What is the HVAC Packaged Units Market Size?

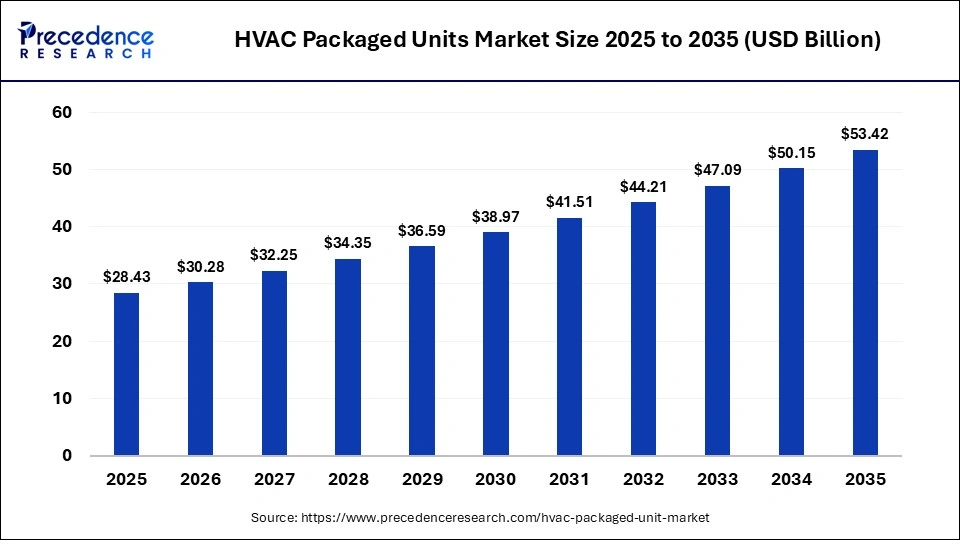

The global HVAC packaged units market size accounted for USD 28.43 billion in 2025 and is predicted to increase from USD 30.28 billion in 2026 to approximately USD 53.42 billion by 2035, expanding at a CAGR of 6.51% from 2026 to 2035. The HVAC packaged units market is experiencing unprecedented growth, driven by the rapid development of residential, commercial, and industrial buildings.

Market Highlights

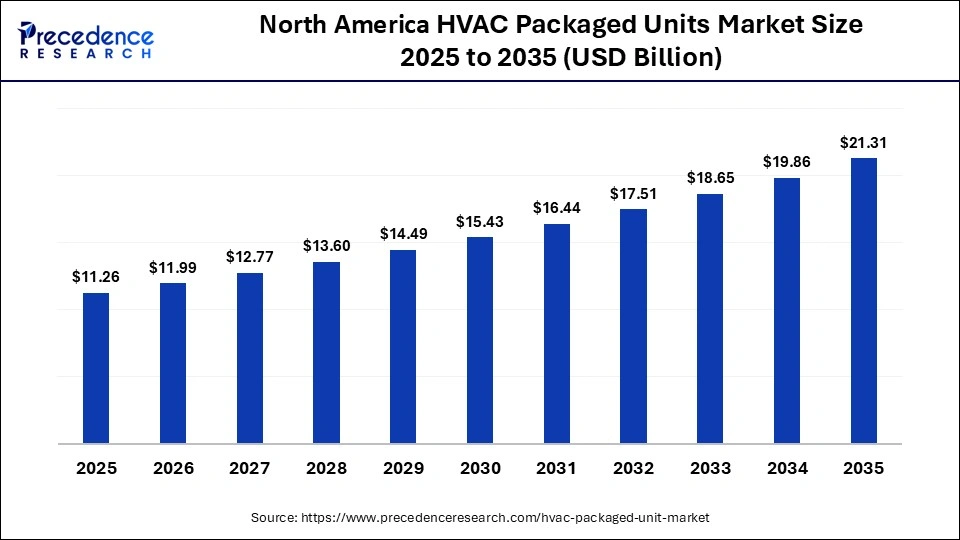

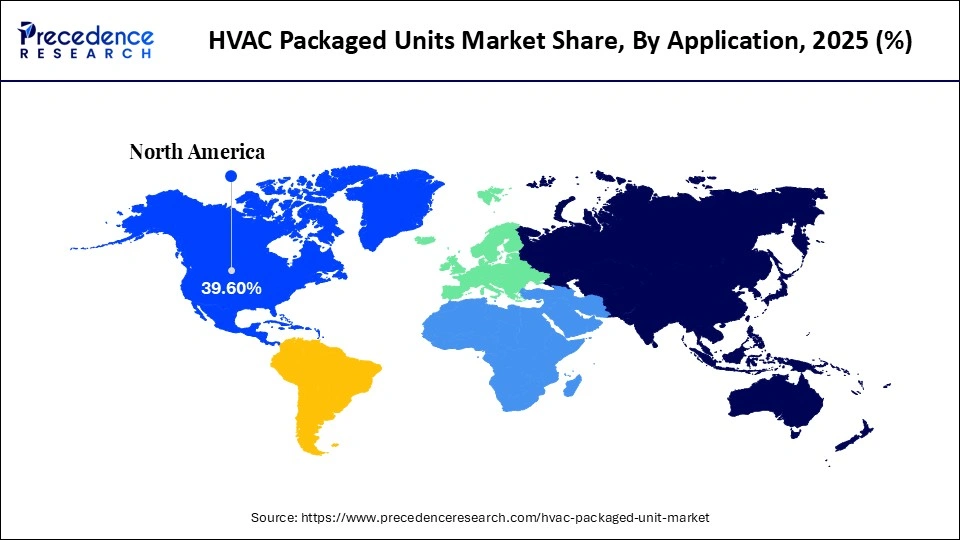

- North America dominated, holding the largest market share of 39.60% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7.20% between 2026 and 2035.

- By product type, the packaged air conditioners segment held the major market share of 44.80% in 2025.

- By product type, the dual-fuel packaged units segment is growing at a remarkable CAGR of 7.10% between 2026 and 2035.

- By capacity, the 10-25 tons segment contributed the largest market share of 36.50% in 2025.

- By capacity, the above 50 tons segment is poised to grow at a CAGR of 6.90% between 2026 and 2035.

- By end-use, the commercial segment captured the biggest market share of 52.30% in 2025.

- By end-use, the residential segment is set to grow at a notable CAGR of 6.60% between 2026 and 2035.

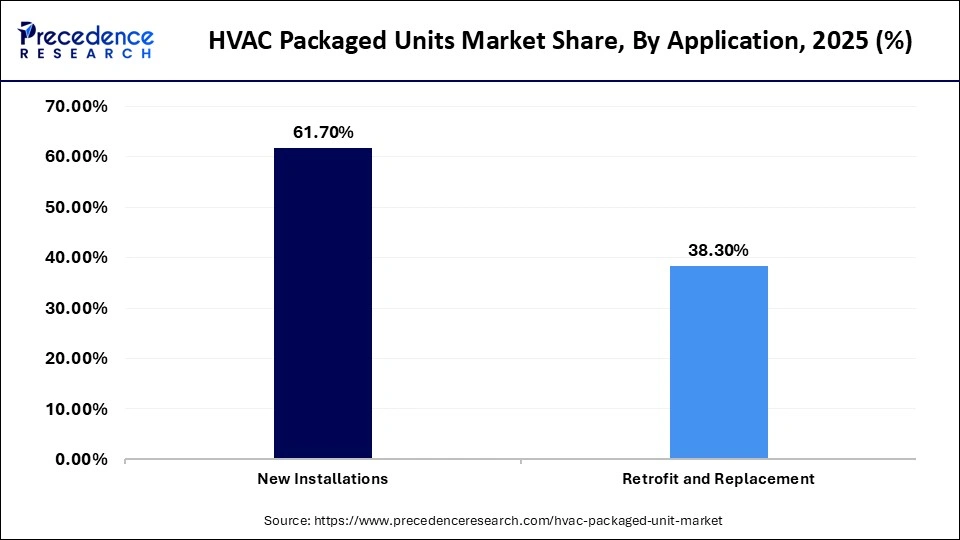

- By application, the new installations segment generated the biggest market share of 61.70% in 2025

- By application, the retrofit & replacement segment is expanding at a solid CAGR of 6.80% between 2026 and 2035.

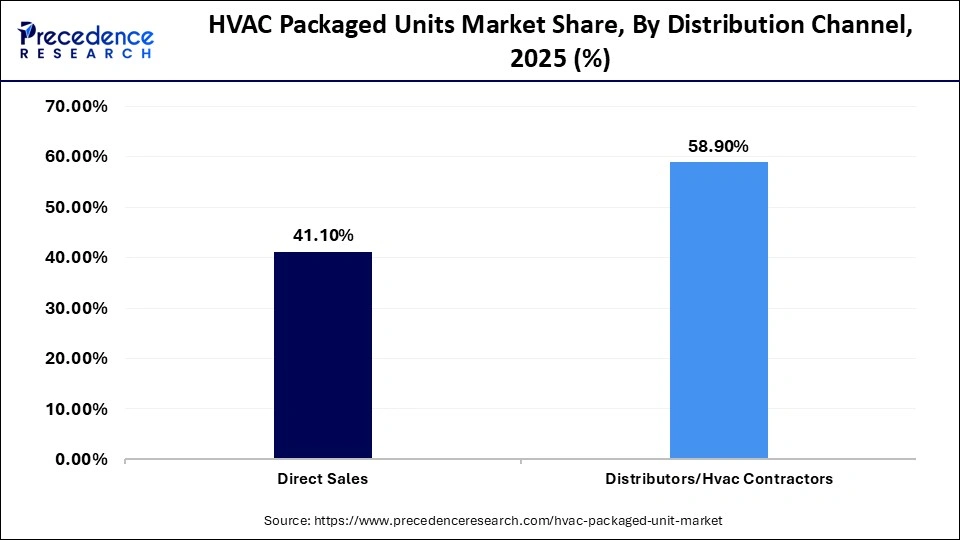

- By distribution channel, the distributors/HVAC contractors segment accounted for the majority market share of 58.90% in 2025.

- By distribution channel, the direct sales segment is projected to grow at a significant 6.40% CAGR between 2026 and 2035.

HVAC Packaged Units Market Overview

Packaged HVAC units simplify home comfort by combining heating and cooling components into one compact system. Their adoption is increasingly tied to construction practices that favor factory-assembled mechanical solutions over field-integrated systems, particularly in projects with tight construction timelines or limited mechanical coordination capacity. A packaged HVAC system is an all-in-one cooling and heating unit that contains the compressor, condenser, evaporator, and air handler. These units are generally installed outdoors, either on rooftops or adjacent ground pads, allowing builders to avoid dedicating indoor mechanical rooms in space-constrained layouts.

Beyond space efficiency, packaged HVAC units offer predictable commissioning outcomes because factory testing reduces variability introduced during on-site assembly. This design approach supports consistent airflow balance, refrigerant charge accuracy, and thermal output performance across installations. As a result, packaged units are increasingly specified in standardized housing developments, modular buildings, and repeat commercial layouts where uniform performance is required across multiple sites.

Packaged HVAC units are commonly used in single-family homes, low-rise residential buildings, modular housing, and light commercial applications. Outdoor placement improves lifecycle serviceability by allowing technicians to perform diagnostics, component replacement, and refrigerant checks without disrupting occupied spaces, which is particularly valuable in schools, clinics, and retail environments where downtime must be minimized.

In July 2024, Bosch's acquisition of Johnson Controls and Hitachi residential and light commercial HVAC assets reflects industry-wide consolidation aimed at expanding packaged unit portfolios across climate zones and regulatory environments, strengthening global product standardization while retaining regional brand recognition.

How Are AI-Driven Innovations Reshaping the HVAC Packaged Units Market?

As AI technology continues to evolve, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the HVAC packaged units market. Packaged HVAC units are being transformed into smart and connected ecosystems through AI and IoT technology. AI integration using machine learning algorithms and IoT sensors automates and optimizes system performance for significant improvements in personalizing occupant comfort, energy efficiency, and predictive maintenance.

AI algorithms effectively analyze vast amounts of data, like external weather conditions, real-time occupancy levels, and energy tariffs, to automatically adjust the system settings. AI-powered systems use machine learning to continuously monitor the performance and condition of components and identify potential issues before they escalate into major failures. Such a proactive approach reduces unplanned downtime, extends equipment lifespan, and minimizes overall maintenance costs.

Beyond basic automation, AI-enabled packaged HVAC units are increasingly capable of learning building-specific usage patterns over time, allowing systems to fine-tune airflow rates, temperature setpoints, and compressor cycling based on historical behavior rather than static schedules. This adaptive control improves thermal consistency across different zones and usage periods, particularly in homes or buildings with irregular occupancy patterns. By reducing excessive cycling and load fluctuations, AI-driven optimization also supports lower energy consumption without compromising comfort.

AI integration further enhances fault detection and diagnostics by correlating sensor data across electrical, mechanical, and thermal subsystems. Parameters such as compressor current draw, refrigerant pressure trends, coil temperature differentials, and fan motor performance are analyzed together to pinpoint early-stage degradation. This enables maintenance teams to shift from time-based servicing to condition-based interventions, improving service planning accuracy and reducing unnecessary part replacements. Over time, these capabilities strengthen system reliability and support, and more predictable lifecycle cost management for packaged HVAC installations.

HVAC Packaged Units Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to experience accelerated growth. The growth of the market is driven by climate change, rapid urbanization, rising investment in infrastructure projects, and increasing consumer demand for connected and environmentally friendly systems with real-time control. Additionally, the rapid technological advancements, such as building automation, IoT, and AI integration, allow for smart control, remote monitoring, and predictive maintenance.

- Global Expansion: Several leading market players in the HVAC packaged units industry, such as Daikin, Carrier, Johnson Controls, Trane Technologies, Carrier/HVAC Corporation, Mitsubishi Electric Corporation, LG Electronics, Midea Group, and Honeywell International Inc., are broadening their geographical reach through various strategies to broaden their geographical reach, such as mergers and acquisitions (M&A), acquisitions, collaborations, and product innovation tailored to regional demands.

- Sustainability Trends: Sustainability is reshaping the HVAC packaged units industry landscape, with the increasing focus on energy efficiency mandates, increasing environmental awareness among consumers and businesses, and stringent environmental regulations. Governments worldwide are increasingly focusing on reducing carbon emissions and combating climate change. Stricter building codes and environmental policies are compelling businesses and consumers to shift towards energy-saving and low-emission HVAC solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.43 Billion |

| Market Size in 2026 | USD 30.28 Billion |

| Market Size by 2035 | USD 53.42 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.51% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Capacity, End-Use, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

What Caused the Packaged Air Conditioners Segment to Dominate the HVAC packaged units industry in 2025?

The packaged air conditioners segment held the largest industry share of 44.80% in 2025, owing to the increasing global temperatures and the increased frequency of heatwaves. Packaged air conditioners contain all cooling components in one unit, such as a compressor, coils, and an air handler. This unit can also work with an electric heating coil or a separate heating system if warmth is required in colder seasons. Their self-contained design simplifies installation and maintenance while enabling consistent cooling performance in residential and light commercial buildings facing prolonged high-temperature conditions.

On the other hand, the dual-fuel packaged units segment is expected to grow at a remarkable CAGR of 7.10% between 2026 and 2035. Packaged dual-fuel systems combine a heat pump and a gas furnace to enhance efficiency. The heat pump provides cooling in the summer and energy-efficient heating during milder weather. The gas furnace activates when temperatures drop too low for the heat pump to function efficiently. This configuration allows the system to automatically switch between electric and gas operation based on outdoor temperature thresholds, optimizing fuel use and operating costs across seasonal conditions. As a result, dual-fuel packaged units are well suited for regions with wide temperature variability, where balancing energy efficiency with reliable cold-weather heating is a key requirement.

Capacity Insights

Why Did the 10-25 Ton Segment Dominate in the HVAC Packaged Units Market?

The 10-25 ton segment is dominating the HVAC packaged units market by holding a majority of 36.50% market share. The growth of the segment is primarily driven by the effective balance of load capacity and energy efficiency, the growing focus on sustainable building practices, and the growing demand from medium-sized commercial facilities such as schools, mid-sized office buildings, retail stores, and restaurants. The 10-25 ton units are ideal for modular and zoned installations, which allow for targeted climate control in different areas of a building. These systems support scalable building designs by enabling phased capacity additions without overloading electrical or gas infrastructure. Their compatibility with advanced controls and energy management systems also helps facility operators monitor usage patterns and optimize performance across multiple zones.

On the other hand, the above 50 tons segment is the fastest-growing in the HVAC packaged units industry and is expected to grow at a significant CAGR of 6.90% between 2026 and 2035. The rapid expansion of data centers is anticipated to create substantial demand for high-efficiency cooling systems to handle significant heat loads. The rapid industrialization and expansion of manufacturing facilities are expected to increase the demand for high-capacity and reliable HVAC solutions to maintain precise environmental conditions. These high-capacity packaged units are increasingly designed with redundant components and advanced thermal controls to ensure continuous operation in mission-critical environments. Their ability to deliver stable temperature and humidity control at scale makes them suitable for facilities where equipment uptime and process consistency are essential.

Application Insights

What Caused the New Installations Segment to Dominate the HVAC Packaged Units Market?

The new installations segment held the largest market share of 61.70% in 2025, owing to the rapid urbanization, global boom in construction, and the increasing consumer demand to integrate advanced energy-efficient and smart technologies. The increasing investment in infrastructural development, such as new residential homes, commercial offices, retail spaces, hospitals, and industrial facilities, requires an HVAC packaged unit as a basic infrastructure component, driving the growth of the segment during the forecast period.

On the other hand, the retrofit & replacement segment is the fastest-growing in the HVAC packaged units market and is expected to expand at a remarkable growth rate of 6.80% between 2026 and 2035. The rising need for the upgrading of older buildings to comply with modern energy efficiency standards, environmental regulations, and improved performance requirements contributes to this segment's fastest growth.

End-use Insights

What Has Led the Commercial Segment to Dominate the HVAC Packaged Units Market?

The commercial segment is dominating the HVAC packaged units market with the largest share of 52.30%. The increasing investment in new commercial construction, such as office buildings, retail spaces, and hospitals, drives the demand for energy-efficient climate control solutions and healthy indoor environments. HVAC packaged units, particularly rooftop-mounted ones, are popular in commercial spaces, as they can free up valuable indoor or ground space, offering a compact solution for climate control.

On the other hand, the residential segment is a significant and rapidly growing segment in the HVAC packaged units industry. The growth of the segment is driven by several factors, such as rapid urbanization, increasing integration of smart technologies, strict government regulations, and increasing demand for advanced ventilation and air filtration systems in residential homes. Building and homeowners are investing heavily in new and more efficient HVAC systems to lower operational costs and enhance indoor air quality.

Distribution Channel Insights

What Has Led the Distributors/HVAC Contractors Segment to Dominate the HVAC Packaged Units Sector?

The distributors/HVAC contractors segment is dominating the HVAC packaged units sector by holding a share of 58.90%. Distributors and HVAC contractors are the primary distribution channels for HVAC packaged units through the B2B and offline segments. Distributors purchase equipment and parts in bulk from manufacturers and then resell them. Contractors are responsible for offering expert advice on product selection, installation, and after-sales service to the end-user.

On the other hand, the direct sales segment is the fastest-growing segment of the HVAC packaged units market, with a growth rate of 6.40%. The direct sales segment represents a vital and rapidly growing segment of the HVAC packaged units industry. Direct sales are often utilized for large commercial or industrial projects where customized and large packaged rooftop units are required. Direct sales assist in building long-term relationships with major clients for bulk procurement and long-term service contracts.

Regional Insights

How Big is the North America HVAC Packaged Units Market Size?

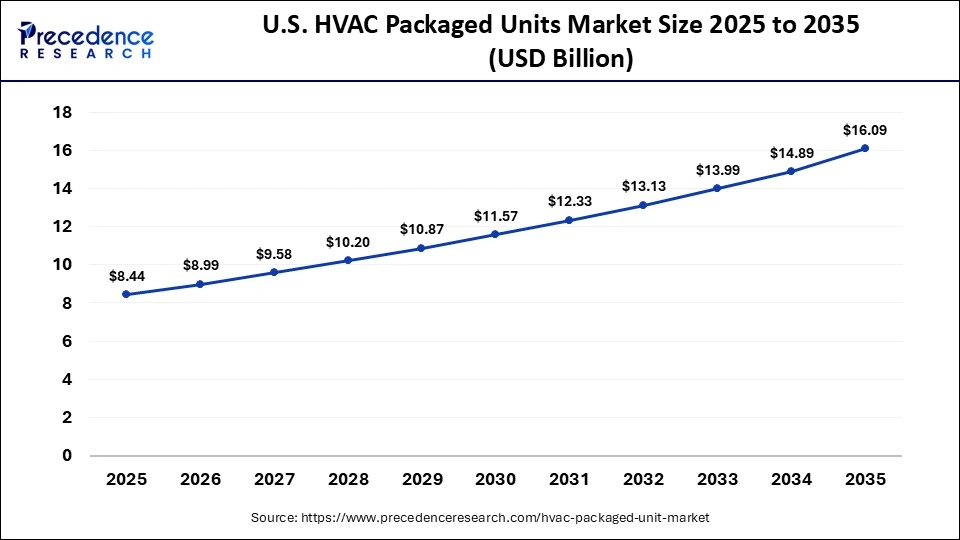

The North America HVAC packaged units market size is estimated at USD 11.26 billion in 2025 and is projected to reach approximately USD 21.31 billion by 2035, with a 6.59% CAGR from 2026 to 2035.

Why Did North America Dominate the HVAC Packaged Units Market in 2025?

North America dominated the HVAC packaged units market, holding the largest market share of 39.6% in 2025. The North America region is home to prominent players and is driving the market's growth through innovation, efficiency, and broad product portfolios for commercial, residential, and industrial needs. This leadership position is attributed to climate change, stringent environmental regulations, rapid expansion of data centers, rise in disposable income, and rapid technological advancements like IoT and AI integration for smart control.

The rising expansion of industrial infrastructure is expected to boost the demand for high-capacity and robust HVAC solutions to maintain precise environmental conditions, fueling the expansion of the market in the North American region. Strong enforcement of emissions standards has accelerated the replacement of legacy burner systems with high-efficiency and low-NOx technologies across industrial facilities. Ongoing investments in advanced manufacturing, logistics hubs, and large-scale commercial developments are also reinforcing sustained demand for reliable thermal systems that support continuous operations and regulatory compliance.

What is the Size of the U.S. HVAC Packaged Units Market?

The U.S. HVAC packaged units market size is calculated at USD 8.44 billion in 2025 and is expected to reach nearly USD 16.09 billion in 2035, accelerating at a strong CAGR of 6.66% between 2026 and 2035.

United States HVAC Packaged Units Market Trends

The United States is transforming the HVAC packaged units market. The United States is a major contributor to the HVAC packaged units industry in the North American region. The rising investment in construction activities, driven by rapid urbanization and infrastructure modernization, spurs the demand for energy-efficient climate control and healthy indoor environments. The growth of the country is also largely driven by the stringent energy efficiency standards and the increasing integration of AI systems with advanced sensors to monitor air quality parameters like humidity, COâ‚‚ levels, and others. AI automatically adjusts ventilation and filtration rates to maintain a healthier indoor environment.

In June 2025, Carrier, a world leader in intelligent climate and energy solutions, partnered with the Department of Energy (DOE) to develop heat pump technologies that result in higher-efficiency commercial rooftop units with lower life cycle costs for end users, including school, retail, and office space clients. Heat pump packaged rooftop units can reduce GHG emissions and energy costs by up to 50 percent compared to conventional natural gas-burning models.

Why Is Asia Pacific Set to See the Fastest Growth in the HVAC Packaged Units Market?

Asia Pacific is the fastest-growing region in the HVAC packaged units market with an expected CAGR of 7.2%, with growth mainly driven by rapid urbanization & industrialization, increasing concern regarding temperature change, rising technological shifts such as AI, IoT, and automation, and increasing demand for all-in-one and compact HVAC solutions. The region has a strong presence of market players such as Daikin, LG, Samsung, Midea, Blue Star, Mitsubishi Electric Corporation, and Hitachi Ltd. These companies have strong brand recognition and drive innovation through various strategic initiatives, which contribute to the region's market growth.

The government's stringent environmental regulations are compelling businesses and consumers to shift towards energy-saving and low-emission HVAC solutions. Large-scale residential construction, commercial real estate development, and industrial park expansion across major Asian economies are further accelerating adoption of packaged HVAC systems. In addition, government-led energy efficiency programs and green building codes are encouraging the deployment of high-performance HVAC solutions that balance cooling demand with emissions reduction goals.

India's HVAC Packaged Units Industry Trends

India's HVAC packaged units industry is experiencing significant growth, driven by the combination of factors such as climate change, rapid urbanization, increasing demand for compact solutions, increasing awareness of the importance of healthy indoor environments, stringent energy-efficiency regulations, and rapid technological innovation. Moreover, increasing consumer demand for smart, sustainable, and remotely manageable units and increasing investment in infrastructure expansion are anticipated to promote the growth of the market in the coming years.

Rising adoption across residential complexes, commercial buildings, and transportation hubs is strengthening demand for packaged systems that simplify installation and maintenance. Government-led initiatives supporting energy-efficient buildings and smart city development are also reinforcing long-term deployment of advanced HVAC packaged units across urban centers.

Why Is Europe Seeing Substantial Growth in the HVAC Packaged Units Market?

The European region holds a substantial market share in the HVAC packaged units market. The growth of the region is attributed to the rapid urbanization, significant investment in new construction & the upgrading of older buildings, and increasing expansion of data centers. European governments are implementing stringent energy efficiency standards and green building codes to reduce carbon emissions and combat climate change, favoring modern HVAC packaged units. The increasing integration of smart technologies, such as IoT, AI, and building automation, enables predictive maintenance, optimized energy usage, and remote monitoring, making it more appealing to residential and commercial building owners.

The renovation of aging commercial and residential building stock across Europe is driving demand for compact HVAC solutions that can be deployed with minimal structural modification. Strong policy support for electrification and low-emission heating systems is also accelerating the replacement of conventional HVAC installations with high-efficiency packaged units.

Germany HVAC Packaged Units Industry Trends

The country is experiencing significant growth, supported by the robust presence of key market players, increasing investment in infrastructural development, growing emphasis on energy conservation, and increasing need for healthy Indoor Air Quality (IAQ). Several building owners prefer modern and high-efficiency packaged units, which allow for seamless integration of advanced features such as IoT connectivity, AI-driven controls, and variable refrigerant flow (VRF) systems to optimize energy savings and enhance building management. Additionally, stringent government regulations and increasing focus on reducing carbon footprints are pushing consumers and businesses to adopt high-efficiency and sustainable HVAC systems.

Why Did the Middle East & Africa See Notable Growth in the HVAC Packaged Units Market?

The HVAC packaged units market is expected to grow notably in the Middle East & Africa region. The rapid urbanization in the region is leading to the continuous development of new residential homes, commercial offices, retail spaces, hospitals, and industrial facilities. The rising awareness of health and well-being has substantially increased demand for advanced filtration and ventilation technologies to ensure cleaner and healthier indoor environments. Additionally, the rising need to comply with stricter environmental regulations and the integration of smart technologies, such as IoT and industrial automation, is driving the expansion of the HVAC packaged units market during the forecast period.

Extreme climatic conditions across large parts of the region are reinforcing demand for high-capacity and durable packaged HVAC systems capable of continuous operation. Ongoing investments in smart cities, healthcare infrastructure, and large-scale commercial projects are further supporting adoption of integrated HVAC solutions that offer reliability, efficiency, and centralized control.

South Africa HVAC packaged units industry Trends

South Africa is experiencing remarkable growth. The country's growth is experiencing demand from rapid urbanization, increasing investment in smart infrastructure development, increasing focus on energy conservation, a rising shift towards advanced & sustainable HVAC solutions, and growing demand for seamless integration of smart technologies. Additionally, strict energy efficiency regulations led by the government aimed at reducing carbon footprint and increasing energy savings significantly contribute to the region's market growth. Such a combination of factors is expected to propel the growth of the HVAC packaged units market in the country during the forecast period.

Who are the Major Players in the Global HVAC Packaged Units Market?

The major players in the HVAC packaged units market include Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls, Trane Technologies plc, Mitsubishi Electric Corporation, LG Electronics, Midea Group, Panasonic Corporation, Samsung, Gree Electric Appliances, Rheem Manufacturing Company, Blue Star Ltd, Voltas Ltd, Hitachi, Ltd., Lennox International, and Honeywell International Inc.

Recent Developments

- In October 2025, Rheem announced the launch of its newest offering, the Endeavor Line Classic Plus Series iR Residential Packaged Dual Fuel Units (RDFXYC). It is designed with both homeowners and contractors in mind; the RDFXYC units combine a heat pump and gas furnace into one versatile system, delivering reliable performance, energy efficiency, and connectivity.(Source: https://www.achrnews.com)

- In April 2025, Foster International announced the launch of its own HVAC brand, FOSTER. This milestone marks a new era of innovation, sustainability, and excellence for the company, further solidifying its position as a pioneer in the industry. Foster features a comprehensive range of energy-efficient systems, including HiWall split units (available in fixed speed, inverter, cooling-only, and heat pump models), ducted split units for seamless integration, and advanced VRF systems with inverter technology.(Source: https://www.fosterintl.com)

Segments covered in the report

By Product Type

- Packaged Air Conditioners

- Packaged Heat Pumps

- Gas/Electric Packaged Units

- Dual-Fuel Packaged Units)

By Capacity

- Less Than 10 Tons

- 10-25 Tons

- 25-50 Tons

- Above 50 Tons

By End-Use

- Residential

- Commercial

- Industrial

By Application

- New Installations

- Retrofit & Replacement

By Distribution Channel

- Direct Sales

- Distributors/Hvac Contractors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting