What is the Digital Step Attenuator Market Size?

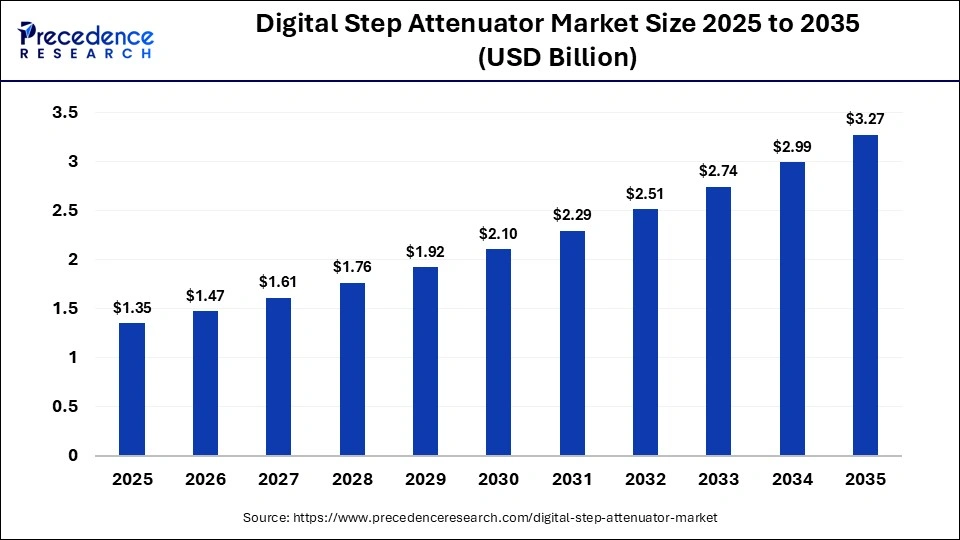

The global digital step attenuator market size accounted for USD 1.35 billion in 2025 and is predicted to increase from USD 1.47 billion in 2026 to approximately USD 3.27 billion by 2035, expanding at a CAGR of 9.24% from 2026 to 2035. The global digital step attenuator market is witnessing robust growth, driven by the rising rollouts of next-gen wireless networks and growing demand for advanced radar systems.

Market Highlights

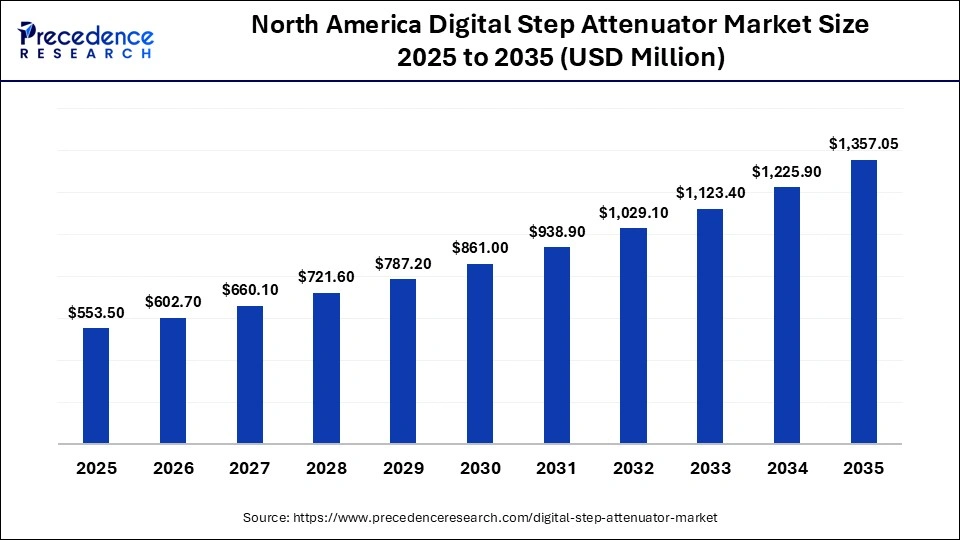

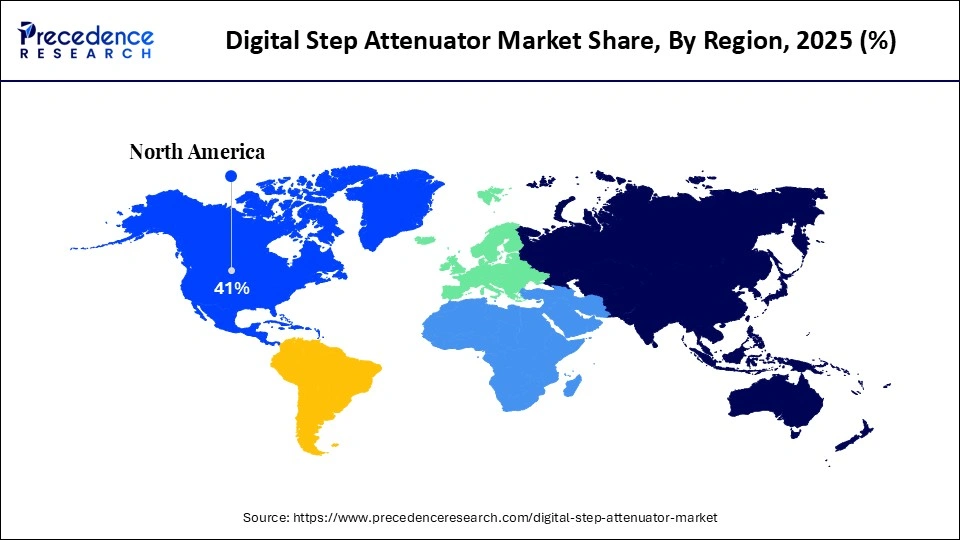

- North America dominated the market, holding the largest market share of 41% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By product type, the programmable digital step attenuators segment held the largest market share of 46% in 2025.

- By product type, the integrated DSA modules (with switches & amplifiers) segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By technology, the GaAs (Gallium Arsenide) segment held the largest market share of 42% in 2025.

- By technology, the SOI (Silicon on Insulator) segment is expected to grow at a significant CAGR between 2026 and 2035.

- By application, the wireless infrastructure (5G/small cells/base stations) segment held the largest share of 34% in the digital step attenuator industry during 2025.

- By application, the automotive radar (ADAS) segment is set to grow at a remarkable rate between 2026 and 2035.

- By end-user, the telecom equipment manufacturers segment held the largest market share of 36% in 2025.

- By end-user, the automotive electronics manufacturers segment is expected to expand at a remarkable growth rate between 2026 and 2035.

Digital Step Attenuator Market Overview

Digital step attenuators (DSAs) are electronic RF and microwave components used to precisely control signal power levels in discrete steps through digital control interfaces such as SPI, serial, or parallel logic. Unlike analog attenuators, DSAs offer high accuracy, repeatability, fast switching speeds, and stable linearity, making them essential in wireless infrastructure, test and measurement equipment, aerospace and defense electronics, satellite communications, and emerging 5G and 6G systems.

Their ability to deliver deterministic attenuation steps is critical in calibration-sensitive environments such as vector signal generators and spectrum analyzers. In base stations and small-cell networks, DSAs support adaptive power control to maintain signal integrity under dynamic traffic conditions. Aerospace and defense systems rely on digital step attenuators for radar cross-section testing, electronic warfare, and secure communication links where precision and reliability are mandatory. Increasing integration into RF front-end modules is reducing system size and power consumption. Advances in semiconductor processes such as silicon germanium and gallium arsenide are improving frequency range and thermal stability. Growing demand for automated RF testing and beamforming architectures is further expanding DSA deployment across next-generation communication platforms.

How Are AI-Driven Innovations Reshaping the Digital Step Attenuator Industry?

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) is driving innovation and accelerating the growth of the digital step attenuator industry by enabling smarter attenuation solutions, optimizing real-time signals, predictive maintenance, and facilitating adaptive control. AI integration of AI into test and measurement equipment spurs the demand for programmable attenuators with digital interfaces (like SPI and I2C). AI streamlines testing cycles, minimizing human error and ensuring consistent quality in high-volume production. AI-powered models can efficiently analyze system data to predict any potential anomalies, failures, and degradation in DSA performance over time, which reduces operational costs and minimizes unplanned downtime.

AI supports the deployment of high-frequency 5G infrastructure and phased-array antennas widely adopted in satellite broadband and automotive ADAS. AI-powered algorithms can efficiently analyze massive datasets to predict signal interference and enhance attenuation parameters in real-time. This reduces latency, improves network performance, and optimizes system reliability, which is vital in applications in defense and telecommunications.

Digital Step Attenuator Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to experience accelerated growth. The growth of the market is primarily driven by increasing RF complexity, higher frequency operation (mmWave), and the growing need for automated, software controlled signal conditioning. The market is rapidly expanding owing to the increasing demand for smaller and integrated electronic devices across various sectors.

- Global Expansion: Several leading players in the digital step attenuator industry, including Mini-Circuits, Analog Devices, Inc., Qorvo, Inc., Infineon Technologies AG, Texas Instruments Incorporated, NXP Semiconductors, Renesas Electronics Corporation, Microchip Technology Inc., Teledyne Technologies, and others. These players are actively expanding their global reach through various strategic initiatives such as acquisitions, key partnerships/collaborations, and new product launches. For instance, in October 2025, Mini-Circuits expanded its offerings with new precision digital step attenuators. The company introduced the ZX76-24G-30-S+, a 50-ohm coaxial solid-state digital step attenuator designed for wideband RF applications spanning 0.1 to 24 GHz. It is engineered for precision and flexibility; the attenuator offers programmable attenuation from 0 to 31.5 dB in 0.5 dB steps, providing fine control over signal levels across a wide frequency range.

- Major Investors: Major investors and key players in the digital step attenuator market primarily include large semiconductor companies and specialized RF component manufacturers. These major players are investing heavily in research and development (R&D) to develop digital step attenuators with broader frequency ranges (up to mmWave), finer step resolution, and improved linearity, catering to the ongoing demanding requirements of 5G/6G and advanced radar systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2026 | USD 1.47 Billion |

| Market Size by 2035 | USD 3.27 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

What Caused the Programmable Digital Step Attenuators Segment to Dominate the Digital Step Attenuator Sector?

The programmable digital step attenuators segment held the largest market share of 46% in the sector, with the segment primarily driven by the growing demand for automation and precise signal control in modern electronic systems, especially in telecommunications and test equipment sectors. In communication systems such as 5G, radar, and satellite communications, there is an increasing need for dynamic signal control. Programmable digital step attenuators provide the flexibility to adjust signal strength for managing complex signal environments and ensuring optimal system performance.

The integrated DSA modules (with switches & amplifiers) segment is expected to grow at a remarkable CAGR between 2026 and 2035. The segment's growth is supported by the rapid expansion of 5G infrastructure, growing demand for high-speed data transmission, and the rising development of advanced semiconductor technologies. Integrated DSA Modules (with switches & amplifiers) are multi-function modules that combine the digital step attenuator with other essential RF components. This integration lowers the need for required board space and simplifies the design by providing a complete signal chain solution.

Technology Insights

Which Segment Dominated in Terms of Technology in the Digital Step Attenuator Market?

The GaAs (Gallium Arsenide) segment dominates the digital step attenuator market, holding a 42% share. Gallium Arsenide (GaAs) technology is widely recognized owing to its superior performance attributes, higher power efficiency, and lower noise levels. GaAs technology is gaining immense popularity for critical applications in telecommunications, aerospace and defense, and automotive radar systems.

The SOI (silicon on insulator) segment is set to be the fastest-growing in the digital step attenuator industry. Silicon SOIs significantly benefit from lower production costs and established manufacturing processes. SOI technology is widely adopted owing to its high linearity, low insertion loss, and high transit frequency over a broad frequency range at an affordable price, which are crucial for high-performance applications such as 5G communication, automotive radar, and high-speed data transmission.

Application Insights

Why Did Wireless Infrastructure (5G/Small Cells/Base Stations) Dominate the Digital Step Attenuator Market?

The wireless infrastructure (5G/small cells/base stations) segment dominated the digital step attenuator market, holding a 34% market share in 2025, owing to the large-scale deployment of 5G networks and the growing demand for precise RF signal management. DSAs provide precise, discrete control over RF signal strength for optimizing the performance of 5G base stations and communication transmitters. The global rollout of 5G wireless networks significantly increases the need for high-performance components that can operate efficiently at higher frequency ranges, including millimeter-wave (mmWave) bands.

The automotive radar (ADAS) segment is expected to show the fastest CAGR over the forecast period. The segment's growth is primarily driven by the increasing demand for enhanced vehicle safety and autonomous driving features, which are often mandated by stringent government safety regulations in various countries. Consumers are increasingly preferring vehicles equipped with advanced safety and convenience features, which compels automakers to integrate sophisticated ADAS, from premium to entry-level models. Regulatory bodies worldwide, such as the EU, NHTSA, and China's NCAP, mandate the inclusion of advanced safety features like automatic emergency braking (AEB), Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), and lane-keeping assist in all new vehicles. These systems rely heavily on advanced radar systems, which drives the demand for digital step attenuators.

End-user Insights

What Caused the Telecom Equipment Manufacturers to Dominate the Digital Step Attenuator Market in 2025?

The telecom equipment manufacturers segment dominates the digital step attenuator market, holding a 36% share, owing to the increasing demand for DSAs in high-frequency applications in 5G/6G infrastructure, satellite communications, and the IoT. The rollout of 5G and 6G networks requires DSAs for precise signal management in base stations. The integration of IoT sensors and smart devices heavily relies on digital step attenuators for efficient power control and signal optimization. Telecom equipment manufacturers use DSAs in automated testing for quality assurance, calibration, and remote monitoring of complex RF systems.

The automotive electronics manufacturers segment is the fastest-growing in the digital step attenuator industry. As the automotive industry is experiencing a rapid transition from hardware-driven to software-driven systems, it pushes manufacturers to favor DSAs that can be easily integrated into space-constrained designs and automated assembly processes. The increasing consumer preference for autonomous (self-driving) and connected (V2X communication) vehicles and strict regulatory safety regulations compel manufacturers to incorporate more electronic components, such as digital step attenuators, that meet stringent automotive-grade standards.

Regional Insights

How Big is the North America Digital Step Attenuator Market Size?

The North America digital step attenuator market size is estimated at USD 553.50 million in 2025 and is projected to reach approximately USD 1,357.05 million by 2035, with a 9.38% CAGR from 2026 to 2035.

Why Did North America Dominate the Digital Step Attenuator Market?

North America dominated the digital step attenuator market, holding the largest share of 41%. The region benefits from a well-established 5G infrastructure and a sustained focus on modernization of radar and electronic warfare systems. Growth is also characterized by expanding wireless communication deployments, rising demand for precise RF signal control, increased adoption of software-defined radios, and continuous advancement in phased-array and AESA radar platforms. Strict vehicle safety regulations and rapid integration of advanced driver-assistance systems and vehicle-to-everything communication modules are further supporting adoption of digitally controlled attenuation solutions.

Defense modernization programs are increasing procurement of DSAs for radar calibration, threat simulation, and electronic countermeasure testing. Large-scale deployment of small cells and massive MIMO base stations is raising demand for high-linearity, fast-switching attenuators in RF front-end modules. Semiconductor test and measurement facilities are expanding use of DSAs in automated RF calibration benches. Strong presence of aerospace, defense, and automotive electronics manufacturers is reinforcing sustained regional demand.

What is the Size of the U.S. Digital Step Attenuator Market?

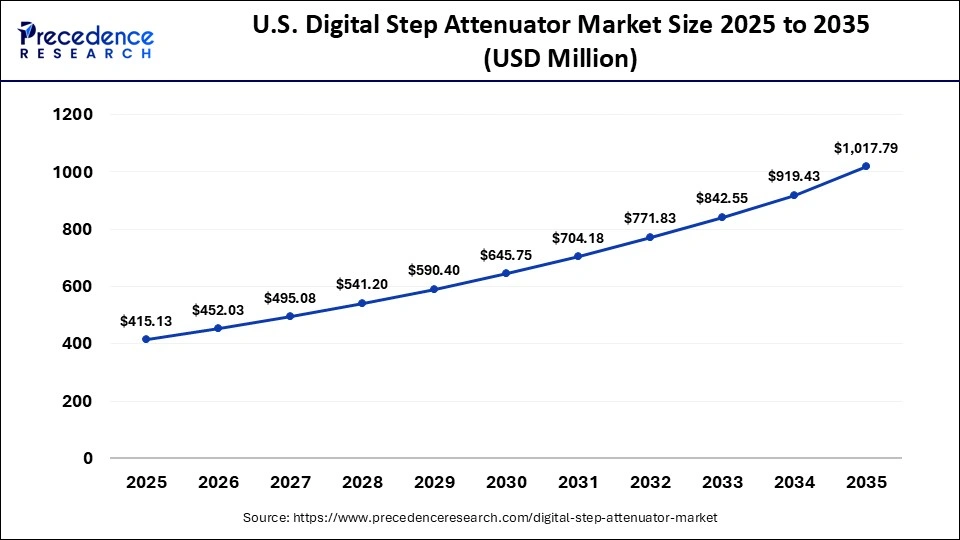

The U.S. digital step attenuatormarket size is calculated at USD 415.13 million in 2025 and is expected to reach nearly USD 1,017.79 million in 2035, accelerating at a strong CAGR of 9.38% between 2026 and 2035.

United States Digital Step Attenuator Market analysis

The United States leads the digital step attenuator market. The United States is a major contributor to the digital step attenuator sector. The country is home to the leading market players, such as Analog Devices (ADI), Qorvo, Skyworks Solutions, Mini-Circuits, MACOM, pSemi, and Guerrilla RF. The country's growth is driven by the presence of a well-established telecom infrastructure, a rapid pace of digital transformation, and growing consumer demand for autonomous (self-driving) and connected (V2X communication) vehicles. In addition, the rising reliance on high-performance testing across industries such as telecom, aerospace, and automotive is expected to propel the country's growth during the forecast period.

Why Is Asia Pacific Set to Be the Fastest-Growing Region in the Digital Step Attenuator Market During the Forecasted Period?

Asia Pacific is the fastest-growing region in the digital step attenuator market, primarily driven by the increasing investments in 5G infrastructure, defense modernization (radar systems), and automated test equipment (ATE). The rising use of automated and remote testing environments in R&D labs and manufacturing facilities drives the region's growth. Several prominent players in the market are increasingly focusing on high-frequency, aerospace/defense systems and high-performance applications like 5G and Wi-Fi 6/7. The region is also experiencing a massive uptake in semiconductor manufacturing growth and increasing demand for high-performance & miniaturized components across applications like wireless communications, aerospace, and instrumentation.

In China, Japan, and South Korea, national 5G rollout programs and defense electronics procurement cycles are directly increasing demand for digitally controlled RF attenuation modules used in base stations, phased-array radar, and electronic warfare test benches, while parallel public and private investments in semiconductor fabs and OSAT facilities across Taiwan, South Korea, and mainland China is expanding the installed base of automated test equipment that integrates high-resolution digital step attenuators at wafer probe and final test stages. Aerospace and defense laboratories across the region are increasingly specifying digitally programmable attenuation to enable remote calibration, temperature-stable measurements, and repeatable RF characterization aligned with military and aerospace test protocols. At the same time, the push toward compact radio units, multi-band antennas, and high-frequency instrumentation is accelerating adoption of surface-mount, low-insertion-loss digital step attenuators that meet strict size, power, and reliability requirements in high-volume production environments.

India's Digital Step Attenuator Market analysis

India's digital step attenuator market is experiencing notable growth, supported by the rising expansion of 5G networks, increasing demand from telecom and defense sectors for precise signal control, rising consumer demand for vehicle safety, and rising advances in semiconductor technologies. Government-led programs such as India's nationwide 5G rollout and defense electronics procurement under indigenization initiatives are increasing deployment of digitally controlled RF attenuation in telecom base stations, military radar, and secure communication systems that require stable and repeatable signal conditioning, while the automotive sector is simultaneously driving demand through the growing integration of advanced driver assistance systems and short-range radar in passenger and commercial vehicles that rely on precise gain control under harsh thermal and vibration conditions. Parallel investments in domestic semiconductor fabrication, assembly, and RF design capabilities are strengthening local demand for high-frequency, low-noise digital step attenuators used in satellite payload testing, defense R&D laboratories, and automated production test platforms that support indigenous electronics manufacturing.

Europe Digital Step Attenuator Market Analysis

The Europe digital step attenuator market is experiencing notable growth driven by the strong telecom infrastructure, rapid growth in sophisticated testing for advanced electronics, rising consumer demand for vehicle safety, increasing spending in defense electronics, and the rising need for industrial IoT & automation. Large-scale 5G standalone network deployments across Western and Northern Europe are increasing the use of digitally controlled RF attenuation for base station calibration, massive MIMO validation, and continuous network optimization workflows. Defense modernization programs in countries such as Germany, France, and the United Kingdom are expanding demand for high-precision digital step attenuators in radar, electronic warfare, and secure communication systems that require stable and repeatable signal conditioning.

Europe's automotive electronics ecosystem, particularly in radar, LiDAR, and sensor fusion development, is increasing integration of DSAs across both R&D validation and high-volume production testing of safety-critical vehicle platforms. In parallel, advanced industrial automation and smart manufacturing initiatives are driving adoption of digitally programmable attenuation in high-frequency instrumentation and automated test equipment used across aerospace, semiconductor, and industrial electronics production environments.

Germany Digital Step Attenuator Market analysis

Germany is experiencing significant growth driven by the accelerated rollout of advanced wireless communication technologies, particularly 5G infrastructure upgrades, the growing requirement for precise RF signal management, increasing adoption of automotive radar systems, rising demand from defense and aerospace electronics programs, and deeper integration of digital step attenuators to maintain stable signal integrity in industrial and test environments. The country's strong automotive manufacturing base is rapidly expanding the deployment of ADAS features such as adaptive cruise control, collision avoidance, and blind-spot detection, increasing the use of high-frequency radar modules that require accurate and repeatable attenuation control across vehicle platforms from economy to premium segments. Defense and aerospace laboratories, along with industrial automation and electronics testing facilities, are incorporating digitally controlled attenuation to support calibration, validation, and long-term signal stability in mission-critical and production-grade systems. These combined telecom, automotive, defense, and industrial drivers are collectively expected to support sustained growth of the digital step attenuator market in Germany during the forecast period.

Why Is the Middle East & Africa Digital Step Attenuator Market Expected to See Remarkable Growth?

The digital step attenuator market is expected to grow at a remarkable rate in the Middle East & Africa region, supported by rising demand from telecom infrastructure deployment, aerospace and defense electronics programs, and expanding IoT-enabled industrial systems. Growth is being driven by accelerated 5G network rollouts and early 6G research initiatives, increased procurement of radar, satellite payloads, and secure communication systems, and wider use of digitally controlled RF components for signal conditioning and test validation.

Countries such as the UAE, Saudi Arabia, and South Africa are key contributors, supported by national digital transformation agendas that include expansion of satellite communication networks, construction of hyperscale data center and edge data centers, and digitization of energy infrastructure across oil, gas, and power transmission operations. In parallel, rising consumer awareness of vehicle safety is increasing adoption of ADAS functions, which is expanding the use of automotive radar and associated RF subsystems that require precise, repeatable attenuation control. Together, these telecom, aerospace, defense, automotive, and industrial digitization drivers are anticipated to propel sustained growth of digital step attenuator adoption across the Middle East & Africa during the forecast period.

South Africa Digital Step Attenuator Market Analysis

South Africa is driving notable growth in the market for digital step attenuators with a special focus on modernizing telecommunications infrastructure and defense systems. The country's growth is attributed to the ongoing deployment of 5G networks, rising focus on advancing satellite networks, significant investment in data centers, and growing demand for compact and software-defined radio systems (SDRs). Moreover, increasing demand for automated and highly accurate test equipment with precise RF control fuels the growth of the digital step attenuator market in the country.

Who are the Major Players in the Global Digital Step Attenuator Market?

The major players in the digital step attenuator market include Analog Devices, Inc., Qorvo, Inc., Skyworks Solutions, Inc., Infineon Technologies AG, NXP Semiconductors, Texas Instruments Incorporated, Renesas Electronics Corporation, Murata Manufacturing Co., Ltd., Peregrine Semiconductor (pSemi), Microchip Technology Inc., Broadcom Inc., Mini-Circuits, Teledyne Technologies, Cobham Advanced Electronic Solutions, API Technologies, MACOM Technology Solutions, Amphenol RF, ROHM Semiconductor, Guerrilla RF, and MaxLinear, Inc.

Recent Developments

- In May 2025, Ranatec, a part of Qamcom Group and a progressive creator of test and measurement equipment for RF and microwave applications, announced its 16-channel Attenuator Box. With 16 individual digitally controlled attenuators for high dynamic signal level adjustment, the Attenuator Box is ideal for transmission loss simulation, signal fading, and MIMO measurements.(Source: https://ranatec.com)

- In November 2025, Qorvo introduced the QPC0045, an ultra-wideband SOI 6-bit digital step attenuator (DSA) designed for precision signal control across a wide range of RF and microwave systems. The attenuator operates from 0.01 to 48 GHz, providing an attenuation range of 31.5 dB with a fine 0.5 dB step size and a typical step error of less than 0.1 dB. The QPC0045 supports multiple control interfaces, including parallel, SPI, and I²C, and enables simultaneous control of multiple DSAs through addressing or daisy-chaining.(Source: https://www.everythingrf.com)

Segments Covered in the Report

By Product Type

- Fixed Digital Step Attenuators

- Programmable Digital Step Attenuators

- Voltage-Controlled Digital Step Attenuators

- Integrated DSA Modules (with switches & amplifiers)

By Technology

- GaAs (Gallium Arsenide)

- CMOS

- SiGe

- SOI (Silicon on Insulator)

- GaN-based DSAs (Emerging, high-power RF)

By Application

- Wireless Infrastructure (5G/Small Cells/Base Stations)

- Test & Measurement Equipment

- Aerospace & Defense (Radar, EW, Avionics)

- Satellite Communication

- Automotive Radar (ADAS)

- Consumer & Industrial RF Systems

By End User

- Telecom Equipment Manufacturers

- Aerospace & Defense OEMs

- Test & Measurement Companies

- Automotive Electronics Manufacturers

- Industrial & Research Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting