What is the Fuel Cell Vehicle Market Size?

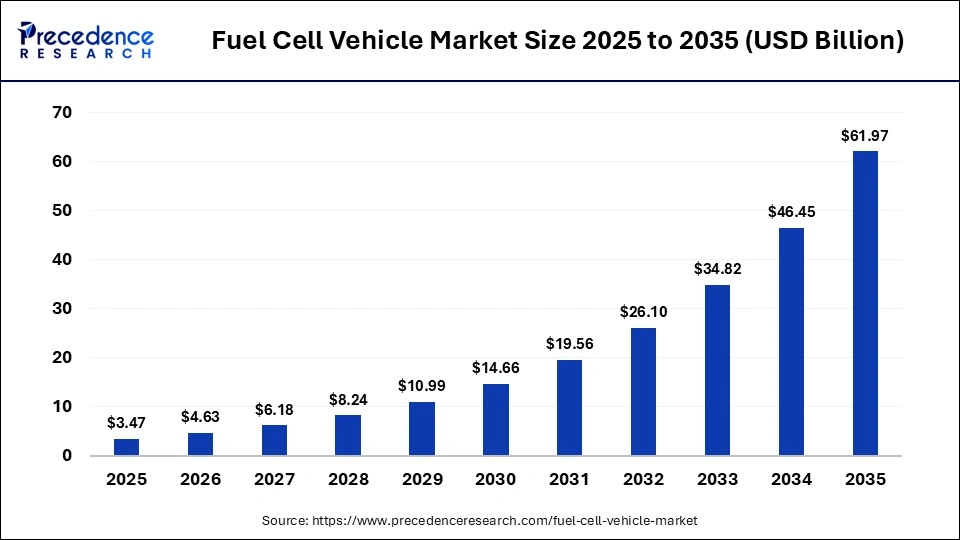

The global fuel cell vehicle market size was calculated at USD 3.47 billion in 2025 and is predicted to increase from USD 4.63 billion in 2026 to approximately USD 61.97 billion by 2035, expanding at a CAGR of 33.41% from 2026 to 2035.The growing demand for eco-friendly vehicles and technological advancements in the automotive sector are driving the market. Additionally, the rapid investment by the automotive companies in opening new manufacturing centers, as well as numerous government initiatives aimed at strengthening the hydrogen infrastructure, is playing a prominent role in shaping the industrial landscape.

Market Highlights

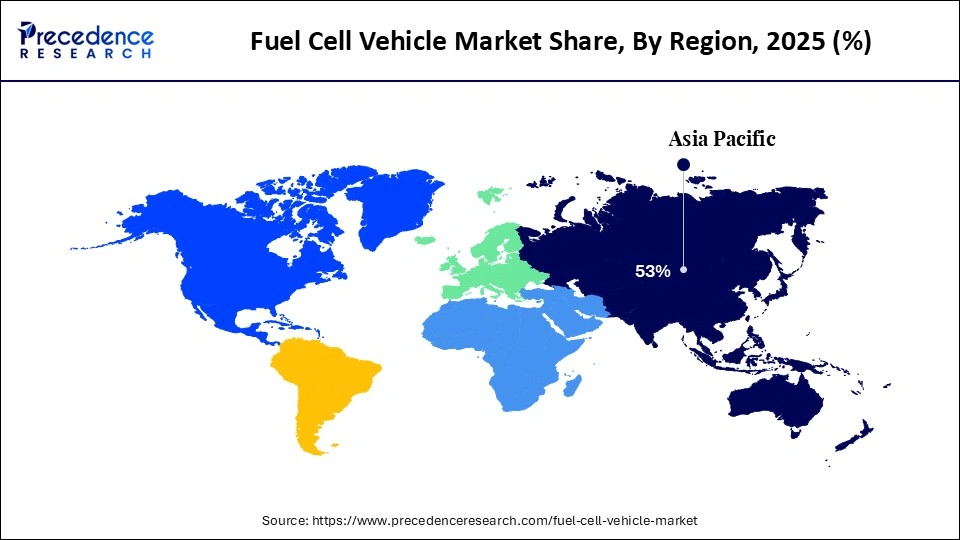

- Asia Pacific led the fuel cell vehicle market by holding the largest share of 53% in 2025.

- North America is expected to grow at a significant CAGR during the forecast period.

- By vehicle type, the passenger cars segment held the largest share of the market in 2025.

- By vehicle type, the light commercial vehicles (LCVs) segment is expected to grow at the highest CAGR between 2026 and 2035.

- By component, the fuel stack segment held the largest share of the market in 2025.

- By component, the humidifier segment is expected to expand at the fastest CAGR during the forecast period.

- By specialized vehicle, the material handling vehicle segment held a considerable share of the market in 2025.

- By specialized vehicle, the auxiliary power unit for the refrigerated truck segment is expected to grow at a significant CAGR during the forecast period.

Market Overview

The fuel cell vehicle industry is a prominent segment of the automotive sector. This industry deals with the production and distribution of fuel cell vehicles across the globe. These vehicles are operated using various technologies, such as proton exchange membrane fuel cell, solid oxide fuel cell, alkaline fuel cell, and phosphoric acid fuel cell. The increasing demand for fuel cell vehicles from the commercial sector, along with research and development related to hydrogen fuel, is driving the market.

The increasing demand for clean and sustainable transportation solutions that reduce greenhouse gas emissions and dependence on fossil fuels also drives the market. Moreover, advances in hydrogen production, storage, and fuel cell technology have improved vehicle efficiency, range, and performance, making FCVs more viable for commercial and consumer use.

What is the Significance of AI in the Fuel Cell Vehicle Industry?

The emergence of Artificial Intelligence has drastically impacted the automotive sector. Nowadays, automakers are integrating AI into production units to enhance efficiency, safety, quality, and flexibility. Fuel cell vehicle manufacturers are deploying AI in their development centers to enable predictive maintenance, accelerate design, improve safety, and deliver real-time energy management. AI algorithms help manage hydrogen consumption, predict maintenance needs, and optimize powertrain operations in real time, improving vehicle range and durability. Additionally, AI supports advanced battery and fuel cell system management, enabling adaptive energy distribution and fault detection.

- In February 2025, Stellantis partnered with Mistral AI. This partnership is aimed at developing an AI-enabled platform for enhancing the vehicle development process.

Fuel Cell Vehicle Market Trends

- Partnerships: Numerous automotive manufacturing companies are partnering with oil & gas companies to strengthen the hydrogen industry infrastructure in different parts of the world. For instance, in December 2025, Hyundai Motor Group partnered with Air Liquide. This partnership is aimed at accelerating the hydrogen ecosystem globally.

- Business Expansions: Several automakers are investing rapidly in opening new manufacturing units to increase the production of fuel cell systems. For instance, in March 2025, Hyundai Motor Co. opened a new production unit in South Korea. This new manufacturing plant is inaugurated to produce around 6,500 fuel cell systems for the automotive sector.

- Government Initiatives: Governments of several nations, including the U.S., India, Germany, Norway, and the UAE, are launching various initiatives for lowering emissions. For instance, in August 2025, the government of Norway announced the Norwegian Global Emission Reduction (NOGER) Initiative. This initiative aims at lowering emissions in this nation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.47Billion |

| Market Size in 2026 | USD 4.63 Billion |

| Market Size by 2035 | USD 61.97Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 33.41% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Component, Specialized Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Vehicle Type Insights

Why Did the Passenger Cars Segment Dominate the Fuel Cell Vehicle Market?

The passenger cars segment dominated the market while holding a major revenue share in 2025. This is mainly due to the increased sales of hydrogen-based passenger cars in several nations, including the U.S., Japan, Germany, Canada, Norway, India, and South Africa. Additionally, the rapid investment by the automotive companies for opening new production units to increase the manufacturing of fuel cell passenger vehicles bolstered the segment. Moreover, the growing emphasis of several automakers, such as Toyota, General Motors, Hyundai, and Honda, on R&D and commercial launches for fuel cell passenger cars is expected to ensure the long-term growth of the segment.

The light commercial vehicles (LCVs) segment is expected to expand at the highest CAGR during the forecast period. This is mainly due to the rising adoption of hydrogen-based LCVs by the manufacturing companies in several countries, such as Germany, Canada, China, and the UAE. The rapid investment by automotive companies for boosting the production of fuel cell LCVs, along with partnerships between commercial vehicle companies and e-commerce brands for deploying hydrogen LCVs, is positively contributing to the segmental growth. Additionally, government incentives and investments in hydrogen infrastructure for commercial fleets are accelerating the deployment of fuel cell-powered LCVs.

Component Insights

What Made Fuel Stack the Dominant Segment in the Fuel Cell Vehicle Market?

The fuel stack segment dominated the market with the largest share in 2025. This is because it is the core component in fuel cell vehicles to convert hydrogen directly into electrical energy for delivering power. Its numerous advantages include environmental benefits, high efficiency, superior power density, and enhanced reliability. Their critical role in vehicle operation and continuous improvements in efficiency and lifespan make this segment central to the market.

The humidifier segment is expected to grow at the fastest CAGR during the forecast period. This is mainly due to the growing application of a humidifier in FCVs to manage moisture levels in the fuel cell stack. Moreover, several functions of a humidifier, such as transferring water vapor, improving vehicle performance, protecting the membrane from dehydration, and enhancing the longevity of proton exchange membrane fuel cell (PEMFC) is expected to drive the growth of the segment.

Specialized Vehicle Insights

Why Did the Material Handling Vehicle Segment Lead the Fuel Cell Vehicle Market?

The material handling vehicle segment led the market in 2025. This is due to the increased demand for FCEVs from the logistics industry for transporting goods in the warehouses. Surging investments by automakers in deploying hydrogen vehicles at manufacturing plants are playing a crucial role in shaping the fuel cell vehicle industry. In addition, strategic partnerships between automotive and e-commerce companies with hydrogen vehicle manufacturers, aimed at using hydrogen-powered material handling vehicles in warehouses and distribution centers, ensure the long-term growth of the segment.

The auxiliary power unit for the refrigerated truck segment is expected to grow at a considerable CAGR during the forecast period. The increasing use of hydrogen-based refrigerated trucks in the pharma industry for transporting medicinal items in different parts of the world is driving the segmental growth. Additionally, the growing focus of the automotive brands on designing FCEV vehicles for the food and beverage sector, coupled with stringent government policies to use eco-friendly vehicles in the logistics sector, is positively contributing to the segment. Collaborations among automotive companies and engine developers to design powerful FCEV trucks for the processed food industry are driving the growth of the segment.

Regional Insights

What is the Asia Pacific Fuel Cell Vehicle Market Size?

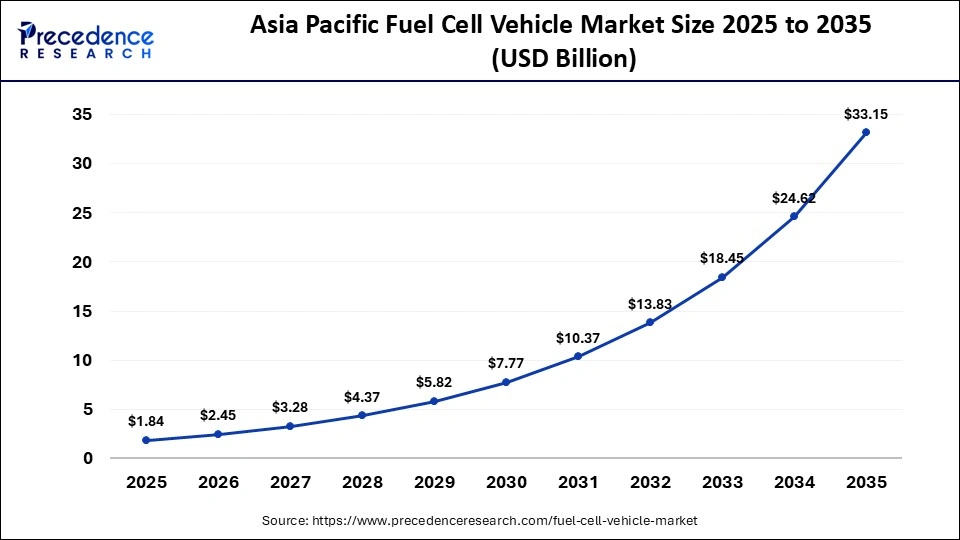

The Asia Pacific fuel cell vehicle market size is expected to be worth USD 33.15 billion by 2035, increasing from USD 1.84 billion by 2025, growing at a CAGR of 33.53% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Fuel Cell Vehicle Market?

Asia Pacific dominated the fuel cell vehicle market by capturing the largest share in 2025. The region's dominance in the market is attributed to the increased sales of hydrogen trucks in several nations, including Japan, China, India, and South Korea. Numerous government initiatives aimed at strengthening the hydrogen infrastructure, coupled with the rise in the number of automotive workshops, also bolstered the market in the region. Moreover, the presence of several market players, such as Hyundai, Nissan, and Toyota, focuses on innovation and research & development in hydrogen technology, which reinforces the region's leadership in the market.

- In November 2025, Toyota announced to launch Hilux FCEV in Thailand. This FCEV is designed for eco-friendly consumers in this nation.

Japan Fuel Cell Vehicle Market Trends

The market is growing in Japan due to strong government support through subsidies, tax incentives, and policies promoting hydrogen infrastructure and clean mobility. Japan has heavily invested in hydrogen refueling stations, making fuel cell vehicles more accessible and practical for consumers. Additionally, Japanese automakers have been early adopters and innovators in FCV technology, launching commercially successful models that boost consumer confidence.

- In June 2025, Honda announced to open a production unit in Moka City, Tochigi, Japan. This manufacturing plant is inaugurated to enhance the production of next-generation fuel cell modules in the country.

How is the Opportunistic Rise of North America in the Fuel Cell Vehicle Market?

North America is expected to expand at a significant CAGR during the forecast period. The growing demand for hydrogen cars from the elite-class consumers in the U.S., Canada, and Mexico is boosting the market growth. Additionally, several government policies aimed at lowering emissions, along with technological advancements in the automotive sector, are positively contributing to the industry. Moreover, the presence of numerous market players, including General Motors, Nikola Corporation, Hyzon Motors, and Cummins, is expected to propel the growth of the market in this region.

- In December 2024, Hyzon launched a 200-kW fuel cell system. This fuel cell system is designed for the truck manufacturers in the U.S.

U.S. Fuel Cell Vehicle Market Analysis

The market in the U.S. is growing due to surging investments by automotive manufacturers in opening new FCEV production centers, along with numerous government initiatives aimed at adopting eco-friendly vehicles. Also, the increasing disposable income of the people, as well as the rapid adoption of hydrogen trucks in the logistics industry, is playing a prominent role in shaping the industrial landscape. Growing environmental awareness, strict emission regulations, and the country's commitment to a carbon-neutral future are further driving the adoption of fuel cell vehicles.

- In June 2024, Honda inaugurated a new fuel cell electric vehicle center in the U.S. This new center is open to increase the production of CR-V e: FCEV for consumers in this region.

What Potentiates the European Fuel Cell Vehicle Market?

The European fuel cell vehicle market is being propelled by stringent emission regulations, strong government incentives, and ambitious decarbonization targets across the region. Investments in hydrogen infrastructure, including refueling stations and production facilities, are making FCVs more accessible and practical for consumers and commercial fleets. Additionally, Europe's focus on sustainable mobility, coupled with significant R&D and pilot projects by automakers and energy companies, is accelerating technological innovation.

Value Chain Analysis

- Raw Materials Sourcing: Raw materials used in the manufacturing of fuel cell vehicles comprise platinum (Pt), iridium, and zirconium (Zr).

Key Companies: Anglo American Plc (NGLOY), Sibanye Stillwater (SBSW), and Ivanhoe Mines (IVPAF). - Component Assembling:Fuel cell vehicles are assembled using advanced processes to integrate the hydrogen fuel cell stack, high-pressure tanks, and electric powertrain in the vehicles.

Key Companies: Honda Motors Co. Ltd, Daimler AG, and Nikola Corporation. - Aftermarket Services and Spare Parts: The availability of high-quality spare parts in the retail centers and online platforms, along with the opening of new garages for providing aftermarket services to FCEV owners, is crucial to industrial development.

Key Companies: Bosch, Denso, and Continental.

Recent Developments

- In October 2025, Hyundai Motor launched the Nexo fuel cell electric vehicle (FCEV). This vehicle is designed to cater to the eco-friendly consumers of Japan.(Source: https://www.automotiveworld.com)

- In September 2025, Hino launched the Profia Z FCV. The Profia Z FCV is a zero-emission heavy-duty truck that is capable of running 650 kilometres with its tanks full.(Source: https://www.electrive.com)

- In September 2025, Toyota Motor Corporation joined hands with Isuzu Motors Limited. This joint venture is aimed at developing a next-generation hydrogen fuel cell bus in Japan.(Source: https://bus-news.com)

Who are the Major Players in the Global Fuel Cell Vehicle Market?

The major players in the fuel cell vehicle market include Daimler AG, Honda Motor Co., Ltd., Nikola Corporation, Toyota Motor Corporation, BMW AG, AUDI AG, AB Volvo, General Motors, Hyundai Motor Group, Ballard Power Systems Inc.

Segments Covered in the Report

By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

By Component

- Fuel Processor

- Fuel Stack

- Power Conditioner

- Air Compressor

- Humidifier

By Specialized Vehicle

- Material Handling Vehicle

- Auxiliary Power Unit for Refrigerated Truck

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content