Knee Osteoarthritis (OA) Injectable Treatments Market Size and Forecast 2025 to 2034

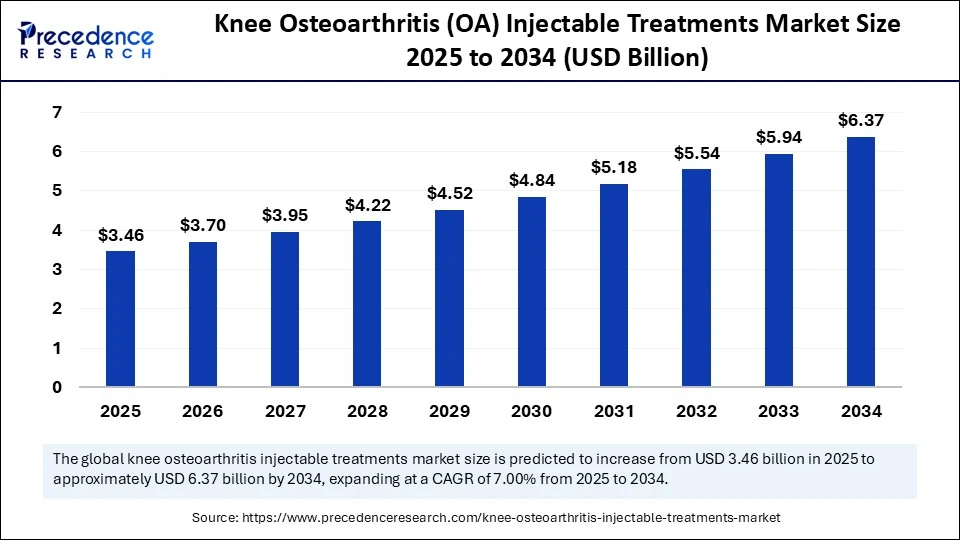

The global knee osteoarthritis (OA) injectable treatments market size accounted for USD 3.24 billion in 2024 and is predicted to increase from USD 3.46 billion in 2025 to approximately USD 6.37 billion by 2034, expanding at a CAGR of 7.00% from 2025 to 2034.The growing aging population, a rise in obesity (a risk factor for the development of knee osteoarthritis), and a preference for non-surgical pain management contribute to the growth of the market.

Knee Osteoarthritis (OA) Injectable Treatments Market Key Takeaways

- The global knee osteoarthritis (OA) injectable treatments market was valued at USD 3.24 billion in 2024.

- It is projected to reach USD 6.37 billion by 2034.

- The market is expected to grow at a CAGR of 7.00% from 2025 to 2034.

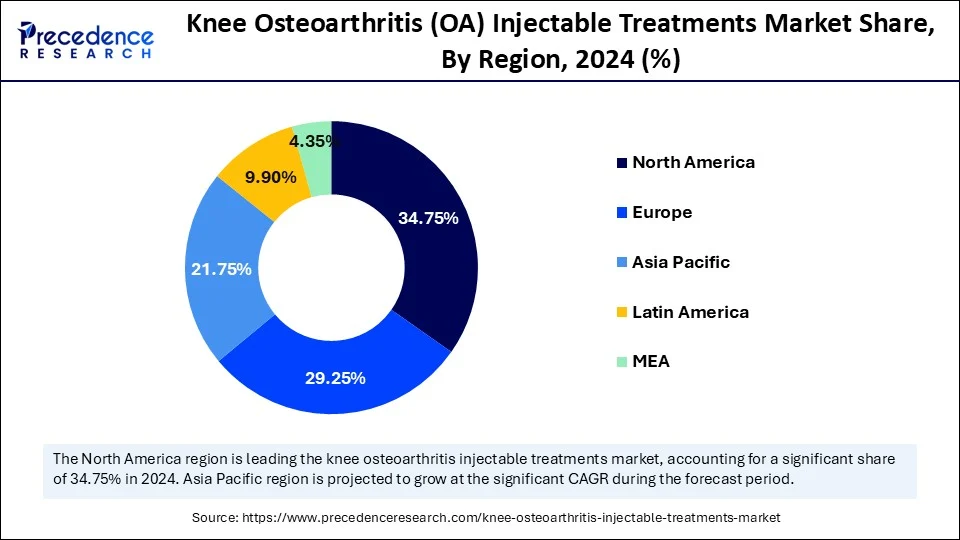

- North America led the knee osteoarthritis (OA) injectable treatments market with the highest share of 34.75% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 9.29% in the market between 2025 and 2034.

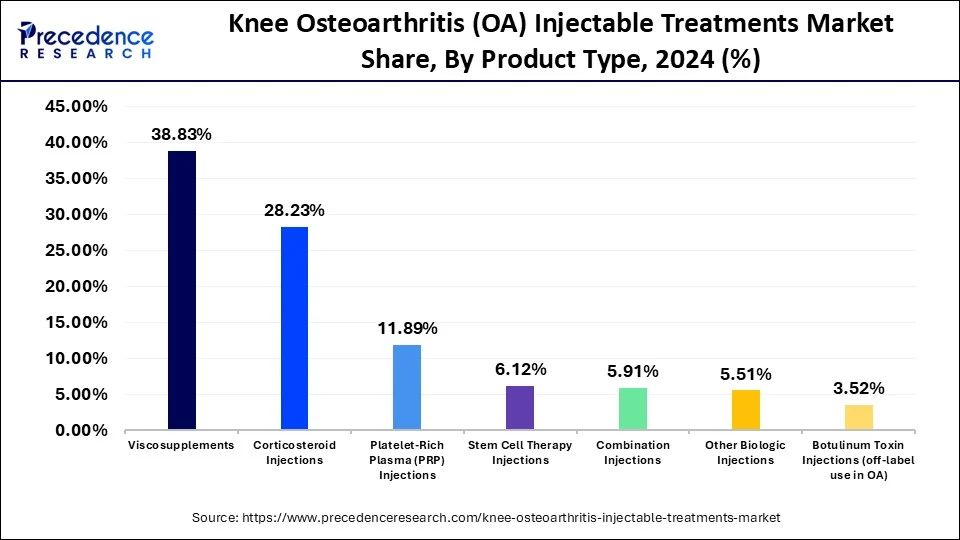

- By product type, the viscosupplements (hyaluronic acid injections) segment captured the biggest revenue share of 38.83% in 2024.

- By product type, the stem cell therapy injections segment is expected to expand at the fastest CAGR of 9.35% over the projected period.

- By mechanism of action, the lubrication (viscosupplementation) segment captured the biggest market share 45.15% in 2024.

- By mechanism of action, the regenerative (PRP, stem cells, APS) segment is expected to expand at the highest CAGR of 8.35% over the projected period.

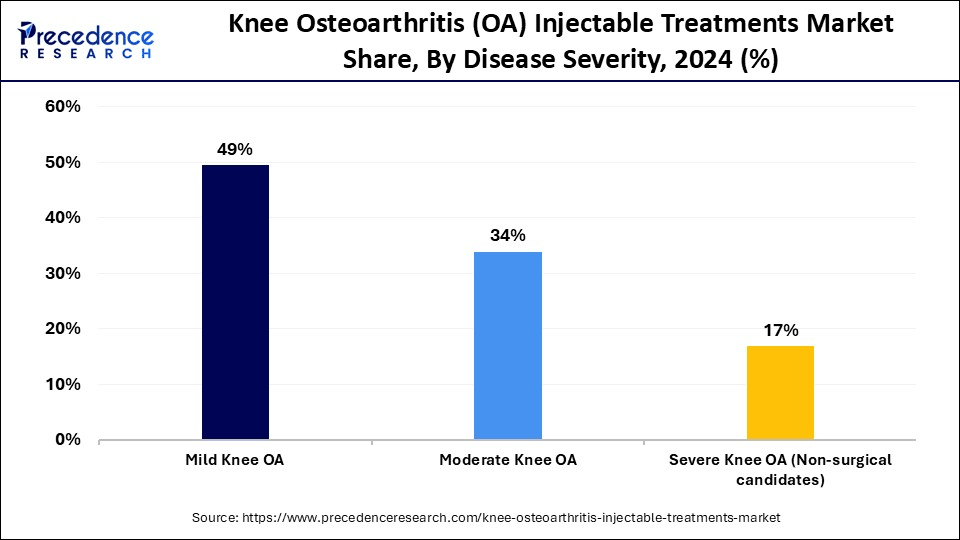

- By disease severity, the mild knee OA segment held the largest market share of 49.40% in 2024.

- By disease severity, the severe knee OA (non-surgical candidates) segment is expected to expand at a the fastest CAGR 7.30% over the projected period.

- By age group, the >60 years segment held the largest market share of 48.61% in 2024.

- By age group, the <40 Years (sports injuries, early onset OA) segment is expected to grow at the fastest CAGR of 8.15% between 2025 and 2034.

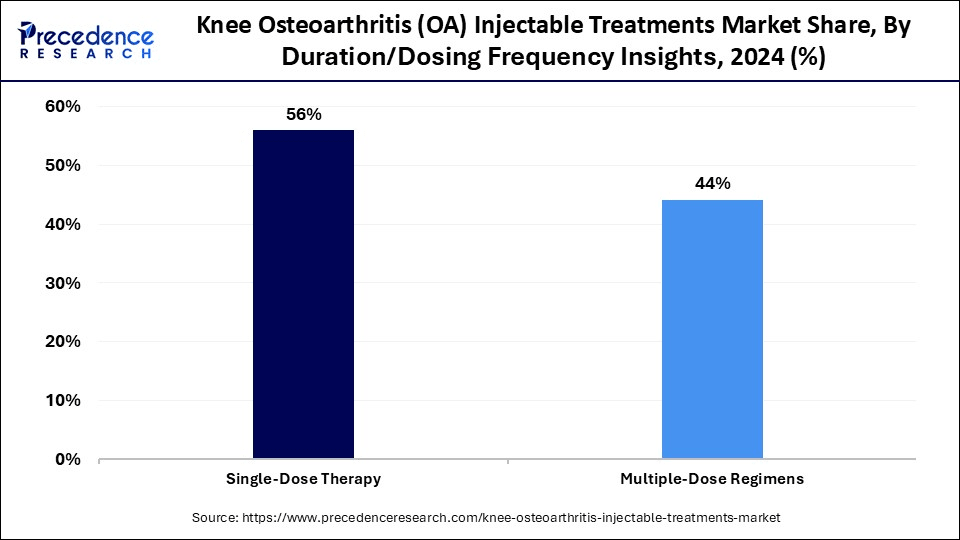

- By duration/dosing frequency, the single-dose therapy segment held the biggest market share of 55.94% in 2024.

- By duration/dosing frequency, the multiple-dose regimens segment is expected to grow at a remarkable CAGR of 6.34% between 2025 and 2034.

- By end-use, the hospitals segment held the largest market share of 43.58% in 2024.

- By end-use, the ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR of 7.43% between 2025 and 2034.

Impact of AI on the Knee Osteoarthritis (OA) Injectable Treatments Market

Artificial intelligence is revolutionizing the injection treatment paradigm of knee osteoarthritis (OA) by providing an avenue for more rapid and precise diagnosis with more tailored therapy planning. There has been a continuous development of AI models that have outperformed standardized scoring in the detection of early change in cartilage degeneration using MRI and X-ray and the timing of injections (hyaluronic acid, platelet-rich plasma, etc.) administration. In addition, AI-powered robots can assist in administrating injections with greater precision, improving patient outcomes and reducing complications.

For Instance, in December 2024, GSK (GlaxoSmithKline) and Relation Therapeutics collaborated on a $45 million partnership to leverage AI for drug discovery in osteoarthritis and fibrotic diseases. Relation Therapeutics will use its AI-driven platform to analyze patient tissue samples and identify potential drug targets for these conditions.

Many startups are using machine learning to explore and optimize the formulations of next-gen biologics ( e.g., JTA-004, XT-150) in order to delay surgical therapy in younger patients. Clinical trials have also begun leveraging AI to create predictive response models and simulations which decrease study duration and improve clinical outcomes for patients. As demand for non-operative OA treatment continues to increase, AI-powered injectable therapies have emerged as the gold standard of care for knee pain and functional involvement.

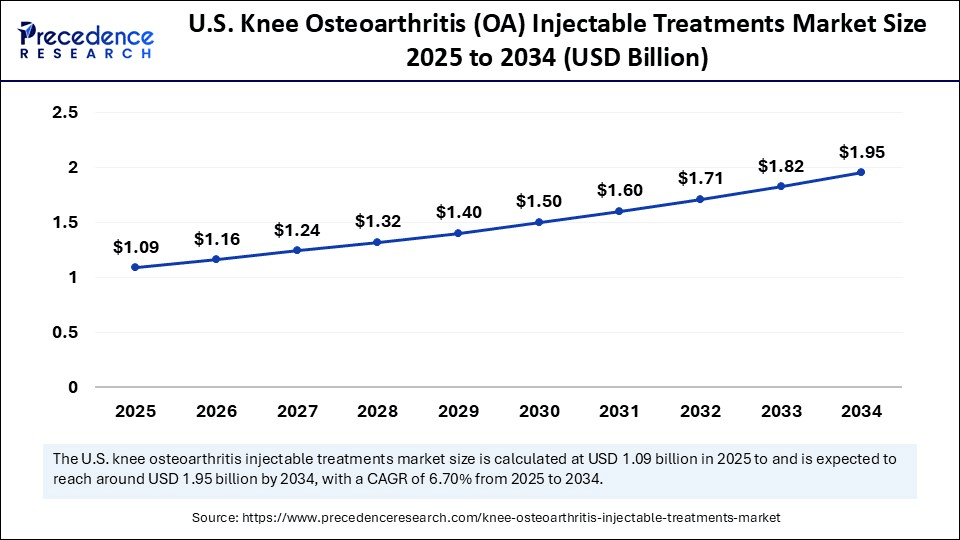

U.S. Knee Osteoarthritis (OA) Injectable Treatments Market Size and Growth 2025 to 2034

The U.S. knee osteoarthritis (OA) injectable treatments market size was exhibited at USD 1.02 billion in 2024 and is projected to be worth around USD 1.95 billion by 2034, growing at a CAGR of 6.70% from 2025 to 2034.

What Factors Contributed to North America's Dominance in the Knee Osteoarthritis (OA) Injectable Treatments Market?

North America registered dominance in the market by holding the largest share 34.75% in 2024. This is mainly due to an aging population, increased prevalence of osteoarthritis, and increased production of novel injectable therapies. A supportive regulatory environment and the early availability of new therapies reinforce the region's dominance. For instance, in April 2023, the U.S. FDA approved MISHA Knee System, a minimally invasive, implantable shock absorber that reduces load and is shown to be superior for pain and function outcomes to high tibial osteotomy. In addition, the FDA, as well as many organizations, seemed to take notice of the successful long-term outcomes of Zilretta, an extended-release corticosteroid injection, in diabetic OA patients from a 37-site Phase 3 trial.

The U.S. is central to this leadership, leading the way with the rising number of clinical research and approvals. Innovative treatments, like MISHA and Zilretta, and next-generation equivalents, such as Nexsphere-F, clearly show that there is a substantial pipeline of known innovative OA therapies in the U.S. with the support of various government agencies, care facilities, and clinical research institutions. The growing aging population and the increasing awareness about the benefits of injectable therapies to preserve the joint rather than replace it are contributing to market expansion. In addition, the country's well-developed healthcare system supports market growth.

Asia Pacific Knee Osteoarthritis (OA) Injectable Treatments Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 9.29% in the coming years. The region is benefiting from supportive regulatory environments. In 2024, China's national OA guidelines included intra-articular mesenchymal stem cell (MSC) injections under selection as repair-based therapy, promoting clinical use. There is a high demand for regenerative medicine. Moreover, rising government initiatives to accelerate the development of novel vaccines support regional market growth.

China is a major player in the market within Asia Pacific due to strong government support and rapid adoption of injectable therapy. The growing prevalence of OA, along with a large aging population, contributes to market growth. In addition, the rising development of novel injections drives the growth of the market in China.

- In July 2024, LG Chem launched Synovian, a single-injection cross-linked hyaluronic acid treatment in China with national insurance coverage, supported with Phase 3 trials showing equal efficacy with multi-injection regimens. Such progress demonstrates Asia-Pacific's flexibility in delivering a patient propensity for regenerative solutions.

(Source: https://www.lgcorp.com)

Market Overview

The knee osteoarthritis (OA) injectable treatments market consists of pharmaceuticals or biologics that manage osteoarthritis symptoms, such as pain and joint stiffness, with an injection. The injectable treatments can include corticosteroid injections, hyaluronic acid injections, platelet-rich plasma (PRP), and stem-cell injections with the aim of improving joint function and delaying the progression of the disease. The market is witnessing rapid growth due to the increasing prevalence of osteoarthritis among older populations and the increasing demand for non-surgical and minimally invasive pain management therapies.

Injectable therapies offer more targeted relief, faster relief, and fewer systemic side effects than oral medications. New developments in biologics (e.g., PRP and stem cell therapies) are changing the landscape of osteoarthritis treatment since they offer the potential for regeneration and not just symptom relief compared to traditional therapies. The growing preference for outpatient care and efforts to develop new delivery systems are accelerating the adoption of injectable therapies for osteoarthritis.

What Are the Major Trends Influencing the Knee Osteoarthritis (OA) Injectable Treatments Market?

- Increasing demand for biologic therapies: Therapies such as platelet-rich plasma and stem cell products are gaining momentum in the osteoarthritis space owing to their therapeutic regenerative capabilities and a greater duration of relief than traditional corticosteroids or hyaluronic acid.

- Technological advancements in drug delivery systems: New technologies such as sustained-release formulations and targeted delivery systems are increasing the effectiveness and duration of injectable drugs used in osteoarthritis.

- Increasing clinical research/trials: Pharmaceutical companies are investing heavily in clinical trials to prove the safety and efficacy of new injectable therapies, specifically in the biologic and combination therapy areas.

- Personalized medicine: Medical professionals are now using personalized medicine interventions to optimize the consideration of a patient's unique clinical profile and the severity of their disease in determining optimal injectable therapies for a patient, while also considering a patient's previous response to treatment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.37 Billion |

| Market Size in 2025 | USD 3.46 Billion |

| Market Size in 2024 | USD 3.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mechanism of Action, Disease Severity, Age Group, Duration / Dosing Frequency, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Aging Population and Increasing Obesity Rates

The growing aging population and obesity rates worldwide are driving the growth of the global knee osteoarthritis (OA) injectable treatments market. Aging and obesity are the most significant contributors to the degenerative process affecting the joint, more specifically in the case of the knee, which is a weight-bearing joint. Worldwide, approximately 365 million people experience knee pain, with prevalence between 10% and 60%, depending on the population. This highlights considerable morbidity associated with knee OA.

Knee OA can develop and progress in older adults, and it may be a result of cumulative degradation of AC and biomechanical loading effects over time. Moreover, the increasing rate of obesity exerts higher stresses (loading) on the joint, progressively worsening the degeneration of cartilage. According to the World Health Organization, as of 2023, nearly 60% of adults in numerous nations fall into the classification of obese. The World Obesity Federation estimated that in 2035, nearly 79% of the world population that is classified as overweight or obese will likely reside in low-income and middle-income countries. The interplay between age and obesity is propelling this market towards more opportunities for businesses that provide non-surgical, minimally invasive injectable treatments for patients at knee OA when the goal is to manage pain and improve function.

Restraint

High Costs and Limited Access to Knee OA Injectables

A key restraint in the knee osteoarthritis (OA) injectable treatments market is the high costs of injectable treatments, combined with limited access in various parts of the world. Innovative therapies such as platelet-rich plasma (PRP) for joint pain and stem cell therapies are tantalizing options for the large part of the global population that deals with knee OA pain; however, these interventions are far out of reach for many people, especially in low- and middle-income countries (LMICs). Biologics often requires multiple treatment sessions, trained and specialized clinicians, and advanced facilities that are equal in cost.

Moreover, even the more widely utilized therapies, such as hyaluronic acid injections, may not be covered by insurance and/or public healthcare systems, particularly in developing nations. Further, given the increasing burden of OA on the elderly and obese, who are more likely already burdened financially, these individuals have less chance of paying for the treatment or will completely forego any therapy altogether. As a result, while demand grows, the cost and limited reimbursement play into the actual uptake of knee OA non-surgical treatments and will invariably impair outcomes for patients, access to earlier intervention, and management for long-term health.

Opportunity

Can Regenerative Injectables Redefine the Future of Knee OA Treatment?

The rising demand for personalized, regenerative therapies creates immense opportunities in the knee osteoarthritis (OA) injectable treatments market. New injectables, notably stem cell and gene-modified injectable formulations, attempt to go beyond traditional therapy that only manages pain by modifying the course of the disease. For example, current clinical trials of autologous stem cell therapies and next-generation platelet-rich plasma (PRP) formulations have treated and demonstrated the ability to regenerate cartilage and alleviate inflammation to a greater extent than prior treatments.

In September 2024, The FDA granted fast track designation (FTD) to intra-articular injection of 3 mL of MM-II, a non-opioid product that uses proprietary suspension of liposomes to relieve joint pain, for the treatment of osteoarthritis (OA) knee pain.

The rising adoption of minimally invasive, long-acting solutions like injections instead of surgical interventions among the aging and obese population also accelerates the further application of this type of treatment modality. In the era of precision medicine, personalized and biologically active, targeted injectables embody a paradigm-shifting opportunity to evolve OA intervention to treat symptoms and potentiate more long-term solutions.

Product Type Insights

Why Did the Viscosupplements Segment Dominate the Market in 2024?

The viscosupplements (hyaluronic acid injections) segment dominated the knee osteoarthritis (OA) injectable treatments market by capturing the biggest share 38.83% in 2024. This is mainly due to their ease of administration, proven effectiveness in reducing mild to moderate OA pain, favorable safety profile, and ability to restore joint lubrication, which made them popular to both patients and physicians. These injections contain hyaluronic acid, which improves joint lubrication and reduces pain and stiffness. Viscosupplementation is the preferred treatment choice among the elderly, as they are effective in reducing pain associated with OA.

The stem cell therapy injections segment is expected to expand at the fastest CAGR of 9.35% over the projected period due to their regenerative benefits and continued cartilage restoration benefits. After administration of autologous adipose-derived stem cells or bone marrow-derived stem cells, these continue to be the potential preferred option for patients who have not responded well to traditional therapies. With the rising preference for cell-based therapies, there is a high demand for stem cell injections. Patient preference for biologic therapies, instead of steroids or other synthetic injections, is rising. In addition, the increased awareness of the proven effectiveness of stem cell therapies and the increased pipeline for stem cell therapies are boosting segmental growth.

Mechanism of Action Insights

Knee Osteoarthritis (OA) Injectable Treatments Market Revenue, By Mechanism of Action 2022-2024 (USD Million)

| By Mechanism of Action | 2022 | 2023 | 2024 |

| Lubrication (Viscosupplementation) | 1,257.68 | 1,356.14 | 1,463.40 |

| Anti-inflammatory (Corticosteroids, PRP) | 796.19 | 823.02 | 850.57 |

| Regenerative (PRP, Stem Cells, APS) | 681.66 | 738.08 | 799.67 |

| Neuromodulation (Botulinum Toxin) | 111.89 | 119.36 | 127.44 |

How Does the Lubrication Mechanism Segment Dominate the Market in 2024?

The lubrication (viscosupplementation) segment dominated the knee osteoarthritis (OA) injectable treatments market with biggest market share of 45.15% in 2024 due to its non-invasive methods and applicability for patients in early- to mid-stage OA. Lubrication produces viscous synovial fluid that improves mechanics and decreases friction. Physicians regularly practice viscosupplementation by remarking that it is not worth surgery; this reinforces its "first-line" treatment. The safety profile, given its low potential for systemic side effects, appears favorable for older populations and less likely to impact safety-overall use in this treatment class; hence, lubrication's dominance is assured.

The regenerative (PRP, stem cells, APS) segment is expected to expand at the highest CAGR 8.35% over the projected period. Regenerative mechanisms have not been identified as early adoption, but they have proven effective in improving disease etiology and not just symptoms. Treatments using PRP, stem cells, and other autologous protein solutions improve repair and decrease inflammation. Regenerative mechanism approaches represent an acceptable option for younger patients and those who wish to avoid surgery. The growing research and development activities to accelerate the production of regenerative therapies further contribute to segmental growth.

Disease Severity Insights

Knee Osteoarthritis (OA) Injectable Treatments Market Revenue, By Disease Severity 2022-2024 (USD Million)

| By Disease Severity | 2022 | 2023 | 2024 |

| Mild Knee OA | 1,392.45 | 1,492.59 | 1,601.25 |

| Moderate Knee OA | 979.34 | 1,034.92 | 1,094.50 |

| Severe Knee OA (Non-surgical candidates) | 475.62 | 509.09 | 545.33 |

Why Did the Mild OA Segment Dominate the Knee Osteoarthritis (OA) Injectable Treatments Market?

The mild OA segment dominated the market with a major share of 49.40% in 2024. People with mild OA are the largest patient population using injectable treatments, as these patients are usually managed early on with non-surgically based care. Patients at this stage are prescribed viscosupplements, corticosteroids, and PRP products to relieve symptoms and slow the progression of the disease (reduce the duration of the disease from mild to moderate to severe). Since this population is most likely to respond to conservative treatment, it is still the most important segment of product demand, primarily in outpatient clinics with physiotherapy components.

The severe knee OA (non-surgical candidates) segment is expected to expand at the fastest CAGR of 7.30% over the projected period. Patients with severe knee OA often require surgical intervention. However, for patients who are unwilling to consider surgical options, injectable treatments such as PRP and stem cell therapy are important alternatives to traditional treatment. With the general aging of the population and an increasing surgical risk among older adults, the demand for non-operative, non-surgical, minimally invasive injectables is greatly increasing in the marketplace. These therapies are increasingly examined in clinical environments to improve and/or preserve joint function and quality of life.

Age Group Insights

Knee Osteoarthritis (OA) Injectable Treatments Market Revenue, By Age Group 2022-2024 (USD Million)

| By Age Group | 2022 | 2023 | 2024 |

| <40 Years (sports injuries, early onset OA) | 422.20 | 455.99 | 492.83 |

| 40–60 Years | 1,024.81 | 1,095.87 | 1,172.68 |

| >60 Years | 1,400.39 | 1,484.74 | 1,575.57 |

Which Age Group Dominate the Market in 2024?

The >60 years segment dominated the knee osteoarthritis (OA) injectable treatments market with the biggest share of 48.61% in 2024. This is mainly due to high rates of age-associated cartilage degeneration among individuals over the age of 60. They routinely use viscosupplements, corticosteroids, and PRP therapies to manage symptoms and maintain mobility. The segment growth is also bolstered by the growing aging population, especially in countries like Japan, the U.S., and parts of Europe. Given the chronic management needs, older adults are frequent and recurring consumers of injectable therapies.

The <40 Years (sports injuries, early onset OA) segment is expected to grow at the fastest CAGR of 8.15% due to the rising incidence of sports injuries in adults. They seek long-lasting regenerative solutions, including PRP and stem cell therapy, and their demographic inclination towards non-invasive treatments allows them to remain active without needing surgeries. The growing popularity of sports medicine and fitness trends and general awareness of early intervention have greatly expanded growth and uptake in this age group.

Duration/Dosing Frequency Insights

Knee Osteoarthritis (OA) Injectable Treatments Market Revenue, By Duration / Dosing Frequency 2022-2024 (USD Million)

| By Duration / Dosing Frequency | 2022 | 2023 | 2024 |

| Single-Dose Therapy | 1,576.34 | 1,689.78 | 1,812.93 |

| Multiple-Dose Regimens | 1,271.07 | 1,346.82 | 1,428.15 |

Why Did the Single-Dose Therapy Segment Dominate the Market in 2024?

The single-dose therapy segment dominated the knee osteoarthritis (OA) injectable treatments market with the largest revenue share of 55.94% in 2024. This is mainly due to its increased patient compliance and reduced cost. Single-dose therapies, such as hyaluronic acid injections, have been the preferred choice due to their convenience, less clinical burden, and better patient compliance. Products like Synvisc-One were all created for a one-time administration and promoted fewer visits, leading to better user experience. This is the preferred dosing option for elderly patients and patients who just want a temporary solution without the worry of repeat procedures.

The multiple-dose regimens segment is expected to grow at a remarkable CAGR of 6.34% during the projection period. Multiple-dose regimens, such as weekly for several weeks or monthly corticosteroids, are becoming a preferred option due to their longer impact on the control of symptoms. These regimens are required for patients with moderate to severe OA or joint dysfunction. They provide more specific and longer time relief when compared to single-dose therapy.

End-Use Insights

Knee Osteoarthritis (OA) Injectable Treatments Market Revenue, By End-Use 2022-2024 (USD Million)

| By End-Use | 2022 | 2023 | 2024 |

| Hospitals | 1,247.79 | 1,327.03 | 1,412.45 |

| Orthopedic Clinics | 857.91 | 918.55 | 984.29 |

| Ambulatory Surgical Centers (ASCs) | 342.88 | 367.32 | 393.82 |

| Sports Medicine Clinics | 203.46 | 215.93 | 229.35 |

| Research Institutes / Regenerative Medicine Centers | 195.36 | 207.78 | 221.17 |

What Made Hospitals the Dominant Segment in the Knee Osteoarthritis (OA) Injectable Treatments Market?

The hospitals segment dominated the market with a major share of 43.58% in 2024. The segment's dominance is attributed to the increased patient pool in these settings due to the availability of advanced infrastructure and skilled personnel who manage complications. Hospitals, therefore, provide the most opportunity for injectable OA therapy use. Most initial treatments and all diagnostics take place in hospitals, especially where older patients and those with complications are involved. Hospitals constantly justify their existence in large part because of integrated imaging, labs, and orthopedics; together, they maximize patient care. The increased reimbursement policies for hospital care further contribute to segmental growth.

The ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR of 7.43% in the upcoming period due to the rising demand for cost-effective treatments. As patients are seeking to reduce hospital visits and costs, they are increasingly preferring ASCs. They offer comprehensive care at lower costs than hospitals and clinics. Moreover, ASCs provide immediate care, reducing waiting times. Patients prefer ASCs because they are convenient and have quicker recoveries. The focus on outpatient procedures is expanding, including regenerative procedures, stem cell therapy, and PRP, making ASCs the ideal partner for next-generation injectable solutions in OA.

Knee Osteoarthritis (OA) Injectable Treatments Market Companies

- Alcon, Inc.

- Allergan plc

- Anika Therapeutics, Inc.

- Arthrex, Inc.

- Bioventus, Inc.

- Ferring Pharmaceuticals Inc.

- Fidia Farmaceutici S.p.A.

- Flexion Therapeutics, Inc.

- Galderma S.A.

- Hyaltech Ltd.

- Landec Corporation (LifeCore Biomedical, Inc.)

- Meiji Seika Pharma Ltd.

- Merz Pharmaceuticals GmbH (Merz Aesthetics, Inc.)

- OrthogenRx, Inc.

- Roche Holding AG (F. Hoffmann-La Roche AG)

- Royal Biologics

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Zimmer Biomet

Recent Developments

- In March 2025, RION, a clinical-stage regenerative medicine company at the forefront of exosome-based therapeutics, announced the enrollment of the first patient in its Phase 1b clinical study evaluating Purified Exosome Product (PEP) for the treatment of Knee Osteoarthritis (OA).

(Source:https://www.biospace.com)

- In January 2025, Nextbiomedical Co., Ltd, announced that it has received Investigational Device Exemption (IDE) approval from the U.S. Food and Drug Administration (FDA) for its clinical trial, named "RESORB", featuring Nexsphere-F. The fast resorbable embolic microsphere will undergo a multi-center trial in the U.S. for market approval, marking a significant milestone in its global expansion strategy. Upon injection through a microcatheter, Nexsphere-F microspheres swell to precisely block the target blood vessels, temporarily cutting off the blood supply to the tissues.

(Source:https://interventionalnews.com)

Segments Covered in the Report

By Product Type

- Viscosupplements (Hyaluronic Acid Injections)

- Single-Injection

- Three-Injection

- Five-Injection

- Corticosteroid Injections

- Triamcinolone Acetonide

- Methylprednisolone

- Betamethasone

- Platelet-Rich Plasma (PRP) Injections

- Leukocyte-rich PRP

- Leukocyte-poor PRP

- Stem Cell Therapy Injections

- Autologous Adipose-derived Stem Cells

- Bone Marrow-derived Stem Cells

- Botulinum Toxin Injections (off-label use in OA)

- Combination Injections

- HA + PRP

- HA + Corticosteroid

- Other Biologic Injections

- Autologous Protein Solution (APS)

- Amniotic Fluid-derived Injections

By Mechanism of Action

- Lubrication (Viscosupplementation)

- Anti-inflammatory (Corticosteroids, PRP)

- Regenerative (PRP, Stem Cells, APS)

By Disease Severity

- Mild Knee OA

- Moderate Knee OA

- Severe Knee OA (Non-surgical candidates)

By Age Group

- <40 Years (sports injuries, early onset OA)

- 40–60 Years

- >60 Years

By Duration / Dosing Frequency

- Single-Dose Therapy

- Multiple-Dose Regimens

- Weekly over 3–5 weeks

- Monthly (e.g., corticosteroids)

By End-use

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers (ASCs)

- Sports Medicine Clinics

- Research Institutes / Regenerative Medicine Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting