What is the Food Glazing Agents Market Size?

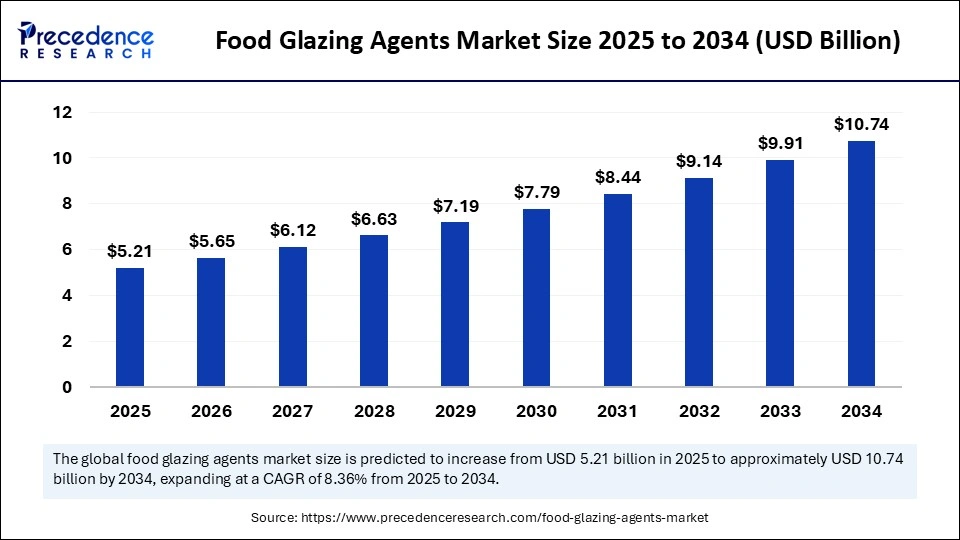

The global food glazing agents market size is estimated at USD 5.21 billion in 2025 and is predicted to increase from USD 5.65 billion in 2026 to approximately USD 11.53 billion by 2035, expanding at a CAGR of 8.27% from 2026 to 2035. The food glazing agents market is growing steadily as consumers demand visually appealing, high-quality food products.

Food Glazing Agents Market Key Takeaways

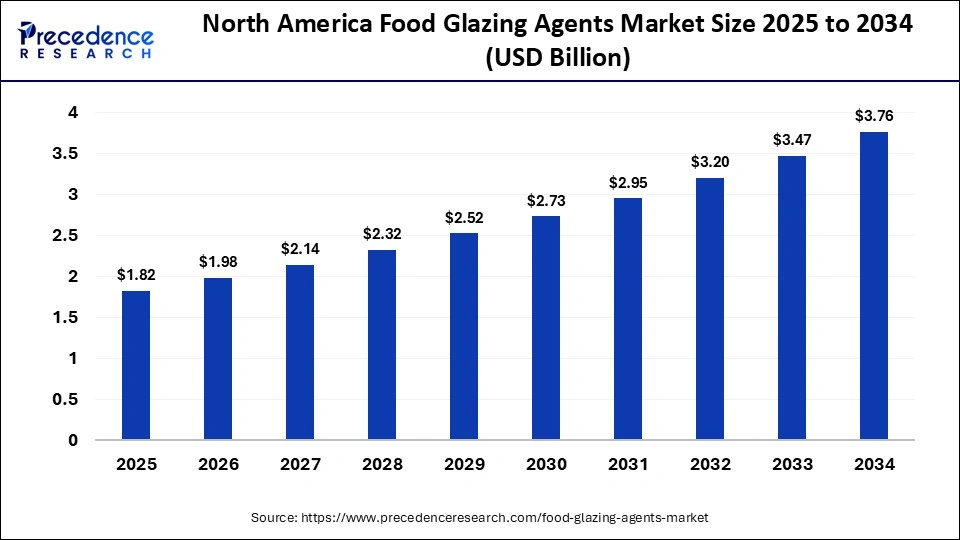

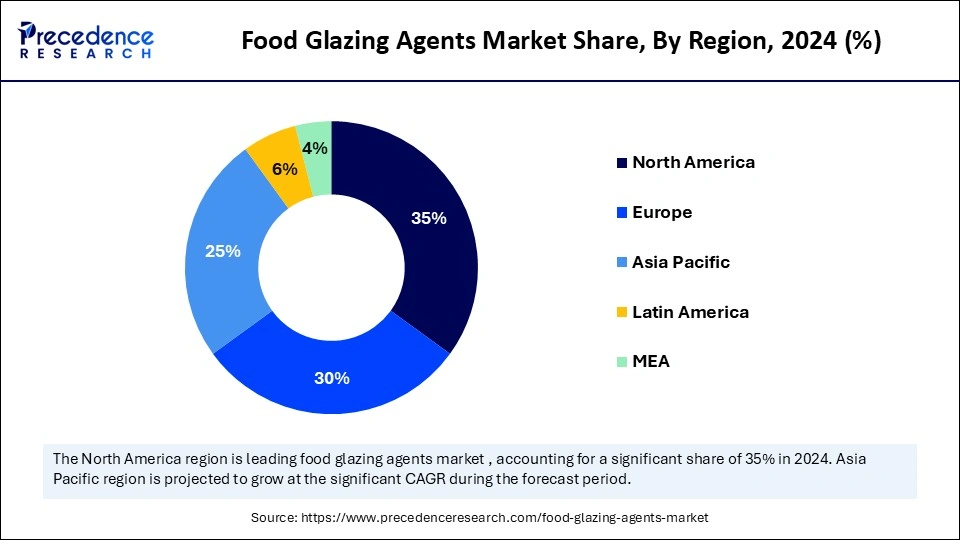

- North America contributed the highest market share of 35% in 2025.

- The Asia Pacific is projected to grow at a significant CAGR from 2026 to 2035.

- By product type, the natural glazing agents segment held the largest market share of 40% in 2025.

- By product type, the specialty functional coatings segment is expected to grow at a strong CAGR between 2026 to 2035.

- By application type, the confectionery products segment captured the biggest market share of 35% in 2025.

- By application type, the pharmaceuticals/nutraceuticals segment is projected to grow at a significant CAGR from 2026 to 2035.

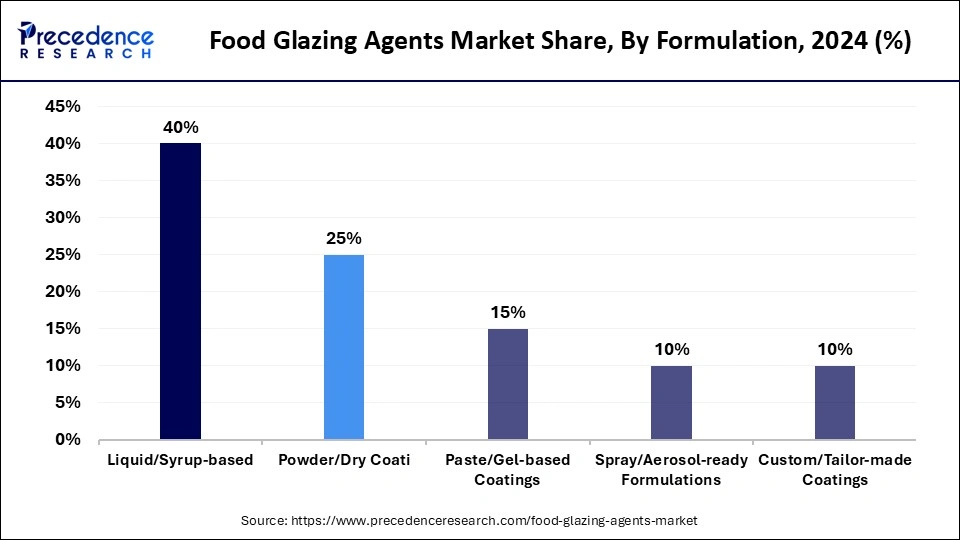

- By formulation, the liquid/syrup-based segment led the market, accounting for a 40% share in 2025.

- By formulation, the custom/tailor-made coatings segment is expected to grow at a notable CAGR between 2026 to 2035.

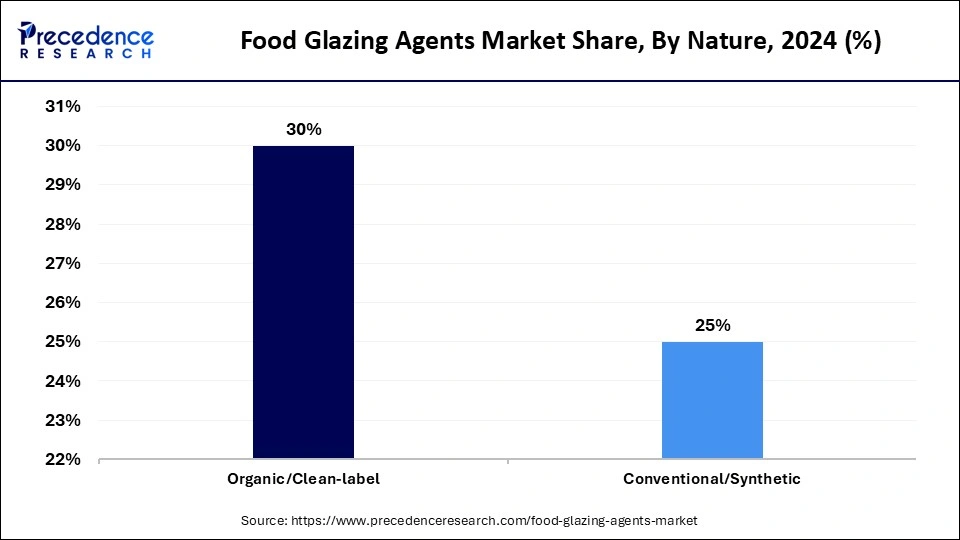

- By nature, the conventional/synthetic segment led the market, accounting for 70% of the market share in 2025.

- By nature, the organic/clean-label segment is growing at a solid CAGR between 2026 to 2035.

- By end user, the confectionery manufacturers segment contributed the highest market share of 30% in 2025.

- By end user, the bakery and snacks manufacturers segment is expected to grow at healthy CAGR between 2026 to 2035.

What is the Food Glazing Agent?

Food glazing comprises ingredients and formulations applied to the exterior surfaces of food products to improve appearance, extend shelf life, provide barrier protection, control moisture migration, and modify texture or mouthfeel. Glazing agents include natural and synthetic waxes, e.g., carnauba, beeswax, shellac, hydrogenated vegetable oils, resinous coatings, edible polymer films, emulsifiers and glyceride-based glossants, and specialty spray- or brush-applied formulations used across confectionery, bakery, snacks, fruits & vegetables, pet food, and pharmaceutical/tablet applications. Suppliers serve food manufacturers, co-packers and ingredient formulators with ready-to-use coatings, custom blends, and technical support for application methods (spraying, enrobing, panning). Key market drivers include demand for improved product visual appeal, convenience-ready snack formats, and natural/clean-label glazing options; regulatory compliance, food-safety standards and sustainability of raw materials are central considerations for product development and purchasing decisions.

The food glazing agents market is primarily driven by the food industry's focus on product differentiation and visual appeal. Food glazing agents act as protective coatings that preserve moisture and enhance shelf stability. They are used in chocolates to prevent blooming, in fruits to retain gloss, and in bakery items for a premium finish. Rising disposable incomes and demand for packaged and ready-to-eat foods have expanded their use globally. Key end-use industries include confectionery, processed foods, and dairy. Growing health awareness is also influencing the adoption of natural, non-toxic glazing materials derived from beeswax, carnauba wax, and shellac.

How is AI contributing to the Food Glazing Agents Industry?

Artificial intelligence enhances the formulation of glazing agents through improved application precision and extended product shelf life. The algorithms perform molecular behavior analysis, which enables automatic visual inspection, coating requirement prediction, inventory scheduling optimization, and regulatory compliance assistance to maintain product quality while minimizing resource waste and producing environmentally friendly coatings and industrial-grade glazing solutions.

Key Technological Shifts in the Market for Food Glazing

The industry is transitioning from synthetic to natural and bio-based food glazing agents. Technologies enabling microencapsulation and improved emulsification have enhanced the performance and durability of coatings. Smart coating systems now enable controlled release of protective compounds and improved adhesion to various food surfaces. Advancements in spray coating and dipping machinery have streamlined industrial applications. Research and development investment is increasingly focused on multifunctional glazing agents that combine protection, shine, and preservation. Digitalization in quality control and formulation tracking also ensures better consistency and compliance with safety standards.

Key Food Glazing Agents Market Trends

- A major trend is the growing preference for sustainable, eco-friendly glazing materials. Plant-based and vegan waxes are replacing animal-derived agents such as shellac.

- Clean-label certifications are gaining prominence as consumers scrutinize ingredient lists. The rise of premium confectionery and bakery segments has heightened the use of high-gloss coatings for luxury presentation.

- There is also a trend toward functional glazing agents that incorporate antioxidants or antimicrobial properties. Manufacturers are aligning with global food safety regulations, which further encourages transparency and product innovation.

Trade Analysis of Food Glazing Agents Market

- The world received 52 shipments of glazing agents between May 2024 and April 2025.

- Twenty-one exporters provided the import supplies, which fifteen global buyers purchased from their network of international traders.

- The import volume experienced a decrease of 7 percent when compared to the previous twelve months.

- The United States ranked first in import activity with 36 shipments, while Mexico and Vietnam followed with 22 and 21 shipments, respectively.

- The three main countries for global export activities remained Germany, the United States, and India.

Food Glazing Agents Market Outlook

The industry operates at the intersection of food processing, packaging, and ingredient innovation. Food glazing agents serve vital functions in bakery, confectionery, fruit, and meat processing industries by improving product appearance and extending shelf life. Major players in the market supply a range of glazing formulations suited for industrial as well as artisanal applications. The demand is particularly strong in regions with developed processed food sectors such as North America and Europe, while Asia-Pacific is emerging as a major growth hub. The competitive landscape is characterized by continuous product innovation, collaborations, and expansion of manufacturing capacities.

Sustainability is becoming a defining theme across the glazing agents market. Manufacturers are shifting from synthetic to bio-based and renewable sources such as carnauba wax, beeswax, and candelilla wax. Clean-label and eco-friendly certifications are gaining consumer trust and influencing purchase decisions. Companies are also focusing on ethical sourcing and carbon-neutral production processes. Packaging innovations and biodegradable formulations further support sustainability efforts. The trend is clear consumers want safe, natural ingredients that align with environmental values, and brands are responding with greener product portfolios.

Investments in the food glazing agents market are primarily directed toward research and development of natural and multifunctional coatings. Leading companies are upgrading their production facilities to support scalable, efficient, and sustainable manufacturing. There is also growing investment in automated coating technologies to enhance precision and reduce waste. Many global players are forming partnerships with agricultural producers for a consistent and traceable raw material supply. Additionally, venture capital and private equity funds are showing interest in startups offering plant-based and biodegradable glazing alternatives. Such investments are expected to drive innovation and accelerate sustainable growth across the value chain.

The market has developed a supportive ecosystem involving raw material suppliers, formulation developers, food manufacturers, and technology providers. Collaboration between ingredient suppliers and food processors ensures efficient application and product optimization. Startups are playing an active role by developing eco-friendly glazing agents derived from renewable plant resources. Many new companies are experimenting with edible film technologies and nanostructured coatings to enhance food safety and shelf life. Government initiatives promoting food innovation and sustainability are further nurturing this ecosystem. Together, established industry leaders and startups are shaping a dynamic, innovation-driven environment for the food glazing agents market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.21 Billion |

| Market Size in 2026 | USD 5.65 Billion |

| Market Size by 2035 | USD 11.53Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.27% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Nature, Formulation, End-User / Customer Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

The natural glazing agents is dominating the food glazing agents market, holding a share of 40%, due to their clean-label appeal and compatibility with health-conscious consumer preferences. Ingredients like carnauba wax, beeswax, and shellac are widely used for their natural origin, gloss enhancement, and protective qualities. These agents offer excellent moisture resistance and are ideal for confectionery and bakery products where shine and freshness matter. As regulatory norms tighten on artificial additives, natural alternatives are becoming the preferred choice across global food sectors. Their biodegradable and non-toxic nature makes them suitable for both food and pharmaceutical applications. The dominance of natural agents also reflects the industry's broader shift toward sustainability and transparency.

In addition, advancements in refining and purification processes are improving the quality and consistency of natural waxes. Manufacturers are expanding sourcing networks to ensure a steady supply of raw materials like palm leaves and beeswax. Innovations in blending techniques are creating hybrid glazing formulations that combine functionality with natural purity. These agents are also being customized for various climates and product surfaces. Consumer demand for label-friendly ingredients continues to strengthen this segment's leadership. Thus, natural glazing agents remain the backbone of the food glazing industry's growth trajectory.

The specialty function coating is the fastest growing in the food glazing agents market with an expected CAGR of 10%, due to its ability to provide added value beyond simple shine or protection. These coatings, including anti-caking and moisture-barrier solutions, help maintain product integrity and extend shelf life under diverse storage conditions. Additionally, flavor and aroma encapsulation coatings enhance sensory experience and product differentiation. Manufacturers are investing in the development of advanced, multifunctional coatings to meet evolving food and nutraceutical needs. Their rising popularity reflects a trend toward high-performance and value-added formulations. These coatings bridge the gap between aesthetic enhancement and product preservation.

The growth is also fueled by technological advances that allow micro- and nano-encapsulation for controlled flavor release. Demand from premium snack, bakery, and pharmaceutical manufacturers further supports expansion. Startups are experimenting with bio-based polymers to replace synthetic binders in these coatings. As product developers seek multifunctional, efficient glazing solutions, specialty coatings are increasingly preferred. The segment's versatility makes it attractive for next-generation product formulations. Consequently, this niche segment is expected to outpace others in innovation and growth rate.

Application Insights

The confectionery product dominates the food glazing agents market, with a 35% share, due to its reliance on shine, texture, and shelf stability. Glazing agents are extensively used in chocolates, candies, and coated nuts to achieve appealing finishes and prevent sticking. The rising consumption of premium and artisanal confectionery products drives steady demand. Manufacturers prioritize uniform coating, smooth texture, and enhanced visual appeal, which glazing agents provide effectively. These coatings also protect against humidity and temperature variations during transport. The confectionery industry's continuous product innovation sustains the dominance of this application segment.

In addition, the shift toward natural ingredients has led confectioners to adopt bio-based and allergen-free glazing solutions. The growth of packaged confectionery in emerging economies further stimulates demand. Custom glazing blends designed for temperature-sensitive coatings are enhancing product shelf life. Automation in coating technology also ensures consistency and efficiency in large-scale confectionery production. As gifting trends and luxury chocolate consumption rise, so will the need for aesthetic finishing. Therefore, confectionery applications will continue to anchor the global market for food glazing agents.

Pharmaceuticals/nutraceuticals are the fastest-growing segment in the market for food glazing agents, with an expected 7% CAGR, driven by the fact that coatings are essential for tablets and capsules, ensuring smooth swallowing and controlled release. Nutraceutical coatings add visual appeal while improving stability and moisture resistance. Growing health awareness and supplement consumption are expanding this application base rapidly. Manufacturers are focusing on non-toxic, hypoallergenic glazing materials suitable for sensitive formulations. Stringent quality and safety standards are also prompting innovation in pharmaceutical-grade coating technologies.

In addition, companies are developing plant-based, solvent-free alternatives to meet regulatory requirements. Nutraceutical brands are particularly adopting glossy, durable coatings for gummies and chewable supplements. Advances in film-coating techniques are enhancing precision and thickness control. The sector also benefits from synergies with food technology, leveraging shared innovation in clean-label and sustainable materials. As preventive health and functional nutrition gain importance, glazing solutions tailored for nutraceuticals are set to grow swiftly. This makes the segment a high-potential opportunity area for coating manufacturers.

Formulation Insights

The liquid/syrup segment is dominating the food glazing agents industry, with a 40% share, due to its clean-label appeal and compatibility with health-conscious consumer preferences. Ingredients such as carnauba wax, beeswax, and shellac are widely used for their natural origins, gloss enhancement, and protective qualities. These agents offer excellent moisture resistance and are ideal for confectionery and bakery products where shine and freshness matter. As regulatory norms tighten on artificial additives, natural alternatives are becoming the preferred choice across global food sectors. Their biodegradable and non-toxic nature makes them suitable for both food and pharmaceutical applications. The dominance of natural agents also reflects the industry's broader shift toward sustainability and transparency.

In addition, advancements in refining and purification processes are improving the quality and consistency of natural waxes. Manufacturers are expanding their sourcing networks to ensure a steady supply of raw materials such as palm leaves and beeswax. Innovations in blending techniques are creating hybrid glazing formulations that combine functionality with natural purity. These agents are also being customized for various climates and product surfaces. Consumer demand for label-friendly ingredients continues to strengthen this segment's leadership. Thus, natural glazing agents remain the backbone of the food glazing industry's growth trajectory.

Custom/tailor-made coatings are gaining rapid traction, with a 10% CAGR, as brands seek differentiation and specialized performance. These coatings are developed to address specific texture, gloss, or protective needs unique to each product. They allow manufacturers to precisely control variables such as drying rate, surface finish, and resistance properties. The growing preference for personalized food and premium packaging supports this demand. Manufacturers collaborate closely with food producers to design coatings that align with brand aesthetics and product functionality. Such customization adds both marketing and technical value.

Nature Insights

The conventional/synthetic segment continues to lead the market with a 70% share of food glazing agents, due to its cost-effectiveness, stability, and well-established supply chain. Synthetic materials offer consistent quality and are easy to process in large volumes. They are widely used in mass-market confectionery and bakery products, where uniform finish and long shelf life are priorities. Their resistance to heat and oxidation also contributes to their continued preference. For many manufacturers, synthetic glazing agents provide predictable performance with minimal formulation challenges. Despite the rise of natural alternatives, they remain vital for large-scale industrial use.

Organic and clean-label glazing agents are witnessing strong growth, with a 30% CAGR, as consumers increasingly value transparency and natural origin. These formulations use renewable, non-GMO, and chemical-free ingredients, such as beeswax and plant oils. They cater to the clean eating trend and align with sustainability goals across the food industry. The demand surge is particularly noticeable in premium confectionery, vegan products, and natural supplements. Brands adopting organic coatings often highlight them as part of their ethical and eco-conscious positioning. The clean-label segment's growth signifies a broader cultural shift toward ingredient integrity.

End User / Customer Insights

The confectionery manufacturers represent the largest end-user group in the market for food glazing agents, with a 30% share, driven by continuous innovation in product appearance and shelf life. These companies rely heavily on glazing agents to coat chocolates, candies, and coated nuts, enhancing gloss and protection. Large-scale confectionery producers favor consistent, high-quality glazing materials compatible with automated production lines. The global demand for visually appealing sweets and premium chocolates sustains steady consumption. Additionally, the use of natural glazes aligns with current consumer trends toward clean and ethical production. This segment's dominance reflects both its scale and its focus on sensory excellence.

Bakery and snack manufacturers are rapidly increasing their use of glazing agents to improve product texture, shine, and moisture retention. Coatings enhance the visual appeal of pastries, cookies, and savory snacks while preventing staleness. The growth of ready-to-eat and packaged bakery items has created new opportunities for glazing solutions. As consumers demand fresher-looking products with longer shelf lives, bakery producers are turning to advanced formulations. Glazing agents also enable even browning and uniform finishing in baked goods. This makes them essential in large-scale and artisanal baking alike.

Food Glazing Agents MarketRegion Insights

The North America food glazing agents market size is estimated at USD 1.82 billion in 2025 and is projected to reach approximately USD 4.04 billion by 2036, with a 8.30% CAGR from 2026 to 2035.

Why North America is Dominating the Food Glazing Agents Market?

North America is dominating the food glazing agents market by holding a share of 35%, driven by its well-established food processing and confectionery industries. The U.S. and Canada have a strong presence of multinational food companies emphasizing product innovation and visual appeal. Demand for glazing agents is particularly high in baked goods, candies, and processed meat coatings. Regulatory frameworks promoting food safety and clean labeling have encouraged the shift toward natural ingredients. Technological advancement in coating systems has supported efficient large-scale production. The mature retail environment and consumer focus on product quality continue to sustain regional leadership.

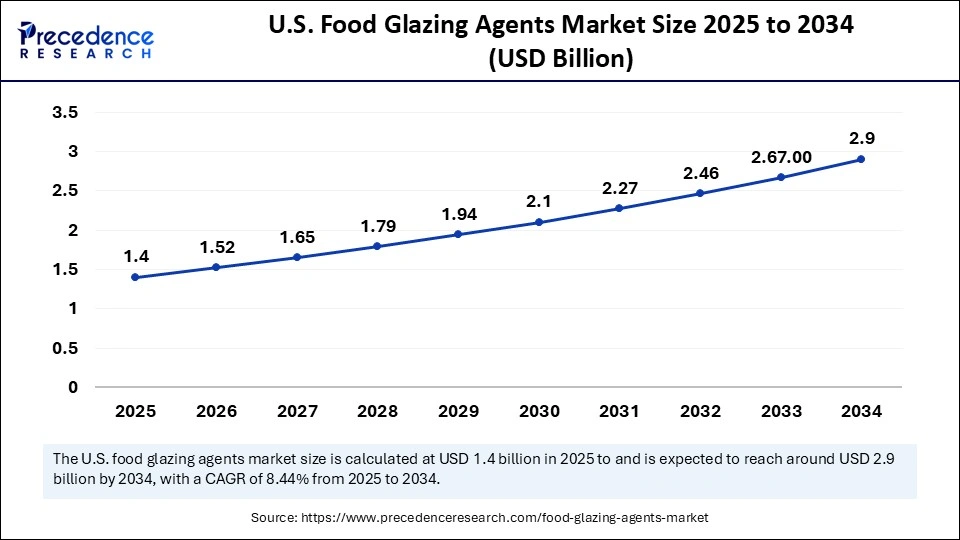

The U.S. food glazing agents market size has grown strongly in recent years. It will grow from USD 1.40 billion in 2025 to USD 3.12 billion in 2035, expanding at a compound annual growth rate (CAGR) of 8.34% between 2026 to 2035.

U.S. Food Glazing Agents Market Analysis

U.S. is dominating the North America, due to its vast packaged food and confectionery market. Major brands are increasingly replacing synthetic glazing agents with natural alternatives to align with consumer preferences. Canada follows closely, supported by its expanding bakery and snack sectors. The presence of advanced R&D facilities fosters innovation in coating technologies. Local manufacturers are also investing in sustainable raw materials, reflecting strong alignment with environmental trends. Overall, North America sets the benchmark for quality, safety, and technological innovation in the market.

The Asia Pacific food glazing agents market size is expected to be worth USD 2.89 billion by 2035, increasing from USD 1.30 billion by 2025, growing at a CAGR of 8.32% from 2026 to 2035.

How is Asia Pacific Becoming the Fastest Growing Region in the Food Glazing Agents Market?

Asia Pacific is set to be the fastest-growing region in the food glazing agents market, driven by rapid urbanization, growing middle-class populations, and increased demand for packaged foods. Countries such as China, India, and Japan are witnessing significant expansion in the confectionery and bakery industries. Rising disposable incomes and Western-style eating habits are fueling demand for visually appealing food products. Food manufacturers are adopting glazing agents to enhance product shelf life and presentation. The region's diverse agricultural base provides access to natural wax sources, supporting localized production. Continuous investment in food processing infrastructure is strengthening the regional market.

China Food Glazing Agents Market Analysis

China leads due to its large-scale food manufacturing industry and growing consumer interest in premium packaged foods. India is also emerging as a key growth hub, supported by its expanding bakery and snack food sectors. In Japan, innovation in natural coatings aligns with strong regulatory standards and consumer awareness. Southeast Asian nations are adopting glazing technologies in fruit preservation and confectionery exports. Government initiatives promoting food exports and processing modernization further accelerate growth. Overall, Asia Pacific's mix of affordability, innovation, and scale positions it as a powerhouse in the glazing agent market.

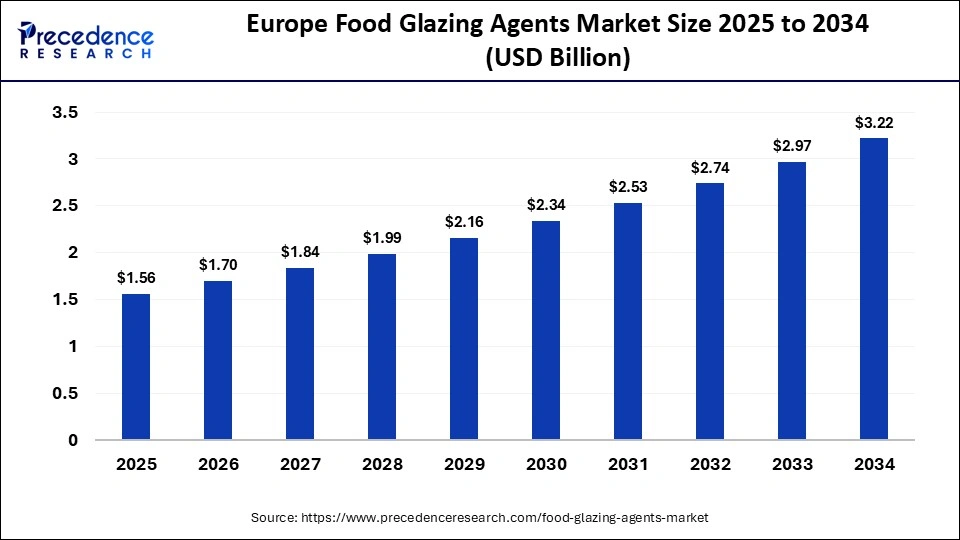

The Europe food glazing agents market size his predicted to rise from USD 1.56 billion in 2025 to USD 3.46 billion in 2035, expanding at a compound annual growth rate (CAGR) of 8.29% between 2026 to 2035.

Why Is Europe Considered a Notable Region in the Food Glazing Agents Market?

Europe is showing notable growth, supported by strong demand for high-quality, natural, and clean-label food products. The region has a well-developed confectionery, bakery, and processed fruit industry where glazing agents are widely used. Sustainability and organic certification are key driving forces for product development. European food companies are investing heavily in plant-based and vegan alternatives to meet consumer expectations. Strict regulatory frameworks ensure quality and transparency, fostering consumer trust. Growing interest in premium chocolate and pastry segments continues to push the use of glazing agents for superior finishes.

Germany Food Glazing Agents Sector

Germany plays a leading role in Europe's food glazing agents sector. The nation's strong bakery and confectionery sectors drive consistent demand for advanced coating solutions. German manufacturers focus heavily on sustainability, using renewable raw materials and eco-friendly formulations. R&D centers in Germany are pioneering innovations in edible films and biodegradable coatings. Local consumers' preference for natural and transparent labeling further boosts market credibility. As a result, Germany stands out as a model for combining technical expertise, sustainability, and market demand in Europe's food glazing agents industry.

Food Glazing Agents Market Value Chain

Purchase of superior ingredients from suppliers who will guarantee a consistent level of functional performance and nutritional value.

Key Players: Carnaúba do Brasil, Strahl & Pitsch, British Wax Refining Company

Technological innovation is central to improving the performance and sustainability of food glazing agents. Modern production techniques enable finer emulsions and better spreadability for even coating. Automation in processing has reduced waste and improved precision in application. New biodegradable and edible film-forming technologies are expanding possibilities for environmentally conscious manufacturers. Nanotechnology and advanced mixing processes are also improving product transparency and adhesion. These innovations collectively enhance product quality while aligning with consumer expectations for natural and safe ingredients.

An operation involving the conversion of raw materials into stable glazing agents without chemical destruction and without compromising shelf life.

Key Players: Capol GmbH, Mantrose-Haeuser Co. Inc., Stearinerie Dubois, Kerry Group

Before commercialization, it is necessary to test adherence to international safety standards and quality standards.

Key Players: SGS, TÜV SÜD, Eurofins Scientific, Intertek, FSSAI

Deliberation of the protection package and delivery of technical advantages and value propositions to a customer.

Key Players: Colorcon Inc., Puratos Group, Döhler Group, Macphie Ltd.

The control of temperature to avoid degradation and provide the best delivery to the end-user.

Key players: Kloosterboer, Americold Logistics, Lineage Logistics, Nichirei Logistics

Food Glazing Agents Market Companies

Cargill is a global leader in food ingredients and additives, offering a wide range of glazing agents derived from natural waxes, oils, and emulsifiers. Its food glazing products enhance appearance, texture, and shelf life in confectionery, bakery, and fruit applications. Cargill’s focus on sustainability and clean-label innovation supports its dominance in the global food glazing agents market.

ADM provides glazing agents and coating systems made from plant-based oils, starches, and emulsifiers. Its solutions enhance food aesthetics and protection while meeting consumer demand for natural, non-synthetic ingredients. ADM’s R&D strength in food texture and functionality helps it serve a diverse range of food processing sectors.

Ingredion develops starch- and polysaccharide-based glazing agents that enhance gloss, texture, and barrier properties in confectionery and bakery applications. The company’s focus on plant-based and sustainable formulations aligns with clean-label and vegan product trends.

Kerry Group offers a comprehensive portfolio of glazing and coating systems that provide visual appeal, moisture control, and improved mouthfeel in food products. The company’s expertise in food science and natural ingredient innovation drives its leadership in texture and sensory enhancement.

Givaudan produces natural and functional food glazing agents that combine flavor, aroma, and visual enhancement. Its glazing technologies improve appearance and stability while ensuring compatibility with natural colorants and flavors.

IFF provides natural and synthetic glazing agents designed for confectionery, snacks, and bakery applications. Its focus on combining visual appeal with flavor retention strengthens its position in value-added food ingredient solutions.

Tate & Lyle manufactures carbohydrate- and emulsifier-based glazing agents that improve food texture and shine. The company emphasizes natural and low-calorie formulations suited for confectionery and coated fruits.

Corbion develops sustainable and plant-based glazing and coating agents, leveraging its expertise in lactic acid and emulsifiers. Its glazing products enhance food stability and reduce moisture loss, particularly in bakery and confectionery segments.

AAK specializes in lipid-based glazing agents derived from plant oils and fats. Its coatings improve surface gloss, moisture resistance, and texture in bakery, chocolate, and confectionery products, promoting clean-label innovation.

Dohler Group provides multifunctional glazing agents formulated with natural waxes and fruit-based ingredients. Its solutions cater to confectionery, dried fruits, and snacks, ensuring both protection and enhanced sensory appeal.

Sensient develops food-grade glazes that enhance color brilliance, shine, and surface protection in confections and baked goods. The company’s color and ingredient systems integrate visual appeal with long-lasting stability.

Kalsec focuses on natural ingredient systems, offering plant-based glazing agents and coating enhancers derived from botanical sources. Its products are designed to meet the growing demand for clean-label, sustainable ingredients.

Kemin produces specialty food coatings and glazing agents that provide oxidative stability and surface protection. Its natural antioxidant systems extend shelf life while maintaining product appearance and freshness.

Recent Developments

- In October 2025, it was observed that India's food and beverages sector and hospitality sector are ready to raise nearly 9000 crores of IPO by various companies. It is said that these sectors would be a major driver of the stock market's rise. The data compiled by ET showed that many companies would soon go public. This surge in India has led to establishing the reach of these sectors to their epitome.

- In October 2025, it was noticed that the honey was being produced in several different colors like red, yellow, purple, etc. The Hindu noted that, if we look, these cases have been repeated more often across the U.S. There were two possible reasons for that: one was the certain flowers, a change in soil, and the M&M chocolate factory, which was situated near the honey production plants. Still, the testing is going to determine how much color-coated honey humans consumed and to identify a possible reason, this experimentation is carried out in laboratories.

- In October 2025, Puratos USA opened a new facility in Pennsauken, New Jersey, dedicated to bakery glaze production. This plant enhances local manufacturing, supporting innovation and sustainability while enabling faster responses to market demands and reducing supply chain risks, according to President Andrew Brimacombe.(Source: https://www.prnewswire.com )

- In July 2025, OLEHENRIKSEN introduces the Peach Glaze Collection, a trio of glow-boosting skincare products that plump and brighten skin and lips. Infused with niacinamide, enhanced vitamin C, hyaluronic acid, and peach extract, it promises a delightful, effective skincare experience.

(Source: https://www.prnewswire.com )

Food Glazing Agents MarketSegments Covered in the Report

By Product Type

- Natural Glazing Agents

- Carnauba Wax

- Beeswax

- Shellac

- Synthetic / Modified Glazing Agents

- Hydrogenated Vegetable Oils

- Resin-Based Coatings

- Emulsion-Based Coating

- Water-Based Glazes

- Oil-In-Water Emulsions

- Glyceride-Based / Fat-Based Coatings

- Mono- And Diglycerides

- Specialty Lipid Coatings

- Specialty Functional Coatings

- Anti-Caking / Moisture Barrier

- Flavor / Aroma Encapsulation

By Application

- Confectionery Products

- Chocolates & Candy

- Coated Nuts

- Bakery Product

- Bread & Pastries

- Cakes & Cookies

- Fruits & Vegetable

- Fresh-Cut Fruits

- Processed / Dried Fruits

- Snacks & Savory Food

- Chips & Extruded Snacks

- Nuts & Seeds

- Pet Food & Feed

- Dry Pet Food

- Treats & Supplements

- Pharmaceuticals/Nutraceuticals

- Tablets & Capsules

- Nutraceutical Coatings

By Formulation

- Liquid / Syrup-Based

- Powder / Dry Coatings

- Paste / Gel-Based Coatings

- Spray / Aerosol-Ready Formulations

- Custom / Tailor-Made Coatings

By Nature

- Organic / Clean-Label

- Conventional / Synthetic

By End User / Customer Segment

- Confectionery Manufacturers

- Bakery & Snack Manufacturers

- Fruit & Vegetable Processors

- Pet Food Manufacturers

- Pharmaceutical & Nutraceutical Companies

- Co-Packers & Contract Manufacturers

- Retail / Food Service Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting