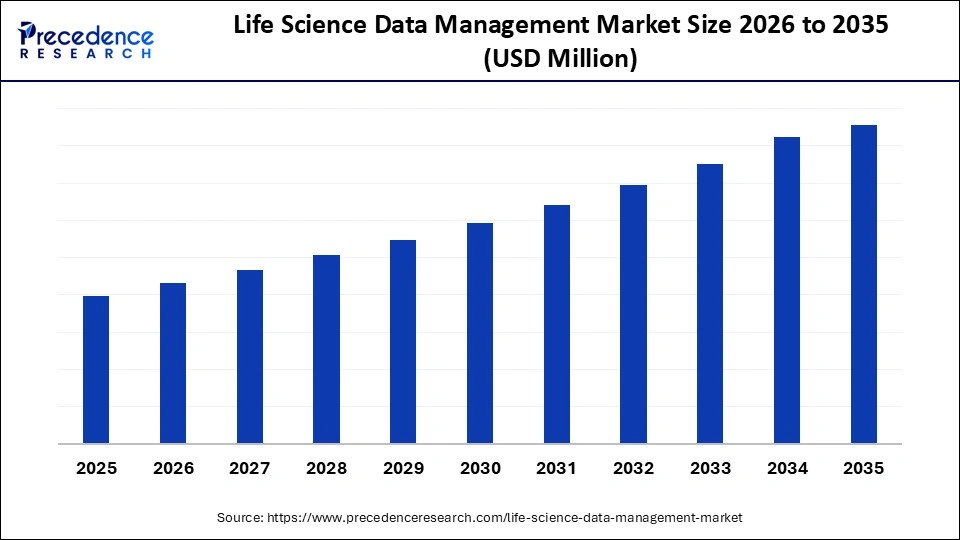

What is the Life Science Data Management Market Size?

The global life science data management market is growing as organizations adopt advanced platforms to handle complex research data, improve workflows, and ensure compliance.This market is growing due to rising volumes of complex biological data requiring efficient and secure management.

Market Highlights

- North America region has dominated the market, having the biggest share in 2025.

- The Asia Pacific is expected to grow at a notable CAGR between 2026 and 2035.

- By data type, the genomic and sequence data segment contributed the largest market share in 2025.

- By data type, the imaging data segment is projected to grow at a notable CAGR between 2026 and 2035.

- By solution/offering, the data storage and archiving solutions segment held the largest market share in 2025.

- By solution/offering, the data integration and harmonization tools segment is growing at a notable CAGR between 2026 and 2035.

- By deployment model, the on-premises deployment segment accounted for the largest market share in 2025.

- By deployment model, the cloud-based/hybrid deployment models segment will grow at a strong CAGR between 2026 and 2035.

- By end user, the pharmaceutical companies segment captured the highest market share in 2025.

- By end user, the biotechnology firms segment is expanding at a strong CAGR between 2026 and 2035.

Why is Data Management Becoming Crucial in Life Sciences?

Data management is becoming a central pillar of the life sciences sector as research organizations, biopharma companies, and clinical institutions generate rapidly increasing volumes of genomic, proteomic, imaging, and real-world clinical data. As digital platforms replace manual workflows, laboratories now rely on structured data pipelines that support seamless capture, storage, organization, and retrieval of scientific information. The widespread adoption of automation tools, cloud environments, and artificial intelligence has transformed how teams process and interpret datasets, helping reduce operational errors and enabling faster scientific insights.

Regulatory expectations are also rising as agencies require complete audit trails, secure data sharing frameworks, and validated systems for electronic records. This has made compliant data handling a business necessity rather than an optional improvement. Additionally, modern discovery programs depend on multidisciplinary collaboration, which requires interoperable systems that allow researchers, clinicians, and external partners to exchange data without compromising accuracy or security.

Market Trends

- Shift to Cloud-Based Platforms: Companies are moving from on-premises systems to scalable cloud solutions to handle large datasets and enable remote collaborations.

- Integration of AI and Machine Learning: Advanced analytics and predictive modeling are being adopted to accelerate drug discovery. Clinical insights and decision making.

- Adoption of real-time data Analytics: Life science firms want faster insights, pushing interest in platforms that support real-time data processing and visualization.

- Rise of interoperable and Unified Data Systems: Organizations are replacing fragmented tools with unified platforms that integrate lab, clinical, and genomic data into one ecosystem.

Life Science Data Management Market Key Technological Shifts

| Technological Shifts | Description |

| Cloud Native Data Infrastructure | Transition from legacy on-premises systems to scalable, cloud platforms that handle large datasets and enable remote, real-time access. |

| AI-Driven Data Processing and Insights | Use of AI/ML to automate data cleaning, accelerate analytics, and generate predictive insights for research and clinical outcomes. |

| Advanced Data Integration & Interoperability | Adoption of unified platforms that connect lab systems. Clinical data and omics data for seamless sharing and collaboration. |

| Blockchain-enabled Data Governance | Implementation of blockchain for secure, immutable data records, audit trails, and compliant sharing of sensitive data. |

| High Performance Computing & Edge Processing | Deployment of HPC and edge tech to rapidly process large biological datasets with reduced latency and improved efficiency. |

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Data Type, Solution / Offering, Deployment Model, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Life Science Data Management Market Segmental Insights

Data Type Insights

Genomic and Sequence Data: Genomic and sequence data segments dominated the life science data management market in 2025 because large, complex datasets produced by next-generation sequencing necessitated reliable, scalable, and high-performance data platforms. Pharmaceutical and biotech firms have made significant investments in data storage, analytics, and security due to their growing reliance on genomic insights for target identification, biomarker discovery, and personalized medicine. The need for sophisticated governance frameworks and infrastructure that comply with regulations has increased as clinical adoption of genomics grows.

Imaging Data: This segment is the fastest-growing because digital pathology radiomics and AI-enabled diagnostics produced extremely high-resolution images that required sophisticated processing and cloud-based scaling capabilities. Automation of clinical workflows, integration with machine learning algorithms, and the uptake of high-throughput imaging systems in research hospitals all contributed to growth. The shift toward multimodal datasets accelerated demand for seamless image management and analytics solutions.

Solution/ Offering Insights

Data Storage and Archiving Solutions: Data storage and archiving solutions dominated the market in 2025 because life science companies required scalable, secure, and compliant systems to store the rapidly growing volumes of clinical genomic and imaging data. The need for regulatory adherence, disaster recovery, and long-term preservation of patient data pushed enterprises toward advanced storage architectures.

Data Integration and Harmonization Tools: Data integration and harmonization tools emerged as the fastest-growing category, driven by the need for interoperable systems to combine disparate datasets from digital health platforms, biobanks, and clinical trials. Precision medicine, real-world evidence studies real world evidence studies and AI-driven drug discovery have all increased demand for standardized analytics-ready data pipelines. Collaboration between institutions and regulatory pressure for transparent data workflows further aided adoption.

Deployment Model Insights

On-Premise Deployment: On-premises deployment dominated the market in 2025, as pharmaceutical firms and research institutes prioritized data sovereignty, security controls, and compliance with strict regulatory mandates. Proprietary algorithms, IP-rich research records, and sensitive patient data were deemed too important to be stored entirely in public clouds. Large enterprises with high-volume workloads maintained private data centers to ensure performance customization and control.

Cloud-Based / Hybrid Deployment: Cloud-based/hybrid deployment models are seeing the fastest growth because businesses worldwide find them cost-effective, scalable, and flexible for handling large, varied datasets. While leveraging the cloud for computationally demanding analytics, hybrid architectures enable safe on-premises storage of sensitive documents. As AI pipelines, multi-omics research, and collaborative platforms required elastic resources and real-time accessibility, adoption skyrocketed.

End User Insights

Pharmaceutical Companies: Pharmaceutical companies dominate the market because they produce enormous datasets from clinical trials and research, necessitating intricate management, compliance supervision, and integrated analytical workflows. Their significant investments in biomarker research, drug discovery pipelines, and real-world evidence studies fueled demand for reliable data platforms. Large budgets and digital transformation initiatives accelerated enterprise-wide adoption.

Biotechnology Firms: Biotechnology firms where the fastest-growing users of life science data management solutions because of their heavy reliance on high-throughput omics technologies and quick adoption of digital-first research models. To accelerate discovery cycles, cloud-native and AI-enabled solutions are given priority by smaller, innovative businesses. Venture capital funding and partnerships with big pharma further expanded technology adoption.

Life Science Data Management Market Regional Insights

North America dominated the market in 2025 due to substantial government funding for genomic and clinical informatics, sophisticated research infrastructure, and the strong presence of major pharmaceutical and biotechnology companies. The region has a long history of early adoption of digital health technologies, and this culture of rapid modernization has pushed organizations to implement advanced clinical data platforms.

The widespread use of AI-enabled cloud systems, automated analytics, and compliant digital workflow tools accelerated institutional investment in structured data environments. Strict regulatory expectations from agencies such as the FDA and HHS also encouraged the deployment of high-performing systems designed to ensure audit readiness, traceability, and secure data storage across clinical and research settings.

The United States dominated the life science data management market in 2025 due to its strong presence of major pharmaceutical and biotech companies, high R&D spending, and advanced digital infrastructure. Large volumes of clinical and genomic data were produced, driving demand for secure, compliant, and scalable data platforms. The U.S. was further strengthened by robust regulatory frameworks and the rapid adoption of cloud and AI technologies, thereby bolstering its dominance of the market.

Asia Pacific was the fastest-growing region because large patient populations, expanding national genomics programs, and rapidly developing biotech ecosystems generated massive volumes of clinical and molecular data. Governments in China, South Korea, Singapore, and India have issued specific policies to support precision medicine, digital health, and AI-enabled research, thereby increasing regional demand for sophisticated data management.

Growth was also supported by new infrastructure in sequencing centers, teaching hospitals, and university research networks, which rely heavily on interoperable data platforms to exchange information across borders. Affordable cloud-based systems are in high demand within early-stage biotech firms, particularly those focused on personalized medicine and computational drug development.

India Life Science Data Management Market Trends

India experienced rapid adoption of life science data management solutions driven by its growing biotech industry, the digitization of healthcare, and government programs supporting genomics and clinical data standardization. The demand for scalable solutions was driven by the growth in digital health data volumes and the cost-effectiveness of cloud infrastructure.

Latin America, the Middle East, and Africa recorded an emerging. Still, slower adoption as digital health programs gained traction and more clinical sites transitioned toward electronic data capture and cloud-based workflows. Growth was fuelled by the expansion of telemedicine, pharmaceutical manufacturing hubs in countries such as Brazil and Saudi Arabia, and increasing interest in population health analytics.

Long-term demand for mobile-integrated and cloud-native platforms is rising as many healthcare facilities move away from paper-based systems and adopt basic digital infrastructure. Market maturity is still progressing gradually because of inconsistent regulatory frameworks, limited digital capacity in rural areas, and variability in national investment levels.

What Will Drive the Next Wave of Demand in Life Science Data Management?

| Future Demand Area | What Drives It | Impact on Industry |

| AI-enabled analytics Platforms | Need for faster drug discovery and clinical insights | Accelerates R&D, reduces cost and time |

| Cloud-Based Scalable Storage | Growing biological datasets and remote collaboration | Improves accessibility, flexibility, and cost efficiency. |

| Real-Time Data Processing Tools | Demand for rapid decision-making in labs and trials | Enhances accuracy, speed, and responsiveness. |

| Integrated, Interoperable, Systems | Fragmented lab and clinical data sources | Enables seamless workflows and unified data ecosystems. |

| Advanced Cybersecurity & Compliance Solutions | Rising privacy laws and data breach risks | Ensure safety, trust, and regulatory adherence. |

| Blockchain-based Data Validation | Demand for secure, tamper-proof data exchange |

Strengthens auditability, traceability, and trust. |

Life Science Data Management Market Companies

Leads the market with offerings in clinical research, AI-enhanced analytics, and technology solutions for clinical trials.

A top provider of cloud-based software for the life sciences industry, specializing in regulatory, clinical, and quality operations.

Applies its Azure and AI tools to improve clinical productivity, supply chain visibility, and regulatory compliance.

Offers a suite of cloud-based solutions for clinical trial management, regulatory compliance, and big data analytics.

A healthcare analytics leader that uses AI and big data to improve patient outcomes and operational efficiency.

Provides AI-powered clinical trial management software and modeling and simulation tools for research and development.

Focuses on optimizing supply chains and managing regulatory compliance through its life sciences offerings

Recent Developments

- In January 2025, Clarivate Plc launched DRG Fusion. This new life sciences analytics platform integrates real-world data to support biopharma and medtech companies in commercial analytics and data-driven decision making. This platform is designed to provide actionable insights across research and commercialization phases, enabling faster and more informed decisions.(Source: https://ir.clarivate.com)

- In July 2025, Oracle rolled out new features for its pharmacovigilance tools, Oracle Argus and Safety One Intake, incorporating AI-powered capabilities to improve safety data management, reporting, and compliance. These enhancements help life science organizations handle large volumes of safety data more efficiently while maintaining adherence to regulatory standards.(Source: https://www.oracle.com)

Life Science Data Management Market Segments Covered in the Report

By Data Type

- Genomic and Sequence Data

- Clinical Trial Data

- Research and Experimental Data

- Imaging Data

- Manufacturing and Process Data

By Solution / Offering

- Data Storage and Archiving Solutions

- Data Integration and Harmonization Tools

- Software Platforms

- Data Analytics and BI Tools

- Workflow and Project Management Tools

- Data Security and Compliance Tools

By Deployment Model

- On-Premise Deployment

- Cloud-Based / Hybrid Deployment

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Diagnostics and Clinical Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting