What is Dietary Fiber Gummies Market Size?

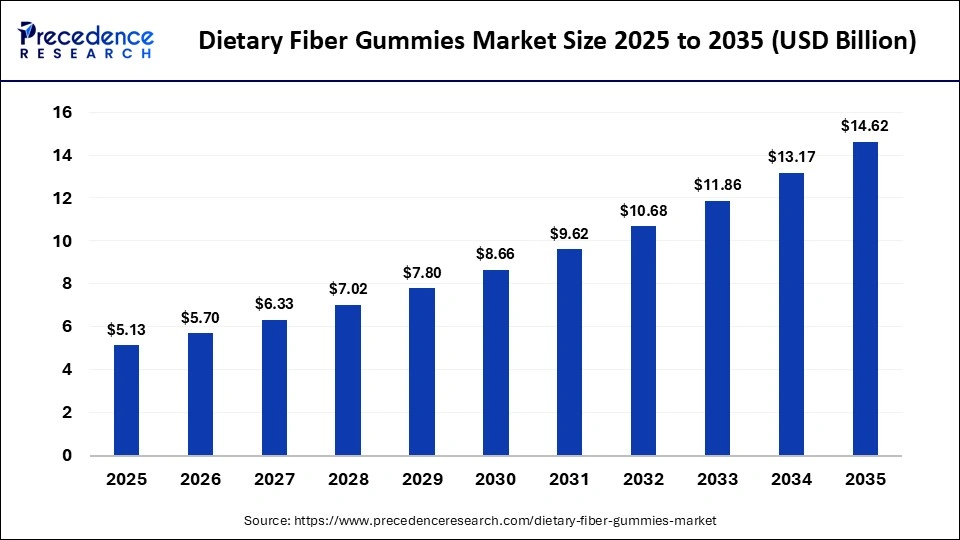

The global dietary fiber gummies market size was calculated at USD 5.13 billion in 2025 and is predicted to increase from USD 5.70 billion in 2026 to approximately USD 14.62 billion by 2035, expanding at a CAGR of 11.04% from 2026 to 2035.The market growth is driven by rising consumer shift toward preventive healthcare measures, increasing burden of lifestyle disorders, growing awareness of fiber deficiency, and high demand for functional foods and nutraceuticals.

Market Highlights

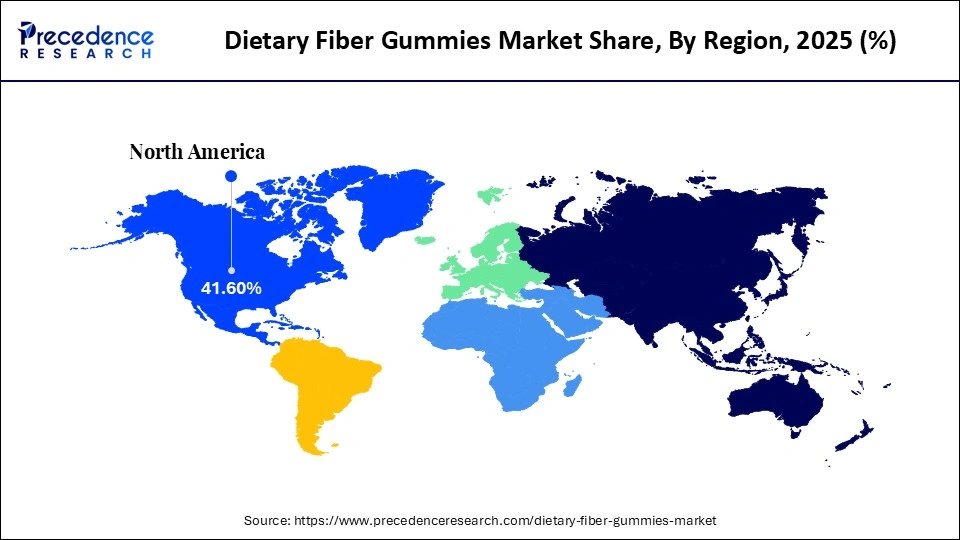

- North America dominated the dietary fiber gummies market with a major share of approximately 41.6% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of approximately 12.9% between 2026 and 2035.

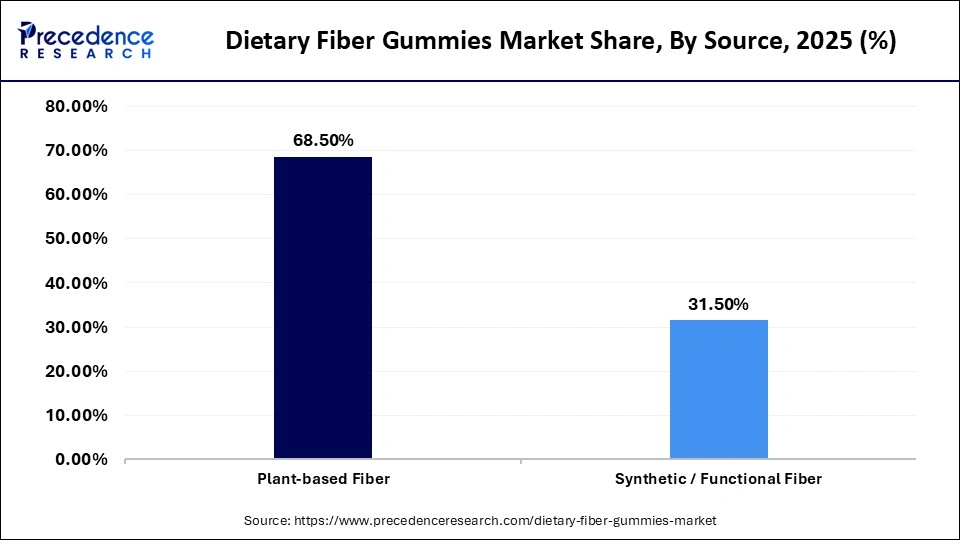

- By source, the plant-based fiber segment dominated the market with the largest share of approximately 68.5% in 2025.

- By source, the synthetic / functional fiber segment is expected to grow at the fastest CAGR during the forecasted period.

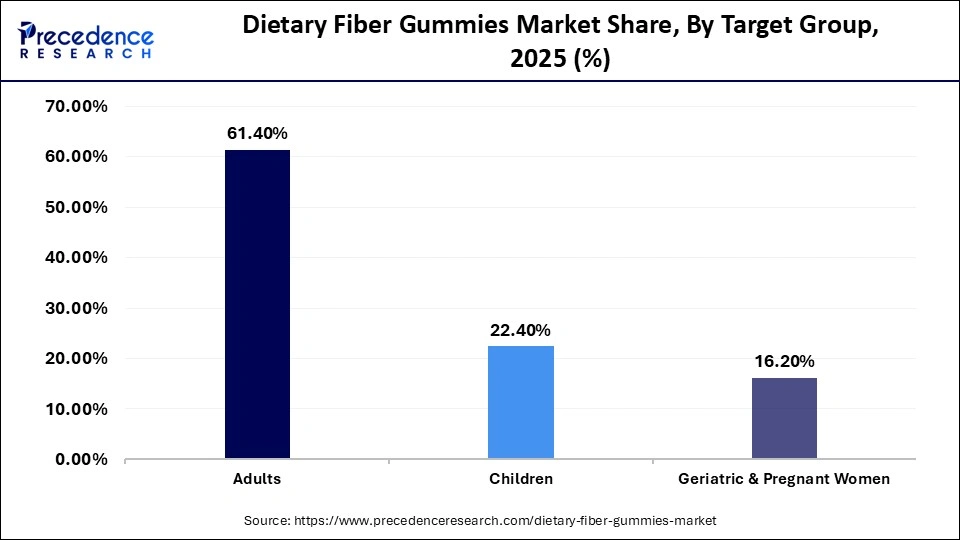

- By target group, the adults segment dominated the market with approximately 61.4% share in 2025.

- By target group, the children segment is expected to grow at the fastest CAGR of 12.6% over the forecast period.

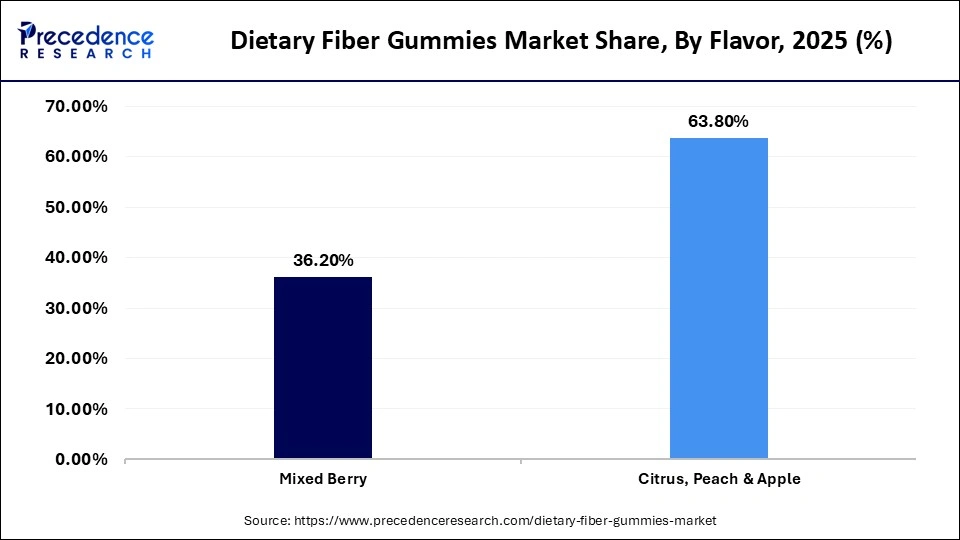

- By flavor, the mixed berry segment dominated the market with a share of approximately 36.2% in 2025.

- By flavor, the citrus, peach and apple segment is expected to grow at the fastest CAGR during the projected period.

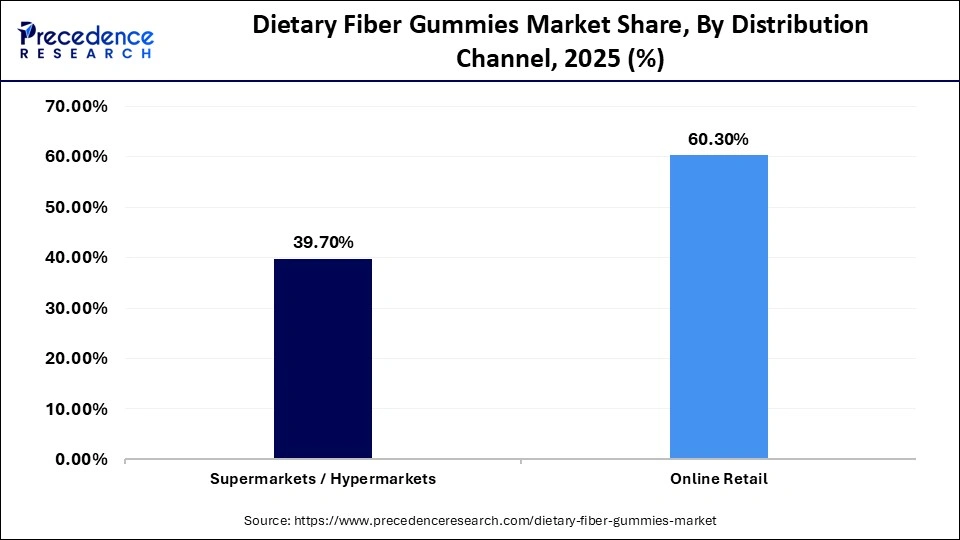

- By distribution, the supermarkets/hypermarkets segment dominated the market with a major share of approximately 39.7% in 2025.

- By distribution, the online retail segment is expected to expand at a CAGR of 13.9% in the coming years.

Market Overview

Dietary fiber gummies are chewable dietary supplements designed to fulfill daily dietary needs conveniently. The dietary fiber gummies market is experiencing robust growth, driven by rising consumer awareness of digestive health, preventive care, and the importance of nutraceuticals in day-to-day life. Dietary fiber gummies are evolving from niche digestive aids to lifestyle wellness staples, as consumers increasingly link gut health to mental well-being and immunity. Dietary fiber gummies demand is increasing across all age groups, driven by pill fatigue. The market mainly targets adults or those who fail to fulfill their daily fiber requirements because of irregular eating habits and a sedentary lifestyle.

Manufacturers have responded by continuous product innovation, offering a variety of flavors, and plant-based sugar-free products that meet evolving consumer preferences. Improved textures, availability of a wide range of flavors, and clean-label ingredients have improved product acceptance. Retail expansion through online platforms, health stores, and subscription-based purchasing is strengthening consumer engagement.

What are the Major Trends Influencing the Dietary Fiber Gummies Market?

- Functional Wellness Focus: Consumers increasingly seek supplements that support not only digestive health but also immunity, mental well-being, and overall wellness. As a result, brands are launching fiber plus gummies that combine prebiotic fiber with postbiotics. Ashwagandha for stress, collagen for beauty-from-within are some of the major examples.

- The Sugar-Free Standard: Consumers are highly worried of metabolic health, prebiotic fiber sweeteners (like FOS or Inulin) are replacing corn syrup, allowing gummies to provide fiber while being marketed as Zero Added Sugar.

- E-commerce & Direct-to-Consumer Sales: Online platforms and subscription models are expanding reach and accessibility, especially among younger, digitally savvy consumers.

- Innovation in Formulation: Introduction of combination gummies with probiotics, vitamins, and other functional ingredients is boosting market differentiation and adoption.

- Rising Health and Wellness Awareness: Digestive disorders associated with sedentary lifestyles are driving greater awareness of gut health and preventive care, boosting demand for fiber supplements in the convenient and palatable form of dietary fiber gummies.

How is AI Reshaping the Dietary Fiber Gummies Market?

Artificial intelligence is significantly reshaping the market for dietary fiber gummies. The potential roles of AI in the market include:

- AI-assisted Product Development: This enables manufacturers to customize their products according to the needs of consumers. AI analyzes market trends and dietary habits to formulate gummies according to the need.

- Personalized Nutrition: Personalized digestive health solutions through the use of AI-assisted nutrition apps, dietary patterns, and biological data studies with the help of AI can help in designing tailored nutrition products.

- Automation and High-Precision Manufacturing: Machine learning algorithms optimize formulation, packaging, and labelling of products. AI also helps in the detection of defects, contamination, and real-time production conditions.

- Digital Consumer Engagement: Digital nutrition platforms driven by AI provide personalized product suggestions and health guidance.

Future Market Overview

- Shift Toward Natural, Clean-Label, and Plant-Based Products: The gradual shift of consumers toward organic, non-GMO, and vegan ingredients is expected to drive the use of tapioca starch and pectin as plant-based products.

- Demand for Convenience and Enjoyment: With increasingly busy lifestyles, consumers are seeking convenient and tasty ways to meet their daily fiber requirements, which is expected to boost the demand for dietary fiber gummies. Gummies provide an attractive alternative to powders and capsules, offering a simple, portable, and palatable solution.

- Product innovation and Functional Formulation: With rising concerns of sugar intake in consumers, manufacturers are innovating low-sugar, sugar-free, new flavors, and fortified gummies with prebiotics and vitamins.

- Technological Advancements and AI Integration: Advancements in manufacturing are leading to the production of high-quality gummies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.13 Billion |

| Market Size in 2026 | USD 5.70 Billion |

| Market Size by 2035 | USD 14.62 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source,Target Group,Flavor,Distribution, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Source Insights

Why Did the Plant-Based Fiber Segment Dominate the Dietary Fiber Gummies Market?

The plant-based fiber segment dominated the market with approximately 68.5% share in 2025. This is because consumers perceive it as safe, natural, and wholesome, aligning with the growing demand for vegan and gelatin-free products. Plant-based fibers are well tolerated at standard dosages, avoiding the gastrointestinal discomfort often associated with synthetic fibers. Widespread acceptance, favorable regulatory support, and the trend toward clean-label, plant-centric formulations further reinforced the segment's leadership in the market.

The synthetic/functional fiber segment is expected to grow at the fastest CAGR in the market during the forecast period. This is mainly due to their safety and controlled dosage. Synthetic fibers include inulin derivatives and polydextrose, known for their improved gut microbiota support and enhanced satiety. Additionally, ongoing product innovation and demand for high-fiber supplements with targeted health benefits, such as weight management or digestive support, are driving the adoption of synthetic fiber in dietary fiber gummies.

Target Group Insights

What Made Adults the Dominant Segment in the Market?

The adults segment dominated the dietary fiber gummies market while holding the largest share of 61.4% in 2025. The dominance of this segment is largely driven by hectic lifestyles and lifestyle-related disorders among working professionals, who increasingly seek convenient and easier alternatives. Adults prefer practical solutions to support digestive health and maintain nutritional balance, fueling demand for dietary fiber gummies.

The children segment is expected to grow at the fastest CAGR of approximately 12.6% over the projection period. The segment growth is driven by the rising awareness among parents about their children's digestive health. Children usually fail to meet their dietary requirements due to poor eating habits, creating demand for dietary fiber gummies. With their palatable taste, chewable form, and ease of administration, these gummies are widely preferred for children.

Flavor Insights

Why Did the Mixed Berry Segment Lead the Dietary Fiber Gummies Market?

The mixed berry segment dominated the market with a share of approximately 36.2% in 2025. The dominance of this segment is driven by growing demand for healthy snacking, ease of consumption, and appealing taste. By combining multiple fruit profiles, mixed berry gummies provide a balanced taste while supporting digestive health and weight management. Their convenience, enjoyable flavor, and association with healthy snacking have made this segment highly popular and widely adopted in the market.

The citrus, peach and apple segment is expected to grow at the fastest CAGR over the forecast period. The segment is driven by the consumer demand for various and naturally palatable taste profiles. Citrus flavor offers a refreshing and tangy taste, peach flavor offers a smooth, sweet, and premium feeling, while apple flavor offers mild sweetness and is mostly preferred due to its familiarity. Their familiar fruity profiles enhance palatability, encouraging regular consumption among both adults and children.

Distribution Insights

How Does the Supermarkets/Hypermarkets Segment Lead the Market in 2025?

The supermarkets/hypermarkets segment led the market with a major share of approximately 39.7% in 2025. This is because these outlets serve as one-stop shops, offering a wide variety of gummies from multiple brands. The segment's dominance is driven by family-oriented multipacks, competitive pricing, discount offers, and the ability for consumers to physically inspect products and compare brands. Strategic partnerships between manufacturers and supermarkets further strengthen this segment's market position.

The online retail segment is expected to grow at the fastest CAGR of approximately 13.9% over the forecast period. The growth of the segment is driven by the increasing trend of digital shopping. Online platforms offer greater product variety, wider brand options, home delivery, and convenience, attracting more consumers. Features such as easy price comparison, customer reviews, and subscription-based purchasing further support sales and boost market growth.

Regional Insights

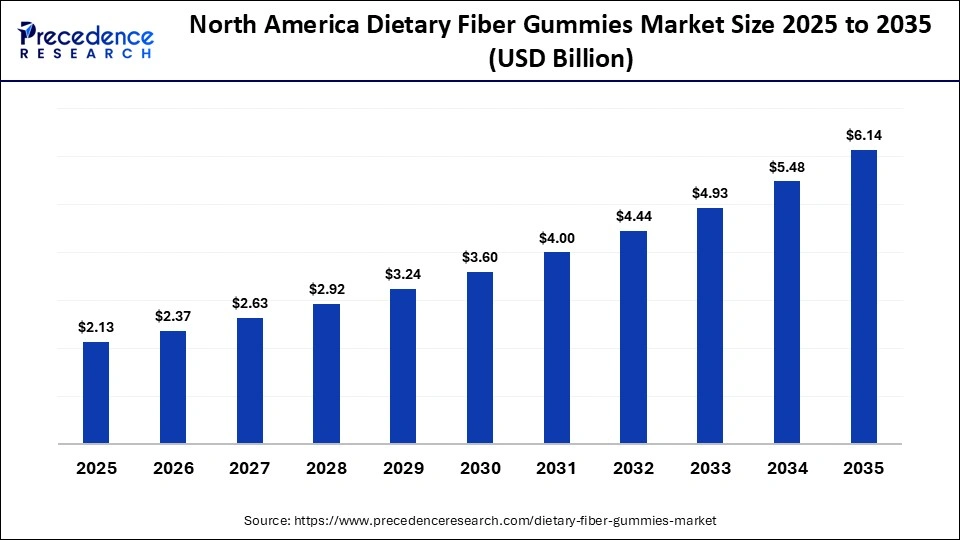

How Big is the North America Dietary Fiber Gummies Market Size?

The North America dietary fiber gummies market size is estimated at USD 2.13 billion in 2025 and is projected to reach approximately USD 6.14 billion by 2035, with a 11.17% CAGR from 2026 to 2035.

What Factors Contribute to North America's Dominance in the Dietary Fiber Gummies Market?

North America dominates the dietary fiber gummies market with approximately 41.6% share in 2025. The region's dominance in the market is attributed to the growing health-conscious population, high awareness of the benefits of dietary fiber, and the increased production and adoption rate of supplements. The high prevalence of lifestyle disorders in the region has boosted the demand for dietary supplements. Functional food manufacturers have been continuously expanding their production facilities to meet the growing demand across the region. Probiotic dietary fiber gummies have gained immense popularity among consumers over the past few years. The region's leadership in the market is further supported by its well-established nutraceutical industry, advanced healthcare infrastructure, and robust distribution channels.

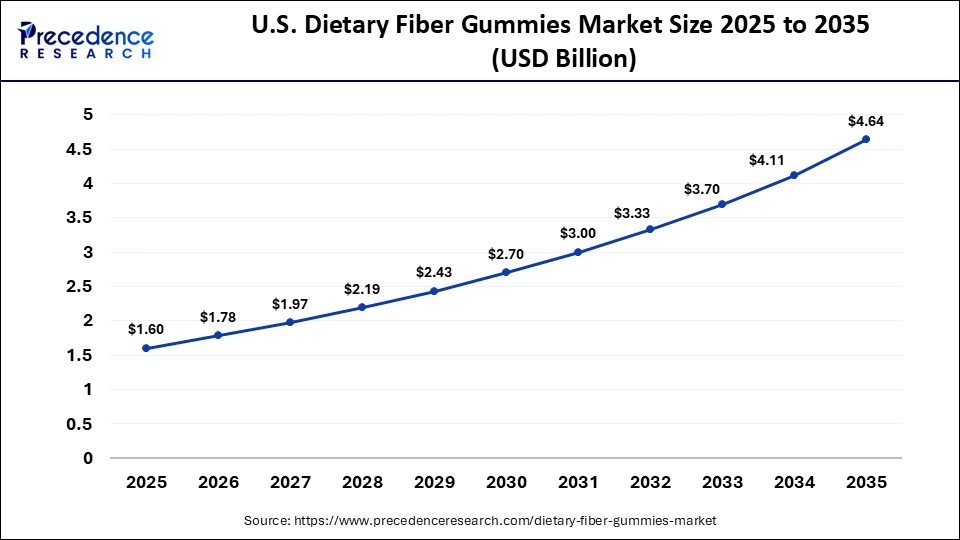

What is the Size of the U.S. Dietary Fiber Gummies Market?

The U.S. dietary fiber gummies market size is calculated at USD 1.60 billion in 2025 and is expected to reach nearly USD 4.64 billion in 2035, accelerating at a strong CAGR of 11.23% between 2026 to 2035.

U.S. Dietary Fiber Gummies Market Trends

The U.S. is a major contributor to the North American dietary fiber gummies market. This is mainly due to the growing health awareness and concerns over digestive health among consumers. With the increasing prevalence of lifestyle-related disorders, there is an increasing demand for dietary fiber gummies across the country. Moreover, the increasing demand for personalized nutrition and the development of clean-label and plant-based formulations are contributing to the market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR of 12.9% over the forecasted period. This is primarily due to rising consumer spending on health products and growing awareness of digestive health. Rapid urbanization and lifestyle shifts are key factors driving the demand for gummies. The expansion of e-commerce platforms and digital marketing is enhancing the accessibility of the product, while local manufacturers and multinational brands are investing in product innovation. Moreover, government initiatives promoting healthy lifestyles and supporting regional product launches are further accelerating market growth.

How is the Opportunistic Rise of Europe in the Dietary Fiber Gummies Market?

Europe is expected to grow at a notable rate in the market, driven by increasing health awareness, which is boosting the demand for low-sugar and functional fiber supplements. Strong focus on gut health and preventive nutrition is encouraging the adoption of dietary fiber gummies. A strict regulatory environment is enhancing consumer trust and market growth. Consumers are shifting towards natural, organic, and vegan-friendly ingredients, contributing to the market expansion.

Dietary Fiber Gummies Market Value Chain Analysis

- Raw Material Procurement: Plant-based fibers, prebiotics, sweeteners, flavors, and gelling agents are sourced from agricultural and various raw material suppliers.

- Processing and Preservation: This stage involves manufacturing gummies, designing them, mixing them with functional ingredients, and applying preservative methods to maintain stability and a longer shelf life.

- Quality Testing and Certification: Various laboratory tests, regulatory compliance, ingredient verification, labelling validation, and health benefits claim certification.

- Packaging and Branding: Attractive packaging materials are used, such as bottles or pouches with attractive designs for branding purposes, focused on health benefits.

Who are the Major Players in the Global Dietary Fiber Gummies Market?

The major players in the dietary fiber gummies market include Church & Dwight Co., Inc., Unilever (Olly Nutrition), Bayer AG, The Clorox Company (RenewLife/Nutranext), SmartyPants Vitamins, Nestlé Health Science, Nature's Way (Schwabe Group), H&H Group (Swisse), Herbaland Naturals Inc., TopGum Industries Ltd., Nordic Naturals, The Honest Company, MegaFood, Amway (Nutrilite), and Haleon plc

Recent Developments

- In October 2025, a popular nutrition brand, BelliWelli, launched watermelon-flavored fiber gummies with collagen and prebiotics.

- In May 2025, Good Enough Brands launched new postbiotic fiber gummies.

- In April 2025,Vivazen launched a new botanical gummies line to provide functional, plant-powered benefits in a portable, chewable format.

Segments Covered in the Report

By Source

- Plant-Based Fiber

- Synthetic/Functional Fiber

By Target Group

- Adults

- Children

- Geriatric and Pregnant Women

By Flavor

- Mixed Berry

- Citrus, Peach and Apple

By Distribution

- Supermarkets/Hypermarkets

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting