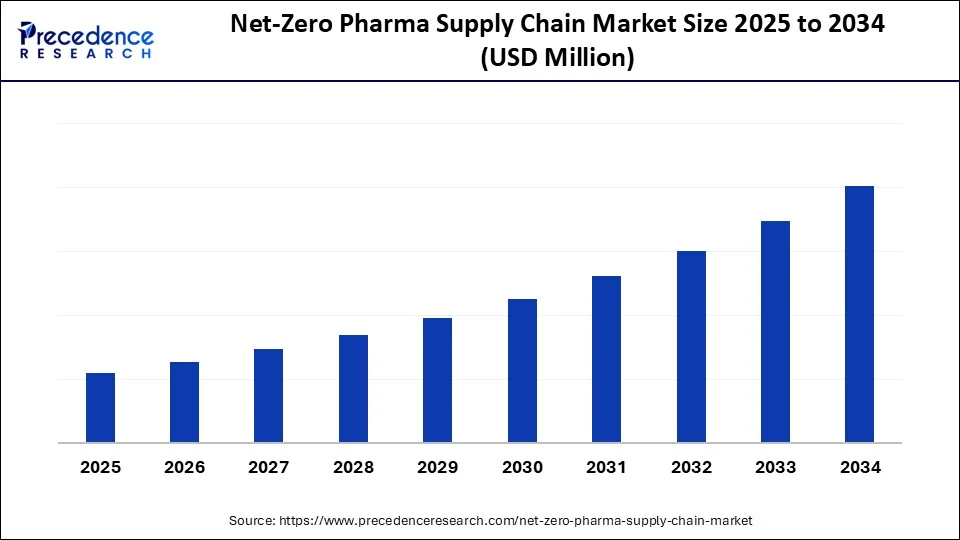

Net-Zero Pharma Supply Chain Market Size and Forecast 2025 to 2034

Net zero pharma supply chain market focus on green logistics, PPAs for cold chain, sustainable packaging, and lifecycle carbon reporting. The market growth is attributed to increasing regulatory mandates, climate-aligned investment strategies, and rising adoption of digital platforms that enable end-to-end carbon visibility across pharmaceutical supply chains.

Net-Zero Pharma Supply Chain MarketKey Takeaways

- Europe dominated the global net-zero pharma supply chain market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By scope in supply chain, the cold chain and logistics segment held a major market share in 2024.

- By scope in supply chain, the end-to-end carbon management platform segment is projected to grow at a significant CAGR between 2025 and 2034.

- By component, the solutions segment contributed the biggest market share in 2024.

- By component, the services segment is expanding at a significant CAGR in between 2025 and 2034.

- By emission scope addressed, the scope 3 segment led the market and is expected to sustain its position during the forecast period.

- By deployment type, cloud-based solutions segment captured the global market with the largest share in 2024.

- By deployment type, the hybrid deployment segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-user, the pharmaceutical manufacturers segment contributed the highest market share in 2024.

- By end-user, the CMOs & CDMOs segment is expected to grow at a notable CAGR from 2025 to 2034.

- By organization size, the large enterprises segment held the major market share in 2024.

- By organization size, the SMEs segment is projected to grow at the highest CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Net-Zero Pharma Supply Chain Market

The net-zero pharma supply chain market is evolving with artificial intelligence (AI), as it assists in restructuring and optimizing operations, reducing emissions, and implementing sustainable technologies. Leading pharmaceutical companies are currently using AI to assess the carbon footprints of their production, delivery, and supply chains. This enables them to pinpoint high-emission areas accurately and take appropriate action. Additionally, AI optimizes route planning and cold chain tracking, significantly decreasing fuel consumption and temperature-related spoilage.

Market Overview

The net-zero pharma supply chain market refers to the ecosystem of products, technologies, services, and strategic processes aimed at decarbonizing and minimizing greenhouse gas (GHG) emissions across the pharmaceutical value chain—from raw material sourcing to distribution, packaging, manufacturing, and waste management—while ensuring compliance with environmental regulations and meeting net-zero emission targets. It encompasses carbon accounting, renewable energy integration, sustainable transportation, circular packaging, green manufacturing, and data platforms that enable pharma companies to operate in alignment with global climate goals, such as those defined by the Science Based Targets initiative (SBTi) or the Paris Agreement.

The increasing pressure on pharmaceutical companies to reduce emissions in global value chains is expected to accelerate the widespread adoption of net-zero technologies in the pharmaceutical supply chain. Net-zero pharma supply chains involve the implementation of carbon-neutral or carbon-negative solutions across all phases of the supply chain. The WHO Foundation estimates that the healthcare sector accounts for 5% of global emissions, with a substantial portion originating from the pharmaceutical industry. Moreover, growing regulatory and stakeholder pressure for emission accountability is projected to drive innovation and investment in net-zero pharmaceutical infrastructure in the coming years.

(Source: https://who.foundation)

Net-Zero Pharma Supply Chain MarketGrowth Factors

- Rising Adoption of Low-Carbon APIs: Growing demand for climate-resilient pharmaceutical ingredients is fuelling greener synthesis pathways across global production units.

- Surging Investment in Decentralized Clean Energy:Increasing installation of on-site renewables such as solar microgrids and hydrogen fuel cells is driving self-sufficient pharmaceutical manufacturing.

- Boosting Digital Twin Integration:The use of AI-powered digital twins for real-time emissions simulation and optimization is transforming how pharma companies model supply chain sustainability.

- Growing Emphasis on Climate-Aligned Procurement: Supplier selection based on carbon intensity and ESG credentials is reshaping pharma value chains and fuelling sustainable sourcing practices.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Scope in Supply Chain, Component, Emission Scope Addressed, Deployment Type, End-User, Organization Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Growing Demand for Transparent Logistics Driving the Net-Zero Pharma Supply Chain Market Forward?

The increasing demand for transparent and traceable net-zero logistics systems is expected to drive market growth. Companies are integrating digital platforms and IoT traceability into their supply chains to enhance tracking visibility across sourcing, manufacturing, and distribution. These technologies ensure real-time emissions monitoring, verification of drug and biologic origins, and cold chain presence for temperature-sensitive products. Accurate traceability also supports the development of strategies to measure Scope 3 emissions, which represent a significant portion of the industry's carbon footprint.

The World Economic Forum (WEF) reported in 2024 that a large percentage of pharmaceutical emissions are linked to the supply chain, emphasizing the need for digitizing and decarbonizing supply chain networks. The trend towards rigorous sustainability reporting is driven by requirements in Europe, North America, and Asia, as regulatory bodies push for comprehensive reporting mechanisms in business structures. Furthermore, strong regulatory pressure for sustainability compliance is likely to accelerate sustainable supply chain transformation.

(Source: https://who.foundation)

Restraint

High Upfront Investment Hampers Net-Zero Transition in Pharma Supply Chains

The high initial investment needs are anticipated to hinder the scalability of net-zero initiatives across pharmaceutical supply chains, thereby slowing market growth. Building a low-carbon infrastructure, installing renewable energy systems, and integrating digital tracking tools necessitate significant capital investments. These financial hurdles also create disparities between large international corporations and smaller companies, which slows down the overall progress of the net-zero transition in the supply chain.

Opportunity

Why Is the Increasing Focus on Decarbonizing Operations Reshaping the Net-Zero Pharma Supply Chain Landscape?

The growing emphasis on decarbonizing pharmaceutical operations is expected to generate significant market opportunities. Major drug producers are adopting energy-efficient technologies, renewable energy, and redesigning production processes to meet science-based emission reduction targets. These efforts aim to cut Scope 1 and Scope 2 emissions in manufacturing facilities and research centers.

Companies are investing in green infrastructure, low-carbon HVAC systems, and smart utility management to improve resource efficiency. The WHO Foundation projects that global healthcare-related emissions will reach six gigatons annually by 2050, equivalent to emissions from approximately 1.26 billion passenger vehicles each year. Additionally, regulations like the EU Green Deal and the U.S. Inflation Reduction Act are providing incentives for decarbonization, accelerating the number of companies pursuing net-zero strategies.(Source:https://who.foundation)

Scope in Supply Chain Insights

Why Did the Cold Chain & Logistics Segment Dominate the Net-Zero Pharma Supply Chain Market in 2024?

The cold chain & logistics segment dominated the net-zero pharma supply chain market in 2024 due to the increased demand for quality products in the pharmaceutical industry, including temperature-sensitive drugs, biologics, and vaccines. Cold chain logistics is crucial for ensuring product efficacy and reducing waste and energy loss across global supply chains. Key players implemented real-time tracking systems, eco-friendly refrigeration transport, and route optimization using AI to minimize fuel consumption and related carbon emissions. The shift towards low-carbon cold chain infrastructure was further supported by regulatory pressures, such as stricter emissions standards for pharmaceutical distribution fleets.

The increased preference for mRNA vaccines and cell therapies necessitates ultra-cold storage. In 2024, the U.S. Environmental Protection Agency (EPA) revised its SmartWay program to include emissions scoring for pharma cold chain carriers, encouraging the use of electric and hybrid freight technologies. Additionally, significant investments in greener storage solutions in the short term and cold chain logistics further drive the segment.

The end-to-end carbon management platforms segment is expected to experience the highest CAGR in the coming years, driven by the pharmaceutical industry's focus on comprehensive decarbonization. These platforms offer built-in solutions to track Scope 1, 2, and 3 emissions across all stages of the supply chain. Furthermore, this software provides real-time carbon awareness throughout procurement and distribution, further promoting its adoption in the coming years.

Component Insights

What Drove Solutions to Emerge as the Leading Component in the Net-Zero Pharma Supply Chain Market?

The solutions segment held the largest revenue share in the net-zero pharma supply chain market in 2024, driven by the popularity of carbon management software and sustainable packaging systems. Pharmaceutical manufacturers primarily utilize digital platforms to monitor emissions, generate sustainability reports, and align procedures with science-based targets. These solutions enable businesses to measure emissions in a granular manner, facilitating data-driven decisions in procurement, logistics, and production. Additionally, increasing regulatory pressure and consumer inquiries drive demand for decarbonization of supply chain solutions.

The services segment is projected to grow at the fastest rate in the coming years due to the rising complexity in sustainable compliance and strategic transformation. Pharmaceutical companies are seeking advice to support them on new global disclosure frameworks and the science-based verification of emissions. Furthermore, the increasing reliance on services is expected to boost institutional capacity along the value chain and aid in accelerating climate targets.

Emission Scope Addressed Insights

Why Did the Scope 3 Segment Receive the Most Focus Across Net-Zero Pharma Supply Chain Strategies in 2024?

The Scope 3 segment led the market and is expected to maintain its dominance during the forecast period, due to the pharmaceuticals' increasing focus on indirect emissions within the value chain. These emissions occur during raw material sourcing, upstream transportation, contract manufacturing, packaging, distribution, and end-of-life disposal. Organizations like AstraZeneca, Novartis, and Pfizer have enhanced their Scope 3 reporting capabilities using emissions monitoring systems and supplier engagement platforms.

Driven by growing pressure from regulators, investors, and sustainability initiatives, companies are considering emissions beyond direct operations. Pharmaceutical firms are expected to increase their engagement with suppliers, logistics companies, and contract manufacturers to minimize embedded emissions. Furthermore, Scope 3 continues to hold strategic priority in decarbonization, further fueling this sub-segment in the market.

Deployment Type Insights

What Made Cloud-Based Solutions the Preferred Deployment Type in the Net-Zero Pharma Supply Chain Market?

The cloud-based solutions held the largest revenue share in the net-zero pharma supply chain market in 2024. These platforms enable real-time tracking of emissions, supplier performance, and integration of ESG data across global operations. The use of cloud deployment facilitated rapid updates and alignment with evolving regulatory frameworks.

- In 2024, the World Economic Forum (WEF) found that cloud-enabled decarbonization systems increased data transparency, reducing IT infrastructure emissions. Additionally, the low cost of entry for cloud-based models further supports their dominance among Tier 1 and Tier 2 pharma suppliers.

The hybrid deployment segment is expected to grow at the fastest CAGR in the coming years, driven by the pharmaceutical industry's need for flexible, secure, and regionally compliant decarbonization technology. Hybrid implementations offer a practical trade-off for digital dexterity in both developed and emerging markets. Furthermore, the balanced computation loads between local and off-site data centers provided by hybrid net-zero pharma supply chain solutions further boost segment growth.

End User Insights

Why Did the Pharmaceutical Manufacturers Lead the Net-Zero Pharma Supply Chain Market in 2024?

The pharmaceutical manufacturers segment dominated the net-zero pharma supply chain market in 2024, as they are trying to control their operations with emissions-intensive work and being directly accountable for increasing global sustainability goals. These firms focused their attention on the goal of decarbonization of core manufacturing processes, such as energy optimization, process remake, and the insertion of renewable. Novartis, AstraZeneca, and GlaxoSmithKline (GSK) were the industry leaders who developed emissions tracking technologies and engaged in protocols in green chemistry to reduce the scope 1 and scope 2 emissions.

The Science-Based Targets initiative (SBTi) awarded the net-zero roadmaps of several pharmaceutical manufacturers aligned to 1.5°C pathways. The on-site programs, such as low-carbon HVAC, energy recovery facilities, and solar, were some of the programs that reduced the intensity of emissions, according to the Carbon Trust. Additionally, the large pharma productions in Europe and North America had shifted to decarbonised utility systems, such as options in waste heat recovery as well as on-site renewables, thus further fuelling the market. According to the MAERSK 2025 report, pharma firms in the Net-Zero Pharma Supply Chain Market are embedding decarbonization into daily operations. Most now set climate targets and allocate budgets to accelerate sustainable supply chain transitions.

(Source: https://www.maersk.com)

The CMOs & CDMOs segment is expected to grow at the fastest rate in the coming years, owing to the increased outsourcing trend, which is combined with the need to ensure compatibility with the sustainability requirements of sponsors. The pharmaceutical companies may have to vet the vendors that supply them with third parties in terms of price and quality, and climate performance. Pharmaceutical Supply Chain Initiative (PSCI) and CDP widened their supplier climate report frameworks to encompass significant transparency in CMOs and CDMOs. Furthermore, the CMOs or CDMOs were nations that joined the UNFCCC Race to Zero Campaign, further boosting the demand for net-zero pharma supply chain solutions.

Organization Size Insights

How Does the Large Enterprises Segment Dominate the Net-Zero Pharma Supply Chain Market in 2024?

The large enterprises segment led the net-zero pharma supply chain market in 2024, due to their strong capital base, superior digital infrastructure, and well-established supply chains. These entities implemented enterprise-level decarbonization solutions, like emission monitoring, supplier sustainability ratings, and AI-driven ESG reporting. They are also investing in decarbonized infrastructure, such as renewable-based labs and low-emission logistics.

The SMEs segment is expected to grow at the fastest CAGR, using flexible, cloud-based sustainability systems for real-time carbon tracking and involvement in low-carbon procurement schemes. Organizations like Access to Medicine Foundation and Health Care Without Harm (HCWH) offer technical assistance to help SMEs align with the decarbonization needs of pharmaceutical multinationals. The installation of ESG-based procurement provisions and Scope 3 reduction incentives by large drug manufacturers is expected to further fuel market growth in this sector.

Regional Insights

Why Did Europe Emerge as the Leading Contributor to the Net-Zero Pharma Supply Chain Market?

Europe dominated the net-zero pharma supply chain market in 2024, holding the largest revenue share, due to its technical environmental standards, high ESG integration, and supportive climate policy. The EMA and European Commission have imposed strict climate reporting requirements in their CSRD, mandating detailed reporting of Scope 1, 2, and 3 emissions from pharmaceutical businesses.

Leading manufacturers like GSK, Novartis, and Sanofi have increased decarbonized activities in Germany, Switzerland, France, and the Nordics, leveraging clean energy grids and green procurement strategies. European pharma's leadership was evident with many companies achieving accreditation with the Science Based Targets initiative (SBTi) to meet net-zero transition plans in 2024. Moreover, European governments have subsidized the pharmaceutical industry with carbon cut and clean infrastructure investment incentives, further facilitating market growth in this region.

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by the rising manufacturing of pharmaceuticals, supply chain innovation, and increasing national climate strategies. Countries like India, China, Japan, and South Korea are expected to boost investments in low-carbon manufacturing and renewable energy integration in drug clusters. National frameworks such as India's Green Pharma Mission and South Korea's Carbon-Neutral Industrial Strategy are also contributing to market growth in this region.

Net-Zero Pharma Supply Chain Market Companies

- Amcor (Sustainable Packaging)

- Avery Dennison

- BCG (Net-Zero Practice for Life Sciences)

- Cardinal Health

- Catalent

- DHL Supply Chain

- Enablon (Wolters Kluwer)

- IBM (Sterling & Envizi)

- IQVIA

- McKinsey & Company (QuantumBlack for decarbonization)

- Microsoft (Sustainability Cloud)

- Oracle (Supply Chain Management Cloud)

- SAP SE

- Schneider Electric

- Siemens AG

- Sphera Solutions

- Thermo Fisher Scientific

- Tracelink

- UPS Healthcare

- Vizient

Recent Developments

- In February 2025, the Energize pharmaceutical supply chain decarbonization initiative announced a landmark aggregated power purchase agreement (PPA) with renewable energy provider X-ELIO, securing 245 GWh of clean energy annually for the next decade. Leading healthcare and pharma firms including Haleon, GSK, Gilead Sciences, and Thermo Fisher Scientific are participating, reinforcing the industry's transition toward low-carbon supply chain operations. (Source: https://www.esgtoday.com)

- In January 2024, SCHOTT Pharma unveiled a decarbonization blueprint aimed at drastically cutting emissions across pharma supply chains. The company reported a 30% COâ‚‚ reduction in the lifecycle emissions of its 10R vial used in parenteral drug delivery—achieved by switching to 100% green electricity since 2021, underscoring its leadership in sustainable pharmaceutical packaging. (Source: https://www.schott-pharma.com)

Latest Announcement by Industry Leader

- In March 2025, the World Business Council for Sustainable Development (WBCSD), working with top pharmaceutical firms and supported by PwC UK, has released the Roadmap to Nature Positive: Foundations for the Pharmaceutical Sector (‘Roadmap'). This document represents a major step in industry's efforts to assess its impacts and dependencies on nature and outlines crucial actions for achieving nature-positive results. “Action on nature matters for health, climate and long-term business success. That's why we've made a commitment, alongside our net zero goal, to contribute to a nature-positive world. This collaboration is helping to identify and prioritize the key issues for our sector, so that we can drive collective action for nature, people and business resilience,” said Claire Lund, VP, Sustainability, GSK.(Source: https://www.wbcsd.org)

Segments Covered in the Report

By Scope in Supply Chain

- Upstream Supply (Raw Material & API Sourcing)

- Manufacturing Operations

- Packaging

- Cold Chain & Logistics

- Warehousing & Distribution

- Reverse Logistics & Waste Management

- End-to-End Carbon Management Platforms

By Component

- Solutions

- Carbon Tracking & Emission Accounting Software

- Green Logistics Optimization Tools

- Sustainable Packaging Materials

- Renewable Energy Solutions

- AI & IoT-based Efficiency Solutions

- Services

- ESG and Carbon Consulting

- Sustainable Procurement & Supplier Audits

- Net-Zero Supply Chain Design

- Compliance Management Services (e.g., Scope 3 disclosure)

By Emission Scope Addressed

- Scope 1 (Direct Emissions: On-site)

- Scope 2 (Indirect Emissions: Purchased Energy)

- Scope 3 (Value Chain Emissions: Suppliers, Logistics, Use Phase)

By Deployment Type

- On-Premise Solutions

- Cloud-Based Solutions

- Hybrid Deployment

By End-User (Application within Pharma Sector)

- Pharmaceutical Manufacturers

- Biotech Firms

- CMOs & CDMOs

- Distributors & Wholesalers

- Pharma Retail Chains & Pharmacies

By Organization Size

- Large Enterprises

- SMEs (including startups focusing on sustainability)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting