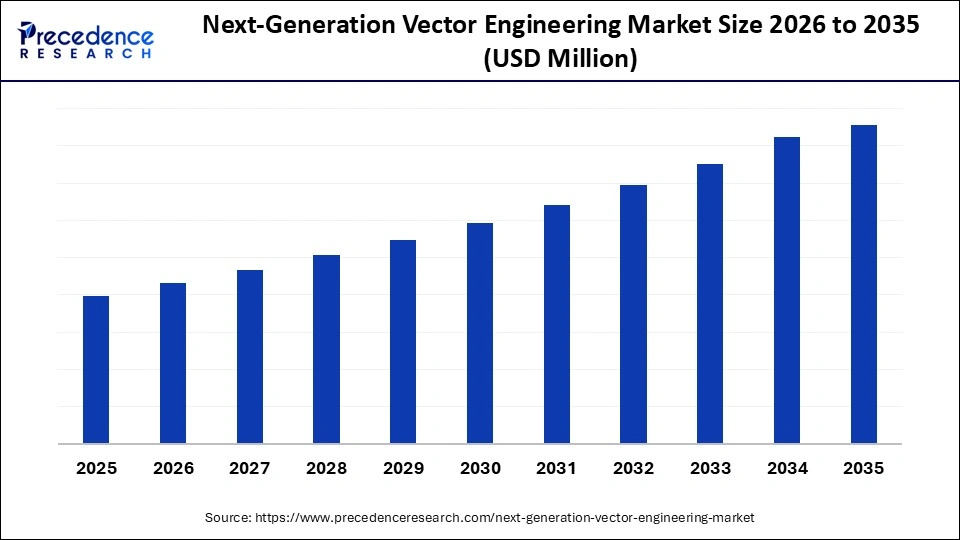

What is Next Generation Vector Engineering Market Size?

The global next generation vector engineering market is expanding rapidly as advances in gene therapy and synthetic biology drive demand for innovative vector design solutions. Market growth is driven by the rising prevalence of genetic disorders and the increasing adoption of viral and non-viral vector-based gene therapies for targeted, personalized treatments.

Market Highlights

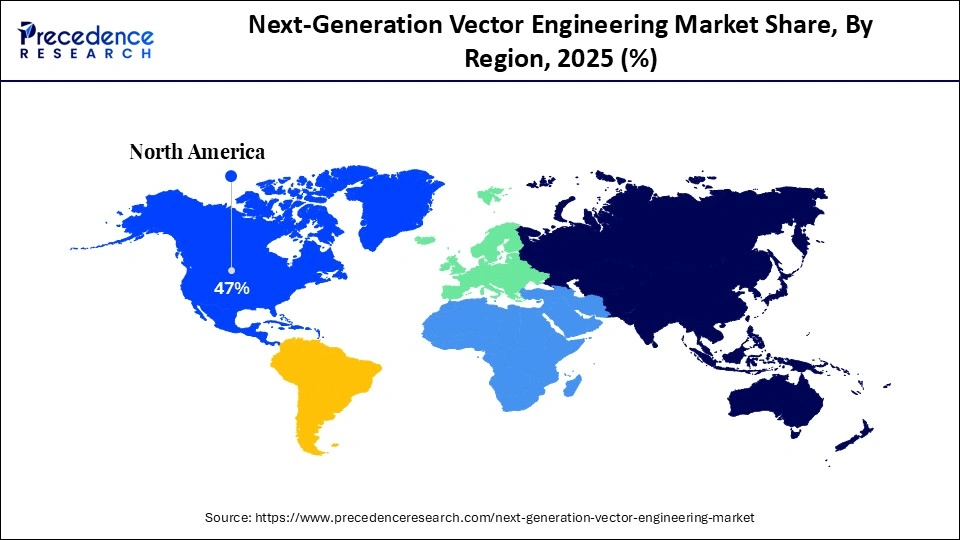

- North America accounted for the largest market share of 47% in 2025.

- The Asia Pacific segment is expected to grow at the fastest CAGR of 16.5% from 2026 to 2035.

- By vector type, the viral vectors segment contributed for a considerable 56% share in 2025.

- By vector, the synthetic & engineered vectors segment is projected to experience the highest CAGR of 18.5% between 2026 and 2035.

- By technology approach, the capsid engineering segment led the market with a 30% market share in 2025.

- By technology approach, the AI/ML-guided optimization systems segment is projected to grow at a strong CAGR of 19.8% from 2026 to 2035.

- By application, the gene therapy segment dominated the market, accounting for 41% of the market in 2025.

- By application, the cell therapy segment is expected to grow at the highest CAGR from 2026 to 2035.

- By workflow stage, the preclinical development segment contributed the highest market shar of 38% in 2025.

- By workflow stage, the discovery & design segment is projected to expand rapidly with an 18% CAGR from 2026 to 2035.

- By end user, the biopharmaceutical companies segment maintained a leading position in the market with a 48% share in 2025.

- By end user, the CDMOs segment is growing at a notable CAGR of 16.2% from 2026 to 2035.

- By delivery route, the Ex vivo segment captured a significant market share of 52% in 2025.

- By delivery route, the In vivo delivery segment will grow at a 17.8% CAGR from 2026 to 2035.

Market Overview of Next-Gen Vector Engineering: Therapeutic Applications, Design Tools, and Production Needs

Rapid growth in demand for treatments of rare genetic disorders and cancers drives expansion in this vector based therapy sector. It involves the use of engineered viral or non-viral vectors, such as AAV, lentivirus, or plasmid-based vectors, that transfer therapeutic genes into patient cells to correct, replace, or regulate malfunctioning genes. By the beginning of March 2023, the international database had registered approximately 3,900 clinical trials in gene therapy in 46 different countries.

Viral vector methodologies are highly popular for their efficient delivery. Rapid regulatory approvals and increasing trial volume highlight the growing ecosystem for complex vector-based therapeutics. Furthermore, the growing number of at-risk populations due to genetic and rare diseases is expected to drive widespread use of these technologies in the coming years.

Impact of Artificial Intelligence on the Next-Generation Vector Engineering Market

Artificial intelligence (AI) plays a significant role in improving the design, optimization, and manufacturing in the next-generation vector engineering market. Leading biotechnology companies are using AI-based algorithms to process complex genomic, proteomic, and transcriptomic datasets, allowing them to identify optimal vector configurations with far greater speed and accuracy than traditional experimental methods. AI-driven sequence engineering supports the discovery of improved capsid variants, enhances tissue tropism, increases transduction efficiency, and reduces immunogenic risk by predicting how the immune system may respond to specific vector designs.

Furthermore, AI tools are increasingly used to model vector host interactions at the molecular level, enabling researchers to anticipate off-target effects and refine payload stability before entering preclinical studies. In manufacturing, AI supports real-time process optimization, yield prediction, and quality control monitoring, which improves batch consistency for viral and non-viral vectors. AI-enabled predictive modeling of clinical outcomes also guides patient stratification, dosing strategies, and trial design, helping companies reduce clinical failure rates and accelerate the development of next-generation gene therapies.

Next-Generation Vector Engineering Market Growth Factors

- Rising Adoption of Personalized Medicine: Growing demand for patient-specific gene therapies is propelling the development of tailored vector platforms.

- Advancements in CRISPR and Gene-Editing Technologies: Breakthroughs in precise genome editing are driving innovation in vector design and delivery efficiency.

- Expanding Clinical Trial Pipeline: An Increasing number of ongoing trials for rare and complex diseases is boosting the need for scalable vector production.

- Growing Biopharma-CDMO Collaborations: Strategic partnerships between biotech firms and contract manufacturing organizations are fuelling access to advanced vector engineering expertise.

- Enhanced Regulatory Support for Gene Therapies: Evolving frameworks in the U.S., EU, and Asia are propelling faster approval and commercialization of vector-based therapies.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vector Type, Technology Approach, Application, Workflow Stage, End User, Delivery Route, and by Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global Metrics, Innovation Drivers, and Competitive Landscape in Next-Generation Vector Platforms

- Japan continues to scale high-volume bioreactor capacity suitable for vector production, spurred by AGC Biologics' Yokohama site, which is being outfitted with two 5,000-L single-use bioreactors, making it one of the largest single-site mammalian/vector-capable facilities in the Asia-Pacific region.

- South Korea is positioning itself as a large-capacity biologics and vector-supporting manufacturer, with Samsung Biologics adding over 180,000 L of biologics capacity at Bio Campus II. Although primarily for proteins, this scale enables rapid conversion toward large-scale viral-vector support for global gene-therapy supply chains.

- The U.K. continues to lead Europe, hosting more than 5,000 activeclinical trials, boosted by the NHS's integrated data systems and the MHRA's recent rapid-review framework. This regional growth directly contributes to faster Phase II/III progressions and improved cross-border recruitment efficiency.

- In 2025, Azalea Therapeutics secured USD 82 million to build dual-vector and in vivo editing platforms. This level of early-stage capital signals accelerating investor confidence in next-gen vector platforms that can bypass current delivery limitations.

- Atsena Therapeutics closed a USD 150 million round backed by Bain and Sofinnova for AAV-based retinal vector engineering. Large late-stage funding rounds strengthen vector optimization pipelines and push more programs toward commercial-scale manufacturing.

- Fuse Vectors secured ~5 M (USD $5.2 M) for its next-gen, cell-free AAV platform. Early funding for manufacturing-focused startups shows growing global demand for scalable, low-contamination vector production technologies.

- In 2025, over 115 new patents for AAV vector technologies were published, with ~15% already granted according to recent industry reporting. This demonstrates that innovations in vector design and delivery continue at a rapid pace. Continuous patent grants encourage companies to invest in next-gen vector R&D, locking in IP protection for novel capsids and delivery methods.

- Shift toward non-viral and hybrid delivery technologies is underway, as evidenced by PROGEN launching lipid nanoparticle (LNP) kits in 2025, expanding beyond AAV analytics to offer customizable LNP-based delivery systems. Emergence of non-viral delivery options diversifies the vector engineering landscape, driving innovation in both viral and non-viral platforms.

Next Generation Vector Engineering Market Segment Insights

Vector Type Insights

Viral Vectors (AAV & Lentiviral dominant): Viral vectors segment dominated the next-generation vector engineering market in 2025, accounting for an estimated 56% market share, driven by their low immunogenicity and long-term gene expression. In 2025, the FDA also approved several INDs of the AAV gene therapies, which hastened the shift to mid- and late-stage trials. Furthermore, the clinical applications of such vectors in oncology and rare diseases were still expanding at major centers, including the University of Pennsylvania Gene Therapy Program, CHOP, Mayo Clinic, and Johns Hopkins Medicine, thereby fuelling growth in the market segment.

Synthetic & Engineered Vectors: The synthetic and engineered vectors segment is expected to grow at the fastest rate in the coming years, accounting for 18.50% CAGR during the forecasted years since demand for these advanced constructs is expected to rise, as developers pursue more flexible payload designs and reduced host immune activation. Biopharma innovators increased collaborations to accelerate the translation of engineered vector technologies into clinical development. Additionally, advanced engineered vectors are a key driver of long-term progress, especially as neurological and systemic gene therapy efforts further expand the segment.

Technology Approach Insights

Capsid Engineering: The capsid engineering segment held the largest revenue share in the next-generation vector engineering market in 2025, accounting for about 30%, due to its central role in improving tropism, reducing immunogenicity, and enhancing the precision of in vivo delivery. Academic institutions further developed de-targeted and immune-evasive capsid design, resulting in momentum in both rare disease and oncology pipelines. Moreover, the ongoing manufacturing scale-ups and clinical adoption trends further underscore the need for reliable, well-characterized capsid frameworks.

AI/ML-Guided Optimization Systems: The AI/ML-guided optimization systems segment is expected to grow at the fastest CAGR in the coming years, accounting for 19.8% growth rate, as they offer high-throughput capsid evolution and make it easier to develop next-generation vectors. Research groups have shown that AI-designed capsids have gained in targeting efficiency and gained traction in early-stage programs. Furthermore, the growing demand for the development of specific, manufacturable vectors that demonstrate clinical performance in a relatively short time further propels the use of AL/ML-guided optimization systems.

Application Insights

Gene Therapy: The gene therapy segment dominated the next-generation vector engineering market in 2025, accounting for an estimated 41% market share as next-generation vectors are increasingly optimized for higher payload capacity, tissue-specific targeting, and improved safety. Increased efforts at the NIH, NHGRI, and the UPenn Gene Therapy Program to develop clinical programs with next-generation capsids capable of overcoming pre-existing immunity further underscore the need to design optimized vectors. Additionally, growing funding for genetic disease programs, such as Duchenne muscular dystrophy and spinal muscular atrophy, based on advanced engineered vectors, further boosts market growth.

Cell Therapy (CAR-T, NK cell vectors): The cell therapy segment is expected to grow at the fastest rate over the coming years, accounting for 17.5% growth rate of the market. Owing to the high use of next-generation vector engineering technology in developing delivery systems for CAR-T, CAR-NK, and engineered stem-cell platforms. Furthermore, the Cleveland Clinic, Johns Hopkins Medicine, and the Karolinska Institute took a step forward with vector platforms designed to be more precise for immune-cell reprogramming, making them suitable for cell-therapy applications.

Workflow Insights

Preclinical Development: The preclinical development segment held the largest revenue share in the next-generation vector engineering market in 2025, at about 38%, due to the focus of research programs on in vivo characterization, biodistribution mapping, and cross-species translatability of engineered vectors. Pharmaceutical developers are increasing investment in preclinical toxicology and vector-optimization platforms, thus fuelling the segment.

Discovery & Design (ML-enabled vector discovery): The discovery & design segment is expected to grow at the fastest rate in the coming years, accounting for an 18% CAGR in the market share, driven by increasing demand for machine-learning-powered vector discovery technology. Moreover, ML-enabled vector platforms minimize experimental redundancy and reduce iteration timelines, further driving high demand for vector engineering in this segment.

End User Insights

Biopharmaceutical Companies: The biopharmaceutical companies segment dominated the next-generation vector engineering market in 2025, with a market share of about 48%, driven by increasing internal programs for vector-optimizing platforms in gene therapy, cell therapy, and mRNA-based therapies targeting complex neurological, metabolic, and malignancy indications.

This dominance was facilitated by intensive pipeline activity, backed by more than 2,000 active gene and cell-based therapy programs in 2025, as tracked by global regulatory agencies such as the FDA, EMA, and PMDA. Furthermore, the biopharma sector increased in-house vector engineering capacity, with rational capacity engineering further boosting market growth.

CDMOs (vector & LNP manufacturing partners): The CDMO segment is expected to grow at the fastest rate in the coming years, with a 16.2% CAGR owing to the growing dependence on foreign capacity to develop an AAV, lentiviral, adenoviral, and next-generation LNP platforms. They address long-standing global capacity issues in the supply of vectors used in GMP. Moreover, next-generation manufacturing hubs are integrating clinical-grade vector delivery into global therapeutic pipelines, further driving demand for CDMO-based vector engineering.

Delivery Route Insights

Ex vivo Delivery (CAR-T, HSC modification): The ex vivo delivery segment held the largest revenue share in the next-generation vector engineering market in 2025, accounting for about 52%. Due to the developers' focus on controlled, high-precision genetic modification environments for CAR-T, CAR-NK, and hematopoietic stem cell (HSC) therapies. Additionally, advanced ex vivo engineering methods improve editing accuracy and reduce off-target integration, thereby fuelling segment growth in the coming years.

In vivo Delivery (incl. BBB-crossing vectors): The in vivo Delivery segment is expected to grow at the fastest rate in the coming years, accounting for 17.8% CAGR. Owing to the high demand for engineered viral capsids, nanoparticles, and BBB-crossing vectors for this type of delivery route. Developments, such as strong innovation in ultra-targeted in vivo delivery of infectious disease, neurology, and metabolic disorder pipelines, grew with increasing support of global agencies. Furthermore, the increasing support from international agencies strengthened innovation in ultra-targeted in vivo delivery for infectious diseases.

Next Generation Vector Engineering Market Regional Insights

North America led the next-generation vector engineering market, capturing the largest revenue share of 47% in 2025, due to the world's highest concentration of gene and cell therapy R&D programs, clinical trial pipelines, and advanced biomanufacturing infrastructure. The United States remains the global center for vector innovation, supported by a dense network of biotechnology companies, academic medical centers, and federally funded research institutes. In 2025, the FDA received more than 2,000 active IND submissions for gene and cell therapy candidates, reflecting the depth of ongoing development programs and the rapid expansion of translational research.

Funding from federal agencies such as BARDA and ARPA-H, along with significant contributions from private foundations and philanthropic groups, continues to strengthen the regional ecosystem by supporting platform technologies, vector optimization tools, and clinical-scale manufacturing facilities. The presence of specialized CDMOs and GMP-compliant production sites enables companies to scale viral and non-viral vector manufacturing more efficiently than most other regions. Continuous investment in AI-enabled vector design, high-throughput screening platforms, and automated production also positions North America at the forefront of next-generation vector engineering.

The U.S. is a major player in the North American market in 2025, owing to its strong gene and cell therapy ecosystem. U.S. institutions increased their investment in engineered capsid programs, high-throughput vector evolution platforms, and AI-driven discovery pipelines. Regulatory leadership, combined with focused research excellence and extensive manufacturing capabilities, is likely to fuel market growth in this region.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by accelerated clinical expansion, government-funded genomic medicine, and massive investments in biomanufacturing. Agencies such as PMDA (Japan), NMPA (China), and MFDS shortened the review processes for gene and cell therapy products, leading to a surge in vector-based development pipelines. Moreover, the growing biotech pipelines, cost-effective production, and favourable regulatory conditions in the Asia Pacific are expected to boost the market growth.

Why Is China Emerging as the Asia Pacific's Powerhouse in Advanced Vector Engineering?

China is leading the charge in the Asia-Pacific market, driven by the high-growth rate in the Chinese vector engineering, gene therapy, and biomanufacturing ecosystem. The Chinese Academy of Sciences, Tsinghua University, ShanghaiTech University, and BGI developed AI-based innovations in vector engineering and LNP delivery. Additionally, the high government investment in genomic medicine, large patient numbers, and growing involvement in oncology and rare-disease studies are expected to position China for a regional leadership role in the coming years.

The Europe region is expected to hold a notable revenue share of the market, fuelled by the well-established regulatory alignment and substantial investment in next-generation gene and cell therapy platforms. Europe took a leading role in regulating and setting quality standards for vectors, with the approval of several advanced therapy medicinal products (ATMPs). Moreover, cross-border research consortia, pan-European trial networks, and academic-industry collaborations continually accelerate innovation, thereby further facilitating market growth in this region.

What Makes the United Kingdom a Notable Force in Europe's Next-Gen Vector Innovation Landscape?

In Germany, regional market growth is driven by advanced vector optimization strategies, including rational capsid evolution, high-fidelity gene transfer systems, and scalable LNP manufacturing. Companies such as Bayer, Merck KGaA, BioNTech, CureVac, and Miltenyi Biotec spent significantly on vector engineering infrastructure, GMP suites, automated quality platforms, and AI-powered discovery machines. Additionally, the intense R&D and robust public-private collaboration are expected to boost market growth further in the coming years.

Next-Generation Vector Engineering Market Value Chain

Designing the therapeutic gene or genetic payload for delivery.

Key Players: Synthego, Twist Bioscience, GenScript, Beam Therapeutics

Production of plasmid DNA or viral backbones used for AAV, LVV, adenoviral, or non-viral vectors.

Key Players: Aldevron, VGXI, PlasmidFactory, Cobra Biologics

Converting vectors into final formulations suitable for in vivo delivery

Key Players: Moderna (LNP tech), Acuitas Therapeutics, Precision NanoSystems

Scaling vectors for clinical trials and commercial supply.

Key Players: Charles River Labs, Oxford Biomedica, Fujifilm Diosynth, AGC Biologics

Delivery of GMP-grade vectors and therapy products to biopharma companies for trials or market.

Key Players: Thermo Fisher Scientific, Catalent, Lonza, WuXi Advanced Therapies

Next-Generation Vector Engineering Market Companies

The Company provides end-to-end viral vector manufacturing and gene therapy support.

They are the leading CDMO for viral vectors, offering development and GMP manufacturing for AAV and lentiviral vectors, supporting both clinical and commercial programs.

Providing modular, scalable viral vector manufacturing (AAV, LVV), with global facilities and end-to-end cell and gene therapy CDMO services, from preclinical to commercial scale.

This organization offers viral vector CDMO services, including AAV manufacturing, plasmid DNA supply, and integrated manufacturing & testing services.

They specialize in lentiviral (LVV) and viral vector platforms for gene therapies. Further, offers custom vector design, manufacturing, and works with several commercial-stage therapies.

Other Next-Generation Vector Engineering Market Companies

- Charles River Laboratories

- Fujifilm Diosynth Biotechnologies

- AGC Biologics

- Sartorius Stedim Biotech

- Merck KGaA (MilliporeSigma)

- Takara Bio

- Vigene Biosciences

- Vector BioPharma

- Cellares

- Aldevron

Recent Developments

- In October 2025, Asimov launched its AAV Edge Stable Producer system, aiming to overcome limitations of traditional transient-transfection workflows and raise AAV manufacturing reliability to standards closer to antibody-based biologics. Alec Nielsen, PhD, co-founder and CEO, stated that the platform is expected to enhance stability, reproducibility, and scalability for next-generation vector production. (Source: https://www.genengnews.com)

- In July 2025, Lonza announced the launch of the 4D-Nucleofector LV Unit PRO, its next-generation large-scale electroporation system engineered for delivering clinically relevant cargos into high-volume T-cell batches. The new unit expands Lonza's non-viral transfection portfolio and is optimized for CRISPR genome-engineering programs and advanced cell-therapy manufacturing applications. (Source: https://www.lonza.com)

- In April 2025, CellFE announced a strategic collaboration with the Harbottle Lab at the German Cancer Research Center (DKFZ) and its spin-out TcellTech. The partnership integrates CellFE's Ryva Mechanoporation System with TcellTech's nanoSMAR gene-expression DNA vector platform to enhance the performance of non-viral DNA vectors. The collaboration is expected to accelerate personalized cell-therapy development by addressing key challenges in delivery and expression. (Source: https://www.cellfebiotech.com)

Next-Generation Vector Engineering MarketSegments Covered in the Report

By Vector Type

- Viral Vectors

- Adeno-associated Viral (AAV) Vectors

- Rationally engineered capsids

- Directed evolution of AAV variants

- Synthetic AAV serotypes

- Lentiviral Vectors

- Self-inactivating (SIN) lentiviral vectors

- Pseudotyped lentiviral vectors

- Adenoviral Vectors

- Gutless adenoviral vectors

- Targeted-tropism-modified variants

- Retroviral Vectors

- Other Viral Vectors (Herpesviral, Vaccinia, Baculoviral, etc.)

- Adeno-associated Viral (AAV) Vectors

- Non-viral Vectors

- Lipid Nanoparticles (LNPs)

- Ionizable lipid-based LNPs

- Targeted/ligand-modified LNPs

- Polymeric Nanoparticles

- Hybrid Nanoparticles (Lipid polymer hybrids)

- Exosomes & Extracellular Vesicles

- DNA & RNA Nanostructures

- Electroporation-based Delivery Vehicles

- Lipid Nanoparticles (LNPs)

- Synthetic & Engineered Vectors

- De novo designed capsids

- Modular synthetic viral shells

- Programmable nucleic acid scaffolds

By Technology Approach

- Capsid Engineering

- Directed evolution

- Rational design

- Machine learning/AI-guided optimization

- Structure-guided capsid modification

- Payload Engineering

- Promoter/Regulatory Element Engineering

- Enhancer Optimization

- Compact gene cassette design

- Tissue-specific constructs

- Targeting & Tropism Engineering

- Receptor-binding domain modifications

- Ligand/antibody-mediated targeting

- Tropism switching and de-targeting

- Blood-brain-barrier (BBB) crossing vectors

- Immunogenicity Reduction / Stealth Engineering

- Removal of immunodominant epitopes

- Shielding strategies (PEGylation, glycosylation, protein shields)

- CpG depletion and sequence modification

- Manufacturability & Scalability Optimization

- High-yield vector constructs

- Stability-engineered vectors

- Improved packaging cell lines

- Low-cost manufacturing-compatible vectors

- Gene Editing-specific Vectors

- CRISPR cargo vectors (Cas9, Cas12, Cas13)

- Base editing & Prime editing delivery vectors

- Split-intein vector systems

- Large-cargo (>5 kb) engineered vectors

By Application

- Gene Therapy

- Rare disease therapies

- Metabolic disorders

- Oncology

- Neurological diseases

- Hematological disorders

- Cell Therapy

- CAR-T cell engineering

- NK cell therapy

- Stem cell modification

- Vaccines

- Next-gen viral vector vaccines

- mRNA/LNP-based vaccines

- Genetic Research & Functional Genomics

- High-throughput screening

- In vivo functional studies

- Disease modelling

- Drug Delivery Research

- Tissue-specific delivery programs

- Blood-brain barrier (BBB) delivery tools

By Workflow Stage

- Discovery & Design

- In silico / ML-based vector design

- Library generation

- Preclinical Development

- In vitro assay development

- In vivo model validation

- Clinical Manufacturing

- Vector scale-up

- Analytical testing

- Commercial Manufacturing

- GMP production

- Quality control & lot release

By End User

- Biopharmaceutical Companies

- Gene therapy developers

- Cell therapy developers

- Vaccine manufacturers

- Academic & Research Institutes

- Contract Development & Manufacturing Organizations (CDMOs)

- Contract Research Organizations (CROs)

- Government & Public Health Research Bodies

By Delivery Route (Vector Use Case)

- In vivo Delivery

- Intravenous (IV)

- Intramuscular (IM)

- Intrathecal / Intracerebral

- Ocular (sub-retinal)

- Pulmonary / Inhalation

- Ex vivo Delivery

- Blood cell modification

- Stem cell editing

- Solid tissue-derived cell modification

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content