What is the Middle East Last Mile Delivery Transportation Market Size?

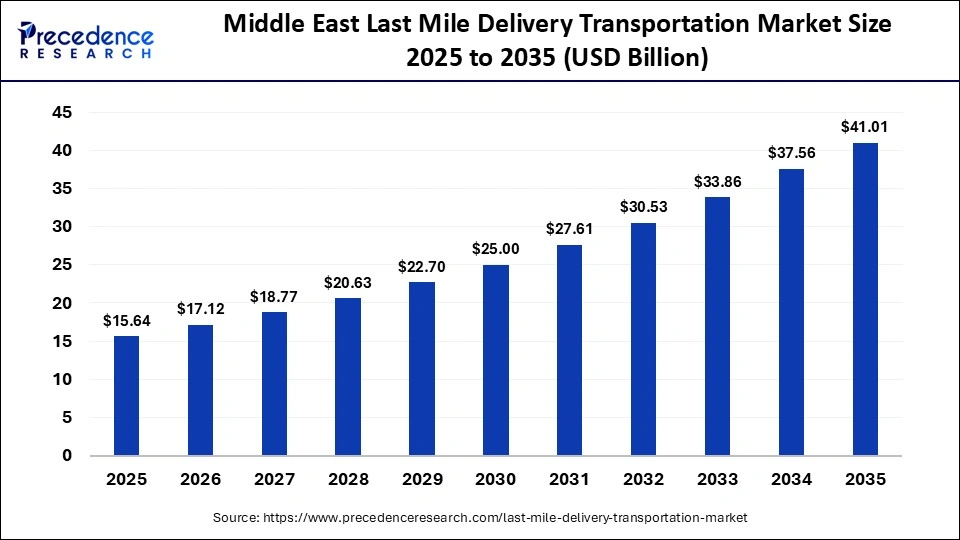

The Middle East last mile delivery transportation market size accounted for USD 15.64 billion in 2025 and is predicted to increase from USD 17.12 billion in 2026 to approximately USD 41.01 billion by 2035, expanding at a CAGR of 10.12% from 2026 to 2035. The Middle East last mile delivery transportation market is expanding rapidly, driven by booming e-commerce demand, smart logistics adoption, and urbanization, leading to stronger network build-outs and service innovations regionally.

Market Highlights

- By country, UAE led the Middle East last mile delivery transportation market held the major market share of 38.5% in 2025.

- By country, Saudi Arabia is estimated to expand the fastest CAGR between 2026 and 2035.

- By service type, the B2C segment accounted for the biggest market share of 54.4% in 2025 and is growing at a strong CAGR of 9.7% from 2026 to 2035.

- By vehicle type, the motorcycles/scooters segment contributed the highest market share of 39.7% in 2025.

- By vehicle type, the drones & autonomous vehicles segment is poised to grow at a notable CAGR of 9.4% between 2026 and 2035.

- By mode of delivery, the standard delivery segment captured 43.2% of market share in 2025.

- By mode of delivery, the on-demand/instant delivery segment is expected to expand at the highest CAGR of 9.8% from 226 to 2035.

- By technology type, the route optimization & tracking segment dominated the market with holding 32.4% of the market share in 2025.

- By technology type, the autonomous & EV-based solutions segment is expanding at a healthy CAGR of 9.4% between 2026 and 2035.

- By application/end-use industry, the e-commerce segment held the largest market share of 42.5% in 2025.

- By application/end-use industry, the food & grocery segment is expected to expand at the highest CAGR of 9.6% from 2026 to 2035.

Why Is the Middle East Last Mile Delivery Transportation Market Accelerating?

The Middle East is experiencing rapid expansion in the last mile delivery transportation market, driven by strong growth in e-commerce and steadily increasing urban populations across Gulf Cooperation Council countries. Rising adoption of digital technologies, including mobile commerce and cashless payment methods, is reshaping consumer purchasing behavior and increasing demand for faster and more reliable delivery services. In response, retailers are investing in micro-fulfillment centers and expanding e-fulfillment networks closer to end consumers to shorten delivery times and improve order accuracy.

To remain competitive, retailers and logistics providers are increasingly deploying technologies such as real-time shipment tracking, route optimization tools, and artificial intelligence to enhance service quality while reducing fulfillment and operating costs. Food delivery platforms continue to scale rapidly across major cities, contributing to higher delivery volumes and more complex logistics requirements. In addition, growth in cross-border trade is increasing demand for efficient last-mile solutions that can handle international parcels and time-sensitive shipments. However, market participants continue to face challenges related to economic volatility, urban traffic congestion, labor constraints, and cost pressures, prompting ongoing investment in automation, fleet optimization, and alternative delivery models to sustain competitiveness.

Artificial Intelligence Is Improving the Middle East Last Mile Delivery Transportation Market

Through smarter planning, predictive forecasting, and enhanced customer experience, artificial intelligence presents new opportunities for improving last mile delivery throughout the Middle East. Many major international companies, such as DHL, have outlined how AI is used to increase route optimization, predict delivery windows, and reduce fuel consumption by providing more accurate route planning through using advanced technologies and machine learning.

In April 2025, the partnership between Aramex and Shipsy's AI-enabled orchestration tools, which was announced, is another instance where AI will facilitate greater precision in the last mile, provide same-day services, and improve territory plans for last mile delivery efforts in the Middle East. The adoption of these technologies is driving change in urban operations throughout the Middle East and making the process of delivering goods in cities faster, more reliable, and more effective.

Transportation of Last-Mile Deliveries in the Middle East: An Outlook for the Future

- Regional Market Overview: In the Middle East, last-mile delivery involves the transportation of goods over the last mile from a centralized location to end consumers; this method of delivery supports the growth of e-commerce through urban areas as it focuses on delivering packages quickly over short distances between the distribution hub and the customers.

- Urbanization & Increased Demand: The rapid population growth in major cities across the GCC is a major factor that contributes to the increase of daily package volumes and the increased frequency in delivery of packages as carriers need to deliver packages more frequently in high-density metropolitan environments where people live.

- Government Policy & Support: Several countries have implemented National Programs to create smart cities and logistics hubs and develop a digital infrastructure, which have provided support for establishing advanced delivery models through better and more efficient delivery methods and more clearly defined rules and regulations for providers of last-mile delivery services.

- Adoption of Technology: The use of GPS/AVL tracking systems, route optimization software (RO), electric vehicles (EV), and automated sorting/packing technology provides greater delivery accuracy to the end user and also provides a lower dependence on fuel and assists providers with meeting their sustainability goals while delivering to urban areas with last-mile operations.

- Infrastructure & Operational Challenges: The inconsistent addressing systems, congestion, and extreme weather conditions in some areas increase the complexity in last-mile delivery; therefore, it is necessary for last-mile providers to invest in micro-fulfillment centers, digital mapping, and more flexible delivery scheduling models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.64 Billion |

| Market Size in 2026 | USD 17.12 Billion |

| Market Size by 2035 | USD 41.01 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.12% |

| Dominating Country | UAE |

| Fastest Growing Country | Saudi Arabia |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Vehicle Type, Mode of Delivery, Application/End-Use Industry, and Country |

Segmental Insights

Service Type Insights

Why Did the B2C Segment Dominate the Service Type in the Middle East Last Mile Delivery Transportation Market?

B2C: This segment dominated the Middle East last mile delivery transportation market in 2025 with a 54.4% share, due to the rapid growth in popularity and access to e-commerce, online marketplaces, and direct-to-consumer retailing. Other factors that have led to B2C's dominance include a high number of smartphone users, growing urban populations, and rising consumer preferences for home deliveries. The growing volume of parcels being delivered has led to more and more retailers utilizing outsourced last-mile services to meet their customers' expectations regarding the speed, reliability, and tracking of their deliveries.

B2C courier express and same-day services are set to be the fastest-growing segment in the forecasted period with a 9.7% CAGR. This segment is seeing increasing demand from consumers for quick, convenient deliveries. With the increasing number of online retailers, quick-commerce providers, and food delivery services, there are many companies that are beginning to invest heavily in quick and efficient fulfillment services for their customers. As more and more people in cities adopt lifestyles that require them to purchase products using quick, rushed methods, as well as more premium services, logistics companies will need to build B2C express service capabilities in key urban areas across the Middle East.

Vehicle Type Insights

What Makes Motorcycles/Scooters the Dominant Vehicle Type for Last-Mile Delivery Transportation in the Middle East?

Motorcycles/Scooters: This segment dominated the market in 2025. Because of the lower cost, superior fuel efficiency, and ability to easily maneuver in heavy urban traffic, the motorcycle/scooter class of vehicles represents the majority of last-mile delivery. Because they are intended for short distances, food orders, and smaller packages, motorcycles/scooters are particularly suited to urban environments with heavy traffic. With their low operational costs, motorcycles/scooters are attractive to delivery fleets since most packages delivered in urban areas are low in weight but delivered numerous times per day.

Drones & Autonomous Vehicles: Drone and autonomous ground vehicle technology is set to see massive growth in the coming years, with the segments expected to grow at a 9.4% CAGR during the forecasted period. This growth is anticipated due to regulatory enterprising and smart city initiatives being undertaken throughout the GCC countries, especially in Saudi Arabia, the UAE, and Kuwait. Logistics providers have begun testing these delivery methods to help reduce their reliance on human labor while at the same time increasing the efficiency of last-mile delivery service. While these technologies have not yet been widely adopted, by leveraging advances in automation, artificial intelligence, and last-mile connectivity technology, many analysts believe there will be an increase in the deployment of drones and autonomous vehicles for high-value and time-sensitive remote deliveries.

Mode of Delivery Insights

Why Did the Standard Delivery Segment Dominate the Market for Last Mile Delivery Transportation in the Middle East?

Standard Delivery: In the Middle East, standard delivery had been the dominant mode of delivery in 2025 with a 43.2% share because of the balance of cost and reliability for both businesses and consumers. Many Middle Eastern customers place a greater priority on how reasonably priced the shipping cost is when they buy items that they do not need immediately. As for retailers, standard delivery is preferred to allow them the opportunity to create the most cost-efficient route and to minimize the cost of logistics. In both cases, this mode continues to be used for items purchased with prior notice, bulk items, and deliveries made either to residential or commercial locations.

On-Demand/Instant Delivery: This segment is set to grow at the highest CAGR of 9.8%, becoming more popular with consumers due to their demand for immediate service. The rapidly increasing use of delivery services by food customers, the ease of use afforded by grocery store delivery applications, and the numerous options offered by quick-commerce retailers, typically those who promise to deliver your purchase within minutes or a few hours, have led many logistics providers to establish hyper-local fulfillment centers and provide customers with diverse delivery methods in urban areas to meet the growing number of people living in cities with an increasing amount of disposable income and with limited amounts of available time to perform daily tasks.

Technology Type Insights

What Is the Reason for the Dominance of Routing Optimization and Real-Time Tracking Technologies in the Market During 2025?

Route Optimization & Tracking: This segment dominated the Middle East last mile delivery transportation market in 2025 with a 32.4% share, because they can increase operational efficiency and enhance the experience of their customers. Logistics providers are able to use these two technologies to reduce delivery time, fuel consumption, and failed delivery attempts. In addition, routing optimization and real-time tracking technologies provide customers with greater visibility, as they can receive up-to-date delivery information and confirmation when their package has been delivered. Overall, routing optimization and real-time tracking technologies have gained popularity because of their immediate return on investment and the ability to scale.

Autonomous & EV-based Solutions: The fastest-growing technologies are autonomous systems and electric vehicles, expected to clock a CAGR of 9.4% during the forecasted period. This is due to the massive pressure for sustainability, along with the impact of digital transformation, which is driving this particular trend. The majority of companies are looking at electric vehicles to reduce their emissions and operating costs. Autonomous systems offer longer-term efficiencies. Continued support from the government for smart mobility, along with advancements in AI and sensor technologies, is also creating an accelerated uptake of these technologies within pilot programs and controlled environments.

Application/End-Use Industry Insights

Why Is E-commerce the Dominant Demand Application Segment in the Middle East Last Mile Delivery Transportation Market?

E-commerce: This segment has exhibited undeniable dominance with a 42.5% share, and the leading demand driver for last-mile delivery due to an increase in online shopping in categories like fashion, electronics, and consumables. Marketplaces or brands have consistently high parcel volume, generating demand for last-mile services across each marketplace and brand's platform. As a result, with young demographics, digital payment acceptance and promotions driving e-commerce are the most significant drivers of demand for last-mile services.

Food & Grocery: The food and grocery delivery segment is anticipated to be the fastest-growing with a 9.6% CAGR in the Middle East last-mile delivery transportation industry, due to shifts in consumer consumption patterns and growth trends toward more app-driven ordering of meals and other daily essential items. The increase in the frequency of ordering and the need for consumers to have items delivered directly to their homes is contributing to demand growth in this area as well. The growth trend is being facilitated by developments in dark stores, micro-fulfillment centers, and a growing understanding by grocery retailers of subscription grocery delivery models. The continued high frequency of orders and the continuing requirement for time-sensitive deliveries in the food and grocery segment will continue to fuel this area of demand for last-mile services.

Country Analysis

The growing presence of technology has caused a change within the Middle Eastern last mile delivery transportation system. With the expansion of e-commerce and the increasing rate of digital automation of the logistics industry, coupled with government investments into developing and upgrading the logistics sector, there is much demand for efficient last mile delivery services in metropolitan areas. In November 2025, 7X and Zelostech unveiled AutoLogiX, a joint venture introducing Level-4 autonomous transport solutions aimed at transforming cargo movement and future autonomous logistics in the Middle East.

As there continues to be an increase in smartphone ownership and the acceptance of digital payment systems, coupled with consumer preferences for receiving their goods at home, consumers across the Middle East are now seeking out delivery options that are efficient and allow for easy access to their orders. Furthermore, Middle Eastern governments in both the gulf and North Africa are recognising the necessity of developing and accommodating fast moving goods, as well as the importance of strengthening their courier service capabilities, particularly in densely populated metropolitan regions. Population growth, rapid urbanisation and regulatory support have also contributed positively to strengthening the Middle East last mile delivery transportation market capability within the region.

UAE Middle East Last Mile Delivery Transportation Market Trends

The United Arab Emirates is the leader of this region, with strong government-supported genome programs, extensive hospital infrastructure, and a clear regulatory framework for genomics research. With the national initiatives and investments in precision medicine, omics-based biomarker studies are currently at the earliest stages of development and translation. The United Arab Emirates (UAE) is one of the most advanced markets in the Middle East regarding last-mile delivery. The country has developed its last-mile delivery market through its rapid urbanization, high penetration of internet services, and high volume of e-commerce, both nationally and across borders.

In December 2025, the UAE's government announced the start of a long-term investment program in transportation that will provide USD 46 billion, which will be devoted to road transportation projects implemented by 2030. These investments are designed to increase the capacity of the highway system, decrease traffic congestion, and improve the efficiency of logistics networks, thereby creating additional opportunities to improve last-mile delivery in urban areas.

Saudi Arabia Middle East Last Mile Delivery Transportation Market Trends

Saudi Arabia is seeing fast growth for last mile delivery due to increased e-commerce, population growth, and national digitization initiatives through Saudi's Vision 2030 program. Major cities like Riyadh, Jeddah, and Dammam make up most of the country's demand for parcel deliveries, and the recent changes in regulations to improve application and evaluation processes for couriers will lead to increased service quality and accountability. In June 2025, JD Logistics' JoyExpress made its debut in Saudi Arabia, enabling same-day or next-day delivery, including COD options, boosting local express delivery infrastructure.

Consumers are demanding more same-day and next-day delivery options from courier services, thus changing the way we think about using transportation networks for our deliveries. In July 2025, Saudi Arabia reported that it had delivered more than 50 million packages in Quarter 2 of the year (Q2 2025) alone. These numbers are proof of the growth of last mile delivery throughout Saudi Arabia and represent the growing reliance of the people of Saudi Arabia on parcel delivery services for retail, grocery delivery, and essential goods.

Egypt Middle East Last Mile Delivery Transportation Market Trends

Egypt is developing as a rapidly growing last-mile delivery market due to its sizable population, fast-growing smartphone usage, and growing digital commerce ecosystem. In addition, urban concentration within Greater Cairo and Alexandria has created a high density of delivery demand. The growth of digital payment systems has driven the growth of online shopping in Egypt, and government investment in ICT infrastructure has been a critical enabler for growth in the logistics sector.

Data published by the Egyptian Ministry of Communications and Information Technology indicates that the number of Egyptian internet users buying products online has increased from under 20% to approximately 50%. As a result, there has been a noticeable increase in parcel volume and an increased requirement for scalable last-mile delivery networks that are supported by the extensively developed physical and logistical infrastructure provided by Egypt Post.

Top Players in the Middle East Last Mile Delivery Transportation Market and their Offerings

- Aramex

- DHL

- FedEx

- Amazon Logistics

- SMSA Express

- Fetchr

- FODEL

- Noon Delivery

- Talabat

- Careem/Careem NOW

- HungerStation

- Mrsool

- Zajil Express

- Barq Express

- Tawseel

Recent Developments

- In June 2025, Saudi Arabia and the UAE are set to receive a US$571 million logistics infrastructure boost through 2030, enhancing supply chains and positioning both nations as key global trade and logistics hubs.(Source: https://icttm.org)

- In April 2025, UAE-based Quiqup launched full logistics operations in Saudi Arabia, expanding e-commerce fulfillment and delivery services with support from Mohammed bin Rashid Innovation Fund (MBRIF) regional innovation funds to strengthen last-mile capabilities.(Source: https://www.logisticsmiddleeast.com)

- In November 2025, Suhail Al Mazrouei, UAE Minister of Energy and Infrastructure, announced a AED 170 billion transport and road investment plan through 2030 to expand transport infrastructure and ease traffic congestion.(Source: https://www.wam.ae)

Segments Covered in the Report

By Service Type

- B2C

- B2B

- C2C

By Vehicle Type

- Motorcycles/Scooters

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Drones

- Autonomous Ground Vehicles

By Mode of Delivery

- Standard Delivery

- Express Delivery

- On-Demand/Instant Delivery

- Click-and-Collect/Parcel Lockers

By Technology Type

- Route Optimization & TMS

- Real-Time Tracking & Visibility

- Autonomous Delivery Systems

- Electric Vehicle & Telematics Solutions

By Application/End-Use Industry

- E-commerce

- Food & Grocery

- Healthcare & Pharmaceuticals

- Mail & Documents

- Others

By Country

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting