What is Lyophilization Equipment and Services Market Size?

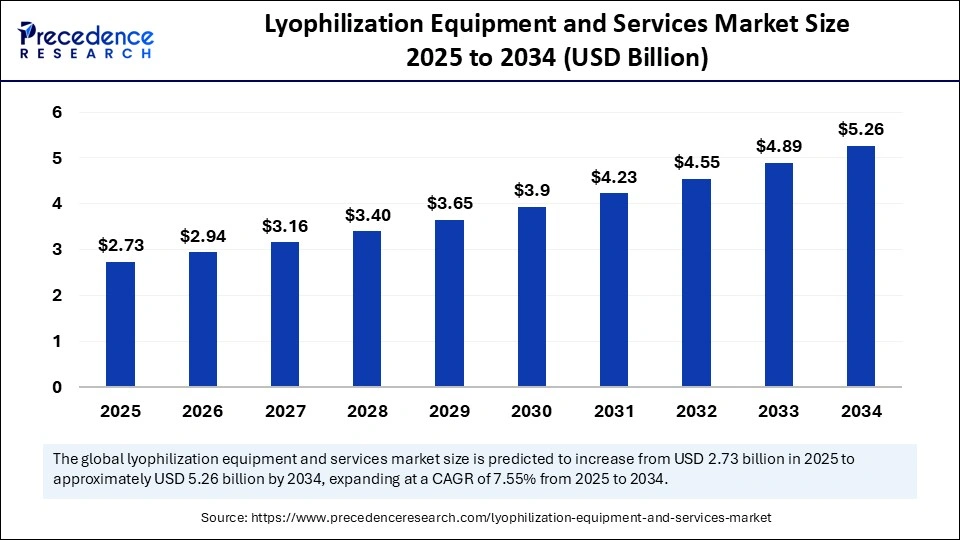

The global lyophilization equipment and services market size accounted for USD 2.73 billion in 2025 and is predicted to increase from USD 2.94 billion in 2026 to approximately USD 5.26 billion by 2034, expanding at a CAGR of 7.55% from 2025 to 2034. The market is experiencing rapid growth due to ongoing advancements in lyophilization technology and high demand for lyophilized products.

Market Highlights

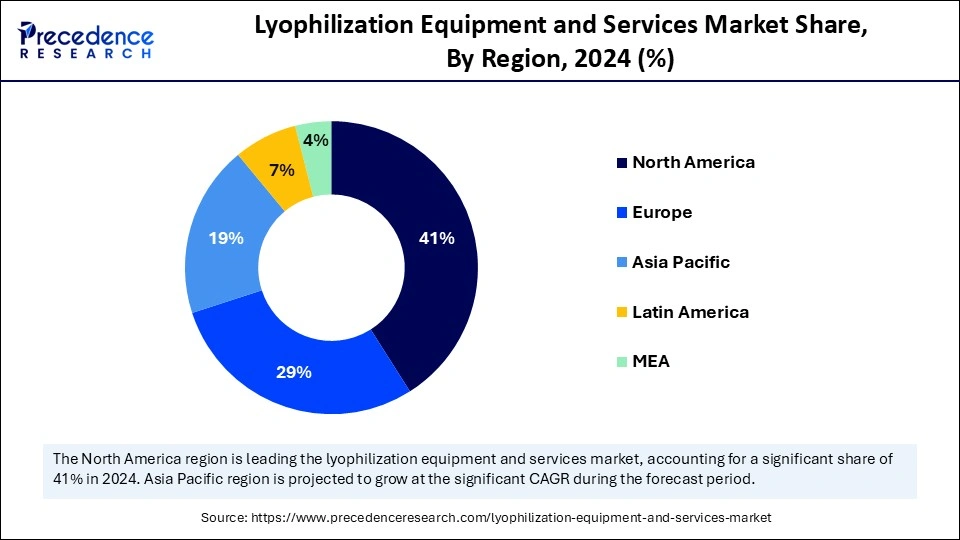

- North America dominated the global lyophilization equipment and services market with the largest revenue share of 41% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By modality, the dryer type segment held the biggest market share in 2024.

- By modality, the services segment is expected to expand at a significant CAGR during the forecast period.

- By application, the pharmaceutical and biotech manufacturing segment contributed the major market share in 2024.

- By application, the food processing and packaging segment is projected to grow at the fastest CAGR between 2025 and 2034.

Market Overview

Lyophilization equipment and associated services play a crucial role in preserving materials by removing water through sublimation. They find applications in pharmaceuticals, biological products, and food manufacturing. The lyophilization process extends shelf life, maintains product quality, and facilitates convenient storage and transportation of these items. The lyophilization equipment and services market is witnessing rapid growth, driven by the rising demand for stable and shelf-stable products, particularly in the pharmaceutical and biotechnology sectors. Advancements in lyophilization technology led to more efficient and effective processes, contributing to the growth of the market. There is a strong emphasis on product quality and stability, boosting the adoption of lyophilization equipment in the pharmaceutical and biopharmaceutical industries.

What is the Significance of AI in the Lyophilization Equipment and Services Market?

Artificial intelligence (AI) is transforming the market for lyophilization equipment and services by enabling more efficient and cost-effective processes. AI is utilized for modeling, analysis, detection, and control in lyophilization, aiding in the optimization of drying conditions, enhancing product quality, and lowering costs. AI-driven digital twins can simulate and model the lyophilization process, allowing for virtual optimization and testing of different parameters before implementation. AI algorithms improve product quality and efficiency by analyzing data from lyophilization processes. Moreover, AI predicts equipment failure, enabling proactive maintenance and reducing downtime.

What are the Key Trends in the Lyophilization Equipment and Services Market?

- Increasing Demand for Lyophilized Products: Lyophilization is leveraged to preserve various products, including pharmaceuticals, food, and biological samples, by facilitating enhanced shelf life and stability.

- Advancements in Lyophilization Technology: Technological advancements and cutting-edge innovations improve control systems, real-time monitoring, and optimized freeze-drying cycles, which further heighten the efficiency and scalability of the process.

- Biopharmaceuticals and Injectable Therapeutics: Lyophilization is essential for the production and stability of biopharmaceuticals and injectable therapeutics, which are increasingly used in healthcare. Also, investments in biopharmaceutical research and development boost the demand for lyophilization equipment and services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.73 Billion |

| Market Size in 2026 | USD 2.94 Billion |

| Market Size by 2034 | USD 5.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Modality, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Injectable Drugs, Biologics, and Vaccines

The increasing demand for injectable drugs, biologics, and vaccines is a major factor driving the growth of the lyophilization equipment and services market. The lyophilization process plays a vital role in preserving the stability and potency of these products by removing moisture without compromising their structure. Lyophilization equipment plays a crucial role in the production of biologics and vaccines. This equipment reduces the need for cold chain storage, making it easier to transport these products without getting spoilage. In addition, the rising demand for stable, long-lasting, and easily transportable pharmaceuticals and food products, along with the growing popularity of lyophilized food products, is driving the growth of the market.

Restraint

High Initial Investment and Operational Costs

One of the major factors restraining the lyophilization equipment and services market is the high initial investment and operational costs of lyophilization equipment. This encompasses the initial purchase price of scale lyophilizers, ongoing energy consumption during sublimation and secondary drying, and maintenance expenses. Lyophilization equipment requires ongoing maintenance to ensure its smooth operation, which leads to increased maintenance costs. In addition, the lyophilization process requires specialized equipment, vacuum systems, and refrigeration units, which can be costly, particularly for smaller businesses.

Opportunity

Increasing Demand for Specialized Lyophilization Services

A significant opportunity for the future growth of the lyophilization equipment and services market lies in the increasing demand for specialized lyophilization services, especially in the biopharmaceutical sector. This is largely due to the growing complexity of drug development, particularly for personalized medicine and cell therapies, which necessitate highly tailored lyophilization processes to ensure stability and efficacy. Specialized services can enhance the capabilities and efficiency of the lyophilization process. Moreover, the increasing outsourcing of lyophilization services is opening up new growth avenues for the market.

Segment Insights

Modality Insights

Why did the Dryer Type Segment Dominated the Lyophilization Equipment and Services Market in 2024?

The dryer type segment dominated the market with the largest revenue share in 2024. This is mainly due to the versatility and crucial role of dryers in the lyophilization process. Tray-style freeze dryers are widely preferred in pharmaceutical and biotechnology manufacturing processes. These dryers are effective for batch processing and provide space-saving vertical stacking capabilities, striking a balance between efficiency, user-friendliness, and cost-effectiveness, which makes them the preferred choice for various industrial applications.

- In September 2023, Bioscreen Instruments PVT, LTD. and CryoDry Instruments PVT, LTD. collaborated to introduce freeze-drying solutions in India. Their state-of-the-art CryoDry freeze dryers, combined with Bioscreen's exceptional service capabilities, are poised to establish new standards of excellence within the industry.

The services segment is expected to expand at a significant CAGR during the forecast period. The growth of the segment is attributed to the rising demand for expertise in equipment setup, maintenance, and optimization. This growth of the segment is further attributed to the increasing need for validation and qualification services, training programs, and technical support to ensure proper equipment operation and compliance. The pharmaceutical and biotech industries are subject to strict regulations, making validation and technical support essential for compliance. As the adoption of lyophilization equipment increases, so does the demand for installation, training, and maintenance services.

Application Insights

What Made Pharmaceutical and Biotech Manufacturing the Dominant Segment in the Market?

The pharmaceutical and biotech manufacturing segment dominated the lyophilization equipment and services market with a major revenue share in 2024, primarily because of the extensive use of lyophilization in the pharmaceutical sector to stabilize and preserve drugs, vaccines, and other biopharmaceuticals. This process prolongs product's shelf life, enhances stability, and simplifies storage and transportation. Additionally, many biologics developers are shifting to outsourcing lyophilization services, particularly for targeted therapies and cell therapies, which require specialized equipment and expertise to support the development and manufacturing of new drugs. Stringent regulations regarding the quality and stability of pharmaceutical products further bolstered the segmental growth.

The food processing and packaging segment is projected to grow at the fastest CAGR in the coming years. The growth of the segment is attributed to the rising demand for clean-label products and perishable goods. The lyophilization process extends the shelf life and preserves the nutritional value and flavor of food items during processing. Furthermore, lyophilization retains the original color, taste, appearance, and texture of food, making it a favorable processing method for various food products. It preserves food quality by preventing heat damage and maintaining texture and nutritional integrity, establishing it as a preferred preservation method.

Regional Insights

U.S. Lyophilization Equipment and Services Market Size and Growth 2025 to 2034

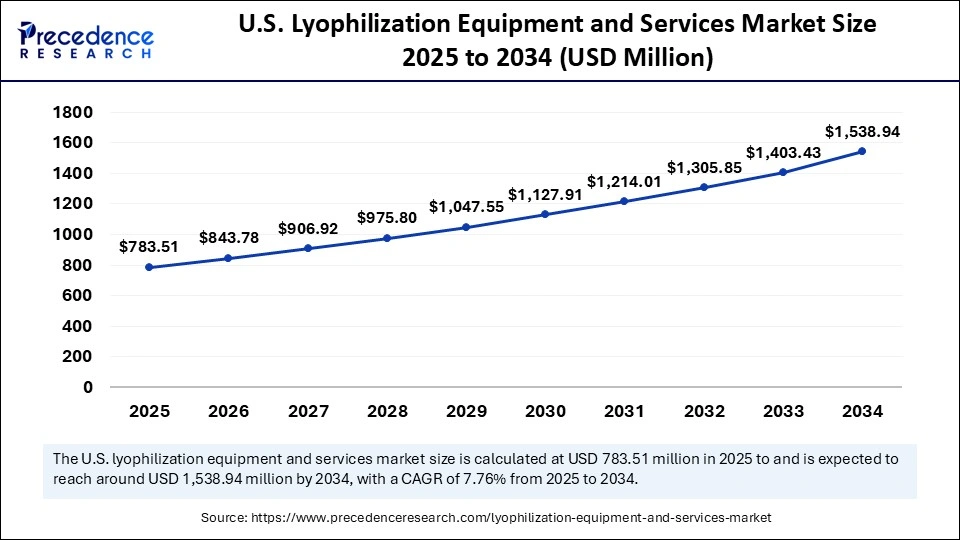

The U.S. lyophilization equipment and services market size is exhibited at USD 783.51 million in 2025 and is projected to be worth around USD 1,538.94 million by 2034, growing at a CAGR of 7.76% from 2025 to 2034.

How Does North America Dominate the Lyophilization Equipment and Services Market in 2024?

North America registered dominance in the market by capturing the largest revenue share in 2024, driven by its well-established biopharmaceutical industry, robust healthcare infrastructure, and government support for research and development. As a hub for pharmaceutical and biotechnology research and development, biopharmaceutical and pharmaceutical companies in North America heavily invest in lyophilization equipment and services to preserve sensitive biopharmaceuticals, injectables, and other products. There is a high demand for personalized medicine, driving the demand for lyophilization, a crucial process for preserving and stabilizing pharmaceuticals for extended storage and distribution.

The U.S. Lyophilization Equipment and Services Market Trends

The U.S. plays a major role in the market due to its significant investments in biotechnology and pharmaceutical research and development and a robust healthcare infrastructure. Additionally, the presence of major industry players such as SP Scientific Products, Lyophilization Technology, Inc., Millrock Technology, and Labconco Corporation enhances its leadership. The U.S. excels in research capabilities, manufacturing facilities, and technological adoption, supporting market growth. Moreover, stringent regulations regarding the quality and safety of pharmaceutical and food products contribute to market growth.

What are the Major Trends in the Lyophilization Equipment and Services Market Within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the upcoming period. This is mainly due to rapid industrialization, increased investments in pharmaceutical and biotechnology R&D, increased spending on packaged and processed foods, and advancements in manufacturing technologies. The rapid expansion of the biopharmaceutical and pharmaceutical industries in countries like China, India, Japan, and South Korea further boosts the demand for lyophilization equipment and services. These countries are also heavily investing in research and development. This investment encourages the adoption of advanced manufacturing technologies in the food and pharmaceutical sectors, contributing to the growth of the market.

China Lyophilization Equipment and Services Market Trends

China plays a significant role in the market. As the largest market in the region for lyophilization equipment and services, China benefits from its status as a major pharmaceutical manufacturer. The increasing demand for lyophilized products such as medicines, health products, and food also propels the growth of the market. Government policies supporting local manufacturing and the rising demand for quality healthcare products contribute to market growth.

Why is Europe Considered a Notable Region in the Lyophilization Equipment and Services Market?

Europe is considered to be a significantly growing area. This is mainly due to its well-established pharmaceutical industry, which emphasizes biologics and vaccine production, boosting the demand for lyophilization equipment. Furthermore, the region is home to various research institutions and universities that actively develop new biopharmaceuticals and lyophilization technologies. Major lyophilization equipment manufacturers like GEA Group, Martin Christ Gefriertrocknungsanlagen, and Syntegon Technology based in countries such as Germany, France, and the UK, contribute to the region's market growth.

In March 2024, Biopharma Group launched a new GMP freeze-drying production facility to offer a much-needed resource to pharmaceutical companies needing small batch production facilities for first-in-human clinical trials. The new GMP facility in Winchester, UK, will provide freeze drying for up to 3,200 2R vials in their ATS Hull S10 freeze dryer, together with full isolation facilities in a grade A cleanroom environment for sterile production of both liquid and lyophilised products.

France Lyophilization Equipment and Services Market Trends

The extensive investment programs provided by the French government support advanced technologies in the biotechnology and pharmaceutical industries, including lyophilization. The development of vaccines and a strong biotechnology sector is fueling the lyophilization equipment and services market in France. Additionally, there is increasing demand for freeze-dried pharmaceuticals, biologics, and vaccines, particularly as the healthcare sector focuses on improving product stability and shelf life.

What Potentiates the Growth of the Lyophilization Equipment and Services Market in Latin America?

The growth of the lyophilization equipment and services market in Latin America is fueled by the increasing demand for high-quality pharmaceuticals, biologics, and vaccines, particularly due to the rising prevalence of chronic diseases and the need for effective preservation methods. Additionally, expanding investments in the region's healthcare infrastructure, regulatory improvements, and a growing focus on biotechnology and pharmaceutical research are driving the adoption of advanced lyophilization technologies for drug development and manufacturing.

Brazil Lyophilization Equipment and Services Market Trends

In Brazil, the market is expanding as the pharmaceutical and biotechnology industries increasingly focus on improving the stability and shelf life of drugs, vaccines, and biologics. Additionally, the growing emphasis on technological advancements, such as automation and energy-efficient systems, is pushing the demand for more sophisticated lyophilization solutions to enhance production capabilities and meet international quality standards.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) present significant opportunities in the market, driven by large-scale government programs and increasing demand for freeze-dried products such as cosmetics, food, and pharmaceuticals. The rising need for advanced preservation technologies also propels the market. Additionally, rising investments in the biotechnology sector, along with a focus on meeting international regulatory standards and improving product shelf life and stability, are accelerating the adoption of advanced lyophilization technologies across key markets in the region.

Saudi Arabia Lyophilization Equipment and Services Market Trends

Saudi Arabia continues to lead the market in the region, owing to its expanding pharmaceutical and medical equipment sectors. The Saudi Food and Drug Authority launched the national biotechnology strategy, which aims to position Saudi Arabia as a leader in medical innovation and biomanufacturing. The increasing demand for high-quality pharmaceuticals, vaccines, and biologics, especially as healthcare infrastructure in the region improves, supports market growth.

Lyophilization Equipment and Services Market Companies

- GEA Group AG

- IMA Industria Macchine Automatiche S.p.A.

- Labconco Corporation

- Martin Christ Gefriertrocknungsanlagen GmbH

- MechaTech Systems Ltd

- Millrock Technology Inc.

- OPTIMA packaging group GmbH

- SP Industries

- Telstar (Azbil Corporation)

- Thermo Fisher Scientific Inc.

- W. L. Gore & Associates Inc.

Recent Developments

- In June 2024, Labconco Corporation launched the Lyph-Seal Tray Dryer, an innovative solution that greatly expands the variety of samples that can be lyophilized and sealed under vacuum. This launch addresses the unique demand of laboratories across various industries to preserve an extensive range of samples, often found in materials science, clinical diagnostics, and cosmetics, by creating a vapor barrier that blocks humidity and dramatically extends the sample shelf life.(Source: https://www.news-medical.net)

- In October 2024, GEA launched its next-generation batch freeze dryers, the RAY Plus series. The new RAY Plus series offers advanced technology that enhances energy efficiency and hygiene, providing a more flexible and efficient solution for the food industry to extend refrigerator-free shelf life while retaining nutritional quality, taste, texture, and appearance. Source: https://www.gea.com)

Segments Covered in the Report

By Modality

- Dryer Type

- Tray-style Freeze Dryers

- Manifold Freeze Dryers

- Rotary Freeze Dryers

- Other Products

- Accessories

- Vacuum Systems

- CIP (Clean-in-place) Systems

- Drying Chamber

- Other Accessories

- Services

By Application

- Food Processing and Packaging

- Pharmaceutical and Biotech Manufacturing

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting