Network Emulator Market Size and Forecast 2025 to 2034

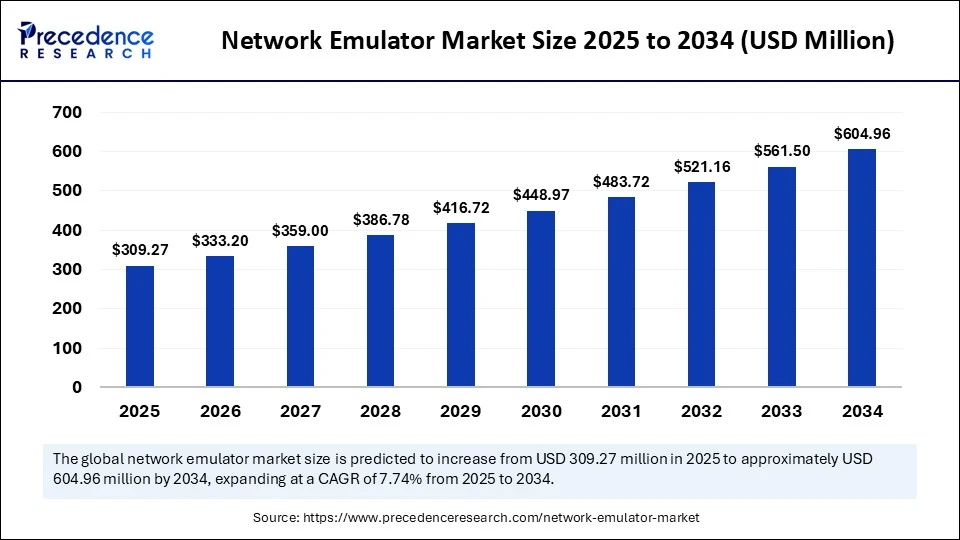

The global network emulator market size accounted for USD 287.05 million in 2024 and is predicted to increase from USD 309.27 million in 2025 to approximately USD 604.96 million by 2034, expanding at a CAGR of 7.74% from 2025 to 2034. The market is growing due to the rising need for testing complex networks in real time to ensure optimal performance, security, and reliability of modern communication systems.

Network Emulator Market Key Takeaways

- In terms of revenue, the global network emulator market was valued at USD 287.05 million in 2024.

- It is projected to reach USD 604.96 million by 2034.

- The market is expected to grow at a CAGR of 7.74 % from 2025 to 2034.

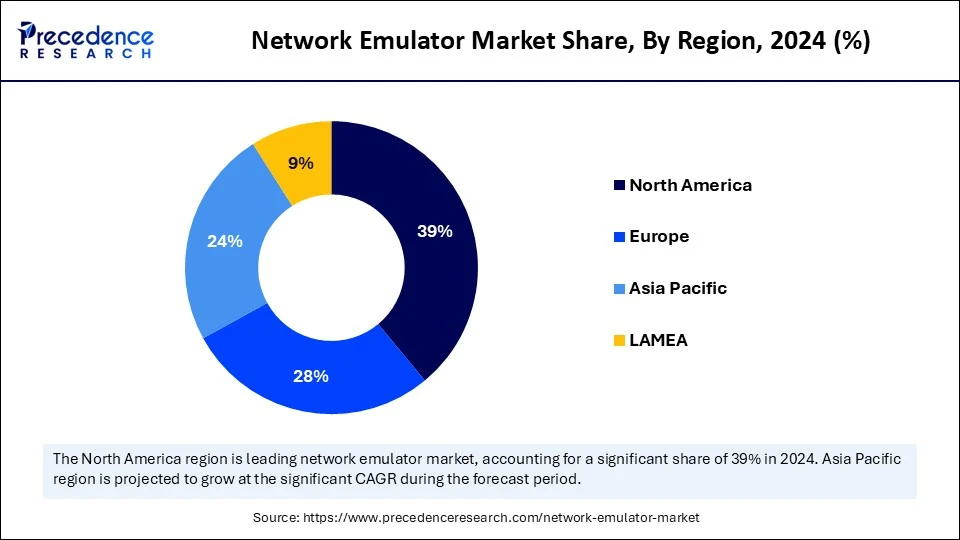

- North America dominated the network emulator market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By offering, the hardware segment held the biggest market share in 2024.

- By offering, the software segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the SD-WAN testing segment held the biggest market share of 25% in 2024.

- By application, the 5G networking testing segment is expected to grow at the fastest CAGR in the upcoming period.

- By vertical, the telecommunications segment captured the highest market share of 29% in 2024.

- By vertical, the automotive & transportation segment is likely to grow at fastest CAGR between 2025 and 2034.

- By testing environment, the lab-based testing segment contributed the highest market share of 38% in 2024.

- By testing environment, the virtualized/cloud testing segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment mode, the on-premises segment held the largest share of 52% in 2024

- By deployment mode, the cloud-based segment is observed to grow at the fastest CAGR during the forecast period.

- By end user, the communication service providers (CSPs) segment generated the major market share of 33% in 2024.

- By end user, the enterprises & data centers segment is likely to expand at the highest CAGR over the projection period.

How is AI revolutionizing testing and simulation in the network emulator landscape?

Artificial Intelligence is bringing intelligent automation, real-time decision-making, and adaptive learning capabilities to the network emulator space, drastically changing testing and simulation. Conventional emulation tools frequently use static network models and pre-made test cases, which can be laborious and inadequate for the dynamic networking environments of today. Machine learning algorithms allow emulators to learn from actual network behavior, produce more realistic traffic patterns, and replicate intricate dynamic network scenarios like cyber threats, latency spikes, and congestion. This greatly enhances test results for next-generation networks like 5G and 6G by increasing the accuracy of forecasting network performance under various scenarios.

Furthermore, AI enhances efficiency in testing by automating the identification of potential network failures or bottlenecks and suggesting corrective actions without human intervention. It also enables emulators to scale testing environments quickly, allowing seamless adaptation to new protocols, devices, and use cases such as IoT and edge computing. With AI-driven predictive analytics, network engineers can proactively test “what-if” scenarios, optimize configurations, and reduce time-to-market for new technologies. As AI capabilities continue to evolve, they are becoming integral to building smarter, faster, and more resilient network infrastructure through advanced simulation tools.

U.S. Network Emulator Market Size and Growth 2025 to 2034

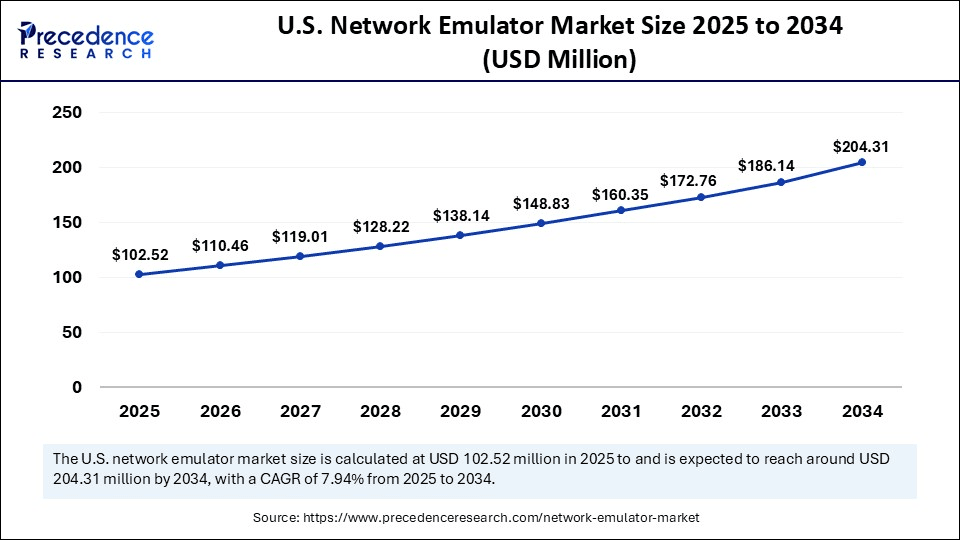

The U.S. network emulator market size was exhibited at USD 95.16 million in 2024 and is projected to be worth around USD 204.31 million by 2034, growing at a CAGR of 7.94% from 2025 to 2034.

What made North America the dominant region in the network emulator market in 2024?

North America dominated the network emulator market, holding the largest share in 2024. This is mainly due to the presence of leading technology providers, quick developments in communication infrastructure, and the widespread use of 5G and SD-WAN technologies. The region's significant investments in cutting-edge networking solutions in sectors like cloud computing, defense, and telecommunications are driving up demand for trustworthy emulation tools. Furthermore, the region's market growth is being reinforced by the strong emphasis on automation, cybersecurity, and real-time network testing.

- On 5 March 2025, Spirent Communications announced the expansion of its 5G network testing capabilities across major data centers in North America to support real-time network emulation and simulation requirements. (Source: https://www.spirent.com)

What makes Asia Pacific the fastest-growing region in the network emulator market?

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by rising investments in 5G and IoT technologies, growing digital ecosystems, and the rapid transition to cloud native apps. Agile testing environments are being prioritized by businesses in the region in order to satisfy growing performance requirements in the IT, automotive, and telecom industries. Government's vigorous push for network modernization, digital innovation, and smart connectivity is anticipated to maintain strong growth momentum.

Market Overview

The network emulator market encompasses hardware and software solutions designed to simulate real-world network conditions such as latency, jitter, bandwidth constraints, packet loss, and congestion to test the performance, reliability, and behaviour of applications, devices, or networks under varying conditions. These emulators are widely used in application development, quality assurance, cybersecurity testing, and network performance analysis across various industries, including telecom, IT, defence, and automotive. Network emulators help reduce deployment risks, accelerate product development, and ensure operational reliability of critical communication infrastructure.

Due to the introduction of ultra-low latency, massive device connectivity, and high data throughput factors that necessitate thorough testing before deployment, 5G significantly contributes to the demand for network emulators. In the race to introduce 5G-enabled solutions, telecom operators, device manufacturers, and application developers can now simulate a variety of real-world network conditions, including fluctuating signal strengths, congestion, and cell handovers, thanks to network emulators. In a variety of situations, this guarantees the security, dependability, and performance of 5G applications. Network emulators are now crucial tools for speeding up the creation, testing, and deployment of next-generation 5G networks and services.

Network Emulator MarketGrowth Factors

- Increasing adoption of 5G and IoT technologies: The rising adoption of 5G and IoT technologies boosts the demand for low-latency and high-bandwidth networks, creating the need for network emulators to test the performance of these technologies.

- Rising need for secure and reliable network infrastructure: Organizations are using emulators to simulate cyber threats and prevent real-world breaches.

- Growth in cloud-based applications and services: Enterprises are validating application performance through network emulators under varying network conditions.

- Expansion of remote work and virtual collaboration tools: Businesses test and optimize network performance for distributed teams.

- Growing complexity of modern network architecture: Emulators help replicate real-world scenarios for accurate troubleshooting and development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 604.96 Million |

| Market Size in 2025 | USD 309.27 Million |

| Market Size in 2024 | USD 287.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Vertical, Testing Environment, Application, Deployment Mode, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rapid 5G Deployment

One of the major factors driving the growth of the network emulator market is the proliferation of 5G networks. As 5G brings high throughput, dense connectivity, and ultra-reliable low-latency communication, testing these intricate networks becomes crucial. By simulating actual 5G environments, network emulators help telecom providers and equipment manufacturers verify device compatibility and performance before rollout. Additionally, they facilitate network slicing, validation, performance benchmarking, and handover testing. Accurate testing tools are becoming increasingly necessary as nations rapidly roll out 5G infrastructure.

Rise in Cloud Computing and Virtualization

As cloud native apps, SaaS platforms, and virtualized infrastructure become more prevalent, thorough pre-development network testing becomes necessary. IT teams can assess how applications respond to changing network conditions, such as jitter, bandwidth restrictions, and high latency, by using network emulators. For mission-critical systems where performance consistency is unavoidable, this is especially crucial. By providing repeatable, controlled test conditions, emulators also assist DevOps and CI/CD pipelines. Emulation tools are crucial to preservation performance and user experiences as multi-cloud and hybrid architectures become more common.

Restraints

High Cost of Deployment and Maintenance

Network emulators can be costly to buy and maintain, particularly high-end models made for business and telecom applications, which hampers the growth of the network emulator market. The price covers not just the hardware and software but also the need for qualified experts to set them up and run them. The perceived advantages are frequently outweighed by this financial burden for small and medium-sized businesses (SMEs), which restricts adoption. Further costs may also be incurred when updating emulators to support developing standards like SD-WAN or 5G. A significant turnoff for an organization on a tight budget is the total cost of ownership.

Complexity in Setup and Operation

Configuring, creating scenarios, and running tests with network emulators frequently call for extensive technical expertise. Setting up complex test cases can be challenging for organizations, particularly in hybrid or multi-vendor environments. The requirement for specialized training may increase operating expenses and cause delays in deployment schedules. This intricacy serves as a barrier for businesses without strong IT departments or simulation technology expertise. If not properly managed, it may also result in underutilization of emulator capabilities.

Opportunities

Increasing Adoption of SD-WAN and Virtual Networks

There is an increasing demand for pre-deployment testing tools, as companies transition from traditional networking to SD-WAN and virtualized infrastructure. Software development teams can verify SD-WAN performance, failover behavior, and policy enforcement across dynamic paths by using network emulators. They also assist in enhancing performance before going live by testing NFV deployments in controlled environments. Providers of emulators do not have the chance to create solutions specifically for virtual environments. This opportunity is further enhanced by growing enterprise interest in flexible cloud-first networks.

Rising Cybersecurity Compliance Requirements

Governments and industries are introducing stricter cybersecurity frameworks, especially for sectors like finance, healthcare, and defense. Network emulators offer a safe and controlled environment to test network behavior against simulated attacks, compliance breaches, and stress scenarios. Vendors can create compliance-specific testing solutions for various regions and regulations, such as HIPAA or GDPR. This opens a significant market for emulators tailored to governance and risk management needs. As compliance becomes non-negotiable, companies will increasingly invest in advanced emulations.

Offering Insights

How does the hardware segment dominate the network emulator market in 2024?

The hardware segment dominated the market, with the rack-mounted emulators segment holding the maximum share of the market in 2024. This is mainly due to the strong performance ability of these emulators to simulate traffic in real time and extensive application in military-grade and telecom R&D settings. Because of their dependability and capacity to replicate intricate network scenarios, they are the preferred option for verifying novel protocols, security guidelines, and equipment configurations involving multiple vendors. Applications like defense communication testing and critical infrastructure that require deterministic behavior and high throughput also depend on these systems. Hardware vendors are coming up with new features like FPGA-based acceleration, faster processing, and more modularity, supporting segmental growth.

The software segment is expected to grow at the fastest CAGR in the upcoming period. In this segment, the cloud native emulator sub-segment is growing rapidly, driven by the rise of cloud infrastructure, agile development practices, and the need for flexible, scalable, and cost-effective testing environments. Cloud-native emulators allow testing in distributed and virtual setups, aligning well with DevOps and CI/CD pipelines, particularly for startups and enterprises focusing on software-defined networks. They offer rapid provisioning, remote accessibility, and seamless integration with automation tools. As software-based networking becomes more prevalent, cloud-native testing is becoming a foundational requirement for network reliability.

Application Insights

Why did the SD-WAN testing segment dominate the network emulator market in 2024?

The SD-WAN testing segment dominated the market in 2024, owing to the growing number of businesses implementing SD-WAN solutions in an effort to improve WAN cost-effectiveness, security, and efficiency. Real-time and pre-deployment emulator testing has become increasingly necessary due to the need to guarantee interoperability, failover handling, and policy enforcement across various network paths. To verify SD-WAN performance, CSPs and businesses use network emulators to replicate a variety of real-world scenarios, including jitter, congestion, and link failure. As cloud access and hybrid work gain popularity, SD-WAN continues to be a key area of investment for big businesses.

The 5G network testing segment is likely to grow at the fastest rate over the forecast period, driven by the global expansion of 5G infrastructure. Network emulators are being used more to replicate real-world 5G traffic scenarios in controlled environments before full-scale deployment, as telecom operators and equipment vendors compete to validate ultra-low latency massive MIMO and network slicing capabilities. Additionally, emulators are necessary for testing Internet of Things devices, base station connectivity, and edge nodes in 5G environments. The growing need for private 5G networks in businesses and industrial areas is driving this market even more.

Vertical Insights

What made telecommunications the dominant segment in the network emulator market in 2024?

The telecommunications segment dominated the market while holding a significant share in 2024, as network emulators are critical in verifying the performance of next-gen telecom services such as VoIP, LTE, and IMS. Telcom companies heavily rely on emulators for product validation, protocol compliance, and performance benchmarking before commercial release. These tools are used extensively in R&D labs, interoperability testing centers, and field simulation labs. The constant evolution in network topologies, from legacy to virtualized and software-defined networks, keeps testing a core activity in this vertical.

The automotive & transportation segment is expected to expand at the highest CAGR over the projection period due to the increasing integration of infotainment and V2X (vehicle-to-everything) communication systems in automobiles. The adoption of emulators in this industry has been greatly accelerated by the requirement to test communication between automobile infrastructure and cloud services in a virtualized setting. Testing the network resilience of autonomous cars in harsh and changing environments is crucial as they develop. Emulators are also used in smart mobility platforms to verify the connectivity of infotainment systems and Over-The-Air (OTA) updates.

Testing Environments Insights

Why did the lab-based testing segment dominate the network emulator market in 2024?

The lab-based testing segment dominated the market in 2024, as enterprises prefer dedicated lab setups for consistent, controlled, and repeatable testing. These environments provide high reliability for validating new software releases, firmware updates, and network designs before going live. Labs allow for deep packet inspection, scenario replays, and customized test cases with minimal external influence. Large-scale labs are often integrated with performance monitoring and analytics tools to accelerate innovation while minimizing risk.

The virtualized/cloud testing segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to a broader industry shift toward remote work, hybrid networks, and edge computing. Virtual test environments allow organizations to run multiple testing scenarios simultaneously without hardware dependency, thereby enhancing scalability and reducing time to market. They also support dynamic resource allocation, which helps in simulating diverse user environments on a scale. With increasing interest in digital twins and virtual testbeds, cloud-based testing is becoming more integral to enterprise QA strategies.

Deployment ModeInsights

How does the on-premises segment dominate the network emulator market in 2024?

The on-premises segment dominated the market by holding the largest share in 2024, driven by increased concerns about data privacy and network configuration control. For safe and low-latency performance assessments, critical sectors like healthcare, finance, and defense depend on on-premises emulators. High levels of customization are supported by this deployment, which frequently integrates with legacy systems. Furthermore, sensitive simulation models running in internal data centers require physical security and isolation, which can only be provided by on-premises configurations.

The cloud-based segment is expected to grow at a rapid pace in the coming years, driven by the global trend toward remote collaboration and SaaS models. Due to its centralized management, subscription-based pricing, and on-demand access, cloud deployment is a popular choice for small and mid-sized enterprises that conduct ongoing testing and development. The model facilitates quicker experimentation and rollbacks while lowering upfront CAPEX. Cloud-delivered emulators are quickly taking over as the new standard for contemporary test workflows, as multi-cloud and hybrid cloud strategies expand.

End User Insights

Why did the communication service providers (CSPs) segment dominate the network emulator market in 2024?

The communication service providers (CSPs) segment dominated the market in 2024 due to their constant need to validate network upgrades, ensure multi-vendor compatibility, and deliver uninterrupted services. Network emulators are central to CSPs' strategy in reducing downtime and improving customer experience. CSPs use emulators in network orchestration labs, fault-injection testing, and NFV validation processes. With the demand for 5G, satellite broadband, and edge computing rising, testing is more critical than ever to maintain service-level agreements.

The enterprises & data centers segment is expected to expand at the fastest CAGR over the forecast period. This is mainly due to the increasing investments in in-house networks, edge computing, and hybrid IT architecture. As enterprises modernize their IT infrastructure, they require powerful emulation tools to test the performance, security, and redundancy of their internal and external communications. These emulators are used to replicate DDoS attacks, simulate multi-branch latency, and validate business continuity plans. Cloud-native businesses and hyperscale data centers, in particular, are driving the demand for flexible testing tools, supporting segmental growth.

Network Emulator Market Companies

- Keysight Technologies

- Spirent Communications

- iTrinegy (GigaIO)

- Apposite Technologies

- Calnex Solutions

- Viavi Solutions

- Packet Storm Communications

- SolarWinds

- Interworking Labs

- Polaris Networks

- Huawei Technologies

- Cisco Systems

- Netropy (Apposite)

- W2BI Inc.

- Aeroflex (Cobham)

- Rohde & Schwarz

- TeraVM (Spirent)

- Network Instruments (Now VIAVI)

- AtlanTecRF

- TestPlant (Eggplant, now part of Keysight)

Recent Developments

- In March 2025, DTI Publishing Corporation launched LabHUB Network Emulator 1.0, a next-generation web-based simulation tool that transforms how computer networking is taught and learned. With real-time packet tracking, hands-on device configuration, and customizable instructor tools, LabHUB brings networking concepts to life in a highly interactive environment.(Source: https://www.wane.com)

- On 25 February 2025, Spirent partnered with the Centre of Excellence in Wireless Technology (CEWiT) to support India's “Bharat 6G Vision,” providing advanced emulation tools for validating 5G core functionalities and accelerating research toward 6G innovation.(Source: https://newswire.telecomramblings.com)

- On 3 June 2025, Keysight to divest Spirent emulation assets to VIAVI as part of a DOJ consent agreement. Keysight will divest certain Spirent business units, channel emulation, and network security to VIAVI to resolve antitrust concerns.(Source: https://www.reuters.com)

Segments Covered in the Report

By Offering

- Hardware

- Portable Emulators

- Rack-mounted Emulators

- Modular & Chassis-based Systems

- Others

- Software

- OS-based Emulator Software

- Virtual Network Functions (VNF) Emulator

- Cloud-native Emulator

- Others

By Application

- SD-WAN Testing

- IoT Device Testing

- Cloud-based Application Testing

- VoIP and Video Streaming Testing

- Autonomous Vehicle Communication Testing

- Satellite and RF Communication Testing

- 5G Network Testing

- Others

By Vertical

- Telecommunications

- Government & Defense

- BFSI

- IT & ITeS

- Healthcare

- Automotive & Transportation

- Research & Academia

- Manufacturing & Energy

- Media & Entertainment

- Others

By Testing Environment

- Lab-based Testing

- Field Testing

- Virtualized/Cloud Testing

- Hybrid Testing Environments

By Deployment Mode

- On-premise

- Cloud-based

- Hybrid

By End User

- Network Equipment Manufacturers (NEMs)

- Communication Service Providers (CSPs)

- Enterprises & Data Centers

- Testing Labs & Certification Bodies

- System Integrators

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting