What is Food Technology Market Size?

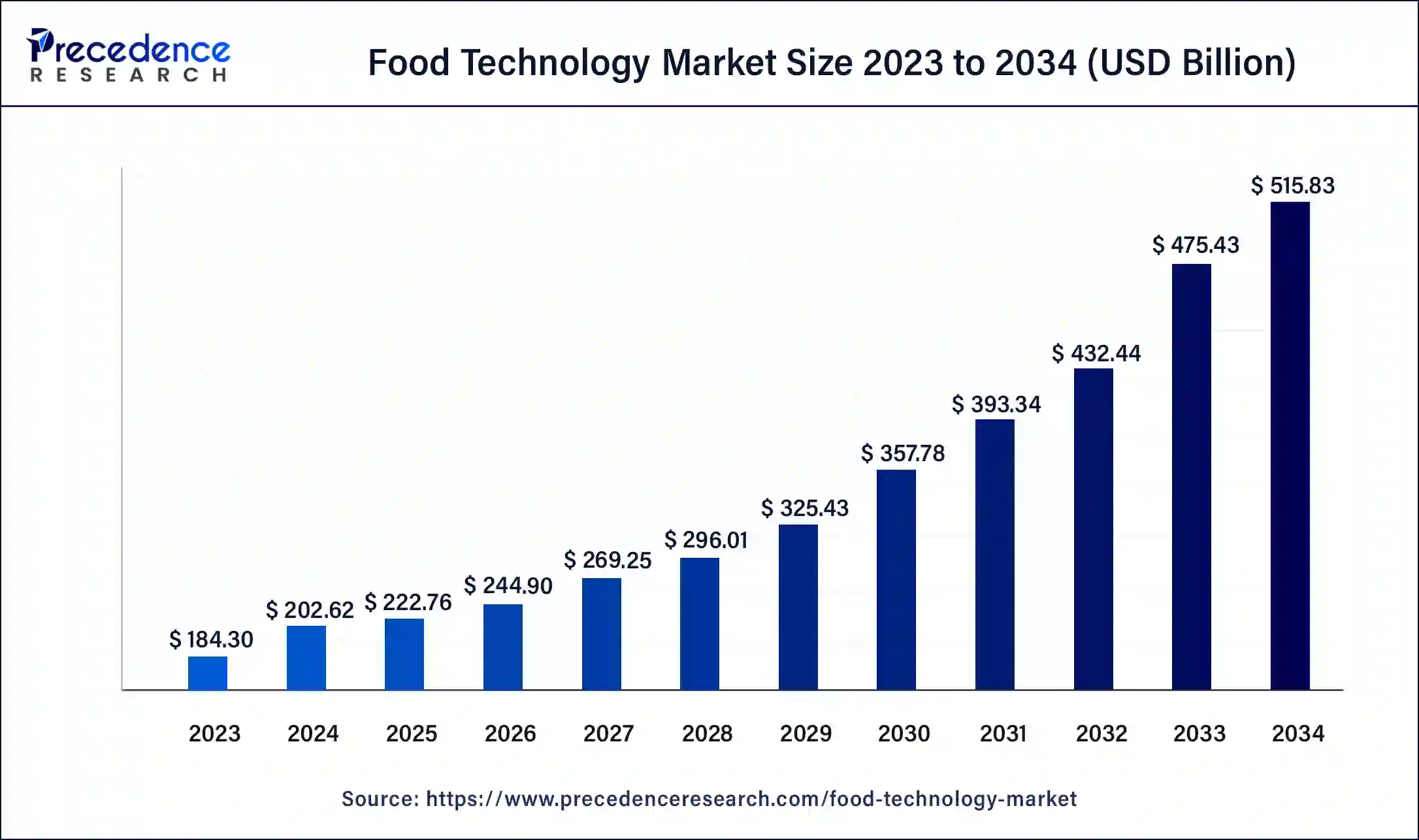

The global food technology market size is calculated at USD 222.76 billion in 2025 and is expected to reach around USD 515.83 billion by 2034, expanding at a CAGR of 9.80% from 2025 to 2034.

Market Highlights

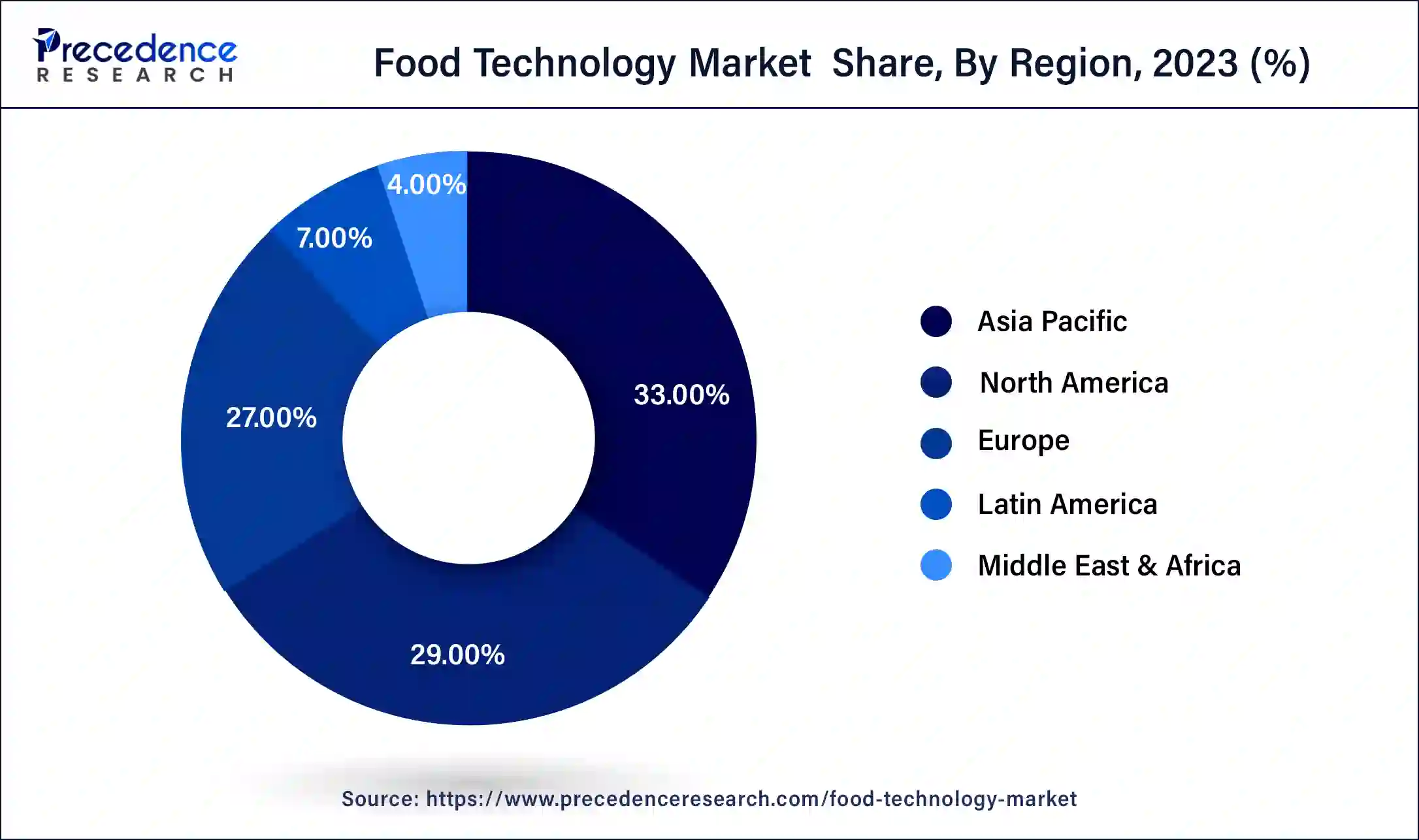

- Asia-Pacific has contributed more than 33% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the hardware segment held the largest market share of 43% in 2024.

- By component, the software segment is anticipated to grow at a remarkable CAGR of 11.13% between 2025 and 2034.

- By industry, the fish, meat, and seafood segment has accounted over 20% of market share in 2024.

- By industry, the dairy products segment is expected to expand at the fastest CAGR over the projected period.

- By application, the food science management segment has recorded over 27% of market share in 2024.

- By application, the delivery segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Food technology involves applying scientific knowledge and techniques to improve the way we produce, process, package, and distribute food. It encompasses various areas, including food engineering, biotechnology, and nutrition science. In simple terms, it is about using innovation to make food safer, tastier, and more sustainable. Food technologists work on developing new food products, finding ways to extend shelf life, and enhancing nutritional value. They also focus on improving food safety measures to prevent contamination and ensure that food meets regulatory standards. Additionally, food technology plays a crucial role in addressing global food challenges by developing solutions to increase food production efficiency and reduce food waste. Overall, food technology plays a vital role in shaping the future of our food supply, making it more accessible, nutritious, and environmentally friendly.

Food Technology Market Data and Statistics

- In April 2023, Aniai, Inc., a South Korea-based company specializing in robotic kitchen technology, unveiled the Alpha Grill, an innovative cooking robot tailored specifically for preparing burgers, leveraging automation and AI capabilities.

- The Good Food Institute reported that investments in plant-based meat, egg, and dairy companies reached a total of USD 2.1 billion in 2020, with Impossible Foods, a prominent player in the plant-based meat sector, securing over USD 1.9 billion in funding to date.

- According to McKinsey & Company's data as of May 2021, DoorDash held a dominant position in various markets, including San Jose with 77% market share, Houston with 56%, Philadelphia with 51%, and San Antonio with 51%. Meanwhile, Uber Eats and Postmates jointly led in Los Angeles with a 50% market share and in New York City with 41%.

- In 2021, the USDA's Economic Research Service (ERS) found that 10.2% of the entire U.S. population, equating to approximately 13.5 billion households, faced food insecurity.

- The World Bank noted that the United States has been among the pioneering nations in industrialization, experiencing significant urbanization rates over the past two centuries.

- The Food Safety Modernization Act (FSMA) in the United States and similar regulations worldwide have prompted companies to invest in technologies like blockchain and IoT for traceability and transparency.

- With approximately 1.3 billion tons of food wasted globally each year, according to the Food and Agriculture Organization (FAO), technologies like predictive analytics and cold chain management are being increasingly adopted to minimize waste along the supply chain.

Food Technology Market Growth Factors

- Increasing awareness of the relationship between diet and health has driven demand for healthier food options. Consumers are seeking functional foods, fortified with vitamins, minerals, and other beneficial nutrients, contributing to the growth of the food technology market.

- With the world's population projected to reach 9.7 billion by 2050, according to the United Nations, there is a growing need for efficient food production and distribution. Food technology innovations such as precision agriculture, vertical farming, and aquaponics are helping meet this demand sustainably.

- Concerns about environmental sustainability are driving the adoption of eco-friendly food production methods. Food technology solutions like alternative proteins (plant-based and lab-grown meat), biodegradable packaging, and waste reduction technologies are gaining traction as consumers and businesses prioritize sustainability.

- Technological advancements in food processing and packaging are enhancing food safety, extending shelf life, and improving convenience. Innovations such as high-pressure processing (HPP), modified atmosphere packaging (MAP), and smart packaging with sensors and indicators are driving market growth.

- Growing investment in research and development by both public and private sectors is fueling innovation in the food technology market. Venture capital funding for food tech startups reached $9.3 billion globally in 2020, according to AgFunder, indicating a strong investor interest in the sector.

- Evolving consumer preferences, including the demand for personalized nutrition, convenience foods, and clean-label products, are shaping the food technology landscape. Companies are leveraging technologies like artificial intelligence (AI), machine learning, and big data analytics to understand and cater to these changing preferences, driving market growth.

Recent Trends

- The food technology market is witnessing strong growth as automation, AI, and IoT are increasingly integrated into food processing, packaging, and quality monitoring to boost efficiency and reduce food waste.

- Startups and established companies are focusing on sustainable food solutions such as plant-based proteins, lab-grown meat, and eco-friendly packaging to meet consumer demand for health and sustainability.

- Smart kitchens, online food delivery platforms, and blockchain-based traceability systems are transforming how food is produced, distributed, and consumed.

Software-driven food solutions, like predictive analytics and digital supply chain management, are becoming the fastest-growing segments in this space.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 222.76 Billion |

| Market Size in 2026 | USD 244.90 Billion |

| Market Size by 2034 | USD 515.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.80% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Industry, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing consumer demand for healthier and sustainable food options

The increasing consumer demand for healthier and sustainable food options has driven a surge in the market demand for food technology solutions. Consumers are becoming more aware of the impact of their food choices on their health and the environment, leading them to seek out products that align with their values. As a result, food companies are under pressure to innovate and develop products that meet these evolving preferences.

Food technology plays a crucial role in meeting this demand by enabling the development of healthier and more sustainable food products. Through advancements in food processing, packaging, and ingredient innovation, companies can create products with reduced sugar, salt, and fat content, as well as incorporate sustainable sourcing practices and environmentally friendly packaging materials. By leveraging technology, food companies can respond to consumer demands for transparency, traceability, and ethical production practices, ultimately driving growth in the food technology market.

Restraint

Limited consumer acceptance of novel food technologies

Limited consumer acceptance of novel food technologies acts as a significant restraint on the market demand for the food technology industry. When consumers are hesitant or skeptical about new food technologies, they may be reluctant to purchase products that incorporate these innovations. This reluctance stems from factors such as unfamiliarity with the technology, concerns about safety and health implications, or simply a preference for traditional or familiar food options.

Additionally, consumer acceptance plays a crucial role in driving demand for food technology products and services. If consumers are not receptive to new food technologies, companies may face challenges in marketing and selling their innovative products, leading to slower adoption rates and lower market demand. Therefore, addressing consumer concerns and educating the public about the benefits and safety of novel food technologies is essential for overcoming this restraint and fostering greater acceptance and demand in the food technology market.

Opportunity

Integration of blockchain technology for supply chain transparency

The integration of blockchain technology for supply chain transparency is creating significant opportunities in the food technology market. By leveraging blockchain, companies can track and record every step of the food supply chain, from farm to table, in an immutable and transparent manner. This enhanced traceability helps build consumer trust by providing verifiable information about the origin, production methods, and quality of food products. Moreover, blockchain technology enables more efficient and secure supply chain management, reducing the risk of fraud, contamination, and foodborne illnesses. With increased transparency and visibility into the supply chain, companies can quickly identify and address issues such as recalls, spoilage, or unethical practices, thus improving overall food safety and quality.

As consumers become more concerned about where their food comes from and how it's produced, the adoption of blockchain technology offers a competitive advantage for companies looking to meet these demands and differentiate themselves in the market.

Segment Insights

Component Insights

The hardware segment held the highest market share of 42% in 2024. In the food technology market, the hardware segment comprises physical devices and equipment used in food processing, packaging, and distribution. This includes machinery such as food processors, packaging machines, refrigeration units, and sensors for monitoring temperature and humidity. Trends in the hardware segment include the adoption of automation and robotics to streamline production processes, the development of smart packaging solutions with integrated sensors, and the use of IoT-enabled devices for real-time monitoring and control of food processing operations.

The software segment is anticipated to witness rapid growth at a significant CAGR of 11.1% during the projected period. In the food technology market, the software segment encompasses various digital solutions and platforms used to manage and optimize food-related processes. This includes software for inventory management, supply chain logistics, quality control, and recipe formulation. Recent trends in this segment include the integration of artificial intelligence and machine learning algorithms for predictive analytics, as well as the development of cloud-based software as a service (SaaS) platforms for enhanced scalability and accessibility. Additionally, there is a growing emphasis on software solutions that enable traceability and transparency throughout the food supply chain.

Industry Insights

The fish, meat, and seafood segment held a 19% market share in 2024. In the food technology market, the fish, meat, and seafood segment refers to the processing, preservation, and distribution of these protein-rich food products. Trends in this segment include the adoption of advanced processing techniques such as high-pressure processing (HPP) and sous-vide cooking, as well as the development of plant-based alternatives and lab-grown meat. Additionally, there is a growing emphasis on sustainability, with initiatives focusing on responsible sourcing, waste reduction, and eco-friendly packaging solutions.

The dairy products segment is anticipated to witness rapid growth over the projected period. The dairy products segment within the food technology market encompasses the production, processing, and distribution of milk-based products such as cheese, yogurt, and butter. Key trends in this segment include the adoption of innovative processing techniques to enhance product quality and extend shelf life, the development of dairy alternatives to cater to lactose-intolerant and vegan consumers, and the integration of digital solutions for improved dairy farm management and supply chain efficiency.

Application Insights

The food science segment has held a 26% market share in 2024. In the food technology market, the food science segment encompasses the study and application of scientific principles to understand the properties and behavior of food. This includes areas such as food chemistry, microbiology, and engineering, aimed at improving food quality, safety, and production processes. Recent trends in food science within the technology sector include advancements in food preservation techniques, development of novel ingredients, and the integration of biotechnology for sustainable food production and nutrition enhancement.

The delivery segment is anticipated to witness rapid growth over the projected period. In the food technology market, the delivery segment refers to the technological solutions and services used to facilitate the distribution and delivery of food products to consumers. This includes online food delivery platforms, delivery logistics software, and meal delivery apps. A notable trend in this segment is the rapid growth of food delivery services driven by consumer demand for convenience and the increasing adoption of digital platforms for ordering food. This trend is expected to continue as more consumers embrace online ordering and delivery options.

Regional Insights

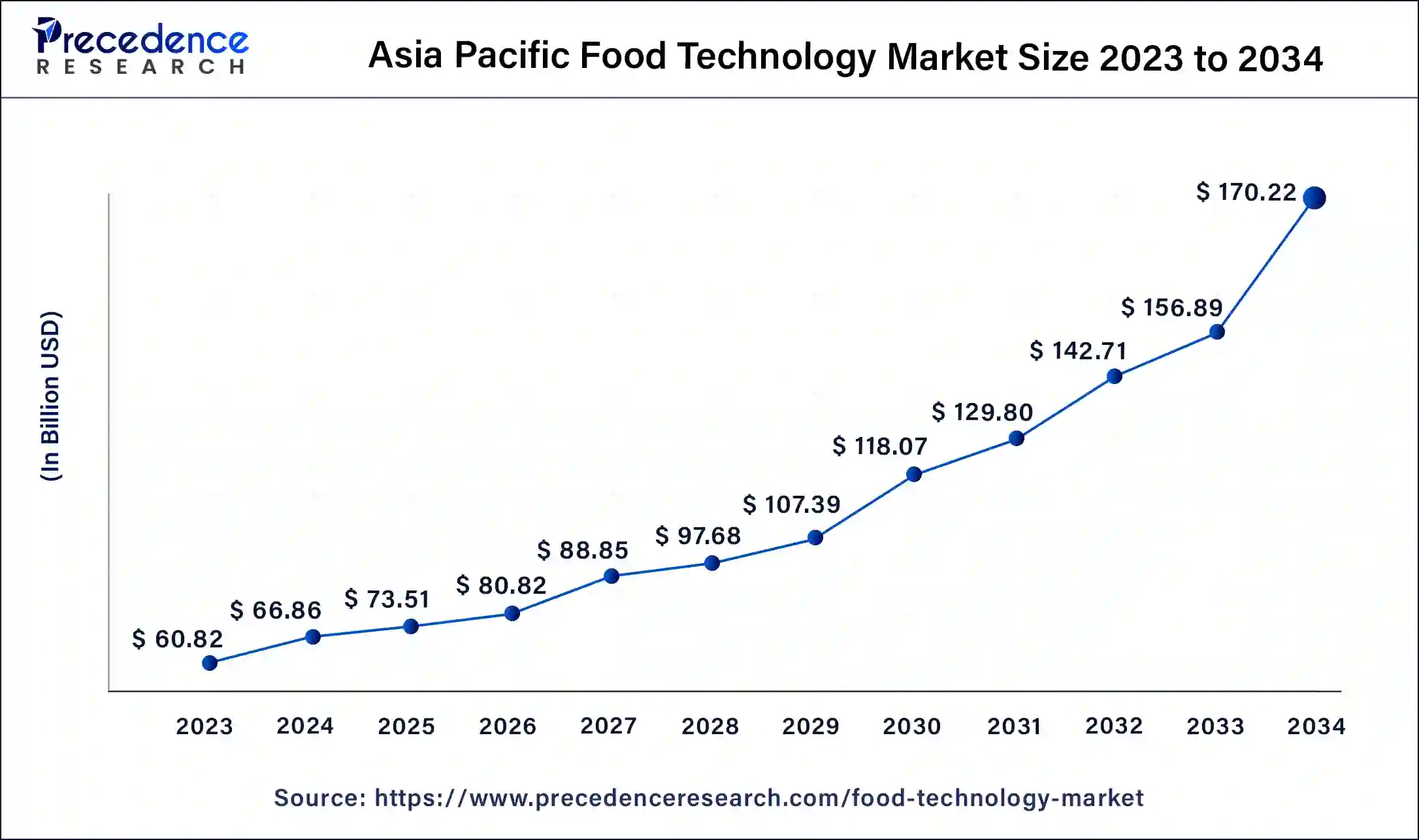

Asia Pacific Food Technology Market Size and Growth 2025 to 2034

The Asia Pacific Food Technology market size is estimated at USD 73.51 billion in 2025 and is projected to surpass around USD 170.22 billion by 2034 at a CAGR of 10% from 2025 to 2034.

Asia-Pacific held a share of 33% in the food technology market in 2024 due to several factors. Firstly, rapid urbanization and rising disposable incomes in countries like China, India, and Japan have led to increased demand for processed and convenience foods. Additionally, the region's large population creates a vast consumer base for food technology products and services. Furthermore, government initiatives to modernize agriculture and food processing industries, coupled with technological advancements and innovations, further contribute to the region's dominance in the market.

North America is experiencing rapid growth in the food technology market due to several key factors. Firstly, there is a strong culture of innovation and technological advancement in the region, fostering the development and adoption of cutting-edge food technologies. Additionally, shifting consumer preferences towards healthier and more sustainable food options are driving demand for innovative solutions. Furthermore, the presence of established food tech companies and robust investment in research and development contribute to the region's leadership in this market. These factors collectively propel the rapid growth of the food technology industry in North America.

Meanwhile, Europe is experiencing notable growth in the food technology market due to several factors. Firstly, increasing consumer demand for healthy, sustainable, and convenient food options has driven innovation and investment in the region. Additionally, supportive government initiatives and regulations promoting food safety, sustainability, and innovation have created a conducive environment for the growth of the food technology sector. Furthermore, Europe's robust infrastructure, skilled workforce, and strong research and development capabilities have contributed to its position as a leading hub for food technology innovation and entrepreneurship.

Food Technology Market Companies

- Beyond Meat

- Impossible Foods

- Cargill, Incorporated

- Tyson Foods

- Nestlé

- ADM (Archer Daniels Midland Company)

- Kerry Group

- Ingredion

- Tyson Foods

- Danone

- Kraft Heinz

- Givaudan

- Conagra Brands

- The Kellogg Company

- Ingredion Incorporated

Recent Developments

- In July 2023, FarMart, an advanced food supply network, introduced Saudabook, India's inaugural technological solution for the food processing industry. This groundbreaking platform extended its ERP system, FarMartOS, to all food processors across India, to modernize the nation's food sector and streamline supply chain processes intelligently.

- In March 2023, CUBIQ FOODS and Cargill, Incorporated, a U.S.-based company, revealed a collaboration to supply innovative fats for plant-based foods. Through this partnership, the companies sought to address the growing demand for healthier ingredients in the market.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Industry

- Fish, Meat, and Seafood

- Fruits and Vegetables

- Grain and Oil

- Dairy Products

- Beverages

- Bakery and Confectionery

- Others

By Application

- Food Science

- Kitchen & Restaurant Tech

- Delivery

- Supply Chain

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting