Field Device Management Market Size and Forecast 2025 to 2034

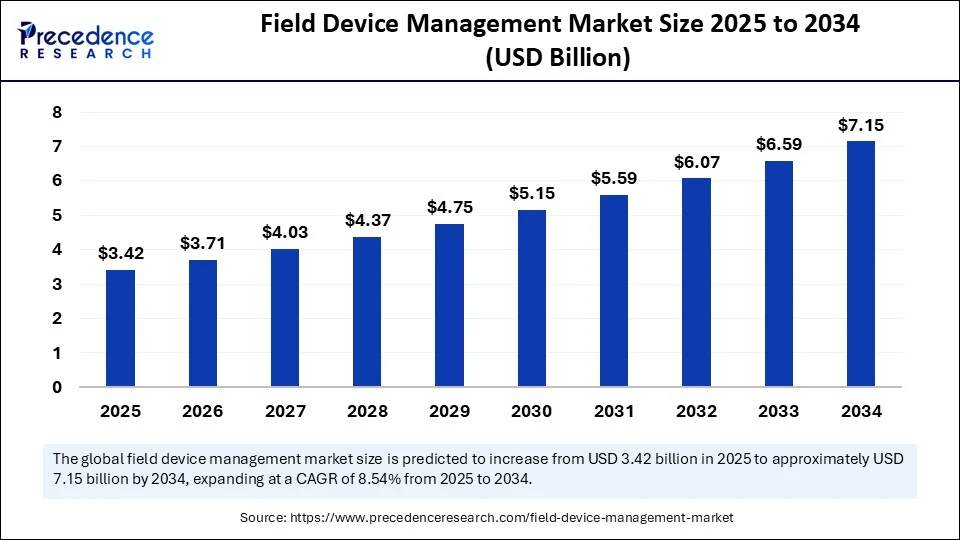

The global field device management market size was calculated at USD 3.15 billion in 2024 and is predicted to increase from USD 3.42 billion in 2025 to approximately USD 7.15 billion by 2034, expanding at a CAGR of 8.54% from 2025 to 2034. The market growth is attributed to the increasing adoption of intelligent diagnostic devices and real-time asset monitoring solutions across various industries.

Field Device Management Market Key Takeaways

- In terms of revenue, the global field device management market was valued at USD 3.15 billion in 2024.

- It is projected to reach USD 7.15 billion by 2034.

- The market is expected to grow at a CAGR of 8.54% from 2025 to 2034.

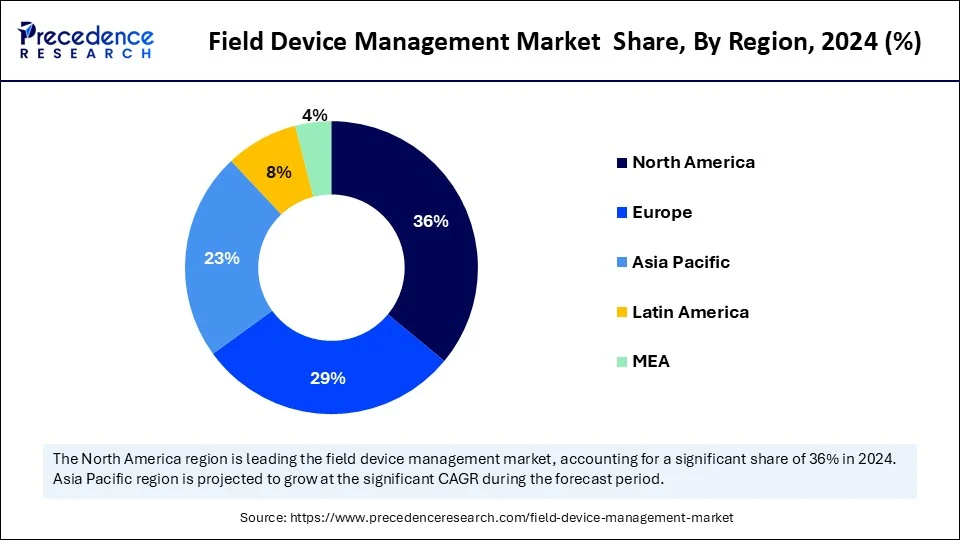

- North America dominated the field device management market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By offering, the hardware segment held the major market share in 2024.

- By offering, the software segment is projected to grow at a significant CAGR between 2025 and 2034.

- By deployment, the on-premises segment contributed the biggest market share in 2024.

- By deployment, the cloud segment is expanding at a significant CAGR between 2025 and 2034.

- By industry, the process industry segment dominated the market in 2024.

- By industry, the discrete industry segment is expected to grow at a significant CAGR over the projected period.

- By protocol, the FOUNDATION fieldbus & HART segment led the market in 2024.

- By protocol, the PROFINET/Ethernet segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Field Device Management Market

Artificial intelligence (AI) is revolutionizing the field device management market by making it intelligent, quicker, and error-free in managing complex industrial activities. Companies are integrating AI models into device management tools to track the health of their equipment and identify anomalies in real-time. Furthermore, the use of AI in field device management provides businesses with a competitive edge, offering a broader view of operations, ensuring cost reduction, and streamlining system ramp-up. AI also analyzes data from field devices to predict potential failures, enabling proactive maintenance and reducing downtime.

U.S. Field Device Management Market Size and Growth 2025 to 2034

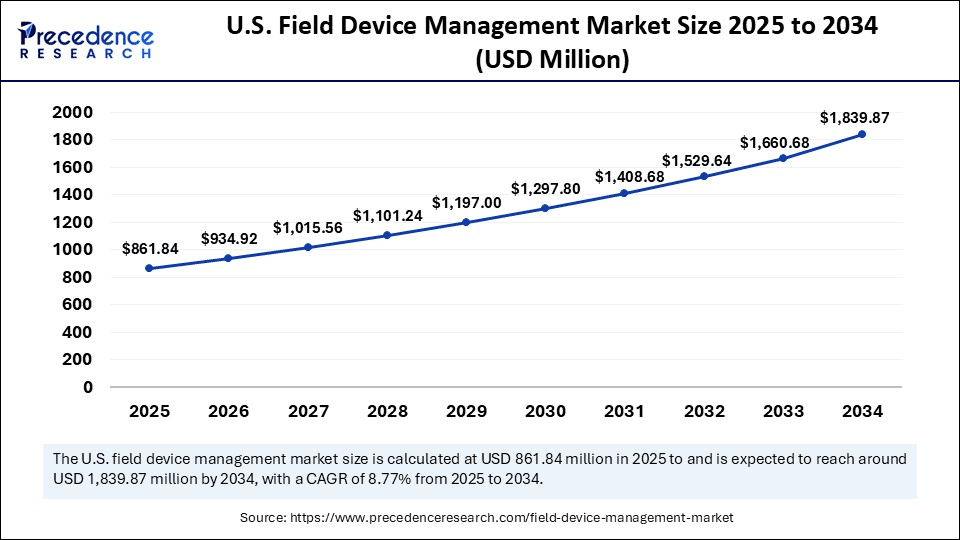

The U.S. field device management market size was exhibited at USD 793.80 million in 2024 and is projected to be worth around USD 1,839.87 million by 2034, growing at a CAGR of 8.77% from 2025 to 2034.

What Made North America the Dominant Region in the Field Device Management Market in 2024?

North America led the field device management market, capturing the largest revenue share in 2024. This was due to the incorporation of improved automation-based systems, high industrial-based construction, and concurrent regulatory requirements in the oil and gas, energy, pharmaceuticals, and chemicals sectors. Major industrial suppliers, including Emerson, Rockwell Automation, and General Electric, launched comprehensive platforms. These platforms provided real-time diagnostics, device lifecycle management, and easier protocol integration.

The ISA noted that increased compliance with ISA‑108 standards correlated with better equipment uptime and reduced unscheduled outage rates in North American plants. Federal entities like the U.S. department of Energy (DOE) and the National Institute of Standards and Technology (NIST) promoted the use of interoperable frameworks and cyber security-compatible infrastructure. Throughout 2024, this improved the spread of IIoT-oriented device management guidelines, thereby further fueling the market in this region.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. This is due to aggressive industrialization, supportive smart factory policies, and increasing automation interest worldwide. Countries such as China, India, South Korea, and Japan have made significant investments in the automotive, electronics, and energy infrastructure sectors, which has driven the demand for intelligent device networks.

Remote-configuration-capable field devices with diagnostics have seen increased deployment by organizations, including the China Instrument and Control Society (CIS) and the Japan Electric Measuring Instruments Manufacturers Association (JEMIMA) in 2024. Companies such as Yokogawa, Mitsubishi Electric, Omron, and Azbil Corporation introduced management tools with cloud and edge capabilities throughout the region in 2024, promising scalability and centralized monitoring. Furthermore, national programs focused on industrial AI, cybersecurity, and M2M protocols have positioned governments to trigger rapid growth in digital transformations and asset management within the APAC region.

Market Overview

Field device management (FDM) involves the use of hardware and software tools to configure, monitor, diagnose, and maintain field instruments, such as sensors, actuators, and transmitters, across industrial environments. By enabling remote access and real-time data analytics, FDM supports Industry 4.0, predictive maintenance, and smart-factory initiatives, enhancing operational reliability and reducing downtime across process and discrete industries.

The rising demand for real-time diagnostics and predictive maintenance of devices drives investments in intelligent field device management systems, which is a driving factor of the field device management market. In 2024, industrial operators utilized ISA-108 standards to integrate diagnostics-enabling sensors, actuators, and transmitters, thereby quantifiably enhancing equipment availability and reducing the need for failure avoidance. This technology integrates smart field instruments with software platforms, enabling centralized configuration, remote observation, and alerts in the form of analytics. Furthermore, the NIST and DOE guidelines strengthened secure deployment architectures to work with ISA/IEC 62443 frameworks, thereby enhancing confidence in software-defined and hybrid asset management infrastructures.

Field Device Management Market Growth Factors

- Rising Demand for Industrial Cybersecurity Integration: Growing awareness of operational vulnerabilities is fuelling the adoption of secure field device management frameworks across critical infrastructure.

- Boosting Integration of Edge Computing Technologies: Increasing edge deployments in industrial settings are driving real-time processing and localized device diagnostics.

- Propelling Compliance with Digital Twin Standards: Growing adoption of digital twins is boosting the need for synchronized device data and lifecycle management tools.

- Growing Emphasis on Lifecycle Asset Traceability: Expanding industrial focus on predictive lifecycle monitoring is propelling demand for unified device management platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.15 Billion |

| Market Size in 2025 | USD 3.42 Billion |

| Market Size in 2024 | USD 3.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment Type, Industry, Communication Protocol, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Increasing Demand for Real-Time Monitoring and Diagnostics Driving Innovation in the Field Device Management Market?

The increasing demand for real-time monitoring and diagnostics is projected to drive market growth. The oil & gas, chemicals, and power generation industries require accurate and real-time data from field instruments to maximize process continuity and avoid the high costs associated with process shutdowns. Smart field device management tools enable continuous monitoring of device health and prompt corrective measures, resulting in improved operational reliability. They minimize manual inspection, reduce upkeep expenses, and optimize manpower allocation in large-scale industrial setups.

The FieldComm Group reported in 2024 that the increased use of smart field products based on the FDI and HART-IP standards was becoming commonplace, noting that diabetes and remote monitoring were becoming integral to the industry. The International Society of Automation (ISA) stated that more than 65% of the installations introduced the concept of smart diagnostics in 2024. Furthermore, the growing need to increase equipment uptime and reduce decision-making time in process control is boosting the demand for field management devices.

(Source: https://www.fieldcommgroup.org)

Restraint

Interoperability Challenges Among Communication Protocols Restrain System Integration

Due to interoperability issues among diverse field communication protocols, system integration is projected to be affected, further hindering market growth. Integration issues still exist among devices using different communication protocols, including HART, PROFIBUS, Modbus, and FOUNDATION Fieldbus, despite standardization efforts by organizations such as the OPC Foundation, FieldComm Group, and IEC TC65. Furthermore, such technical differences slow down the implementation timelines, inflate engineering costs, and hinder smooth connections, thus further hampering market expansion.

Opportunity

Growing Adoption of IIoT Technologies

The growing adoption of Industrial Internet of Things (IIoT) technologies is anticipated to create immense opportunities for players competing in the field device management market. The increasing use of the Industrial Internet of Things (IIoT) is accompanied by the growth of integrating linked field equipment. Centralized control flow field device management systems that support these connected devices provide interoperability among communication protocols and facilitate troubleshooting. According to the OPC Foundation, 2024 is marked by a dramatic increase in the implementation of OPC UA-enabled field devices, underscoring its importance in facilitating seamless, vendor-neutral connectivity to IIoT environments. Furthermore, the increasing adoption of industrial automation across manufacturing and process industries is expected to accelerate the deployment of intelligent field asset solutions.

Offering Insight

Why Did the Hardware Segment Lead the Market in 2024?

The hardware segment dominated the field device management market with the largest share in 2024. This is mainly due to the increased usage of smart field instruments, including transmitters, sensors, actuators, and positioners. Hardware has been a priority for the industrial sector in replacing outdated equipment and aligning plant infrastructure with the modernization needs of automation. Furthermore, the proliferation of IoT devices in various industries necessitates more hardware for field device management, such as sensors and communication modules. Advancements in sensor technology further bolstered the segmental growth.

The software segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing use of analytics, device lifecycle management platforms, and centralized configuration platforms. Software platforms are in high demand that provide predictive diagnostics, automatic calibration tracking, and ease of integration. The software solutions enable the integration of device data, regardless of protocols and vendors, to reduce servicing time and minimize error possibilities during commissioning and maintenance. Vendors, such as Honeywell, ABB, and Rockwell Automation, are making their software more granular. Furthermore, the launch of new, advanced software by these companies is expected to further facilitate the segment growth in the coming years.

Deployment Type Insights

What Made On-Premises Deployment the Preferred Choice Among Industrial Users?

The on-premises segment held the largest revenue share of the field device management market in 2024 due to the increased concerns over data security. On-premises deployment enables businesses to have control over field devices, reducing data breaches. Such systems cater to the strict industrial demands at the facility level. Industrial players in other fields, such as oil and gas, petrochemicals, and power generation, implemented them locally in their plants to maintain all sovereignty over sensitive data and hardware deployments. Moreover, the ISA/IEC 62443 standards continued to form the basis of on-premises security infrastructures as they were beefed up to safeguard critical infrastructure.

The cloud segment is expected to grow at the fastest CAGR in the coming years, as industries are rapidly shifting toward distributed and centralized operations. Cloud platforms enable easy remote configuration, firmware updates on devices, and the scalability of device provisioning across different sites. Additionally, the cloud-hosted dashboards and centralization of data offered engineers greater visibility into their operations and predictive maintenance capabilities, further fueling the demand for this cloud-based management software.

Industry Insights

How Did the Process Industry Segment Dominate the Market in 2024?

The process industry segment dominated the field device management market in 2024. This is mainly due to the high reliance of process industries, like oil & gas and chemicals, on field devices for operations. They need FDM for efficiency, safety, and regulatory compliance. The complexity of these plants, large-scale deployments, and early tech adoption drive FDM use. Integration with automation, predictive maintenance, remote monitoring, and strong ROI further solidified the process industry's dominance.

The discrete industry segment is expected to grow at the fastest rate in the coming years, fueled by trends like electrification, Industry 4.0 implementation, and autonomous production. Modern sensors, robotics, and field devices in high-speed assembly and test lines require easy configuration, diagnostics, and lifecycle management. The increasing adoption of automation and smart manufacturing technologies in discrete manufacturing, such as robotics and automated guided vehicles (AGVs), necessitates efficient management of field devices.

In 2024, OPC UA Companion Specifications were extended for automotive machine-to-machine communication by the OPC Foundation, establishing groundwork in discrete manufacturing for scalable and interoperable deployment. The launch of cloud-enabled and edge-enabled device management systems meets the needs of fast line reconfiguration, quality assurance monitoring, and real-time fault detection. These systems, featuring automated calibration, firmware updates, and predictive alerts, enhance production flexibility, further propelling market growth in this sector.

Protocol Insights

Why Did the FOUNDATION Fieldbus and HART Segment Dominate the Field Device Management Market in 2024?

FOUNDATION fieldbus & HART segment held the largest revenue share in the field device management market in 2024, primarily due to its extensive use in process industries and its support for advanced diagnostics and interoperability. HART's large installed base allowed manufacturers to access diagnostic data without significant infrastructure changes. Furthermore, HART-enabled devices still formed the basis of an estimated three-quarters of global process automation systems, bolstering the segment's dominance.

The PROFINET/Ethernet-IP segment is expected to grow at the fastest CAGR in the coming years. This is due to the increasing need for high-speed deterministic communications in discrete and hybrid industrial applications. In digitally transformed plants, manufacturers also require protocols that can integrate IT and OT systems without any issues. These protocols should facilitate real-time data exchange and easy configuration. PROFINET and Ethernet/IP offer great bandwidth capabilities, time-sensitive networking (TSN), and are compatible with the latest PLCs and industrial IoT solutions.

In 2024, the PROFIBUS & PROFINET International (PI) and ODVA organizations improved their protocol stacks to effectively support edge computing, cloud integration, and cybersecurity enhancements. These improvements further boost applications in automotive, food and beverage, and electronics. Companies have specifically optimized these management technologies for increased network transparency, asset monitoring, and predictive capabilities in high-velocity production systems. Moreover, the growing need for communication that transitions from legacy loops into smart, high-performance networks further fuels the segment's growth.

(Source: https://www.arcweb.com)

Field Device Management Market Companies

- ABB Ltd.

- Azbil Corporation

- Emerson Electric Co.

- Endress+Hauser Group

- FANUC Corporation

- Festo Inc.

- Hach Company

- Hamilton Company

- Honeywell International Inc.

- Metso Oyj

- Mitsubishi Electric Corporation

- Omega Engineering

- OMRON Corporation

- Phoenix Contact

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Valmet Oyj

- Weidm�ller Interface GmbH

- Yokogawa Electric Corporation

Recent Developments

- In February 2024, Bellevue, WA � Esper, a leading provider of device management solutions, has announced extended support for Apple iOS and iPadOS devices, enhancing its platform's ability to manage mixed device fleets. Building on its strength in Android management, Esper now delivers a unified �single pane of glass� experience for enterprises managing both iOS and Android systems.(Source: https://www.esper.io)

- In December 2023, ABB announced enhancements to its Ability Field Information Manager (FIM 3.0) software, introducing broader connectivity and improved support for multiple communication protocols. The update aims to improve operational workflows by enabling system engineers and maintenance teams to configure, commission, diagnose, and maintain devices more efficiently and intuitively.(Source: https://www.iotinsider.com)

- In October 2024, Phonism, a telecom device management leader, officially launched Inlayer, a next-generation platform developed to manage all types of network devices using AI and automation. Expanding beyond telecom, Inlayer is designed to support routers, IoT endpoints, POS systems, and other connected devices, offering businesses a scalable, all-in-one management solution for modern device ecosystems.(Source: https://www.prnewswire.com)

- In May 2024, Nordic Semiconductor announced the general availability of nRF Cloud Device Management, marking a significant enhancement to its cloud-based services. The new offering joins Nordic's existing location and security services to complete the nRF Cloud suite, making it the first comprehensive solution for large-scale deployment.(Source:https://www.nordicsemi.com)

Latest Announcement by Industry Leader

- In June 2025, Fleet (fleetdm.com), the open device management company, today announced that it has raised $27 million in Series B funding, bringing its total funding to $52.3 million. The oversubscribed round, led by Ten Eleven Ventures, follows 6x revenue growth over the last two years and will accelerate the development and adoption of Fleet's open device management platform. The platform offers both self-hosting and cloud-hosted options, ensuring that organizations of all types and sizes can see and secure all of their computing devices�on their own terms. �Fleet helped us avoid being forced to the cloud by our current MDM provider. We were able to migrate everything over to Fleet a few weeks ahead of our renewal,� said Scott MacVicar, Head of Developer Infrastructure and Corporate Technology at Stripe. �And now Stripe is in control.� �Fleet is open source, so we built things to be open from the beginning," said Fleet CEO Mike McNeil. "Hosting is part of that. Fleet has always prioritized folks being able to host wherever they want. Over time, we've added enterprise-grade managed hosting, and many organizations prefer that since it's simpler. But we'll always let customers choose."(Source: https://www.businesswire.com)

Segments covered in the Report

By Offering

- Hardware (e.g., isolators, gateways, multiplexers)

- Software (configuration, diagnostics, data analytics)

By Deployment Type

- On Premises

- Cloud

By Industry

- Process Industries

- Oil & Gas, Chemicals, Energy & Power, Food & Beverage, Pharma, Metals & Mining, Others

- Discrete Industries

- Automotive, Manufacturing, Aerospace & Defense

By Communication Protocol

- FOUNDATION Fieldbus & HART

- PROFIBUS

- PROFINET

- Modbus TCP/IP

- Ethernet/IP

- Other (ISA 100, BRAIN, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content