What is the Ionic Liquids Market Size?

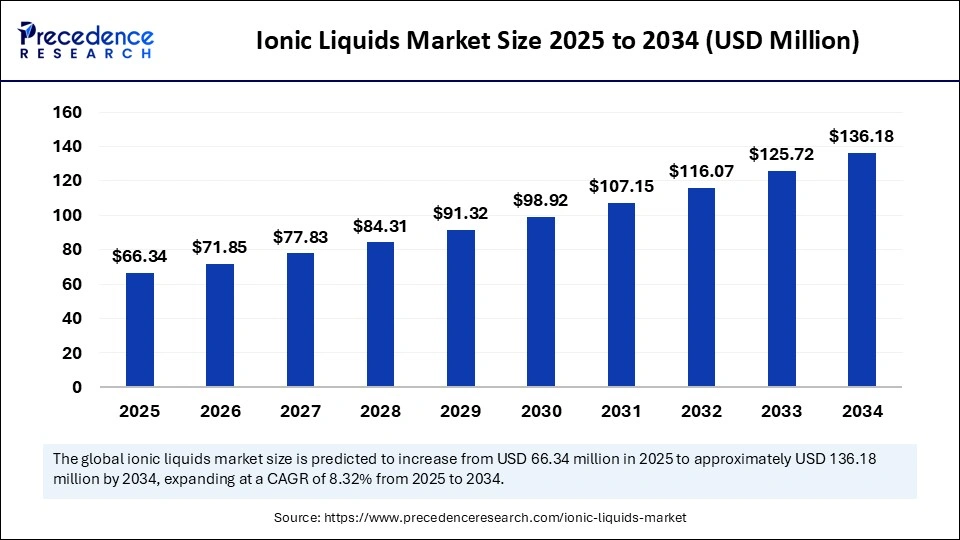

The global ionic liquids market size accounted for USD 66.34 million in 2025 and is predicted to increase from USD 71.85 million in 2026 to approximately USD 136.18 million by 2034, expanding at a CAGR of 8.32% from 2025 to 2034. Market growth is driven by the increasing adoption of ionic liquids as sustainable, high-performance electrolytes for energy storage, chemical processing, and environmental applications.

Market Highlights

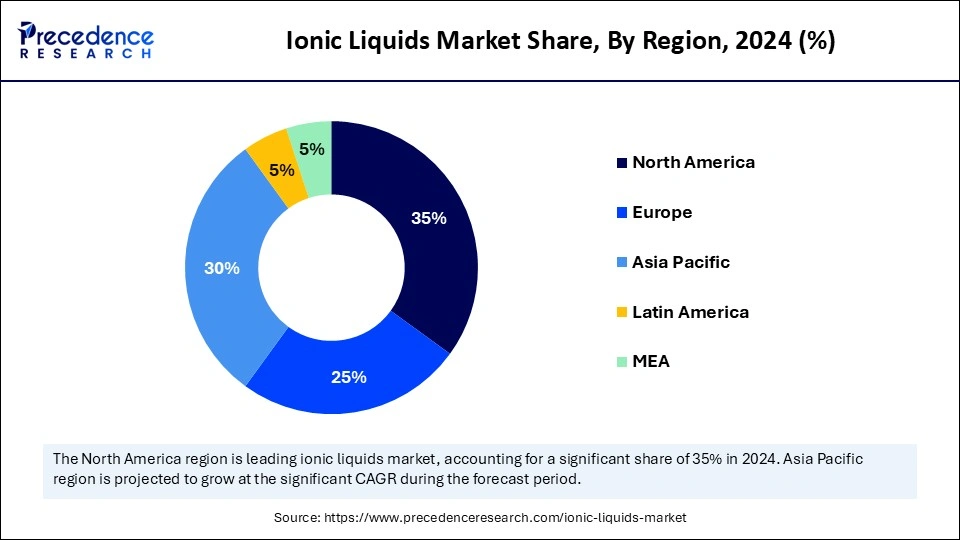

- North America segment held a dominant presence in the market in 2024, accounting for an estimated 35% market share.

- The Asia Pacific segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the room temperature ionic liquids (RTILs) segment accounted for a considerable \ market share in 2024, holding a share of about 55%.

- By type, the high-temperature ionic liquids segment is projected to experience the highest CAGR between 2025 and 2034.

- By application, the chemical synthesis & catalysis segment contributed the highest market share of 28% in 2024.

- By application, the gas separation & CO‚ capture segment is growing at a notable CAGR from 2025 to 2034.

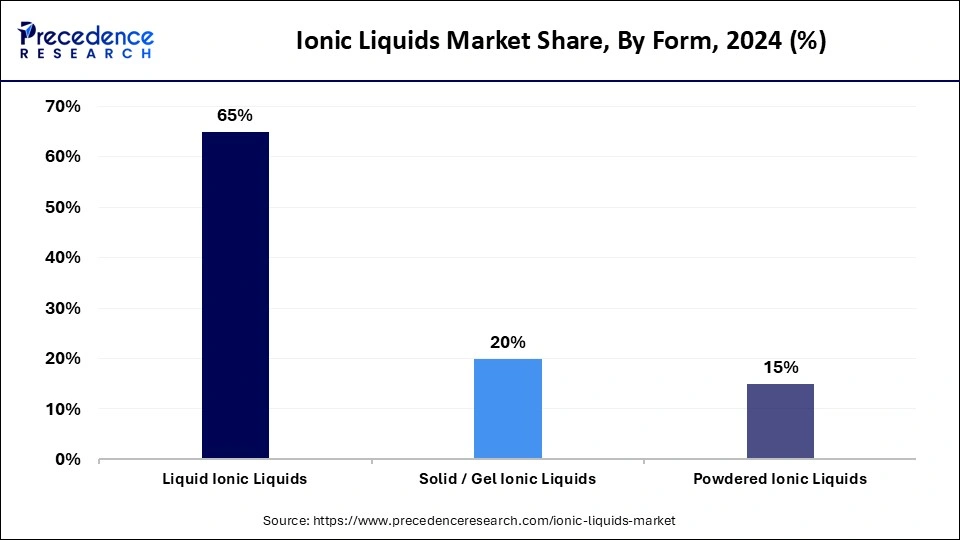

- By form, the liquid ionic liquids segment held the major market share of 65% in 2024.

- By form, the solid / gel ionic liquids segment is anticipated to grow with the highest CAGR from 2025 to 2034.

- By end-user industry, the chemicals & petrochemicals segment generate the biggest market share of 30% in 2024.

- By end-user industry, the environmental & waste treatment segment is projected to expand rapidly between 2024 and 2034.

Market Overview

What Are Ionic Liquids?

The need to develop sustainable energy solutions that are being encouraged across the world is a leading force behind the high demand for ionic liquids. Governments and other international bodies are investing more in novel materials that improve energy efficiency and reduce environmental impact. The policy of Vision 2020 by the U.S. Department of Energy which points out the applications of ILs in achieving a sustainable chemical process.

Thereby cutting energy spending by as much as possible, and decreasing the amount of hazardous waste. Ionic liquids are salts that exist in the liquid state at room temperature, and have some interesting characteristics which include low volatility, high thermal stability, and dissolve a diverse array of substances. Furthermore, these properties make them ideal candidates for use in energy storage systems, such as batteries and supercapacitors, leading to high demand in the ionic liquids market.

Key Technological Changes in the Ionic Liquids Market

Artificial intelligence (AI) is transforming the ionic liquids industry, enabling more intelligent, faster, and more sustainable innovation in research, manufacturing, and application development. Companies are applying AI-based molecular modeling. This predicts the physicochemical properties of ionic liquids, enabling the design of new compounds. Furthermore, the technology enables chemical organizations to make informed choices, which eventually makes AI a pillar of the next stage of chemical industry development.

Ionic Liquids MarketGrowth Factors

- Rising Demand for Safer Electrolytes in Batteries: Growing concerns over flammability in lithium-ion batteries are propelling the adoption of non-volatile ionic liquids as safer alternatives.

- Driving Green Chemical Processes: The push for sustainable and energy-efficient chemical manufacturing is boosting research into ionic liquids as environmentally friendly solvents.

- Advancements in COâ‚‚ Capture Technologies: Innovations in carbon capture applications are fuelling interest in ionic liquids for industrial emission reduction and climate change mitigation.

- Growing Adoption in Pharmaceuticals and Biotechnology: Expanding use of ionic liquids as solvents and catalysts is driving new applications in drug formulation and bio-processing.

- Propelling Industrial Catalysis Efficiency: The ability of ionic liquids to improve reaction selectivity and reduce energy consumption is enhancing their uptake in chemical industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 66.34 Billion |

| Market Size in 2026 | USD 71.85 Billion |

| Market Size by 2034 | USD 136.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Form, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global Trade Dynamics and Emerging Applications of Ionic Liquids in Speciality Industries

- Germany ranks second in global ionic liquid exports, with an estimated export value of USD 25–30 million. The nation's export portfolio includes speciality coatings, performance additives, and advanced intermediates, reflecting its strong industrial base and technological expertise.

- India is a significant importer of speciality and fine chemicals, including ionic liquids. In FY25 (year-to-date), organic chemical imports reached‚ 128,470 crore (~USD 15.03 billion), while inorganic chemical imports stood at 51,034 crore (~USD 5.97 billion). This underscores India's growing demand for advanced chemical solutions.

- China is a significant exporter of organic chemicals, including ionic liquids. In 2023, the value of exports for commodity group 29 "Organic chemicals" from China totalled $77 billion, with a notable portion attributed to ionic liquids.

- The U.S. is a major exporter of organic chemicals, including ionic liquids. In 2023, the U.S. exported between $32 to 50 billion worth of organic chemicals, with a significant portion attributed to ionic liquids.

- China, the world's largest electric vehicle battery producer, contributed to over 30% growth in global EV battery demand in 2024 (IEA). This surge directly increased exports of electrolyte precursors and ionic liquid intermediates, as Chinese producers like Solvionic Asia and IoLiTec China scaled shipments to Japan, Korea, and Europe for use in solid-state and high-voltage lithium batteries.

- India's imports of speciality ionic compounds used in energy storage reached new highs in FY 2025, aligning with its US$3.06 billion import bill for lithium-ion cells (IISD). The CSIR-CECRI and Tata Chemicals Advanced Materials Division have launched pilot projects to synthesise ionic liquids domestically for next-generation sodium-ion and lithium-sulfur batteries.

- The European Union, through ECHA and Cefic, reported that imports of high-purity ionic liquids from North America and East Asia rose by 14% in 2024, driven by demand from European gigafactories focusing on cobalt-free cathode chemistries and next-gen electrolyte formulations.

- Tesla's US $4.3 billion battery supply deal with LG Energy Solution (Reuters 2025) includes sourcing ionic liquid-modified electrolytes for enhanced performance in next-gen 4680 cells, representing one of the largest industrial integrations of ionic liquids in EV manufacturing to date.

- China has launched the world's first 1,000-ton ionic liquid cellulose fibre plant, setting a new benchmark for green industrialisation and contributing significantly to achieving China's dual carbon goals.

Ionic Liquids MarketSegment Insights

Type Insights

The room temperature ionic liquids segment dominated the ionic liquids market in 2024, accounting for an estimated 55% market share, due to their superior characteristics of thermal stability, low volatility, and extensive electrochemical range. Furthermore, the current developments in RTIL formulation are keeping the use of the formulations on the rise to secure future growth and domination of the market.

The solid ionic liquids / polymeric ILs segment is expected to grow at the fastest rate in the coming years, accounting for 10% of market share, as they possess better mechanical strength, processability, and stability than the traditional RTILs. Moreover, the ongoing research and development in the optimisation and study of PILs, their applications in higher-level applications are projected to increase, thus leading to their fast growth in the market.

Application Insights

The chemical synthesis catalysis segment accounted for the largest revenue share in the ionic liquids market in 2024, with about 28%. Due to their characteristic behaviour of being thermally stable, less volatile, and capable of dissolving the widest possible range of materials.

Research in the recent past has also helped to cement the use of ionic liquids in catalysis. In 2024, scientists created acidic metal-based functionalized ionic liquids ([DA-2PS][XCly]2). They are effective catalysts in the production of bio-based polyethene furanoate (PEF) polyester out of furan-2,5-dicarboxylic acid and ethylene glycol. Furthermore, the catalysts were shown to be thermally stable and had two acidic active sites, leading to improved selectivity and reaction efficiency, thus further boosting the segment.

The gas separation & CO2 capture segment is expected to grow at the fastest CAGR in the coming years, accounting for 15% market share. Owing to their low vapour pressure and suitable modification of the molecular structure to meet particular needs. Additionally, the rising popularity and investment in using ionic liquids in environmental applications place this segment as an important technology in solving global carbon emission problems.

Form Insights

The liquid ionic liquids segment dominated the ionic liquids market in 2024, accounting for 65% of the market share. Due to their properties, such as low volatility, high thermal stability, and high solvating behaviour. They find application in chemical synthesis, catalysis, and energy storage systems.

The IUPAC, 2024 report states that the application of ILs in industry processes has increased considerably due to their application as volatile organic compounds and efficiency in reactions. Furthermore, the liquid ILs remain versatile and sustainable, making them a subject of continuous uptake in pharmaceutical, materials science, and next-generation chemical applications.

The solid/gel ionic liquids segment is expected to grow at the fastest rate in the coming years, accounting for an estimated 20% market share. Owing to the strength and stability of polymers, to facilitate safer, high-performance applications in lithium-ion batteries and electrochemical capacitors

Fraunhofer Society 2024 also found some progress in polymeric ILs for the solid-state energy devices, including better ionic conductivity and mechanical integrity. Moreover, the solid ILs are also finding application in sensors and flexible electronics, further facilitating the segment growth.

End User Industry Insights

The chemical & petrochemicals segment held the largest revenue share in the ionic liquids market in 2024, accounting for 30% of the market share, as they utilise a large quantity of ionic liquids. Furthermore, the increasing industrial use of ionic liquids in chemical manufacturing processes to meet the higher environmental standards in North America is further propelling the market in the coming years.

The waste treatment and environmental segment is expected to grow at the highest 7% CAGR during the coming years in the ionic liquids market. Owing to the mounting pressure on regulation to stop industrial pollution and refine the waste remediation techniques. In 2024, the IEA identified ionic liquids as a potential substance in future carbon capture technology with a higher CO2 absorption rate and less energy consumption than conventional amine-based processes.

Ionic liquids have also demonstrated high efficiency in carbon capture, wastewater treatment and heavy metals recovery, and are much safer and more efficient alternatives to traditional solvents. These factors put the environmental and waste treating segment as one of the most active drivers of future ionic liquids market growth.

Ionic Liquids MarketRegional Insights

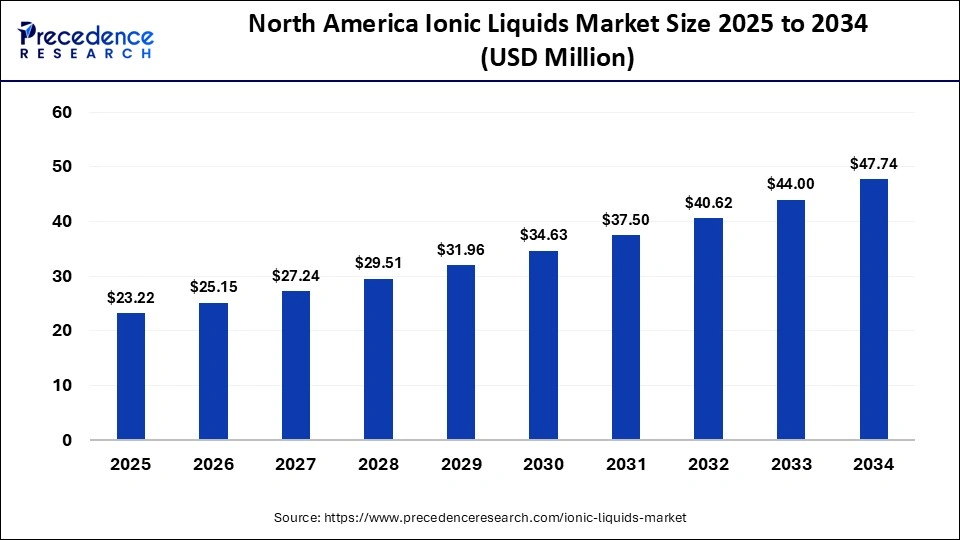

The North America ionic liquids market size is estimated at USD 23.22 million in 2025 and is projected to reach approximately USD $47.74 million by 2034, with a 8.35% CAGR from 2025 to 2034.

Why Is North America at the Forefront of the Ionic Liquids Market?

North America led the ionic liquids market, capturing the largest revenue share in 2024, driven by its powerful industrial sector, a developed R&D ecosystem, and favorable environmental regulations. Ionic liquids innovation in the United States continues to be a global centre, with groups like the NSF and the ACS.

They are providing financial backing to numerous large-scale projects aimed at creating bio-based and task-specific ionic liquids. Additionally, the market adoption has been made firmer by regulatory support from the U.S EPA, which still encourages the use of green solvents as part of its Safer Choice Program.

The U.S. ionic liquids market size has grown strongly in recent years. It will grow from USD 17.42 million in 2025 to USD 36.04 million in 2034, expanding at a compound annual growth rate (CAGR) of 8.40% between 2025 and 2034.

U.S. Leads North America's Ionic Liquids Market

The United States continues to be the powerhouse in the innovation and commercialisation of ionic liquids in North America. Joint ventures involving BASF Corporation, Honeywell UOP and Chevron Phillips Chemical in ionic liquids-based alkylation reactions have escalated to commercial-scale usage in refineries in the United States. The strong network of R&D taking place in the country, supported by the U.S Department of Energy (DOE) speeding up the developments in ionic liquids.

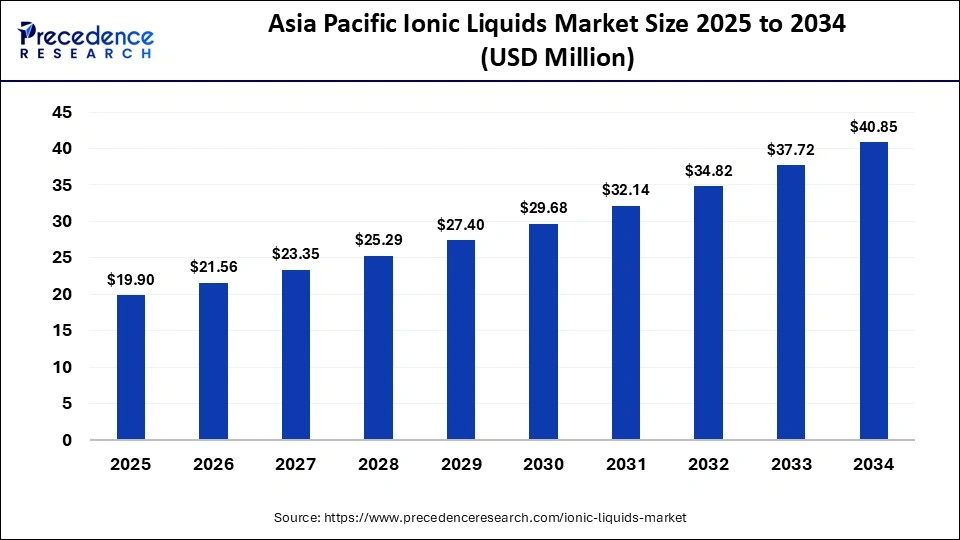

The Asia Pacific ionic liquids market size is expected to be worth USD 40.85 million by 2034, increasing from USD 19.90 million by 2025, growing at a CAGR of 8.35% from 2025 to 2034.

Why Is Asia Pacific Set to Grow at the Fastest Rate in the Ionic Liquids Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the rapid industrialisation, increasing energy requirements and increased environmental awareness. China, India, Japan and South Korea are working hard to introduce ionic liquids in next-generation battery production, metal extraction and in wastewater treatment systems.

- In 2024, a study published by CPCIF noted a year-over-year growth in industry usage of ionic liquids to store energy, largely due to alliances between CATL, BYD, and Ionic Materials. Additionally, the growing foreign investments in high-technology materials and circular economy projects will ensure the continued high growth rates in the next decade.

China Surges Ahead in Asia Pacific as Ionic Liquid Applications Accelerate Industrial Transformation

China is the most rapidly developing market of ionic liquids in the Asia Pacific region, which is motivated by the rapid progress of its industrial convergence and vigorously pursued sustainability objectives.The major domestic companies, including BYD, CATL and Jinkai Chemical, have introduced ionic liquid electrolytes in the operation of next-generation solid-state and sodium-ion batteries to provide stability and safety. On the other hand, the Chinese national framework of Made in Green 2025 is boosting the R&D of sustainable solvents and recycling systems, making China one of the global leaders in the application and innovation of ionic liquids.

The Europe ionic liquids market size is valued at USD 16.59 million in 2025 and is projected to reach approximately USD 34.05 million by 2034, with a 8.36% CAGR from 2025 to 2034.

Why Is Europe Showing Notable Growth in the Ionic Liquids Market?

The Europe region is expected to hold a notable revenue share of the market due to its strong environmental sustainability and materials innovation. Cefic (2024) announced more applications of ionic liquids in recycling and carbon capture initiatives, especially in Germany, France, and the Netherlands. Additionally, the strict REACH regulations promoted the use of non-volatile, safer solvents in industry and laboratories.

Germany Powers Europe's Ionic Liquids Market Momentum Through Green Chemistry and Carbon-Neutral R&D

Germany is becoming the most vibrant growth contributor in the ionic liquids industry in Europe. The chemical environment in Germany, which is based on BASF, Evonik Industries and Clariant, is quickly developing the use of ionic liquids in catalysis, separation technologies, and battery electrolytes. The emphasis on carbon neutrality by 2045 and the focus on green chemistry R&D are expected to increase the power of Germany in the region in the next few years.

Ionic Liquids Market Value Chain

The production of ionic liquids begins with sourcing high-purity cations and anions, organic salts, and speciality precursors required for IL synthesis.

Key Players: BASF, Evonik Industries, Merck KGaA, Solvionic, Proionic GmbH

Raw chemicals are processed into specific ionic liquid formulations, customised for applications in batteries, electrochemistry, catalysis, and solvents.

Key Players: Iolitec Ionic Liquids Technologies, RoCo Global, Solvionic, Kanto Chemical, Syensqo

Ionic liquids undergo purification, filtration, and characterisation to ensure high purity, thermal stability, and compatibility for end-use applications.

Key Players: Merck KGaA, BASF, Strem Chemicals, Johnson Matthey, Ilika Technologies

Purified ILs are integrated into target applications such as electrolytes for lithium-ion batteries, supercapacitors, catalysts for chemical reactions, or COâ‚‚ capture systems.

Key Players: LG Chem, Panasonic Energy, Tesla (for battery electrolytes), Arkema, Solvay

Finished ionic liquids are supplied to energy storage manufacturers, chemical process industries, pharmaceuticals, and research institutions worldwide.

Key Players: Solvionic, Proionic, RoCo Global, BASF, Merck KGaA

Used ionic liquids, especially from battery or industrial processes, are recovered and recycled to reduce environmental impact and lower production costs.

Key Players: Johnson Matthey, Umicore, BASF, Shell

Ionic Liquids Market Companies

BASF SE is one of the leading producers and developers of ionic liquids, focusing on their use as green solvents, catalysts, and electrolytes. The company’s ionic liquid technologies enhance process efficiency and sustainability across chemical, energy storage, and materials industries. BASF’s strong R&D capabilities support the advancement of next-generation ionic liquids for cleaner and more efficient industrial applications.

Beijing Chemical Works manufactures a wide range of ionic liquids and specialty chemicals for research and industrial use. The company supplies customized ionic compounds used in catalysis, electrochemistry, and extraction processes.

China Ionic Liquid Co. specializes in the development and production of task-specific ionic liquids for applications in energy storage, chemical synthesis, and environmental remediation. Its focus on scalability and quality positions it as a major supplier in the Asia-Pacific market.

Cytec Industries, now part of Solvay, produces high-performance ionic liquids used as solvents, catalysts, and extractants. Its technology is widely used in metal extraction, electrochemical systems, and advanced materials.

As part of Solvay’s specialty polymer division, Cytec Solvents develops ionic liquid formulations tailored for high-performance applications such as energy storage, polymer processing, and catalysis.

EMD Millipore, a subsidiary of Merck KGaA, supplies research-grade ionic liquids for laboratory and analytical applications. Its portfolio supports academic and industrial research in green chemistry and electrochemistry.

IoLiTec (Ionic Liquids Technologies GmbH) is a leading European company dedicated to the research, development, and production of ionic liquids. Its extensive catalog includes ionic liquids for catalysis, battery electrolytes, and COâ‚‚ absorption. The company is known for its strong innovation in functionalized ionic liquid design and sustainability-oriented chemistry.

Iolitec focuses on advanced ionic liquid development for energy, nanotechnology, and materials processing. Its proprietary ionic liquids are used in electrochemical and catalytic processes with a focus on renewable applications.

Ionic Liquids Technologies Ltd. produces high-purity ionic liquids for chemical synthesis, separation processes, and energy storage systems. The company emphasizes environmentally friendly production and performance optimization.

Merck KGaA offers a diverse range of ionic liquids through its research chemicals division, supporting pharmaceutical, materials science, and electronics industries. Its deep expertise in chemical synthesis enables high-purity, application-specific formulations.

New Era Chemicals supplies laboratory and industrial-grade ionic liquids for catalysis, solvent systems, and nanomaterial synthesis. The company serves academic, research, and specialty manufacturing markets.

RareChem develops custom ionic liquids and fine chemicals used in electrochemistry, energy storage, and separation processes. Its focus on innovation and purity supports specialized R&D and industrial projects.

Shanghai Chengjie Chemical manufactures ionic liquids and specialty organic compounds for use in catalysis and electrochemical applications. The company provides custom synthesis and large-scale supply solutions to global clients.

Solvent Innovation specializes in the development of task-specific ionic liquids for green chemistry, extraction, and electrochemical systems. Its research-driven approach enables customized solutions for energy and catalysis industries.

Recent Developments

- In October 2025, Verde AgriTech Ltd. announced significant progress at its Minas Americas Global Alliance Project in Minas Gerais, Brazil, confirming strong ionic-adsorption behaviour across multiple exploration trenches. Ammonium-sulfate leach tests produced primary leach solutions (PLS) showcasing high concentrations of magnet rare earth elements, namely neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb), while maintaining exceptionally low thorium and uranium impurities, both at or below detection levels. These results underscore the project's potential to strategically contribute to the global supply of critical materials used in green technologies and advanced electronics. (Source: https://www.globenewswire.com)

- In September 2025, MEDRx announced that the U.S. Food and Drug Administration (FDA) had approved Bondlido, a novel lidocaine patch jointly developed with D. Western Therapeutics Institute, Inc., for the treatment of post-herpetic neuralgia (PHN) in adults. The company confirmed that preparations for the commercial launch are underway, including partner selection, with U.S. sales expected to commence in the first half of 2026. The approval highlights MEDRx's growing expertise in transdermal drug delivery and strengthens its position in the global pain management therapeutics market. (Source: https://www.drugs.com)

- In April 2025, Arkema, a leading French specialty chemical manufacturer, announced the acquisition of a 78% stake in Proionic, an Austrian start-up specializing in ionic liquid-based electrolytes for solid-state lithium-ion batteries. The acquisition enhances Arkema's materials portfolio, enabling it to support diverse battery technologies and advance next-generation energy storage innovations.(Source: https://cen.acs.org)

Ionic Liquids MarketSegments Covered in the Report

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting