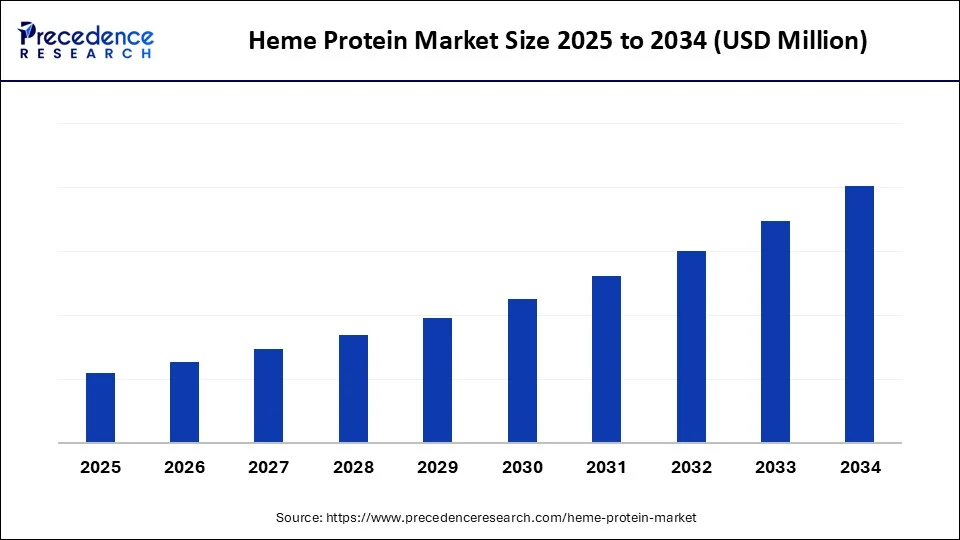

Heme Protein Market Size and Forecast 2025 to 2034

Rising demand in pharmaceuticals and food industries is boosting the heme protein market, with ongoing advancements in biotechnology. The growth of the market is driven by the rising demand for functional foods, plant-based meat alternatives, and advanced applications in pharmaceuticals and biotechnology.

Heme Protein MarketKey Takeaways

- North America dominated the global heme protein market with the largest market share of 39% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By protein type, the hemoglobin segment captured the biggest market share of 35% in 2024.

- By protein type, the cytochrome segment is anticipated to show considerable growth over the forecast period.

- By source, the animal-based segment held the highest market share of 60% in 2024.

- By source, the recombinant expression systems segment is anticipated to show considerable growth over the forecast period.

- By application, the pharma and drug discovery segment contributed the highest market share of 40% in 2024.

- By application, the food technology segment is anticipated to show considerable growth over the forecast period.

- By end-user, the pharma & biotech companies segment generated the major market share of 50% in 2024.

- By end-user, the food and beverage companies segment is expected to show considerable growth over the forecast period.

Impact of AI on the Heme Protein Market

Artificial Intelligence is significantly accelerating growth and innovation in the market for heme protein. AI can optimize the production of heme protein. Microbial fermentation, enhanced by AI, optimizes strain engineering, models proteins, and designs metabolic pathways for more efficient and cost-effective heme protein production. AI also supports supply chain and quality control. The use of AI-powered tools is increasing innovation in synthetic biology and food technology. Moreover, AI helps in quality control throughout the production process, ensuring consistent quality and detecting contaminants.

Market Overview

The heme protein market refers to the global industry surrounding the production, modification, application, and commercialization of heme-containing proteins, which are proteins that incorporate a heme prosthetic group—a complex containing an iron ion (Fe) held in a heterocyclic ring known as a porphyrin. These proteins are crucial in biological oxidation-reduction reactions, oxygen transport, catalysis, and signal transduction.

Heme proteins, including hemoglobin, myoglobin, cytochromes, peroxidases, and nitric oxide synthases, are widely utilized in biotechnology, pharmaceutical research, food technology (e.g., plant-based meat), diagnostics, and environmental biosensing. The market is growing rapidly due to the increasing popularity of sustainable and plant-based beef alternatives. The rising awareness of health and environmental concerns, combined with robust investments in alternative protein technologies, are driving market growth.

What Factors Are Fueling the Rapid Expansion of the Heme Protein Market?

- Increasing Demand for Alternative Proteins: The growing use of plant-based products and cultivated meat products is driving the need for heme proteins that mimic the flavor and color of meat. The heme, which gives a substitute meat flavor, has made this plant-based ingredient an indispensable component of the alternative protein market and attracted both vegans and flexitarians.

- Synthetic Biology and Fermentation Developments: Technological advances in microbial fermentation and synthetic biology enable the scalable and affordable production of heme proteins. Created yeast and bacteria can produce heme more effectively, making it now viable as a commercial operation, and it is being used in various areas, including food, pharmaceuticals, and biotech.

- Increasing Health Consciousness and Awareness among Consumers: People are becoming increasingly conscious of the health and environmental consequences of conventional meat. The heme proteins offer an ethical and nutritious alternative to the situation, satisfying the ethical and dietary demands of younger consumers who are concerned about consuming clean-label, cruelty-free, and climate-conscious foods

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Protein Type, Source, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Awareness of Health Benefits

The increased awareness of the health-related benefits associated with heme proteins is playing a crucial role in stimulating the heme protein market. Heme proteins, including hemoglobin, myoglobin, and cytochromes, are integral to vital biological processes such as oxygen transport, cellular respiration, and enzymatic reactions. With increased exposure to the concept of nutrition, there has been growing interest in the significance of heme proteins in promoting physiological wellness, particularly due to their high bioavailability of iron, which is essential in preventing iron deficiency anemia, a prevalent nutritional disorder worldwide. Moreover, the use of energy metabolism and improvement of physical performance also contribute to the popularity of these products in sports nutrition and wellness. This trend of health awareness is driving demand through the food, pharmaceutical, and nutraceutical sectors.

Restraint

Regulatory Hurdles

The regulatory approval processes are complex and require a significant amount of time, which is one of the challenges in the heme protein market. Regulatory agencies, such as the U.S. FDA and the European EFSA, as well as others in other parts of the world, require specific information about the safety, toxicity, allergenicity, and nutrition-related considerations of these ingredients before licensing their use in human food sources. Although this is a necessary undertaking to ensure the safety of the general public, it may slow down the release of products and restrict market growth, especially among new businesses with restricted funds. Companies need to invest a significant amount of money to ensure compliance with regional standards, including testing, documentation, and legal consultation. Such challenges hinder innovation and increase development expenses.

Opportunity

Increasing Demand for Plant-Based Alternatives

Heme protein has significant potential for the future due to the skyrocketing demand for plant-based meat substitutes. One of the biggest opportunities is to tap into the growing flexitarian and vegan populations as people worldwide explore ways to minimize their meat intake due to health concerns, sustainability issues, and animal welfare concerns. Emerging interest in functional foods that cater to specific health needs, including preventing iron deficiency, muscle growth, recovery, and optimizing cognition. With an increasing preference for more personalized nutrition, several food technology firms are well-positioned to develop specific, heme-enriched formulations.

Protein Type Insights

Why Did the Hemoglobin Segment Dominate the Market in 2024?

The hemoglobin segment dominated the heme protein market with a 35% share in 2024. Hemoglobin, one of the key iron-containing proteins present in red blood cells, is vital for vertebrate oxygen transport. It is used in biomedical and food industries due to its versatility and high bioavailability. In healthcare, it is used in blood substitutes and for diagnostics. Moreover, hemoglobin is highly rich in iron, making it possible to fortify the nutrients against iron-deficient anemia. Future biotechnology developments, like recombinant hemoglobin production, are expected to improve its scale and affordability.

The cytochrome segment is expected to grow at the fastest CAGR over the forecast period, under which the cytochrome P450 sub-segment is leading the charge. This is mainly due to the increasing usage of CYP enzymes in drug metabolism, biocatalysis, and biotechnology. They play a key role in the metabolic profiling of new drugs in pharmaceuticals. Their utility in drug discovery, development, and personalized medicine makes them essential in the industry. In healthcare, CYP enzymes are increasingly vital in industrial applications, facilitating complex chemical reactions under mild conditions, thus addressing environmental and economic concerns. Market interest is also driven by the increasing use of CYP-based tests in pharmacogenomics and toxicology.

Source Insights

How Does the Animal-Based Segment Dominate the Heme Protein Market in 2024?

The animal-based segment dominated the market, capturing a 60% revenue share in 2024. Heme iron from animal sources is a well-known and bioavailable source, abundant in red meat, poultry, and fish due to high concentrations of heme proteins like hemoglobin and myoglobin. These proteins are crucial for oxygen delivery, transport, storage, muscle metabolism, and enzymatic processes. They are supplemented with food and dietary supplements, particularly for individuals with iron deficiency. Although there is growing interest in sustainable and vegetal substitutes, animal sources are the gold standard because they are naturally plentiful and efficient.

The recombinant expression systems segment is expected to grow at a significant CAGR in the upcoming period, as they can produce heme proteins using various host organisms like bacteria (e.g., E. Coli), yeast (e.g., Pichia pastoris), and mammalian cells. They can also produce certain proteins, which are usually difficult to obtain from natural materials. Recombinant expression systems offer advantages such as high purity, controlled expression, functional flexibility, and reproducible production volumes. They are applied in pharmaceuticals and biotechnology to study protein behavior, drug metabolism (e.g., Cytochrome P450), and the generation of therapeutic enzymes.

Application Insights

What Made Pharma & Drug Discovery the Dominant Segment in the Market in 2024?

The pharma & drug discovery segment led the heme protein market while capturing a revenue share of 40% in 2024. Heme proteins, such as cytochromes and catalases, are essential for oxygen transport, cellular respiration, and enzymatic oxidation-reduction reactions. They play an essential role in pharmacokinetics, toxicology, and personalized medicine, particularly through cytochrome P450 enzymes in drug metabolism. The pharmaceutical industry uses these proteins to study drug-drug interactions and metabolic pathways and predict adverse effects. Their use in drug discovery and biomedical research will significantly drive market growth as the industry personalizes treatment processes.

The food technology segment is expected to grow at the highest CAGR over the forecast period, under which the plant-based meat analogs sub-segment is leading the charge. This is mainly due to the growing consumer demand for vegan and meat alternatives. The introduction of heme proteins, like leghemoglobin in soy or recombinantly expressed in yeast, is a significant innovation, recreating the flavor, aroma, and color of meat. Food technology companies are investing heavily in research to improve the serviceability, safety, and scalability of heme-based ingredients in meat analogs. Advancements in food science and synthetic biology are enabling the customization of heme proteins for flavor and nutritional value.

End-User Insights

How Does the Pharma & Biotech Companies Segment Dominate the Heme Protein Market in 2024?

The pharma & biotech companies segment captured a 50% revenue share in 2024, driven by the need for heme proteins in biomedical research, diagnostics, and drug development. Heme proteins, such as hemoglobin and cytochrome P450, are involved in numerous cellular and physiological processes, including oxygen transport, redox reactions, and drug metabolism. Increased focus on precision medicine and biologics has boosted the demand for high-purity heme proteins in pharma and biotech companies. Recombinant protein technology allows for large-scale production, ensuring consistent quality and functionality for R&D and therapeutic applications.

The food & beverage companies segment is expected to grow at the fastest CAGR in the upcoming period, driven by the rising demand for plant-based, sustainable food products. A major innovation in plant-based meat alternatives is the production of heme proteins through recombinant fermentation, which mimics the flavor, texture, and appearance of conventional meat. This is of great interest to food manufacturers catering to health-conscious and environmentally-aware consumers. The segmental growth is also fueled by the rise of flexitarians and a trend towards green food consumption. Food and beverage companies are investing more in research and development to incorporate clean-label, nutrient-rich, and ethically sourced food narratives into their products.

Regional Insights

Why Did North America Dominate the Heme Protein Market in 2024?

North America led the global market for heme protein with the largest share of 39% in 2024. This dominance is attributed to its strong R&D base, a well-developed biotech industry, and the presence of major players in both pharmaceuticals and food technology. The region also leads in technological advancements like recombinant protein manufacturing and precision fermentation, crucial for the mass production of heme proteins. Supportive legal environments and government funding have further boosted the production and commercialization of heme protein-based products.

The U.S. is a major contributor to the market. This is mainly due to its well-established pharmaceutical and food processing industries. A well-developed research ecosystem, including universities, biotech companies, and government institutions, actively researches heme proteins. Supporting venture capital investments and advanced manufacturing capabilities enables both startups and established players to increase production and introduce new heme protein-based products.

Why is Asia Pacific Experiencing the Fastest Growth in the Heme Protein Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to increasing health awareness, a growing food processing industry, and rising investments in biotechnology. There is a high demand for high-protein, iron-enriched, and functional foods. High urbanization rates, rising disposable incomes, and increased health consciousness are driving the consumption of health supplements and substitutes made with heme proteins. Government support for food security and biotechnology, through research funds and favorable policies, provides an excellent opportunity for market development.

China is a major player in the market due to the expanding biotechnology and food processing industries. Chinese startups and food tech companies are experimenting with biotechnology, plant-based, and recombinant heme proteins to create alternative meat products. The government's focus on food sustainability and improved health outcomes is fostering an environment where functional foods and therapeutic protein innovation are viable.

What are the Major Factors Boosting the Growth of the European Heme Protein Market?

The European heme protein market is expected to grow at a notable rate in the upcoming period due to increased health awareness, sustainability goals, and high innovation in the food and pharmaceutical industries. The growing demand for plant-based and functional foods that promote health and environmental sustainability is likely to boost the growth of the market. Ethical sourcing, nutritional transparency, and sustainable alternatives are becoming important to European consumers, making heme protein-derived products, especially recombinant or plant-based offerings, attractive for meat alternatives and iron-fortified foods.

The UK is leading in the heme protein market within Europe with its active biotech and food tech ecosystem. Research institutions and start-ups in the UK are exploring alternative solutions to heme proteins in therapeutics and nutritional supplements and actively investigating plant-based meat alternatives. UK consumers are showing interest in plant-based meat, which is likely to drive the growth of the market.

Heme Protein Market Companies

- Sigma-Aldrich (Merck KGaA)

- Thermo Fisher Scientific

- Abcam plc

- Recombinant Protein Technologies

- Creative BioMart

- Biorbyt Ltd.

- Promega Corporation

- BioVision Inc.

- Biomatik Corporation

- Enzo Life Sciences

- Genscript Biotech Corporation

- Novus Biologicals (A Bio-Techne Brand)

- Rockland Immunochemicals Inc.

- Impossible Foods Inc. (Food tech application – soy leghemoglobin)

- Jackson ImmunoResearch

- OriGene Technologies Inc.

- ProSpec – Protein Specialists

- Aviva Systems Biology

- US Biological Life Sciences

- QED Bioscience Inc.

Recent Developments

- In June 2025, Moolec Science received a US patent for its Piggy Sooy technology, a new soybean gene-edited to express large degrees of porcine hemeproteins in its seeds. The patent, granted by the United States Patent and Trademark Office (USPTO), covers the plants, seeds, methods to develop them, and food compositions derived from the plant.

- In April 2024, Swedish food tech startup Ironic Biotech secured €1M in pre-seed investment to advance the development of its heme iron ingredient made from plants and produced using precision fermentation.

- In September 2023, a Korean award-winning food-tech startup, HN Novatech, planned the launch of ACOMS, the world's first proprietary heme-based seaweed ingredient specifically for plant-based meat applications.

(Source: https://vegconomist.com)

(Source: https://www.greenqueen.com.hk)

(Source: https://www.proteinproductiontechnology.com)

Segments Covered in the Report

By Protein Type

- Hemoglobin

- Human Hemoglobin

- Bovine Hemoglobin

- Recombinant Hemoglobin

- Myoglobin

- Cytochromes

- Cytochrome c

- Cytochrome P450

- Peroxidases

- Horseradish Peroxidase (HRP)

- Glutathione Peroxidase

- Catalases

- Nitric Oxide Synthase (NOS)

- Other Heme Enzymes

By Source

- Animal-Based

- Natural blood-derived

- Organs (e.g., liver, heart, muscle)

- Recombinant (Biotech Engineered)

- E. coli-based expression

- Yeast/fungal systems

- Plant cell-based

- Synthetic/Plant-Derived

By Application

- Pharmaceutical & Drug Discovery

- Enzyme assays

- Drug metabolism studies (e.g., CYP450)

- Redox biology research

- Biotechnology & Research

- Biosensors

- Protein engineering

- Structural biology

- Food Technology

- Plant-based meat analogs

- Color and flavor enhancement

- Clinical Diagnostics

- Blood-based biomarkers

- HRP-labeled antibodies

- Environmental Applications

- Bioremediation

- Oxidative degradation studies

By End Use

- Pharmaceutical & Biotech Companies

- Academic & Research Institutes

- Food & Beverage Manufacturers

- Clinical Diagnostic Laboratories

- Environmental Testing Organizations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting