What is the Investigational New Drug CDMO Market Size?

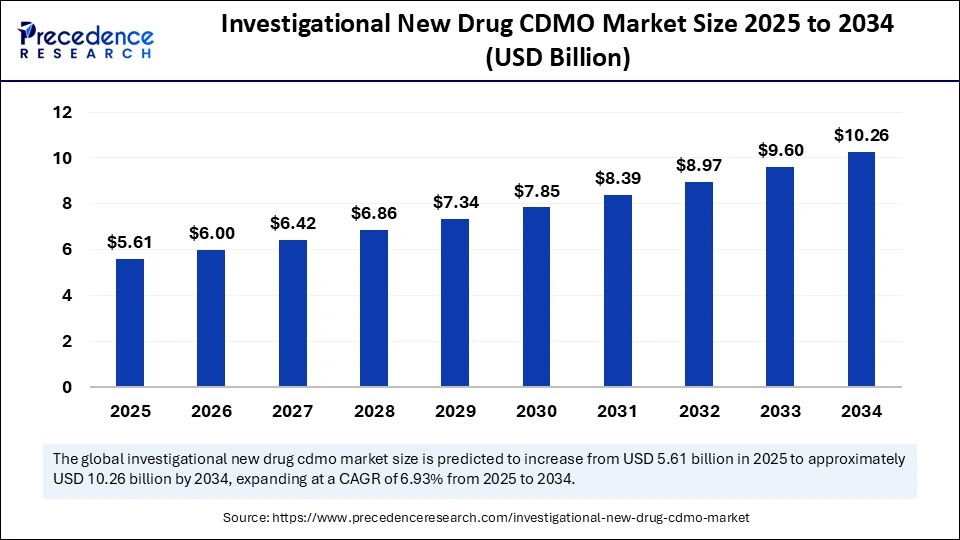

The global investigational new drug CDMO market size is calculated at USD 5.61 billion in 2025 and is predicted to increase from USD 6 billion in 2026 to approximately USD 10.90 billion by 2035, expanding at a CAGR of 6.87% from 2026 to 2035.

Investigational New Drug CDMO MarketKey Takeaways

- In terms of revenue, the investigational new drug CDMO market is valued at 5.61billion in 2025.

- It is projected to reach 10.90billion by 2035.

- The market is expected to grow at a CAGR of 6.87% from 2025 to 2035.

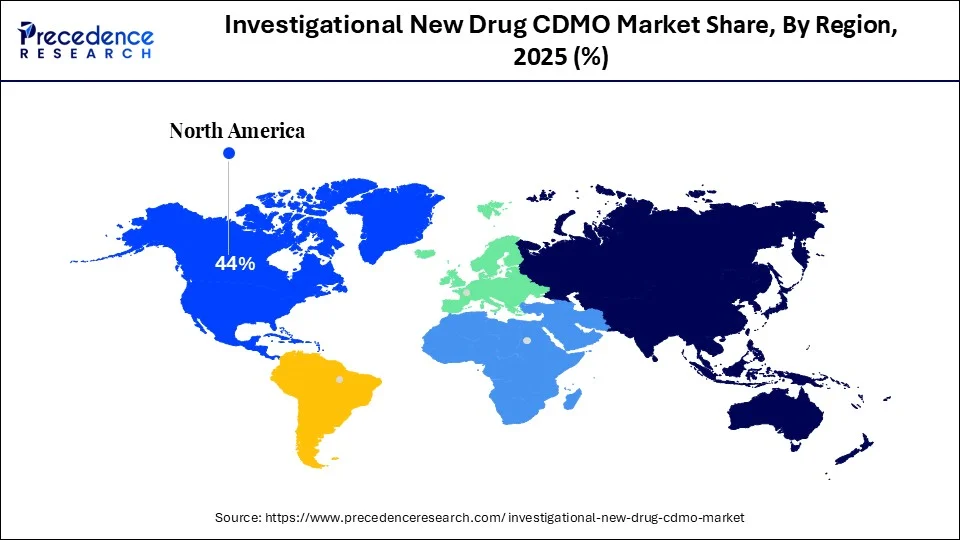

- North America dominated the global market with the largest revenue share of 44% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2035.

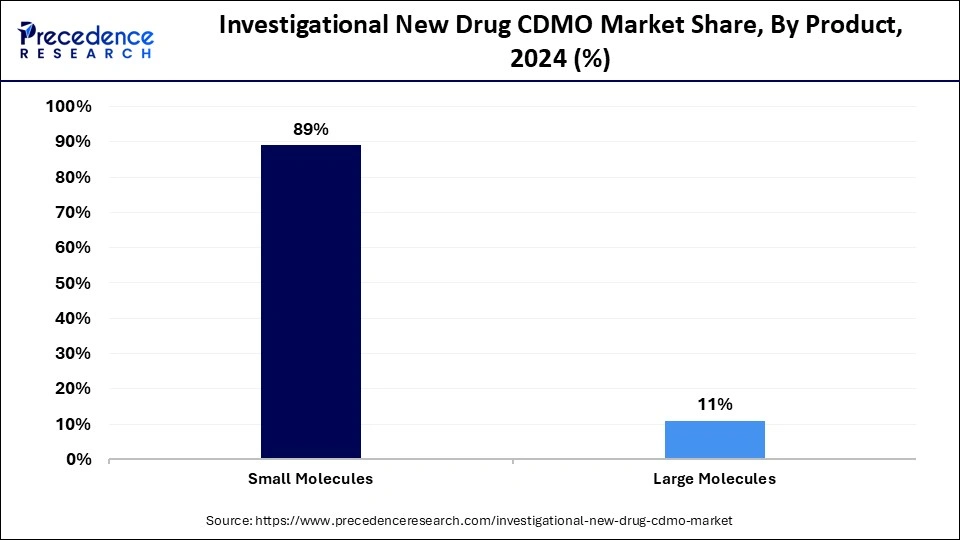

- By product, the small molecules segment captured the biggest revenue share of 89% in 2025.

- By product, the large molecules segment is expected to expand at the fastest CAGR over the projected period.

- By service, the contract development segment captured the highest market share in 2025.

- By service, the contract manufacturing segment is expected to expand at a notable CAGR during the forecast period.

- By end-user, the pharmaceutical companies segment held the biggest market share in 2025.

- By end-user, the biotech companies segment is expected to grow at a remarkable CAGR between 2026 and 2035.

Market Overview

The investigational new drug CDMO market encompasses organizations that provide contract development and manufacturing services to either drugs or biopharma companies to prepare and submit IND applications to regulatory agencies. Services provided by CDMOs typically include preclinical research, formulation development, analytical testing, and the manufacturing of clinical trial materials. CDMOs are essential for providing an accelerating development of early-stage drug development by offering specialized knowledge, regulatory expertise, and developable infrastructure. The evolution of complex IND requirements opens new avenues for CDMOs within the drug development lifecycle. The rising drug development pipeline, collaborations between drug developers and CDMOs, and rising demand for personalized drugs are contributing to the growth of the market.

Impact of Artificial Intelligence on the Investigational New Drug CDMO Market

Artificial Intelligencehas propelled forward many of the capabilities of the investigational new drug CDMO market. The adoption of AI is improving the efficiency, accuracy, and creativity of many essential components of drug development and production. AI-based automation and predictive analysis are also optimizing the production of sterile injectables while mitigating the potential for contamination and documenting product quality consistency.

In addition to finding scheduling efficiencies in batch production processes, as well as monitoring in-process sample analyzers, AI tools have advanced inventory management practices, enabling better control of lead time and interruptions in the supply chain. Some of the new technologies and processes implemented with AI include the use of digital twins to model production parameters virtually and generative AI to predict the need for a formulation of medicine at a faster pace than traditional approaches. Additionally, documentation for regulatory compliance has become digitally automated with AI using natural language processing.

What are the Key Trends in the Investigational New Drug CDMO Market?

- Increasing Biopharmaceutical R&D: Rising investments in biopharmaceutical research are resulting in ever-higher demand for IND-support services because companies want to bring innovative therapies to clinical trials faster and within an efficient framework.

- Increasing Complexity of Drug Molecules: The growing complexity of biologics and the development of personalized medicines demands specific types of development and manufacturing expertise. This is compelling pharmaceutical companies to partner with CDMOs that can offer tailored IND-enabling support.

- Regulatory Compliance and Guidance: CDMO staff has specialized and deep regulatory knowledge and is knowledgeable about IND application requirements. As clients need and seek IND submission strategies that are compliant with an evolving compliance environment, these relationships can assist with developing compliance strategies, minimizing the risk, and reducing the chances of delays or rejections.

- Rising Orphan Drug Approval & Fast-Track Designations: Rising approvals for orphan drugs and fast-track programs have increased the expected speed and access to developing and bringing drugs to market. Drug developers are relying on CDMOs to alleviate their need to go through rapid IND submissions with compliance.

Market scope

| Report Coverage | Details |

| Market Size by 2035 | USD 10.90 Billion |

| Market Size in 2025 | USD 5.61 Billion |

| Market Size in 2026 | USD 6 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.87% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Service, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Clinical Trials

The increase in the number of clinical trials worldwide is one of the major factors driving the growth of the investigational new drug CDMO market. ClinicalTrials.gov currently lists 539,598 studies with locations in all 50 States and in 229 countries and territories. There is an emerging trend as the U.S. alone has reported more than 158,321 (29%) clinical trials in May 2025. In short, the expansions of complex therapies, including mRNA vaccines and monoclonal antibodies, which require very specialized manufacturing capabilities, can lead to an increase in clinical trials. Pharmaceutical manufacturers are outsourcing their drug development activities to CDMOs due to the complexity of manufacturing. Outsourcing manufacturing to CDMOs enables pharmaceutical companies to focus on core competencies and reduce manufacturing costs. CDMOs have well-established facilities, equipment, and expertise to produce clinical materials, significantly shortening the timeline for certified good manufacturing practice compliance and use of resources.

Restraint

Regulatory Challenges

Regulatory complexities are among the major factors limiting the growth of the investigational new drug CDMO market. The path from nonclinical stage research to an investigational new drug (IND) approval is often quite complicated and is covered by a regulatory overlay of FDA, EMA, and national agency rules and regulations. CDMOs must ensure compliance with Good Manufacturing Practices (GMP), Good Clinical Practices (GCP), and Good Laboratory Practices (GLP), which require exhaustive documentation, continual audits, validated processes, and quality control systems.

- In 2025, many CDMOs were confronted with operational delays as the FDA increased scrutiny over drug development data integrity and drug contamination, especially in the context of biologics and gene therapy manufacturing. Regulatory compliance requirements are a burden, especially to small and mid-sized CDMOs that do not have the same internal compliance infrastructure as larger firms. The more onerous regulations become, particularly with respect to novel therapies such as mRNA and CAR-T therapies, there is a risk that the costs and complexities of maintaining compliance may hinder innovation by slowing drug development pipelines.

Opportunity

Biotech Innovation and Emerging Markets

There are exciting opportunities for the investigational new drug CDMO industry thanks to the emergence of new markets and increased biotech innovation globally. Countries such as Brazil, South Korea, and Singapore are continuing to enhance their pharmaceutical infrastructure and linkages to draw multinational collaboration. South Korea has shifted its focus on biotechnology, opening new avenues for CDMOs. For instance, In March 2025, the government announced plans to increase the country's biotechnology output nearly fivefold, from USD 43 billion in 2020 to USD 149 billion by 2035. There is also rising demand for gene therapy, RNA-based therapeutics, and advanced personalized medicine, creating the need for CDMO services with highly specialized capabilities.

How Small Molecules Segment Dominated the Investigational New Drug CDMO Market in 2025?

The small molecules segment dominated the market with the largest share in 2025. This is mainly due to their essential role in drug discovery and development processes. Small molecules are relatively easier to manufacture, are well characterized in terms of chemistry, and generally demonstrate predictable pharmacokinetics. CDMOs, by and large, have the infrastructure and previous experience to manage small molecule projects, which gives confidence to pharmaceutical firms when they want to commit to an outsourcing partner. Their ability, relative to biopharmaceuticals, to scale up methodologies and advance through regulations demonstrates the small molecule segment dominance.

The large molecules segment is expected to expand at the fastest CAGR over the projected period due to the rising demand for biologics like monoclonal antibodies and cell-based therapies. As innovation in biopharmaceuticals continues to accelerate, CDMOs are expanding their capabilities in complex manufacturing methodologies like cell culture, purification, and cold-chain logistics. The increased focus on precision medicine and biologics development by startups and established companies alike is contributing to the growth of this segment.

Segment Insights

Service Insights

Which Service Segment Dominated the Investigational New Drug CDMO Market in 2025?

The contract development segment dominated the market by capturing a major revenue share in 2025. Contract development services play a crucial role in drug development. As pharmaceutical and biotech companies continue to invest in novel drug development, the need for contract development services is likely to rise. These services enable pharma and biotech companies to alleviate their internal R&D burdens and timelines in moving from discovery to IND submission. CDMOs represent expertise in toxicology studies, regulatory/pathways, and preparation of clinical trial material that are becoming increasingly cost-prohibitive for clients and therefore CDMOs are now indispensable partners in investigational drug development.

The contract manufacturing segment is expected to expand at a notable CAGR during the forecast period. This is due to the increasing number of therapies moving to clinical phases. Contract manufacturing services provide cost-effective, GMP-compliant manufacturing. There is a growing trend of outsourcing manufacturing among small- and mid-sized biotech firms. The rising need for specialized and flexible manufacturing capacities also fuels the segment growth.

End-user Insight

What Made Pharmaceutical Companies the Dominant Segment in 2025?

The pharmaceutical companies segment dominated the investigational new drug CDMO market in 2025 because of their existing drug development pipelines and extensive investment in outsourced services. Pharma companies often turn to CDMO partners to complete the IND process, often to access CDMO's wealth of technical knowledge and regulatory expertise. The combination of regulatory knowledge, technical expertise, and infrastructure allows pharma companies to focus on their core competencies while accessing scaling development and manufacturing processes, especially in the early phases of development.

The biotech companies segment is expected to grow at a remarkable CAGR during the projection period due to the increasing utilization of external capabilities and infrastructures to progress before filing investigational drug applications. Many biotech companies utilize limited internal assets, which makes strategic collaboration with CDMO partners crucial to advancing their pipeline candidates. It is worth noting that the strong rise of CDMO services in the biotech sector is in part due to increased venture capital funding, as well as innovation in new therapy areas such as gene therapy, oncology, and rare diseases.

Regional Insights

What is the U.S. Investigational New Drug CDMO Market Size?

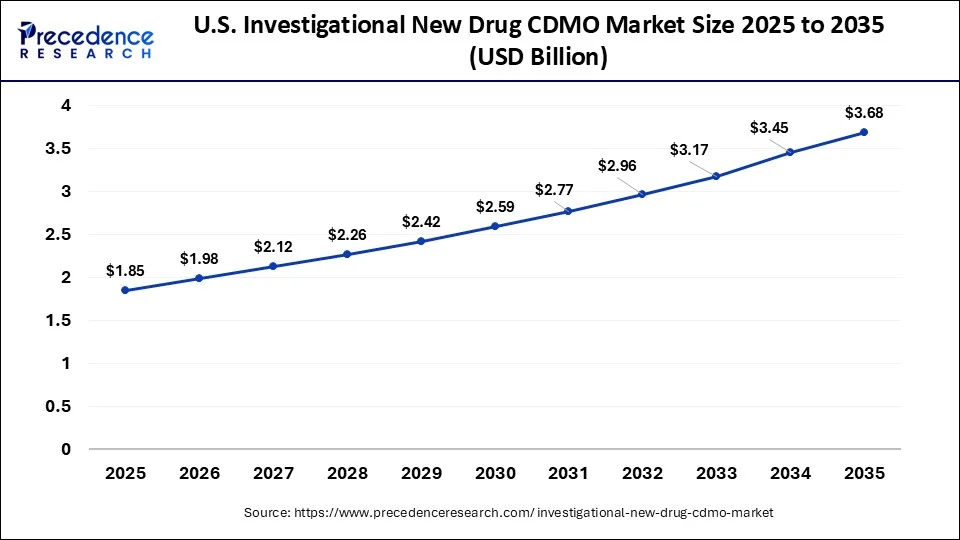

The U.S. investigational new drug CDMO market size was exhibited at USD 1.85 billion in 2025 and is projected to be worth around USD 3.68 billion by 2035, growing at a CAGR of 7.12% from 2026 to 2035.

What Factors Contributed to North America's Dominance in The Investigational New Drug CDMO Market?

North America registered dominance in the market with the largest share in 2025. This is due to its solid pharmaceutical R&D ecosystem and the presence of leading biopharmaceutical companies. The area also possesses an favorable regulatory environment, clinical trial networks, and considerable funding for drug discovery and development. With the U.S. FDA offering accelerated approval pathways, such as Fast Track and Breakthrough Therapy, more IND submissions are possible, prompting pharmaceutical and biotech companies to outsource their drug development requirements. Furthermore, the sizeable presence of CDMOs possessing greater technological capability and regulatory knowledge is attractive for IND development in the early phases.

The U.S. has emerged as a major force in the North American investigational new drug CDMO market. The U.S. is home to some of the major CDMOs, biotechnology companies, academic research institutions, and global pharmaceutical companies. As a result, the U.S. remains the country with the most IND filings and an emerging market in drug development. With many startups entering the space, the demand for new specialized CDMO services has remained substantial. The U.S. also attracts a considerable amount of venture capital and public funding into new innovative therapies, including gene and cell therapies, thus continuing to stimulate the level of demand for a full-service CDMO solution to develop and supply IND-enabling studies and manufacturing.

What Opportunities Exist in the Investigational New Drug CDMO Market Within Asia Pacific?

Asia Pacific is expected to expand at the fastest CAGR in the coming years. The availability of reasonably priced services, expanding clinical research infrastructure, and increased governmental support for pharmaceutical innovation contribute to the growth of the market. Pharmaceutical companies in the region are looking to reduce R&D costs and accelerate development timelines. This significantly creates the need for contract manufacturing and development services. Governments of various Asian countries are investing heavily in novel drug discovery and development, contributing to the growth of the market. Chinese CDMOs have expanded their capabilities within the CDMO space to offer end-to-end IND support from early clinical studies to clinical manufacturing.

What are the Major Trends in the Investigational Drug CDMO Market within Europe?

Europe is considered to be a significantly growing area. The region is home to major pharmaceutical companies. Rising R&D investments and a high demand for outsourcing services support regional market growth. Many CDMOs in the region are expanding their services in Europe, particularly for biologics, cell & gene therapies, and personalized medicine. Additionally, collaborations between academia and CDMOs to foster research and innovation create opportunities in the market.

Germany is leading the charge. Germany is a pharmaceutical manufacturing powerhouse that combines scientific excellence with industrial prowess, boasting the ability to offer early-stage development services from many CDMO participants. With a strong emphasis on adhering to high quality and regulatory standards, Germany attracts clients from all over the globe. Government support, an active scene in biotech, and far-reaching and equipped research campuses enable overall IND drug development outsourcing power and strength throughout Germany.

What are the Advancements in the Investigational New Drug CDMO Market in Latin America?

Latin America is witnessing substantial growth and is expected to keep growing. This growth is driven by pharmaceutical and biotech firms seeking greater agility, reduced costs, and improved operational efficiency. The region has also experienced a surge in pharmaceutical Research and Development activities, due to healthcare needs, demographic shifts, and supportive government initiatives that help in promoting local drug manufacturing. Brazil, Mexico, and Colombia are leading players in the region.

Brazil Investigational New Drug CDMO Market Trends: The country's market is driven by the increasing demand for outsourced manufacturing, expertise, and cost-effective solutions. The increased complexity of pharmaceutical molecules, growing biologics pipelines, as well as the rising demand for personalized medicine are pushing the market further.

What are the Key Trends in the Investigational New Drug CDMO Market in the Middle East and Africa?

The Middle East and Africa region is expected to grow at a steady rate in the upcoming years. This growth is due to increasing investments and collaborations, which foster market growth. Countries like the UAE and South Africa are leading players in the region. Government organizations are also supporting the development of new drugs through initiatives and funding. Moreover, the rising prevalence of chronic disorders and advancements are pushing innovation and market adoption.

UAE Investigational New Drug CDMO Market Trends: Academic institutions and pharma companies in the country are increasingly adopting AI technologies for new drug discovery. The UAE government is also encouraging more organizations to develop and use AI tools for drug discovery. Adoption of advanced technologies, including digital regulatory platforms and flexible manufacturing systems, is improving efficiency, scalability, and regulatory compliance.

Additionally, the expansion of biologics and complex therapeutics in the UAE is fueling demand for high-quality IND support services for both domestic and export.

Major Key Players in Investigational New Drug CDMO Market

Catalent, Inc. is a leading global CDMO specializing in drug development, clinical supply, and manufacturing services with a strong focus on supporting investigational new drug (IND) programs across multiple dosage forms and therapeutic areas.

Catalent operates an extensive global network of development and manufacturing facilities across North America, Europe, and Asia. The company supports pharmaceutical, biotechnology, and emerging biotech clients from early-stage development through clinical trials and commercialization, making it a preferred partner for IND-enabling and early clinical programs.

Core Offerings

- Preclinical & IND-Enabling Services – Integrated formulation development, analytical testing, and regulatory support to accelerate IND submissions.

- Clinical Trial Manufacturing– Small- and mid-scale production of oral solid, sterile injectables, biologics, and advanced delivery systems.

- Clinical Supply Services – Packaging, labeling, storage, and global distribution of investigational products.

- Drug Delivery Technologies– Proprietary platforms for bioavailability enhancement and modified-release formulations.

- Cell & Gene Therapy Development – Specialized services for early-stage CGT programs supporting IND filings.

Competitive Differentiators

- End-to-end support from preclinical development through clinical supply

- Strong expertise across multiple dosage forms and delivery technologies

- Integrated regulatory and CMC support for IND submissions

- Global footprint enabling multinational clinical trials

- Scalable development platforms supporting rapid program progression

Recent Breakthroughs

- Partnerships with emerging biotech companies for early-stage and IND-enabling development.

- Collaborations with pharmaceutical firms seeking specialized small-molecule expertise.

Recent News

- October 2025 – New Corporate Brand Launch: Catalent unveiled a refreshed global corporate brand to reflect its strategic emphasis on elevated customer service and partnering with biopharma innovators. This rebranding positions the company to reinforce its role as a full-service CDMO partner to the industry.

- June 2025 – Manufacturing Partnership Milestone: Catalent completed a successful upstream process transfer for GenSight Biologics' gene therapy candidate, supporting clinical development and future regulatory filings.

Lonza Group AG is a global CDMO leader offering comprehensive IND-enabling development and manufacturing services, particularly strong in biologics, small molecules, and advanced therapeutic modalities.

Lonza operates a broad global manufacturing and development network across Europe, North America, and Asia. The company supports IND programs for small biotech firms as well as large pharmaceutical companies, with a strong reputation for quality, regulatory

Core Offerings

- IND-Enabling Development Services – Process development, formulation, analytical development, and CMC documentation.

- Small Molecule Development & Manufacturing – Route scouting, API development, and early-phase clinical manufacturing.

- Biologics & Advanced Therapies – IND support for monoclonal antibodies, cell therapies, and gene therapies.

- Regulatory & Quality Support – Comprehensive regulatory strategy and documentation for global IND submissions.

- Clinical Manufacturing Services– GMP manufacturing for Phase I and Phase II clinical trials.

Competitive Differentiators

- Deep expertise in complex biologics and advanced therapeutic products

- Strong regulatory track record supporting global IND filings

- Highly integrated development-to-manufacturing model

- Advanced process development and analytics capabilities

- Flexible capacity for early-stage and fast-moving programs

Recent Collaborations

Strategic partnerships with biotech innovators developing next-generation biologics and cell therapies.

Recent News

- July 2025 – Strong CDMO 2025 Start: Lonza reported stronger-than-expected CDMO revenue in H1 2025 with high utilization in mammalian, bioconjugate, and small molecule services and ongoing customer negotiations for its Vacaville biologics facility.

Siegfried Holding AG

Siegfried Holding AG is a global CDMO focused on small molecule drug substances and drug products, with strong capabilities in supporting IND-stage development and early clinical manufacturing.

Siegfried operates development and manufacturing sites across Europe, North America, and Asia. The company serves pharmaceutical and biotechnology clients with a strong emphasis on high-quality API development and early-phase drug product manufacturing.

Core Offerings

- IND-Enabling API Development– Route development, process optimization, and analytical support for small molecules.

- Early-Phase Clinical Manufacturing – GMP production of drug substances and drug products for Phase I and II trials.

- Formulation Development– Oral solid and sterile drug product development supporting IND submissions.

- Regulatory & CMC Support – Documentation and regulatory assistance for IND filings.

- Technology Transfer & Scale-Up– Smooth transition from development to clinical manufacturing.

Competitive Differentiators

- Strong specialization in small molecule chemistry

- High-quality API development with regulatory compliance focus

- Flexible and customer-centric project execution

- Integrated drug substance and drug product capabilities

- Strong European manufacturing base with global reach

Recent Collaborations

Partnerships with emerging biotech companies for early-stage and IND-enabling development.

Recent News

August 2025 – Profitable Growth & Capacity Expansion: Siegfried reported continued profitable growth under its EVOLVE+ strategic plan, with investments in ophthalmic drug production and fill-finish capacity expansions planned for 2026–2027, reflecting continued expansion in development and manufacturing services.

Other Major Key Players

- Patheon Inc.

- Recipharm AB

- Covance

- IQVIA Holdings Inc.

- Cambrex Corporation

- Charles River Laboratories International, Inc.

- Syneous Health

Recent Developments

- In March 2025, Shilpa Medicare has launched a new full service ‘hybrid' CDMO, which enable Shilpa to serve both small and large molecules customers as well as peptides, with oncology as a particular therapeutic specialty. This dual approach enables pharmaceutical companies to leverage Shilpa's extensive expertise in oncology without the direct risks and lengthy timelines associated with development. (Source: https://www.contractpharma.com)

- In October 2024, Pharmaceutics International, Inc. (Pii), a trusted provider of pharmaceutical development and manufacturing services, today announced the launch of its pioneering Accelevate Early Development Platform. This cutting-edge platform is designed to accelerate the preparation of Investigational New Drug (IND) submissions, offering small to mid-sized pharmaceutical companies the ability to reach IND readiness in 100 days for aseptic products. (Source: https://www.businesswire.com)

Segments Covered in the Report

By Product

- Small Molecules

- Large Molecules

By Service

- Contract Development

- Small Molecule

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Pathology and Safety Pharmacology Studies

- Drug Substance Synthetic Route Development

- Drug Substance Process Development

- Form Selection Crystallization Process Development

- Scale-up of Drug Substance

- Pre Formulation

- Preclinical Formulation Selection

- First In Man Formulation/ Process Development

- Analytical Method Development / Validation

- Release Testing of Drug Substance and Drug Product

- Work Up Purification Steps

- Telescoping & Process Refining

- Initial Optimization

- Formal Stability of Drug Substance and Drug Product

- Large Molecule

- Cell Line Development

- Process Development

- Upstream

- Microbial

- Mammalian

- Downstream

- MABs

- Recombinant Proteins

- Others

- Upstream

- Small Molecule

- Contract Manufacturing

- Small Molecule

- Oral Solids

- Liquid and Semi-solids

- Injectables

- Others

- Large Molecule

- MABs

- Recombinant Proteins

- Others

- Small Molecule

By End-use

- Pharmaceutical Companies

- Biotech Companies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting