Human Biospecimens Market Size and Forecast 2025 to 2034

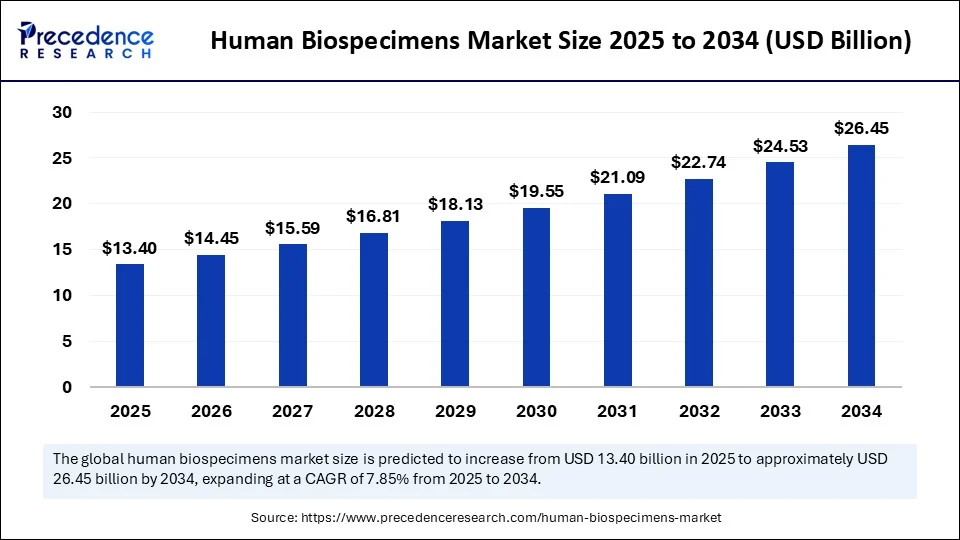

The global human biospecimens market size accounted for USD 12.42 billion in 2024 and is predicted to increase from USD 13.40 billion in 2025 to approximately USD 26.45 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. The market is growing due to increasing demand for personalized medicine, biomedical research, and advancements in diagnostic and drug development technologies.

Human Biospecimens Market Key Takeaways

- In terms of revenue, the global human biospecimens market was valued at USD 12.42 billion in 2024.

- It is projected to reach USD 26.45 billion by 2034.

- The market is expected to grow at a CAGR of 7.85% from 2025 to 2034.

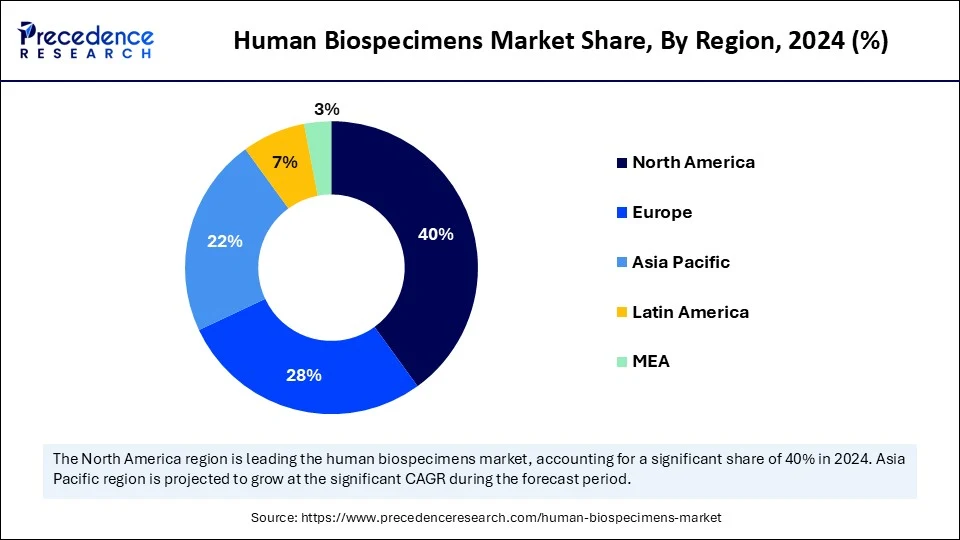

- North America dominated the human biospecimens market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By specimen type, the FFPE tissue segment held the biggest market share of 30% in 2024.

- By specimen type, the cfDNA/RNA & Fresh Frozen tissue segment is expected to grow at the fastest CAGR in the coming years.

- By application, the cancer research segment contributed the highest market share of 45% in 2024.

- By application, the precision medicine segment is observed to grow at the fastest CAGR during the forecast period.

- By end user, the pharma & biotech companies segment captured the major market share of 50% in 2024.

- By end user, the CROs segment is expected to grow at the fastest CAGR in the upcoming period.

- By storage type, the cold storage (−80°C or LN2) segment generated the major market share of 60% in 2024.

- By storage type, the ambient/room temp stabilized segment is emerging as the fastest growing.

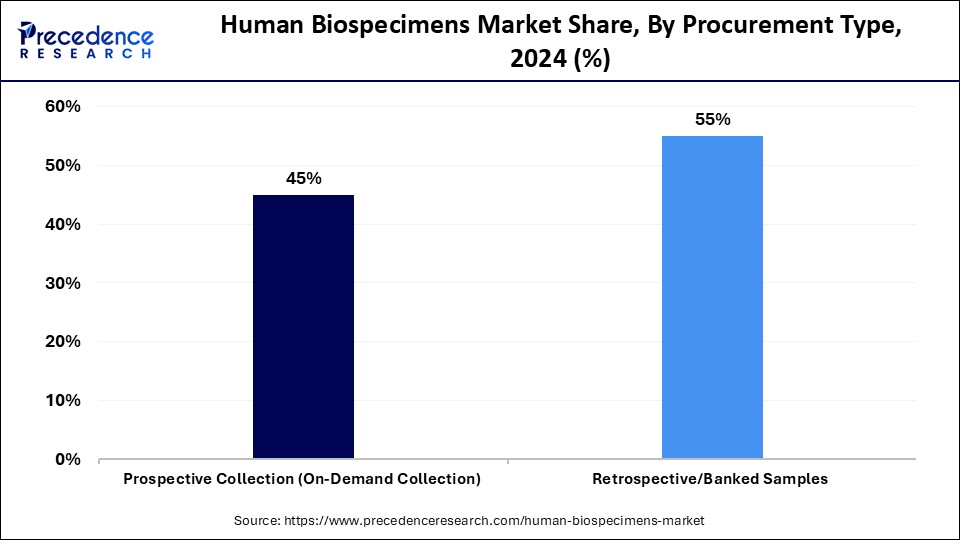

- By procurement type, the retrospective (banked) samples segment accounted for the significate market share pf 55% in 2024.

- By procurement type, the prospective collection segment is observed to grow at the fastest rate during the forecast period.

Impact of AI on the Human Biospecimens Market

By improving the methods of specimen collection, processing, management, and analysis, artificial intelligence (AI) is significantly revolutionizing the market for human biospecimens. AI algorithms increase the value of stored specimens for research and personalized medicine applications by enabling the quicker and more precise identification of biomarkers, disease patterns, and patient-specific molecular profiles. AI can optimize the management of biospecimen inventories, improving safety and reducing errors.

In biobanking, AI-driven systems enhance specimen cataloging, automate inventory management, and optimize cold storage operations, thereby reducing human error and ensuring improved sample traceability. Machine learning models can predict sample degradation, assess quality in real-time, and flag inconsistencies, thus maintaining the high integrity of specimens for clinical use. Overall, AI is unlocking new possibilities in biospecimen utilization by streamlining operational workflows, improving data integration, and enabling scalable, intelligent research infrastructure.

U.S. Human Biospecimens Market Size and Growth 2025 to 2034

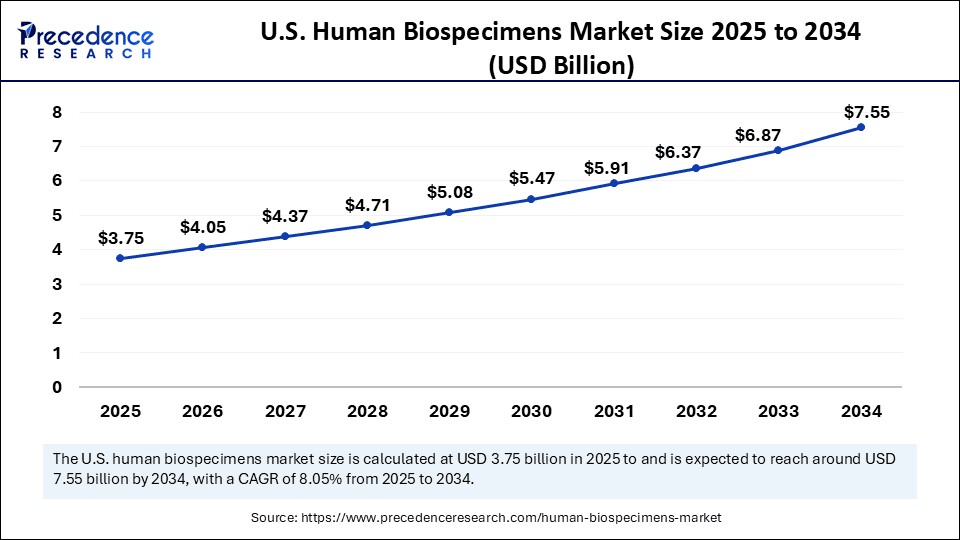

The U.S. human biospecimens market size was exhibited at USD 3.48 billion in 2024 and is projected to be worth around USD 7.55 billion by 2034, growing at a CAGR of 8.05% from 2025 to 2034.

What Made North America the Dominant Region in the Market in 2024?

North America dominated the human biospecimens market by holding the largest share of 40% in 2024 due to its robust biopharmaceutical industry, sophisticated healthcare infrastructure, and established biobanking networks. There are stringent regulations and ethical guidelines surrounding the collection and storage of human biospecimens for research. The rising investments in biomedical research bolstered the growth of the market within the region. Sharing and standardization of specimens is encouraged by NIH NCI and other agency initiatives. To speed up innovation, academic institutions and business entities also work closely together. This region's established infrastructure with well-defined regulations and funding for cutting-edge research is driving its market dominance. The U.S. is a major player in the market. The country is home to major players in the market. Moreover, the country boasts a well-established research infrastructure, supporting market growth.

Asia Pacific is emerging as the fastest-growing region due to rising funding for clinical trials and the expansion of biobanks. There is a high demand for region-specific biospecimens due to the expanding population and emphasis on individualized healthcare. Asian countries are actively establishing international partnerships and updating their research infrastructure. The rising demand for personalized medicine, the high prevalence of chronic diseases, and increasing R&D activities support regional market growth.

Market Overview

The human biospecimens market refers to the collection, storage, processing, and distribution of biological samples derived from the human body, such as blood, plasma, serum, tissue, urine, saliva, DNA/RNA, and other bodily fluids, for use in medical research, diagnostics, drug discovery, biomarker validation, precision medicine, and clinical trials. These biospecimens are stored under strict ethical, regulatory, and quality-controlled conditions in biobanks and are made available to pharmaceutical companies, CROs, academic institutions, and diagnostic developers. The market is supported by increasing demand for personalized medicine, oncology research, and the rise of multi-omics studies (genomics, proteomics, transcriptomics, etc.).

Human Biospecimens Market Growth Factors

- Rising Demand for Personalized Medicine: Personalized therapies require precise molecular and genetic profiling, increasing the need for high-quality human biospecimens such as blood, tissue, and DNA samples.

- Expansion in Biomedical Research: Academic institutions and pharmaceutical companies are using human samples for disease modeling, biomarker discovery, and therapeutic development.

- Advancements in Genomics and Proteomics: Breakthroughs in omics technologies enable deeper analysis of human specimens, boosting their value in diagnostics and drug discovery.

- Growth in Biobanks and Biorepositories: The expansion of biobanks worldwide is improving accessibility to diverse, well-annotated biospecimens for research and clinical trials.

- Increased R&D Spending by Pharma and Biotech: Pharmaceutical and biotechnology companies are investing heavily in R&D, creating sustained demand for ethically sourced and well-preserved human specimens.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.45 Billion |

| Market Size in 2025 | USD 13.40 Billion |

| Market Size in 2024 | USD 12.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Specimen Type, Application, End Use, Storage Type, Procurement Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Focus on Personalized Medicine

The demand for bio samples that facilitate molecular proteomic and genomic profiling is increasing as healthcare moves toward customized treatment regimens. DNA blood and human tissues are necessary for customizing treatments based on biomarkers unique to each patient. This trend is forcing medical facilities, research institutions, and biotech companies to source high-quality specimens to develop more specialized and efficient treatments. Diverse specimen libraries are also necessary for population medicine. This factor is driving market expansion by increasing demand for innovative diagnostic and treatment approaches tailored to individual samples.

Expansion of Biobanks and Global Biorepositories

The growth of biobanks, centralized facilities that store a variety of human samples along with related clinical data, is improving access to and quality of specimens. Standardized, ethically sourced materials are available for use in academic, clinical, and commercial settings through these repositories. International networks facilitate researchers' access to uncommon and regionally specific samples, fostering cooperation and accelerating innovation. Additionally, the capacity to digitize and scale specimen inventories is increasing cross-border accessibility to biospecimens because biospecimens are becoming more widely available and standardized globally. This driver promotes market growth.

Restraints

Ethical and Legal Concerns

There are serious regulations and considerations regarding the collection, use, and privacy of human biospecimens. Access to useful samples may be restricted by stringent laws governing informed consent of donor anonymity and data use. Obtaining international and institutional review board (IRB) approvals can be challenging for researchers. Any ethical violation has the potential to erode public confidence and result in legal repercussions. Moreover, high costs associated with establishing sample storage infrastructure hamper the growth of the human biospecimens market.

Limited Availability of Rare and Diverse Specimens

Biospecimens from rare disease groups and underrepresented populations are increasingly needed, but they are hard to find. This scarcity impacts the generalizability and inclusivity of study findings. It is challenging to collect and preserve a diverse range of high-quality specimens due to logistical constraints and demographic limitations. Personalized medicine initiatives may not succeed if they are not widely represented. This limitation diminishes the breadth and equity of diagnostic and therapeutic research.

Opportunity

Increasing Collaborations between Pharma and Academic Institutions

To access a variety of specimen pools, pharmaceutical companies are increasingly joining forces with hospitals, universities, and biobanks. These partnerships help improve study designs, accelerate drug discovery, and bring clinical research closer to real-world populations. Additionally, joint ventures provide academic biorepositories with infrastructure support and funding. As a result, these partnerships can improve access to rare or regionally specific specimens and global research capacity.

Specimen Type Insights

What Made Tissue Specimens the Dominant Segment in the Human Biospecimens Market in 2024?

The tissue specimens segment dominated the market with the share of 30% in 2024, under which the FFPE (formalin-fixed paraffin-embedded) tissue held a major share as a sub-segment. This is mainly due to its extensive application in histopathological analysis, with a capacity for long-term preservation and suitability for molecular testing and immunohistochemistry. FFPE tissue samples are the preferred option for biobanks and diagnostic laboratories because they are frequently utilized in cancer research, biomarker studies, and retrospective clinical trials. Their supremacy in translational research and clinical diagnostics is further supported by their capacity to preserve tissue architecture and protein integrity.

The nucleic acids segment is expected to grow at the fastest rate in the upcoming period, under which the ctDNA/cfDNA (circulating tumor/DNA) sub-segment is leading the charge due to its applications in liquid biopsy genomics and precision medicine. The increasing need for high-quality molecular data further supports segmental growth. The use of ctDNA/cfDNA is increasing in clinical research because it enables non-invasive cancer diagnostics, prenatal testing, and disease progression monitoring.

Application Insights

Why Did the Cancer Research Segment Dominate the Market in 2024?

The cancer research segment dominated the human biospecimens market with share of 45%, accounting for the largest share in 2024. This is mainly due to the increased burden of cancer worldwide. This significantly increased the number of cancer research studies, boosting the need for tissue, blood, and tumor samples to identify treatment responses, tumor microenvironments, and mutations. These samples are crucial for the development of immunotherapies, precision oncology, and the identification of biomarkers. The growing oncology-focused R&D and the high demand for disease-specific specimens further support segmental growth.

The precision medicine segment is expected to grow at the fastest CAGR in the coming years, driven by the growing need for customized treatments based on molecular genetics and biomarker profiling. The demand for premium human specimens, including cfDNA, FFPE tissues, and fresh frozen samples, has increased due to the growth of pharmacogenomics, rare disease diagnostics, and cancer genomics. Further speeding up the incorporation of bio-specimens in precision medicine research and clinical trials are developments in sequencing technologies and the increased focus on targeted treatments by pharmaceutical companies and healthcare providers.

End User Insights

How Does the Pharma & Biotech Companies Segment Dominate the Human Biospecimens Market?

The pharma and biotech companies segment dominated the market while capturing the largest revenue share of 50% in 2024. This is due to their extensive drug development pipelines, which heavily rely on high-quality human specimens. Utilizing samples from preclinical trials, precision drug targeting, and biomarkers validation, these businesses frequently collaborate with biobanks and academic institutions. The ongoing demand for annotated biospheric from ethical sources is fueled by their significant investments in immunotherapies for rare diseases and oncology. Additionally, before approval, regulatory agencies frequently demand specimen-based validation.

The contract research organizations (CROs) segment is expected to expand at the fastest rate during the projection period due to the rising outsourcing activities. Clinical research and specimen-based studies are increasingly being outsourced to CROs. They help pharmaceutical companies by locating, handling, and evaluating biospecimens. They also provide regulatory knowledge and scalability to expedite drug development schedules. Additionally, they facilitate multicenter studies and provide access to worldwide sample pools. The demand for CRO is rising swiftly due to the trend toward cost optimization and leaner internal R&D.

Storage Type Insights

Why Did the Cold Storage (−80°C or LN2) Segment Dominate the Human Biospecimens Market in 2024?

The cold storage (−80°C or LN2) segment dominated the market with share of 60% in 2024 due to its ability to sustain the effectiveness of specimens for extended periods. Cold storage maintains the structural and functional integrity of proteins, RNA, DNA, and other biomolecules. For maintaining biospecimens used in clinical trials and molecular research, it is the gold standard. Ultra-low freezers equipped with monitoring systems are used in the majority of biobanks and high-throughput laboratories to prevent sample deterioration. These storage techniques guarantee compatibility with cross-institutional research and future testing requirements. Global biobank standards and the need for long-term preservation are reinforcing the dominance of this segment.

The ambient/room temp stabilized segment is expected to grow at a rapid pace during the forecast period as it requires little infrastructure, which is inexpensive and easy to transport. Advances in preservation kits and stabilization media are enabling proteins, RNA, and DNA to survive without freezing. This methodology is perfect for decentralized clinical trials, remote sampling, and environments with limited resources. It also supports green lab initiatives by reducing energy use and carbon emissions.

Procurement Type Insights

How Does the Retrospective (Banked) Samples Segment Dominate the Market in 2024?

The retrospective (banked) samples segment dominated the market with share of 55% in 2024 as they offer immediate access to well-annotated, ethically approved specimens, allowing researchers to conduct studies without waiting for collection cycles. Biobanks with extensive historical data provide critical insights into disease progression and treatment outcomes. These samples also reduce research timelines, support population-based studies, and enable validation of AI-based models. Their broad accessibility and existing datasets make them invaluable for hypothesis-driven research. This segment is dominating the market, driven by faster access and the availability of annotated data sets.

The prospective collection segment is expected to grow at the fastest rate over the study period due to the increased need for specialized specimens that meet specific research requirements. By defining collection criteria such as patient profiles, sample size, and timing, researchers can guarantee quality and relevance for specialized or changing study needs. This methodology facilitates sophisticated inclusion procedures and flexible trial designs. Additionally, it improves future workflows by enabling real-time data integration.

Human Biospecimens Market Companies

- BioIVT

- Precision for Medicine

- BioChain Institute Inc.

- Conversant Bio (part of Discovery Life Sciences)

- Indivumed GmbH

- REPROCELL Inc.

- US Biolab Corporation, Inc.

- Biobank Graz (Medical University of Graz)

- ProteoGenex Inc.

- Seracare Life Sciences (part of LGC Group)

- Asterand Bioscience

- OriGene Technologies, Inc.

- Biomax Informatics AG

- Tissue Solutions Ltd.

- Human BioMolecular Research Institute (HBRI)

- AMS Bio (AMS Biotechnology)

- National Disease Research Interchange (NDRI)

- IQVIA (Biospecimen Services)

- Boca Biolistics

- BioRepository Inc.

Recent Developments

- In June 2025, Elucidate and Sapien Bioscience announced a strategic partnership to turn Sapien's extensive biobank assets into AI-ready, multimodal data products for use in drug and diagnostic development.

(Source: https://www.businesswire.com) - In May 2025, Predictive Oncology Inc. announced that it has been leveraging its extensive biobank of over 150,000 tumor samples to advance drug discovery and biomarker research using AI and ML. This initiative follows Regeneron Pharmaceuticals' acquisition of 23andMe, which underscores the industry's shift towards utilizing real-world data for drug development.

(Source: https://www.nasdaq.com)

Segments Covered in the Report

By Specimen Type

- Tissue Specimens

- FFPE (Formalin-Fixed Paraffin-Embedded) Tissue

- Fresh Frozen Tissue

- Tumor Biopsies

- Normal Tissue Samples

- Biofluids

- Whole Blood

- Plasma

- Serum

- Urine

- Saliva

- CSF (Cerebrospinal Fluid)

- Fastest Growing: Plasma

- Cellular Material

- PBMCs (Peripheral Blood Mononuclear Cells)

- Buccal Cells

- Stem Cells

- Nucleic Acids

- Genomic DNA

- RNA

- ctDNA/cfDNA (circulating tumor/DNA) – Fastest Growing

By Application

- Cancer Research

- Drug Discovery and Development

- Diagnostics and Biomarker Discovery

- Translational and Genomic Research

- Precision Medicine

- Infectious Disease Studies (e.g., COVID-19, HIV, TB)

- Neurology and Cardiovascular Research

By End Use

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Hospitals and Biobanks

- Diagnostic Laboratories

- Government & Non-Profit Organizations

By Storage Type

- Cold Storage (−80°C or LN2)

- Ambient/Room Temperature Stabilized

- Cryogenic (Liquid Nitrogen, −196°C)

- Formalin-Fixed Storage

By Procurement Type

- Prospective Collection (On-Demand Collection)

- Retrospective/Banked Samples

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting