North America Process Spectroscopy Market Size and Forecast 2025 to 2034

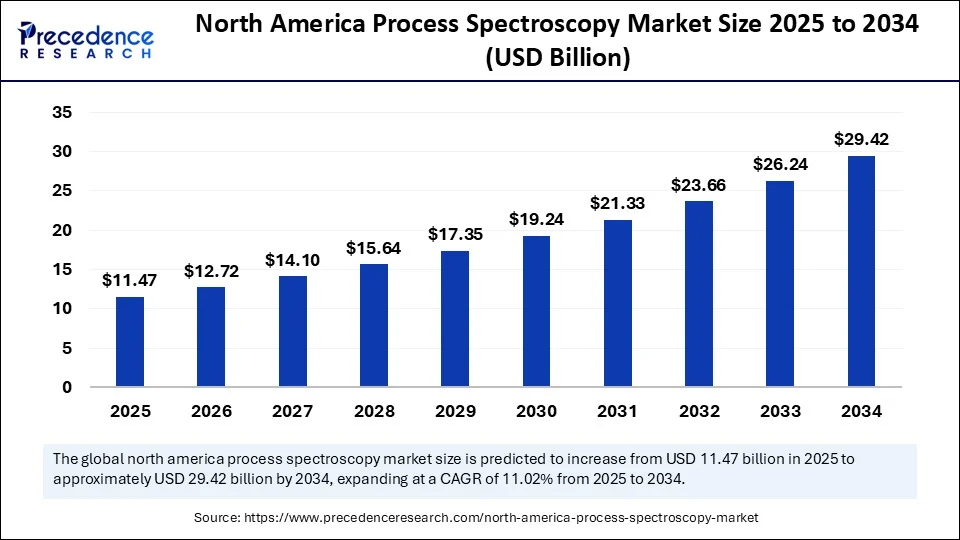

The North America process spectroscopy market size was calculated at USD 10.34 billion in 2024 and is predicted to increase from USD 11.47 billion in 2025 to approximately USD 29.42 billion by 2034, expanding at a CAGR of 11.02% from 2025 to 2034. The North America process spectroscopy market is growing due to the increased need for real-time quality control in industries such as pharmaceuticals, food, and chemicals.

North America Process Spectroscopy Market Key Takeaways

- In terms of revenue, the North America process spectroscopy market was valued at USD 10.34 billion in 2024.

- It is projected to reach USD 29.42 billion by 2034.

- The market is expected to grow at a CAGR of 11.02% from 2025 to 2034.

- By technology, the molecular spectroscopy segment held the largest market share in 2024.

- By technology, the mass spectroscopy segment is expected to grow at the fastest CAGR during the forecast period.

- By component, the hardware segment captured the biggest market share in 2024.

- By component, the software segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the pharmaceuticals segment generated the major market share in 2024.

- By application, the water & wastewater management segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on the North America process spectroscopy Market

Artificial intelligence significantly impacts the North America process spectroscopy market by enhancing data analysis, permitting real-time process control, improving quality assurance, and accelerating research and development. AI-powered spectroscopy assists in identifying anomalies and ensuring product consistency, which is vital in regulated industries such as pharmaceuticals. By determining spectral information in real time, AI can optimize parameters, facilitate predictive process control, as well as enable automated decision-making to ensure consistent product quality along with efficient production. North American firms are investing heavily in AI-powered solutions to boost innovation and maintain their market leadership.

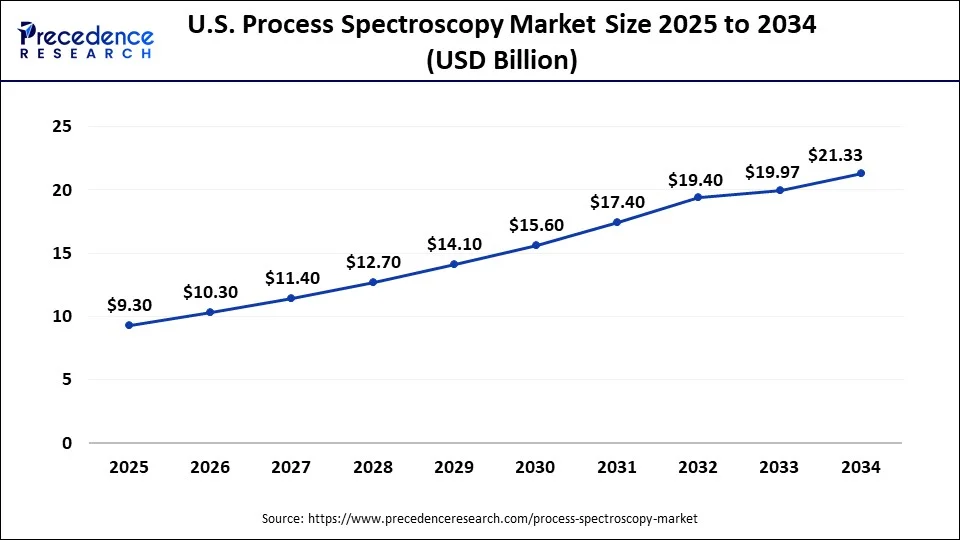

U.S. Process Spectroscopy Market Size and Growth 2025 to 2034

The U.S. process spectroscopy market size was evaluated at USD 7.24 billion in 2024 and is projected to be worth around USD 21.33 billion by 2034, growing at a CAGR of 11.08% from 2025 to 2034.

Market Overview

The significance of the process spectroscopy market lies in its global leadership and innovation, boosted by strong chemical, pharmaceutical, and food/beverage industries requiring real-time, automated quality control and even regulatory compliance. The presence of key industries such as chemicals, food processing, and pharmaceuticals drives the requirement for process spectroscopy solutions for process optimization, real-time analysis, and also quality assurance. Significant investment in research and development, along with partnerships between academia as well as industry, foster continuous innovation in spectroscopic techniques.

North America Process Spectroscopy Market Growth Factors

- Increasing R&D investments along with the development of developed treatments are driving the need for spectroscopy in bioprocess monitoring and even ensuring product quality.

- The incorporation of Industry 4.0 principles with process spectroscopy improves operational efficiency and even data-driven decision-making across industries.

- Advances in software-driven chemometrics as well as specialized software solutions are increasing the utility and also accuracy of spectroscopy information for industrial applications.

- Rising environmental standards and even regulatory requirements are significant factors, pushing industries to accept process spectroscopy for compliance and safety.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.42 Billion |

| Market Size in 2025 | USD 11.47 Billion |

| Market Size in 2024 | USD 10.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.02% |

| Dominating Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Component, and Application |

Market Dynamics

Drivers

Increasing Investments from F&B Sector

Rising investments in the food & beverage and chemical industries fuel the North America process spectroscopy market by increasing need for real-time quality and also safety assurance, compliance with strict regulatory standards, along with operational efficiency. Spectroscopy assists identifying contaminants and adulterants, guaranteeing compliance with stringent food safety regulations in North America. Spectroscopy offers insights into chemical reactions and product characteristics, funding the advancement of new and enhanced chemical products.

Restraint

High Initial Investment

The cost is affected by the type of instrument, its performance features, along with ongoing operational expenses such as maintenance and training. While there's no universal figure, expenses can range significantly, with fundamental handheld units at the lower end and high-performance, developed systems potentially costing hundreds of thousands of dollars. The high upfront investment can act as an entry barrier for new firms and may deter smaller organizations or research institutions with restricted budgets from adopting these technologies. Beyond the purchase costs, there are ongoing expenses for calibration, routine maintenance, and the demand for specialized software as well as skilled personnel to operate the equipment.

Opportunity

Integration of Advanced Technologies

The integration of AI and ML with spectroscopy provides North American companies a competitive advantage by permitting enhanced accuracy, speed, and even automation in process control, leading to enhanced efficiency, quality, and also cost savings. AI and ML algorithms can determine vast and complex spectral information with high precision and speed, decreasing manual labor and human error, which is vital for critical industries such as pharmaceuticals. The ability to consistently identify anomalies and discrepancies in spectral data guarantees higher product quality and even compliance with stringent regulations.

Technology insights

The molecular spectroscopy segment dominates the North America process spectroscopy market due to the region's developed pharmaceutical and also chemical industries, early acceptance of Process Analytical Technology (PAT) boosted by strict FDA regulations, substantial investments in R&D, and a strong base of leading producers and solution providers. The existence of strict regulatory bodies such as the FDA encourages the adoption of PAT, which depends heavily on advanced spectroscopy for real-time quality control as well as process optimization.

The mass spectroscopy segment is witnessing the fastest growth due to increasing need in the pharmaceutical along with biotechnology sectors for molecular analysis as well as drug development, alongside technological developments that enhance speed and accuracy. Mass spectrometry is indispensable for drug discovery, development, and even proteomics analysis because of its high sensitivity, accuracy in detecting and quantifying compounds, and capability to manage complex biological systems. In the food and beverage field, mass spectrometry is vital for quality assurance, ingredient analysis, as well as contamination detection, guranteeing compliance with strict food regulations.

Component insights

This is because of its robust industrial base in chemicals, pharmaceuticals, and food & beverages, which need real-time analysis and quality control. The region benefits from a mature regulatory framework, as well as substantial R&D investments contributing to advanced spectroscopic apparatus, and early adoption of technologies such as Industry 4.0 and IoT integration for automated manufacturing. North America's well-known pharmaceutical, chemical, and even food & beverage sectors drive the requirement for hardware solutions for quality assurance.

The software segment is witnessing the fastest growth as it offers the widespread acceptance of Industry 4.0 integration needs real-time quality control, advanced data analysis, together with automated decision-making via AI and machine learning. Investing in smart, AI-based spectroscopy software gives firms a competitive edge by allowing predictive and automated quality control, that is becoming a competitive necessity. Spectroscopy software assists industries optimize their processes by offering real-time insights into product quality as well as reaction kinetics, leading to decreased waste and increased efficiency.

Application insights

The pharmaceutical segment dominates the North America process spectroscopy market due to the sector's high need for real-time quality control, stringent regulatory compliance boosted by agencies such as the FDA, and the rising target on personalized medicine and developed biopharmaceuticals, which need precise analytical methods. Spectroscopy is vital at every stage of drug discovery, formulation, as well as manufacturing, from analyzing chemical structures along with compositions to monitoring stability and detecting impurities. The existence of leading biotechnology, pharmaceutical, and life science firms in North America creates a significant customer base along with the requirement for high-quality analytical instrumentation.

The water & wastewater management segment is growing rapidly, fueled by the demand to upgrade aging infrastructure, assent with stringent regulations, and manage water scarcity through advanced monitoring as well as treatment technologies such as process spectroscopy. Governments and regulatory bodies impose increasingly stringent rules for water quality along with wastewater discharge. This drives the requirement for advanced technologies to ensure compliance, creating process spectroscopy essential for monitoring.

North America Process Spectroscopy Market Companies

- Thermo Fisher Scientific, Inc.

- Kaiser Optical Systems, Inc.

- Danaher Corporation

- Bruker

- Agilent Technologies, Inc.

Recent Developments

- In April 2025, Thermo Fisher Scientific is employing an improved platform technology, and even a new CHO K-1 cell line that can decrease timelines to Investigational New Drug (IND) filing from 13 to nine months, assisting biotech and pharmaceutical firms overcome logistical complexities within pre-clinical biologic drug development. (Source: https://pharmaceuticalmanufacturer.media)

- In November 2024, Agilent Technologies Inc. declared a new organizational structure to accelerate the firm's operational transformation to drive higher expansion through a market-targeted, customer-centric enterprise strategy. The new structure, which includes new leadership roles, takes effect immediately.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Technology

- Atomic Spectroscopy

- Mass Spectroscopy

- Molecular Spectroscopy

- NIR

- FT-IR

- Raman

- NMR

- Others

By Component

- Hardware

- Software

By Application

- Polymer

- Pharmaceuticals

- Water & Wastewater Management

- Pulp & Paper

- Oil & Gas

- Metal & Mining

- Chemical

- Food & Agriculture

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting