Hyaluronic Acid Personal Care Products Market Size and Forecast 2025 to 2034

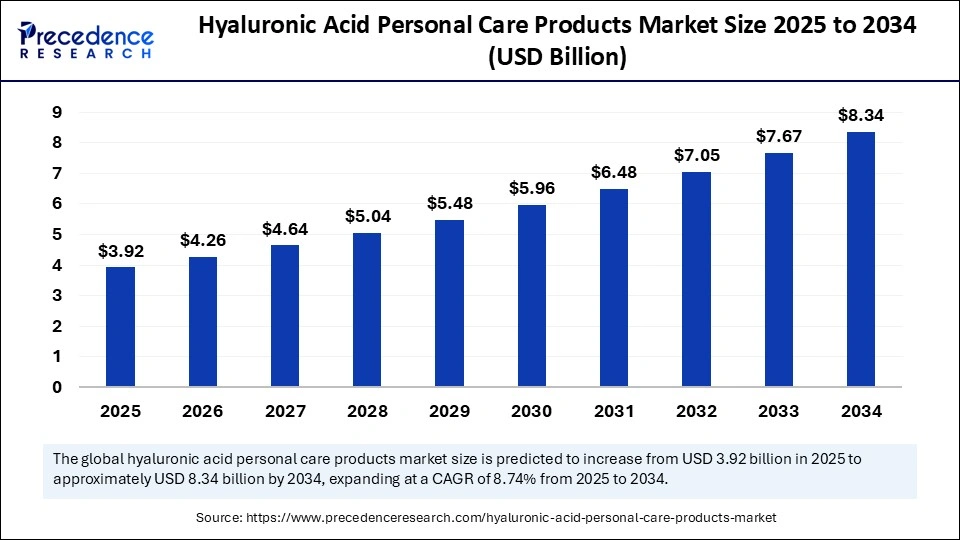

The global hyaluronic acid personal care products market size was estimated at USD 3.61 billion in 2024 and is predicted to increase from USD 3.92 billion in 2025 to approximately USD 8.34 billion by 2034, expanding at a CAGR of 8.74% from 2025 to 2034. The market for hyaluronic acid personal care products has experienced a massive spike in growth during recent years, reflecting increasing consumer awareness and demand for skincare and beauty products containing this popular ingredient. As we look to the future, the market is expected to continue its expansion, driven by innovations and expanding applications across the personal care industry.

Hyaluronic Acid Personal Care Products Market Key Takeaways

- In terms of revenue, the global hyaluronic acid personal care products market was valued at USD 3.61 billion in 2024.

- It is projected to reach USD 8.34 billion by 2034.

- The market is expected to grow at a CAGR of 8.74% from 2025 to 2034.

- North America dominated the chemical subsea and offshore services market in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the skincare products segment led the market in 2024.

- By product type, the haircare products segment is expected to grow at the fastest CAGR during the forecast period.

- By formulation type, the topical segment captured the biggest market share in 2024.

- By formulation type, the encapsulated / time-release HA formulations segment is projected to expand rapidly during the forecast period.

- By end use, the online direct-to-consumer brands segment contributed the highest market share in 2024.

- By end use, the retail chains & supermarkets segment is predicted to witness significant growth over the forecast period.

- By consumer group, the women segment generated the major market share 2024.

- By consumer group, the men segment will gain a significant share of the market over the studied period.

- By distribution channel, the online platform segment accounted for a considerable market share in 2024.

- By distribution channel, the offline segment is expected to grow at the fastest rate in the market during the forecast period.

How Is AI Transforming the Hyaluronic Acid Personal Care Market?

Artificial intelligence is reshaping the way hyaluronic acid personal care products are developed, marketed, and personalized. AI-powered skin analysis tools are enabling brands to recommend customized formulations based on individual hydration levels, age, and skin type. Predictive analytics help manufacturers anticipate consumer trends and optimize product innovation pipelines. AI is also improving supply chain efficiency by forecasting demand and ensuring the timely availability of raw materials. Virtual try-on applications and digital beauty advisors enhance consumer engagement and drive online sales. Additionally, AI-driven R&D platforms are streamlining formulation testing, reducing time to market for new hyaluronic acid-based products. AI personalization becomes central to beauty. AI is playing a pivotal role in connecting science with consumer expectations.

Market Overview

The hyaluronic acid personal care products market refers to the industry focused on skincare, haircare, and cosmetic formulations that incorporate hyaluronic acid (HA) as a primary active ingredient due to its exceptional hydrating, anti-aging, and skin-repair properties. This acid functions as a humectant, attracting and retaining moisture, making it highly effective in improving skin elasticity, plumpness, and reducing fine lines. Its applications have expanded from traditional anti-aging creams to advanced serums, dermo cosmetics, sunscreens, hair serums, and even oral beauty supplements. The growing consumer preference for natural, science-backed, and multifunctional ingredients drives their widespread adoption across premium, mass, and clinical personal care brands. Increasing awareness of preventative skincare and rising demand in Asia, North America, and Europe further accelerate the market.

Emerging innovations include cross-linked hyaluronic acid formulations, encapsulated HA for slow release, and hyaluronic acid-based clean beauty lines.The global hyaluronic acid personal care products market is witnessing robust growth as consumers prioritize products with clinically tested efficacy and multifunctional benefits: rising effectiveness and multifunctional benefits. Rising disposable incomes, particularly in emerging economies, are enabling broader access to premium skincare solutions. The demand for clean-label, safe, and scientifically backed ingredients is further propelling market expansion. Increased urbanization and environmental stressors are driving more consumers to seek hydrating and protective products. Manufacturers are responding with a variety of product formats, from lightweight gels to high-concentration ampoules. With its strong value proposition, hyaluronic acid continues to shape consumer preferences and brand strategies across the personal care landscape.

Market Key Trends

- Rising preferences for clean beauty and dermatologically tested formulations.

- Growth in hybrid products that combine hydration with anti-aging, sun protection, or brightening.

- Expansion of e-commerce and direct-to-consumer beauty brands leveraging digital platforms.

- Increased demand for sustainable packaging and environmentally responsible formulations.

- Growing popularity of K-beauty and J-beauty routines that emphasize hydration as a foundation of skincare.

- Collaborations between cosmetic chemists and dermatologists to create clinically validated formulations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.34 Billion |

| Market Size in 2025 | USD 3.92 Billion |

| Market Size in 2024 | USD 3.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Formulation Type, End Use, Consumer Group, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Intense Hydration Newly Branded As Luxury

One of the strongest drivers in the market is the consumer emphasis on deep hydration as a key aspect of healthy, youthful skin. Hyaluronic acid's unique ability to hold up to 1000 times its weight in water makes it a highly desirable ingredient across personal care categories. Social media and beauty influencers continue to highlight hydration-focused routines, amplifying consumer awareness. Aging populations in developed economies are also turning to hyaluronic acid products for their anti-wrinkle and plumping benefits. Meanwhile, hot and humid climates in Asia are fueling demand for lightweight, hydrating formulations. The synergy of science-backed efficacy and lifestyle-driven beauty aspirations makes hydration a powerful growth engine for the market.

- In August 2025, Louis Vuitton announced the launch of a new cosmetics line, consisting of lipsticks, lip balms, and eyeshadows, set to be available online from 25th August and in global stores from 29th August 2025. The Pat McGrath-backed collection is set to include ingredients such as shea butter and hyaluronic acid to provide long-lasting comfort. (Source: https://www.businesstimes.com.sg)

Restraint

The High Cost of Purity

Despite strong growth, the market faces challenges related to cost and consumer skepticism. High-quality hyaluronic acid, especially biofermented or naturally derived variants, can be expensive to produce, limiting affordability for mass-market consumers. Additionally, the oversaturation of products labeled with hyaluronic acid has created confusion, as not all formulations deliver the same effectiveness. Regulatory scrutiny on ingredient claims further complicates brand messaging. Counterfeit and low-quality products in the online marketplace can erode consumer trust. Moreover, ongoing competition with other trending skincare ingredients, such as peptides and ceramides, adds pressure. These challenges underscore the importance of transparency, education, and cost-efficient innovation in sustaining market growth.

Opportunity

Beyond Skincare: Expanding Horizons

Opportunities for the market extend beyond traditional skincare into hair care, body care, and even men's grooming products. Brands are exploring innovative applications, such as hyaluronic acid-infused shampoos and conditioners to improve scalp hydration and hair strength. The growing wellness trend is encouraging crossover products that link skincare with holistic health, such as supplements and indigestible hyaluronic acid. Expansion into affordable, mass-market lines also offers potential for broader consumer adoption. With increasing demand in emerging markets, localized formulations tailored to regional climates present another growth avenue. Companies that leverage both innovation and accessibility are well-positioned to capture untapped opportunities in this dynamic market.

- In April 2025, LipoTrue Science & Biotechnologies announced the development of Se(HA)+™, a naturally enriched hyaluronic acid ferment derived from a bacterium that inherently encodes HAS enzyme, which synthesizes hyaluronic acid. This process allows for the synthesis of enriched hyaluronic acid ferment with a broad spectrum composition that provides both HA-like and HA-booster efficacies that mimic and enhance the skin's own hyaluronic acid network.

(Source: https://cosmeticsbusiness.com)

Product Type Insights

Why Did Moisturizers & Creams Dominate in the Hyaluronic Acid Personal Care Products Market in 2024?

The moisturizers & creams have become a dominant force in the hyaluronic acid personal care products industry, owing to their widespread consumer acceptance and essential role in daily skincare products that deliver deep hydration, reduce fine lines, and enhance skin elasticity, making them a must-have in anti-aging and hydration-focused regimens. The versatility of these formulations allows brands to cater to different skin types, from dry to oily, further solidifying their popularity. Growing awareness of skin health and preventive aging has boosted consumer demand, particularly among urban populations. The ease of application and availability in multiple price ranges also make moisturizers and creams highly accessible to consumers. This has allowed them to retain their position as the leading product category across both premium and mass-market brands.

The market dominance of moisturizers and creams is also supported by strong promotional campaigns from major skincare companies. Brands emphasize visible hydration benefits and plumping effects in their marketing, which resonates strongly with consumers. Additionally, the inclusion of hyaluronic acid in combination with other actives, such as vitamin C or peptides, has made creams more multifunctional. Their consistent usage in daily skincare routines ensures repeat purchases, driving sustained sales. With rising consumer inclination toward clean-label and dermatologically tested formulations, moisturizers and creams continue to be the backbone of the hyaluronic acid personal care market.

The haircare products segment is the fastest-growing in the hyaluronic acid personal care products space, prompted by the rising demand for targeted and premium haircare solutions. Hyaluronic acid serums help restore hydration, reduce breakage, and protect hair against environmental stressors, appealing to consumers seeking intensive care. These products cater especially to individuals dealing with chemically treated, heat-styled, or color-damaged hair. The rising trend of skincare principles in hair products has further boosted the adoption of hyaluronic acid-based serums. Social media campaigns highlight glossy, healthy hair outcomes have also increased demand.

Their rapid growth is also tied to the premium positioning of hair serums, which aligns with evolving consumers' willingness to spend more on self-care. E-commerce platforms and salon-exclusive ranges have expanded access to these specialized products. Additionally, brands are innovating with leave-in treatments and hybrid formulas that combine hydration with scalp health benefits. As consumers shift from basic cleansing to holistic hair repair, hyaluronic acid hair serums and treatments are emerging as a high-potential growth area.

Formulation Type Insights

The topical segment has become a dominant force in the hyaluronic acid personal care products market, given its wide acceptance and ease of use. Available in creams, gels, lotions, and serums, they offer visible hydration benefits and fit seamlessly into skincare routines. Their non-invasive nature and affordability compared to injectables further drive widespread adoption. Tropical products appeal to a broad demographic, from young consumers seeking preventive care to older populations addressing aging concerns. Their versatility across skincare, haircare, and cosmetics reinforces their dominance.

The dominance of topical formulations is also supported by retail and e-commerce availability. Frequent product launches by both established and emerging brands ensure continuous consumer engagement. Advancements in formulations, including combinations with rational, peptides, and antioxidants, enhance effectiveness and consumer trust. Dermatologist endorsements and positive consumer reviews further bolster credibility. With steady demand across geographies, tropical formulations remain the cornerstone of the hyaluronic acid market.

The encapsulated / time-release HA Formulations are the fastest-growing in the hyaluronic acid personal care products space, considering consumer demand for advanced, science-driven skincare. These formulations use microencapsulation effectively in the skin. The technology ensures controlled release, improved stability, and enhanced penetration, leading to superior results. Premium skincare brands are actively incorporating encapsulated hyaluronic acid into serums, creams, and specialized treatments. This innovation appeals to consumers seeking long-lasting hydration and anti-aging benefits.

The rapid growth of encapsulated products also reflects the broader trend toward personalization and efficacy in skincare. Consumers are increasingly willing to invest in advanced formulations that promise visible improvements. Scientific claims and technological differentiation help brands position encapsulated formulations as premium solutions. Marketing narratives around smart delivery systems resonate strongly with tech-savvy and health-conscious consumers. As innovation continues, encapsulated hyaluronic acid formulations are expected to capture a growing share of the market.

End Use Insights

Why Did the Online Direct-to-Consumer Segment Dominate the Hyaluronic Acid Personal Care Products Market in 2024?

The online direct-to-consumer brands have become a dominant force in the hyaluronic acid personal care products market, owing to their agility, personalized marketing, and strong consumer engagement. These brands leverage e-commerce platforms, social media, and influencer partnerships to reach a wide audience quickly. Hyaluronic acid products are often featured in subscription boxes, personalized skincare kits, and digital campaigns, making them highly visible to younger demographics. D2C brands also benefit from shorter supply chains, which enable them to launch products faster and respond to trends more effectively.

The dominance of online D2C brands is reinforced by their ability to offer affordability alongside premium quality formulations. They cater to niche consumer needs, from vegan and cutlery-free products to formulations designed for sensitive skin. Interactive tools, such as skin quizzes and AI-driven recommendations, enhance consumer trust and retention. Moreover, their storytelling approach resonates with consumers seeking authenticity and transparency. As digital shopping habits continue to grow, online D2C brands remain central to the hyaluronic acid personal care market.

The retail chains & supermarkets are the fastest-growing in the hyaluronic acid personal care products industry, entitled to outlets offering the advantage of immediate product availability and the ability to test or sample items. Hyaluronic acid products displayed on shelves benefit from strong visibility and impulse buying. Growing partnerships between global brands and large retail chains further drive accessibility. Supermarkets are also expanding their premium skincare aisles, catering to consumers seeking affordable luxury.

Consumer Group Insights

Why Did Women Dominate the Hyaluronic Acid Personal Care Products Market in 2024?

The women have become a dominant force in the hyaluronic acid personal care products industry, driven by higher skincare and cosmetic adoption rates. Their focus on hydration, anti-aging, and aesthetic appeal makes them key drivers of market demand. Women across age groups actively seek hyaluronic acid-based products, from moisturizers to lip care, reinforcing category growth. Marketing campaigns heavily target female audiences, highlighting visible hydration and plumping benefits.

Men are the fastest-growing segment in the hyaluronic acid personal care products industry, because it is gaining popularity among men for hydration, anti-aging, and post-shaving care. Growing acceptance of skincare routines among male consumers has opened new opportunities for brands. Marketing campaigns tailored to men's needs, focusing on simplicity and functionality, are accelerating adoption.

Distribution Channel Insights

Why Did Online Platforms Dominate in 2024?

The online platforms have become a dominant force in the hyaluronic acid personal care products market, on account of e-commerce giants, brand-owned websites, and specialty beauty platforms collectively driving strong sales. Online shopping also enables comparison, consumer reviews, and personalized recommendations, enhancing buyer confidence. Subscription models and discounts further encourage repeat purchases.

The offline are the fastest-growing in the hyaluronic acid personal care products industry, including specialty stores, pharmacies, and department stores, are the fastest-growing. Many consumers prefer in-person shopping to experience textures, test shades, and seek advice from beauty advisors. Offline presence builds consumer trust and reassures authenticity, especially in regions where counterfeit concerns exist. Retail expansions in emerging economies are opening new growth avenues for offline sales.

Regional Insights

Why Does the Asia Pacific Lead the Hyaluronic Acid Personal Care Products Market?

By region, North America dominated the global market for hyaluronic acid personal care products in 2024, following its strong beauty culture and rapid adoption of advanced skincare routines. Countries like South Korea, Japan, and China are global trendsetters in beauty innovation, often pioneering new formulations and application methods. The widespread influence of K-beauty and J-beauty has cemented hydration-focused routines as a global benchmark. Rising disposable incomes and a growing middle class further fuel demand across Southeast Asia and India. The region's large, youthful population also represents a strong consumer base for entry-level skincare infused with hyaluronic acid. This cultural emphasis on skincare as a daily ritual ensures Asia Pacific's continued leadership in the market.

In addition, the region's manufacturer ecosystem and access to bio-fermentation technologies provide a cost advantage for local producers. Many global beauty brands source or partner with Asian manufacturers to meet the demand for high-quality, affordable products. Local players are also gaining prominence by offering tailored solutions that address specific climate conditions and skin concerns. E-commerce penetration, driven by platforms like Tmall, Lazada, and Shopee, is accelerating product reach to diverse consumer groups. The convergence of innovation and affordability, and cultural alignment, solidifies Asia Pacific as the hub of hyaluronic acid personal care product growth and leadership.

How Is North America Driving Innovation and Pioneering Growth in the Market?

North America is the fastest-growing region in the hyaluronic acid personal care products sector, because of its focus on scientific validation and premium beauty solutions. Consumers in the US and Canada are increasingly seeking dermatologist-recommended and clinically proven formulations. The region's high awareness of anti-aging and wellness trends supports strong demand for multifunctional, high-efficacy products. The popularity of clean beauty movements is also prompting brands to incorporate transparent ingredient sourcing and ethical production practices. With the growing influence of social media and beauty influencers, hyaluronic acid-based products are gaining mass appeal.

Furthermore, North America benefits from advanced research and development ecosystems, where biotechnology and dermatology intersect to create next-generation formulations. The rising adoption of online shopping channels, subscription beauty boxes, and personalized skincare solutions is further fueling growth. Men's grooming and body care segments are also increasingly embracing hyaluronic acid-infused products, widening the consumer base. Strategic mergers, acquisitions, and collaborations among leading beauty brands are expected to accelerate innovation and expand market access. These factors make North America a hotbed for rapid expansion, positioning it as the fastest-growing region in the global market.

Hyaluronic Acid Personal Care Products Market – Value Chain Analysis

Raw Material Sourcing

Hyaluronic acid used in personal care products is typically obtained through bio-fermentation of microorganisms, like bacteria, or traditionally extracted from animal sources like rooster combs, where specific bacteria are cultivated under controlled laboratory conditions to produce a fine powder. This biotechnological method offers a sustainable and reliable alternative to conventional animal-derived sources, while also addressing ethical concerns.

Hyaluronic Acid Personal Care Products Market Companies

- L'Oréal Group

- Estée Lauder Companies Inc.

- Procter & Gamble (P&G)

- Unilever PLC

- Shiseido Company, Limited

- Beiersdorf AG

- Johnson & Johnson Consumer Health

- Amorepacific Corporation

- Colgate-Palmolive Company

- Kao Corporation

- Coty Inc.

- Revlon, Inc.

- Mary Kay Inc.

- The Ordinary (DECIEM Beauty Group)

- Glossier Inc.

- Clarins Group

- Dr. Barbara Sturm Skincare

- PCA Skin

- Hylamide

- Himalaya Wellness Company

Recent Developments

- In August 2025, Nigerian beauty and wellness brand Winsome by TAH launched a new collection of lip products that blend elegance, nourishment, and everyday usability. The range features the Glow Boss Lip Oil in Bed of Paradise and “Watermelon” flavors, the Sleek Boss High-Shine Lip Gloss, and the Like a Boss Matte Lip Stix. Each product is enriched with Hyaluronic Acid, Vitamin E, and Coconut Oil, designed to both care for and enhance the lips. Founder Queen Iyimide Shola-Shittu highlighted that the line was created for women “living real lives who are bold, busy, and beautiful, offering practical beauty solutions that align with their lifestyles.(Source: https://guardian.ng)

- In August 2025, Beiersdorf is set to introduce skin longevity to the mass market with the launch of its first-ever epigenetic serum under the Nivea brand. The new Nivea Cellular Epigenetics Rejuvenating Serum is powered by Epicelline, a patented epigenetic ingredient that the company says supports skin longevity by addressing visible signs of ageing. The formula also incorporates three types of hyaluronic acid to enhance hydration and rejuvenation benefits.

(Source: https://www.beiersdorf.com)

Segments Covered in the Report

By Product Type

- Skincare Products

- Moisturizers & Creams

- Serums

- Face Masks & Sheets

- Sunscreens

- Cleansers & Toners

- Others

- Haircare Products

- Shampoos

- Conditioners

- Hair Serums & Treatments

- Scalp Care Products

- Others

- Cosmetic & Makeup Products

- Foundations & Primers

- Lip Care (Balms, Gloss, Treatments)

- Eye Makeup (Mascara, Concealers, Eye Creams)

- Others

- Oral Beauty Supplements (Nutricosmetics)

- Others

By Formulation Type

- Topical (Creams, Serums, Lotions)

- Encapsulated / Time-Release Ha Formulations

- Cross-Linked Ha Formulations

- Oral Supplements

- Others

By End Use

- Dermatology Clinics & Med-Spas

- Online Direct-To-Consumer Brands

- Retail Chains & Supermarkets

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Others

By Consumer Group

- Women

- Men

- Unisex

- Children & Teenagers

By Distribution Channel

- Online Platforms (E-Commerce, D2C)

- Offline (Retail Chains, Pharmacies, Beauty Specialty Stores)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting