What is Healthcare Contract Development and Manufacturing Organization Market Size?

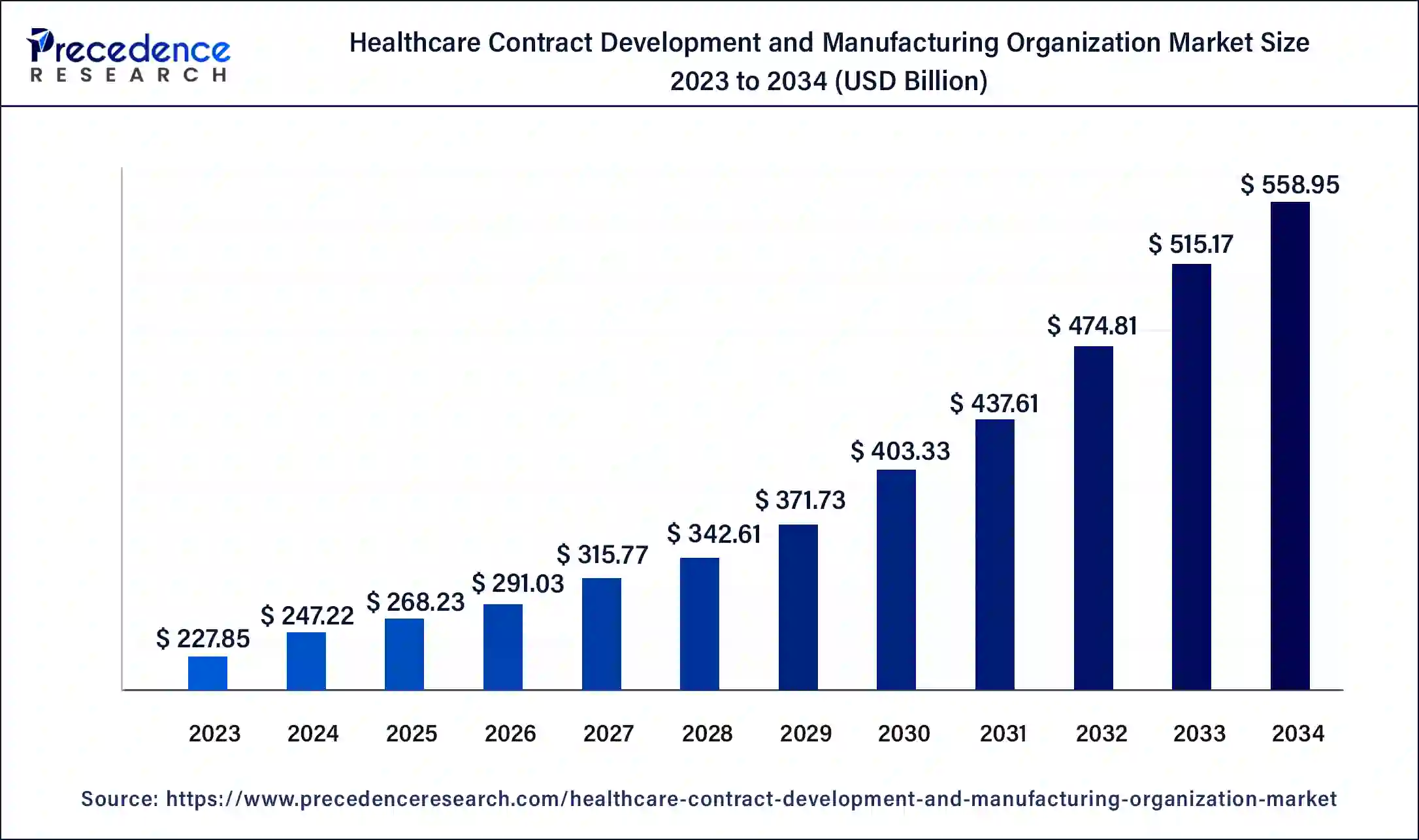

The global healthcare contract development and manufacturing organization market size is estimated at USD 268.23 billion in 2025 and is predicted to increase from USD 291.03 billion in 2026 to approximately USD 600.45 billion by 2035, expanding at a CAGR of 8.39% from 2026 to 2035

Market Highlights

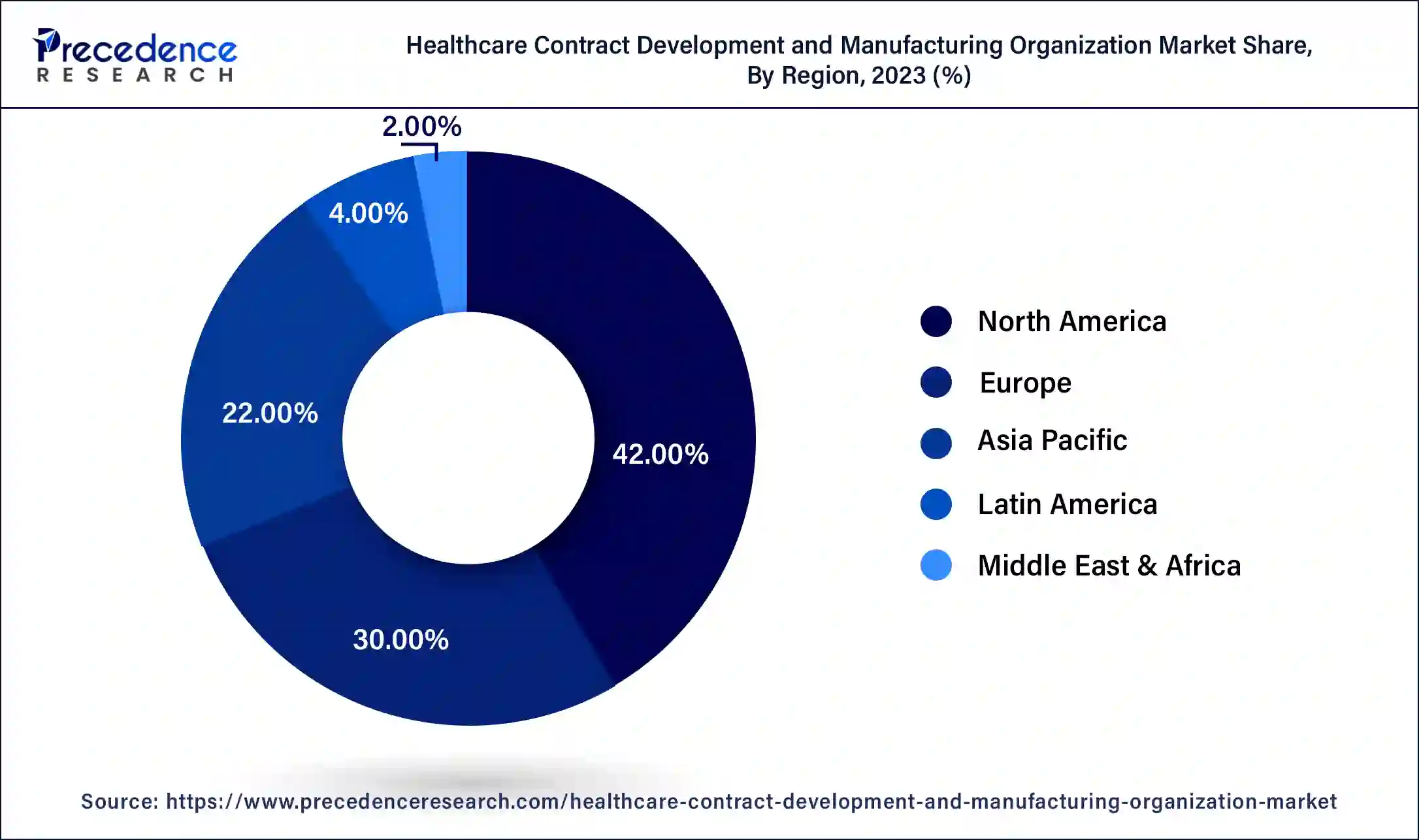

- North America led the global market with the highest market share of 42% in 2025.

- Asia Pacific region is estimated to expand the fastest CAGR between 2026 to 2035

- By Services, the contract manufacturing segment held the largest market share in 2025.

Healthcare Contract Development and Manufacturing Organization Market Growth Factors

A contract development and manufacturing organization is a corporation or organization that provides classified services to other organizations on a contract basis, ranging from medication discovery to drug manufacture for a variety of therapeutic uses. These contract development and manufacturing organizations primarily function as an end user for small businesses that lack manufacturing capacity in the development of novel medications.

The healthcare contract development and manufacturing organizations are pharmaceutical industry institutions that provide a wide range of services on a contract basis, from medication development to drug manufacturing. This contract allows the bulk of pharmaceutical companies to outsource those aspects of their operations that can support scalability or allow the big company to focus on drug discovery and marketing instead. The formulation development, pre-formulation, clinical trials , formal stability, stability studies, registration, and commercial production batches are all services that pre-formulation provide. The goal of service providers is to focus on a single technology or dosage form while simultaneously ensuring end to end consistency and efficiency for all of their outsourcing customers.

The healthcare contract development and manufacturing organization market will be driven by the increased demand for specialist medical gadgets. A primary driver for the healthcare storage contract manufacturing industry in the growing population of older individuals and their inactive lifestyle. As a result, these variables will greatly boost the healthcare contract development and manufacturing organization market growth during the forecast period.

The disruption in the supply chain is one of the primary restraints in the healthcare contract development and manufacturing organization market. In addition, challenges with connectivity and standardization will slow industry expansion in the near future. Furthermore, the purchase of small businesses via contract with healthcare manufacturers will limit the component outsourcing.

However, because corporations are lining up for acquisitions and mergers, this approach will assist to down production costs. Additionally, the increased utilization of multi-product facilities, as well as many technological innovations and developments, will create new growth prospects for the healthcare contract development and manufacturing organization market during the forecast period.

The surge in desire to outsource various operations that are time demanding by the pharmaceutical companies is expected to boost the growth of the healthcare contract development and manufacturing organization market. The pharmaceutical industry's rise will aid the healthcare contract development and manufacturing organization market's expansion in the upcoming years. The increased support of contract development and manufacturing organizations in lowering the capital and operational expenses will assist the market in achieving maximum income in the near future.

The healthcare contract development and manufacturing organization market will be driven in the next years by a boom in regulatory affairs, which are positive, and quality assurance services. Furthermore, increasing shipping costs and the danger of violation of intellectual property rights could stifle the healthcare contract development and manufacturing organization market expansion throughout the projection period.

A company and a manufacturer sign a contract for contract manufacturing. For a specific period of time, the manufacturer provides the company with various components. The pharmaceutical and medical device components, as well as other services for drug manufacturing, are provided by contract manufacturers in the healthcare industry. The healthcare contract development and manufacturing organization market is being driven forward by the expiration of medical device patents and increased rivalry among large businesses. In addition, the healthcare contract development and manufacturing organization market is being boosted by the increased desire for convenient devices.

The major market players in the healthcare contract development and manufacturing organization market also offer customized services to fulfill the specific needs of medical device inventors and designers. Furthermore, the North America will continue to dominate the healthcare contract development and manufacturing organization market in the coming years. In addition, emerging countries in the Asia-Pacific region are thriving in the healthcare contract development and manufacturing organization market.

Market Outlook

- Market Growth Overview: The healthcare contract development and manufacturing organization market is expected to grow significantly between 2025 and 2034, driven by the rising outsourcing, growth in biologics and advanced therapies, and increasing research and development spending.

- Sustainability Trends: Sustainability trends involve green chemistry & sustainable processes, waste management & circular economy initiatives, and water conservation & pollution prevention.

- Major Investors: Major investors in the market include Thermo Fisher Scientific Inc., Labcorp, Novo Holding A/S, Catalent, Inc., Danaher Corporation, and Lonza Group Ltd.

- Startup Economy: The startup economy is focused on service specialization and vertical integration, next-generation equipment and process technology, and geographical expansion and cost competitiveness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 268.23 Billion |

| Market Size in 2026 | USD 291.03 billion |

| Market Size by 2035 | USD 600.45 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.39% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Segment Insights

Services Insights

In 2025, contract manufacturing dominated the market for healthcare contract development and manufacturing organization, accounting for the majority of revenue 74% in 2023. This is mostly wing to the pharmaceutical and medical device industries' strong penetration of contract manufacturing.

On the other hand, the contract development is expected to grow at fastest rate during the forecast period. The contract development has various advantages over in-house drug development, including access to industry specialists, shorter time to market, lower costs, and a greater concentration on core skills.

Regional Insights

U.S. Healthcare Contract Development and Manufacturing Organization Market Size and Growth 2026 to 2035

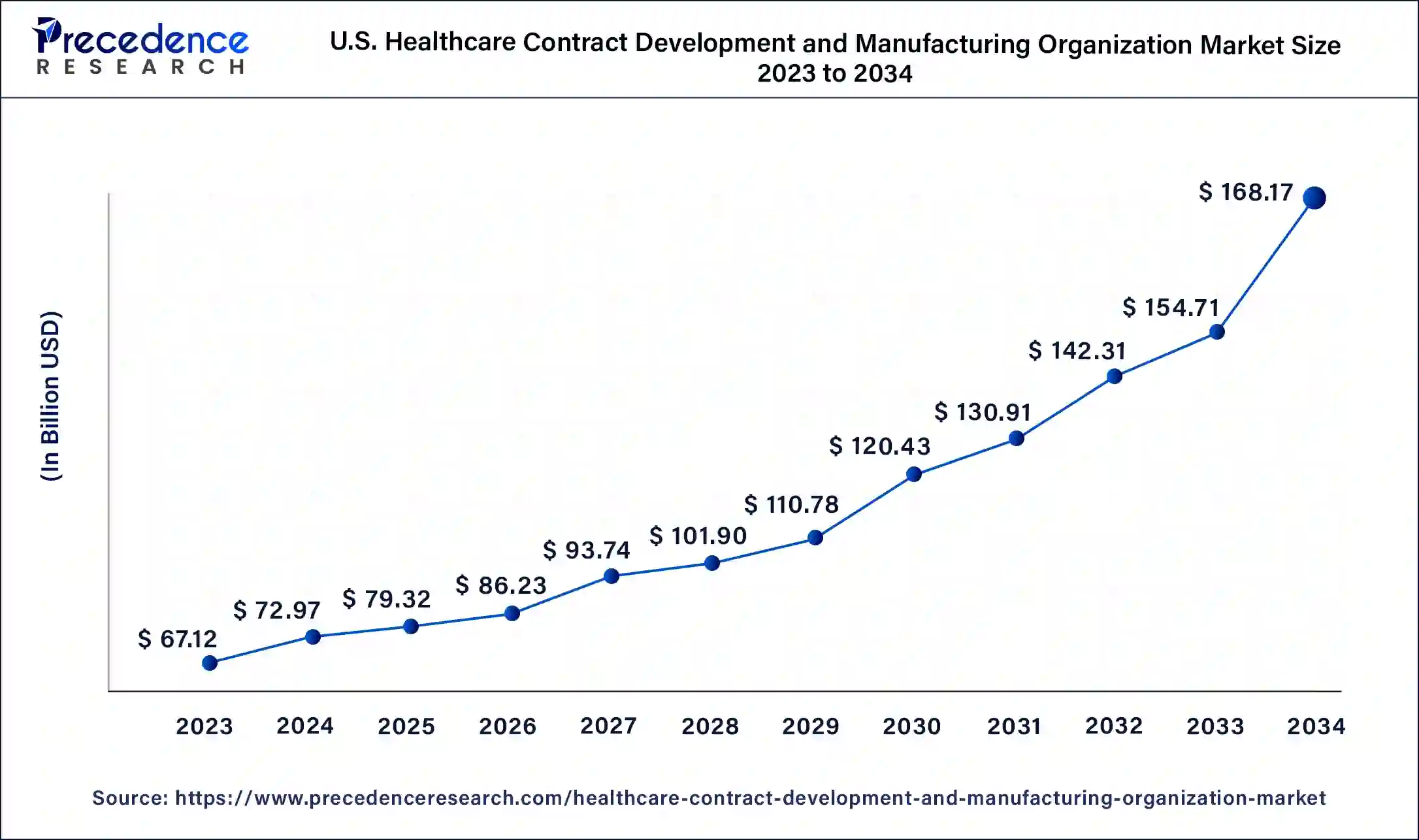

The U.S. healthcare contract development and manufacturing organization market size is estimated at USD 79.32 billion in 2025 and is predicted to be worth around USD 180.92 billion by 2035, at a CAGR of 8.6% from 2026 to 2035.

North America region accounted revenue share of 42% in 2025. The North America region's demand for healthcare contract development and manufacturing was boosted by the growth of the pharmaceutical industry. As a result, in terms of contract development and manufacturing of medical devices, North America's market is predicted to increase rapidly.

U.S. Healthcare Contract Development and Manufacturing Organization Market Trends

U.S. is a major contributor to the market in North America. The growing demand for biologics, rising investments in R&D activities, increased collaborations and M&A activities among pharmaceutical companies, government support, booming generic drug market and rising incidences of chronic diseases are driving the market growth. Adoption of advanced technologies such as AI-powered analytics, single-use bioreactors and continuous manufacturing by CDMOs are enhancing production capacity, quality control and regulatory compliance.

- For instance, in October 2024, NorthStar Medical Radioisotopes, LLC, inaugurated its state-of-the-art Radiopharmaceutical Contract Development & Manufacturing (CDMO) Facility in Wisconsin which will provide development services and dose manufacturing capacity for key medical radioisotopes, including Ac-225, Lu-177, Cu-64, Cu-67, and In-111 among others.

Asia Pacific region is expected to develop at the fastest rate of 10% during the forecast period. The major changes to the European Union regulatory framework are anticipated, potentially affecting market access and entrance. Due to the Europe region's severe regulatory laws, the market for healthcare contract development and manufacturing organization is likely to flourish.

Asia Pacific Healthcare Contract Development and Manufacturing Organization Market Trends:

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. The market growth is driven by factors such as robust regulatory frameworks fostering innovation, need for compliance with quality standards to accelerate market reach, increased emphasis on development of complex drugs and medical devices, growing demand for biosimilars and availability of cost-effective skilled workforce.

Furthermore, government initiatives attracting foreign investments, rising trend of outsourcing drug development and manufacturing activities, and surging demand for pharmaceutical [products with increasing healthcare expenditure are fuelling the market expansion.

China Healthcare Contract Development and Manufacturing Organization Market Trends

The Chinese healthcare contract development and manufacturing organization market is growing due to strong government support and increasing demand for outsourced pharmaceutical R&D and manufacturing. A primary trend involves the shift towards high-value services in biologics and HPAPIs, moving beyond traditional generics. Strategic capacity expansion and the adoption of advanced technologies like AI are key operational focus areas for major players.

Value Chain Analysis of the Healthcare Contract Development and Manufacturing Organization Market

- Research & Development (R&D) and Discovery Support

This initial stage involves providing specialized services to identify potential drug candidates, perform early-stage testing, and optimize drug development processes.

Key Players: Charles River Laboratories, ICON plc (via PPD and Labcorp partnerships), and WuXi AppTec - Active Pharmaceutical Ingredient (API) Manufacturing

This core stage involves the production of the biologically active component of the drug product, requiring specialized chemical synthesis and processing capabilities.

Key Players: Lonza Group, Catalent, Inc., Albemarle Corporation, and Aarti Industries Limited - Drug Product Formulation & Manufacturing (DP) / Fill-Finish

In this stage, the API is combined with other ingredients to create the final dosage form (tablets, capsules, injectables), and prepared for packaging through processes like aseptic fill-finish.

Key Players: Catalent, Inc., Vetter Pharma International GmbH (specializing in injectables), Piramal Pharma Solutions, and Recipharm AB. - Packaging, Logistics, & Supply Chain Management

The final stage focuses on primary and secondary packaging of the finished drug products, adhering to strict labeling regulations, serialization requirements for traceability, and subsequent distribution to global markets.

Key Players: Recipharm AB and Piramal Pharma Solutions

Key players in Healthcare Contract Development and Manufacturing Organization Market & Their Offerings

- Flex : While primarily known as a global manufacturing giant, Flex contributes to the healthcare CDMO market by leveraging its large-scale electronics manufacturing expertise for medical devices and components.

- Covance Inc.: Now the clinical research and drug development business of Labcorp, Covance contributes significantly by offering a comprehensive suite of early-stage research, clinical trial support, and central laboratory services.

- Lonza Group Ltd .: Lonza is a major global CDMO that significantly contributes to the market through its end-to-end service offering, from drug discovery to commercial manufacturing for both small molecules and biologics.

- Thermo Fisher Scientific Inc.: Thermo Fisher contributes to the CDMO market both as a key supplier of laboratory equipment and through its PPD clinical research services and Patheon commercial manufacturing brands.

- Jabil: Jabil contributes to the healthcare market primarily through its manufacturing services for medical devices, diagnostics, and pharmaceutical delivery systems, leveraging its global manufacturing footprint and expertise in complex plastics and electronics integration.

- Catalent Inc.: Catalent is a leading global CDMO that provides advanced delivery technologies and development solutions for drugs, biologics, and consumer health products.

- Sanmina Corporation: Sanmina contributes to the healthcare sector by providing integrated manufacturing solutions for complex medical and diagnostic equipment, similar to Flex and Jabil.

- IQVIA Holdings Inc.: Primarily known as a contract research organization (CRO), IQVIA contributes to the broader drug development market by providing advanced analytics, technology, and clinical trial management services. Their expertise is centered on leveraging data and human science to help

- pharmaceutical companies optimize clinical development and commercialization strategies.

- Siegfried Holding AG: Siegfried is a major CDMO specializing in the development and manufacturing of APIs and drug products for the pharmaceutical industry. They contribute by offering a range of services from chemical synthesis to secondary packaging, ensuring the reliable and quality-compliant supply of essential drug components.

- Recipharm AB: Recipharm contributes as a major European CDMO that offers manufacturing services for pharmaceutical products in various dosage forms, along with development, packaging, and logistics solutions.

Recent Developments

- In March 2025, HAS Healthcare Advanced Synthesis SA, a globally leading developer and producer of active pharmaceutical ingredients (APIs), anticancer compounds and high-potency active pharmaceutical ingredients (HPAPIs) announced the planned acquisition of a globally known manufacturer of chemical and biological APIs, Cerbios-Pharma SA. The partnership aims at creating a leading international group in the CDMO sector which is backed by 65 Equity Partners.

- In January 2025, Akums Drugs & Pharmaceuticals Ltd., India's leading Contract Development and Manufacturing Organization (CDMO), launched its new cutting-edge sterile manufacturing facility, committed to manufacture lyophilized products.

- In September 2024, CELLTRION, Inc., a biopharmaceutical company, declared the full-scale launch of its Contract Development and Manufacturing Organization (CDMO) at the “Morgan Stanley Global Healthcare Conference” held in New York.

The introduction of new products for outsourcing various processes in the pharmaceutical industry, as well as the expansion of key market competitors, are expected to drive the healthcare contract development and manufacturing organization market growth in the near future. The healthcare contract development and manufacturing organization market is expected to develop significantly in the forecast period due to the increase in acquisitions and definitive agreements made by the leading market leaders.

Segments Covered in the Report

By Services

- Contract Manufacturing

- Preclinical

- Bioanalysis and DMPK studies

- Toxicology Testing

- Other Preclinical Services

- Clinical

- Phase I

- Phase II

- Phase III

- Phase IV

- Laboratory Services

- Bioanalytical Services

- Analytical Services

- Cell Line development

- Process Development

- Microbial

- Mammalian

- Others

- MABs

- Recombinant proteins

- Others

- Upstream

- Downstream

- Others

- Small Molecule

- Large Molecule

- Contract Development

- MABs

- Recombinant proteins

- Others

- Solid Dose Formulation

- Liquid Dose Formulation

- Injectable Dose Formulation

- Class I

- Class II

- Class III

- Small Molecule

- Large Molecule

- High Potency API

- Finished Dose Formulations

- Medical Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting