What is the Enzyme Engineering Market Size?

The global enzyme engineering market is witnessing rapid growth as industries utilize engineered enzymes to improve efficiency in pharmaceuticals, food processing, and biofuels.The market is witnessing robust growth driven by growing demand in the pharmaceutical & diagnostic sector, rising focus on sustainable practices across various industries, increasing demand for processed foods & beverages, growing investments in research and development activities, and rapid advancements in enzyme engineering.

Enzyme Engineering Market Key Takeaways

- North America held the largest share in the enzyme engineering market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By technology, the rational design segment captured the biggest market share 2024.

- By technology, the directed evolution segment is expected to witness a significant CAGR during the forecast period.

- By product type, the industrial enzymes segment held the major market share in 2024.

- By product type, the specialty enzymes segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the pharmaceuticals & biotechnology segment contributed the highest market share in 2024.

- By application, the biofuels segment accounted for considerable growth over the forecast period.· By end-user, the industrial manufacturers segment generated the major market share in 2024.

- By end-user, the academic & research institutes segment is expected to grow significantly during the forecast period.

What Is Enzyme Engineering?

The market is experiencing significant demand for engineered enzymes from various sectors such as pharmaceuticals, biotechnology, food & beverages, biofuels, textiles, industrial manufacturing, agriculture, and environmental. Enzyme engineering is the process of tailoring existing enzymes or generating enzymes with novel and improved characteristics.

Rational design, directed evolution, hybrid/integrated approaches (rational + evolutionary), and other emerging methods (AI/computational, CRISPR-based, etc.) are the major approaches used widely in enzyme engineering. The enzyme engineering market refers to the development, modification, and application of enzymes using advanced techniques such as protein engineering, directed evolution, recombinant DNA technology, and computational design to enhance enzyme stability, activity, and specificity.

AI Shifts in the Enzyme Engineering Market

In the rapidly evolving technological landscape, artificial intelligence emerges as a game-changer and holds potential for growth and innovation in the enzyme engineering market. AI algorithms predict optimal mutations for enhancing enzyme function, which enables researchers to effectively engineer enzymes with significantly increased catalytic efficiency and stability. Several researchers are increasingly leveraging machine learning algorithms to create new enzymes and proteins. This is a crucial step in protein design as new enzymes are widely used across medicine and industrial manufacturing.

The incorporation of AI-driven solutions assists in lowering development cycles, reducing costs, and enabling the creation of specialized enzymes for numerous industrial and therapeutic uses. AI-engineered enzymes are being extensively developed for advanced diagnostics, therapeutics, and drug synthesis. AI's role in accelerating the research process positions it as a crucial tool responsible for advancing the global transition towards a more efficient and sustainable process.

- In September 2025, Samsara Eco, the startup that launched the plant in Jerrabomberra near Canberra, claims to be the first company to develop “textile-to-textile” recycling – a process that extracts plastic fibres from end-of-life garments so they can be reused to create new clothing. A commercial-scale plant that will use AI-developed enzymes to recycle waste textiles and plastics has opened in New South Wales, Australia.(Source: https://www.thechemicalengineer.com)

Enzyme Engineering Market Outlook

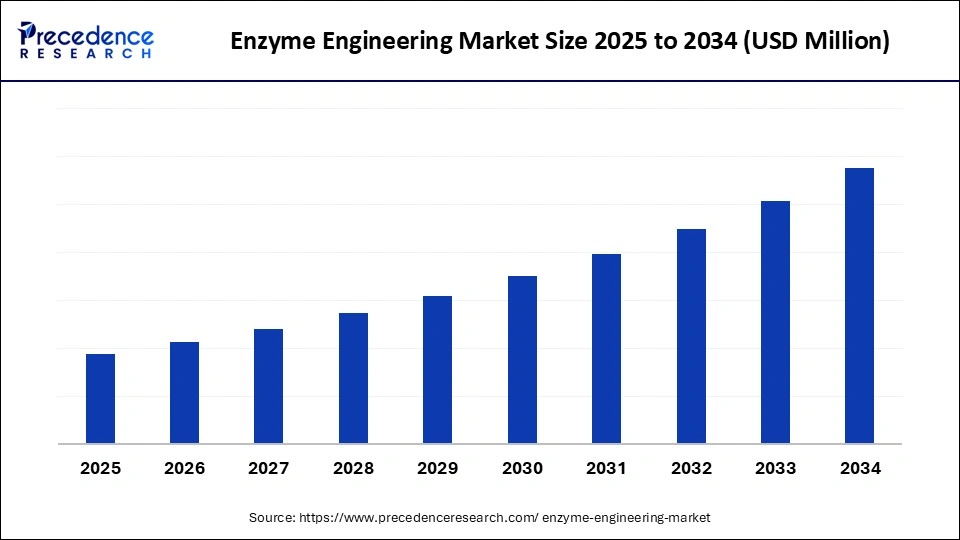

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth owing to the increasing demand for sustainable industrial processes, biocatalysis in drug development, green chemistry practices, and supportive government initiatives and regulations. As the emerging market continues to develop, the market is experiencing increasing demand for enzyme-based solutions for various applications such as drug formulation, disease diagnostics, biofuel production, textile processing, starch processing, and others.

- Sustainability Trends: The market is experiencing a push for sustainable and eco-friendly solutions. Several industry players are increasingly adopting enzyme-based solutions as environmentally friendly alternatives. Enzymes act as natural catalysts to replace harsh chemicals, generate less waste, and reduce energy consumption in production processes, which leads to cleaner production practices and reduced pollution in the environment. Enzymatic processes are more energy-efficient and align with corporate ESG goals, contributing to a more circular economy.

- In August 2024, AB Enzymes announced a new distribution agreement in the pulp & paper segment with APC Group, a premier specialty chemical and process solution provider in Asia. This strategic partnership grants APC Group sole rights to distribute AB Enzymes' innovative products in China, India, most of Southeast Asia, and the Middle East. It underscores both companies' commitment to promoting sustainable solutions and environmental stewardship in the region.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in September 2025, Brenntag Specialties, the global market leader in chemicals and ingredients distribution, entered a distribution agreement with Lallemand Bio-Ingredients Food Enzymes for Food & Nutrition in North America. The agreement expands the current Europe collaboration into North America. Through this expanded agreement, Lallemand's Nutrilife baking enzyme range will collaborate with Brenntag Nutrition & Food to deliver commercial and technical expertise and direct access to a comprehensive and growing baking enzyme portfolio for Brenntag's U.S. and Canada customers. The company's new collaboration with Lallemand in North America is designed specifically to bring cutting-edge enzyme innovations to the baking industry.

Major Investment and Government Initiatives in the Market

- In May 2025, Roche announced that it plans to invest up to USD 550 million in its diagnostics site in Indianapolis by 2030. The site will become a major hub for the manufacturing of Roche's continuous glucose monitoring (CGM) systems, marking a new milestone in Roche's long history of revolutionizing healthcare. Indianapolis serves as the North American headquarters for Roche Diagnostics. This latest expansion underscores Roche's commitment to advancing science, driving innovation, and delivering cutting-edge solutions that improve patient outcomes.(Source: https://diagnostics.roche.com)

- In September 2024, the Indian government plans to boost ‘2G ethanol' production and set up enzyme-manufacturing facilities to reduce imports. The first such manufacturing plant may come up in Haryana's Manesar and will likely be a supplier to the proposed 2G bio-ethanol plants in Mathura (Uttar Pradesh), Bhatinda (Punjab), and an existing plant in Panipat (Haryana). The BioE3 (Biotechnology for Economy, Environment and Employment) policy aims to set up ‘bio-foundries' that will produce biotechnology-developed feedstock and catalysts.(Source: https://www.thehindu.com)

- In August 2025, Bihar launched its newly amended Biofuel Policy 2025, marking a major step toward sustainable industrial growth and positioning the state as a future green energy hub. The policy aims to attract substantial investment in the biofuel sector, create large-scale employment, and provide significant environmental benefits. The Deputy Chief Minister announced an ambitious target of establishing 10 compressed biogas (CBG) plants in Bihar by the end of this year, with an expected investment of over Rs1,500 crore. These plants are projected to produce 5 lakh tonnes of CBG annually.(Source: https://patnapress.com)

- In February 2024, Codexis, Inc., a leading enzyme engineering company, entered into an agreement with Roche for an exclusive, global license for the company's newly engineered double-stranded DNA (dsDNA) ligase for next-generation sequencing (NGS) library preparation and the company's EvoT4 DNA ligase. Additionally, in February 2021, the company announced its expansion of its operations into a new 36,000-square-foot facility in San Carlos, CA, under a ten-year lease. This facility will provide space for additional research and development laboratories and related office space.(Source: https://www.codexis.com)

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Product Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Breakthroughs Made by Market Players in the Market

| Key player | Date | Breakthrough |

| NREL, the University of Massachusetts Lowell, and the University of Portsmouth (A successful collaboration involving a trio of research institutions) |

In June 2025 | The researchers, from the National Renewable Energy Laboratory (NREL), the University of Massachusetts Lowell, and the University of Portsmouth in England, partnered on the biological engineering of improved PETase enzymes that can break down polyethylene terephthalate (PET). With its low manufacturing cost and excellent material properties, PET is used extensively in single-use packaging, soda bottles, and textiles. (Source: https://www.nrel.gov) |

| Olon and Biosphere | In May 2023 | Olon and Biosphere have jointly announced they have developed a new production process through the engineering of the target enzyme, which has given extremely positive conversion results. (Source: https://manufacturingchemist.com) |

| Corbion and Brain Biotech | In August 2025 | Corbion, a global leader in sustainable ingredients, and Brain Biotech AG, a pioneer in specialty enzyme and microbial technology, have announced a strategic collaboration to develop innovative biobased antimicrobial compounds. The partnership marks a significant step towards advancing food preservation solutions that meet the ongoing demand for natural and sustainable products. (Source: https://www.chemanalyst.com) |

| eXoZymes Inc. | In April 2025 | eXoZymes Inc., a pioneer of AI-engineered enzymes that can transform sustainable feedstock into nutraceuticals, medicines, and other essential chemicals, announced its latest initiative - BioClick - a pioneering concept designed to enhance and accelerate the engineering of enzymes for advanced chemical reactions. Funded in part by a $300K grant from the National Institutes of Health (NIH), this project has the potential to revolutionize how medicines and other bio-based compounds are created. (Source: https://www.globenewswire.com) |

Segmental Insights

Technology Insights

Which Segment Is Dominating the Enzyme Engineering Market by Product Type?

The rational design segment dominated the global enzyme engineering market in 2024. Rational design is widely adopted due to precise control and structural insights. Rational design is technically easy and inexpensive. The rational design strategy to engineer enzymes is to predict the potential mutants based on the understanding of the relationships between function and protein structure. On the other hand, the directed evolution segment is expected to witness remarkable growth during the forecast period.

Directed evolution is rapidly expanding due to its ability to generate novel enzymes efficiently. Directed evolutions assist in protein engineering by significantly improving the stability of proteins in high temperatures or harsh solvents, which enhances the binding affinities of therapeutic antibodies and changes the substrate specificity of pre-existing enzymes.

Product Type Insights

What Causes the Industrial Enzymes Segment to Dominate the Market for Enzyme Engineering?

The industrial enzymes segment held a dominant presence in the enzyme engineering market in 2024. Enzyme engineering modifies enzymes to improve their performance, enabling their use across diverse industries such as food and beverage, detergents, biofuels, textiles, animal feed, agriculture, and environmental sustainability through bioremediation. Engineered enzymes are crucial in the production of biofuels, food processing, detergents, textiles, and fine chemicals. The development of highly efficient biocatalysts assists in reducing waste, conserving energy, and protecting the environment, contributing to a sustainable future. On the other hand, the specialty enzymes segment is expected to grow at a notable rate. The growth of the segment is attributed to the unique properties of specialty enzymes that make them valuable for several applications in pharmaceuticals, research & biotechnology, diagnostics, and nutraceuticals. Such factors are boosting the segment's expansion in the coming years.

Application Insights

How Did the Pharmaceuticals & Biotechnology Segment Dominate the Enzyme Engineering Market in 2024?

The pharmaceuticals & biotechnology segment held the majority of the market share in 2024. The growth of the segment is driven by the strong demand for drug synthesis, diagnostics, and therapeutics, rapid advancements in biotechnology, and the expansion of personalized medicine. The major applications are in pharmaceuticals & biotechnology, such as drug synthesis, chiral synthesis, diagnostics & genomics, advanced therapeutics, and biocatalysis.

On the other hand, the biofuels segment is projected to grow at a CAGR between 2025 and 2034. The growth of the segment is driven by the increasing focus on renewable energy and enzymatic bioethanol production. Moreover, the increasing adoption of the circular economy model and increased government support for promoting the use of biofuels encourage enzyme manufacturers to develop more efficient and sustainable solutions.

End-User Insights

How Did the Industrial Manufacturers Segment Dominate the Enzyme Engineering Industry in 2024?

The industrial manufacturers segment held the largest share in the enzyme engineering market. The sustainability trends and rapid innovations in enzyme engineering are leading to the development of new and high-performance enzymatic solutions for various industries. Industrial manufacturers are key users across the food & beverages, textile, biofuel, detergent, and other industries. On the other hand, the academic & research institutes segment is anticipated to grow notably during the forecast period, owing to high adoption of enzyme engineering in biotech R&D.

- In March 2023, Amano Enzyme USA Co., Ltd., in conjunction with the University of Minnesota, Minneapolis, MN, announced it is sponsoring the first-ever Enzyme Technology Symposium between top academic researchers and industry professionals from North America and Japan.

Regional Insights

Why Is North America Dominating the Enzyme Engineering Market With the Majority of the Market Share?

North America dominated the global enzyme engineering market in 2024, accounting for the early adoption of advanced technologies in the pharma and biotech sectors. This region's dominance is primarily due to the robust manufacturing infrastructure for enzyme-based solutions across pharmaceuticals, textiles, agriculture, chemical food & beverages, biofuels, and industrial chemicals.

Moreover, government support for innovation in healthcare, rising investment in advanced research and development activities, advancements in biotech, the demand for sustainable practices, and rising disease burdens are anticipated to propel the region's growth during the forecast period. The region is experiencing a rapid expansion of the diagnostic sector, which has led to an increasing use of molecular diagnostic techniques, such as Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS), spurring the demand for specific enzymes, particularly DNA-modifying enzymes. The rapid advancement in enzyme engineering provides crucial tools for optimizing the specificities of natural enzymes for novel substrates and can be applied for generating new enzymes.

Several market players are planning to expand their geographical presence, and these major manufacturing companies are setting foot in the North American region. Such a combination of factors is expected to boost the growth of the enzyme engineering market in the region.

- In June 2025, Enzene, a pioneer in fully-connected continuous biologics manufacturing technology, announced that ahead of the official opening of its biologics manufacturing facility in Hopewell, close to Princeton in New Jersey, it had expanded its plans for the site. Located in the heart of the Northeast's biopharma corridor, the site will now incorporate a further 26,000 square feet of drug substance manufacturing suites, laboratories, storage, dispensing, and warehousing.(Source: https://www.enzene.com)

On the other hand, the Asia-Pacific is anticipated to grow at the fastest CAGR. The region's growth is driven by the increasing consumer demand for processed foods, rapid industrialization, growing demand for personalized medicine, increasing R&D activities in biotechnology, rising technological improvement in enzyme engineering, rapid advancements in the pharmaceutical & biotech sector, rising need for next-generation enzymes for industrial applications.

The region is witnessing supportive regulatory frameworks promoting sustainable manufacturing practices along with the increasing demand for sustainable and efficient enzyme-based solutions across various industries such as pharmaceuticals, environmental, food & beverages, textile, agriculture, chemicals, and biofuels.

Supportive government policies, including tax credits, subsidies, and grants, promote the use of biofuel production to lower greenhouse gas emissions and reduce dependence on fossil fuels. In August 2025, Bihar launched its newly amended Biofuel Policy 2025, marking a major step toward sustainable industrial growth and positioning the state as a future green energy hub.

The policy aims to attract substantial investment in the biofuel sector, create large-scale employment, and provide significant environmental benefits. The Deputy Chief Minister announced an ambitious target of establishing 10 Compressed Biogas (CBG) plants in Bihar by the end of this year, with an expected investment of over Rs1,500 crore. These plants are projected to produce 5 lakh tonnes of CBG annually.

Enzyme Engineering Market Country-level Investments & Funding Trends

- In October 2024, Danish pharmaceutical company Novo Nordisk announced an additional investment of R$500 million in Brazil. The funds will be used to construct a new annex at the company's plant in Montes Claros, Minas Gerais. The expansion aims to boost the production of enzymes essential for manufacturing Ozempic and Wegovy, medications used to treat diabetes and obesity. With this investment, the company's total investment in Brazil over the next two years will reach R$1.3 billion.(Source: https://valorinternational.globo.com)

- In July 2025, Iberia Pharmaceuticals, a Gurugram-based company, announced its new high-tech manufacturing and research facility, spanning 60,000 sq. ft. in Jhajjar, Haryana. The next-generation unit is expected to be operational by mid-2026 and generate 600+ jobs in this facility. The company has made a massive investment of Rs 70 crore and is proud to be a part of the government-backed ‘Make in India' movement. The facility is designed to serve customers with science-baked, derma-driven, wellness products.(Source: https://www.biospectrumindia.com)

- In October 2024, HLB Group acquired GenoFocus, a producer of specialty enzymes for customized industrial applications. HLB Group's seven affiliates, including HLB, HLB Panagene, HLB Life Science, HLB Therapeutics, and HLB Investment, acquired a 26.48 percent stake in GenoFocus and secured management control.(Source: https://www.koreabiomed.com)

- In September 2024, Kemin Industries acquires CJ Youtell BioTech to expand global enzyme capabilities. Kemin Industries acquired CJ Youtell Biotech, expanding its enzyme portfolio and fermentation capacity to deliver more sustainable, integrated solutions worldwide.(Source: https://www.aquafeed.com)

Enzyme Engineering Market Companies

- Novozymes A/S – World leader in industrial enzymes, providing biocatalysts for food, feed, bioenergy, and pharmaceuticals.

- DuPont de Nemours, Inc. (IFF) – Offers enzymes for food, beverage, and bio-based solutions through its Nutrition & Biosciences division.

- DSM-Firmenich – Supplies specialty enzymes for nutrition, health, and sustainable industrial applications.

- Codexis, Inc. – U.S. biotech company focused on engineered enzymes for pharmaceuticals, food, and industrial bioprocessing.

- AB Enzymes GmbH (Associated British Foods) – Produces enzymes for baking, food processing, animal feed, and technical industries.

- Amano Enzyme Inc. – Japanese company specializing in enzymes for food, pharmaceuticals, and diagnostics.

- BASF SE – Provides enzymes and biocatalysts for detergents, food, feed, and biofuel industries.

- Thermo Fisher Scientific Inc. – Offers research and diagnostic enzymes for biotechnology, pharmaceuticals, and healthcare.

- Chr. Hansen Holding A/S – Supplies enzymes, cultures, and natural ingredients for dairy, food, and agriculture.

- Dyadic International, Inc. – Develops enzyme expression systems for biopharma, industrial enzymes, and alternative proteins.

- Biocatalysts Ltd. – UK-based company specializing in custom enzyme development and fermentation solutions.

- EnzymeWorks, Inc. – Focuses on enzyme engineering and biocatalysis solutions for green chemistry and drug development.

- Sanofi (Genzyme for Therapeutic Enzymes) – Provides therapeutic enzymes for rare diseases and biopharmaceutical applications.

- Creative Enzymes – U.S.-based provider of enzyme products, assays, and custom enzyme services for research and industry.

- Advanced Enzyme Technologies Ltd. – Indian company producing enzymes for food, animal nutrition, and pharmaceuticals.

Recent Developments

- In October 2024, a research team led by the University of California, Irvine, engineered an efficient new enzyme that can produce a synthetic genetic material called threose nucleic acid. The ability to synthesize artificial chains of TNA, which is inherently more stable than DNA, advances the discovery of potentially more powerful, precise therapeutic options to treat cancer and autoimmune, metabolic, and infectious diseases. (Source: https://news.uci.edu)

- In January 2024, Denmark-based biotechnology company Novozymes and Denmark-based bioscience company Chr. Hansen announced they have completed a planned merger, creating the newly formed company Novonesis. Novonesis is a world-leading biosolutions partner for better business, healthier lives, and a healthier planet. (Source: https://www.novonesis.com)

Segments Covered in the Report

By Technology

- Rational Design

- Directed Evolution

- Hybrid/Integrated Approaches (Rational + Evolutionary)

- Other Emerging Methods (AI/Computational, CRISPR-based, etc.)

By Product Type

- Industrial Enzymes

- Specialty Enzymes

By Application

- Pharmaceuticals & Biotechnology

- Food & Beverages

- Biofuels & Renewable Energy

- Industrial Applications (Textiles, Detergents, Pulp & Paper, etc.)

- Agriculture (Animal Feed, Crop Enhancement, etc.)

- Environmental Applications (Bioremediation, Waste Management, etc.)

- Other Applications (Cosmetics, Diagnostics, etc.)

By End-User

- Industrial Manufacturers

- Pharmaceutical & Biotech Companies

- Academic & Research Institutes

- Other End-Users (Environmental Agencies, Specialty Labs, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting