Discover the growing impact of viral vector gene therapies, driven by rising genetic disorders, FDA approvals, and advanced manufacturing. Learn about key viral vectors AAV, LV, and Ad and the expanding pipeline, with 29 FDA-approved therapies as of early 2025.

Viral vector gene therapies are gaining traction, with the rise in genetic and rare disorders, recent FDA approvals, and advances in manufacturing technologies. It is necessary to take into account the difficulties and the possibility of standardization to meet growing demands.

Over the past two decades, viral vector gene therapies have achieved notable preclinical and clinical successes. They are derived mainly from three viral vectors, including lentivirus (LV), adenovirus (Ad), and adeno-associated virus (AAV). These three viral vectors account for almost 80% of approved viral-based gene therapies. Other viral vectors include herpes simplex virus (HSV) and retrovirus (RV). As of the first quarter of 2025, the U.S. Food and Drug Administration (FDA) has approved a total of 29 viral vector-based gene therapies.

|

Products |

Indications |

Companies |

Approval Year |

|

Gendicine |

Head and neck cancer |

Shenzhen SiBiono GeneTech |

2003 |

|

Oncorine |

Head and neck cancer; nasopharyngeal cancer |

Shanghai Sunway Biotech |

2005 |

|

Rexin-G |

Solid tumors |

Epeius Biotechnologies |

2006 |

|

Glybera |

Lipoprotein lipase deficiency |

uniQure |

2012 |

|

Imlygic |

Melanoma |

Amgen |

2015 |

|

Strimvelis |

Adenosine deaminase deficiency |

Orchard Therapeutics |

2016 |

|

Yescarta |

Diffuse large B-cell lymphoma; Hodgkin's lymphoma; follicular lymphoma |

Kite Pharma |

2017 |

|

Luxturna |

Leber congenital amaurosis; retinitis pigmentosa |

Spark Therapeutics |

2017 |

|

Kymriah |

Acute lymphocytic leukaemia; diffuse large B-cell lymphoma; follicular lymphoma |

Novartis |

2017 |

|

Zolengsma |

Spinal muscular atrophy |

Novartis |

2019 |

|

Tecartus |

Metachromatic leukodystrophy |

Kite Pharma |

2020 |

|

Delytact |

Malignant glioma |

Daiichi Sankyo |

2021 |

|

Skysona |

Early cerebral adrenoleukodystrophy (CALD) |

Bluebird bio |

2021 |

|

Carteyva |

Diffuse large B-cell lymphoma; follicular lymphoma; mantle cell lymphoma |

JW Therapeutics |

2021 |

|

Abecma |

Multiple myeloma |

Bluebird bio |

2021 |

|

Roctavian |

Hemophilia A |

BioMarin |

2022 |

|

Hemgenix |

Hemophilia B |

uniQure |

2022 |

|

Upstaza |

Aromatic l-amino acid decarboxylase (AADC) deficiency |

PTC Therapeutics |

2022 |

|

Adstiladrin |

Bladder Cancer |

Merck |

2022 |

|

Carvykti |

Multiple myeloma |

Legend Biotech |

2022 |

|

Zynteglo |

Transfusion-dependent beta thalassaemia |

Bluebird bio |

2022 |

|

Vyjuvek |

Dystrophic epidermolysis bullosa |

Kyrstal Biotech |

2023 |

|

Elevidys |

Duchenne muscular dystrophy |

Sarepta Therapeutics |

2023 |

|

Lyfgenia |

Sickle cell disease |

Bluebird bio |

2023 |

|

Beqvez |

Hemophilia B |

Pfizer |

2024 |

|

Tecelra |

Synovial sarcoma |

Adaptimmune |

2024 |

|

Breyanzi |

Relapsed/Refractory Chronic Lymphocytic Leukaemia |

Bristol Myers Squibb |

2024 |

|

Libmeldy |

Metachromatic leukodystrophy |

Orchard Therapeutics |

2024 |

|

BBM-H901 |

Hemophilia B |

Belief BioMed |

2025 |

Viral Vector: The Clinical Frontier

The majority of viral vector gene therapies are indicated for rare diseases and cancer. However, ongoing efforts are made to determine the safety and efficacy of these therapies for non-rare indications. In 2025, researchers assessed AAV-based gene therapies to partially reverse a genetic cause of deafness in animal models. Such advancements result in a surge in the number of clinical trials worldwide across different phases. As of October 2025, 112 studies were registered on clinicaltrials.gov related to viral vector gene therapy as an indication, of which 76 are Phase 1 studies, 69 are Phase 2, and 17 are Phase 3 studies. This further potentiates the need for rapid expansion of manufacturing to address the challenges of commercial-scale manufacturing.

Strengthening the Development: Manufacturing Evolution

Leading players are beginning to implement strategic solutions to bridge the gap between development and manufacturing capabilities. Monoclonal antibodies have a long history of technological development, during which manufacturing methods have been established reciprocally, with in-house or in collaboration with a contract development and manufacturing organization (CDMO). This inspires biopharmaceutical companies to use different production systems and downstream processes for viral vector gene therapies. Companies aim to develop products with a low cost of goods (COG) per dose by increasing bioreactor yields and using efficient purification techniques.

Gene Therapy’s Investment Pulse

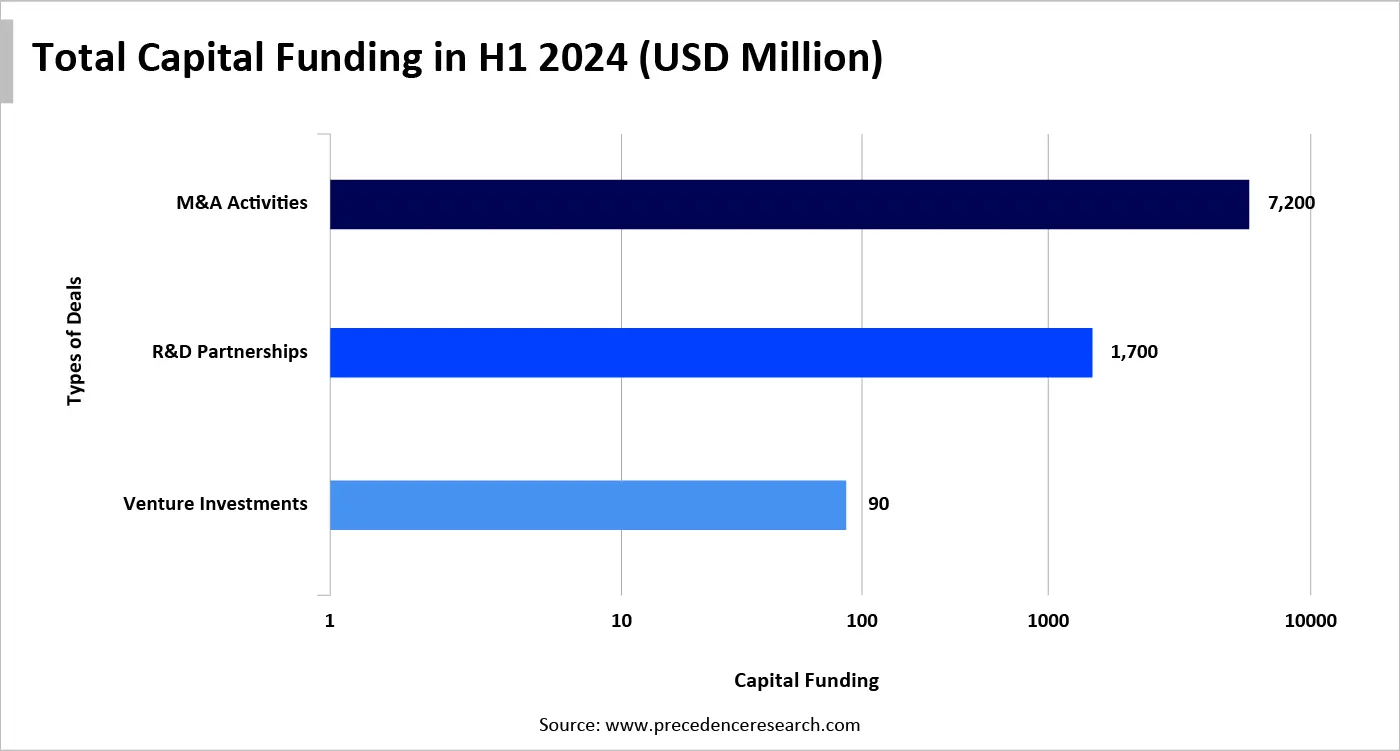

Numerous private equity firms and venture capitalists invest heavily in viral vector manufacturing startups. According to DealForma for Reuters, gene therapy companies raised approximately $1.4 billion in venture capital funding across 39 venture rounds in 2024. The gene therapy sector also witnessed a surge in R&D partnerships and M&A activities. In the first half of 2024, the industry recorded 29 deals, generating $11 billion in value and $400 million in upfront payments and equity. Additionally, there were 3 M&A deals in H1 2024 at a value of $7.4 billion. These capital investments support the development and manufacturing of viral vector gene therapies. However, our analysis suggests that such investments fail to solve the bottlenecks and challenges of viral vector manufacturing.

Conventional Production Pathways for Viral Vector

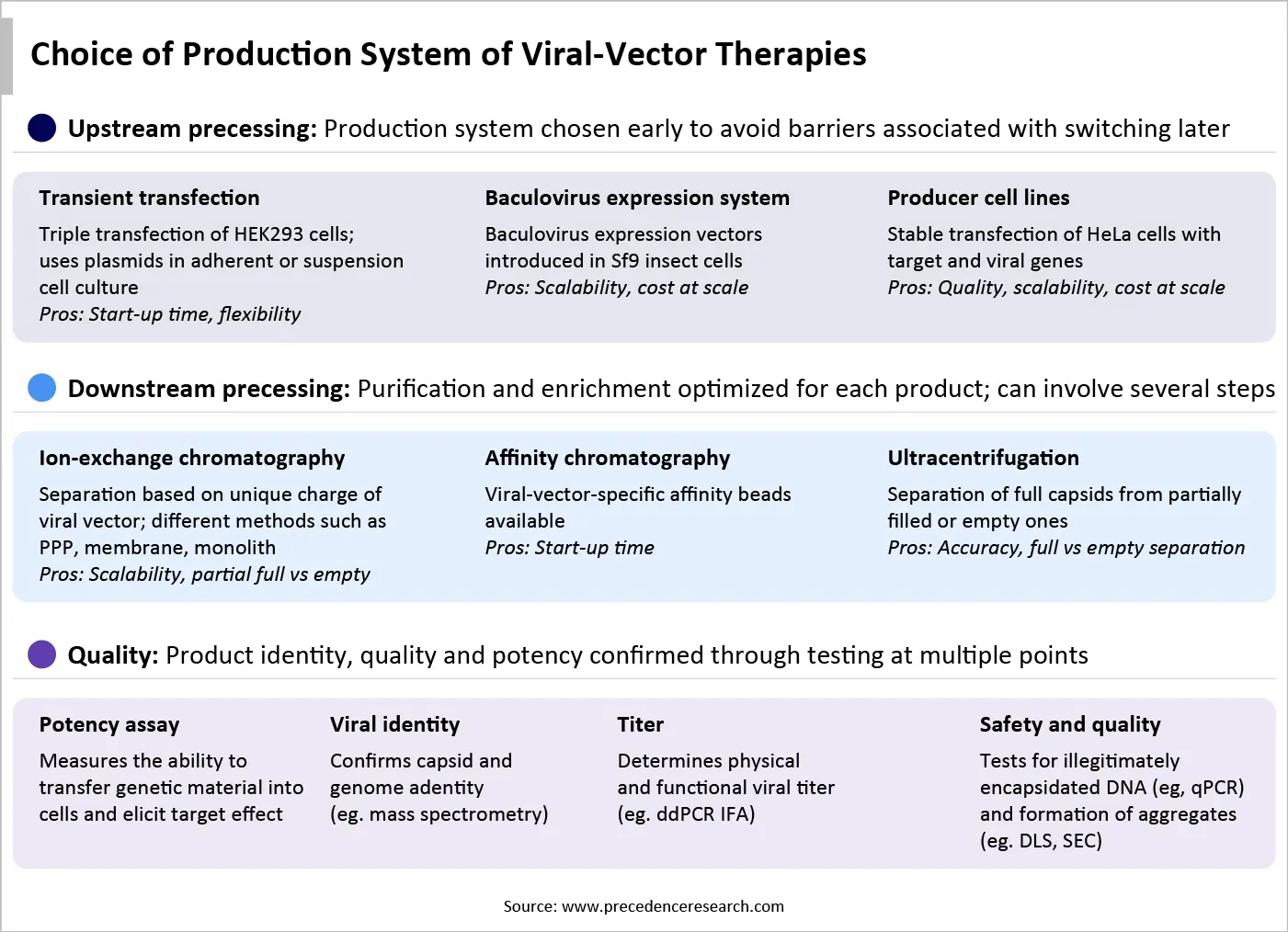

Upstream bioprocessing steps for viral vector manufacturing include cell culture, cell expansion, transfection, and viral vector production, while downstream bioprocessing includes cell harvesting, cell lysis, clarification, and further purification and concentration. Manufacturing is concluded with the fill/finish formulation step. It primarily involves two culturing approaches: scale-out of adherent cell systems based on 2D planar technologies and scale-up of 3D suspension cell cultures in stirred tank bioreactors. Developers are shifting from small-scale operations to large-scale apparatus, such as stainless steel or single-use bioreactor culture systems. Critical process parameters (CPPs), such as shear forces, pH conditions, and temperature, contribute to product yields.

Breaking Barriers in Viral Vector Production

In recent years, exciting developments have been made in addressing manufacturing issues in viral vector production. Innovative approaches and technologies have emerged to break down the barriers that limit scalability. These advancements are not only needed to enhance production efficiency but also to foster high-quality and cost-effective viral vector manufacturing.

Key Manufacturing Challenges

- Lack of a Universal Production Process

- Poor Downstream Processing

- Collaboration with Regulators

Emerging Opportunities

- Dynamic Sourcing Strategy

- Smart Capital Deployment

- Streamlining End-to-End Operations

- Digitization in Manufacturing

- Pioneering Future Innovations

Lack of a Universal Production Process

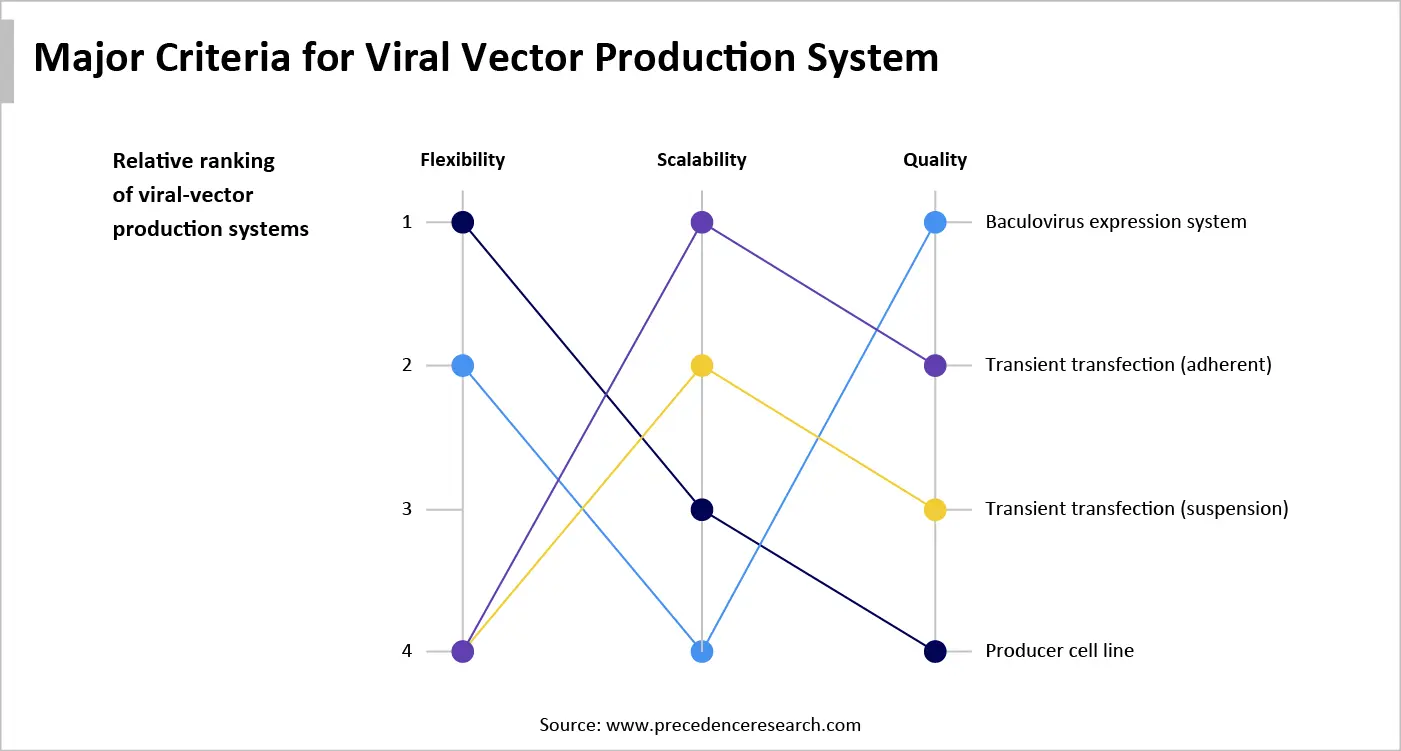

The choice of an appropriate upstream production system poses challenges in flexibility, scalability, and quality. These three criteria are essential to rapidly develop and commercialize safe and effective viral vectors. There are currently no universal, standardized manufacturing processes for viral vector production than many gold standards of monoclonal antibodies. This is because viral vectors are larger and more complex molecules, requiring greater control and biosafety.

Flexibility in viral vector production refers to the ability of viral vectors to adapt to the production processes and ease scalability. Both the transient transfection systems (adherent and suspension) are highly flexible compared to other systems. This allows researchers to easily modify expression constructs or experimental conditions without the need for cell line generation, accelerating the speed of development. Thus, transient transfection systems are predominantly used in the early stages of development to optimize and test the drug candidate.

Flexibility in viral vector production refers to the ability of viral vectors to adapt to the production processes and ease scalability. Both the transient transfection systems (adherent and suspension) are highly flexible compared to other systems. This allows researchers to easily modify expression constructs or experimental conditions without the need for cell line generation, accelerating the speed of development. Thus, transient transfection systems are predominantly used in the early stages of development to optimize and test the drug candidate.

Scalability is one of the critical parameters in viral vector manufacturing, as it defines the transition of a product from small-scale to pilot-scale and large-scale production. It can directly affect cell growth and viral vector productivity. This is due to the need for multiple rounds of manual handling and manipulation of cell cultures within a biosafety cabinet, potentiating the risk of contaminants. Among all the cell culture systems, the baculovirus expression system possesses the highest scalability, making it suitable for large-scale manufacturing.

Quality of a viral vector encompasses numerous features, including high transduction efficiency, targeting specificity, safety, stability, scalability, low immunogenicity, controlled gene expression, and large packaging capacity. Producer cell lines contribute to the development of quality viral vectors. Key players develop proprietary platforms to develop gene therapies from producer cell lines.

The implications for industry leaders are clear. Developers must make an informed decision based on the market environment, the size of the prospective patient group, and the level of confidence in the existing molecule. Currently, almost all gene therapies are developed using the transient transfection system. The change of the production system is difficult during the later stage of drug development.

Poor Downstream Processing

Major challenges faced by researchers and manufacturers related to downstream processing include: 1) efficient clarification of the cell lysate; 2) low titers; 3) removal of DNA; 4) ineffective assembly of the virus and incorporation of the DNA. This results in high contamination and low yields. Physical characteristics of viral vectors and their accumulation within the cells and media differ considerably.

Novel approaches are designed to enhance efficiency in cell harvesting and lysis, clarification, ultracentrifugation, affinity chromatography, ion-exchange chromatography, and virus clearance strategies. In spite of these, a high degree of process optimization is necessary to deal with low yields of viral vectors. It is estimated that viral vectors have a manufacturing yield of 50%, while monoclonal antibodies achieve a 90% yield. Hence, Precedence Research estimates that downstream processes will become more standardized over time, with expanding industry experience and novel platform strategies.

Collaboration with Regulators

Navigating the complex regulatory compliance for viral vector gene therapies have been a persistent challenge for manufacturers and developers. Regulatory challenges mainly arise due to complex manufacturing with stringent quality control (GMP), safety concerns like immune responses and off-target responses, and the need for long-term monitoring. This encourages regulatory authorities to issue appropriate guidelines about gene therapy. Gene therapies are highly complex and lack long-term clinical data, necessitating a more cautious stance in their evaluation. Developers must stay alert to the scrutiny process of gene therapies, as they may hamper the regulatory process.

Another challenge for manufacturers is to provide comprehensive analytical data and substantiation to regulatory bodies to demonstrate compliance. This step is different from the traditional drug development and approval process. Additionally, scale-up of viral vectors from laboratory stage to commercial stage often leads to difficulties in manufacturing enough doses to meet the demands of a larger patient population, slowing the timeline to critical milestones and regulatory approval. Regulatory guidelines will continue to evolve as new products are approved, leading to the development of a standardized universal regulation.

Emerging Opportunities

The future of viral vector gene therapy manufacturing is promising, driven by public-private partnerships, venture capital investments, development of more scalable technologies, and the growing demand for personalized therapeutics. The five major points that need to be implemented include: 1) Dynamic sourcing strategy; 2) smart capital deployment; 3) streamlining end-to-end operations; 4) digitization in manufacturing; and 5) pioneering future innovations. Such measures will facilitate viral vector gene therapy manufacturing at a faster pace.

Dynamic Sourcing Strategy

As cell and gene therapies rapidly advance, manufacturers need to determine an effective manufacturing strategy. Companies can choose between in-house manufacturing and outsourcing services to specialized CDMOs. The choice depends on multiple factors, such as financial and operational capabilities, stage of the product lifecycle, process modality, and short- and long-term strategies.

In-house manufacturing provides a company with complete control over its manufacturing processes, enabling manufacturers to make effective decisions. It helps companies to develop tailored products based on patients’ needs and to alter the product. It also minimizes the risk of breaching the confidentiality rights of a proprietary product. Process optimization and improvement are comparatively easier with in-house manufacturing, facilitating future intellectual property (IP) development. It can be more cost-effective in the long run, as companies utilize platforms for novel gene therapies.

In contrast, outsourcing services to CDMOs has its own advantages, including access to advanced technologies and specialized facilities, along with relevant expertise. Outsourcing saves manufacturers’ time and costs, enabling them to focus on their core competencies, such as product sales and marketing. Often, biotech and biopharma startups opt for outsourcing services as they lack suitable manufacturing infrastructure. CDMOs possess skilled professionals who provide tailored solutions to complex manufacturing problems. They offer flexibility in their services as they either provide end-to-end services or personalized services for a particular stage.

Smart Capital Deployment

Companies must make sure about the deployment of investments regarding the scale of investment required and the choice of production platform. Investments should be made by considering the future scalability aspect of viral vector manufacturing. It is estimated that modular production suites can provide some flexibility for scaling production and allow expansion as key development milestones are met. Innovative platforms are designed to optimize the yield and quality of the specific viral vector.

Large biotech companies invest in strengthening their in-house manufacturing infrastructure. This helps them to generate more revenue by offering manufacturing services to other firms. By leveraging dedicated facilities, companies can eliminate the risk of supply chain shortages and manage quality control throughout the manufacturing process. However, making appropriate and precise decisions is difficult for companies, as viral vector manufacturing optimization is still in its infancy.

Streamlining End-to-End Operations

Streamlining end-to-end operations from initial research to supply chain management plays a crucial role in viral vector gene therapy. Continuous efforts are made to improve and optimize the process development, analytical, and manufacturing of viral vectors. This enables companies to expedite the viral vector development process, thereby expanding their product pipeline and reinforcing their market position. Companies must select raw material suppliers that deliver high-quality and reliable materials like GMP-grade plasmids that are required at every manufacturing stage.

End-to-end operations are achieved by collaborating with CDMOs, as they focus on multiple projects simultaneously. CDMOs can help major companies ramp up their production and develop specific viral vectors for specific gene therapies. This leads to the development of high-quality products with lower COG. Numerous gene therapy and gene-modified cell therapy products require cold-chain logistics to facilitate their secure storage and distribution. Stockpiling or long-term storage of viral vectors is challenging, as they take about a month to produce and require storage at ultracold temperatures to fulfill growing demand.

Digitization in Manufacturing

Digitization drives the future of viral vector manufacturing through digital tools and automation, enhancing process efficiency, accuracy, and reproducibility. Artificial intelligence (AI) and machine learning (ML) algorithms can improve manufacturers’ competitiveness and enable faster gene therapy manufacturing. They can analyze vast amounts of data and identify promising capsid designs that enhance viral vector packaging and cell transduction efficiency. Integrating AI and ML in bioreactors can enable real-time monitoring of key parameters.

AI-based predictive analytics can detect potential errors in manufacturing, allowing manufacturers to make critical decisions. AI and ML can revolutionize the tech transfer process of viral vector manufacturing to document parameters and enable a more consistent and scalable manufacturing. Apart from manufacturing, digitization simplifies laboratory processes through an electronic lab notebook (ELN), leading to enhanced data security and integrity, as well as streamlined workflows.

Moreover, digitization can aid in transforming viral vector storage and supply chain processes. It allows developers to constantly monitor and maintain the desired temperatures through advanced sensors. Suppliers can also keep a track of their products during transportation by indicating signs of product degradation. Digital transformation optimizes processes and facilitates patient access to life-changing treatments for rare diseases. Thus, digital transformation not only benefits manufacturers but also suppliers, healthcare professionals, and patients.

Pioneering Future Innovations

Innovative advancements are made in cell and gene therapy manufacturing processes to overcome potential challenges associated with conventional manufacturing. Some examples of innovations include advanced producer cell lines, moving toward more continuous manufacturing processes, and using more agile models. Advanced producer cell lines are developed to improve stability, remove raw material bottlenecks, and reduce batch-to-batch variability. They can also simplify upstream processing by eliminating transfection.

Continuous biomanufacturing (CBM) is a transformative approach that enables consistent product quality, reduces processing time, and improves overall efficiency. It eliminates the need for batch manufacturing, thereby increasing product yields. Some studies have reported that shifting from batch to continuous manufacturing can lower production costs by 60-80%. Thus, the winners will be those who seek out external innovations to implement their own pipelines in response to the burgeoning cell and gene therapy field.

Exclusive Insights into Viral Vector Manufacturing

Our experts observe that manufacturing will continue to be a crucial area of distinction in the near future. Developers need to select the appropriate production system, viral vector platform, optimize downstream processing, and standardize chemistry, manufacturing, and controls (CMC). The future of viral vector gene therapy includes expansion to more sophisticated R&D and organizational strategies. Manufacturers must keep in mind the essential factors in determining the success of gene therapies, such as the number of patients to be served, unmet needs, and market sizes.

Precedence Research suggests that companies should balance between investing in proprietary technologies and choosing the right platform strategies. More companies are focusing on novel gene therapy products rather than copying others’ formulations. This helps them stand out amongst the competition. Digitization plays a vital role in transforming the future of viral vector manufacturing. Innovative manufacturing strategies are adopted to improve overall product quality and lower production costs.

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation