What is the Electric Vehicle Battery Swapping Market Size?

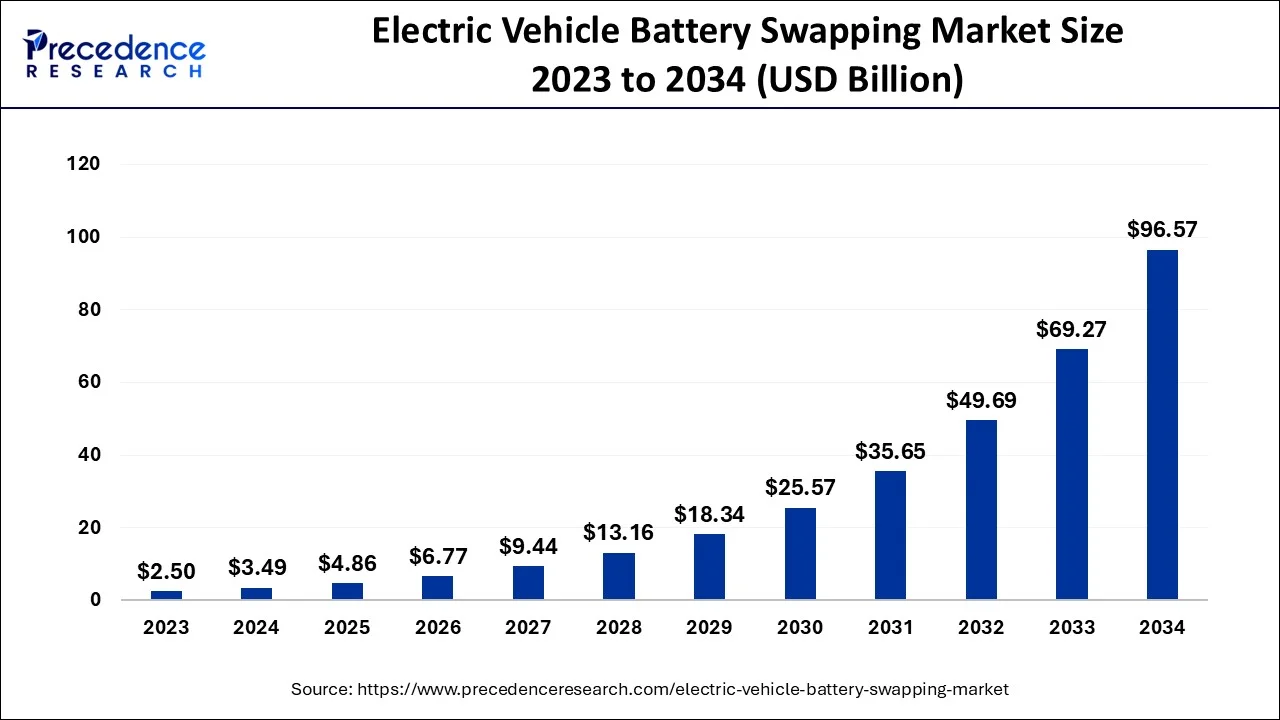

The global electric vehicle battery swapping market size is estimated at USD 4.86 billion in 2025 and is anticipated to reach around USD 118.72 billion by 2035, expanding at a CAGR of 37.56% from 2026 to 2035. The market is driven by rapid penetration of Electric Vehicles (EVs), government initiatives to promote clean mobility, and the requirement for faster charging alternatives.

Market Highlights

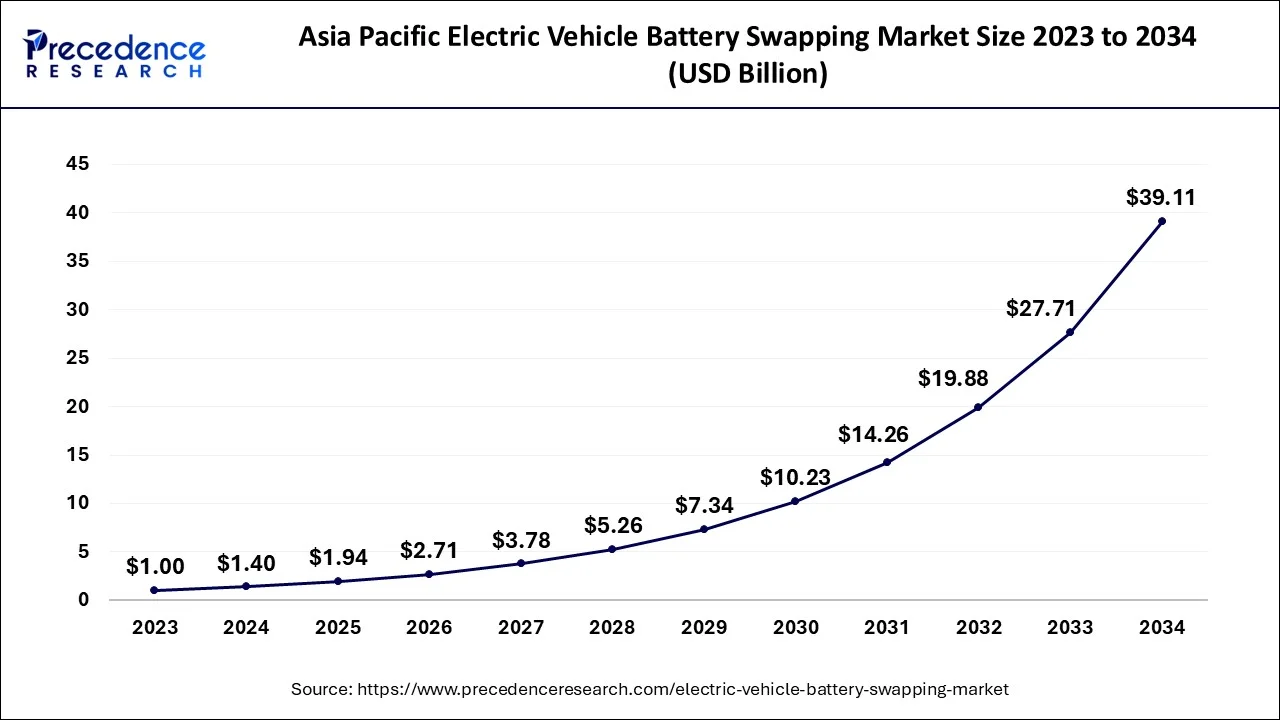

- Asia Pacific electric vehicle battery swapping market is valued at USD 1.00 billion in 2025.

- By vehicle type, the two-wheeler segment garnered largest revenue share of 69% in 2025.

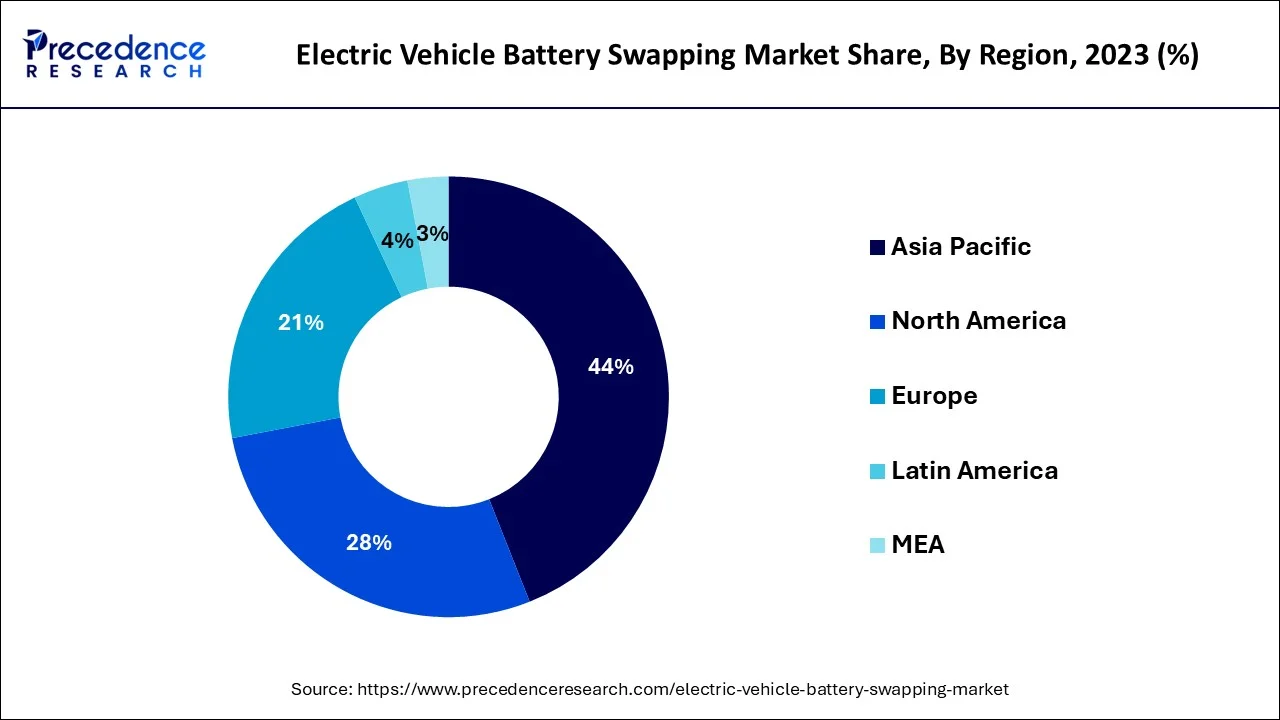

- In 2025, Asia pacific region accounted largest market share of around 44%.

- Europe will show good growth rate in near future.

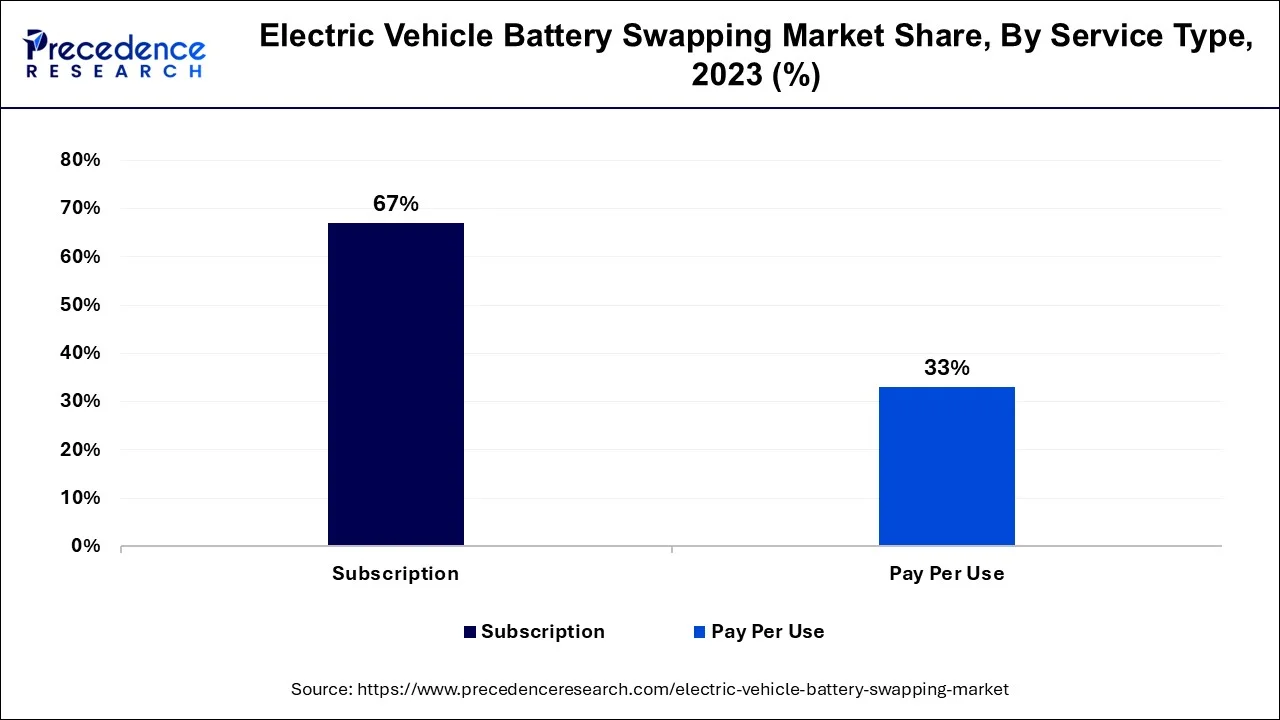

- By service type, the subscription segment accounted 67% revenue share in 2025.

Market Overview

This market segment mainly deals with the exchange of the discharged battery of an electric vehicle with completely charged battery unit immediately without wasting much time in recharging the old battery of the electric vehicle. The time which is wasted in this recharging process costs a great deal pertaining to the fast services which are demanded by the modern world. This procedure of exchanging and old battery which is discharged with a new fully charged unit is known as swapping of battery in the electric vehicle segment which provides quicker solutions in order to deal with anxiety. This working of a battery in the electric vehicle requires around 10 minutes or less and demands or smaller area in order to perform in the entire process of exchanging or swapping. It requires a much smaller space as compared to the charging stations.

BaaS has also shown a considerable alteration in the way these processes work by individualizing the entire concept of owning an electric vehicle and owning a battery individually. This new process helps to reduce the total cost of the electric vehicle which helps to boost the market for the batteries as well as electric type of vehicles. The owner of the electric vehicle and sub only for the machine and not for the energy which is required for functioning of the vehicle. In the energy required for the functioning of the vehicle is rented separately depending upon the needs of the consumer.

The rapid increase in the demand of electric vehicles has not matched the availability of the charging stations which are supplied for the public. This increases the total time which is required to charge a single battery of the vehicle as there are a large number of consumers and a very few number of charging stations. Manufacturers on the other hands are striving hard to reduce the total charging time of a single battery of the electric vehicle. The rapid increase of e-mobility has also boosted the demand for battery swapping services which helps to save a considerable amount of time of the consumers. This market of battery swapping has been segmented according to the service type, region and vehicle type.

The occurrence of the covid 19 pandemic made a great impact on the automotive industry worldwide which showcased a declining market for the old and new vehicles. The demand and supply chain of the used vehicles was hampered immensely. The business and revenue return of the key market players were impacted directly as a result of the decline in demand and supply chain which was hampered by the weak economic conditions worldwide. On the other hand, the pandemic helped to accelerate numerous beneficial trends the market even after the presence of a number of challenges for the startups. Rapid need for electrification has also help to increase the demand and supply of the segment full stop the concept of shared mobility has also helped to boost the market to a great extent. The presence of two wheelers and three wheelers in the market has supported this segment greatly. The recent trend of rentals and delivery has also boosted the sales and demand of the old and used vehicles. With the preparation for the upcoming market a concrete understanding of the altered mindset and strategies will help the stakeholders to upgrade their systems in the electric vehicle battery working market.

Electric Vehicle Battery Swapping Market Growth Factors

The rapid demand for major steps by the leading manufacturers and market players towards the global climate change and alterations in the environment has increased the demand for battery swapping services which are majorly required by the electric vehicle consumers who required quick charging facilities without wasting much time. The increasing awareness towards global warming and high carbon emissions in the environment has boosted the market for battery swapping services for the electric vehicle segment. The time which is required for recharging a totally exhausted battery is for more as compared to the time which is taken for swapping a fully charged battery unit into the electric vehicle of the consumer. Depending upon the demands and requirements of the consumers, the manufacturers have introduced a variety of electric vehicles into the market. The need for fast charging has increased as a result of the busy lifestyle which is followed by the working class of people. Rapid urbanization has increased the demand for power supply and quick services in the market.

The entire process of battery swapping hardly takes 10 minutes which is very beneficial for the consumers. Increased use of electric mobility has also boosted the market for the electric vehicle battery swapping market and services. Another initiative which is taken up by the manufacturers is separating the ownership of the batteries from the ownership of the electric vehicles. This has helped to boost the market for the electric vehicle segment to a great extent. The owner of the electric has to spend only for the ownership of the vehicle and not the battery unit which is usually provided as a part of the electric vehicle. A fully charged battery is supplied by the company as a part of its service to the customer which helps the consumer to receive a prompt delivery and service from the company. In case the battery of the electric vehicle gets fully discharged, a fully charged battery is supplied to the consumer immediately within 10 minutes which does not occupy much space as that of a charging station. The battery shop in services requires very less space and time to provide accurate service to the consumers.

Additionally, the maintenance and care of a battery is also taken away from the consumer which makes it easy for the user to carry on with an electric vehicle in the long run. The entire maintenance and care of a battery unit is taken up by the service provider of the battery swapping services. Hence, the total cost of maintaining an electric vehicle is reduced by a tremendous amount. The occurrence of the pandemic showed a negative impact on the battery swapping services as a result of the restricted movement and lockdowns which were imposed by the government. Hence, the demand for quick services was hampered directly. The demand for battery swapping services had increased in the health care sector where the need for a fully charged battery is very important in order to provide accurate service to the individuals.

The household sector has also shown a considerable increase in the demand for the battery swapping services. The rapid demand for electric vehicles pertaining to the increasing prices of the petroleum products has helped to boost the market size of the electric vehicle battery swapping market. People are looking forward to electric vehicles as an option for long distance travel. The electric vehicle battery swapping services is a very reliable backup for the long-distance travels where time is considered to be precious.

Market Outlook

- Industry Growth Overview:Battery swapping complements urban mobility delivery methods and business practices alike, and will help grow valuable revenue streams for trucking firms, municipalities, and other operators.

- Sustainability Trends: Due to the way that battery swapping initiatives extend the usable lifespan of batteries through the use of battery-to-battery applications and expert-level maintenance, battery recycling becomes much less complicated, and there is a clear and directive corridor for end-of-life processing of all used battery materials, which leads to improved overall efficiencies for the recycling of these critical resources.

- Global Expansion: Partnerships between automotive manufacturers, energy providers, and urban planners are the driving force behind global expansion. The emergence of battery swapping initiatives in many developing economies will provide an alternative to grid access issues and raise the level of the electric vehicle adoption rate more quickly than previously anticipated.

- Startup Ecosystem: Innovators in the startup community are excited about the current opportunities in the battery swapping industry and are developing products like artificial intelligence-powered battery diagnostics, compact swapping station designs, and flexible subscription programs for the fleets and shared mobility companies that operate in these same areas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.86 Billion |

| Market Size in 2026 | USD 6.77 Billion |

| Market Size by 2035 | USD 118.72 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 37.56% |

| Asia Pacific Market Share in 2025 | 44% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Opportunity

A significant opportunity in the EV battery swapping market is its ability to remove time spent for battery charging. In India, quick turnaround is essential for fleets and delivery services, and battery swapping can refresh the entire area with energy in under five minutes. SUN Mobility, for example, has more than 500 swap stations in India, enabling more than a million swaps a month. This availability of swaps results in limited downtime and less range anxiety, making EVs more accessible to sectors utilizing Transport as a Service including taxis and e-rickshaws. With India targeting more than 50% of two- and three-wheelers using swaps by 2030, battery swapping is rapidly gathering momentum.

Segment Insights

Service Type Insights

The market has been divided into two categories where the subscription variety has shown a tremendous growth pertaining to its easy accessibility. The affordable prices that are offered by the companies and manufacturers have boosted the market during the forecast period. The lower cost that has to be paid during every swap of a battery imposed lesser pressure on the consumer of the electric vehicle. The battery is leased to the consumer as per requirement depending upon the needs of the business.

The pay per use design has formed the next sector where a higher demand is expected from the market during the forecast period. The private vehicle users prefer this design more as compared to the former one. The consumers who do not require a vehicle very often and wish to avoid heavy expenses opt for this facility where the needs are fulfilled without spending a heavy amount from the pocket of the user.

Vehicle Type Insights

The market has been divided into three categories. The two wheeler category has shown the maximum sales and demand as a result of the high number of daily commuters in the society. The next sector which is covered under the segment is the three wheeler vehicles which are used as public transport mainly in the Asia Pacific regions. The three wheeler vehicles are expected to show a better revenue return during the forecast period as a result of its high sales and demand along with new brands. The battery swapping services offers better time management and durability. The battery swapping services are very useful for the three wheeler owners who usually have a low social economic status.

Regional Insights

What Made Asia Pacific the Leading Market for Electric Vehicle Battery Swapping?

The Asia Pacific electric vehicle battery swapping market size is evaluated at USD 1.94 billion in 2025 and is predicted to be worth around USD 48.13 billion by 2035, rising at a CAGR of 37.87% from 2026 to 2035.

The Asia Pacific region is leading the market overall as a result of the high sales it experiences. It is the largest market for the electric vehicle segment and hence it supports the batteries swapping services to a great extent. The huge working class which resides in this region desires for cheaper transport facilities which provide a great opportunity for the electric vehicle segment.

Since the battery swapping services reduces the maintenance cost of the electric vehicle, it is preferred by the working class of people. The next region which is expected to show considerable growth is the European market. The strict regulations of the North American market regarding carbon emissions have helped to boost the electric vehicle battery swapping market.

China Electric Vehicle Battery Swapping Market Analysis

China is experiencing rapid growth in the EV battery swapping battery due to a combination of factors such as government support, technological advancements, and the demand for faster charging solutions. Government subsidies and pilot programs encourage the development of battery swapping infrastructure. The technological developments in battery standardization and swapping efficiency make the process more viable. Additionally, the need for rapid refueling for commercial EVs and fleet operators, as well as the potential to reduce the upfront cost of EVs through battery leasing, further drive the growth of this market. China's large and growing EV market provides a strong foundation for the development of battery swapping infrastructure.

India Electric Vehicle Battery Swapping Market Analysis

India's EV market is experiencing rapid growth, especially in two- and three-wheelers. This increase in demand for EVs, particularly in urban areas, creates a need for efficient and convenient charging solutions, making battery swapping an appealing option. The Indian government has been actively promoting battery swapping infrastructure through various policies and incentives. This includes establishing a framework for battery swapping, providing financial incentives to companies investing in swapping infrastructure, and setting standards for battery swapping stations. Battery swapping eliminates the need for long charging times, allowing vehicles to be quickly refueled and back on the road. This is a significant advantage for users who need to operate their vehicles frequently, such as commercial drivers and fleet operators.

Why is North America Second Growing Market?

Then is North America with the U.S. leading regional growth. As, electric two-wheels and light delivery vehicles, mainly focused on last mile logistics, have increased demand for battery swap. Market have witnessed emerging start-ups and established EV technology companies establish swap station networks with logistics and shared-ridership business partners. The "micro-mobility" trend of several U.S. cities is related in some instances to battery swapping being a more efficient type of REFUELING option than charging. Also, increased consumer awareness combined with clean energy programs at the state-level adds a firm base for potential growth in this market section.

U.S. Electric Vehicle Battery Swapping Market Analysis

The U.S. market is driven by federal funding programs that promote innovative charging solutions, along with private companies advancing battery-swapping technologies. The federal government is actively expanding the national electric-vehicle charging network through multiple funding initiatives. At the same time, several U.S. companies are accelerating the development and deployment of battery-swapping systems, particularly for commercial fleets and specialized applications. Leading players such as Ample have introduced battery-swapping technology through strategic partnerships with fleet operators, further strengthening the country's EV ecosystem.

What Makes Europe the Fastest-Growing Region in the Market?

Europe is positioned to be the fastest-growing region in the electric vehicle battery swapping market due to greater policy support, environmental mandates, and increased investment in electrification infrastructure development. Several countries are putting support behind EV battery swapping which are particularly led by Germany, who has dedicated pilot programs and incentives for EV fleet operators, and several auto manufacturers have developed partnership with battery technology firms, among others. More than convenience, Europe sees battery swapping as a fast, convenient alternative to charging stations in line with eco-sustainability and reduction in fossil fuels

France Electric Vehicle Battery Swapping Market Analysis

The French government has introduced a range of electric-mobility initiatives, focusing in particular on substantial subsidies for the purchase of electric vehicles. Domestic companies such as ZEWAY are also contributing to this transition by developing a nationwide network of battery-swapping stations for electric scooters. Together, these efforts aim to make electric vehicles more accessible to the public and to strengthen the European automotive industry. Key measures include financial incentives such as the ecological bonus and social-leasing schemes. In July 2025, the European Union selected one of six major electric-vehicle battery projects for funding, including AGATHE, an advanced gigafactory designed to reduce greenhouse-gas emissions in France, with a total investment of €852 million.

What Factors Drive the Latin American Electric Vehicle Battery Swapping Market?

The Latin American market is expected to grow at a notable rate during the forecast period. This regional expansion is driven by private-sector initiatives and the development of broader charging infrastructure. South American countries such as Chile have adopted ambitious electromobility goals, including achieving 100% electrification of public transport by 2040. Others, like Argentina, are attracting investments in battery manufacturing and expanding their lithium industries.

In Chile, energy transition laws emphasize renewable energy storage and infrastructure development. Meanwhile, companies such as Gogoro and U Power are accelerating market growth by introducing major investments and new two-wheeler products in countries including Brazil, Colombia, and Chile.

Brazil Electric Vehicle Battery Swapping Market Analysis

Brazil leads the market in Latin America. The market in the country is growing due to the rapid shift toward electric vehicles. In July 2025, the International Council on Clean Transportation (ICCT Brazil), with support from the United Nations Environment Programme (UNEP), reported that the transition to electric vehicles could significantly increase job creation in Brazil by 2050. By September 2025, the country had already demonstrated strong market momentum, surpassing 200,000 electrified light-vehicle sales for the year. In August 2025, Contemporary Amperex Technology Limited (CATL), a leading Chinese battery manufacturer, announced plans to begin producing electric-vehicle batteries in Brazil, further strengthening the nation's position within the regional EV supply chain.

What Potentiates the Growth of the Electric Vehicle Battery Swapping Market Within the Middle East & Africa?

The market in the Middle East & Africa (MEA) is driven by strong private-sector initiatives in Africa as well as targeted government programs promoting electric vehicles. In October 2025, Spiro, Africa's leading two-wheel transportation and battery-swapping company, secured a $100 million investment, marking one of the region's largest commitments to electric mobility. Growing commercial interest and an increasingly favorable environment for future collaborations are further driving market expansion. In addition, governments across the region have focused on building a domestic EV battery industrial chain through new agreements and strategic investments made in 2024 and 2025.

Saudi Arabia Electric Vehicle Battery Swapping Market Analysis

The Saudi government and state-funded companies aim to develop and install a comprehensive network of fast-charging stations across the kingdom. Many companies are working to build a fully localized EV charging network, including hardware and software, designed to address and overcome specific climate challenges. Domestic companies are also striving to make the charging network more accessible and affordable for drivers. The Public Investment Fund (PIF) and the Saudi Electricity Company have formed a joint venture to establish a national charging network.

Electric Vehicle Battery Swapping Market-Value Chain Analysis

- The EV battery swapping supply chain is more than the hardware used in the swapping processes. It also includes service management, analysis of data, and the lifecycle of batteries. Battery Swapping companies such as NIO, Gogoro, and Ample utilize software technology to manage battery data and maintain predictive maintenance for their users.

- Battery Design and Standardization: To allow batteries interchangeability on different platforms and thus reduce the complexity of managing battery costs, the manufacturers focus on modularizing the battery architecture.

- Infrastructure Management and Platforms: Battery swapping operators build automated stations that integrate cloud-based systems with infrastructure that assesses battery health, tracks battery inventory, and authenticates customers in real-time.

- Lifecycle, Analytics, and Secondary Use of Batteries: Central to battery swapping operators is their approach to managing multiple uses for aging batteries as stationary storage. Battery swapping operators can optimize their battery utilization and increase their profitability.

Electric Vehicle Battery Swapping Market Companies

- Numocity

- BAIC

- ChargeMyGaadi

- NIO

- KYMCO

- Amplify Mobility

- Gogoro

- Sun Mobility

- Lithion Power

- Ample

- ECHARGEUP

- Amara Raja

- Aulton New Energy Automotive Technology

- Others

Latest Updates on Electric Vehicle Battery Swapping Market in 2025

- Battery-as-a-Service (BaaS)

It is a business model where customers pay for battery usage or access rather than purchasing the battery outright. This model, which includes battery leasing, renting, and swapping, aims to make EVs more affordable and accessible by reducing the initial financial burden of battery ownership. BaaS reduces the initial investment required for EV ownership and make it more attractive to budget-conscious buyers. Customers can switch to a different battery capacity or usage plan based on their needs, and battery swapping provides a quick and convenient way to recharge. BaaS can offer lower running costs than conventional ICE vehicles, as the per-kilometer cost of electricity is typically less than the cost of fuel. BaaS can reduce the hassle of EV ownership by handling battery maintenance and replacement, and customers do not need to worry about battery degradation.

- Automated Swapping Stations

They offer a faster, more convenient way to power electric vehicles (EVs) by allowing quick battery exchanges instead of traditional charging. These stations use robotic systems to swap a depleted battery pack for a fully charged one in a matter of minutes, potentially revolutionizing how EVs are powered. Swapping is significantly faster than charging, potentially reducing downtime for EVs. Drivers can avoid long charging times and potentially "range anxiety," as they can quickly replace their battery with a full one. Modular swapping stations can be expanded or reconfigured to meet changing demand.

Recent Developments

- In may 2025, Changan Automobile announced that it had delivered 1,000 Oshan 520 models, the first electric vehicle (EV) based on CATL's Choco-SEB swappable batteries that can gain a full recharge in 100 seconds. (Source: https://electrek.co)

- In May 2024, the Maharashtra government announced the establishment of battery recycling hubs in Mumbai, Pune, Nagpur, and Chhatrapati Sambhajinagar. The initiative offers funding around Rs 10 lakh per station, for DC charging and battery swapping stations. (Source: https://punemirror.com)

- In December 2024, CATL, a global leader in innovative new energy technology in collaboration with nearly 100 partners unveiled Battery Swap Ecosystem to promote the standardization of battery swapping, with the focus on the standardization of battery dimensions. (Source: https://www.catl.com)

- NIO and Sinopec together introduced the NIO Power Swap Station 2 which is located at Sinopec's station. This project is situated in China. It is the first of its kind under this collaboration. It is also the second of its kind under this segment where battery swapping takes place. It mainly represents the introduction of NIO Power Swap Station 2. This event took place in April 2021.

- In June 2021, Ample and ENEOS landed into a collaboration in order to install the technology for battery swapping in Japan. The passenger companies and delivery services will be making use of them in the initial phase by the end of March 2022.

Segments covered in the report

By Vehicle Type

- Two-Wheeler

- Three-Wheeler Passenger vehicle

- Three-Wheeler Light commercial vehicle

- Four Wheeler Light commercial vehicle

- Buses

- Others

By Service Type

- Subscription

- Pay Per Use

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content