Infrastructure For Business Analytics Market Size and Forecast 2025 to 2034

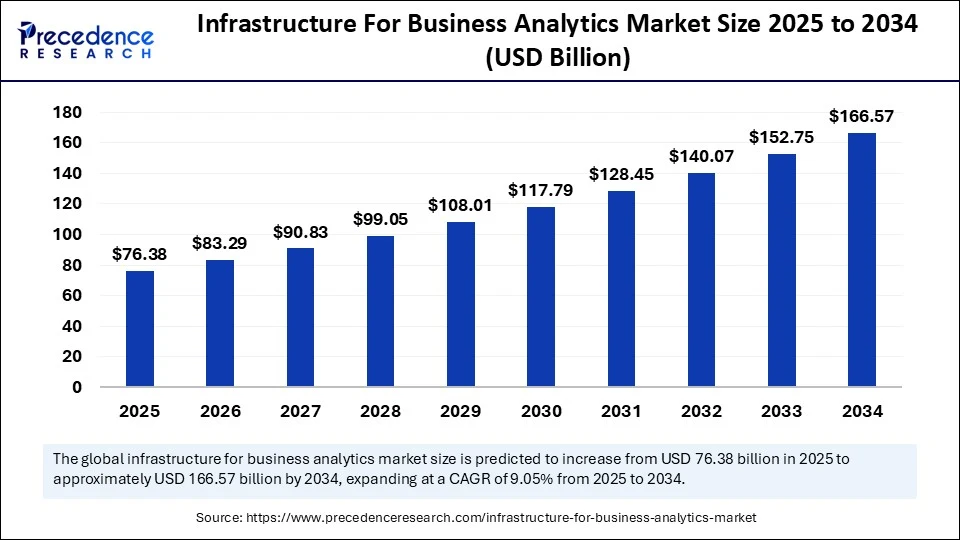

The global infrastructure for business analytics market size accounted for USD 70.04 billion in 2024 and is predicted to increase from USD 76.38 billion in 2025 to approximately USD 166.57 billion by 2034, expanding at a CAGR of 9.05% from 2025 to 2034. The cloud migration, the growing demand for real-time analytics, the widespread adoption of data lakehouse architectures, and stricter regulatory/compliance requirements are expected to boost the growth of the global infrastructure for business analytics market over the forecast period. Several key players in the market are widely adopting effective strategies to expand their market share and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, fuelled by the increasing investment in IT-driven infrastructure and increasing focus on data-driven decision-making across all sectors.

Infrastructure For Business Analytics Market Key Takeaways

- In terms of revenue, the global infrastructure for business analytics market was valued at USD 70.04 billion in 2024.

- It is projected to reach USD 166.57 billion by 2034.

- The market is expected to grow at a CAGR of 9.05% from 2025 to 2034.

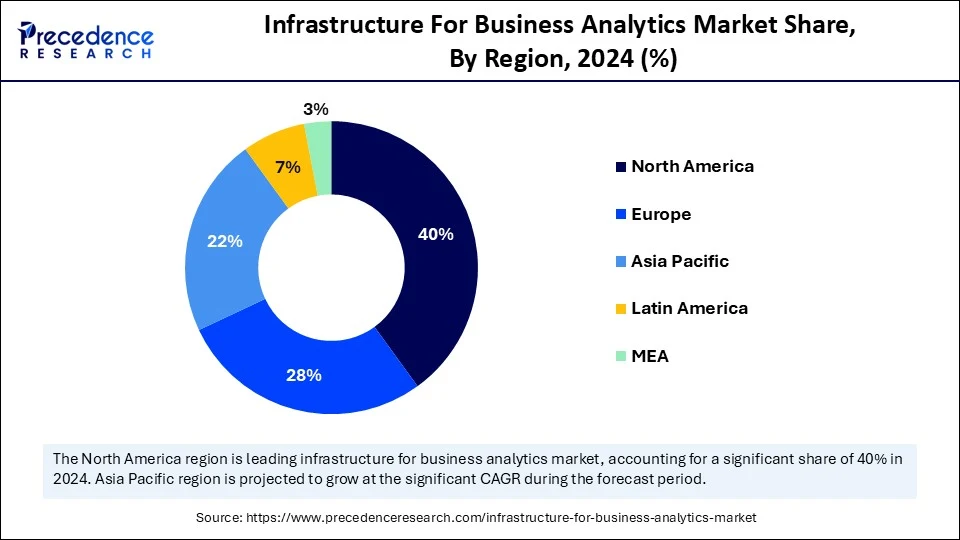

- North America led the global infrastructure for business analytics market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By infrastructure component, the storage & data platforms segment captured the biggest market share of 30% in 2024.

- By infrastructure component, the accelerated computer segment is also experiencing the fastest growth during the forecast period.

- By services / commercial model, the implementation & integration services segment contributed the highest market share of 38% in 2024.

- By services / commercial model, the managed services segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By industry vertical, the financial services segment held the biggest market share of 18% in 2024.

- By industry vertical, the healthcare & life sciences segment is expanding at a significant CAGR from 2025 to 2034.

- By organization size, the large enterprises segment generated the major market share of 62% in 2024.

- By organization size, the mid-market enterprises segment is experiencing rapid growth during the forecast period.

How Can Artificial Intelligence Improve the Infrastructure for Business Analytics Market?

In the evolving technological landscape, Artificial intelligence emerges as a driving force and holds potential for growth and innovation in the infrastructure for business analytics market by effectively handling huge data volumes and complex computational demands. The incorporation of Artificial Intelligence (AI) drives accurate, faster, and predictive insights. AI integration enables automated processes, advanced forecasting, and personalized insights in the market. The increasing shift towards cloud-based platforms has significantly increased the adoption of, fuelled by cost-efficiency, scalability, and accessibility to advanced AI tools. Therefore, Artificial Intelligence integration improves the infrastructure for business analytics market by allowing real-time & in-depth insights through automation and conversational interfaces, ensuring seamless data flow, effectively managing complex models, and offering real-time inference.

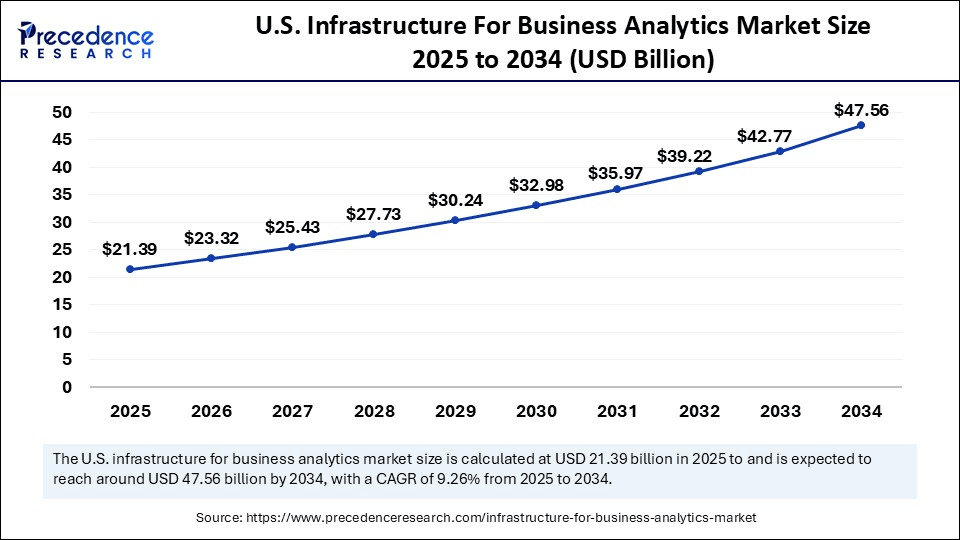

U.S. Infrastructure For Business Analytics Market Size and Growth 2025 to 2034

The U.S. infrastructure for business analytics market size was exhibited at USD 19.61 billion in 2024 and is projected to be worth around USD 47.56 billion by 2034, growing at a CAGR of 9.26% from 2025 to 2034.

How Did North America Lead the Infrastructure for the Business Analytics Market in 2024?

North America held the dominant share of the infrastructure for business analytics market in 2024. The region benefits from the expanding digital economy, rising adoption of cloud-based technologies, well-developed technology-driven infrastructure, growing need for improved operational efficiency, surging investment in smart infrastructure, and growing demand for data-driven decision-making across various sectors such as healthcare, BFSI, public sector & utilities, retail energy & oil & gas, manufacturing, and others. The market is experiencing exponential growth from the rapid advancements in machine learning, artificial intelligence, cloud computing, and big data analytics. The adoption of advanced technologies allows businesses to gain real-time insights and predictive analysis on evolving consumer behavior, assisting companies in making more informed, accurate, faster, and data-driven decisions. Additionally, the rising volume of data generated by businesses and the rising demand for real-time business intelligence significantly fuel the growth of the infrastructure for business analytics market during the forecast period. Furthermore, governments and large and mid-market enterprises in countries like the United States and Canada are increasingly investing in tech infrastructure, accelerating expansion of the market in the coming years. Such a combination of factors is expected to propel the growth of the infrastructure for business analytics market in the North American region.

What Made Asia Pacific the Fastest-Growing Region in the Infrastructure for Business Analytics Market in 2024?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The region's fastest growth is attributed to the increasing presence of key market players, rapid expansion of smart infrastructure, increasing technological innovation, and rising demand for real-time and predictive analytics. The ongoing digital transformation across diverse industries is anticipated to drive the growth of infrastructure for business analytics market in the region. The supportive government and funding for digitalization policies are likely to fuel the expansion of the market in the region. In addition, the proliferation of AI and machine learning technologies, and the widespread adoption of cloud-based platforms, especially among Small and Medium-sized Enterprises (SMEs), accelerates the market's revenue in the region.

- In August 2025, Reliance Industries Ltd (RIL) unveiled Reliance Intelligence, a new wholly-owned subsidiary that will spearhead the company's push into artificial intelligence (AI). Reliance Intelligence will build gigawatt-scale AI-ready data centres, which would be powered by green energy and engineered for training and inference at a national scale. The initiative, Chairman and Managing Director Mukesh Ambani stated that is aimed at establishing India as a global hub for AI innovation. Gigawatt-scale, AI-ready green energy-powered data centres are already under construction in Jamnagar to support national-scale AI training and inference. Reliance to bring together leading global technology firms and open-source communities, combining their strengths with Reliance's execution capabilities, ensuring “India-first compliance” in AI.(Source: https://www.indiainfoline.com)

Market Overview

The infrastructure for business analytics market comprises the hardware, software, cloud services, data platforms, networking, and managed services that together enable organizations to collect, store, process, secure, and analyze structured and unstructured data at scale. This market covers foundational compute (servers, GPUs/TPUs), storage (data warehouses, data lakes, lakehouses, object/file/block storage), database & query engines, real-time streaming platforms, networking, edge compute, integrated analytics stacks, orchestration, and the professional/managed services required to deploy, operate and govern analytics workloads (ETL/ELT, MLOps, DataOps, observability, security). Its purpose is to deliver business intelligence, reporting, ML/AI, streaming analytics, and prescriptive decisioning across industries.

What Are the Key Trends in the Infrastructure for the Business Analytics Market?

- The rising shift towards managed/consumption-based cloud models is expected to contribute to the overall growth of the infrastructure for business analytics market.

- The supportive government framework and surging investment in IT infrastructure are anticipated to accelerate the market's growth during the forecast period.

- The increasing need for improved operational efficiency is likely to drive the growth of the infrastructure for business analytics market in the coming years.

- The growing demand for data-driven decision-making is expected to drive the growth of the market during the forecast period.

- The rising investments in smart infrastructure are estimated to promote the growth of the infrastructure for business analytics market during the forecast period.

- The emergence of edge computing, artificial intelligence (AI), and the Internet of Things (IoT) is anticipated to fuel the expansion of the infrastructure for business analytics market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 166.57 Billion |

| Market Size in 2025 | USD 76.38 Billion |

| Market Size in 2024 | USD 70.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Infrastructure Component, Services / Commercial Model, Industry Vertical, Organization Size / Buyer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Real-Time Insights Across Various Industries

The rising demand for real-time insights across various industries is expected to boost the growth of the infrastructure for business analytics market during the forecast period. The market is experiencing escalating demand for real-time insights from various industries such as BFSI, healthcare, public sector & utilities, retail energy & oil & gas, manufacturing, and others. These industries require data-driven insights to effectively manage risks, improve operational efficiency, and stay competitive. By effectively identifying any inefficiencies and optimizing processes through data analysis, it assists businesses across various sectors to streamline operations and manage resources efficiently. Data-driven insights provide a clearer and more accurate understanding of the business landscape. Therefore, the real-time and continuous intelligence assists companies to promptly adapt to any market changes, make informed & real-time decisions, identify new revenue opportunities, and gain a competitive edge in the market.

Restraint

High Initial Investment

The high initial investment is anticipated to hamper the market's growth. A significant upfront investment is required for the implementation of on-premise solutions, including hardware, software, and maintenance, which can often be a barrier for businesses with limited budgets. In addition, data security concerns and a lack of skilled personnel to manage and interpret complex analytics solutions. May hinder the growth of the global infrastructure for business analytics market during the forecast period.

Opportunity

How Is the Increasing Adoption of Cloud Computing Impacting the Market Expansion?

The widespread adoption of cloud computing is projected to offer lucrative growth opportunities to the infrastructure for business analytics market during the forecast period. Cloud platforms offer scalability, flexibility, cost-effectiveness, and secure environments for storing, processing, and analyzing vast & complex datasets. The widespread digitalization trend, especially in developed and developing countries, has significantly increased the adoption of cloud-based analytics solutions. Cloud-based platforms allow businesses to scale their analytics capabilities without making a lump-sum hardware investment, and play a vital role in managing fluctuating data loads. Moreover, the rising accessibility and affordability of cloud-based analytics solutions assist small and medium-sized enterprises (SMEs) in leveraging advanced analytics, expanding their market presence.

- In November 2024, NTT DATA, a global leader in digital business and IT services, announced the expansion of its strategic partnership with Google Cloud to accelerate the adoption of cloud-based data analytics and generative AI solutions for customers across key markets in the Asia Pacific. By combining NTT DATA's technology and industry expertise and client base of large enterprises with Google Cloud's best-in-class data analytics, AI, and cloud capabilities, the partnership will empower enterprises to spearhead innovation, enhance operational efficiency and agility, and propel their business.(Source: https://services.global.ntt)

Infrastructure Component Insights

What Made the Storage & Data Platforms Segment Lead the Infrastructure for Business Analytics Market in 2024?

The storage & data platforms segment was dominant, with the biggest share of the global infrastructure for business analytics market in 2024. The segment includes data warehouses (MPP), data lakes (HDFS, object storage), lakehouse platforms, operational databases / OLTP, and data marts / columnar stores. The storage and data platforms enable the efficient collection, processing, and analysis of large-volume datasets. Data Platforms play a crucial role in managing the entire data lifecycle, from collection and processing. The growth of the segment is mainly driven by the rising volume of big data, coupled with the increasing need for real-time business intelligence across industries. On the other hand, the accelerated compute segment is also experiencing the fastest growth, owing to the rising need for high-performance computing in AI and analytics. The segment includes Graphics processing units (GPUs) and field programmable gate arrays (FPGAs), and TPUs (Tensor Processing Units). The market is rapidly shifting toward accelerated computing, using TPUs, GPUs, and FPGAs to handle the complex and massive datasets of AI and machine learning.

Services / Commercial Model Insights

What Causes the Implementation & Integration Services Segment to Dominate the Infrastructure for Business Analytics Market?

The implementation & integration services segment held a dominant presence in the market in 2024. The implementation and integration services are crucial for effectively designing and deploying the business analytics solutions. The implementation and integration services remain significant for both on-premises and cloud deployments, as several companies are increasingly seeking expert guidance to design, deploy, and maintain effective analytics ecosystems. On the other hand, the managed services segment is expected to grow at a notable rate. The segment's growth is attributed to the robust demand for specialized professional and managed services. Managed service providers (MSPs) provide enhanced security measures and ensure compliance and governance on various platforms such as Azure, AWS, and others.

Organization Size / Buyer Type Insights

How Did the Large Enterprises Segment Dominate the Infrastructure for Business Analytics Market in 2024?

The large enterprises segment dominated the market in 2024. Large enterprises are extensively adopting cloud-based analytics infrastructure for its high cost-effectiveness and scalability. These enterprises are also preferring hybrid solutions as they offer a good balance of cloud flexibility and on-premises control and security, vital for various data-sensitive industries. Large enterprises primarily generate and manage huge volumes of complex data across different departments, which increases the need for sophisticated infrastructure to efficiently process and store it. On the other hand, the mid-market enterprises segment is expected to register the fastest growth. Mid-market enterprises are increasingly shifting to cloud-based business intelligence and analytics platforms, offering cost-effective and scalable solutions for data visualization, integration, and predictive analytics. Mid-market companies are increasingly adopting cloud platforms over on-premise solutions to manage and analyze data as well as enable remote access.

Industry Vertical Insights

How Did the Financial Services Segment Dominate the Infrastructure for Business Analytics Market in 2024?

The financial services segment held the largest share in the infrastructure for business analytics market in 2024. Financial services companies are heavily investing in cloud-based platforms and Artificial Intelligence (AI) and machine learning (ML)-driven analytics to effectively manage huge & complex datasets and improve real-time data-driven decision-making. Financial institutions are leveraging this advanced analytics infrastructure for a variety of critical business functions, such as risk management, fraud detection, operational efficiency, Regulatory compliance, and customer personalization. On the other hand, the healthcare & life sciences segment is expected to grow significantly in the coming years. The rapid growth of the segment is driven by the rising need to enhance patient care, improve operational efficiency, and optimize clinical trials. The increasing use of remote patient monitoring tools, which generate vast amounts of real-time data, has led to an increasing need for scalable analytics infrastructure. Several healthcare organizations are increasingly leveraging external partners or outsourcing analytics to access specialized expertise and sophisticated tools, assisting in mitigating the high cost of developing in-house capabilities.

Infrastructure for Business Analytics Market Companies

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Snowflake Inc.

- Databricks

- IBM (Cloud & Data Platforms)

- Oracle Corporation

- SAP SE

- Teradata

- Cloudera

- SAS Institute

- Hewlett Packard Enterprise (HPE)

- Dell Technologies (PowerScale, ECS)

- VMware

- Cisco Systems

- Informatica

- Tableau (Salesforce)

- Palantir Technologies

- Accenture

Industry Leader Announcements

- In June 2025, Jabil Inc., a pioneer in engineering, supply chain, and manufacturing solutions, announced it intends to invest approximately USD 500 million over the next several years to expand its footprint in the Southeast United States to support cloud and AI data center infrastructure customers. This significant commitment will enable new large-scale manufacturing capabilities, capital investments, and workforce development.(Source: https://www.businesswire.com)

Recent Developments

- In May 2025, Hitachi Digital Services, the digital consultancy and technology services subsidiary of Hitachi, Ltd. (HTHIY), announced a five-year agreement with Envista Holdings Corporation (NVST) to deliver end-to-end IT managed services across Envista's operations in more than 60 countries. Under this agreement, Hitachi Digital Services to provide 24/7 global IT services-including application support, network infrastructure, analytics and business intelligence, and cybersecurity-through its global delivery centers in India, Mexico, Portugal, the U.S., and Vietnam.(Source: https://finance.yahoo.com)

- In June 2025, Amazon announced its plan to invest nearly USD 20 billion in Pennsylvania to expand its data center infrastructure for AI innovation and cloud computing technologies. This landmark investment is expected to create at least 1,250 new high-skilled jobs while supporting thousands of other jobs in the Amazon Web Services (AWS) data center supply chain.(Source: https://www.aboutamazon.com)

Segments Covered in the Report

By Infrastructure Component

- Compute

- General-purpose Servers (x86)

- Accelerated Compute (GPUs, TPUs, FPGAs)

- Edge Compute Nodes / Appliances

- Storage & Data Platforms

- Data Warehouses (MPP)

- Data Lakes (HDFS, object storage)

- Lakehouse Platforms

- Operational Databases / OLTP

- Data marts / Columnar stores

- Data Integration & Orchestration

- ETL / ELT Engines

- Stream Processing Engines (Kafka, Flink, Pulsar)

- Workflow Orchestrators (Airflow, Prefect)

- Analytics & ML Platforms

- BI / Visualization Engines

- ML Platforms / Feature Stores

- Model Serving & MLOps Tools

- Networking & Connectivity

- High-speed LAN / Fabric

- WAN / SD-WAN / Direct Cloud Connect

- Edge Networking

- Security & Governance Infrastructure

- Identity & Access Management

- Data Catalogs & Lineage

- Encryption, Tokenization, DLP

- Compliance & Audit Tools

- Observability & Platform Ops

- Monitoring, Logging, APM

- Cost & Resource Management

By Services / Commercial Model

- Implementation & Integration Services

- Managed Services (platform ops, monitoring, MLOps)

- Cloud Consumption / Managed SaaS Pricing

- Professional Services & Training

- Support & Maintenance

By Industry Vertical

- Financial Services

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Manufacturing & Industrial IoT

- Telecom & Media

- Public Sector & Utilities

- Energy & Oil & Gas

- Technology & SaaS

- Transportation & Logistics

- Others

By Organization Size / Buyer Type

- Large Enterprises (Global / Fortune)

- Mid-market Enterprises

- SMBs / Departments

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting