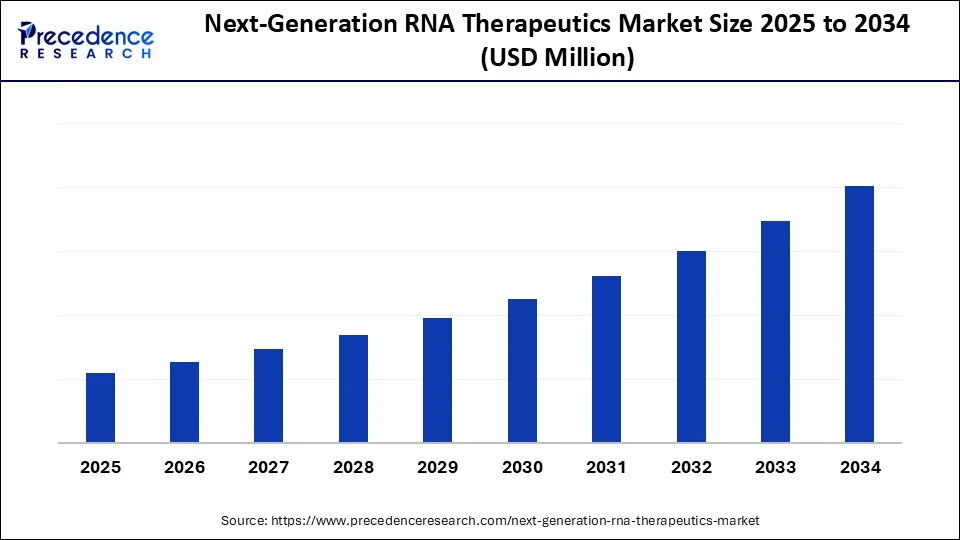

Next-Generation RNA Therapeutics Market Size and Forecast 2025 to 2034

The next-generation RNA therapeutics market is poised for strong growth as mRNA, siRNA, and antisense technologies enable innovative therapies for complex and previously untreatable diseases.The market growth is attributed to rising institutional funding and expanding applications of RNA platforms in oncology, rare genetic disorders, and infectious disease therapeutics.

Next-Generation RNA Therapeutics Market Key Takeaways

- North America dominated the global next-generation RNA therapeutics market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By therapy type, the mRNA-based vaccines segment held the major market share of 38% in 2024.

- By therapy type, the circular RNA (circRNA) segment in the next-generation RNA therapeutics market is projected to grow at a CAGR between 2025 and 2034.

- By application, the infectious diseases segment contributed the biggest market share of 34% in 2024.

- By application, the oncology segment is expanding at a significant CAGR between 2025 and 2034.

- By delivery mechanism, the lipid nanoparticles (LNPs) segment generated the major market share of 41% in 2024.

- By delivery mechanism, the extracellular vesicles segment is expected to grow at a significant CAGR over the projected period.

- By end-user, biopharmaceutical companies contributed the highest market share of 45% in 2024.

- By end-user, the CROs/CMOs segment is expected to grow at a notable CAGR from 2025 to 2034.

What Has Been the Impact of Artificial Intelligence on the Next-Generation RNA Therapeutics Market?

Artificial intelligence (AI) is essential in transforming the market trend in the next-generation RNA therapeutics market as it leads to innovation in the discovery, development, and commercialization. Scientists are using AI algorithms to filter through vast amounts of genomic and proteomic data and discover new RNA targets quickly, and develop optimized molecules with improved stability and efficacy. On the clinical development side, AI enables prediction of trial design, patient population analysis, prediction of outcomes, and minimization of recruitment difficulties, thereby speeding the regulatory process.

Market Overview

Ramping up funding and strategic partnerships is the recent trend in the next-generation RNA therapeutics market, leading to its growth. This space brings to bear on the previously undruggable genes precision technology using messenger RNA, siRNA, and antisense oligonucleotides to enable new developments in oncology, rare genetic diseases, and infectious diseases. In 2024, the NIH invested approximately 15.4 million over three years with its collaboration partner (NSF) to gain more insight into the structure and modifications of RNA and their uses in therapeutics. (Source: https://www.genome.gov)

National Institutes of Health researchers have developed delivery technologies and platforms to edit RNA to access deeper tissue, translate faster, and achieve greater efficacy. The WHO emphasized in the year 2022 that more than 9.7 million deaths due to cancer each year, are necessitate the development of novel RNA-based oncology therapeutics, and therefore, this area is poised to rise. Moderna and BioNTech have both launched new RNA products aimed at influenza and malaria, respectively. They are also part of a larger push spearheaded by the Gates Foundation and European Medicines Agency to expedite trials of promising new treatments addressing infectious disease burdens due to their applied immunogens. Furthermore, the growing clinical validation pipeline will usher in significant growth in the domain of RNA therapies in the coming years.(Source:https://www.who.int)

Next-Generation RNA Therapeutics Market Growth Factors

- Driving Advances in RNA Editing Tools: Expanding innovation in CRISPR-Cas and base-editing platforms is driving precise modification of disease-causing genes, strengthening therapeutic pipelines.

- Boosting Personalized Medicine Adoption: Growing demand for RNA-based solutions tailored to individual genetic profiles is boosting the shift toward precision therapeutics in rare and complex diseases.

- Fuelling Next-Gen Vaccine Development: Rising focus on mRNA vaccines for infectious diseases beyond COVID-19 is fuelling global immunization strategies and accelerating clinical translation.

- Growing Cross-Sector Partnerships: Increasing collaboration between biotech firms, academic institutions, and non-profits is growing the ecosystem required for rapid RNA therapeutic advancement.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Application, Delivery Mechanism, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Clinical Validations and Regulatory Wins Driving the Next-Generation RNA Therapeutics Market?

Increasing clinical validations and regulatory wins expand therapeutic credibility across mRNA vaccines, siRNA, and antisense programs is expected to drive the market. Drug developers feature key oncology, cardiometabolic, and rare-disease data that justify expanded trials and more forward positioning in treatment lines. Moderna and Merck reported in 2024, long-lasting efficacy of the personalized cancer vaccine mRNA-4157 (V940) in combination with pembrolizumab in an expanded population of high-risk melanoma patients with up to 36 months of follow-up data. There was a prolongation of recurrence-free and distant metastasis-free survival rates. (Source: https://investors.modernatx.com)

In the same year, Geron won FDA approval of the first telomerase inhibitor (imetelstat, Rytelo) in myelodysplastic syndrome, a sign that RNA-based and oligonucleotide modalities are also attracting greater regulatory confidence. Sponsors solidify the worth of RNA medicines by walking the talk with real-world results as the first mRNA RSV vaccine, mRESVIA, is accepted by the FDA in 2024 to work with adults over 60 years of age, becoming the first non-COVID-related respiratory protection. Furthermore, the increasing prevalence of chronic and rare diseases sustains large, durable addressable populations for RNA-based interventions, further boosting the market in the coming years.(Source:https://www.fda.gov)

Restraint

Hamper Clinical Translation Through Delivery and Stability Challenges

Delivery and stability concerns are anticipated to restrain progress in the Next-generation RNA therapeutics market. Molecules of RNA degrade very quickly in biological fluids, and in order to attain acceptable bioavailability, special modifications and delivery systems are needed. Although lipid nanoparticles and GalNAc conjugates are highly innovative approaches, their delivery to extrahepatic organs has not been consistent, precluding applications in the brain and lungs. Furthermore, the manufacturing complexity is expected to hinder the scalability in the next-generation RNA therapeutics market.

Opportunity

Why Is Growing Investment in Research and Development Anticipated To Reshape the Next-Generation RNA Therapeutics Market?

Increased capital investments and business alliances catalyse building-out platform capabilities in the areas of discovery, delivery, and manufacturing, which are expected to create immense opportunities for market growth. Stakeholders point to a significant recovery in financing. Q3 2024 seed and series A financing rebounded more than threefold compared to Q2, as investors regained confidence in RNA and cell and gene therapies. Strategic partnerships gained momentum in 2024. Novartis entered into a collaboration with Voyager Therapeutics, including the payment of a USD 100 million upfront fee and up to USD 1.2 billion in milestones in RNA delivery systems to treat neurological diseases.

- In June 2024, Roche agreed to pay USD 42 million in upfront and up to USD 1.8 billion in milestones to Ascidian Therapeutics to develop RNA exon-editing programs across neurology and ophthalmology. Cross-national collaborations, started earlier with investments in research through the AMED (the Japanese Agency of Medical Research and Development), collaborated with U.S. and European networks in collaborative development of gene delivery technologies. Furthermore, the spurring of precision-medicine adoption through multi-omic stratification aligns targets with genetically defined subpopulations, likely to facilitate the market growth.

(Source: https://www.asgct.org)

(Source: https://ir.voyagertherapeutics.com)

(Source: https://www.fiercebiotech.com)

Therapy Type Insights

Is mRNA Therapy Set to Remain the Leading Pillar of the Next-Generation RNA Therapeutics Market?

The mRNA-based vaccines segment dominated the next-generation RNA therapeutics market in 2024, accounting for an estimated 38% market share, as they earned global validation during the COVID-19 pandemic. In August 2024, Moderna and Pfizer-BioNTech had their updated vaccines (Covering KP.2 and JN.1 variants) cleared by the U.S. FDA, and this will enable the continued adoption in many countries around the globe.

Outside of COVID-19, the mover continued into infectious disease, as Moderna received FDA approval of mRESVIA in May 2024 as the first-ever mRNA vaccine against RSV among older adults, emphasizing a new area of incoming therapeutics. The EMA and the Japanese Ministry of Health also fast-tracked approvals of mRNA, embodying international regulatory convergence about flexibility. Additionally, the strong clinical pipeline, expedited international regulatory approval, and cross-pathogenic capabilities of these vaccines further facilities the segment growth.

(Source: https://www.fda.gov)

(Source: https://www.cidrap.umn.edu)

The circular RNA (circRNA) is expected to grow at the fastest rate/fastest CAGR in the coming years, owing to its longer life time, lower degradation, and higher translational efficacy than linear mRNA. MedComm review confirmed that circRNAs withstand exonuclease action, which offers longer-acting proteins at reduced dosages, improving patient adherence and clinicalрю outcome. Furthermore, the government-sponsored programs promoting translational circRNA-related work are expected to fuel the market in the coming years.

Application Insights

Will Oncology Continue to Dominate Applications in the Next-Generation RNA Therapeutics Market?

The infectious diseases segment held the largest revenue share in the next-generation RNA therapeutics market in 2024, accounting for 34% of the market share, due to the introduction of mRNA vaccines against respiratory viruses globally. The growing number of regulatory approvals of new vaccine applications added to the dominance of this segment. These measures were echoed by the European Medicines Agency and the Japan Pharmaceuticals and Medical Devices Agency, giving greater speed to these initiatives by way of global approval in unison.

CEPI's 100-Day Mission in 2024 further highlighted the value and importance of RNA vaccines in the future response to emerging infectious threats, a trend that points to RNA vaccines as a foundation in the future of outbreak response. Moreover, the rise in the acceptance of RNA vaccines into immunization routines is likely to support the segment to maintain leadership in the coming years.

The oncology segment is expected to grow at the fastest CAGR in the coming years, owing to the growth of oncology is influenced by the development of personalized cancer vaccines and RNA-based immunotherapies. In 2024, BioNTech reported encouraging results of its Phase II trial in melanoma at the Society of Immunotherapy of Cancer (SITC) in terms of improved recurrence-free survival in combination with checkpoint inhibitors. Additionally, the RNA-based therapeutics have the potential to enhance current therapies, thus further facilitating the segment in the coming years.(Source: https://www.sitcancer.org)

Delivery Mechanism Insights

Are Lipid Nanoparticles Expected to Stay the Preferred Delivery Mechanism in the Next-Generation RNA Therapeutics Market?

The lipid nanoparticles segment dominated the next-generation RNA therapeutics market in 2024, which held a market share of about 41%, due to their role as the platform with the most proven validation in the field of success in commercial and clinical deployments. The leadership of the segment is also enhanced by regulatory amendments of new technologies in the form of mRNA-based vaccines. Furthermore, the increased trust in LNP-based systems to deliver RNA payload safely and successfully is expected to boost the market in the coming years.

The extracellular vesicles segment is expected to grow at the fastest rate in the coming years, owing to its increasing prioritization by biopharmaceutical companies. Partnerships between Codiak BioSciences, Evox Therapeutics, and multinational pharma companies, which announced EV-RNA programs in late 2024. These partnerships involved working up of EV production platforms and the engineering of improved stability and therapeutic loading efficiency. Moreover, the potential of EVs and the importance of implementing standardized characterization and quality controls to foster rapid clinical adoption are expected to drive the segment growth.

End-user Insights

Will Hospitals and Specialty Clinics Sustain Their Role as the Primary End-Users in the Next-Generation RNA Therapeutics Market?

The biopharmaceutical companies segment held the largest revenue share in the next-generation RNA therapeutics market in 2024, accounting for 45% of the market share, due to extensive investing in research and development, clinical trials, and commercializing RNA-based therapeutics. Furthermore, the NIH RNA Initiative in the U.S. and the Horizon Europe funding scheme in the European Union gave a boost to the activities of corporate research and development, thus further facilitating the market growth.

The CROs/CMOs segment is expected to grow at the fastest CAGR in the coming years, owing to the rising outsourcing trend in RNA drug development. Biopharmaceutical companies are expected to increasingly utilise CROs/CMOs to reduce costs, speed up timelines, and access specialised abilities in RNA delivery and large-scale production. Additionally, the lack of in-house GMP-compliant RNA production on a global scale during pandemic-related vaccine delivery further highlights the growing need for CROs/CMOs services in the coming years.

Regional Insights

Is North America Positioned to Retain Its Dominance in the Next-Generation RNA Therapeutics Market?

North America led the next-generation RNA therapeutics market, capturing the largest revenue share in 2024, which held a market share of about 40%, due to expansive NCAA and NSF funding cycles, strong, established manufacturing networks, and the steady flow of regulation and policy momentum through the U.S. FDA. The NIH RNA Innovation program grew in 2024, with funds totaling more than USD 2,6 billion invested in RNA biology, drug delivery, and therapeutic applications, an achievement that secures the U.S. a leadership role in translational RNA science worldwide. (Source: https://pmc.ncbi.nlm.nih.gov)

The regulatory approval of Moderna to enable mRESVIA, the first mRNA-based RSV vaccine, in May 2024, highlights North America as a leader in its speed to bring next-generation therapies to market. This has gained traction through the Canadian effort Genome Canada, where several RNA-based projects emerged in Ontario and Quebec to advance vaccine and oncology research. Furthermore, North America has been an influential hub in RNA therapeutics as clinical trials are expanded through public-private partnerships, such as the Accelerating Medicines Partnership (AMP), which provides greater access and inclusion of diverse populations in trials.(Source:https://www.modernatx.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the rapidly expanding biotech infrastructure, domestic R&D investment together with policies to minimize dependence on Western suppliers. In 2024, AMED hardened its commitment to support self-amplifying RNA vaccines and siRNA, in addition to Japan approving an Arcturus self-amplifying mRNA COVID vaccine, Kostaive, which targets variants of JN.1.

Investments by the Chinese Academy of Sciences (CAS) and NSFC in RNA drug discovery, in oncology, and as antivirals have led to trial initiations by Chinese companies. Create expanded RNA vaccine pipelines with direct Government of India funding, echoing lessons learnt in pandemic-era production by India. Additionally, the capacity-building, local innovation, and prioritization by the central government make the Asia Pacific region a focal point of RNA therapeutic growth throughout this decade.(Source: https://ir.arcturusrx.com)

Next-Generation RNA Therapeutics Market Companies

- Alnylam Pharmaceuticals

- Arcturus Therapeutics

- Arrowhead Pharmaceuticals

- AstraZeneca

- BioNTech SE

- Chimeron Bio

- CureVac AG

- eTheRNA Immunotherapies

- Gilead Sciences

- Ionis Pharmaceuticals

- Moderna Therapeutics

- Pfizer

- Replicate Bioscience

- Roche

- Sarepta Therapeutics

- Silence Therapeutics

- Takeda

- Translate Bio (Sanofi)

- Vaccibody (Nykode Therapeutics)

- Vertex Pharmaceuticals

Recent Development

- In May 2025, AbbVie and ADARx Pharmaceuticals announced a collaboration and license option agreement to develop small interfering RNA (siRNA) therapeutics targeting neuroscience, immunology, and oncology. siRNA molecules regulate gene expression at the mRNA level, preventing the production of disease-causing proteins. This partnership underscores AbbVie's strategy to expand its RNA therapeutics portfolio and ADARx's expertise in late clinical-stage RNA technologies.

- In May 2027, Biogen Inc. entered a strategic collaboration with City Therapeutics, a privately held biopharma advancing RNA interference (RNAi)-based medicines. The partnership will focus on developing novel RNAi therapies for central nervous system (CNS) diseases, combining City's RNAi trigger engineering with Biogen's proprietary drug delivery technologies. Biogen will lead IND-enabling studies, global clinical development, and commercialization.

- In July 2025, Inverna Therapeutics, a Denmark-based biotech co-founded by the University of Southern Denmark and Argobio, officially launched as a specialist in next-generation RNA therapeutics. The company's lead program focuses on Huntington's disease, supported by its core platform in sequence-based splice modulation.

- In January 2025, Argobio announced the formation of Inverna Therapeutics in collaboration with the University of Southern Denmark. The company will concentrate on severe genetic diseases, beginning with Huntington's disease. Inverna's proprietary platform, developed from the research of Professor Brage Storstein Andresen, focuses on splice modulation technology. The approach is expected to deliver safer, more targeted RNA-based therapies compared with conventional antisense and RNA drugs, creating new opportunities for rare disease treatment.

(Source: https://news.abbvie.com)

(Source: https://www.globenewswire.com)

(Source: https://investors.biogen.com)

(Source: https://www.news-medical.net)

(Source: https://www.contractpharma.com)

(Source: https://www.biopharminternational.com)

Segments Covered in the Report

By Therapy Type

- mRNA-Based Therapeutics

- Vaccines (infectious disease, oncology)

- Protein Replacement Therapies

- Circular RNA (circRNA)

- Protein-Coding circRNA

- Non-Coding circRNA

- Self-Amplifying RNA (saRNA)

- Cancer Immunotherapy

- Infectious Disease Vaccines

- RNA Interference (RNAi)

- siRNA Therapeutics

- miRNA Therapeutics

- RNA Aptamers

- Diagnostic Aptamers

- Therapeutic Aptamers

- Small Activating RNA (saRNA)

- Gene Activation Therapies

By Application

- Infectious Diseases

- Oncology

- Rare Genetic Disorders

- Cardiovascular Diseases

- Neurological Disorders

- Autoimmune & Inflammatory Conditions

By Delivery Mechanism

- Lipid Nanoparticles (LNPs)

- Polymer-Based Nanocarriers

- Extracellular Vesicles (EVs)

- Viral Vectors

- Others

By End-User

- Biopharmaceutical Companies

- Contract Research & Manufacturing Organizations (CROs/CMOs)

- Academic & Research Institutes

- Hospitals & Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting