What is the Integrated Delivery Network Market Size?

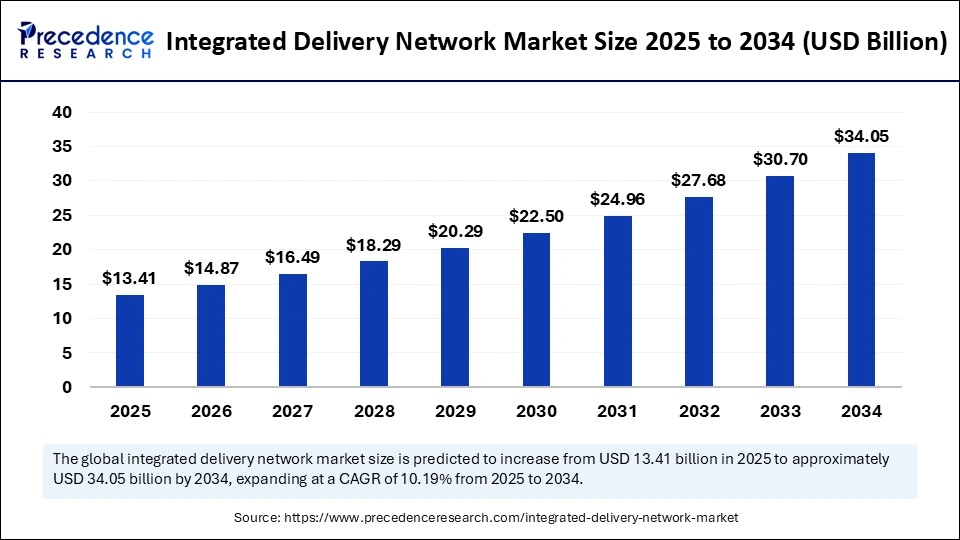

The global integrated delivery network market size accounted for USD 13.41 billion in 2025 and is predicted to increase from USD 14.87 billion in 2026 to approximately USD 37.18 billion by 2035, expanding at a CAGR of 10.74% from 2026 to 2035. The growth of the market is driven by the rising need for a comprehensive range of healthcare services and value-based care.

Integrated Delivery Network MarketKey Takeaways

- In terms of revenue, the integrated delivery network market is valued at $ 13.41billion in 2025.

- It is projected to reach $37.18billion by 2035.

- The market is expected to grow at a CAGR of 10.91% from 2026 to 2035.

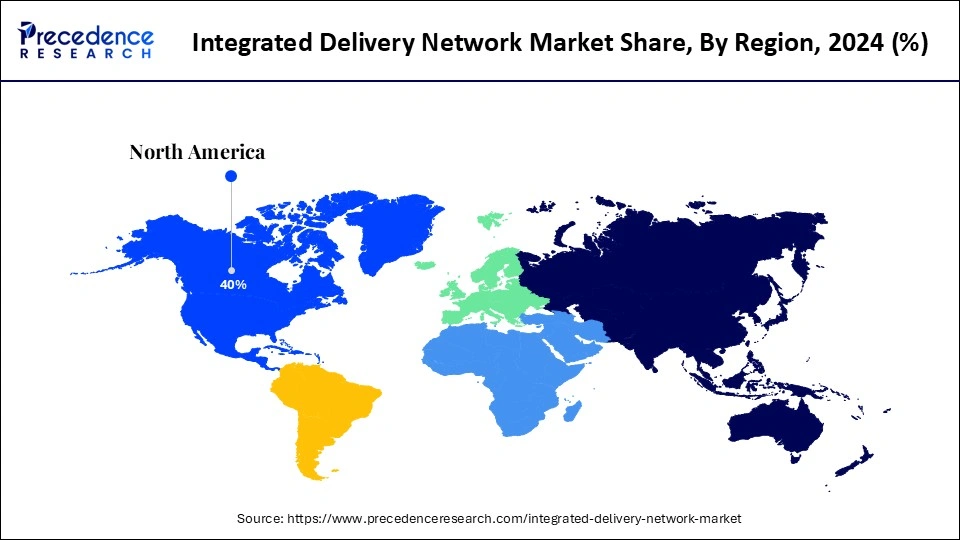

- North America held the biggest revenue share of 40% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 12.32% between 2026 to 2035.

- By service, the acute care segment contributed the largest revenue share in 2025.

- By service, the long-term health segment is expected to grow at a significant CAGR during the forecast period.

- By integration model, the vertical integration segment captured the largest revenue share in 2025.

- By integration model, the horizontal integration segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By facility, the acute facilities segment dominated the market in 2025.

- By facility, the outpatient facilities segment is expected to expand at the highest CAGR from 2026 to 2035.

Market Overview

An integrated delivery network (IDN) is a collaborative healthcare system that unifies hospitals, physician groups, and other care providers under a single organizational umbrella to deliver coordinated, cost-effective, and high-quality patient care. These networks aim to streamline healthcare services by integrating clinical, administrative, and financial operations, thereby enhancing efficiency and patient outcomes.

Integrated delivery networks are rapidly transforming the healthcare sector by consolidating services across hospitals, outpatient clinics, and physician groups into cohesive systems. These networks enhance care coordination, reduce operational inefficiencies, and improve patient outcomes. With rising healthcare costs and increasing demand for value-based care, the need for IDNs is rising as they offer a strategic solution to streamline patient management, share resources, and optimize healthcare delivery. The widespread adoption of electronic health records, telehealth, and artificial intelligence is furthering the shift toward connected and interoperable healthcare ecosystems, making IDNS a cornerstone of modern healthcare infrastructure.

AI at Helm of Innovation in Integrated Delivery Networks

Artificial intelligence (AI) is reshaping the landscape of the integrated delivery network market by enhancing decision-making, streamlining workflow, and improving patient engagement across care systems. Through predictive analytics, AI helps identify at-risk patients earlier, personalize treatment plans, and reduce hospital readmissions. AI-powered platforms facilitate seamless data exchange between different providers within the network, breaking down silos and enabling real-time access to patient records, diagnostics, and outcomes. Moreover, AI-driven automation is optimizing administrative functions such as scheduling, billing, and claims processing, significantly reducing cost and human error. Natural language processing is used to extract valuable insights from unstructured clinical notes, while machine learning models support clinical decision-making by recommending evidence-based treatment options. Ultimately, AI empowers an integrated delivery network to transition overall healthcare quality while maintaining economic sustainability.

- In May 2025, Apple announced a plan to launch the smart home hub with AI and a built-in camera by the end of the year. Apple is reportedly developing a smarter home hub equipped with artificial intelligence capabilities and an integrated camera, aiming to enhance home automation experiences.

(Source: https://in.mashable.com)

Integrated Delivery Network MarketGrowth Factors

- Rising demand for value-based care: Governments and insurers worldwide are shifting from volume-based to value-based payment models, pushing IDNs to offer coordination and cost-effective care.

- The rapid adoption of digital health technologies: The surge in EHRs, AI, telemedicine, and cloud computing has created a favorable environment for IDNs to thrive and offer integrated solutions.

- Healthcare cost containment: IDNs help reduce redundant testing, streamline operations, and cut administrative costs by centralizing services and resources.

- Aging population and chronic disease management: The global rise in chronic conditions necessitates continuous and coordinated care, making INDs ideal for long-term health management.

- Favorable government policies and reimbursements: Initiatives promoting healthcare interoperability and integration are encouraging the formation and expansion of IDNs.

- Increased focus on patient-centric care: IDNs enable seamless patient experiences across multiple providers, supporting the trend towards personalized and holistic care.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 37.18Billion |

| Market Size in 2025 | USD 13.41 Billion |

| Market Size in 2026 | USD 14.87 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Integration Model, Facility, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Healthcare Digitization

The surge in healthcare digitalization is the most influential force driving the growth of the integrated delivery network market. As hospitals and clinics shift toward centralized electronic health records, cloud-based systems, and AI-assisted diagnostics, IDNs are becoming the backbone of a coordinated care approach. This shift allows patient data to move effortlessly across departments and institutions, significantly reducing redundancies, enhancing clinical accuracy, and supporting value-based care. Government mandates encouraging healthcare interoperability and pay-for-performance models further strengthen the case for IDNs as essential healthcare infrastructure.

Restraint

High Costs and Data Security Concerns

While the promise of integrated delivery networks is immense, the pathway to true integration is riddled with challenges. Legacy IT systems, varying standards of care, and disparate data formats create a bottleneck in interoperability. The financial burden of upgrading infrastructure, training personnel, and ensuring cyber security can deter smaller organizations. Establishing and maintaining an integrated delivery network requires substantial investments in infrastructure and staffing. Moreover, protecting patient data is a major concern in IDN, requiring robust security measures. These issues not only delay progress but also compromise the quality and consistency of care delivery.

Opportunity

Need to Expand Service Offerings

The rising need to expand healthcare services, especially in rural and underserved areas, creates lucrative growth opportunities in the integrated delivery network market. IDN can expand healthcare services by adding new facilities and programs. With the rise of telehealth, remote monitoring, and mobile clinics, IDNs can bridge vast care delivery connected networks. Additionally, the emergence of consumer-driven healthcare, where patients demand transparency, continuity, and convenience, has opened new doors for INDs to deliver superior, consistent services. Strategic collaborations between tech companies and healthcare providers can further amplify innovation and reach, driving long-term growth.

Segment Insights

Service Insights

The acute care segment dominated the integrated delivery network market with the largest revenue share in 2024, primarily due to its critical role in addressing immediate, high-intensity medical conditions such as surgeries, traumas, and emergency treatments. Hospitals within IDNs are often the central nodes of care, where advanced diagnostics, intensive care units (ICUs), and specialist teams converge to deliver life-saving interventions. The segment's dominance is also reinforced by increasing hospital admissions, the prevalence of chronic diseases requiring acute care, and the growing complexity of cases requiring cross-specialty coordination.

On the other hand, the long-term health segment is expected to grow at a significant CAGR during the forecast period as healthcare systems focus on continuity, prevention, and post-acute care. With an aging global population and rising incidences of chronic diseases, long-term care is becoming integral to IDNs. Services such as rehabilitation, geriatric care, palliative care, and chronic disease management are in high demand. This trend is further driven by the increasing use of telehealth, remote patient monitoring, and home healthcare, allowing IDNs to extend their care continuum well beyond hospital walls.

Integration Model Insights

The vertical integration segment led the integrated delivery network market in 2024. In vertical integration, IDNs consolidate various stages of the care journey, ranging from primary consultations to acute hospital services and post-discharge care, under a single umbrella. This structure enhances control over quality, streamlines data flow, and reduces redundancies. It also enables IDNs to implement value-based models more effectively, ensuring that patient care remains central to operational and financial strategies.

Meanwhile, the horizontal integration segment is expected to grow at the fastest CAGR in the coming years as healthcare providers seek to scale and standardize services across regions. This form of integration involves merging multiple hospitals or facilities at the same level of care to create large, unified systems. The surge in partnerships and mergers among hospital networks and outpatient centers reflects this trend, aimed at enhancing resource efficiency, negotiating power with insurers, and expanding geographic reach.

Facility Insights

The acute facilities segment held the largest revenue share of the integrated delivery network market in 2024. Acute facilities such as tertiary hospitals, trauma centers, and surgical units remain at the forefront of IDNs. These facilities not only handle complex, time-sensitive medical cases but also anchor the clinical expertise and infrastructure that support surrounding outpatient and long-term care services. Their role in handling critical patient flow, specialist interventions, and advanced diagnostics places them at the heart of most integrated systems.

On the other hand, the outpatient facilities segment is expected to expand at the fastest rate during the projection period, driven by the shift toward value-based care, cost containment, and patient convenience. These include urgent care centers, ambulatory surgical centers, and diagnostic labs that provide high-quality services without requiring hospital admission. The adoption of preventive care models, increased preference for same-day procedures, and technological advances in mobile diagnostics are fueling the expansion of outpatient care within IDNs.

Regional Insights

What is the U.S. Integrated Delivery Network Market Size?

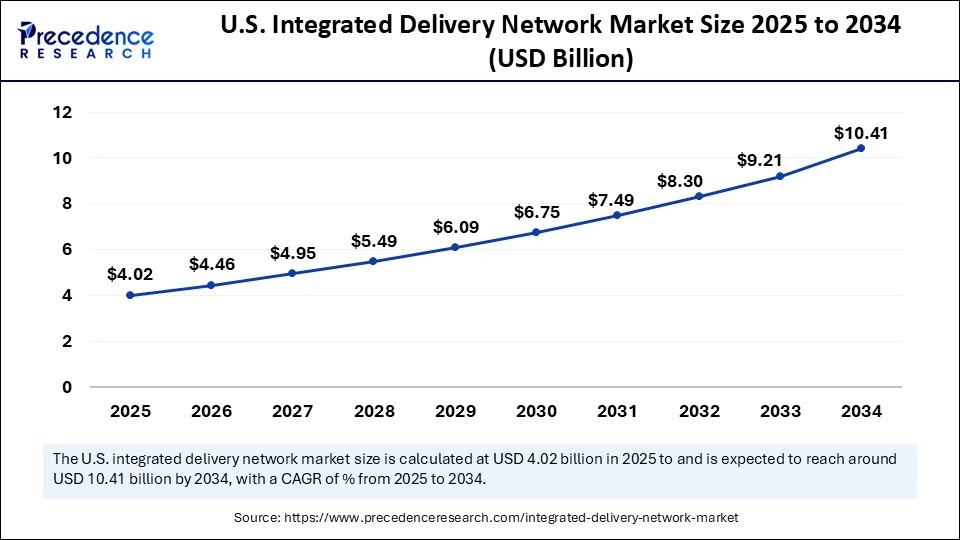

The U.S. integrated delivery network market size was exhibited at USD 4.02 billion in 2025 and is projected to be worth around USD 11.42 billion by 2035, growing at a CAGR of 11.01% from 2026 to 2035.

What Made North America the Dominant Region in 2024?

North America dominated the integrated delivery network market by generating the largest revenue share of 40% in 2024. This is mainly due to its robust healthcare infrastructure, widespread adoption of electronic health records, and a mature payer-provider ecosystem. Large health systems are placing a strong emphasis on transitioning into fully integrated delivery models. These organizations leverage AI, cloud computing, and telehealth solutions to unify care pathways across hospitals, outpatient centers, and rehabilitation centers. In addition, favorable government policies, such as the Affordable Care Act and the push toward value-based reimbursement, have accelerated integration and care coordination efforts. Leading players like Kaiser Permanente, the Mayo Clinic, and Ascension Health have become benchmarks in how IDNs can reduce costs while improving patient outcomes.

Can Asia Pacific Redefine the Future of Connected Healthcare?

Asia Pacific is growing at a notable CAGR of 12.32% during the forecast period, fueled by rapid urbanization, a rising middle-class population, and a growing need for cost-effective and accessible healthcare. Countries such as India, China, and South Korea are increasingly investing in healthcare digitization, supported by government initiatives like India's Ayushman Bharat and China's “Healthy China 2030” plans. These programs aim to create interconnected care models by linking primary care, specialty hospitals, and diagnostics through national health information platforms. Moreover, the proliferation of mobile health apps, wearable devices, and telemedicine in the region has enabled a decentralized yet connected model of patient care. The private sector is also playing a vital role by forming public-private partnerships and scaling vertically integrated systems in underserved areas.

What Opportunities Exist in the European Integrated Delivery Network Market?

Europe is considered to be a significantly growing area. There is a strong focus on universal healthcare, patient rights, and cross-border health initiatives. While adoption varies across European countries, there is a strong push toward integration through centralized digital health records and standardized treatment protocols. Nations like Germany, the Netherlands, and Sweden are leading the way with pilot programs that link general practitioners, specialists, and rehabilitation centers into a single care network. The European Union's ongoing investments in health data interoperability and AI in healthcare are accelerating the formation of pan-European integrated care systems. Additionally, growing awareness of population health management and aging demographics has prompted national healthcare providers to prioritize long-term care and chronic disease management within IDNs.

Integrated Delivery Network Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

Centers for Medicare & Medicaid Services (CMS), |

Affordable Care Act (ACA)(ACO/IDN frameworks), |

Patient data privacy & security, |

IDNs in the U.S. operate under a complex web of healthcare delivery, reimbursement, privacy, and quality standards. ACA provisions support value-based care and coordination. HIPAA/HITECH focuses on patient data protection across care settings. |

|

European Union |

European Commission, |

EU General Data Protection, Regulation (GDPR) |

Patient data privacy & security, |

GDPR is a cornerstone for patient data use and sharing within IDNs across the EU. Healthcare delivery and reimbursement are largely governed by Member States (e.g., NHS in the UK – now outside the EU; Germany's G-BA standards). |

|

Asia Pacific |

China National Health Commission (NHC), |

China's Health System Reform Policies, |

Patient records & interoperability, |

APAC regulators are increasingly focusing on interoperable health records and digital integration; some countries have national patient ID and health data frameworks supporting IDNs. |

|

Latin America |

Brazil Ministry of Health |

Unified Health System (SUS) regulations (Brazil), |

Public and private IDN integration, |

Fragmented private/public health systems; regulators support integrated delivery approaches through national coverage expansions. Data privacy laws (LGPD in Brazil) impact patient data sharing. |

|

Middle East & Africa |

Saudi Ministry of Health, |

National eHealth Strategies, |

Integrated health records, |

Emerging digital health regulations (e.g., the UAE's health data policies) support integrated delivery models; many nations align with GHDI/IMDRFand WHO health system strengthening guidelines. |

Integrated Delivery Network Market Companies

- Kaiser Permanente

- Mayo Clinic

- Cleveland Clinic

- Intermountain Healthcare

- Geisinger Health System

- UPMC (University of Pittsburgh Medical Center)

- Ascension Health

- Providence St. Joseph Health

- Trinity Health

- Sutter Health

- Baylor Scott & White Health

- Advocate Aurora Health

- Banner Health

- Dignity Health

- Henry Ford Health System

- Northwell Health

- Partners HealthCare

- Sentara Healthcare

- Spectrum Health

- Mercy

Recent Development

- In November 2025, Fujitsu announced the launch of an integrated package of core system support services specifically for the food distribution industry. These services are tailored for the food sector, not the healthcare industry.

(Source: https://global.fujitsu/en-global/pr ) - In October 2025, PAHO, the World Bank, and the IDB released a technical document on Integrated Health Service Delivery Networks (IHSDNs) in the Americas. The initiative aims to offer guidance to countries on addressing health service fragmentation and developing more integrated health systems.

(Source: https://www.paho.org/en/news/ ) - In February 2025, VSee Health, Inc. announced the successful renewal of a USD 2 million, two-year contract with a top 50 Integrated Delivery Network (IDN) hospital system. This renewal significantly expands the partnership, doubling the number of covered hospital beds and incorporating VSee Health's autonomous self-driving robot solutions for neurocritical care.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Service

- Acute Care

- Primary Care

- Long-term Health

- Specialty Clinics

- Others

By Integration Model

- Vertical

- Horizontal

By Facility

- Acute Facilities

- Outpatient Facilities

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting