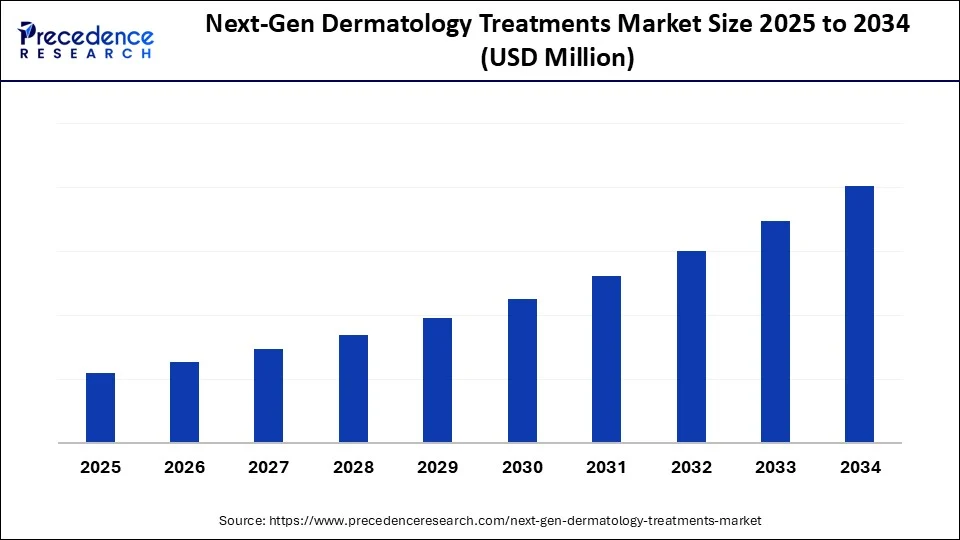

Next-Gen Dermatology Treatments Market Size and Forecast 2025 to 2034

Cutting-edge biologics, AI diagnostics, microneedles & personalized skincare fuel the next gen dermatology treatments market through 2030. The growth of the next-gen dermatology treatments market is driven by the rising demand for personalized skincare and the growing aesthetics awareness. Ongoing advancements in targeted therapies and minimally invasive procedures further support market growth.

Next-Gen Dermatology Treatments MarketKey Takeaways

- North America dominated the next-gen dermatology treatments market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By treatment type, the biologics and targeted therapies segment held the highest market share of 40% in 2024.

- By treatment type, the energy-based devices segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By indication, the psoriasis and atopic dermatitis segment captured the major market share in 2024.

- By indication, the alopecia areata and vitiligo segment is expected to expand at a notable CAGR over the projected period.

- By delivery platform, the injectables segment contributed the highest market share in 2024.

- By delivery platform, the device-based non-invasive systems segment is expected to expand at the remarkable CAGR over the projected period.

- By end user, the dermatology clinics & MedSpas segment generated the largest market share in 2024.

- By end user, the hospitals / skin care departments segment is expected to expand at a notable CAGR over the projected period.

How is AI Transforming the Next-Gen Dermatology Treatments Market?

Artificial intelligence (AI) is significantly revolutionizing the market for next-gen dermatology treatments by improving diagnostics, treatment, and patient care. AI enhances the delivery of dermatology treatments, enabling a more personalized approach. In Europe, the world's first autonomous AI system for skin cancer detection, DERM, has received Class III CE marking. The system, now deployed at over 26 NHS sites, is able to diagnose skin cancers with 99.8% accuracy autonomously. This system has become the first clinically approved AI system to diagnose skin cancer in the world, assessing over 110,000 patients, reducing unnecessary referrals, and waiting time for treatment.(Source:https://www.emjreviews.com)

Similarly, AI dermoscopy tools now rival expertise in determining the level of significance of benign dermatoscopic cases. Furthermore, new models like DermDiff and DermDiT address bias by using non-dermatological photos to create skin images of all colors, thereby achieving equitable diagnostic accuracies across all skin tones. Apps like Miiskin and Clarify Medical's AI-assisted phototherapy, in particular, are also innovating treatments for chronic skin conditions by providing real-time home monitoring of conditions like psoriasis. If anything, the domain of dermatology is managing an often disparate delivery of patient care like never before through AI, ushering in an era of smarter, timelier, and more equitable healthcare.

Market Overview

The next-gen dermatology treatments market refers to the rapidly evolving field of skin and aesthetic care that leverages cutting-edge therapies, biologics, regenerative medicine, energy-based devices, and digital technologies. These treatments go beyond conventional topical creams and antibiotics by addressing complex skin disorders and cosmetic concerns through precision medicine, targeted immunotherapies, and non-invasive or minimally invasive modalities. The market growth is driven by the rising incidence of chronic skin diseases (e.g., psoriasis, acne), increasing consumer demand for aesthetics, and technological advances in delivery systems.

Next-Gen Dermatology Treatments MarketGrowth Factors

- Growing Incidence of Skin Diseases: The rising incidence of skin diseases, such as eczema, psoriasis, and skin cancer, drives the need for advanced dermatological treatments and diagnostics that are effective, accurate, durable, and targeted.

- Innovative Technologies: New and emerging technologies, such as artificial intelligence in skin diagnostics, robotic-assisted surgeries, and laser-based therapies, are transforming dermatology with treatment options that are faster, more precise, and less invasive.

- Increasing Focus on Aesthetic Outcomes:The growing consumer focus on appearance and skin health has a positive impact on demand for next-generation cosmetic dermatology procedures, such as non-invasive anti-aging, anti-pigmentation, and skin rejuvenation treatments.

- Biologics and personalized medicine: The shift to using biologics or biologic drugs, combined with genomics-based therapy, enables personalized treatments that confer advantages over traditional medications for treating complex skin diseases in terms of efficacy and side effect profiles.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Indication, Delivery Platform, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Approvals for Novel Therapies

A major factor driving the growth of the next-gen dermatology treatments market is the increasing approvals for novel therapies by regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Commission. Several breakthrough treatments have been approved in recent years, significantly changing the landscape of dermatology. One powerful example is the approval of Vyjuvek (B-VEC), the first topical gene therapy for dystrophic epidermolysis bullosa (DEB), which demonstrated a robust wound-healing outcome in patients. (Source: https://investors.arcutis.com)

Moreover, nearly 9 million people in the U.S. have plaque psoriasis, with over half having scalp involvement and even more presenting with the disease in other hair-bearing areas. In May 2025, Zoryve foam was approved for the treatment of psoriasis and seborrheic dermatitis, with very high rates of success compared to the placebo. Similarly, in June 2023, the FDA also approved Litfulo (ritlecitinib) for adolescents aged 12 and older with severe alopecia areata, achieving very good results in hair regrowth.(Source:https://www.pfizer.com)

Restraint

Is Regulatory Uncertainty the Greatest Obstacle for the Next-Gen Dermatology Treatments Market?

One significant limiting factor is regulatory uncertainty regarding advanced manufacturing technologies. The U.S. Government Accountability Office (GAO) stated in a 2023 report that the FDA supported advanced manufacturing to enhance supply-chain resilience; however, only a few drugs were manufactured using advanced manufacturing technologies, as the FDA had not established requirements, targets, or metrics to evaluate its initiatives. GAO interviews with 15 industry stakeholders indicated that uncertainty regarding the FDA review length and the reviewer's knowledge of the technology weakens the business case and slows adoption.(Source: https://www.gao.gov)

Similarly, a peer-reviewed study stated that perceived and measured regulatory risk were among the key barriers, and global harmonization differences complicate post-approval changes, making it less likely that a particular technology will be adopted. Lengthy and complex approval processes for novel drugs and devices, along with the high costs associated with them, hinder the market's growth.

Opportunity

Could Gene-Silencing Therapies Transform the Future of Dermatology?

There is a significant opportunity for the next-generation dermatology treatments space as RNA-based therapies, specifically small interfering RNA (siRNA) platforms, gain traction. In May 2025, AbbVie and ADARx Pharmaceuticals announced a partnership to develop siRNA-based treatments for chronic skin conditions, such as psoriasis and autoimmune skin diseases. This reflects a trend where dermatological treatments move from surface management to molecular management. RNA therapeutics provide the ability to silence genes in a granular way, which promotes treatment for the underlying cause of skin disorders. As momentum builds in the regulatory approval process and biotech investment, the RNA gene-silencing therapy space can have a transformative impact on dermatology precision medicine going forward. (Source:https://www.dermatologytimes.com)

Treatment Type Insights

Why Did the Biologics & Targeted Therapies Segment Dominate the Next-Gen Dermatology Treatments Market in 2024?

The biologics & targeted therapies segment dominated the market with the largest share in 2024. The dominance of the segment stems from the ability of biologics and targeted therapies to precisely target complex immune-mediated skin diseases, such as psoriasis and atopic dermatitis. Biologics and targeted therapies precisely target specific molecular pathways, providing superior effectiveness and reduced toxicity compared to traditional therapies. The acceptance and use of biologics and targeted therapies are driven by the continued approval from the FDA, as well as patient requests for long-term remission. The pharmaceutical investment in monoclonal antibodies and IL-inhibitors is making biologics the leading pharmaceutical option in first-line treatment for chronic diseases in dermatology, regardless of the clinical environment, whether in a clinic or outpatient setting.

The energy-based devices segment is expected to grow at the fastest rate in the coming years, primarily due to their crucial role in non-invasive skin rejuvenation, scar reduction, and acne treatment. The development of fractional lasers and energy-based platforms utilizing radiofrequency and ultrasound, which are both safer and more effective, and can accommodate a wider range of patient skin types, will help facilitate this segment. The appeal for less downtime associated with aesthetic procedures is of great interest to patients as they become more accustomed to the limited options for quick-fix, office-based solutions.

Indication Insights

How Does the Psoriasis & Atopic Dermatitis Segment Dominate the Market in 2024?

The psoriasis & atopic dermatitis segment dominated the market in 2024, driven by the strong potential of biologics and targeted therapies in treating these conditions. These chronic inflammatory skin diseases affect millions of people worldwide, requiring long-term management and control, and provide an important space for innovation going forward. Newer-generation therapies, including IL-23 inhibitors and IL-4 inhibitors, have significantly improved patient outcomes. There have been many developments clinically and regulatory approval, which serve to reinforce their importance in dermatology.

The alopecia areata & vitiligo segment is expected to grow at the highest CAGR over the projection period due to the rising development of JAK inhibitors and new gene therapies indicated for these conditions. A report published by the NIH in 2023 reported the approval of Baricitinib for alopecia areata. This is a competitive inhibitor of the JAK family of non-receptor protein kinases, predominantly acting against JAK-1 and JAK-2 subtypes. This inhibitor is approved for use in severe cases of alopecia areata and moderate to severe atopic dermatitis in adults. The rapid shift toward immunomodulating targeted therapies in dermatology further influences segmental growth.

Delivery Platform Insights

Which Delivery Platform Segment Dominate the Market in 2024?

The injectables segment held the largest share of the market in 2024, driven by their increased adoption, particularly in aesthetic dermatology and systemic therapies. The advantages of precision, rapidity, and efficacy make injectables the delivery platform of choice for a variety of biologics, neurotoxins, and dermal fillers, regardless of whether the treatment is being performed in a therapeutic or a cosmetic setting, or whether the purpose of the treatment is severe psoriasis treated with monoclonal antibodies, or smoothing wrinkles, or restoring lost volume in the face.

The device-based non-invasive systems segment is expected to grow rapidly during the forecast period, driven by the increasing demand for painless, needleless administration. Technologies, including micro-needle patches, transdermal delivery systems, and wearable devices, are gaining increasing acceptance for delivering active ingredients directly to the skin. Device-based non-invasive systems increase patient comfort and compliance, especially in the context of chronic care and cosmetic maintenance.

End User Insights

Why Did the Dermatology Clinics & MedSpas Segment Dominate the Next-Gen Dermatology Treatments Market in 2024?

The dermatology clinics & MedSpas segment led the market while holding the largest share in 2024, as they are specialized centers that provide a wide range of medical and cosmetic dermatologic treatments. These centers have trained dermatologists on staff and are equipped with standardized devices to administer injectables, energy-based therapies, and utilize advanced skin care programs. These centers have continually upgraded their technological and service offerings, fostering a high level of patient trust that has established them as the preferred options for next-generation dermatological solutions.

The hospitals / skin care departments segment is likely to expand rapidly in the coming years, as these settings are the primary point of contact. Consumers often demand more convenient, low-cost, and user-managed approaches to skin care, which hospitals offer. This boosts the patient pool in these settings. Moreover, the availability of reimbursement policies for these settings encourages people to receive care from them, contributing to segmental growth.

Regional Insights

How Does North America Lead the Next-Gen Dermatological Treatments Market?

North America registered dominance in the market while capturing the largest share in 2024. The region's leadership in the next-gen dermatology treatments market is attributed to several factors, including the early adoption of biologics, high preference for aesthetic procedures, and a greater understanding of skin care. The region has been experiencing almost an exponential growth in the adoption of new and innovative biologics, also known as small molecules, into dermatology. This includes products like the oral JAK inhibitors and non-steroidal topical organic creams for eczema, psoriasis, or atopic dermatitis. Furthermore, favorable reimbursement policies and increased awareness of skin health have boosted the adoption of premium aesthetic approaches to skin care, thereby bolstering regional market growth.

The U.S. is a major contributor to the market, as it hosts many of the world's leading biotech and dermatology treatment manufacturing companies. The country is at the forefront of developing next-generation biologics, classified into topical and injectable categories. In March 2025, Arcutis announced that Zoryve (roflumilast cream) for the treatment of atopic dermatitis had expanded coverage from multiple U.S. insurers and gained Health Canada approval for paediatric use, emphasizing the exchange of application across companies, countries, and industries. The FDA has provided the strongest regulation and protection for dermatological biopharma applications previously unheard of, combined with increasing patient demand for meaningful, advanced treatment options. This will continue to provide a clear path for innovation in skin care treatment applications and solidify the U.S. as the anchor in the market. (Source: https://www.arcutis.com)

What Makes Asia Pacific the Fastest-Growing Market for Next-Gen Dermatological Treatments?

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by technological innovations in cosmetic dermatology devices and the increasing popularity of medical tourism in the region. Countries like South Korea and Japan, both of which boast cutting-edge non-invasive dermatology technologies, including laser therapy, high-intensity focused ultrasound (HIFU), and radiofrequency skin treatments, can commercialize next-generation dermatology devices more quickly than anywhere else in the world. Both countries have strong R&D ecosystems that are contributing to the commercialization of next-generation connected dermatology devices. Both countries maintain a strong "beauty" culture where skincare is greatly valued. Moreover, they are bringing together technologies, urbanization, digital health, and advanced skincare treatment awareness, which is leading to a rapidly growing demand for innovative new skincare treatments in the region.

South Korea is a major player in the market in Asia Pacific. South Korea is already internationally recognized as a leader in aesthetic medicine and skincare technology, and it has invested in further development and research related to next-generation dermatology devices. The Korean Ministry of Food and Drug Safety (MFDS) recently approved several advanced technologies for dermatology, including dual-modality laser platforms and AI-derived diagnostic imaging methods. In addition to significant government support, South Korea's vibrant beauty culture, combined with its international innovation and export of dermatological equipment, solidifies its position in the market.

Next-Gen Dermatology Treatments Market Companies

- AbbVie (Allergan)

- Eli Lilly

- Amgen

- Sanofi & Regeneron

- Leo Pharma

- UCB Pharma

- Incyte

- Pfizer

- Almirall

- Revance

- Cutera

- Candela

- Lumenis

- Venus Concept

- L'Oréal Active Cosmetics

- Johnson & Johnson (Neutrogena Skin360)

- DermaSensor

- Forefront Dermatology / U.S. Dermatology Partners

- SkinCeuticals / Skinbetter Science

- CureSkin, Remedico, SkinAI (India)

Recent Developments

- In July 2025, Board-certified dermatologist Dr. Ashley Magovern and her daughters launched FAWN, a science-backed skincare brand for teens. FAWN emphasizes clean ingredients and specific dermatological efficacy, creating room in the next-gen skincare offerings for young people.(Source: https://www.prweb.com)

- In July 2025, Clear Dermatology and Investigate MD launched two phase 2 clinical trials investigating a new generation of neuromodulators for glabellar lines. The aims of the clinical trial studies included assessing the safety and efficacy of longer-lasting wrinkle treatment options beyond and in addition to traditional botulinum toxin offerings

(Source: https://kalkinemedia.com)

- In May 2024, At the Viva Technology Paris 2024 L'Oréal unveiled six innovative beauty tech initiatives that highlighted AI skin diagnostics and on-demand beauty services. The announced advancements underscore L'Oréal's commitment to the development of next-generation dermatological solutions and tech-enabled personalized skincare.(Source:https://www.cosmeticsdesign-europe.com)

- In May 2025, The FDA approved Sun Pharma's LED Blue-U photodynamic therapy device for actinic keratosis, a tool that advancesthe dermatologic treatment space by providing a next generation therapy option thatuse non-invasive, light-based phototherapy technology to treat pre-cancerous skin lesions, improving efficiency and user experience.(Source:https://www.dermatologytimes.com)

Segments Covered in the Report

By Treatment Type

- Biologics & Targeted Therapies

- IL-17, IL-23, TNF-alpha inhibitors for psoriasis and atopic dermatitis

- JAK inhibitors for vitiligo and alopecia areata

- Energy-based Devices

- Laser (fractional, ablative, Q-switched)

- RF microneedling, ultrasound, cryolipolysis

- Hybrid technologies (e.g., radiofrequency + COâ‚‚ laser)

- Regenerative Therapies

- PRP (Platelet-Rich Plasma), stem cell–based treatments

- Exosome-based skincare

- Personalized Topical & Oral Therapies

- Microbiome-based creams, prescription digital therapeutics

- Medical Aesthetics

- Injectable toxins, fillers, collagen boosters

By Indication

- Psoriasis & Atopic Dermatitis

- Alopecia Areata & Vitiligo

- Acne & Rosacea

- Melasma, Hyperpigmentation, and Scarring

- Aesthetic Indications (skin tightening, wrinkle reduction, pigmentation correction)

By Delivery Platform

- Injectables

- Topical Advanced Formulations

- Nanocarrier, microneedle patches

- Device-based Non-invasive Systems

- Digital Therapeutics & AI Dermatology Apps

- AI-driven acne monitoring, remote care tools

By End User

- Dermatology Clinics & MedSpas

- Hospitals / Skin Care Departments

- Home-use Devices / DTC Models

- Teledermatology Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting