What is the Obesity GLP-1 Market Size?

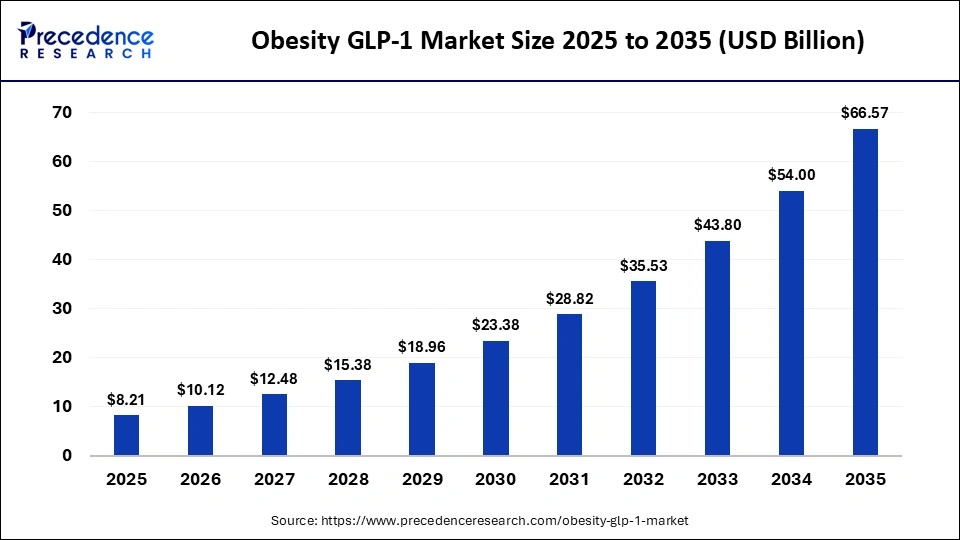

The global obesity GLP-1 market size accounted for USD 8.21 billion in 2025 and is predicted to increase from USD 10.12 billion in 2026 to approximately USD 66.57 billion by 2035, expanding at a CAGR of 23.28% from 2026 to 2035. This market is growing due to the rising global prevalence of obesity and strong clinical evidence demonstrating GLP-1 drugs' effectiveness in weight management and metabolic health.

Market Highlights

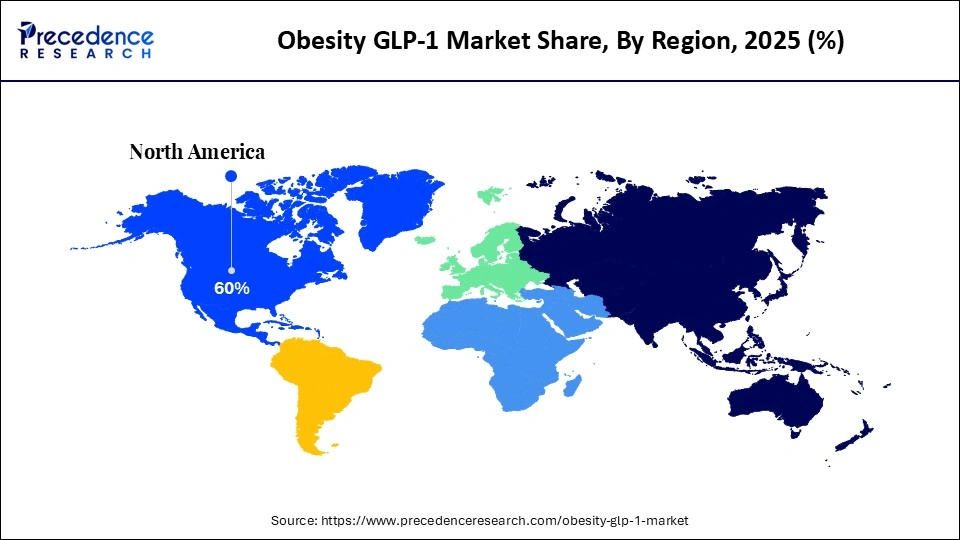

- North America dominated the market with approximately 60% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By drug type, the semaglutide segment held the biggest market share of approximately 46% in 2025.

- By drug type, the tirzepatide segment is expected to expand at the fastest CAGR between 2026 and 2035.

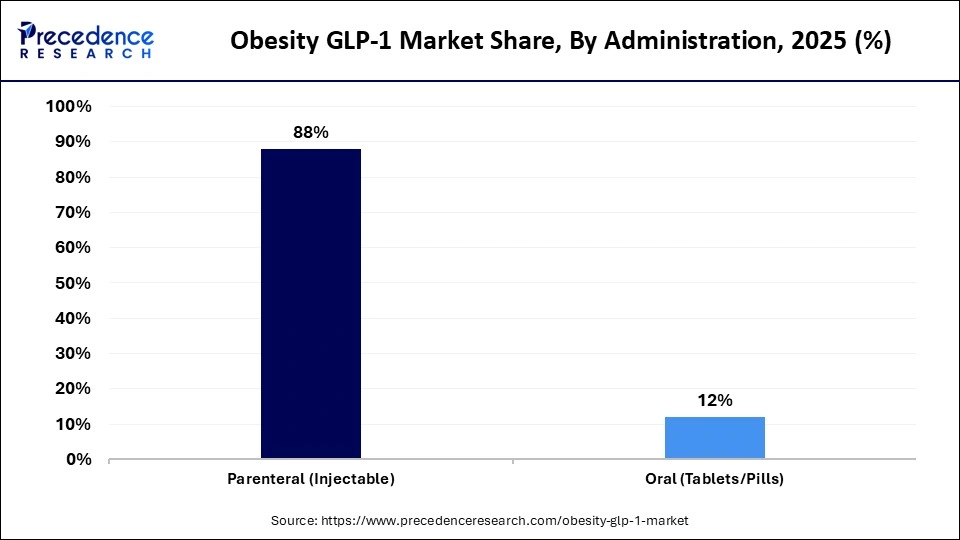

- By route of administration, the parenteral segment contributed the highest market share of approximately 88% in 2025.

- By route of administration, the oral segment is expected to grow at a strong CAGR between 2026 and 2035.

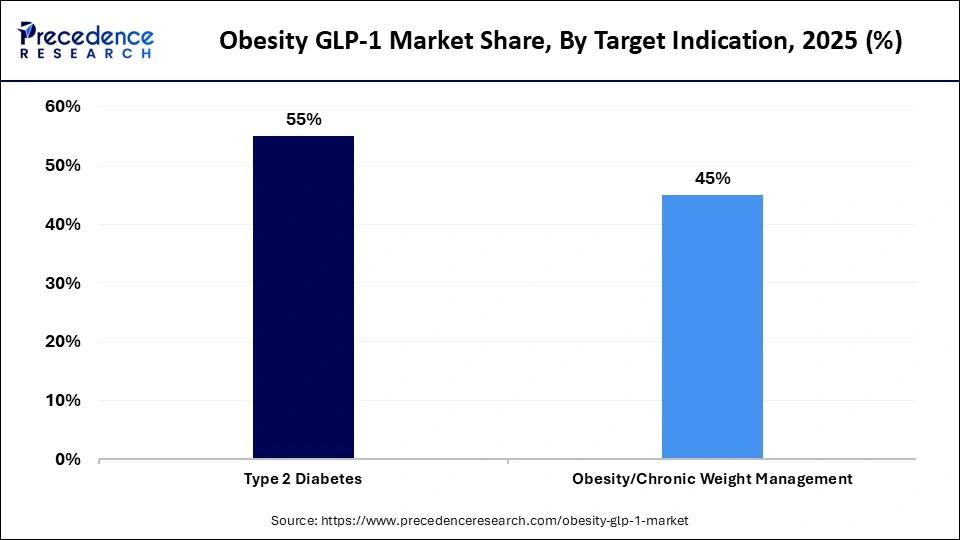

- By target indication, the type 2 diabetes segment held a major market share of approximately 55% in 2025.

- By target indication, the obesity/chronic weight management segment is expected to expand at the fastest CAGR from 2026 to 2035.

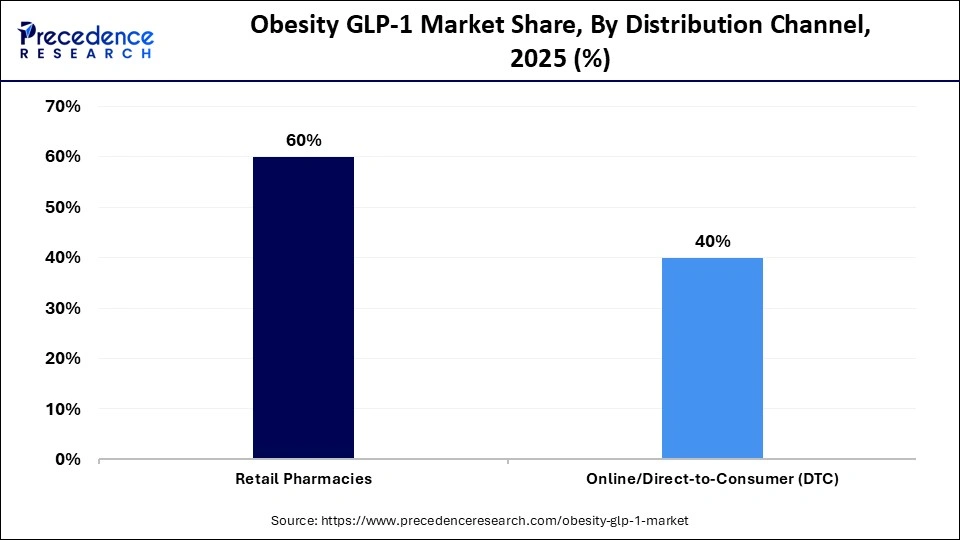

- By distribution channel, the retail pharmacies segment generated the biggest market share of approximately 60% in 2025.

- By distribution channel, the online/direct-to-consumer (DTC) segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the Obesity GLP-1 Market Gaining Momentum?

The obesity GLP-1 market is experiencing rapid growth due to the rising prevalence of obesity and the increasing demand for effective non-surgical weight management solutions. Strong clinical evidence demonstrating sustained weight loss and cardiometabolic benefits is boosting confidence among patients and healthcare providers. Additionally, expanded insurance coverage and favorable regulatory approvals are accelerating market adoption, while ongoing research and development of patient-friendly, long-acting formulations is supporting long-term growth.

How is Artificial Intelligence Influencing the Obesity GLP-1 Market?

Artificial Intelligence (AI) is transforming the obesity GLP-1 market by enabling personalized treatment strategies through patient profiling, predictive analytics, and biomarker identification. AI helps healthcare providers determine the most effective dosing, monitor patient adherence, and optimize long-term outcomes. AI-driven analytics improve therapy efficacy and adherence by identifying ideal patient profiles and optimizing dosing strategies. AI also helps with demand forecasting and speeds up drug development, which helps manufacturers improve market efficiency and streamline supply chains.

Major Market Trends

- Rapid adoption of GLP-1 receptor agonists as first-line obesity treatments due to strong real-world weight-loss outcomes.

- Growing shift toward long-acting, once-weekly injectable formulations to improve patient compliance.

- Increasing focus on cardiometabolic benefits, including reduced cardiovascular risk, alongside weight management.

- Expansion of label indications beyond diabetes, strengthening GLP-1 positioning in obesity care.

- Rising integration of digital health tools and AI for patient monitoring, adherence tracking, and outcome optimization.

- Strong investment in next-generation GLP-1 combinations targeting enhanced efficacy and reduced side effects.

Future Market Outlook

- The large global population of untreated and obese individuals is expected to create sustained demand for pharmacological interventions.

- Growing acceptance of medical management of obesity over surgical or lifestyle-only approaches.

- Expansion opportunities in emerging markets with improving healthcare access and awareness.

- Development of oral GLP-1 formulations offering needle-free treatment options.

- Potential for personalized obesity therapies using AI-driven patient profiling and biomarker analysis.

- Increasing payer support and reimbursement coverage, enabling broader patient access and long-term market growth

Government Initiatives Supporting the Obesity GLP-1 Market

As obesity is increasingly recognized as a chronic, high-burden disease, government initiatives are playing a key role in supporting the obesity GLP-1 market. Health authorities and international organizations are promoting medical weight management through improved access to advanced therapies, combined lifestyle and pharmacotherapy approaches, and updated treatment guidelines. Adoption of GLP-1 therapies is being boosted by integrated care models for obesity and diabetes, expanded reimbursement policies, and inclusion of obesity medications in public health programs. Additionally, long-term demand is indirectly reinforced by initiatives that support domestic pharmaceutical manufacturing, preventive healthcare programs, and obesity awareness campaigns.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.21 Billion |

| Market Size in 2026 | USD 10.12 Billion |

| Market Size by 2035 | USD 66.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 23.28% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Type, Route of Administration, Target Indication, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Type Insights

What made semaglutide the dominant segment in the obesity GLP-1 market?

The semaglutide segment dominated the market with a major share of 46% in 2025 because of its robust clinical efficacy in glycemic control and weight loss, which is backed by a wealth of empirical data. Strong physician confidence, widespread regulatory approvals, and high patient adoption all helped to establish its leadership. Stable demand was also bolstered by well-known branded goods and robust reimbursement coverage in several nations. The segment's leading position is further reinforced by the availability of long-acting formulations.

The Tirzepatide segment is expected to grow at the fastest CAGR in the coming years, driven by a dual GIP and GLP-1 receptor mechanism providing better results for weight loss. Adoption of Tirzepatide is being accelerated by strong clinical trial results showing improved efficacy over conventional GLP-1 therapies. Further bolstering rapid growth are expanding label indications and raising physician awareness.

Route of Administration Insights

Why did the parenteral segment dominate the obesity GLP-1 market?

The parenteral segment dominated the market while holding the largest share of 88% in 2025 because injectable formulations provide precise dosing, rapid absorption, and sustained therapeutic effects, which are critical for achieving effective weight loss and glycemic control. These formulations are particularly preferred for chronic management of obesity, as they ensure higher bioavailability compared to oral alternatives and allow the use of long-acting, once-weekly or once-daily therapies. Additionally, parenteral GLP-1 treatments have strong clinical validation, which increases physician confidence and patient adherence, further driving market dominance.

The oral segment is expected to grow at the fastest CAGR in the coming years because of the increasing demand for convenient, needle-free treatment options that improve patient adherence and comfort. Oral formulations make long-term therapy more appealing, especially for patients hesitant about injections, and they allow broader adoption in outpatient and home-care settings. Additionally, advancements in drug delivery technologies are enhancing the bioavailability and efficacy of oral GLP-1 therapies, further fueling their market growth.

Target Indication Insights

Why did the type 2 diabetes segment dominate the obesity GLP-1 market?

The type 2 diabetes segment dominated the market with a 55% share in 2025 because GLP-1 therapies have been used for glycemic control for a long time, and diabetes is very common worldwide. Widespread adoption was aided by the dual advantages of blood sugar regulation and weight loss. Market leadership was strengthened by strict reimbursement regulations and the incorporation of clinical guidelines. Another important factor reinforcing the segment's dominance is doctors' confidence in GLP-1 treatments for the treatment of diabetes.

The obesity/chronic weight management segment is expected to grow at the fastest CAGR during the forecast period, fueled by growing awareness of obesity as a chronic illness and rising obesity rates worldwide. Adoption of obesity GLP-1 is increasing because of the expansion of regulatory approvals for weight management. Key growth drivers are raising patient awareness and the need for efficient non-surgical treatments. Better long-term results from weight loss are also speeding up the segment's growth.

Distribution Channel Insights

What made retail pharmacies the leading segment in the obesity GLP-1 market?

The retail pharmacies segment led the market with a 60% share in 2025 because they offer wide accessibility and convenience for patients seeking prescriptions and ongoing therapy refills. These pharmacies benefit from strong distribution networks, trusted brand presence, and immediate product availability, making them the preferred choice for both new and returning patients. Additionally, retail pharmacies often provide counseling support, insurance processing, and promotional discounts, which further drive adoption and sustained use of GLP-1 therapies.

The online/direct-to-consumer (DTC) segment is expected to grow at the fastest CAGR in the coming years due to the increasing preference for home delivery and digital access to medications, which offers convenience and privacy for patients managing chronic obesity. Growth is also driven by the rise of telehealth consultations and digital prescriptions, enabling easier patient access to GLP-1 therapies without visiting physical stores. Additionally, online platforms often provide competitive pricing, subscription refills, and reminders for adherence, which are boosting patient convenience and accelerating market expansion.

Regional Insights

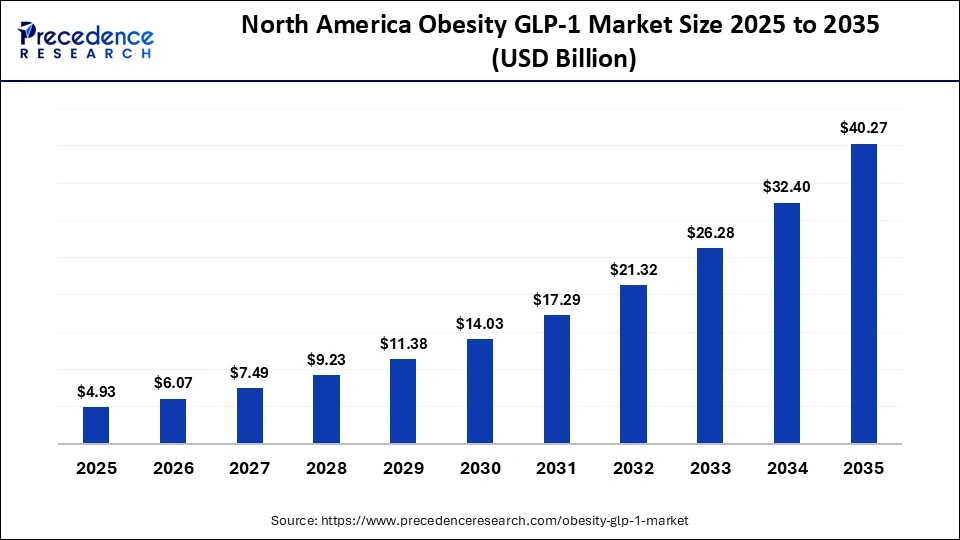

How Big is the North America Obesity GLP-1 Market Size?

The North America obesity GLP-1 market size is estimated at USD 4.93 billion in 2025 and is projected to reach approximately USD 40.27 billion by 2035, with a 23.37% CAGR from 2026 to 2035.

What made North America the dominant region in the obesity GLP-1 market?

North America registered dominance in the market by capturing a 60% share in 2025. The region's dominance in the market is attributed to the high prevalence of obesity and the presence of a sophisticated healthcare system. Strong reimbursement frameworks and the early adoption of cutting-edge GLP-1 therapies helped sustain market leadership. The presence of a large number of pharmaceutical companies and a high awareness among medical professionals and patients about the benefits of GLP-1 ensure the long-term dominance of the region in the market.

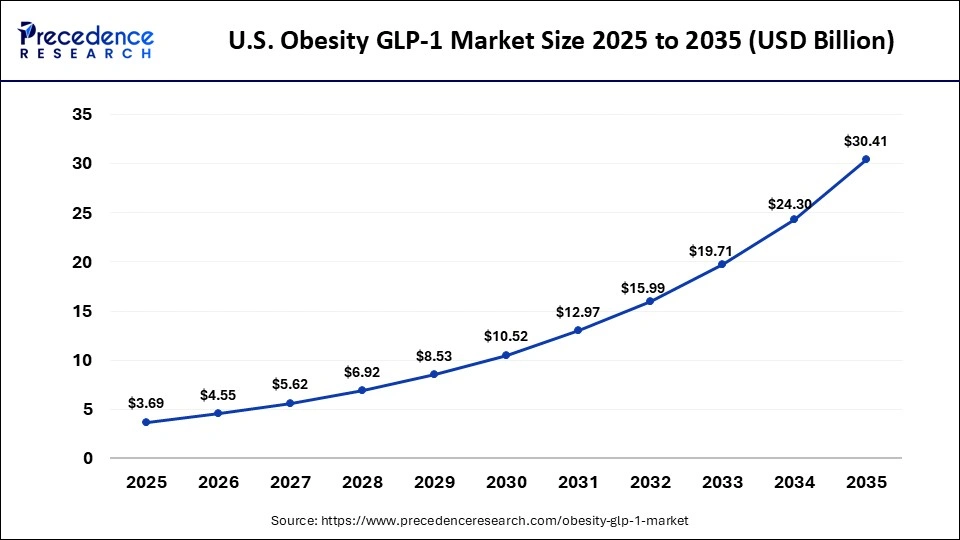

What is the Size of the U.S. Obesity GLP-1 Market?

The U.S. obesity GLP-1 market size is calculated at USD 3.69 billion in 2025 and is expected to reach nearly USD 30.41 billion in 2035, accelerating at a strong CAGR of 23.48% between 2026 and 2035.

U.S. Obesity GLP-1 Market Trends

The market in the U.S. is growing due to the high prevalence of obesity and strong clinical acceptance of GLP-1 therapies for long-term weight management. Growth is further supported by favorable regulatory approvals, expanded insurance coverage, and widespread physician adoption, making these treatments more accessible. Additionally, high patient awareness, advanced healthcare infrastructure, and major pharmaceutical presence, along with direct-to-consumer and telehealth models, are enhancing nationwide access to GLP-1 therapies.

How is the opportunistic rise of Asia Pacific in the market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to the rising prevalence of obesity and diabetes in emerging economies. Expansion is supported by improved healthcare access, growing pharmaceutical distribution networks, and increasing awareness of medical weight management. Additionally, urbanization, a growing middle-class population, and lifestyle changes are further driving adoption and market growth in the region.

India Obesity GLP-1 Market Trends

India is a major contributor to the market within Asia Pacific due to the rising prevalence of diabetes, obesity, and growing awareness of medical weight management. Market growth is further supported by urbanization, the expansion of endocrinology and specialty clinics, and broader access to healthcare services. While affordability and limited reimbursement remain challenges, increasing demand among urban populations and ongoing healthcare reforms and awareness campaigns are expected to accelerate adoption and overall market expansion.

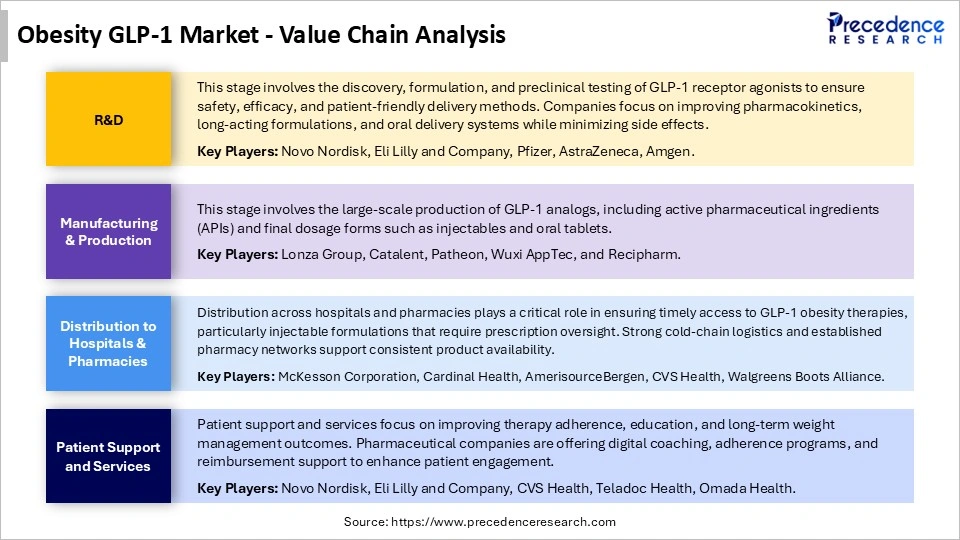

Obesity GLP-1 Market Value Chain Analysis

Who are the Major Players in the Global Obesity GLP-1 Market?

The major players in the obesity GLP-1 market include Novo Nordisk A/S, Eli Lilly and Company, Amgen, Viking Therapeutic, AstraZeneca, Roche (Carmot Therapeutics), Boehringer Ingelheim, Pfizer Inc., Altimmune, Inc., and Structure Therapeutics.

Recent Developments

- In February 2026, Pfizer announced positive Phase 2b trial results for its ultra-long-acting injectable GLP-1 (PF-08653944), demonstrating significant weight loss with monthly dosing. The company noted the candidate's competitive safety profile and sustained efficacy over 28 weeks, with plans to advance it into Phase 3 trials in 2026. (Source: https://www.pfizer.com)

- In February 2026, Novo Nordisk announced the broad American availability of the Wegovy pill, introducing the first and only oral GLP-1 receptor agonist for adult weight loss. The once-daily pill is now accessible through retail pharmacies across the U.S.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Drug Type

- Semaglutide (Wegovy/Ozempic)

- Tirzepatide (Zepbound/Mounjaro)

- Liraglutide (Saxenda)

- Emerging Oral GLP-1s

By Route of Administration

- Parenteral (Injectable)

- Oral (Tablets/Pills)

By Target Indication

- Type 2 Diabetes

- Obesity/Chronic Weight Management

By Distribution Channel

- Retail Pharmacies

- Online/Direct-to-Consumer (DTC)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting