What is the Gate-All-Around (GAA) Transistor Market Size?

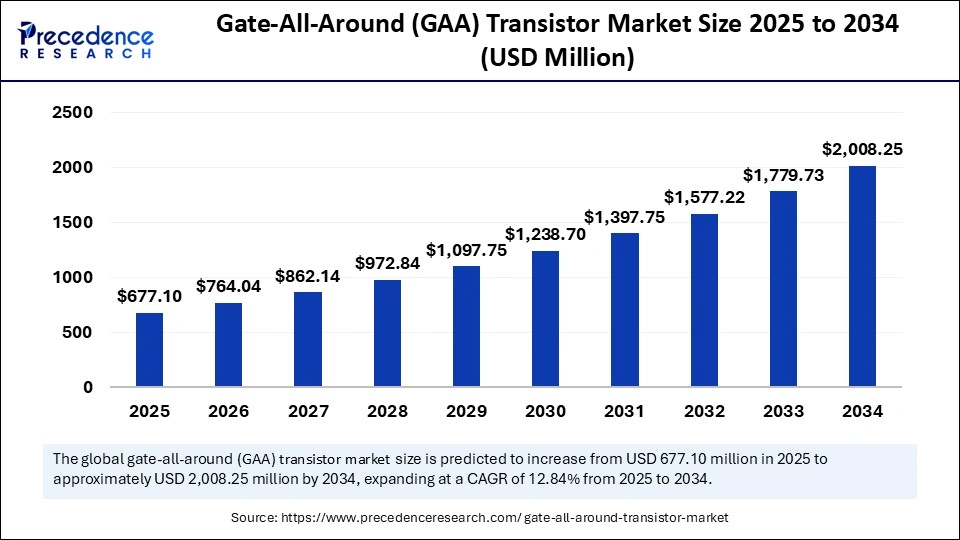

The global Gate-All-Around (GAA) transistor market size accounted for USD 600.05 million in 2024 and is predicted to increase from USD677.10 million in 2025 to approximately USD 2,008.25 million by 2034, expanding at a CAGR of 12.84% from 2025 to 2034. The sector represents a significant advancement in semiconductor design, offering improved performance and scalability for future electronic devices. As the market for GAA transistors continues to grow, understanding its market size and projected expansion is essential for stakeholders and industry analysts.

Market Highlights

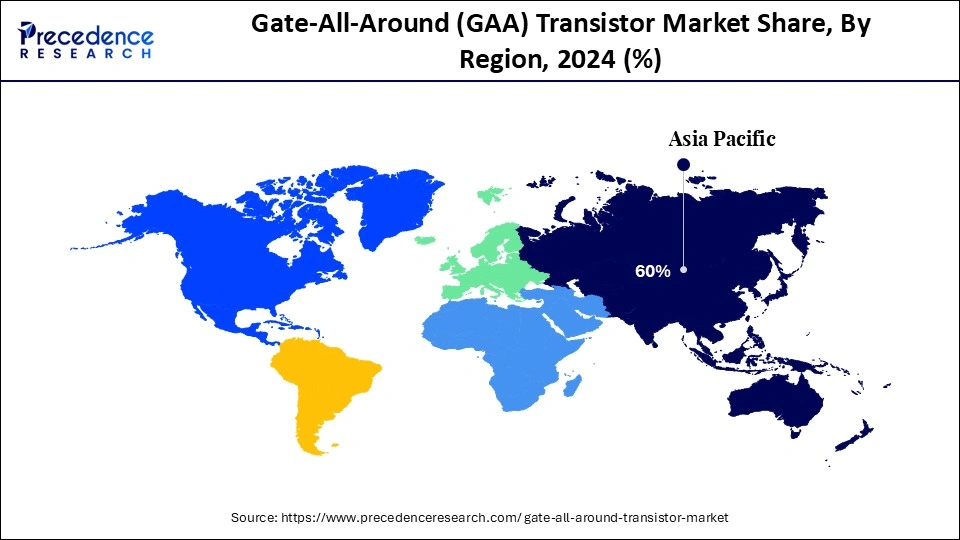

- Asia Pacific dominated the Gate-All-Around (GAA) transistor market with the largest market share at 60% in 2024.

- By region, North America is expected to expand at the fastest CAGR 25% between 2025 and 2034.

- By device type/architecture type, the nanosheet GAA transistors segment held the biggest market share of 55% in 2024.

- By device type/architecture, nanowire GAA transistors segments captured the highest market share of 30% share, is expected to grow at a remarkable CAGR between 2025 and 2034.

- By technology node type, the 5nm/4nm node segment contributed the maximum market share of 45% in 2024.

- By technology node type, 3nm / 2nm nodes currently held the biggest market share of 40% inn 2024 and are expected to grow at a significant CAGR during the forecasted period.

- By application type, the high-performance computing segment accounted for the significant market share of 35% in 2024.

- By application type, mobile SoCs are expected to grow at a remarkable 25% CAGR between 2025 and 2034.

- By end-user type, the foundries segment generated the major market share of 50% in 2024.

- By end-user type, IDMs are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 600.05 Million

- Market Size in 2025: USD 677.10 Million

- Forecasted Market Size by 2034: USD 2,008.25 Million

- CAGR (2025-2034): 12.84%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Why is the Gate-All-Around (GAA) Transistor Market Surging Ahead?

The gate-all-around (GAA) transistor market is rapidly evolving as the semiconductor industry pushes beyond the limits of finFET architectures. GAA transistors, with their superior electrostatic control and reduced leakage, are emerging as the next-generation building blocks for advanced nodes below 3nm. The exponential growth in demand for high-performance computing, mobile devices, and artificial intelligence applications drives their adoption. As chipmakers race to deliver faster and more energy-efficient processors, GAA technology is becoming central to their roadmaps. Leading foundries are heavily investing in mass production capabilities, signaling a transition period for the global chip industry.

How AI is Impacting the Gate-All-Around (GAA) Transistor Market?

Artificial Intelligence is both a driver and a beneficiary of the market for gate-all-around (GAA) transistors. Training and deploying advanced AI models require chips that deliver high throughput with minimal power leakage, an area where GAA significantly outperforms FinFET. AI workloads are also shaping design strategies, prompting foundries to optimize GAA transistors for data-intensive tasks such as natural language processing, image recognition, and generative models. At the same time, AI-powered tools are streamlining the design, simulation, and defect detection of GAA transistors. This reduces development timelines and enhances manufacturing yields.

Market Key Trends

- Transition from FinFET to GAA at sub-3nm nodes.

- Strong investments in EUV lithography and advanced materials to support GAA production.

- Collaboration between foundries and fabless design houses for early adoption.

- Rising demand for low-power, high-density chips in the mobile and HPC sectors.

- Government incentives are driving the development of local semiconductor manufacturing capabilities.

- Integration of AI-driven design automation in GAA research and development.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 600.05 Million |

| Market Size in 2025 | USD 677.10 Million |

| Market Size by 2034 | USD 2,008.25 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type / Architecture, Technology Node, Application, End User / Buyer, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Limitations of Traditional FinEFT Architecture Drive Growth in the Gate-All-Around (GAA) Transistor Market

The primary driver of the gate-all-around (GAA) transistor market is the need for enhanced performance at increasingly smaller process nodes. As FinEFT architectures approach their physical limitations, chipmakers are compelled to adopt new transistor designs that can sustain Moore's Law. Gate-all-around (GAA) transistors offer superior control over channel leakage, enabling higher efficiency and lower power consumption. This is crucial for devices like smartphones, where energy efficiency directly impacts user experience. Furthermore, the increasing reliance on high-performance computing for AI, 5G, and autonomous vehicles underscores the urgency of this issue.

Restraints

Complicated Manufacturing Processes and Significant Cost Undertakings Slow Down Market Growth

Despite its promise, the gate-all-around (GAA) transistor market faces several restraints. High manufacturing complexity significantly raises costs, making it challenging for smaller foundries to adopt the technology. Yield optimization remains a persistent issue, as even minor defects can undermine the efficiency of GAA transistors. Integration into existing fabs requires massive infrastructure upgrades, deterring many players. These challenges slow down the widespread adoption of Gate-all-around (GAA) transistors in cost-sensitive applications.

Opportunity

Advances in Quantum Computing and AI Processors Expected to Spur Growth in the Gate-All-Around (GAA) Transistor Market

The gate-all-around (GAA) transistor market presents significant opportunities in advanced applications, including AI processors, quantum computing, and next-generation smartphones. By enabling ultra-low power consumption and higher transistor density, GAA can support more powerful chips without compromising form factor. This opens new avenues for foldable devices, AR/VR headsets, and IoT ecosystems. Another opportunity lies in its role within the automotive sector, as electric and autonomous vehicles demand efficient chips for real-time processing.

Segmental Insights

Device Type / Architecture Insights

Why are Nanosheet GAA Transistors Dominating the Gate-All-Around (GAA) Transistors Market?

The nanosheet gate-all-around transistor is dominating the market for gate-all-around transistors, holding a 55% share. The stacking sheet configuration allows for prodigious drive currents. Their architecture provides an exquisite balance of scalability, manufacturability, and electrostatic control, rendering them the natural successor to FinFET at advanced nodes. Due to their structural simplicity compared to more exotic geometries, nanosheets are more readily integrated into existing fabrication processes. Industry giants, notably Samsung and TSMC, have already initiated commercial pilot production, thereby consolidating the hegemonic position of nanosheets. Their adoption is accelerated by the insatiable demand for compact, efficient semiconductors in mobile and data-intensive devices.

Despite this, beyond their immediate dominance, nanosheets embody a transitional archetype that elegantly bridges FinFET to the more esoteric transistor paradigms of the future. Their stacked channels enable designers to fine-tune device characteristics with remarkable flexibility, catering to the varied needs of CPUs, GPUs, and AI accelerators. Importantly, their manufacturing does not demand wholesale abandonment of existing infrastructure, sparing foundries from fiscal profligacy. This synergy between performance and manufacturability explains their rapid ascendancy as the prevailing GAA architecture.

The nanowire gate-all-around transistor is the fastest-growing segment in the market, holding a 30% share. Their geometry encircles the channel entirely, virtually nullifying leakage and enabling unprecedented device miniaturization. Such attributes render nanowires indispensable for sub-3nm nodes, where planar structures encounter formidable physical limitations. They are particularly coveted for high-performance computing and AI workloads, where efficiency and precision are sacrosanct. The allure of nanowires lies not merely in performance but also in their potential to redefine the bounds of Moore's Law. As such, their share of the gate-all-around (GAA) transistor market is poised to grow rapidly in the coming decade.

Moreover, nanowires embody the aspirational vanguard of semiconductor design, catering to the insatiable appetite for miniaturization without sacrificing reliability. Their superior gate control ensures they are optimally suited for both energy-frugal mobile processors and exascale supercomputing. The industry's gravitation toward these designs is driven by the prospect of fabricating chips that consume less power, perform more efficiently, and last longer. Research institutions and leading fabs are investing heavily in perfecting the intricacies of nanowire fabrication.

Technology Node Insights

Why 5nm/4nm Nodes Dominating the Gate-All-Around (GAA) Transistor Market?

The 5nm and 4nm node technology presently constitute the dominant bastion of gate-all-around transistor adoption, holding a share of 45%, undergirded by early commercialization endeavors. Foundries such as Samsung have already brought nanosheet-based designs into production at these nodes, demonstrating the feasibility of scaling beyond FinFET. This nascent adoption imbues 5nm and 4nm with a tangible commercial momentum, unlike their more speculative successors. Demand is sustained by mobile system-on-chips and AI processors, which strike a balance between performance and cost sensitivity. The industry's confidence in these nodes stems from their pragmatic equilibrium between innovation and manufacturability.

Additionally, the gravitas of these nodes is reinforced by their pivotal role in enabling flagship smartphones, laptops, and servers. They embody a technological threshold where efficiency and affordability converge, ensuring mass-market adoption. Fabless companies have already optimized their designs for these geometries, further anchoring their dominance. The infrastructural and intellectual investments made in 5nm/4nm cannot be summarily abandoned, as they secure their hegemony for the foreseeable future.

The 3nm/2nm node technologies are the fastest-growing domains of gate-all-around transistor deployment, accounting for a 40% share of the market. These nodes represent the next evolutionary leap, enabling unprecedented transistor density and energy efficiency. Their utility is particularly germane to high-performance computing, artificial intelligence, and mobile SoCs, where even marginal gains are of paramount importance. Although still in the incipient stages of mass production, they have galvanized the industry with their transformative promise.

Moreover, 3nm and 2nm nodes symbolize the confluence of ambition and necessity. As Moore's Law teeters on its physical precipice, these geometries breathe new vitality into the axiom of perpetual scaling. They enable system designers to reconcile the seemingly contradictory imperatives of higher performance and lower energy consumption. Governments and industry titans alike are investing prodigious sums to accelerate their commercialization.

Application Insights

Why is High-Performance Computing (HPC) Leading the Market for Gate-All-Around (GAA) Transistors?

High-performance computing has emerged as the primary application of transistors, accounting for the lion's share of demand in the gate-all-around (GAA) transistor market, accounting for a 35% share. CPUs, GPUs, and AI accelerators derive immense benefit from the electrostatic precision and density that the gate-all-around transistor affords. The insatiable hunger for faster simulations, generative AI training, and complex analytics has made HPC the lodestar of gate-all-around transistor utilization. Here, nanosheets have already been deployed to support server-grade chips, underscoring their commercial viability. Data centers and cloud providers, under relentless pressure to enhance efficiency, provide a steady, voluminous market. Thus, HPC forms the dominant fulcrum upon which GAA adoption pivots.

Furthermore, HPC epitomizes the convergence of necessity and innovation in transistor design. The colossal energy requirements of supercomputing mandate architectural advancements that only a gate-all-around transistor can furnish. By enabling more transistors per unit area without incurring exorbitant leakage, gate-all-around transistors reconcile efficiency with brute-force computation. This alignment with HPC imperatives explains why the segment towers above all others in market share. The widespread adoption of HPC across various industries, from pharmaceuticals to finance, ensures a consistent demand for these technologies.

The automotive sector, particularly electric vehicles and advanced driver-assistance systems (ADAS), which hold a 35% share, constitutes the most fertile growth frontier for gate-all-around transistors. The inexorable rise of EV adoption has amplified the need for efficient, compact, and resilient chips. Gate-all-around transistors, with their superior power control and reliability, are uniquely positioned to meet these exigencies. Infotainment, real-time navigation, and autonomous driving algorithms require chips that strike a balance between performance and rugged durability. The sector's evolution is catalyzing exponential demand for semiconductor innovation. Hence, automotive and EV chips represent the fastest-growing segment of applications.

Governmental mandates for greener mobility and safer roads further fuel this acceleration. As vehicles metamorphose into computers on wheels, their reliance on sophisticated chips becomes ineluctable. The gate-all-around transistor's ability to extend battery efficiency while enabling complex real-time processing is a boon for EV manufacturers. Moreover, automakers are forging closer alliances with chip designers to expedite adoption.

End User / Buyer Insights

Why are Foundries Dominating the Gate-All-Around (GAA) Transistor Market?

Foundries have indisputably established themselves as the dominant end users of gate-all-around transistors, holding a 50% share and commanding half the market. Giants like TSMC, Samsung, and Intel are marshaling their prodigious resources to spearhead the adoption of gate-all-around transistors. These fabs are the crucibles wherein architectural innovations transition from theory to practice. By assuming the herculean responsibility of mass production, foundries dictate the tempo of global adoption. Their scale allows them to amortize the astronomical costs of infrastructure and yield optimization. Thus, they remain the fulcrum of the gate-all-around transistor ecosystem.

In addition, foundries play the dual role of innovators and enablers. Their collaborations with fabless design houses ensure that the gate-all-around transistor is seamlessly integrated into next-generation processors. The imprimatur of a major foundry lends commercial credibility to any emergent technology. By virtue of their ubiquity and indispensability, foundries consolidate gate-all-around transistor dominance in the market's architecture. Their enduring supremacy is reinforced by governmental incentives to bolster domestic semiconductor sovereignty. Consequently, foundries stand unrivalled as the dominant custodians of gate-all-around transistor proliferation.

Integrated Device Manufacturers (IDMs), though historically overshadowed by foundries, are rapidly ascending as the fastest-growing end-user group in the gate-all-around (GAA) transistor market. Companies such as Intel and a few Asian giants are reinvigorating their IDM strategies by directly embedding GAA in their proprietary product lines. This vertical integration enables them to exert greater control over design, fabrication, and deployment. The imperative catalyzes their adoption trajectory, allowing them to differentiate in fiercely competitive markets.

Moreover, IDMs symbolize a paradigm shift toward integrated innovation in the semiconductor industry. Their ability to simultaneously refine device architecture and end-product application shortens the feedback loop of innovation. This accelerates time-to-market and creates bespoke solutions tailored to automotive, mobile, or AI-centric applications. With GAA offering fertile ground for differentiation, IDMs are uniquely incentivized to accelerate the adoption of their solutions. Their burgeoning share reflects both their ambition and their capacity to absorb risk. Thus, IDMs emerge as the fastest-growing constituency in the GAA end-user ecosystem.

Regional Insights

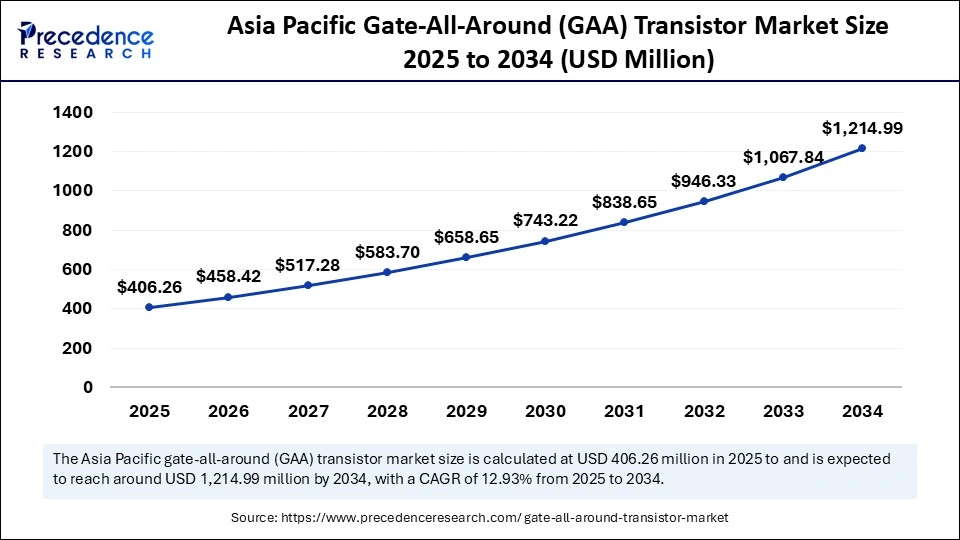

Asia Pacific Gate-All-Around (GAA) Transistor Market Size and Growth 2025 to 2034

The Asia Pacific Gate-All-Around (GAA) transistor market size was evaluated at USD 360.03 million in 2024 and is projected to be worth around USD 1,214.99 million by 2034, growing at a CAGR of 12.93% from 2025 to 2034.

Why Is Asia Pacific the Rising Star in the Gate-All-Around (GAA) Transistor Market?

Asia Pacific dominated the Gate-All-Around (GAA) transistor market, holding the largest market share of 60% in 2024, due to the presence of major foundries and a robust semiconductor manufacturing ecosystem. Countries like Taiwan, South Korea, and China lead in production capacity, backed by robust supply chains and skilled labor. The region's dominance is reinforced by its critical role in consumer electronics, where gate-all-around adoption is most pronounced. With leading players actively transitioning to gate-all-around, the Asia Pacific is setting the global benchmark. In addition, government investments in semiconductor independence further fuel the region's lead.

At the same time, the Asia Pacific benefits from a dense network of supply chains, research hubs, and design companies that accelerate innovation. Close collaboration between foundries and fabless companies fosters quicker commercialization of the gate-all-around technology. Moreover, the region's manufacturing scale helps absorb high production costs more effectively. As demand for advanced AI and 5G processors grows, the Asia Pacific is positioned to stay at the forefront of this mass production.

Why Is North America Fastest Growing the Fastest-Growing Gate-All-Around (GAA) Transistor Market?

North America is the fastest-growing region in the gate-all-around (GAA) transistor market, holding a 25% share, driven by strong investments in research and development (R&D) and advanced chip design. The presence of leading fabless companies and tech giants accelerates the adoption of AI and cloud computing applications. Federal initiatives to bolster domestic semiconductor manufacturing are also strengthening growth. Additionally, North America's robust venture ecosystem supports startups innovating in GAA materials and design automation.

The region is also witnessing an increase in collaborations between foundries and design companies aimed at accelerating commercialization. High demand for AI-driven chips in sectors such as autonomous driving and cloud platforms drives the need for GAA transistors. While local manufacturing capacity in the U.S. is still catching up to that of Asia, the establishment of new fabs will help narrow this gap. Growing awareness of supply chain resilience further fuels domestic production initiatives. With strong technological capabilities and a push for self-reliance, North America is emerging as the fastest-growing hub for GAA adoption.

Gate-All-Around (GAA) Transistor Market: Value Chain Analysis

- Raw Material Sourcing: The fabrication of gate-all-around (GAA) transistors primarily relies on ultra-pure silicon and silicon germanium (SiGe) for the channel, which is meticulously grown through epitaxial processes on a silicon wafer. Complementing these are advanced dielectric materials, such as hafnium oxide, employed for the gate insulation layer, along with gate metals like titanium nitride, which necessitate highly sophisticated deposition techniques to ensure precision and performance.

- Testing and Certification: Testing and certification of gate-all-around (GAA) transistor market products advanced methodologies to validate their intricate, multi-layered architectures and functional reliability. This includes employing micro-hard X-ray fluorescence (μHXRF) for precise critical dimension analysis, leveraging TCAD simulations to capture quantum-scale phenomena, and conducting rigorous electrical assessments, such as DC/AC I-V and C-V measurements, to evaluate device performance and leakage characteristics.

- Distribution and Sales: The distribution and commercialization of gate-all-around (GAA) transistors center on their emergence as the successor to FinFETs in advanced semiconductor nodes, specifically at 3nm and below. Major foundries such as Intel and Samsung have already integrated GAA technology into their cutting-edge nodes (e.g., Intel's 18A and Samsung's SF2), signaling the early phase of its market adoption. Sales are predominantly business-to-business, with integrated device manufacturers (IDMs) and fabless firms procuring these high-performance chips from foundries. Meanwhile, market intelligence providers such as IndustryARC and Research and Markets project robust growth for GAA transistors in the years to come.

Gate-All-Around (GAA) Transistor Market Companies

- TSMC

- Samsung Electronics

- Intel

- GlobalFoundries

- IBM Research

- ASML

- Applied Materials

- Lam Research

- KLA Corporation

- NVIDIA

- AMD

- Qualcomm

- Broadcom MediaTek

- Intel Foundry Services (IFS)

- SK hynix

- Micron Technology

- Cadence Design Systems

- Synopsys

- Arm Holdings

Recent Developments

- In September 2025, TSMC announced its forthcoming 2nm process is poised to become a landmark achievement in the semiconductor industry, drawing intense interest from nearly every major player. According to reports from KLA, a leading semiconductor equipment supplier, about 15 companies are already developing chips based on TSMC's N2 technology, with a strong emphasis on high-performance computing applications such as CPUs for PCs, servers, and gaming consoles.

- Apple, long known for being the earliest adopter of TSMC's newest nodes, is once again expected to lead the way, deploying N2 for its upcoming A19/A19 Pro chips in iPhones and iPads, the next wave of M-series processors for Macs, and even future modem designs. This time, however, Apple won't stand alone at the front; AMD and MediaTek have both confirmed N2-based product launches for 2026, while Intel is widely speculated to leverage the process for its Nova Lake processors. Qualcomm and Broadcom are also likely contenders, enticed by the substantial performance and efficiency benefits that the N2 node promises to deliver.(Source:https://www.guru3d.com)

Segments Covered in the Report

By Device Type / Architecture

- Nanosheet GAA Transistors

- Nanowire GAA Transistors

- Other GAA Variants

By Technology Node

- 5nm / 4nm Nodes

- 3nm / 2nm Nodes

- Sub-2nm / experimental

By Application

- High-Performance Computing

- Mobile SoCs

- Data Centers / Cloud

- Automotive & EV Chips

- Other Electronics

By End User / Buyer

- Foundries

- IDMs (Integrated Device Manufacturers)

- Fabless Semiconductor Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting