What is the Design-to-Source Intelligence Market Size?

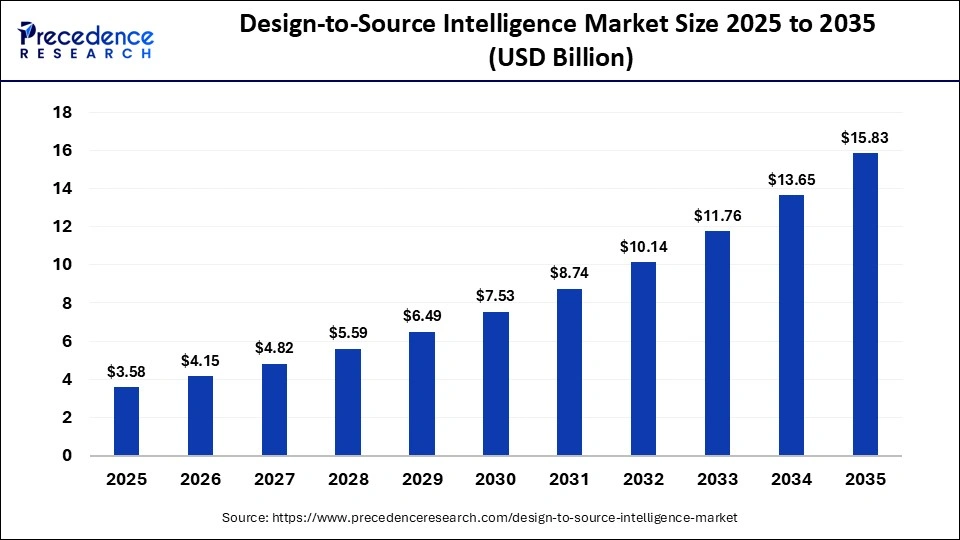

The global design-to-source intelligence market size accounted for USD 3.58 billion in 2025 and is predicted to increase from USD 4.15 billion in 2026 to approximately USD 15.83 billion by 2035, expanding at a CAGR of 16.03% from 2026 to 2035. The primary drivers of the market are evolving consumer preferences, technological advancements, and growing regulatory support, all of which contribute to its growth.

Market Highlights

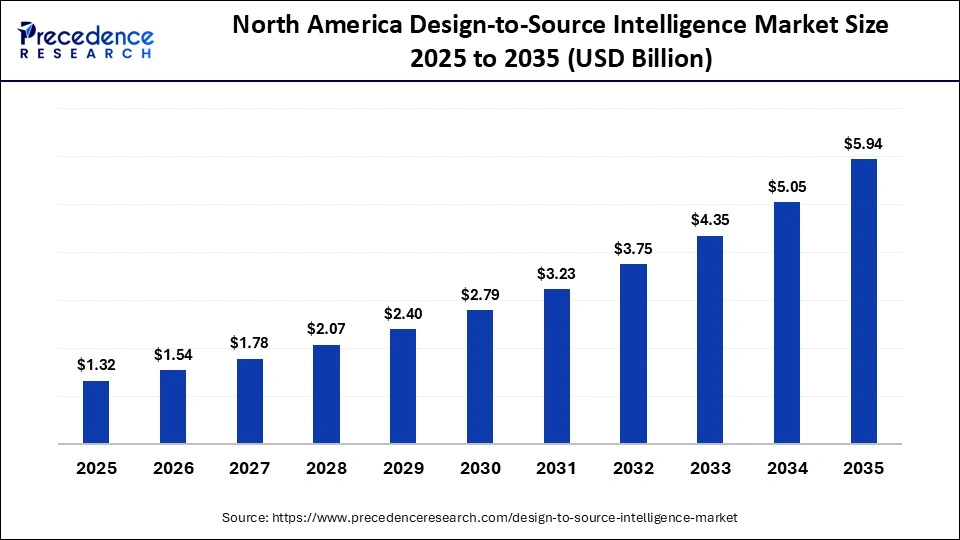

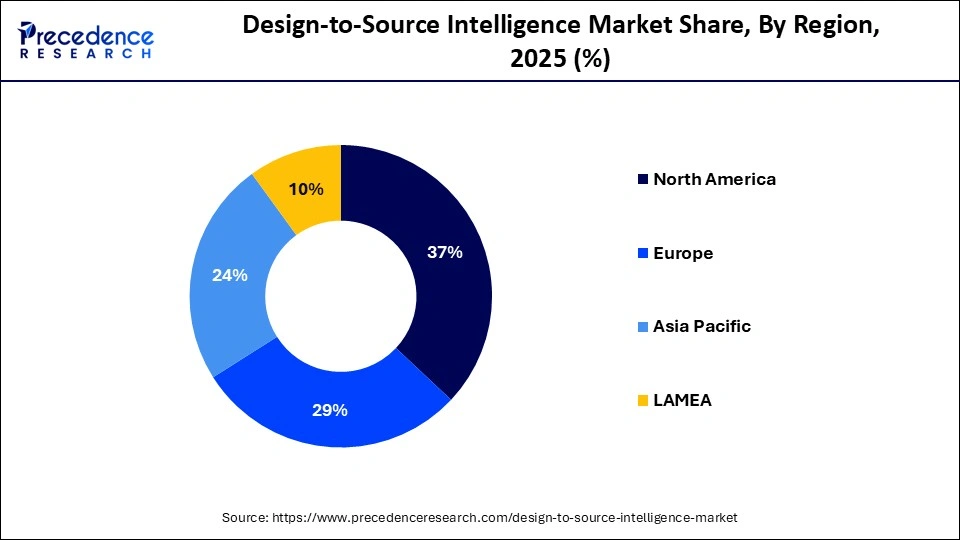

- North America dominating the global markets, holding the largest market share of 37% in 2025.

- The Asia Pacific is expected to grow at a significant CAGR from 2026 to 2035.

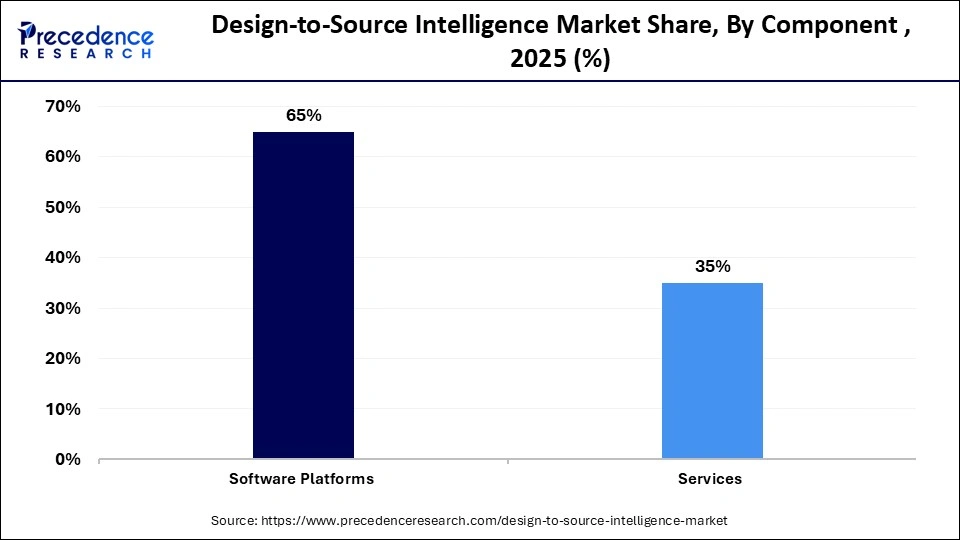

- By component, the software platforms segment led the market, with the highest market share of 65% in 2025.

- By component, the managed & support services segment is expected to grow at a strong CAGR between 2026 and 2035.

- By solution type, the should-cost & cost breakdown analytics segment contributed the major market share of 34%, in 2025.

- By solution type, the risk, compliance & ESG intelligence segment is growing at a solid CAGR from 2026 to 2035.

- By deployment mode, the cloud-based/SaaS segment captured the biggest market share of 60% in 2025.

- By deployment mode, the cloud-based/SaaS segment is projected to grow at a healthy CAGR from 2026 to 2035.

- By enterprise function, the procurement & strategic sourcing segment held the largest market share of 38% in 2025.

- By enterprise function, the sustainability & ESG teams segment is poised to grow at a strong CAGR between 2026 and 2035.

What Constitutes the Design-to-Source Intelligence Market?

The global design-to-source intelligence market comprises software platforms, analytics tools, and advisory services that connect product design data with sourcing, procurement, and supply chain intelligence. These solutions allow organizations to make cost-effective, sustainable, and resilient sourcing decisions early in the product lifecycle by directly linking design specifications with materials selection, supplier capabilities, pricing structures, risk exposure, and regulatory compliance requirements. Design-to-source intelligence platforms leverage artificial intelligence, machine learning, advanced data analytics, and digital twin technologies to support should-cost modeling, supplier evaluation, material substitution analysis, and carbon footprint assessment at the design stage.

By embedding sourcing intelligence into product development workflows, organizations can reduce redesign cycles, shorten time-to-market, and mitigate downstream supply chain risks. Persistent supply chain disruptions, margin pressure, sustainability and compliance mandates, near-shoring strategies, and rising adoption of digital procurement and product lifecycle management-integrated solutions across manufacturing and industrial enterprises drive market growth.

Key Technological Shifts in the Design-to-Source Intelligence Market

Design-to-source intelligence is evolving from static sourcing tools into dynamic, insight-driven platforms that actively guide procurement decisions by directly linking product design data with sourcing intelligence. Advanced analytics and AI capabilities are increasingly used to translate design specifications into real-time cost estimates, supplier availability, and risk assessments, enabling earlier and more informed decision-making.

Cloud-based platforms support seamless collaboration among engineering, sourcing, and supply chain teams, even when they are distributed across different regions. Integration of digital twins and simulation tools allows organizations to evaluate multiple sourcing scenarios before designs are finalized, reducing redesign risk and downstream disruptions. At the same time, automation is minimizing manual data handling by connecting CAD, PLM, and procurement systems into a unified workflow. Together, these developments are transforming design-to-source intelligence into a proactive decision-support function rather than a reactive, cost-control activity applied late in the sourcing process.

Key Market Trends

- Enterprises are increasingly adopting design-to-source intelligence to reduce overall product costs and accelerate time-to-market by embedding sourcing considerations early in the product development process. By linking design specifications with supplier pricing, availability, and risk data at the concept and design stages, organizations can avoid late-stage redesigns, reduce procurement bottlenecks, and improve cost predictability across complex supply chains.

- One key mechanism driving this shift is early supplier involvement, which allows sourcing and engineering teams to evaluate design alternatives, supplier capabilities, and cost implications from the outset rather than after specifications are finalized. Early supplier input on manufacturability, material selection, lead times, and compliance requirements helps improve design feasibility, reduce sourcing risks, and streamline the transition from design to production.

- Among the many reasons to adopt the practice of sourcing intelligence, companies consider sustainability, which involves using materials that can be fully traced and have a low carbon impact. As more companies opt to produce modular and configurable product designs, they are also driving the need for adaptable sourcing insights. In general, the industry has shifted towards integrating data-driven ecosystems, which not only facilitate design innovation but also help in sourcing that is both resilient and cost-efficient.

Design-to-Source Intelligence Market Outlook

- Industry Outlook: The direct-to-source intelligence market is poised for rapid growth from 2025 to 2034, driven by drivers like rising pressure to reduce product costs and shorten time to market, which is pushing organizations to align design decisions early with sourcing feasibility, supplier availability, and cost optimization insights. The other driver of the market is growing supply chain complexity and risk, driven by global sourcing, geopolitical uncertainty, and sustainability requirements, which increase the need for real-time visibility into supplier performance.

- Global expansion: One of the main factors behind the worldwide expansion of the design-to-source intelligence market is the supply-demand imbalance due to the growth of multinational manufacturers that require more transparency and control over their decentralized design and procurement process.

- Major Investment: The two major investors are SAP, which has contributed to the industry in expanding design-to-source intelligence by embedding sourcing analytics into broader PLM/ERP ecosystems. They provide the backbone integration between product design, procurement planning, and supplier data to support cross-functional intelligence. The other major investor is Coupa, whose focus often centers on delivering real-time data that influences sourcing and component decisions long before manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.58 Billion |

| Market Size in 2026 | USD 4.15 Billion |

| Market Size by 2035 | USD 15.83 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Solution Type, Deployment Mode, Enterprise Function, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Are Software Platforms Dominating the Design-to-Source Intelligence Market?

Software Platforms: The segment dominates the design-to-source intelligence market, holding a 65% share, driven by design data, supplier intelligence, pricing benchmarks, and analytics in a single environment. Companies use them to increase cost transparency, reduce product development cycles, and improve sourcing decisions. The adoption of AI-driven cost modeling, digital twins, and predictive analytics is on the rise. The ability to scale and easy integration with ERP and PLM systems are also reasons for the increasing demand. While companies are moving towards data-driven procurement, software platforms are still the major revenue driver.

Managed & Support Services: The managed and support systems are the fastest-growing in the design-to-source intelligence market, with a healthy CAGR, driven by the increasing complexity of implementation and the continuous platform optimization requirements. Quite a few enterprises lack the in-house expertise to fully leverage advanced analytics and AI-powered sourcing tools. The service providers facilitate system integration, supplier onboarding, data cleansing, and performance monitoring. Ongoing support leads to better user engagement and faster ROI realization. Small and medium-sized enterprises are particularly well-positioned to benefit from external expertise. As the platform's level increases, the demand for managed services continues to grow.

Solution Type Insights

Why Should-Cost & Cost Breakdown Analytics Dominate the Design-to-Source Intelligence Market?

Should-Cost & Cost Breakdown Analytics: The should-cost and cost breakdown segment dominates the design-to-source intelligence market, with a 34% share, as tools enable enterprises to dissect product costs and allocate them to materials, labor, overhead, and profits. With this knowledge, manufacturers can negotiate effectively with their suppliers and limit the instances in which costs exceed what was planned. Besides, when integrated with design data, the cost can be one of the very first aspects considered in the product lifecycle. The growing pressure on margins across industries is the main reason more companies are adopting this method. Thus, cost-focused analytics remain at the core of design-to-source strategies.

Risk, Compliance & ESG Intelligence: The risk, compliance & ESG intelligence segment is dominating the design-to-source intelligence market, with a strong CAGR, as supply chains become more global and more regulated. Organizations must deal with an increased number of risks arising from supplier disruptions, geopolitical uncertainties, and difficulty in meeting regulations. What these solutions do is give users the ability to see, in real time, the performance, financial viability, and compliance of their suppliers across different indicators. The adoption of these measures is driven by the market's growing attention to ethical sourcing and regulatory transparency. One benefit of integrating risk intelligence into sourcing decisions is greater resilience.

Deployment Mode Insights

Why Cloud-Based/SaaS Dominated and Fastest Growing the Design-to-Source Intelligence Market?

Cloud-based/SaaS: This segment is dominating the design-to-source market, holding a 60% share. It is also expected to be the fastest-growing segment, with a significant, driven by the need to upgrade computer and design-intelligence systems more easily. The main advantage of cloud platforms is that they enable real-time collaboration among design and procurement teams worldwide. If integration with third-party sources is done properly, it can only improve an analytics system's capabilities. Recent security upgrades and compliance certifications have been among the factors driving the adoption of this technology. All these factors are behind most organizations' decision to opt for cloud deployment, regardless of the sector they operate in.

Enterprise Function Insights

Why Procurement & Strategic Sourcing Dominated the Design-to-Source Intelligence Market?

Procurement & Strategic Sourcing: The segment dominates the design-to-source intelligence market, holding a 38% share, thanks to its intelligence solutions for procurement and strategic sourcing teams. Using advanced analytics, these teams can optimize supplier selection and develop more efficient cost structures. The sourcing strategies adopted are data-driven, informed by early-stage design insights. Collaboration with procurement workflows yields better negotiation outcomes. Enterprises are employing these instruments to align their sourcing decisions with business objectives.

Sustainability & ESG Teams: The segment is dominating the design-to-source intelligence market, driven by a comprehensive monitoring of the environmental and social impacts of their suppliers. By using design-to-source intelligence, companies can track the carbon footprints, material sourcing, and other compliance standards. Different industries are jumping on the ESG reporting bandwagon. The feed-forward integration of sustainability metrics into sourcing not only facilitates the strategic alignment but also tightens the bond between them.

Regional Insights

How Big is the North America Design-to-Source Intelligence Market Size?

The North America design-to-source intelligence market size is estimated at USD 1.32 billion in 2025 and is projected to reach approximately USD 5.94 billion by 2035, with a 16.23% CAGR from 2026 to 2035.

Why North America Is Dominating the Design-to-Source Intelligence Market?

North America dominates the design-to-source intelligence market, holding a 37% share, supported by early adoption of digital procurement platforms, advanced product lifecycle management systems, and AI-enabled supply chain tools. Strong demand for integrated design and sourcing solutions is driven by the large presence of manufacturing enterprises across aerospace, automotive, electronics, and healthcare, where early cost visibility and supplier alignment are critical to complex product development.

High levels of R&D spending and a sustained focus on cost optimization and supply chain resilience further reinforce the region's leadership. Organizations across North America place strong emphasis on supplier risk management, regulatory compliance, and sustainability performance, which increases reliance on intelligence-driven sourcing platforms. In addition, the region's mature IT infrastructure and enterprise software ecosystem enable seamless integration between design, sourcing, and procurement workflows, accelerating adoption at scale.

What is the Size of the U.S. Design-to-Source Intelligence Market?

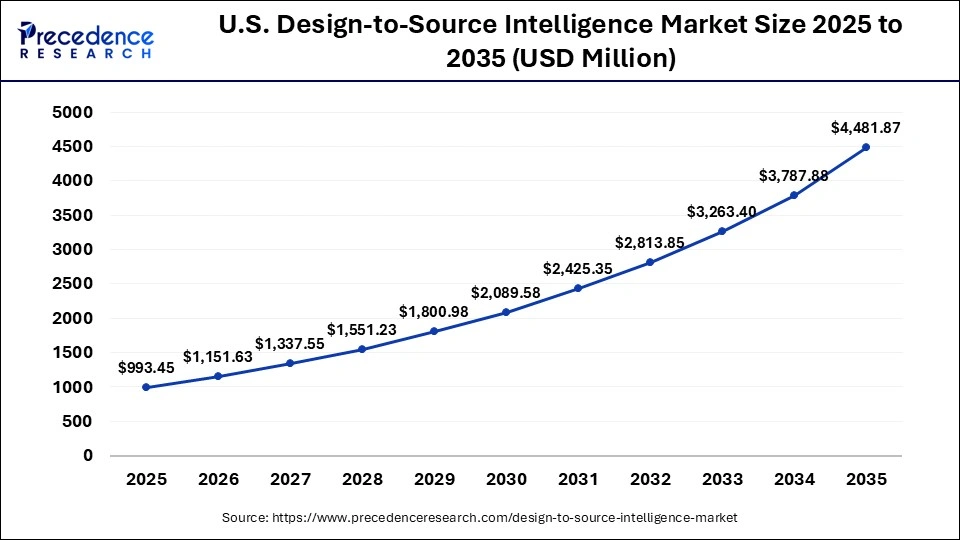

The U.S. design-to-source intelligence market size is calculated at USD 993.45 million in 2025 and is expected to reach nearly USD 4,481.87 million in 2035, accelerating at a strong CAGR of 16.26% between 2026 and 2035.

U.S. Design-to-Source Intelligence Market Analysis

The U.S. dominates the design-to-source intelligence market, supported by widespread adoption among Fortune 500 manufacturers and technology-driven startups. Companies across aerospace, automotive, electronics, and industrial manufacturing are investing heavily in digital twins, predictive analytics, and cloud-based sourcing intelligence platforms to shorten product development cycles, improve should-cost accuracy, and reduce supply chain risk early in the design phase.

Canada is showing steady progress in the market, driven by growth in advanced manufacturing, industrial automation, and digitally enabled supply chain initiatives. Canadian manufacturers are increasingly adopting design-to-source platforms to improve supplier visibility, support compliance requirements, and strengthen coordination between engineering and procurement teams, particularly in automotive, industrial equipment, and energy-related manufacturing sectors.

Why Is Asia Pacific the Fastest-Growing Region in the Design-to-Source Intelligence Market?

Asia Pacific is the fastest-growing region in the design-to-source intelligence market, registering a double-digit CAGR, driven by expanding industrial production and rising adoption of data-driven sourcing practices across manufacturing hubs. The region has seen strong growth in electronics, automotive, and consumer goods manufacturing, where high product volumes and short development cycles require agile and cost-efficient sourcing decisions at the design stage.

To manage increasingly complex multi-tier supplier networks, enterprises across the Asia Pacific are adopting design-to-source intelligence platforms that link design specifications with supplier cost, availability, and risk data. Rising labor costs in countries such as China and parts of Southeast Asia are pushing manufacturers to optimize material selection, supplier mix, and design-for-manufacturability strategies. In addition, government-supported smart manufacturing and industrial modernization programs are encouraging manufacturers to integrate engineering, sourcing, and procurement workflows, further supporting market growth.

China Design-to-Source Intelligence Market Analysis

China is at the forefront of design-to-source intelligence adoption, driven by its vast manufacturing ecosystem and a strong focus on cost competitiveness and supplier optimization across complex, multi-tier supply chains. In India, growth is being supported by national manufacturing initiatives such as Make in India, as well as by the increasing adoption of digital procurement platforms among large manufacturers and export-oriented suppliers. Japan and South Korea are leveraging design-to-source technologies to support precision manufacturing, tighter supplier quality control, and close integration between engineering and sourcing teams, particularly in automotive, electronics, and industrial equipment production.

How Is Europe Witnessing Notable Growth in the Design-to-Source Intelligence Market?

Europe is gaining noticeable growth in the design-to-source intelligence market, driven by a strong focus on sustainability, regulatory compliance, and cost transparency. To link product design to environmentally responsible, cost-efficient sourcing, manufacturers are increasingly adopting design-to-source intelligence platforms. The main sectors benefiting from this shift include automotive, aerospace, and industrial machinery, where material selection, supplier compliance, and lifecycle costs are tightly regulated. Industry 4.0 initiatives are also facilitating adoption by enabling deeper integration between engineering, procurement, and production systems. The growing complexity of cross-border supply chains is making the need for integrated intelligence platforms more pressing.

European manufacturers are using design-to-source tools to assess supplier carbon footprints, compliance with REACH and other EU regulations, and total cost of ownership at the design stage. Countries such as Germany, France, and Italy are seeing strong uptake among export-oriented manufacturers that must coordinate sourcing across multiple EU and non-EU suppliers. In addition, increasing localization and near-shoring efforts are driving demand for platforms that support supplier comparison, risk assessment, and design-for-manufacturability decisions early in product development.

Germany Design-to-Source Intelligence Market Analysis

Germany leads the region due to its strong industrial base and its early adoption of smart manufacturing practices across automotive, machinery, and industrial equipment production. France and the UK show steady implementation, largely driven by demand from the aerospace, defense, and advanced engineering sectors, where early-stage cost control and supplier compliance are critical. Italy and Spain are seeing adoption primarily in automotive manufacturing and industrial components production, where manufacturers use design-to-source intelligence to optimize material sourcing, manage supplier networks, and improve production efficiency.

What Made Latin America a Prominent Region in the Design-to-Source Intelligence Market?

Latin America is showing substantial progress as manufacturers upgrade their procurement and sourcing practices to better manage cost and supply risk. A major driver of demand for design-to-source intelligence is rising foreign investment in automotive, electronics, and industrial manufacturing, particularly in countries such as Brazil and Mexico. In the face of supply chain volatility, companies are seeking stronger cost control, supplier transparency, and early-stage sourcing insights.

Manufacturers are increasingly using design-to-source platforms to evaluate local versus imported components, manage currency and logistics risk, and qualify regional suppliers during the design phase. Automotive OEMs and tier suppliers are adopting these tools to support localization strategies and comply with regional content requirements. At the same time, growing adoption of digital procurement systems is improving coordination between engineering and sourcing teams across domestic and international supplier networks.

Design-to-Source Intelligence Market Analysis

Brazil holds a leading position in the region, supported by its large manufacturing base and well-established automotive sector. Mexico benefits strongly from nearshoring trends and close integration with North American supply chains, which is driving the adoption of design-to-source intelligence to manage cross-border sourcing and supplier coordination. Argentina and Chile are showing gradual uptake, primarily within industrial manufacturing and energy-related sectors, where companies are beginning to adopt more structured sourcing and procurement intelligence to improve cost control and supplier visibility.

Why Is the Middle East and Africa Seeing Substantial Growth in the Design-to-Source Intelligence Market?

The Middle East and Africa region has seen substantial growth in the design-to-source intelligence market, driven by ongoing industrial diversification and large-scale infrastructure development. Governments across the region are investing heavily in manufacturing, energy, construction, and industrial projects that require more structured, cost-efficient, and risk-aware sourcing strategies. As supply chains become more complex and increasingly global, organizations are adopting design-to-source intelligence platforms to improve supplier visibility, manage cost volatility, and align procurement decisions with long-term industrial and localization objectives.

In Gulf countries such as Saudi Arabia and the United Arab Emirates, national industrial programs are encouraging local sourcing, supplier qualification, and cost transparency, which increases demand for integrated design and sourcing platforms. Large infrastructure and energy projects rely on early-stage cost modeling and supplier evaluation to control capital expenditure and reduce procurement risk. In parallel, growing adoption of digital procurement systems is enabling closer collaboration between engineering and sourcing teams across regional and international supplier networks.

Design-to-Source Intelligence Market Analysis

The UAE leads adoption in the region, supported by its focus on smart manufacturing and advanced industrial systems that prioritize cost transparency and supplier optimization. Saudi Arabia is expected to support further market expansion through large-scale industrial and economic diversification programs that require structured sourcing and early-stage cost control. South Africa is showing a steady upward trend in adoption, driven primarily by automotive manufacturing and mining-related industrial operations. Other emerging markets in the region are gradually incorporating design-to-source intelligence to improve procurement transparency, supplier evaluation, and sourcing efficiency across complex industrial projects.

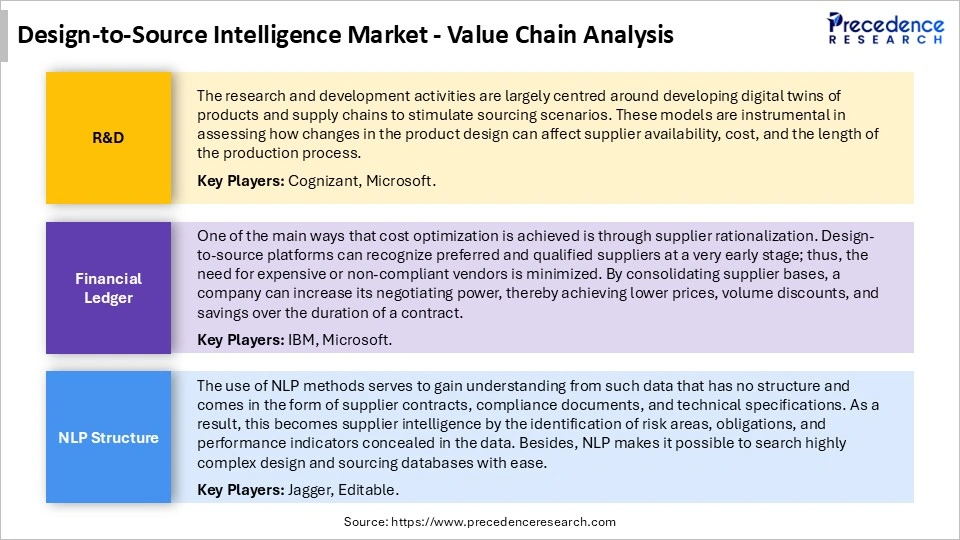

Design-to-Source Intelligence Market Value Chain

Top Companies in the Design-to-Source Intelligence Market

- ADM

- Blue Diamond Growers

- Califia Farms, LLC

- Daiya Foods Inc.

- Source Intelligence

- HCL Technologies Limited

- Zensar Technologies

- EDITED

- ITMAGINATION

- Linagora

- SPEC India

- TradeGood

Segment Covered in the Report

By Component

- Software Platforms

- Services

- Consulting & Implementation

- Managed & Support Services

By Solution Type

- Should-Cost & Cost Breakdown Analytics

- Supplier Discovery & Benchmarking

- Material Intelligence & Substitution Analysis

- Design Optimization & Cost-Reduction Insights

- Risk, Compliance & ESG Intelligence

By Deployment Mode

- Cloud-Based/SaaS

- On-Premise

- Hybrid Deployment

By Enterprise Function

- Procurement & Strategic Sourcing

- Product Design & Engineering

- Supply Chain & Operations

- Finance & Cost Management

- Sustainability & ESG Teams

By Industry Vertical

- Manufacturing (Industrial, Machinery)

- Automotive & Mobility

- Aerospace & Defense

- Consumer Goods & Electronics

- Energy & Utilities

Healthcare & Medical Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting