What is the Health Information Exchange (HIE) Market Size?

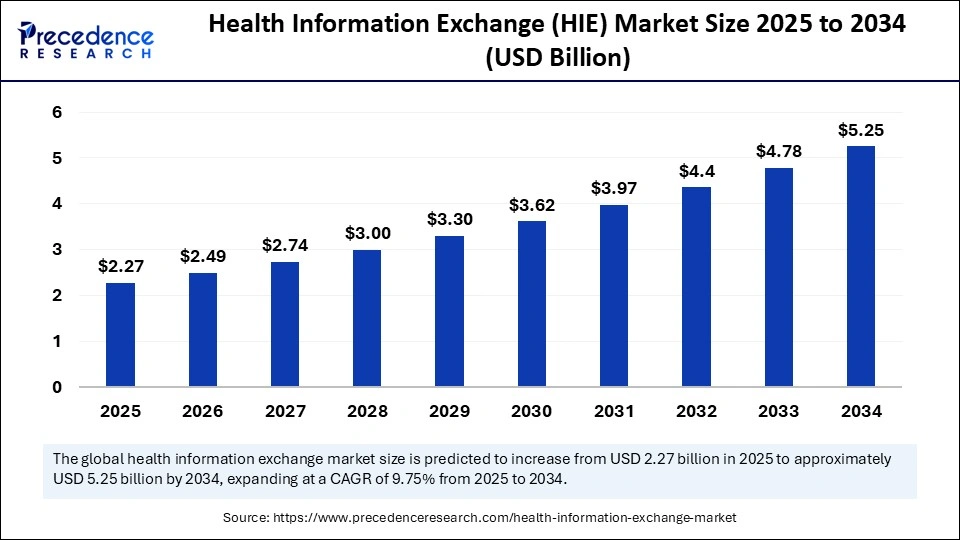

The global health information exchange (HIE) market size is valued at USD 2.27 billion in 2025 and is predicted to increase from USD 2.49 billion in 2026 to approximately USD 5.25 billion by 2034, expanding at a CAGR of 9.75% from 2025 to 2034. The market is witnessing robust growth, driven by increasing demand for seamless data interoperability, digital healthcare adoption, and initiatives to enhance patient care efficiency.

Health Information Exchange (HIE) Market Key Takeaways

- In terms of revenue, the global health information exchange (HIE) market was valued at USD 2.07 billion in 2024.

- It is projected to reach USD 5.25 billion by 2034.

- The market is expected to grow at a CAGR of 9.75% from 2025 to 2034.

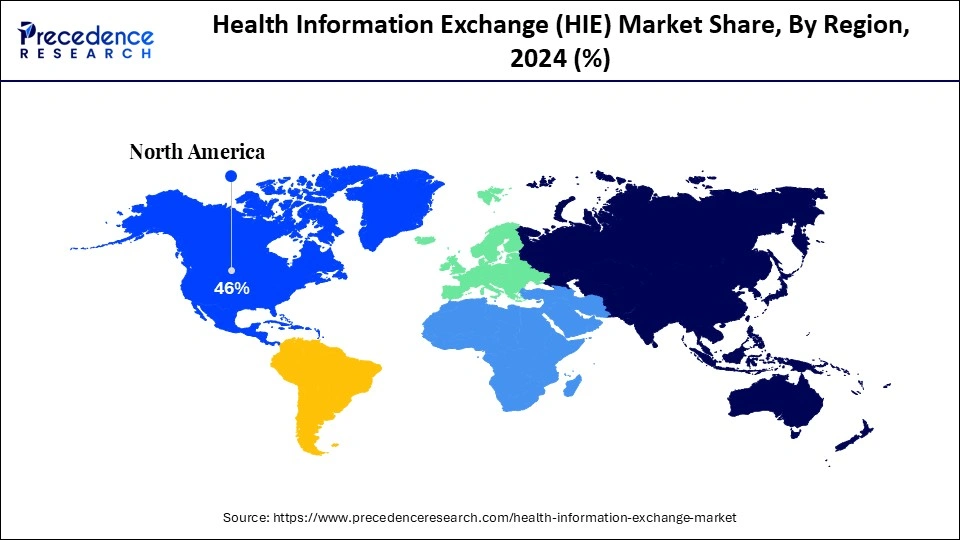

- North America dominated the health information exchange (HIE) market with the largest market share of 46% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By deployment model, the cloud-based segment held the biggest market share of 60% in 2024.

- By deployment model, the on-premise segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By type of exchange, the query-based exchange segment captured the highest market share of 45% in 2024.

- By type of exchange, the directed exchange segment is expected to expand at a notable CAGR over the projected period.

- By component, the software segment contributed the maximum market share of 70% in 2024.

- By component, the services segment is expected to expand at a notable CAGR over the projected period.

- By end user, the healthcare providers segment accounted for the significant market share of 65% in 2024.

- By end user, the healthcare payers segment is expected to expand at a notable CAGR over the projected period.

- By the exchange model, the centralized model segment generated the major market share of 55% in 2024.

- By the exchange model, the hybrid model segment is expected to expand at a notable CAGR over the projected period.

Market Overview

Health information exchange (HIE) is the secure electronic sharing of patient health information among different healthcare providers and organizations. HIE improves care coordination, reduces errors, and decreases redundancies in clinical workflows. The market is growing due to the widespread adoption of electronic health records (EHRs), government regulations requiring and promoting interoperability, and an overall movement toward value-based care.

Technologies such as cloud-based data storage, AI-based analytics, and blockchain technology are making data secure, providing real-time access to patient data, and allowing clinical providers to make informed decisions based on their patients' complete history and other data sources. Ultimately, HIE is an important catalyst for an efficient, unified, and patient-centered healthcare delivery system.

How Artificial Intelligence is Transforming the Health Information Exchange

Artificial Intelligence (AI) is disrupting Health Information Exchange (HIE) systems and creating serious revelations around interoperability, standardization of data, and real-time decision support within HIEs. In July 2025, the Centers for Medicare & Medicaid Services (CMS) broadened its interoperability initiative to support the sharing of health information by leveraging partnerships with Amazon, Anthropic, Apple, Google, and OpenAI. (Source: https://www.aha.org)

These initiatives are evidence of a trend to utilize AI-enabled solutions in HIEs, which can help reduce administrative burden while empowering clinicians with actionable insights. As healthcare systems increasingly rely on digitally-enabled ecosystems, the use of AI in health information exchange platforms is fundamental for creating efficiencies in patient-centered care and delivering a more efficient healthcare system.

Health Information Exchange (HIE) Market Growth Factors

- EHR Penetration: The widespread adoption of electronic health records (EHRs) is an accelerator of HIE expansion as it provides a base for sharing patient data electronically and ultimately digital health records. This improves patient data accessibility, accuracy, and collaboration between healthcare providers.

- Regulatory Support: Government mandates and healthcare policies to facilitate interoperability support HIE adoption to ensure standardized data exchanges, compliance, and more positive health outcomes in hospitals, clinics, and other care settings.

- Transition to Value-Based Care: The shift from volume to value in healthcare positioning makes HIE critical for coordinated patient care, decreasing redundancies, and facilitating evidence-based treatment decisions.

- Emerging Technologies: The increased capabilities and accessibility from cloud computing, new AI data analytic tools, and blockchain technologies may provide improved data security, allow underlying data to be accessed in real-time, and develop predictive analytics to enhance clinical decision-making faster and smarter, increasing the likelihood of adoption of the HIE.

Market Outlook

- Industry Growth Overview: Digitalization, government support, interoperability demand, and the worldwide need for better-coordinated care delivery are the main factors through which the HIE market is expanding and making healthcare more efficient overall.

- Sustainability Trends: Sustainability stresses the importance of value-added services, standard data practices, strong leadership, secured information management, privacy protection, and the digital health resilience of the world market in the long run.

- Global Expansion: Across the globe, the countries vary in their stages of technology adoption but have commonalities in the areas of information transfer to be improved, patient outcomes, national strategies, and healthcare system modernization efforts.

- Major Investors: Epic Systems, Oracle, InterSystems, NextGen Healthcare, Optum, and Orion Health are the major players that invest, thus leading to the improvements of interoperability and the development of the ecosystem of different markets.

- Startup Ecosystem: The startups are the driving force behind the innovations of AI, blockchain, interoperability in the HIEs, which leads to strengthening of the security, efficiency, scalability, and connectivity within the healthcare systems and HIEs that are changing globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.25 Billion |

| Market Size in 2025 | USD 2.27 Billion |

| Market Size in 2026 | USD 2.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Type of Exchange, Component, End-user, Exchange Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is Government-Mandated Interoperability the Key Driver of HIE Adoption?

The government policy and regulation have been the dominant drivers of Health Information Exchange (HIE) adoption. The federal government invested over USD 2.4 billion in state systems to improve electronic health information exchange infrastructure with the HITECH Act. (Source: https://www.gao.gov)

More recently, the Office of the National Coordinator for Health IT (ONC) adopted information-blocking rules and certification criteria under the 21st Century Cures Act to promote interoperability, expand public health data exchange, and support real-time access to electronic health information to a wider range of constituents. The government initiatives created a common set of standards, allowing providers to share patient data more securely and efficiently, which has driven increased HIE to all parts of the healthcare continuum.

Restraint

What is Holding the Health Information Exchange Revolution Back?

The health information exchange (HIE) market continues to face multiple obstacles in its implementation, with one of the biggest obstacles being data privacy and security issues. The recent data breaches of healthcare data are amply illustrated by the sad statistic that over 276 million patient records were exposed in 2024, averaging more than 758,000 patient records per day.(Source: https://cyberpress.org)

These actions cast doubt on the safety of sensitive health data, which leads many facilities, hospitals, and clinics to view HIE with hesitation. The challenge is especially daunting for smaller healthcare providers, as the cost and burden of compliance and cybersecurity are often too high, and this increases the hurdles associated with HIE. These breaches slow the progress of digital health transformation and affect patient trust.

Opportunity

What's Driving New Opportunities in the Health Information Exchange (HIE) Market?

One key opportunity driver in the health information exchange (HIE) market is the growing embrace of standards-based interoperability most notably, in new ways using standard protocols like FHIR APIs. According to the 2025 Interoperability Roadmap report, 78% of countries surveyed have laws governing electronic health data exchange, while 73% of those laws either require or recommend using FHIR as part of those laws or guidelines (up from 65% the year before). (Source:https://fire.ly)

Along with regulations like TEFCA (Trusted Exchange Framework and Common Agreement) in the U.S., which support nationwide health data sharing by connecting health information networks (HINs) across the country. Not only does this increasing demand signal a level of importance for HIE in supporting real-time data movement to drive clinical decision making, but it positions HIE as a foundational foray into the business of personalized medicine, value-based care, and digital health transformation. (Source: https://www.healthit.gov)

Deployment Model Insights

Which Deployment Model Dominates the Health Information Exchange (HIE) Market in 2024?

In the health information exchange (HIE) market, the cloud-based segment dominated in 2024, as healthcare organizations tend to prefer options that allow for limitless scalability, remote access, and cost-efficiency. Cloud platforms are great data storage, data integration, and data sharing solutions across providers and payers without hosting the entire infrastructure directly. Cloud makes it simple to manage large amounts of patient data while creating logical linkages and is compatible with core standards of interoperability.

The on-premise segment is the fastest-growing model in the forecasted period. This is a result of many institutions being focused on high security, high control, and regulatory compliance. Many of the large hospitals and government healthcare organizations prefer their patient information systems to remain on-premises simply to keep direct authority over sensitive patient data. With increasing concerns of data privacy and customization needs, we will see an incremental increase incrementally on-premise for a narrow segment of healthcare.

Type of Exchange Insights

Why does the Query-based Exchange Dominate the Health Information Exchange (HIE) Market?

The query-based exchange segment is the most dominant component in the health information exchange (HIE) market. Query?based exchange enables healthcare providers to actively search and retrieve patient information from multiple sources in real time. As a result, query?based exchange facilitates care coordination, supports clinical decision?making, and limits duplicate tests/procedures. It is the most successful exchange type because of its potential to improve patient safety while accessing data across healthcare systems.

The directed exchange segment is the fastest?growing exchange type. As the directed exchange slowly takes hold, HIE networks are gaining traction through secure transfer of patient information from known and relied on healthcare actors. Directed exchange is often utilized for referrals, discharge summaries, and care transitions. As healthcare becomes more reliant on secure communication, including privacy and compliance with healthcare data standards, directed exchange appears to be emerging across HIE networks.

Component Insights

Which is the Most Dominant Component in the Health Information Exchange (HIE) Market?

The software segment was the largest in the health information exchange (HIE) market in 2024. since software is the cornerstone of data integration, interoperability, and secure sharing across healthcare systems. Robustly developed HIE software solutions facilitate electronic health records (EHRs), analytics, and adherence to data standards, which enables providers to reduce workflow friction. The steady increase in the scale of digital health technology and, subsequently, the need to exchange patient data in real-time is sustaining strong software demand.

The managed services sub-segment of the services segment is anticipated to have the fastest growth. A trend is developing in which many healthcare organizations are contracting HIE management annually to a specialized service provider to alleviate operational load and implementation failure. Managed services impose expertise to provide management of the integrations of applications, data security protocols, and ensure routine maintenance is enacted and in working condition to offload the responsibility from the provider, allowing focus to be set on patient-centric practices.

End User Insights

Which End User Segment Dominated the Health Information Exchange (HIE) Market in 2024?

The healthcare providers segment accounted for a large portion of the health information exchange (HIE) market in 2024, as hospitals, clinics, and other diagnostic centers rely heavily on data exchange in order to provide care to their patients effectively. Providers benefit from improved clinical decision-making, reduced duplicative tests, and improved communication and coordination amongst departments. There is also the push for value-based care, along with the digitalization of a patient's record, which is driving a lot of adoption from healthcare providers.

The healthcare payers segment is becoming the fastest-growing end-user of HIE solutions. Insurance companies and government payers have adopted HIE in order to access accurate patient data, reduce costs in claims processing, and decrease fraud. The combination of real-time health information will allow payers to improve their own population health analytics, develop value-based reimbursement models, and increase preventive care efforts, making this segment quickly grow.

Exchange Model Insights

Why Exchange Model Dominated the Health Information Exchange (HIE) Market in 2024?

The centralized model segment is the dominant model in the health information exchange (HIE) market, because it is the easiest way to store patient health data in a single repository, with authorized participants accessing patient health care records. The centralized model provides much simpler management, improved interoperability, and faster access to patient records. The structured framework of the centralized model has made it the most taken-up model by healthcare organizations, where efficiency, coordination of care, and the transfer of patient data between organizations are most important.

The hybrid model segment is the fastest-growing exchange model, combining both centralized and decentralized models. Flexible hybrid models offer a combination of centralized data with distributed access based on the organizational elements of its members. As healthcare systems have placed a high value on interoperability as well as security, the hybrid model is building momentum through its ability to provide effective, customizable, and secure data sharing solutions for robust access in diverse healthcare systems.

Regional Insights

U.S. Health Information Exchange (HIE) Market Size and Growth 2025 to 2034

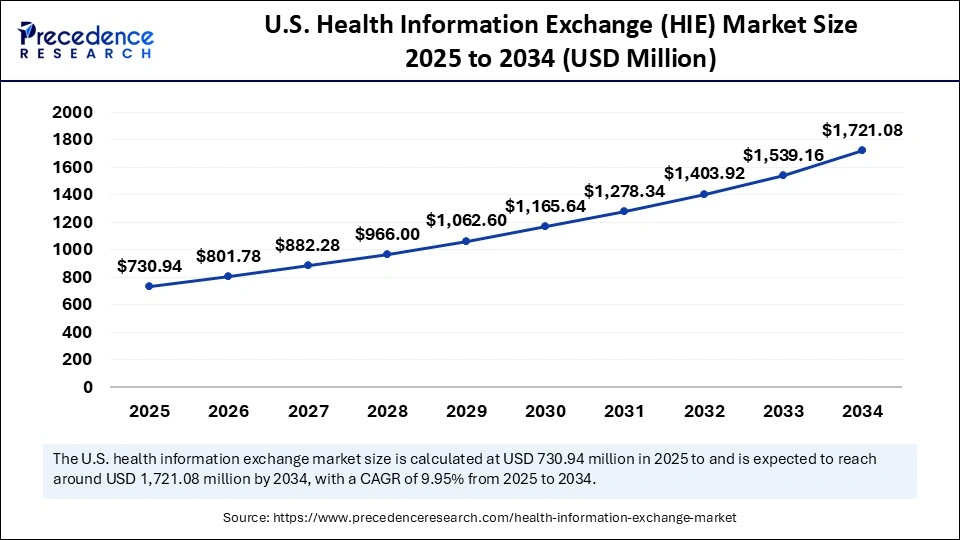

The U.S. health information exchange (HIE) market size is evaluated at USD 730.94 million in 2025 and is projected to be worth around USD 1,721.08 million by 2034, growing at a CAGR of 9.95% from 2025 to 2034.

Why is North America the most Dominant Region in the Health Information Exchange (HIE) Market in 2024?

North America remains in the lead of the health information exchange landscape because of its innovative healthcare digitalization, strong reimbursement models, and active participation by both private and public stakeholders. Health systems increasingly adopted HIE platforms to enhance population health analytics, care coordination, and clinical decision making. Concerning chronic diseases and the transition to value-based care, the demand for real-time exchange capability across providers, payers, and patients continues to grow. Investments in AI-driven predictive analytics and cloud-based HIE solutions are making it easier for organizations to take the next step from summary data sharing to predictive/goal-oriented exchange.

In terms of the HIE environment, the U.S. leads the pack with the scale of its electronic health record (EHR) integration and its regulatory environment that drives innovation as it relates to interoperability. While there is an increased need for patient authorship, backed by federal rules on information blocking, there continues to be some uncertainty that will fuel the adoption of APIs and FHIR-based interfaces by providers. When all of these adoption factors are taken into consideration, along with the sheer scale of U.S. healthcare spending, the U.S. is the focal point of HIE innovation and is setting the pace for the expected benchmarks of data liquidity and patient-centered exchange models.

Why is Asia Pacific Projected to be the Fastest-Growing Region during the Forecast Period?

The health information exchange (HIE) market in the Asia Pacific has experienced accelerated growth driven by increasing healthcare digitalisation, expanding government initiatives, and the growing usage of telemedicine and mobile health solutions. Investments in cloud-based infrastructure, AI in analytics, and standards-based data exchange are transitioning silos of fragmented pilot projects into scalable regional networks. The emphasis on secure patient data sharing and public health surveillance is motivating collaboration across institutions and enhancing HIE maturity in a rapidly maturing Asia Pacific market.

India is leading the way in the region's HIE evolution primarily through the Ayushman Bharat Digital Mission (ABDM), which has established a massive digital health ecosystem that assigns unique health IDs (ABHA) to millions of citizens. Digital-first telehealth programs and the emergence of cloud-based hospital information systems are further driving national demand for interoperable HIE solutions. Leveraging innovations in HIE makes India a real-world test-bed for large and complex HIE deployments, with real and measurable improvements in care coordination and health data accessibility.

What are the Driving Factors of the Health Information Exchange Market in Europe?

The market in Europe is characterized by digital health transformation, government-led modernization, and healthcare data infrastructure building that focuses on interoperability, implementation of data policies, secure information exchange, and creation of healthcare ecosystems that are collaborative in nature and support better patient outcomes and clinical workflows across different regional systems.

Germany Health Information Exchange (HIE) Market Trends:

The HIE market in Germany grows through steady digital investments, health record updates, partnerships among institutions, and backing by the government, thus enabling the creation of systems that are adaptable to the needs of specific regions and that place a high value on interoperability, privacy protection, data governance, seamless information exchange, and improved care coordination among dispersed health care networks.

Value Chain Analysis

- R&D: Conducting research and early development while having an eye on the efficiency, cost, and productivity, the department is able to make a choice of the most promising candidates and boost the scientific innovation towards commercial readiness.

Key players: Pfizer, Roche, Johnson & Johnson - Clinical Trials & Regulatory Approvals: By the method of optimizing clinical trial design, patient recruitment, data collection, and regulatory submissions, the entire process will be secured, and the market will receive approvals quickly due to safety, efficacy, and compliance.

Key Players: IQVIA, ICON plc - Formulation & Final Dosage Manufacturing: The transition of APIs into stable, large-scale final dosage forms is being scrutinized, and research is being done along with regulatory compliance, and patient outcomes will all be improved.

Key Players: Novartis, Gilead Sciences, Lonza - Packaging & Serialization: The company is updating its packaging operations and serialization systems, assuring the product's authenticity, safety, and regulatory compliance.

Key Players: West Pharmaceutical Services, Catalent - Distribution: The secure, efficient, transparent, compliant product delivery to hospitals, pharmacies, or HIE networks is guaranteed by analyzing logistics, warehousing, inventory, transportation, and cold-chain.

Key Players: McKesson Corporation, Cardinal Health, AmerisourceBergen

Health Information Exchange (HIE) Market Companies

- Cerner Corporation

- Allscripts Healthcare Solutions, Inc.

- McKesson Corporation

- GE Healthcare

- Meditech

- eClinicalWorks

- NextGen Healthcare

- Orion Health

- InterSystems Corporation

- Optum, Inc.

- IBM Corporation

- Siemens Healthineers

- Athenahealth, Inc.

- Health Catalyst, Inc.

- CPSI

- Oracle Corporation

- Infor

- Philips Healthcare

- HealthFusion

- SAP SE

Recent Developments

- In April 2025, OnID and MyLigo launched a transformative pilot integration designed to revolutionize individuals' access, manage, and sharing of their personal health information. Jim St. Clair, CEO of MyLigo, stated, “Empowering patients to take control of their health information is not just our vision it's the future of healthcare.” (Source:https://cbs4indy.com)

- In August 2025, SacValley MedShare (SVMS), a designated Qualified Health Information Organization (QHIO) and trusted Health Information Exchange (HIE), announced the statewide launch of the NinePatch platform to transform whole person care and community health across California.

(Source: https://www.kron4.com) - In July 2025, Converge Health, a women-owned healthcare tech consulting firm, aims to improve data exchange and interoperability, offering consulting and executive leadership for health systems and vendors.

(Source: https://www.healthcareittoday.com) - In July 2025, KONZA National Network launched Birth Connect, a service providing timely alerts to OB/GYNs when a birth parent under their care has delivered a baby.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Deployment Model

- Cloud-based

- On-premise

By Type of Exchange

- Directed Exchange

- Query-based Exchange

- Consumer-mediated Exchange

By Component

- Software

- Services

- Professional Services

- Managed Services

By End-user

- Healthcare Providers

- Hospitals

- Physician Practices

- Long-term Care Providers

- Healthcare Payers

- Government Agencies

By Exchange Model

- Centralized Model

- Decentralized Model

- Hybrid Model

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content