia Pacific data center substation market size is exhibited at USD 3.71 billion in 2025 and is projected to be worth around USD 7.36 billion by 2034, growing at a CAGR of 7.90% from 2025 to 2034.

What is the key reason for the Asia Pacific data center substation market's dominance?

Asia Pacific held the largest market share of 35% in 2024. A key reason for Asia Pacific's assertion in the global data center substation market is its strategic geographical location, which can serve as a mediator to transmit data efficiently to other regions. Driven by increasing demand for AI, cloud, and digital infrastructure, the Asia Pacific is set to add 4,174 MW of capacity with a huge investment of $58.7 billion by the year-end of 2027, highlighting its future target and potential to grow further.

Rapid digitalization is again a major factor driving the region's growth. Many enterprises are shifting their work to cloud services for better services to consumers and seamless technology integration, driving demand for efficient and reliable data center hosting providers, creating a requirement for robust substations totally dedicated to offering uninterrupted energy supply to data centers.

Why is the Middle East & Africa data center substation market expanding rapidly?

The Middle East and Africa are expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is expanding due to a couple of leading factors like massive investment in data centers, growing cloud and AI demand, strategic use of land, along greenfield development. The Public Investment Fund of Saudi Arabia is committing $6 billion to develop one of the largest data center ecosystems across the globe, highlighting the region's strategic plans and aim to deliver uninterrupted services. It is part of Saudi Arabia's Vision 2030. Also, leading companies like Agility Logistics Park are establishing data center campuses in Middle Eastern countries, and preferably locating data centers nearer to substations for easy power access, are again accelerating the region's growth.

In addition to this, many African countries are actively establishing renewable energy projects, such as N'Diaye Wind Farm in Senegal and in Gabon, initiatives like hydropower to generate a stable power supply for data centers and their development. Also, the UAE-based data center firm, Khazna, is developing many data centers in countries such as Turkey and Kenya, with the potential to expand its capacity in the future.

Value Chain Analysis

- Power Generation

Data center substation operators collect electricity from different sources, such as the conventional power grid and renewable energy sources. For reliability, hyperscale facilities also utilize on-site energy generation.

Key players:Adani Green Energy, Adani Power, Cummins, Tata Power Supply

- Distribution Network Management

This stage involves equipment and services that manage the energy flow of power generation and distribution from the substations to the data center servers.

Key players:Eaton, Schneider Electric, Hitachi Energy, Legrand, Vertiv, and Rittal.

- Energy Storage Systems

Energy storage is a crucial factor of data center reliability and sustainability to avoid power interruptions. They leverage UPS systems, battery energy storage systems, and alternative storage options like flywheel energy storage, flow batteries, and thermal energy storage.

Key players: CATL, Chem, Panasonic, ABB, Vertiv, Energy Vault, Tesla, and Fluence.

Data Center Substation Market Companies

- ABB

- Siemens Energy

- Hitachi Energy

- Schneider Electric

- Eaton

- GE Grid Solutions

- Mitsubishi Electric

- Toshiba Energy Systems & Solutions

- Hyundai Electric

- Hyosung Heavy Industries

- WEG

- Virginia Transformer Corporation

- CG Power and Industrial Solutions

- Bharat Heavy Electricals Limited (BHEL)

- Powell Industries

- Schweitzer Engineering Laboratories (SEL)

- Larsen & Toubro (L&T)

- SPX Transformer Solutions

- TBEA Co., Ltd

- Fuji Electric

Recent Developments

- In June 2025, a new substation is going to be built in Noida, at the Yamuna authority area in India, to fulfil the rising electricity demand and provide power to a data center, which is expected to be built by next year.(Source:https://timesofindia.indiatimes.com)

- In June 2025, to support digitalization in the UK and enable economic growth, the national grid has initiated work on a new substation that powers data Centers in Buckinghamshire.(Source: https://sustainabilitymag.com)

Segments Covered in the Report

By Product Type

- Power Transformers

- Step-down Power Transformers (HV to MV)

- Distribution Transformers (MV to LV)

- Dry-Type Transformers

- Oil-Immersed Transformers

- Switchgear

- Gas-Insulated Switchgear (GIS)

- Air-Insulated Switchgear (AIS)

- Vacuum Circuit Breaker (VCB) Panels

- Protection & Control Systems

- Protection Relays

- Bay Control Units / RTUs

- Power & Energy Meters

- Power Distribution Units

- Low Voltage Switchboards

- Bus Ducts

- Intelligent PDUs

- Reactive Power & Quality Solutions

- Capacitor Banks

- Harmonic Filters

- Power Factor Correction Systems

- Voltage Regulation Systems

- Voltage Regulators/Stabilizers

- Static VAR Compensators (SVC)

- Automation & Monitoring

- Substation SCADA/EMS

- Power Monitoring & Analytics

- Modular Substation Solutions

- Skid-mounted Substations

- Containerized Substations

By Voltage Level

- Extra-High Voltage (EHV) / High Voltage (HV) (>110 kV)

- Medium Voltage (MV) (1 kV–110 kV)

- Low Voltage (LV) (<1 kV)

By Cooling Medium

- Mineral Oil Filled

- Ester / Synthetic Fluid Filled

- Dry-Type / Air-Cooled

By End-user Data Center Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge / Micro Data Centers

By Deployment Type

- Greenfield New Builds

- Brownfield Upgrades & Expansions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting