What is the Last Mile Delivery Transportation Market Size?

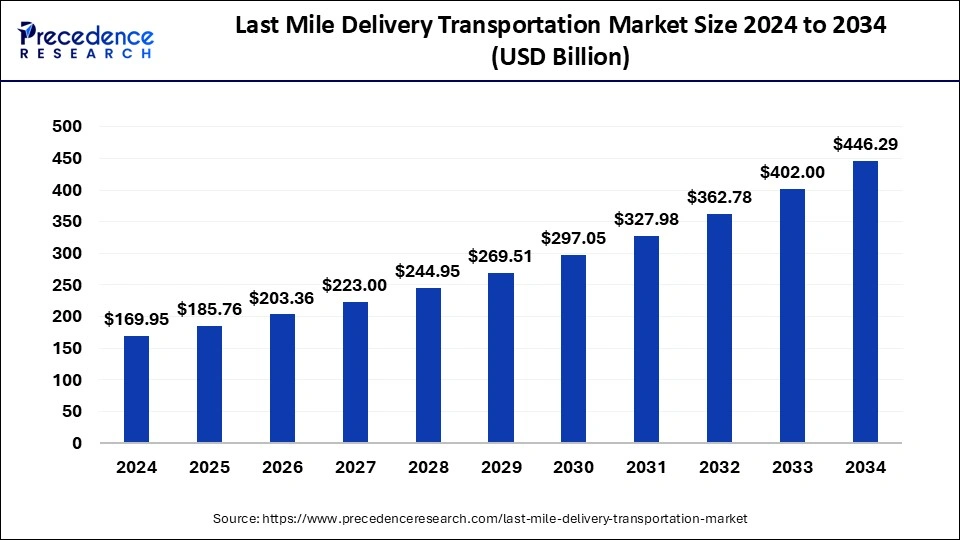

The global last mile delivery transportation market size is calculated at USD 185.76 billion in 2025 and is predicted to increase from USD 203.36 billion in 2026 to approximately USD 487.20 billion by 2035, expanding at a CAGR of 10.12% from 2026 to 2035.

Market Highlights

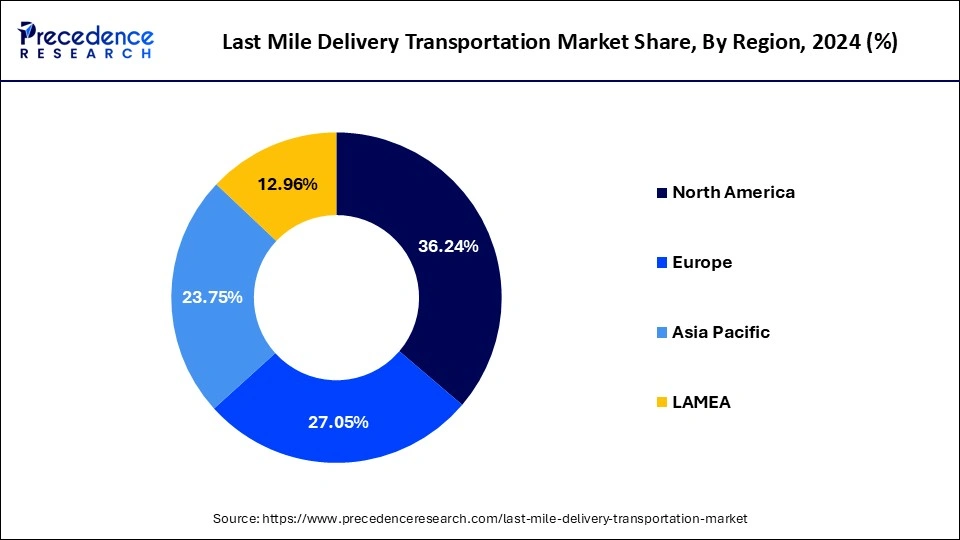

- North America led the global market with the highest market share of 36.24% in 2025.

- Asia Pacific region is estimated to expand at a CAGR of 13.5% between 2026 and 2035.

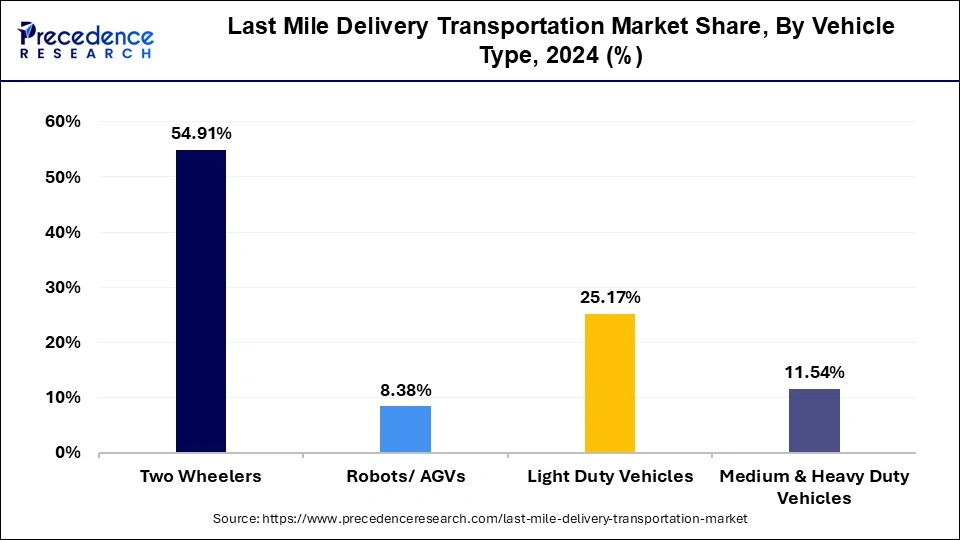

- By vehicle type, the two wheelers segment has held the largest market share of 54.91% in 2025.

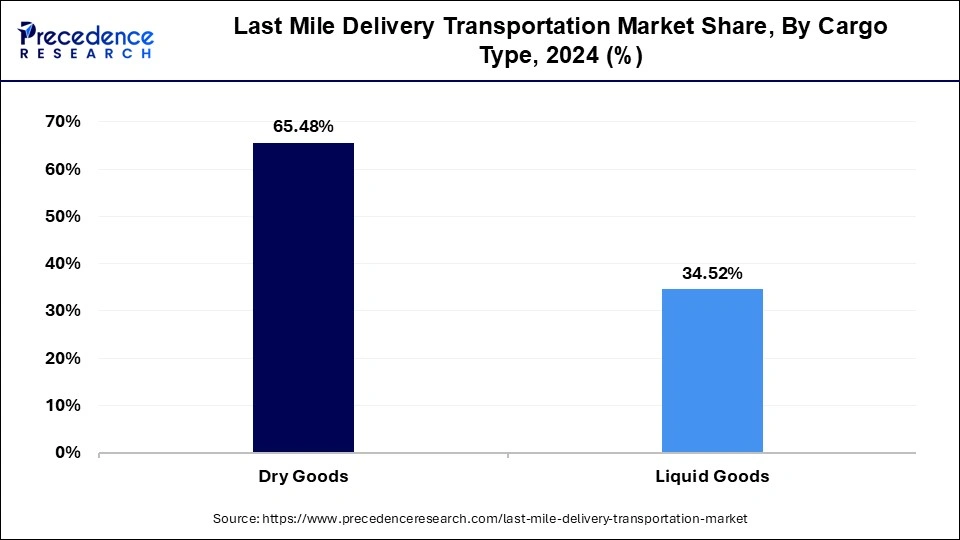

- By cargo type, the dry goods segment captured the biggest revenue share of 65.48% in 2025.

- By delivery speed, the within 2 days segment is estimated to hold the highest market share of 64.68% in 2025.

- By End Use, the FMCG products segment generated over 33.03% of revenue share in 2025.

Last Mile Delivery Transportation Market Growth Factors

Last mile delivery is also called as logistic of last mile which comprise of transportation of services and goods to final doorstep of customer from the distribution hub. The main goal of this delivery system is to provide the demanded goods & services to the customer's demanded location within the time frame with a predefined rate and in proper condition. Also, the last mile delivery business is refined and is likely to reach heights in forthcoming time period. Many shoppers and retailers are now focusing more towards the last mile logistics, which will help them stand different in the market. Furthermore, Amazon prime has transformed itself into an online retail distribution channel where, the goods & services demanded are delivered to the customer in decided time line with proper condition. In addition, coming to the rural area, the delivery points are at a certain distance and the parcel rates are low comparatively, where the market of last mile delivery is impacted. Moreover, the inefficiencies and costs of market has further been impacted by continuous growth in the online distribution channels in the retail sales of U.S., which will gradually increase the number of parcels, and this will lead to rise in expectations of customer for faster and free delivery system & services.

Along with the rise in global shipment via digitally advanced supply chains and Omni channel modes, last mile strategies which are ultramodern in nature are getting more pivotal to shippers and customers. In addition, various service providers are observing integration and process standardization changes, buying preferences of guests, and preferred mode of delivery which is impacting new priorities of investment.

The developments which are technological and are under the last mile delivery scope is redefining the delivery transportation of last mile. Also, few of the progressions that are estimated to make inroads in the market comprise of uptake of electric vehicles among mounting environmental concerns, autonomous delivery vehicles and entry of semiautonomous vehicles. Therefore, such innovations are likely to be fulfilled with stringent guidelines related to emission and thus diminish delivery costs owing to which, the entry of these technologies within the current market landscape could be earlier than expected.

The impact of the COVID-19 pandemic on the growth of the global last mile delivery transportation market was quite negative during 2020. This had impacted each and every vertical of industry. The supply chain disruptions and trade restrictions had adverse effects on the growth of the global last mile delivery transportation market.

The factors such as growing middle class population in developed and developing regions are driving the growth of the global last mile delivery transportation market. The rapid industrialization and urbanization and expansion of the logistics industry is supporting the growth of the global last mile delivery transportation market.

One of the prominent factors driving the growth of the global last mile delivery transportation market is the rising penetration of the internet and usage of mobile phones. The growing e-commerce sector is also boosting the growth of the global last mile delivery transportation market.

On the other hand, the regulations imposed by government authorities for control of carbon emissions and greenhouse gases emissions is a major challenge for the expansion of the global last mile delivery transportation market. Moreover, the well-established charging infrastructure for electric vehicles is supporting the development of last mile delivery transportation market.

Market Trends

- Growing E-commerce Sector: The growing expansion of the e-commerce sector and rising online shopping increase demand for last-mile delivery transportation services. The growing consumer demand for flexible, fast, and reliable delivery options like next-day or same-day delivery helps in the market growth.

- Technological Advancements: The growing technological advancements in the last-mile delivery transportation, like Artificial Intelligence, autonomous vehicles, automation, drones, and real-time tracking, help in the market growth. The technological advancements reduce cost and enhance delivery efficiency.

- The Growing Consumer Expectations: The growing consumer expectations, like faster delivery, increase demand for last-mile delivery transportation. The growing demand for next-day and same-day delivery fuels the need for an efficient last-mile delivery solution.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 185.76 Billion |

| Market Size in 2026 | USD 203.36 Billion |

| Market Size by 2035 | USD 487.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.12% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle, Cargo, End User, Ownership, Solution, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Vehicle Insights

The two wheelers segment dominated the last mile delivery transportation market in 2025. Two-wheelers, such as motorcycles, scooters, and bicycles, offer superior agility and maneuverability compared to larger vehicles like cars or trucks. This enables delivery personnel to navigate through congested urban areas, narrow streets, and tight spaces more efficiently, reducing delivery times and improving overall productivity.

Two-wheelers are generally more affordable to purchase, operate, and maintain than four-wheeled vehicles. They have lower upfront costs, fuel consumption, and maintenance expenses, making them a cost-effective option for last-mile delivery operations, especially for small and medium-sized businesses with limited budgets.

Global Last Mile Delivery Transportation Market, By Cargo Type, 2022-2024 (USD Billion)

| By Cargo Type | 2022 | 2023 | 2024 |

| Two Wheelers | 80.4 | 86.6 | 93.3 |

| Robots/ AGVs | 9.2 | 11.5 | 14.2 |

| Light Duty Vehicles |

37.5 | 40.0 | 42.8 |

| Medium & Heavy Duty Vehicles |

15.8 | 17.7 | 19.6 |

Cargo Insights

The dry goods segment held the largest share of the last mile delivery transportation market in 2025. Dry goods, including consumer products such as electronics, clothing, household goods, and non-perishable food items, constitute a significant portion of e-commerce orders. The growing popularity of online shopping and direct-to-consumer delivery services has led to a surge in demand for last mile transportation services for dry goods.

Dry goods encompass a wide range of products that do not require refrigeration or special handling during transportation. This makes them well-suited for various modes of last mile delivery, including traditional delivery vans, trucks, bicycles, and even drones. The versatility of dry goods allows for efficient and cost-effective transportation solutions in urban, suburban, and rural areas.

Global Last Mile Delivery Transportation Market, By Cargo Type, 2022-2024 (USD Billion)

| By Cargo Type | 2022 | 2023 | 2024 |

| Dry Goods | 93.8 | 102.1 | 111.3 |

| Liquid Goods | 49.2 | 53.7 | 58.7 |

Delivery Speed Insights

The within 2 days segment dominated the last mile delivery transportation market with the largest share in 2025 and is likely to continue its growth trajectory over the studied period. This is mainly due to the increasing consumer desire for same-day or next-day delivery. Within 2 days delivery reduces transportation charges and enhance consumer satisfaction. Advanced technologies, such as tracking and monitoring and route optimization solutions, are enabling faster delivery, supporting segmental growth.

Global Last Mile Delivery Transportation Market, ByDelivery Speed, 2022-2024 (USD Billion)

| By Delivery Speed | 2022 | 2023 | 2024 |

| Within 2 Days | 91.0 | 99.9 | 109.9 |

| 2-5 Days |

27.7 | 29.9 | 32.4 |

| 5-10 Days |

16.0 | 17.1 | 18.4 |

| More than 10 Days |

8.3 | 8.8 | 9.3 |

End-use Insights

The FMCG products segment accounted for the largest market share in 2025. The increased trend of online grocery shopping is a major factor that supported the segment's dominance. Some FMCG products, especially edible ones, have limited shelf life. Thus, they require fast and efficient delivery to reach consumers on time.

The food delivery segment is projected to expand at the fastest rate in the coming years. The segmental growth is attributed to the increasing food delivery platforms. With the changing lifestyles, the consumption of packaged, ready-to-eat food is increasing. Since food items have short shelf life, they require last-mile delivery services to reach consumers quickly. Moreover, the expansion of cloud kitchens contributes to segmental growth.

Ownership Insights

The third party logistics (3PL) segment held the dominant share of the market in 2025 and is projected to grow at the fastest rate during the projection period. This is mainly due to the increasing demand for outsourced delivery services. Outsourcing last-mile delivery to 3PLs is cost-effective, especially for businesses with fluctuating delivery volumes. 3PLs provide flexible solutions, which enable businesses to adjust their delivery capacity.

Global Last Mile Delivery Transportation Market, By Ownership, 2022-2024 (USD Billion)

| By Ownership | 2022 | 2023 | 2024 |

| In-house |

49.2 | 53.0 | 57.1 |

| Third Party Logistics (3PL) |

93.7 | 102.8 | 112.8 |

Regional Insights

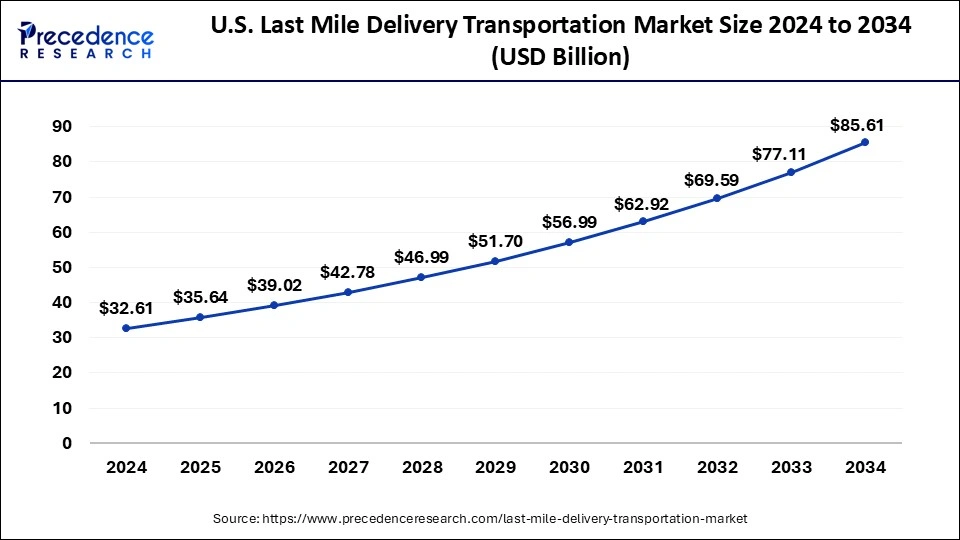

U.S. Last Mile Delivery Transportation Market Size and Growth 2026 to 2035

The U.S. last mile delivery transportation market size is exhibited at USD 35.64 billion in 2025 and is projected to be worth around USD 93.46 billion by 2035, growing at a CAGR of 10.12% from 2026 to 2035.

North America dominated the last mile delivery transportation market in 2025. North America has well-developed transportation infrastructure, including road networks, highways, airports, and distribution centers, which support efficient last mile delivery operations. The presence of modern logistics facilities and fulfillment centers enables logistics providers to streamline delivery processes and meet customer expectations for timely and cost-effective deliveries. The rapid growth of e-commerce and online retailing has fueled the demand for last mile delivery services in North America. With the increasing popularity of online shopping platforms such as Amazon, Walmart, and Target, consumers expect fast and efficient delivery of their purchases, driving the need for reliable last mile logistics solutions.

United States Last Mile Delivery Transportation Market

The strong presence of e-commerce and growing demand for online shopping in the country increases demand for last-mile delivery transportation. The growing technological advancements, like autonomous vehicles, real-time tracking, and route optimization, help in the growth of the market. The well-developed logistics infrastructure, like vast networks of distribution centres, roads, and warehouses, increases demand for last-mile delivery transportation. The growing expansion of new technologies like autonomous vehicles & drones, and the growing investment in the upgradation of logistics infrastructure, help in the market growth. The strong presence of key logistics companies like Amazon, FedEx, and UPS drives the overall growth of the market.

What Makes Asia Pacific the Fastest-Growing Region in the Last Mile Delivery Transportation Market?

Asia Pacific is observed to expand at the fastest rate during the forecast period. The region is experiencing rapid urbanization, leading to dense populations and increased demand for goods and services in urban areas. With a large and growing urban population, there is a high volume of last mile deliveries required to meet the needs of consumers, businesses, and e-commerce platforms. The rising disposable income and expanding middle class in Asia Pacific have led to increased consumer spending on retail goods, groceries, and other products. As more people gain access to online shopping and digital payment methods, the demand for home delivery services has surged, particularly in urban areas where convenience is valued.

China Last Mile Delivery Transportation Market

China is a major contributor to the last-mile delivery transportation market. The growing smartphone penetration and availability of mobile-based delivery services increase demand for last-mile delivery transportation solutions. The well-developed infrastructure, like smart highways, helps in the market growth. The growing technological advancements like AI, automation, real-time monitoring, real-time optimization, and drone delivery help in the market growth. The presence of the largest e-commerce sector and the growing online shopping drive the overall growth of the market.

What Potentiates the European Market?

The European last mile delivery transportation market is driven by the rapid expansion of e-commerce, increasing consumer demand for fast and flexible deliveries, and the adoption of advanced technologies such as route optimization, real-time tracking, and autonomous delivery vehicles. Well-developed urban infrastructure and strong logistics networks further support efficient last-mile operations, driving overall market growth.

UK Last Mile Delivery Transportation Market Analysis

The market in the UK is growing due to the surge in online shopping, growing consumer demand for faster and more flexible deliveries, and the adoption of advanced technologies like AI-driven route optimization and real-time tracking. Well-established logistics networks, urban infrastructure, and major players like Amazon and DHL further drive market expansion.

Top Companies Operating in the Market & Their Offerings

- DB Schenker

DB Schenker provides global logistics solutions, including air, ocean, and land transport, contract logistics, supply chain management, and freight forwarding. The company focuses on integrated digital platforms, real-time tracking, and efficient, sustainable transportation services. - DHL Global Forwarding

DHL Global Forwarding offers international air and ocean freight, customs clearance, and supply chain solutions. Their services include end-to-end shipment visibility, temperature-controlled logistics, and technology-driven optimization for businesses of all sizes. - FedEx Corporation

FedEx delivers express shipping, freight, e-commerce, and supply chain solutions worldwide. It provides real-time tracking, route optimization, and specialized services like temperature-sensitive shipments and logistics management to meet diverse business and customer needs. - Interlogix Pty. Ltd.

Interlogix provides freight forwarding, customs brokerage, and supply chain management services. The company focuses on optimizing transportation solutions, digital shipment tracking, and tailored logistics strategies for industries across Australia and international markets. - J&J Global Limited

J&J Global Limited offers international logistics, freight forwarding, warehousing, and distribution services. Their offerings include real-time shipment tracking, multimodal transport solutions, and customized logistics strategies to ensure efficient, reliable delivery worldwide.

Recent Developments

- In June 2025, Gintaa launched its logistics SBU to revolutionize food e-commerce last-mile delivery. The operation begins in Hyderabad, New Delhi, and Mumbai at the end of June 2025. The operation will enhance delivery speed and operational efficiency. The SBU leverages an in-house delivery fleet, AI-driven tools, and bio-friendly packaging.

(Source: ahmedabadmirror.com) - In May 2025, Trackonomy announced the launch of LastMile solutions for logistics leaders grappling with blind handoffs to third-party contractors, missed deliveries, costly manual scanning, repeat deliveries, and a lack of visibility. LastMile solutions deliver a scalable, automation-driven system to eliminate inefficiencies, reduce costs, and enhance visibility.

- In January 2025, Burq launched last-mile delivery innovations to transform grocery delivery and retail operations. The company unveiled a suite of groundbreaking features to redefine delivery. With tailored solutions that scale with businesses, a unified network of providers, and cutting-edge analytics, Burq is making it easier for brands to deliver faster, more reliable service while optimizing their operations and customer experiences.

Segments Covered in the Report

By Vehicle Type

- Two Wheeler Vehicle

- Robots/AGVs

- Light Duty Vehicles

- Medium & Heavy Duty Vehicles

By Cargo Type

- Dry Goods

- Liquid Goods

By Delivery Speed

- Within 2 Days

- 2-5 Days

- 5-10 Days

- More than 10 Days

By End Use

- Food Delivery

- FMCG Products

- Health/Pharmaceutical Products

- Automotive Products

- Electronic Products

- Others

By Ownership

- In-house

- Third Party Logistics (3PL)

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting