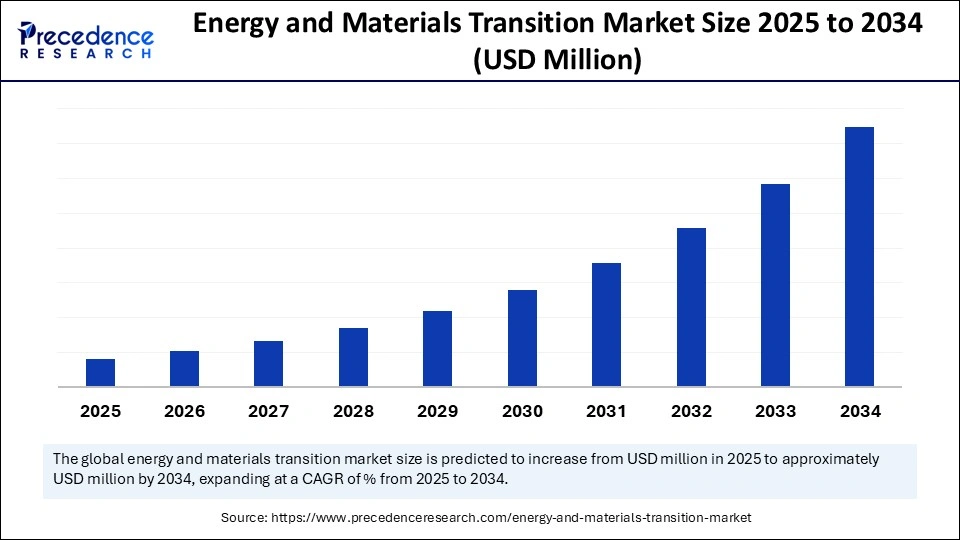

Energy and Materials Transition Market Size and Forecast 2025 to 2034

Discover insights into the energy and materials transition market, including drivers, challenges, and emerging opportunities in clean energy and materials. The market growth is attributed to increasing government regulations on carbon emissions, rising investments in renewable energy infrastructure, and technological advancements in energy storage and smart grid systems.

Energy and Materials Transition MarketKey Takeaways

- Asia Pacific dominated the energy and materials transition market in 2024.

- North America is expected to grow at the highest CAGR between 2025 and 2034.

- By energy source, the renewable energy segment held the major market share in 2024.

- By energy source, the non-renewable segment is expected to grow at the highest CAGR during the forecast period.

- By technology, the energy storage systems segment contributed the biggest market share in 2024.

- By technology, the EV charging infrastructure segment is expected to expand at the fastest pace in the coming years.

- By application, the power generation segment dominated the market in 2024.

- By application, the residential & commercial buildings segment is expected to grow at a significant CAGR over the projected period.

- By sector, the power and utilities segment contributed the largest market share in 2024.

- By sector, the transportation segment is expected to grow at a notable CAGR from 2025 to 2034.

- By business model, the distributed energy systems segment captured the highest market share in 2024.

- By business model, the energy as a service (EaaS) segment is expected to grow at the fastest CAGR during the forecast period.

How Does AI Impact the Energy and Materials Transition Market?

Marvelous progress is possible in low-carbon energy and materials systems due to AI's ability to improve the planning, implementation, and use of these technologies. Artificial Intelligence is applied by developers to boost battery storage, make photovoltaics more efficient, and improve the performance of wind turbines using current data and predictions. AI helps to identify compounds that are sustainable. Furthermore, grid operators used AI to bridge the gap between supply and demand, incorporate green energy into the grid, and catch any interruptions early.

Market Overview

The energy and materials transition market is witnessing significant growth, driven by the increased efforts of industries to lower greenhouse emissions. The market revolves around the production and distribution of technologies and solutions that help replace fossil fuel systems with renewable energy. There is a rapid shift toward renewable energy sources, driven by the need to reduce carbon emissions and environmental impact. This transformation depends greatly on new technologies, including advanced battery storage systems, smart grids, and green hydrogen production. This further helps to integrate solar and wind energy more easily into the energy system. Furthermore, long-term support from regulators and growing climate commitments are expected to fuel the demand for energy transition technologies.

Energy and Materials Transition MarketGrowth Factors

- Rising Demand for Decentralized Energy Systems: Increasing adoption of localized energy generation is driving demand for flexible, efficient energy solutions.

- Growing Electrification of Transportation: Expanding electric vehicle markets are propelling investments in related infrastructure and clean energy integration.

- Boosting Energy Efficiency Regulations: Stricter efficiency standards across industries stimulate the development and deployment of advanced transition technologies.

- Fueling Innovation in Grid Modernization: Smart grid advancements and digital monitoring systems are enhancing energy management and operational reliability.

- Expanding Corporate Sustainability Commitments: Businesses are driving market growth by adopting renewable energy and sustainability targets aligned with global ESG goals.

- Propelling Off-Grid and Remote Area Electrification: Increasing focus on energy access in underserved regions fuels demand for modular and renewable-based energy systems.

- Driving Growth Through Public-Private Partnerships: Collaborative funding and policy support accelerate the deployment of clean energy projects and infrastructure upgrades.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Energy Source, Technology, Application, Sector, Business Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Do Corporate Sustainability Goals Drive the Adoption of Low-Carbon Technologies?

With growing concerns regarding climate change and greenhouse gas emissions, several companies are setting targets to mitigate climate change challenges. This creates the need for low-carbon technologies. Firms operating in automotive, manufacturing, and construction are deciding on science-based targets and shifting their supply chains to address emission challenges. In 2025, more than 10,000 organizations have either set or said they will adopt science-based climate targets approved by the Science Based Targets Initiative (SBTi). These teams should make use of advanced electric heating and energy management tools that break down materials naturally. Companies are, therefore, making these transitions to support their environmental, social, and corporate governance goals and gain the trust of their stakeholders. BloombergNEF's study Energy Transition Investment Trends 2025 found that Investment in the low-carbon energy transition worldwide grew 11% to hit a record USD 2.1 trillion in 2024.

(Source: https://www.esgtoday.com)

(Source: https://about.bnef.com)

Restraint

High Upfront Costs Hamper Adoption of Advanced Transition Technologies

The high initial investment required for procuring advanced transition technologies is expected to hinder the growth of the energy and materials transition market. The initial cost of installing advanced change-related technology is very high, limiting adoption in price-conscious and underdeveloped markets. Establishing energy and material transition infrastructure requires substantial investments in energy storage systems, carbon capture equipment, and green hydrogen plants. This creates barriers for small organizations. Many firms struggle to secure funds without strong support from the government or long-term agreements.

Opportunity

How Are Government Investments Accelerating Global Energy and Materials Transition?

Increasing government investments in clean technologies are expected to create immense opportunities for the players competing in the market. More money from the government for clean technology research drives factories and utilities to use sustainable solutions. Publicly offered subsidies, tax reductions, and research grants help companies develop low-emission power sources, capture carbon, and create green hydrogen facilities. This creates demand for solutions, including energy and materials that help achieve decarbonization over the long run. According to the IEA, in 2024, global expenditure on clean energy by governments reached a historic high of USD 2 trillion, and most of that, around 80%, went to the U.S., European Union, and China. In August 2024, the European Commission's Recovery and Resilience Facility had already supplied €265.4 billion, allowing for the addition of more than 100 GW of new renewable energy throughout member states. Furthermore, public funding encourages a worldwide trend toward making energy more reliable for cutting emissions, thus further fuelling the market.

(Source: https://about.bnef.com)

(Source: https://energy.ec.europa.eu)

Energy Source Insights

The renewable energy segment dominated the energy and materials transition market with the largest share in 2024 due to the fast growth and widespread use of wind power. Both governments and private companies increased their investments in wind energy, both onshore and offshore, to comply with regulations for less pollution and to add more diverse sources of energy. Moreover, having feed-in tariffs and renewable energy standards in several regions bolstered the growth of this segment.

The non-renewable segment is expected to grow at the highest CAGR during the forecast period, owing to advances in cleaner alternatives to fossil fuels and interim energy sources. It is believed that natural gas and advanced carbon capture storage help maintain sufficient energy and also cut harmful emissions. Experts expect industries to make use of blue hydrogen, a natural gas that is turned into green hydrogen using carbon capture. This helps smooth out the impact of non-renewable energy sources. Furthermore, with the new regulations stressing the importance of emission reduction and keeping energy supplies steady, investing in retrofitting current infrastructure has become more common to use cleaner, non-renewable methods.

Technology Insights

The energy storage systems segment held the largest revenue share of the energy and materials transition market in 2024. This is mainly due to their important role in making the grid more flexible and optimizing energy usage. The rising use of lithium-ion batteries in utility and business applications is the result of continual improvements in their capacity, performance, and costs. Low-carbon efforts were accelerated in North America, Europe, and Asia-Pacific due to government support and encouraging policies. The IEA noted that global storage capacity increased by an impressive 30% in 2024 due to rising decarbonization and electrification pushing the industry. Furthermore, energy storage systems are used more widely in both commercial and residential sectors as a backup plan during blackout, boosting the segmental growth.

(Source: https://www.iea.org)

The EV charging infrastructure segment is expected to expand at the fastest pace in the coming years, driven by the rising popularity of electric vehicles and new emission goals set by different countries. The expansion of fast charging stations, smart charging, and V2G is expected to greatly influence transportation energy systems. Moreover, the EV charging infrastructure becomes crucial for helping clean mobility and driving the market of energy and materials transition.

Application Insights

The power generation segment dominated the energy and materials transition market in 2024. This is mainly due to the energy sector's shift toward renewables and away from fossil fuels. Both utilities and independent power producers made renewable power plants, energy storage integration, and updated grid systems the main priorities to strengthen efficiency and safety. With stricter rules and greater incentives from governments worldwide, there is rapid growth in solar, wind, and hydro energy projects to reduce dependence on fossil fuels. Furthermore, the World Bank highlighted the need for more spending on clean energy projects in emerging countries, thus further supporting the energy and material markets.

The residential & commercial buildings segment is expected to grow at a significant CAGR over the projected period, owing to the growing need for energy efficiency and more strict rules for carbon neutrality. Building operations are changing due to the increased use of advanced materials, efficient HVAC systems, and smart meters that use on-site renewable energy. In 2024, the U.S. Department of Energy (DOE) pointed out that retrofitting buildings with energy-saving measures became much more frequent, pushed by support from the government and a growing interest among consumers. Furthermore, the new energy performance rules passed by the government organization regarding energy and material transition for residential spaces will further fuel the market in the coming years.

(Source: https://www.energy.gov)

Sector Insights

The power & utilities segment held the largest revenue share of the energy and materials transition market in 2024 due to the increased infrastructure upgrades that created the need for both renewable energy sources and devices for energy storage. To meet regulatory demands, businesses had to speed up closing coal-fired plants and put more money into solar, wind, and hydropower options. According to the International Energy Agency (IEA), in 2023, utility-scale renewable capacity rose significantly with favorable policies, and the cost of renewable technology dropped. Moreover, the energy sector continues to be a strong driver in promoting wider energy transitions, fueling the market.

(Source: https://www.iea.org)

The transportation segment is projected to grow at the highest CAGR in the coming years, owing to the high number of electric vehicles and greater demand for environment-friendly transport. Governments across the globe have set tough goals for increasing electric vehicle (EV) numbers, which has encouraged more spending on EV production, new batteries, and charging points.

According to the International Renewable Energy Agency (IRENA), more people bought electric vehicles in 2024, partly because there were more vehicle models to choose from and the public was accepting them more. Furthermore, the new smart charging methods help to make energy use more efficient and encourage more use of renewable power. This situation makes transportation a key force propelling new energy and materials solutions.

(Source: https://www.iea.org)

Business Model Insights

The distribution energy systems segment dominated the energy and materials transition market in 2024. This is mainly due to their growing utilization by small-scale energy generation. More rooftop solar, community microgrids and behind-the-meter batteries point to a move to better energy security and less waste during transmission. BNEF reported that there was a rapid increase in distributed energy resources, for their lower costs of photovoltaics and battery storage. Furthermore, distributed generation is becoming more commonplace with strong policies and modern finance ideas, such as net metering and peer-to-peer energy trade.

The energy as a service (EaaS) segment is projected to grow rapidly in the future years. As energy requirements become flexible, scalable, and cost-effective without needing to pay for equipment, the importance of EaaS models is increasing quickly. Multiple services in energy supply, control, efficiency, and renewables are provided by EaaS companies either by subscription or payment per use. Additionally, the companies desire clear and responsible ways to handle energy, so sustainability reporting and adopting ESG values prompt more use of EaaS.

Regional Insights

Asia Pacific led the energy and materials transition market, capturing the largest revenue share in 2024. This is mainly due to its large manufacturing sector and wide use of renewable power. Due to quick city growth and government plans in countries such as China, India, and Japan, spending on solar, wind, and energy storage projects rose rapidly. According to the International Renewable Energy Agency (IRENA), in 2024, Asia-Pacific installed the most renewable energy worldwide, thanks to helpful policies and cheaper technology, along with many big infrastructure projects.

More industries and vehicles have switched to electricity in Central Asia, and the demand for clean energy is rising. The deployment of clean energy has been supported by public-private partnerships and new ways of financing, particularly in countries where providing energy access is very important. Furthermore, the growing emphasis on improving both the economy and energy security is expected to drive the market in this region.

(Source: https://www.irena.org)

North America is anticipated to grow at the fastest rate in the market during the forecast period, owing to strong government support and greater corporate efforts to reduce carbon. Due to the Inflation Reduction Act and similar support, more renewable energy projects, upgrades to the electrical grid and energy efficiency technologies were put into use in the US and Canada. EIA revealed that funding in 2024 for clean energy projects was higher, supported heavily by actions from both national and local governments.

Private sector progress in batteries and hydrogen supported the area's movement toward clean energy. A greater focus on handling climate disasters and keeping the grid protected has resulted in more development of microgrids and further use of small energy resources. Through its 2024 report, BloombergNEF found that more investment in renewable startup businesses in North America sparked new developments in greener energy technology. Furthermore, the IEA stressed that having government and industry work together helped expedite projects for making green hydrogen.

(Source: https://about.bnef.com)

Europe is expected to experience notable growth during the forecast period due to the growing concerns over climate change. The region's ambitious goal is to become carbon neutral by 2050 further supports regional market growth. The EU's Green Deal and Fit for 55 inspired member states to invest faster and set challenging goals for energy and emissions. In its 2024 report, the European Commission stated that the region kept adding more renewable energy as part of new advancements in offshore wind and green hydrogen. Efforts were made for the public and private sectors to cooperate in financing large-scale projects focused on infrastructure and cutting carbon. Additionally, Europe has taken a leading role by developing circular economy plans that help with the move to cleaner energy and make better use of resources, facilitating the market growth in the coming years.

(Source: https://www.eca.europa.eu)

Energy and Materials Transition Market Companies

- Brookfield Renewable Partners

- Canadian Solar

- EDP Renewables

- Enphase Energy

- First Solar

- GE Renewable Energy

- Iberdrola

- NextEra Energy

- Plug Power

- Siemens Gamesa

- Sunrun

- Tesla

- Vestas

- Xcel Energy

Recent Developments

- In December 2024, Rio Tinto and Imperial College London established the Rio Tinto Centre for Future Materials with a commitment of $150 million over the next decade. This center aims to accelerate innovation in sustainable material technologies critical to the energy transition. Supported by the UK Government, the initiative will drive advancements in the responsible sourcing, processing, usage, and recycling of materials to ensure environmental, economic, and social sustainability across supply chains.

- In September 2023, global reinsurer SCOR strengthened its commitment to climate by aligning its underwriting and investment policies with its broader energy transition strategy. As part of its Forward 2026 plan, SCOR aims to increase insurance coverage for low-carbon energy by a factor of 3.5 by 2030, and engage with clients accounting for at least 30% of SCOR Specialty Insurance Single Risk premium over the next three years to evaluate and support their ESG transition strategies.

- In April 2024, United Nations Secretary-General António Guterres announced the formation of a high-level UN Panel on Critical Energy Transition Minerals. Co-chaired by Ditte Juul Jørgensen, Director-General for Energy at the European Commission, and Ambassador Nozipho Mxakato Diseko of South Africa, the panel will focus on developing voluntary global principles for equity, transparency, and sustainability in extractive industries. This framework will serve as a guide for governments and stakeholders to align mineral supply chains with climate and human rights goals.

(Source: https://economictimes.indiatimes.com)

(Source: https://www.riotinto.com)

(Source: https://www.scor.com)

(Source: https://energy.ec.europa.eu)

Segments Covered in the Report

By Energy Source

- Renewable Energy

- Non-Renewable

By Technology

- Energy Storage Systems

- Grid Modernization & Smart Grids

- Carbon Capture and Storage (CCS)

- Hydrogen Production Technologies

- EV Charging Infrastructure

By Application

- Power Generation

- Transportation Electrification (EVs, Charging)

- Industrial Decarbonization

- Residential & Commercial Buildings

- Heating and Cooling

- Grid Integration

By Sector

- Power & Utilities

- Transportation

- Industrial

- Residential

- Commercial

- Agriculture

By Business Model

- Centralized Energy Systems

- Distributed Energy Systems

- Energy-as-a-Service (EaaS)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting