What is the Fuels Lubes and Petrochemicals Market Size in 2026?

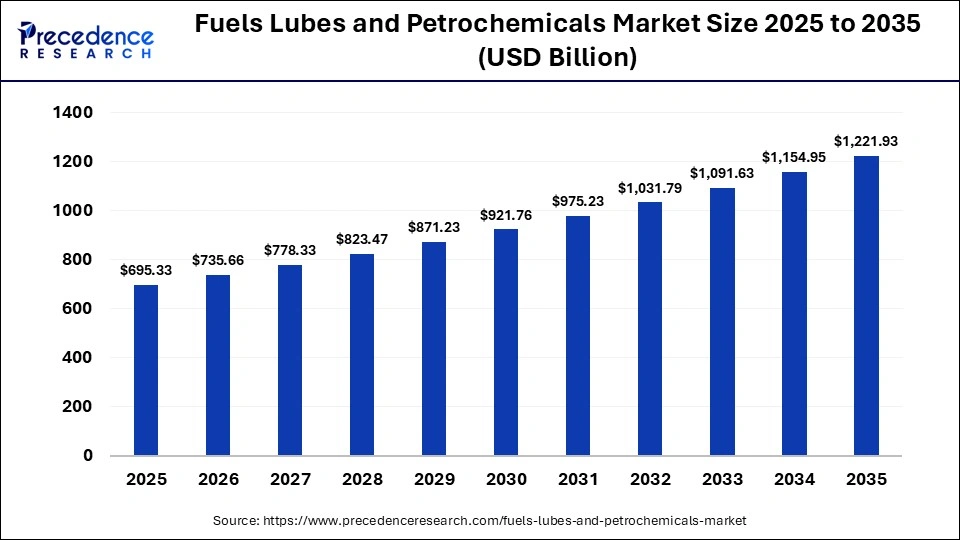

The global fuels lubes and petrochemicals market size accounted for USD 695.33 billion in 2025 and is predicted to increase from USD 735.66 billion in 2026 to approximately USD 1,221.93 billion by 2035, expanding at a CAGR of 5.80% from 2026 to 2035. The market is driven by transportation demand, industrial expansion, and rising energy consumption. Growth in automotive production, aviation, and manufacturing supports lubricant and fuel usage, while petrochemicals benefit from packaging and construction applications. Sustainability trends and cleaner technologies increasingly influence product innovation.

Key Takeaways

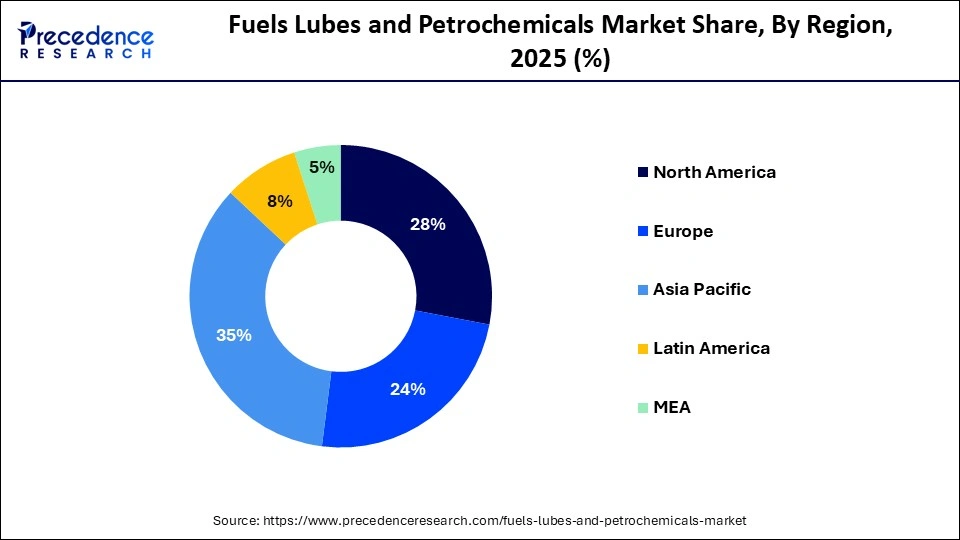

- Asia-Pacific led the fuels lubes and petrochemicals market in 2025.

- The Middle East & Africa are expected to expand at the highest CAGR in the market between 2026 and 2035.

- By type, the fuels segment held a dominant revenue share of the market in 2025.

- By type, the petrochemicals segment is expected to grow at the highest CAGR between 2026 and 2035.

- By application, the aerospace and defense segment dominated the market in 2025.

- By application, the automotive segment is expected to expand rapidly from 2026 to 2035.

Why is the Fuels Lubes and Petrochemicals Market Gaining Strategic Momentum?

Fuel refers to energy sources such as gasoline, diesel, and aviation turbine fuel used to power transportation and industries. Lubricants reduce friction and wear in engines and machinery, enhancing efficiency and lifespan. Petrochemicals are chemical products derived from petroleum and natural gas used in plastics, textiles, and packaging. The market holds strategic importance due to its critical role in energy security, industrial growth, and global supply chains.

How Can AI Integration Transform the Global Fuels Lubes and Petrochemicals Market?

Artificial intelligence (AI) integration is transforming the fuels, lubes, and petrochemicals industry through real-time process optimization, advanced predictive maintenance, and intelligent refinery modelling. Companies are deploying AI-driven digital twins to simulate refining and petrochemical yields, reduce energy intensity, and cut operational losses.

Machine learning (ML) algorithms enhance lubricant formulation development and performance testing. AI-powered demand forecasting improves fuel distribution planning, while automated quality control systems ensure compliance and minimize waste. Across integrated complexes, AI supports feedstock optimization, emissions monitoring, and margin management, enabling faster, data-driven decisions and improved operational resilience.

Primary Trends Influencing the Fuels Lubes and Petrochemicals Market

- Energy Transition and Low-Carbon Fuels: Refineries and energy companies are increasingly investing in cleaner fuels such as low-sulfur diesel, sustainable aviation fuel, and renewable diesel. Decarbonization strategies, carbon capture initiatives, and stricter environmental regulations are accelerating the shift toward lower-emission energy solutions across transportation and industrial sectors.

- Growth in Electric and Hybrid Mobility: The rapid adoption of electric vehicle and hybrid vehicles is reshaping fuel demand patterns while increasing the need for advanced thermal management fluids and specialized lubricants. Traditional lubricant manufacturers are developing new formulations compatible with electric drivetrains and battery systems to remain competitive.

- Circular Economy and Recycling Initiatives: Companies are focusing on plastic waste recycling, chemical recycling technologies, and re-refining used lubricants. Circular economy practices are helping reduce environmental impact, improve resource efficiency, and meet regulatory mandates, while creating new revenue streams within petrochemical value chains.

- Petrochemical Integration with Refineries: Integrated refinery-petrochemical complexes are gaining importance as companies shift from fuel-focused output toward higher-margin petrochemical production. This strategy helps balance fluctuating fuel demand and supports growing requirements for plastics, packaging materials, and specialty chemicals, propelling the fuels lubes and petrochemicals market.

- Digitalization and Smart Operations:The adoption of digital technologies, including advanced analytics, AI, and predictive maintenance systems, is enhancing operational efficiency. Smart monitoring improves asset performance, reduces downtime, optimizes supply chains, and lowers operational costs across fuel and lubricant production facilities.

- Feedstock Diversification and Bio-Based Alternatives: Producers are increasingly exploring bio-based feedstocks, natural gas liquids, and alternative raw materials to reduce dependence on crude oil. This diversification strengthens supply security, improves sustainability credentials, and aligns with global climate commitments.

- Expansion in Emerging Economies: Rising industrialization, urbanization, and vehicle ownership in developing regions are driving demand for fuels, lubricants, and petrochemical products. Infrastructure development and manufacturing growth continue to support long-term consumption patterns in these high-growth markets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 695.33 Billion |

| Market Size in 2026 | USD 735.66 Billion |

| Market Size by 2035 | USD 1,221.93 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.80% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Tyep, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Which Type Segment Dominated the Fuels Lubes and Petrochemicals Market?

The fuel segment dominated the market in 2025 due to sustained global demand for transportation energy, including road, aviation, and marine fuels. Economic activity, freight movement, and infrastructure development drive consumption. Additionally, limited immediate substitutes for liquid fuels in heavy transport and industrial sectors, coupled with established distribution networks and refining capacity, reinforce its leading role in the market.

The petrochemicals segment is expected to be the fastest-growing segment in the market due to the rising demand for high-performance plastics, increased use of petrochemical derivatives in automotive and consumer electronics, expanding applications in packaging and construction, and advancements in refining technologies that improve efficiency and product quality, driving broader industrial and consumer adoption.

Application Insights

Which Application Segment Led the Fuels Lubes and Petrochemicals Market?

The aerospace and defense segment led the market in 2025 due to stringent performance and safety requirements, high demand for specialized aviation fuels and advanced lubricants, continuous military modernization programs, and increased air travel. Long product lifecycles, regulatory compliance standards, and the need for reliability in extreme conditions further reinforce its leading position.

The automotive segment is expected to witness the fastest growth in the market over the forecast period, due to rising demand for lightweight polymers, synthetic rubber, and performance fluids used in modern vehicles. Increasing production of SUVs, commercial vehicles, and two-wheelers across emerging economies boosts consumption of engine oils, transmission fluids, and specialty additives. Additionally, evolving emission norms and the shift toward hybrid mobility require advanced formulations, accelerating innovation and product upgrades across automotive applications.

Regional Insights

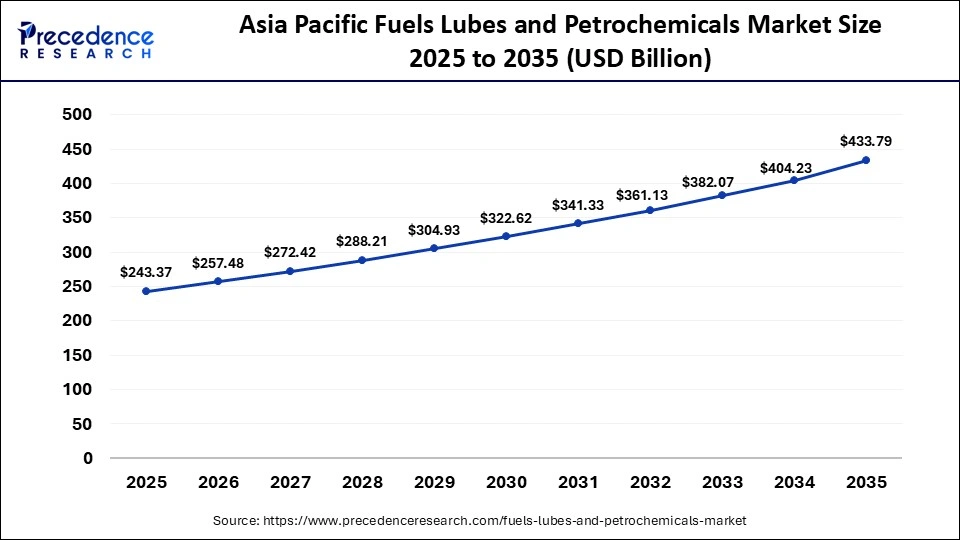

Asia Pacific Fuels Lubes and Petrochemicals Market Size and Growth 2026 to 2035

The Asia Pacific fuels lubes and petrochemicals market size is expected to be worth USD 433.79 billion by 2035, increasing from USD 243.37 billion by 2025, growing at a CAGR of 5.95% from 2026 to 2035.

Why Asia-Pacific Dominated the Fuels Lubes and Petrochemicals Market?

Asia-Pacific held a major revenue share of the market in 2025 due to rapid industrialization, expanding automotive and manufacturing sectors, and surging energy demand from urbanization. Strong petrochemical capacity investments in China, India, and Southeast Asia support large-scale production and export growth. Additionally, government policies favor infrastructure development and increased refinery output, while rising consumer consumption and logistics activities further elevate regional fuel and lubricant requirements.

China Market Trends

China's market is evolving through a shift toward chemical-centric refining, where more crude output is converted into polymers and intermediates instead of transport fuels. Demand from electric vehicles, electronics, construction, and advanced manufacturing is increasing the consumption of specialty lubricants and engineered plastics. Upgrades in process efficiency, cleaner fuel standards, and domestic feedstock diversification are steadily strengthening production resilience and long-term industry growth.

How is the Middle East and Africa Growing in the Fuels Lubes and Petrochemicals Market?

The Middle East and Africa are expected to host the fastest-growing market in the coming years through extensive hydrocarbon reserves that underpin large-scale refining and petrochemical investments. Integrated complexes in GCC countries maximize value from crude, while Africa's emerging processing capacity supports regional demand. Strategic export infrastructure, competitive feedstock costs, and growing production of specialty chemicals and base oils strengthen the region's role in global supply chains and industrial growth.

UAE Market Trends

The UAE is advancing its fuels, lubricants, and petrochemicals sector by expanding integrated refining-to-chemicals capacity, particularly through the TA'ZIZ industrial ecosystem and Borouge polymer expansions in Ruwais. The country is increasing production of polyolefins, specialty chemicals, and higher-grade base oils aimed at Asian and European export markets. Digital plant optimization, low-carbon hydrogen integration, and carbon capture deployment are also shaping industry trends, reinforcing the UAE's position as a high-value downstream hub.

Will North America Grow in the Fuels Lubes and Petrochemicals Market?

North America is expected to grow at a notable CAGR in the foreseeable future, due to sustained shale-driven ethane and natural gas liquids availability, which supports cost-efficient expansion of ethylene, propylene, and downstream polymer production across integrated Gulf Coast hubs. Refiners are increasingly prioritizing refinery-to-chemicals configurations to maximize petrochemical output over conventional fuel streams.

In addition, scaling of sustainable aviation fuel co-processing, expansion of Group II and Group III base oil capacity, rising demand for specialty additives, and investments in advanced recycling and circular polymer infrastructure are collectively strengthening regional competitiveness, export momentum, and long-term industrial growth.

U.S. Market Trends

The U.S. is dominant in North America's market due to its large-scale shale oil and gas production, which ensures steady, cost-advantaged feedstock for refining and petrochemical operations. Extensive Gulf Coast infrastructure supports integrated refining-to-chemicals complexes and strong export capabilities. The country also leads in advanced base oil production, specialty lubricant formulations, sustainable aviation fuel development, and chemical recycling investments, reinforcing its technological and supply chain leadership across the region.

Which Factors Contribute to the Fuels Lubes and Petrochemicals Market in Europe?

Europe is considered to be a significantly growing area, due to its transition to lower-carbon fuels and advanced chemical products. Investments in bio-derived feedstocks, circular plastics recycling, and sustainable lubricant formulations are expanding regional capabilities. Strong demand for high-performance materials in automotive, aerospace, and industrial sectors, coupled with regulatory support for cleaner energy and chemical innovation, positions Europe to capture a larger share of higher-value petrochemical and specialty product markets.

Which Factors Make Latin America Grow at a Considerable CAGR in the Market?

Latin America is expected to grow at a considerable CAGR in the upcoming period, due to expanding domestic refinery upgrades that increase conversion to higher-value petrochemicals, rising automotive and industrial lubricant demand, and investments in downstream chemical facilities. Strengthening energy infrastructure and increased processing of heavier crude grades enhance regional output. Additionally, growing use of specialty polymers in packaging and construction, along with efforts to adopt cleaner fuel standards, supports sustained market expansion.

Fuels Lubes and Petrochemicals Market Value Chain Analysis

- Feedstock Procurement

Crude oil, natural gas, and natural gas liquids are sourced through upstream exploration and production activities. Feedstock is transported via pipelines, tankers, and terminals to refineries and petrochemical complexes for primary processing.

Key Players: Saudi Aramco, ExxonMobil, Shell plc, and BP plc, among others

- Chemical Synthesis and Processing

Refineries convert crude oil into fuels through distillation, cracking, and reforming processes. Petrochemical units further process feedstocks into base chemicals such as ethylene, propylene, aromatics, and other intermediates.

Key Players: Reliance Industries Limited, Sinopec, BASF, and Dow Inc., among others.

- Compound Formulation and Blending

Base oils and chemical intermediates are blended with additives to manufacture finished lubricants, specialty fluids, and polymer compounds. Advanced formulation ensures product stability, performance efficiency, and compliance with industry standards.

Key Players: Chevron Corporation, TotalEnergies, Valvoline Inc., and LyondellBasell, among others.

- Regulatory Compliance and Safety Monitoring

Companies implement environmental monitoring, emissions control, and workplace safety protocols across production facilities. Compliance involves regular audits, reporting, and adherence to fuel quality and chemical safety regulations.

Key Players: Environmental Protection Agency, European Chemicals Agency, International Energy Agency, and Occupational Safety and Health Administration, among others.

Fuels Lubes and Petrochemicals Market Companies

- Endurance Technologies (India)

- Jayashree Polymers (India)

- Imperial Auto Industries (India)

- Polyrub Extrusions (India)

- Gates Corporation (USA)

- Continental AG (Germany)

- Hutchinson SA (France)

- Toyoda Gosei (Japan)

- Sumitomo Riko (Japan)

- Yokohama Rubber Co., Ltd. (Japan)

- Parker Hannifin Corporation (USA)

- Trelleborg AB (Sweden)

- HoseMaster Inc. (USA)

- Nylex (Australia)

- Schieffer (global)

- Kedge Trading (global)

- Goodyear Tire & Rubber (USA)

- Semperit AG Holding (Austria)

- Codan Rubber Danmark A/S (Denmark)

Recent Developments

- In February, 2026, Shell Lubricants Egypt unveiled a refreshed lubricants portfolio engineered to meet 2025 API SQ performance standards, including Shell Helix Ultra with PurePlus Technology that delivers high-load, high-temperature engine protection and improved fuel economy for modern passenger cars.

(Source: https://www.dailynewsegypt.com) - In January 2026, PETRONAS Lubricants International launched its first‑ever JASO‑certified engine lubricants for Japan's newest high‑efficiency passenger engines, including PETRONAS Syntium Supreme JASO GLV2 and PETRONAS Urania 5000 JASO DL‑1, engineered with CoolTech+, delivering improved heat management and fuel economy tailored to regional standards.(Source: https://www.petronas.com)

- In January 2026, Motul India showcased its next-generation lubrication technologies, including E-Gen thermal fluids for EVs, sustainable NGEN lubricant ranges made from re-refined base oils, and advanced solutions for hydrogen internal combustion engines, highlighting its push into future mobility fluids.

(Source: https://www.autocarpro.in)

Segments Covered in the Report

By Type

- Fuels

- Lubes

- Petrochemicals

By Application

- Automotive

- Aerospace and Defense

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting