Internet Data Center Market Size and Forecast 2025 to 2034

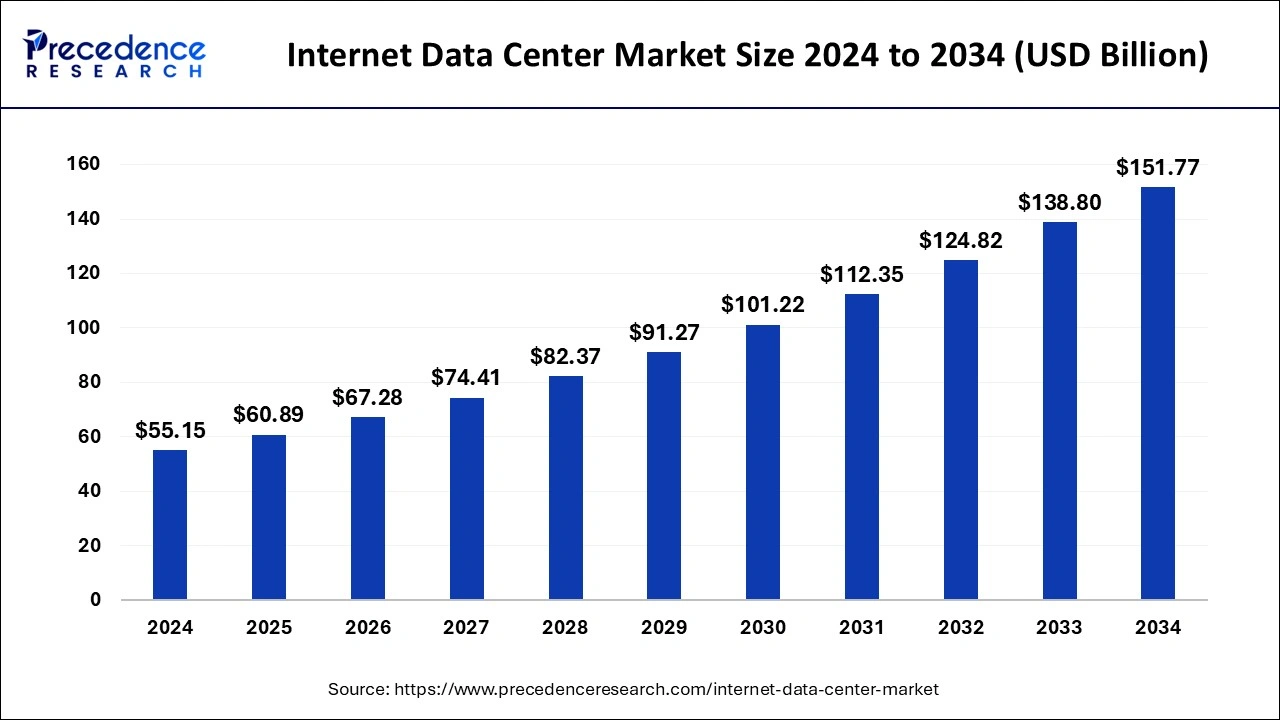

The global internet data center market size was estimated at USD 55.15 billion in 2024 and is predicted to increase from USD 60.89 billion in 2025 to approximately USD 151.77 billion by 2034, expanding at a CAGR of 10.65% from 2025 to 2034.

Internet Data Center MarketKey Takeaways

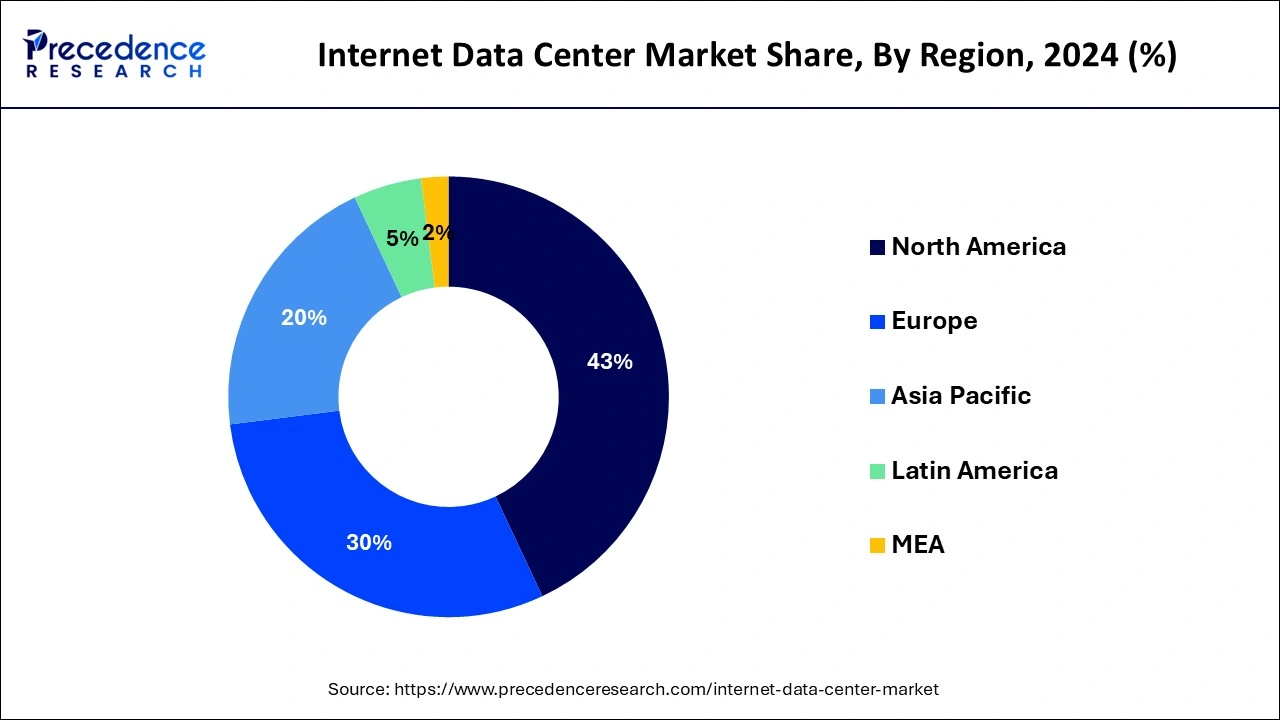

- North America dominated the market with a 43% market share in 2024.

- Asia-Pacific is expected to witness the fastest rate with a CAGR of 14.2% during the forecast period of 2025-2034.

- By end-use, the cloud service Provider (CSP) segment held the largest segment of 38% in the internet data center market in 2023.

- On the other hand, the e-commerce & retail segment is expected to grow at a significant rate of 15.2% during the forecast period.

- By service, the colocation segment held the largest share of 43% in 2024.

- By service, the content delivery network (CDN) segment is expected to grow at a notable rate of 10.3% during the forecast period.

- By deployment, the public segment held the largest share of 56% in 2024.

- By deployment, the hybrid segment is expected to grow at a significant CAGR of 16.2% during the forecast period.

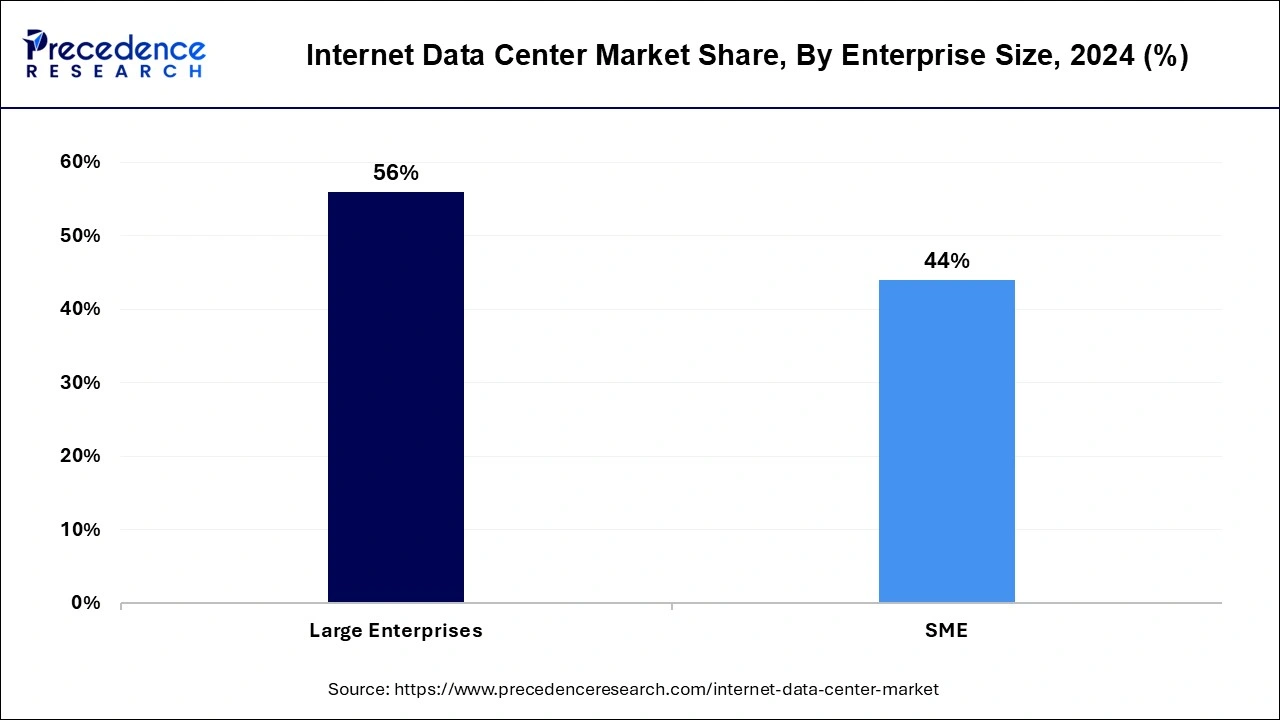

- By enterprise size, the large enterprises segment held the dominating share of 56% in 2024.

- Whereas the small and medium-sized enterprises (SME) segment is expected to grow at a notable CAGR of 18.3% during the forecast period.

U.S.Internet Data Center Market Size and Growth 2025 to 2034

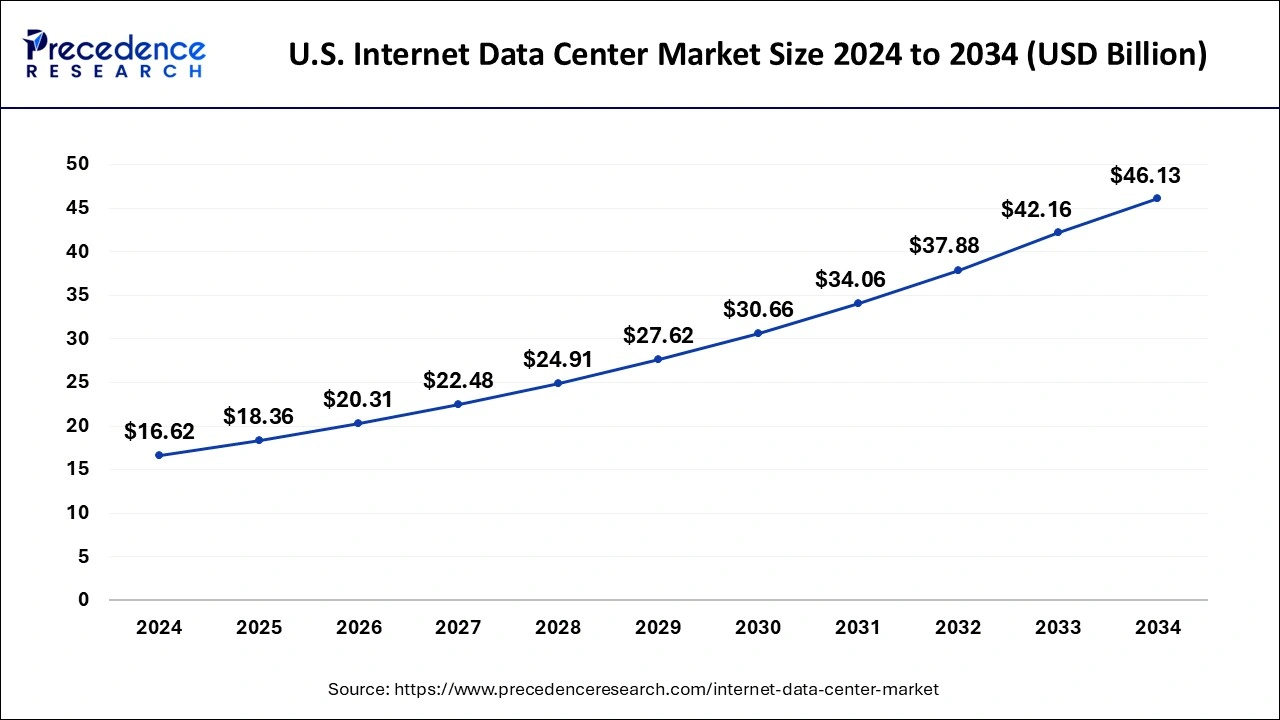

The U.S. internet data center market size was estimated at USD 16.62 billion in 2024 and is anticipated to reach around USD 46.13 billion by 2034, poised to grow at a CAGR of 10.75% from 2025 to 2034.

North America dominated the internet data center market with the largest market share of 43% in 2024. The region's thriving business climate and growing economy contribute to the market's upward trajectory. Businesses across various industries in North America, including e-commerce, entertainment, finance, and healthcare, rely on IDC services to access networking and data storage tools for developing and deploying cutting-edge digital solutions.

The growth of IDC in North America is significantly influenced by the region's status as a global financial center. Given the financial sector's stringent data security and compliance standards, IDC services have become a popular choice for storing crucial financial data and applications. The increasing popularity of FinTech solutions and the provision of online banking services contribute to sustained high demand for secure and reliable data center services in the region. North America's leadership in the IDC market reflects its pivotal role in driving technological advancements and meeting the evolving needs of diverse industries.

Asia-Pacific is expected to exhibit the fastest CAGR of 14.2% over the forecast period. The rapid urbanization and economic expansion in the region are instrumental in driving the widespread adoption of digital technology. This surge in digitalization is creating a heightened demand for innovative data center services, catering to the diverse needs of companies, both large and small, as they strive to enhance and support their operations.

The growth of Internet Data Centers (IDCs) in the Asia-Pacific region is further fueled by the tremendous digital transformation occurring in emerging markets such as China and India. These markets are experiencing a significant uptick in demand for IDC services to meet the escalating requirements for data storage and computing capabilities.

- In December 2021, Global edge solution provider EdgeConneX made a strategic entry into the market through an investment in the China-based colocation operator Chayora.

Asia-Pacific, with its substantial population and the development of a growing middle class, represents a sizable consumer base. This demographic shift is a key driver contributing to the expansion of the IDC market in the region. IDCs play a crucial role in enabling digital experiences as more consumers in the region embrace activities such as internet streaming, online purchasing, and digital payments. The increasing reliance on digital services is propelling the need for robust and scalable data center solutions, making the Asia Pacific region a focal point for the growth of the IDC market.

Market Overview

The internet data center market offers a facility that encompasses networked computers, servers, and storage systems for the storage, processing, management, and distribution of large volumes of data over the internet. These centers are equipped with high-speed internet connections and advanced security measures to ensure the efficient operation of internet-based services and applications. The future outlook for the IDC market is highly optimistic.

The increasing reliance on cloud-based services, Internet of Things (IoT) devices, and big data analytics is expected to drive the demand for data storage and processing facilities in the coming years. The growing popularity of e-commerce, social media, streaming services, and online gaming necessitates the establishment of more IDCs to cater to the expanding user base and their requirements.

Ongoing digital transformation initiatives by businesses across various sectors further contribute to the need for IDCs to manage and process vast amounts of data. Moreover, technological advancements, including edge computing, artificial intelligence (AI), and machine learning (ML), are key drivers of the IDC market's growth. These technologies require computing resources closer to end-users to minimize latency and enhance performance, thereby fueling the demand for edge data centers.

Internet Data Center Market Data and Statistics

- In February 2022, the Chinese government made an announcement approving the development of approximately ten national data center clusters and the establishment of around eight computing hubs. This strategic move is aimed at fostering the growth of the internet data center market in China.

- In November 2020, the United States Immigration & Customs Enforcement (ICE) Agency made a substantial investment, exceeding USD 100 million, in cloud services. This investment was directed towards utilizing the cloud environments of both Amazon Web Services (AWS) and Microsoft Azure. The significant financial commitment underscores the importance of cloud services in supporting the operations and data management needs of government agencies, such as the Immigration & Customs Enforcement Agency in the United States.

Internet Data Center MarketGrowth Factors

- The demand for internet data center (IDC) services from cloud service providers (CSPs) is on the rise, driven by the ongoing trend of companies shifting their IT operations to the cloud. This trend, in turn, stimulates investments in data center infrastructure. The regional distribution of IDCs plays a crucial role in market expansion, as it enables companies to strategically position data centers to reduce latency and support real-time applications.

- Corporations are increasingly compelled to invest in high-quality Internet Data Center (IDC) facilities due to a combination of factors, including stringent data security regulations, the necessity for robust business continuity planning, and the growing importance of disaster recovery capabilities. The stringent data security rules necessitate secure and controlled environments for housing critical IT systems.

- Business continuity planning and disaster recovery requirements drive the need for IDC facilities with strong security measures, redundancy in systems, and reliable power and cooling infrastructure. These technical improvements and investments ensure that critical IT systems can operate continuously in such facilities, providing a secure and reliable environment for data processing and storage.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.65% |

| Market Size in 2025 | USD 60.89 Billion |

| Market Size by 2034 | USD 151.77 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for data storage and processing

The global internet data center market is experiencing notable trends, including the swift adoption of cloud and edge computing solutions, driven by the escalating demands for data storage and processing.

- In 2020, Google announced that it achieved carbon neutrality for all its data centers and planned to run all its operations on carbon-free energy by 2020. Such commitments demonstrate a broader industry trend toward sustainability.

- In recent years, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have continued to expand their cloud services, introducing new features and regions to cater to the increasing demand for cloud-based solutions.

The growth of the Internet of Things (IoT), artificial intelligence (AI), and big data analytics is contributing to the development of highly efficient and sustainable data centers. Companies are placing increased emphasis on green initiatives, prioritizing energy efficiency, the use of renewable power sources, and the reduction of carbon footprints. Furthermore, there is a growing demand for hyperscale data centers, driven by the requirements for enhanced computing performance, speed, scalability, and connectivity. Additionally, the market is witnessing a shift towards modular and containerized data centers, aiming to achieve greater flexibility and cost-effectiveness in deployment.

Restraint

Technological upgradations

In the internet data center market, the rapid evolution of technology necessitates continuous upgrades and investments to remain competitive. Staying current with the latest advancements is crucial, and companies face challenges in adapting to dynamic technological changes, including integrating new hardware, software, and infrastructure solutions. This ongoing need for innovation can strain resources and budgets, making it imperative for companies to proactively embrace and invest in cutting-edge technologies.

Opportunity

Rapid growth of edge computing solutions and cloud services

Organizations are increasingly embracing edge computing solutions, strategically positioning data centers closer to the point of data generation. This shift is driven by the escalating need for real-time data processing and heightened sensitivity to latency. Edge data centers within internet data centers (IDCs) ensure faster response times, enhancing the efficiency of applications such as IoT, autonomous driving, and augmented reality. The emergence of edge computing is generating new opportunities and requirements, contributing to the expansion of the Internet data center market.

Similarly, rapid growth of cloud services is creating more opportunities for the IDC market expansion. Cloud service Providers (CSPs) are actively investing in and expanding their data center infrastructures to meet the surging demand for cloud-based services. This ongoing commitment to enhancing cloud capabilities underscores the dynamic nature of the IDC market, aligning with evolving technological trends and the increasing reliance on cloud computing resources.

End-use Insights

The cloud service provider (CSP) segment dominated the market with the highest market share of 38% in 2024. CSPs play a pivotal role in driving the revolution in cloud computing by offering a diverse array of essential cloud services. These services, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), are integral to modern corporate operations. The escalating demand for on-demand, scalable, and cost-effective cloud solutions has fueled the growth of CSPs, whose services heavily rely on internet data center (IDC) infrastructure.

The e-commerce & retail segment is anticipated to achieve the fastest CAGR of 15.2% over the forecast period in the internet data center market. The remarkable growth of the e-commerce sector has spurred an increased demand for internet data center (IDC) services. E-commerce and retail enterprises, in their pursuit to uphold online storefronts, manage extensive product catalogs, and deliver seamless consumer experiences, require resilient and scalable digital infrastructure. IDCs play a pivotal role by providing the essential network, processing, and storage resources necessary for high-performance, secure, and reliable e-commerce operations.

Service Insights

The colocation segment dominated the internet data center market, holding the highest market share of 43% in 2024. The growing popularity of colocation services is primarily attributed to their cost-effectiveness. Constructing and maintaining a private data center entail significant upfront capital costs and ongoing operational expenses, making it a potentially expensive endeavor. Colocation offers a more affordable alternative, allowing businesses to utilize shared infrastructure and facilities, resulting in substantial cost savings. The pay-as-you-use business model of colocation is particularly advantageous for companies aiming to optimize their IT budgets, eliminating the need for significant investments in separate data center hardware.

The Content Delivery Network (CDN) segment is projected to experience the fastest CAGR of 10.3% over the forecast period. This growth is driven by the increasing importance of effective content delivery, given the surge in digital content and online services, leading to a substantial rise in data usage. CDNs play a crucial role by distributing content across a network of strategically placed servers, improving performance, enhancing user experience, and reducing latency. The rapid expansion of streaming video, online gaming, and e-commerce has significantly fueled the growth of the CDN segment. In the realm of e-commerce, CDNs are indispensable for swiftly delivering web pages, graphics, and product content to customers, thereby enhancing user experience and boosting conversion rates.

Deployment Insights

The public segment dominated the internet data center market with 56% in 2024. The significant growth of the public segment is driven by the increasing demand for scalable and cost-effective cloud computing services. Major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have expanded their global network of data centers to deliver public cloud services. These services liberate organizations from the complexities of managing on-premises data centers and hefty upfront investments in infrastructure. Public cloud services allow businesses to scale their infrastructure up or down according to their requirements.

The hybrid deployment segment is anticipated to exhibit the fastest CAGR of 16.2% over the forecast period. The emergence of hybrid deployments is attributed to the recognition that not all workloads are uniform. While some data and applications benefit from the scalability and cost-effectiveness of the public cloud, others require the security, management, and compliance features provided by private data centers. The hybrid approach enables businesses to strategically allocate tasks to the most suitable environment, maximizing resource utilization and financial efficiency. This flexibility in deployment options addresses diverse workload requirements and aligns with the varying needs of organizations across different industries.

Enterprise Size Insights

The large enterprises segment held the largest share of 56% in 2024. The prevalence of data-intensive applications in the IT operations of major businesses is a key factor contributing to the dominance of large enterprises in the market. These companies manage vast amounts of data, necessitating sophisticated network infrastructure, computing power, and storage. The demand from large enterprises for IDC services is driven by the continuous growth of data needs, particularly with the rise of big data analytics and machine learning applications.

The small and medium-sized enterprises (SME) segment is projected to register the fastest CAGR of 18.3% over the forecast period. SMEs are rapidly adopting cloud computing and undergoing digital transformation. As awareness of the benefits of digital technology spreads among small and medium-sized businesses, there is an increasing need for scalable and cost-effective IT infrastructure to support their operations, contributing to their overall growth and competitiveness.

Internet Data Center Market Companies

- Alibaba Cloud (China)

- Amazon Web Services, Inc. (United States)

- AT&T Intellectual Property (United States)

- Lumen Technologies (CenturyLink) (United States)

- China Telecom Americas, Inc. (United States)

- CoreSite (United States)

- CyrusOne (United States)

- Digital Realty (United States)

- Equinix, Inc. (United States)

- Google Cloud (United States)

- IBM (United States)

- Microsoft (United States)

- NTT Communications Corporation (Japan)

- Oracle (United States)

- Tencent Cloud (China)

Recent Developments

- In September 2023, Google, Microsoft, Schneider Electric, and Danfoss jointly unveiled a collaborative initiative known as the Net Zero Innovation Hub for Data Center. This groundbreaking project is developed in partnership with the Danish Data Center Industry. The proposed location for this innovative center is Fredericia, Denmark.

- In November 2020, the United States Immigration & Customs Enforcement Agency invested over USD 100 million in cloud services, utilizing the Amazon Web Services and Microsoft Azure cloud environments.

- In January 2020, Vapor IO announced its ambitious plans to establish 36 edge data center sites across the United States by 2021.

Segments Covered in the Report

By Service

- Hosting

- Colocation

- CDN

- Others

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- CSP

- Telecom

- Government/Public Sector

- BFSI

- Media & Entertainment

- E-commerce & Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting