Healthcare Education Market Size and Growth 2025 to 2034

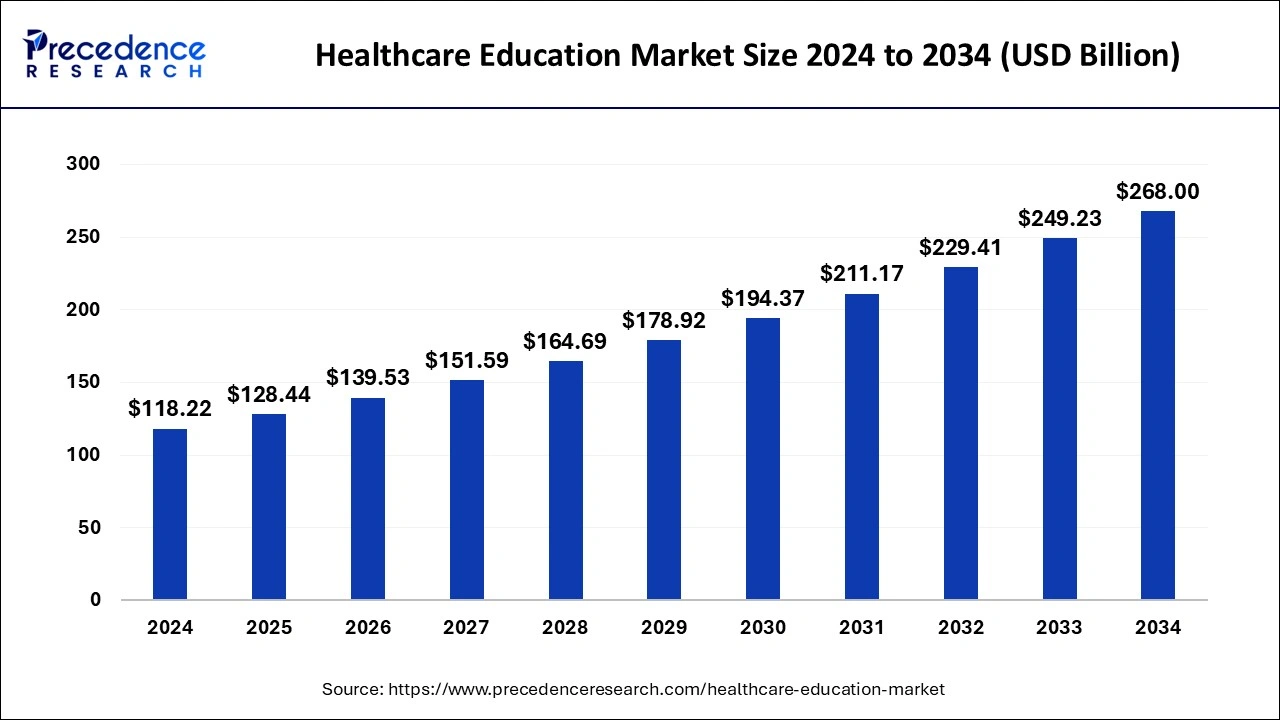

The global healthcare education market size was estimated at USD 118.22 billion in 2024 and is predicted to increase from USD 128.44 billion in 2025 to approximately USD 268.00 billion by 2034, expanding at a CAGR of 8.53% from 2025 to 2034.

Healthcare Education Market Key Takeaways

- In terms of revenue, the market is valued at $ 128.44 billion in 2025.

- It is projected to reach $ 128.44 billion by 2034.

- The market is expected to grow at a CAGR of 8.53% from 2025 to 2034.

- Asia Pacific dominated the healthcare education market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By provider, the universities & academic centers segment dominated the market in 2024.

- By provider, the continuing medical education providers segment is expected to grow at the highest CAGR in the market during the forecast period.

- By delivery mode, the e-learning segment dominated the market in 2024.

- By delivery mode, the classroom-based courses segment is expected to grow at the highest CAGR in the market during the forecast period.

- By application, the academic education segment dominated the market in 2024.

- By application, the cardiology segment is expected to grow at the highest CAGR in the market during the forecast period.

- By end user, the students segment dominated the market in 2024.

- By end user, the physician's segment is expected to grow rapidly in the market during the forecast period.

Market Overview

The healthcare education market refers to the businesses involved in the system that is used to educate people about health. The ultimate goal of health education is to improve a person's quality of life or health status by directly influencing their knowledge, behavior, or attitude on health-related topics. In order to enhance the quality of life and health status, healthcare education employs a variety of intervention strategies. The healthcare education market is fragmented with multiple small-scale and large-scale players, such as Apollo Hospitals, Cengage Learning, TACT Academy for Clinical Training, Zimmer Biomet Holdings, Olympus Corporation, GE Healthcare Limited, Gundersem Health Systems Inc., Pearson Education (Pearson Plc.), McGraw-Hill Education.

The National Commission for Health Education Credentialing (NCHEC) is a non-profit organization that provides certification and professional development opportunities for health education specialists in the United States. NCHEC was established in 1988 to improve the quality and consistency of health education in the United States. NCHEC offers several credentialing programs, including the Certified Health Education Specialist (CHES) and the Master Certified Health Education Specialist (MCHES) designations.

Healthcare Education Market Growth Factors

- Novel and innovative educational models stimulate the interests of students.

- A recent shift towards the online mode of learning enables the reach of various programs to remote areas.

- State funding enabling subsidized learning for the economically backward allows healthcare education to reach the less fortunate.

Technological Advancement

Virtual Reality and Augmented Reality are changing the nature of hands-on training by developing truly immersive simulations that allow learners to practice clinical and hands-on skills in scenarios that would normally require the use of a patient. Some chatbots and virtual tutors can give immediate feedback to learners, and AI can offer detailed suggestions for improvement.

Predictive analytics are being used that allows educators to track learner continues progress and activities across multiple platforms and use the data to suggest areas for improvement. Together, technology is raising the quality, accessibility, and efficiency of healthcare education and, most importantly, improving patient care and health outcomes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 128.44 Billion |

| Market Size by 2034 | USD 268 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Provider, Delivery Mode, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing public knowledge of healthcare

The demand for healthcare education is being driven by the growing public knowledge of healthcare. Healthcare workers with training in disease management, health promotion, and preventive care are in greater demand as people become more proactive about their health. These can boost the healthcare education market.

Technological developments in healthcare industries

The technological developments in healthcare industries can boost the healthcare education market. Telemedicine, digital health programs, and medical equipment are examples of technology developments in the healthcare industry. These technologies are being incorporated into healthcare education in the region, drawing students who are interested in innovative healthcare methods.

Restraint

The unpopularity of healthcare education in rural areas

The unpopularity of healthcare education in rural area may slowdown the healthcare education market. The educational institute may discontinue the program of the healthcare education due to the low response and interest among people in rural areas so the people in rural areas are unaware of healthcare education which result in slow down the healthcare education market.

Opportunity

The rising interest among people in attending programs of healthcare education in rural areas

The rising interest in programs for attending programs of healthcare education in rural areas can be the opportunity to raise the demand in the healthcare education market. The programs for people in rural areas of healthcare education are essential for enhancing patient outcomes and lowering healthcare costs. Through the provision of accessible and comprehensive information, facilitation of effective communication, and emotional and informational support, these programs help people in rural areas to raise awareness about healthcare education, which may raise the healthcare education market.

Provider Insights

The universities & academic centers segment dominated the healthcare education market in 2024. In between specialized training and continuing education, universities and academic institutions often provide a broad range of comprehensive programs that address several facets of healthcare education, including undergraduate, graduate, and doctorate degrees. These schools are approved and frequently enjoy well-established reputations, which guarantee high-quality instruction and draw professionals and students looking for respectable credentials.

Academic institutions such as universities are frequently at the forefront of medical innovation and research. Because of their participation in advanced research, they are able to incorporate the newest developments and technology into their courses, giving students access to current information and abilities.

The continuing medical education providers segment is expected to grow at the highest CAGR in the healthcare education market during the forecast period. In order to maintain their licenses and certifications, a lot of healthcare professionals, such as physicians, nurses, and other practitioners, must accrue a specific amount of continuing medical education (CME) credits. The continual demand for CME courses is guaranteed by this statutory need. With the constant introduction of new procedures, tools, and best practices, the healthcare industry is always changing.

The necessity for continuing education is fueled by the requirement for healthcare workers to remain abreast of these breakthroughs in order to deliver the best treatment possible. Patient safety and the caliber of the treatment received are becoming more and more important. CME directly affects the standard of patient care and safety by assisting healthcare workers in developing their knowledge and abilities. Healthcare workers must get advanced knowledge and skills in particular areas due to the tendency in the medical industry toward more specialization and subspecialization.

Delivery Mode Insights

The e-learning segment dominated the healthcare education market in 2024. Healthcare workers may access training materials whenever it's convenient for them, thanks to e-learning, which allows flexibility in terms of both time and place. This is especially crucial for working healthcare professionals who have to juggle continuing education with their professional responsibilities. E-learning lowers the price of traditional on-site education by saving on things like lodging, transportation, and facility fees. Because of its affordability, it's a desirable choice for both students and educational institutions.

Digital technological advancements have greatly raised the caliber and engagement of e-learning platforms. Interactive modules, virtual simulations, and multimedia information are some of the features that improve and captivate the learning process. The COVID-19 epidemic hastened the spread of e-learning by forcing educational institutions to switch to an online format due to lockdowns and physical distancing measures. This change brought e-learning into the mainstream and showed its viability and efficacy in providing healthcare education.

The classroom-based courses segment is expected to grow at the highest CAGR in the healthcare education market during the forecast period. The practice of medicine is frequently necessary for healthcare education, especially for clinical skills and procedures that are not well taught through online learning. Courses conducted in a classroom provide students with the hands-on practice they need to become proficient in these areas. Peer-to-peer cooperation and direct communication between students and teachers are made easier in in-person settings.

The development of cooperation and communication skills, both of which are critical in healthcare settings, depends on this contact. Access to simulation laboratories, where students may rehearse processes in a safe, authentic setting, is provided by many classroom-based courses. The gap between academic understanding and practical application is lessened with the use of these simulations.

Application Insights

The academic education segment dominated the healthcare education market in 2024. Academic education provides the fundamental information and abilities required for a variety of healthcare positions, which serve as the basis for professional employment in the field. The prerequisite courses for becoming a licensed professional, such as a doctor, nurse, pharmacist, or other healthcare provider, include undergraduate, graduate, and doctorate degrees.

Academic institutions offer comprehensive curricula covering a wide range of disciplines, from specialist professions to basic medical sciences. Students must get this depth and breadth of education in order to be prepared for the intricate and multidimensional nature of the healthcare industry. In order to guarantee excellent instruction, universities and other academic institutions frequently follow strict accreditation requirements. Academic education is the preferred option for both students and businesses since it is accredited, which is necessary for professional recognition and licensure.

The cardiology segment is expected to grow at the highest CAGR in the healthcare education market during the forecast period. Cardiovascular diseases (CVDs) continue to be the primary cause of morbidity and death. In order to provide healthcare workers with the knowledge they need to successfully manage heart disorders, such as hypertension, coronary artery disease, and heart failure, there is an increasing demand for specialized education in cardiology.

Cardiology is developing at a rapid pace, and novel therapies, interventional procedures, and diagnostic methods call for ongoing education and training for medical professionals. Keeping up with these developments is essential to enhancing patient outcomes and boosting the need for cardiac education. Specialized training is necessary for the integration of cutting-edge technology such as wearables, telemedicine, and artificial intelligence (AI) in cardiology practices. The need for educational programs to change in order to instruct medical personnel on how to use new technologies efficiently is one factor driving the expansion of the cardiology education market.

End-user Insights

The students segment dominated the healthcare education market in 2024. Many students pursue degrees in medical, nursing, pharmacy, allied health sciences, and other healthcare-related areas at the undergraduate, graduate, and doctorate levels. Students are the greatest end-user group as a result of this high enrollment, which fuels the demand for infrastructure and resources for healthcare education. The number of students seeking healthcare education has increased as a result of the rising need for healthcare workers throughout the world. The growing frequency of chronic illnesses, aging populations, and the growth of healthcare services are some of the factors that have made jobs in healthcare more appealing.

The physician segment is expected to grow rapidly in the healthcare education market during the forecast period. In order to keep their qualifications and licenses current, physicians must participate in continuing education. In order to guarantee that physicians remain current with the newest medical information, technology, and best practices, CPD is mandated by regulatory authorities and medical boards. Physicians must always learn new things since medical technology and therapies are evolving at a rapid rate. To give the greatest patient care, they must be up to date on new breakthroughs in pharmaceuticals, surgery, diagnostic instruments, and other fields.

Regional Insights

Asia Pacific dominated the healthcare education market in 2024. The healthcare sector in the area is expanding quickly due to a number of causes, including rising middle-class wages, urbanization, population increase, and rising healthcare costs. Increased demand for qualified healthcare workers as a result of this increase means more chances for healthcare education. The need for improved healthcare services is being driven by the growing middle-class population in Asia Pacific nations, such as China, India, and Southeast Asian countries. The need for skilled healthcare workers brought about by this demographic shift is fueling the expansion of healthcare education. Asia Pacific governments are making large investments in workforce development, education, and healthcare infrastructure. The sector is expanding as a result of initiatives, including skill development programs, scholarships, and financial aid for healthcare education.

- In January 2024, Fujitsu announced the launch of a large scale health education initiative for Fujitsu's approximately 70,000 employees in Japan to encourage employees to take proactive steps to maintain and improve their oral and dental health. Oral and dental health affects overall wellbeing and is an important element in achieving better quality of life.

North America is expected to grow at a significant rate in the healthcare education market during the forecast period. North America has highly developed healthcare systems, with a large infrastructure supporting medical education and training, especially in the United States and Canada. This comprises a large number of highly regarded research facilities, medical schools, and universities. Also, the region allocates substantial funds to medical education and research. Medical schools, research projects, and instructional initiatives get significant support from both the public and commercial sectors, which propels improvements in healthcare education.

Healthcare Education Market Companies

- GE Healthcare Limited

- Gundersem Health Systems Inc.

- Apollo Hospitals

- TACT Academy for Clinical Training

- Zimmer Biomet Holdings

- Olympus Corporation

- Pearson Education (Pearson Plc.)

- McGraw-Hill Education (Platinum Equity)

- Cengage Learning

Recent Developments

- In March 2024, UNICEF, IIT Bombay, and the International Institute of Health Management Research, New Delhi, opened registration for a 10-week-long "Digital Health Enterprise Planning Course." The goal of this new course is to prepare healthcare professionals, including doctors, nurses, pharmacists, policymakers, and IT professionals, to lead the digital transformation of India's healthcare system.

- In January 2024, Wolters Kluwer team up with Kortext to release the AI-powered Lippincott Medical Education eBook library. The AI-powered digital solution is meant to enhance access to medical educational content for students and universities in India.

- In October 2023, Northwestern University launched a new master's degree in Health Professions Education. The master's degree program will be designed to equip healthcare professionals with the competencies needed to excel as educators and practitioners of healthcare. The program also features residency in mastery learning and simulation-based curriculum development in person.

- In May 2024, according to the data collected from the Indonesian Ministry of Health, as many as 5.2 percent of Indonesian teenagers aged 13-17 years have had sexual intercourse. With this statistic in mind, it only makes sense that an organization like The Yayasan Gemilang Sehat Indonesia (YGSI) exists to spread awareness regarding sexual and reproductive education for Indonesian youths.

- In May 2024, GITAM University, Hyderabad, launched the book, “‘Effective Leadership and Governance in Medical Institution of Higher Education (published by Elsevier) by handing over the first copy to K.R. Sethuraman, former SBV Vice-Chancellor.

- In March 2024, UNICEF India, in collaboration with the International Institute of Health Management Research, New Delhi, and IIT Bombay, unveiled a digital course to equip healthcare professionals with the skills to drive the digital transformation of India's healthcare sector.

Segment Covered in the Report

By Provider

- Universities & Academic Centers

- Continuing Medical Education Providers

- Oems/ Pharmaceutical Companies

- Learning Management Systems

- Educational Platforms

- Medical simulation

By Delivery Mode

- Classroom-based Courses

- E-Learning Solutions

By Application

- Academic Education

- Cardiology

- Neurology

- Radiology

- Internal Medicine

- Pediatrics

- Other Applications

By End-user

- Students

- Physicians

- Non-physicians

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting