Orthopedic Braces and Support, Casting and Splints Market Size and Forecast 2025 to 2034

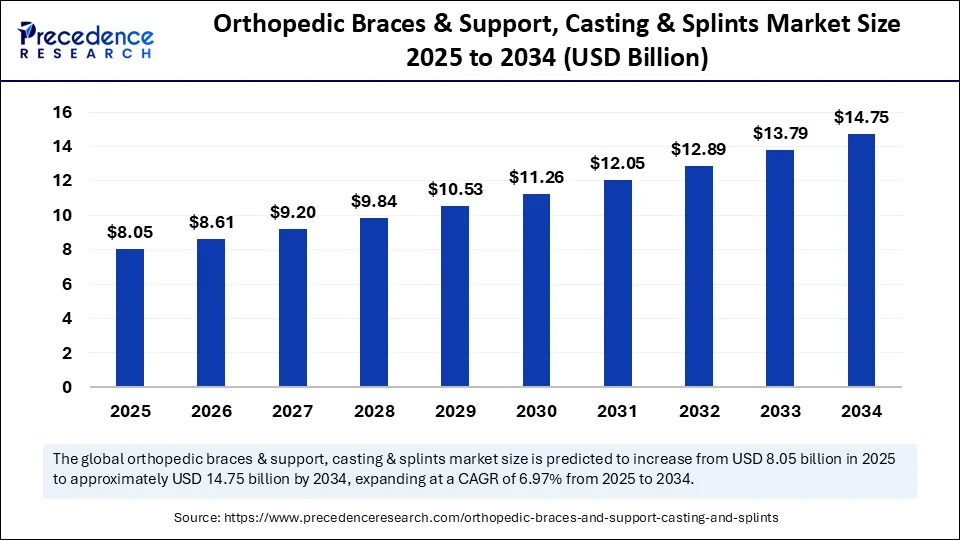

The global orthopedic braces and support, casting and splints market size accounted for USD 7.53 billion in 2024 and is predicted to increase from USD 8.05 billion in 2025 to approximately USD 14.75 billion by 2034, expanding at a CAGR of 6.97% from 2025 to 2034. The growth of the orthopedic braces & support, casting & splints market is growing steadily due to the increasing incidences of musculoskeletal disorders and sports injuries. An ageing population, increasing spending on healthcare, and advances in material science and smart device technology further contribute to market growth.

Orthopedic Braces and Support, Casting and Splints MarketKey Takeaways

- In terms of revenue, the global orthopedic braces and support, casting & splints market was valued at USD 7.53 billion in 2024.

- It is projected to reach USD 14.75 billion by 2034.

- The market is expected to grow at a CAGR of 6.97% from 2025 to 2034.

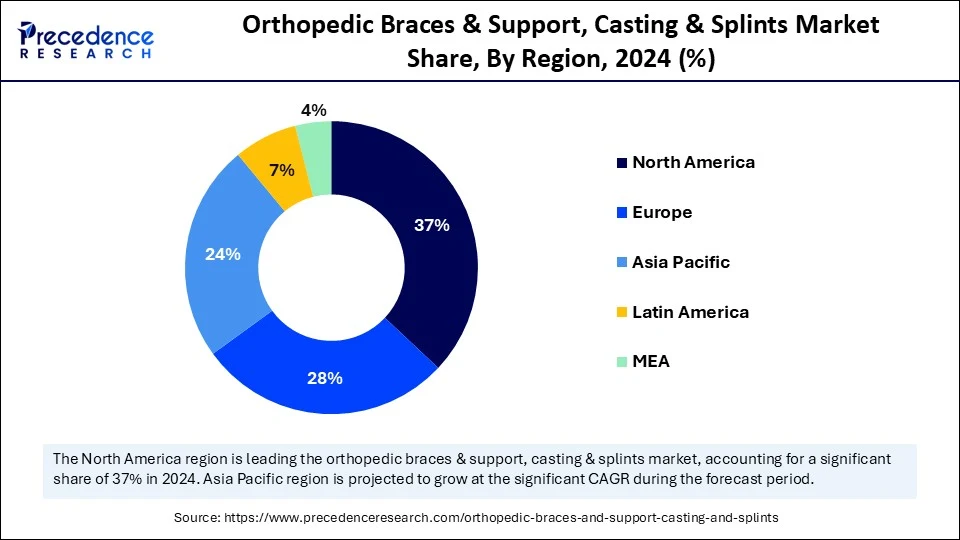

- North America led the orthopedic braces and support, casting and splints market with the highest revenue share of 37% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 7% between 2025 and 2034.

- By product type, the orthopedic braces and supports segment held the highest market share in 2024.

- By product type, the casting supplies & equipment segment is expected to grow at approximately 7.1% CAGR between 2025 and 2034.

- By material, the metal segment led the market in 2024.

- By material, the thermoplastic segment is expected to expand at a notable CAGR over the projected period.

- By application, the fracture management segment captured the highest market share in 2024.

- By application, the post-operative care segment is expected to expand at the highest CAGR over the projected period.

- By distribution channel, the hospitals / ortgopedic clinics segment generated the major market share in 2024.

- By distribution channel, the e-commerce / online sales segment is expected to grow at a CAGR of approximately 8.3% during the forecast period.

Impact of AI on the Orthopedic Braces & Support, Casting & Splints Market

Artificial Intelligence is revolutionizing the market by enabling personalized care, predictive insights, improved diagnostics, efficient manufacturing, and remote patient monitoring, ultimately leading to better patient outcomes and more efficient healthcare delivery. AI is also used in the design and manufacturing of orthopedic devices, optimizing processes, reducing costs, and improving the quality of products. AI-enabled 3D printing led to the development of unique, custom-made hand and finger splints, posture correctors, and prophylactic braces that are lightweight, breathable, and offer the comfort and accuracy needed. Leading experts at industry forums, including OSMA's spring 2025 meeting, have described agentic AI systems embedded in wearable braces and support devices, providing adaptive support during movement and optimizing a real-time feedback loop.(Source: https://orthofeed.com)

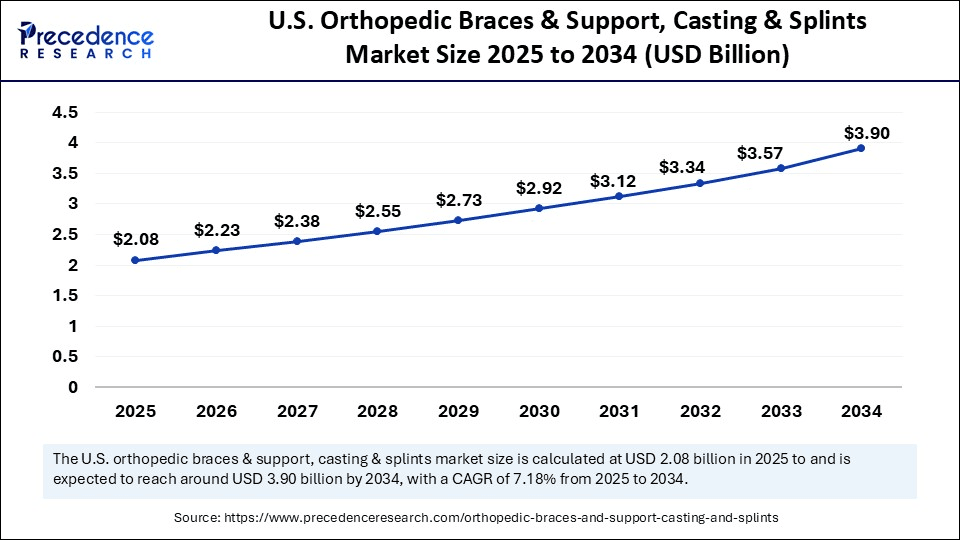

U.S. Orthopedic Braces and Support, Casting and Splints Market Size and Growth 2025 to 2034

The U.S. orthopedic braces and support, casting and splints market size was exhibited at USD 1.95 billion in 2024 and is projected to be worth around USD 3.90 billion by 2034, growing at a CAGR of 7.18% from 2025 to 2034.

What Made North America the Dominant Region in the Orthopedic Braces & Support, Casting & Splints Market in 2024?

North America registered dominance in the orthopedic braces & support, casting & splints market while capturing the largest share in 2024 due to its advanced healthcare system, high adoption of innovative medical devices, and a growing number of orthopedic injuries linked to an aging population and sports activities. The rising incidence of orthopedic surgeries, presence of global medical device manufacturers, strong insurance coverage, and increased awareness of musculoskeletal health also drive demand for orthopedic braces in the region. Furthermore, government initiatives support mobility aids and promote the integration of technological advancements in braces and splints bolstered regional market growth.

The U.S. is a major contributor to the North American orthopedic braces & support, casting & splints market. The U.S. boasts a strong healthcare system for medical devices, with widespread access to orthopedic specialists. Millions of Americans experience musculoskeletal conditions annually, driving high demand for these devices. Active investments and R&D in smart devices, supported by leading brands like DJO Global and Össur, alongside favorable FDA pathways for product innovation, further contribute to market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Orthopedic Braces & Support, Casting & Splints Market?

Asia Pacific is expected to experience the fastest growth in the upcoming period. This is mainly due to heightened awareness of orthopedic health, an growing aging population, and an increase in sports and accidental injuries. Countries in the region are enhancing access to orthopedic healthcare services, while urbanization is driving demand for mobility aids. Economic growth and rising health expenditures have led to a shift from traditional treatment methods to modern approaches. Additionally, government initiatives advocating for disability support and injury recovery are enabling the market to flourish, particularly in developing markets with rapidly improving healthcare infrastructure.

India is a leading player in the market in Asia Pacific due to its large population, rising injury rates, and an increasing aged population. Government initiatives like Ayushman Bharat have expanded access to orthopedic services, including orthopedic devices. The rising number of domestic medical manufacturers, coupled with partnerships with international med-tech companies, is improving product availability and affordability. Growing investment in rehabilitation centers and public health awareness campaigns further support India's leadership in the orthopedic braces & support, casting & splints market within Asia Pacific.

Market Overview

The orthopedic braces and support, casting & splints market encompasses devices and supplies designed for immobilization, support, and rehabilitation of musculoskeletal injuries and disorders. This includes braces & supports (e.g., knee, wrist, spinal), casting supplies (plaster/fiberglass casts and accessories), and splinting supplies (dynamic and static splints). The market is experiencing rapid growth due to the rising incidence of sports injuries, an aging population with orthopedic issues, and increased post-operative rehabilitation. Advancements in technology lead to enhanced patient comfort and compliance through 3D-printed splints and new, lightweight, flexible materials, supporting market growth.

Orthopedic Braces and Support, Casting and Splints MarketGrowth Factors

- Rising Sports and Accident Injuries: The rising popularity of sports and increasing number of road accidents, more orthopedic braces, casts and splints are required for injury management and quicker rehabilitation.

- Growing Geriatric Population: As people age, they are more susceptible to degenerative conditions such as arthritis and osteoporosis which mean individuals need greater usage of support device for pain relief, joint stabilization, and improvement of mobility.

- Growing Demand for Post-Surgical Rehabilitation: Increased number of orthopedic surgeries, like joint replacements and fractures, means greater demand for braces and casting products as patients go through their recovery and rehabilitation process.

- Advancements in material technology: The development of better lightweight, durable, breathable materials mean better comfort for the patient and better compliance as patients are encouraged to adopt greater orthopedic support products through their rehabilitation and recovery.

- Increased access to healthcare: The development of better healthcare infrastructure and awareness in the developing world is leading to better diagnosis and treatment of musculoskeletal disorders which is leading to more product demand in the developing regions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.75 Billion |

| Market Size in 2025 | USD 8.05 Billion |

| Market Size in 2024 | USD 7.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Musculoskeletal Disorders

The global surge in the prevalence of musculoskeletal (MSK) disorders is a major factor driving the growth of the orthopedic braces & support, casting & splints market. Global health organizations are increasingly becoming aware of the burden of MSK disorders on a global scale. According to the World Health Organization (WHO), musculoskeletal disorders affect over 1.71 billion people worldwide, with low back pain cited as the single leading cause of disability. The WHO also reports that musculoskeletal disorders account for nearly 17% of global years lived with disability (YLDs). (Source: https://www.who.int/news-room)

- Since 2023, MSK disorders have been on the rise and continue to increase in burden due to an aging populations, increasing physical inactivity levels, and rising rates of obesity. The long-term management of many MSK disorders often relies on orthopedic braces and splints in providing pain relief, improving mobility, and ultimately avoiding surgical management, which represents a significant portion of demand globally. (Source:https://www.who.int)

Restraint

Limited Access to Orthopedic Services

A key factor restraining the growth of the orthopedic braces & support, casting & splints market is the lack of integration of orthotic services into public health systems, as highlighted by the World Health Organization (WHO). Many countries lack effective policy frameworks or resourcing for prosthetics and orthotics, restricting patient access to essential devices. Though orthoses may be clinically indicated, they are often not supplied due to insufficient workforce, limited service infrastructure, and lack of funding through universal health coverage schemes.

This means that even when clinically warranted, millions of people, especially in low- and middle-income countries, cannot receive their prescribed braces or splints. The service gap limits market uptake, since unmet need persists, and falling short of supply mechanisms will hinder more widespread market utilization even though the patient population is increasing globally with musculoskeletal conditions.

Opportunity

Did FDA‑Approved Sensor Trackers Fuel the Next Disruption in Orthopaedic Bracing?

A significant opportunity in orthopedic braces & support, casting & splints market is the transition toward wearable sensors that objectively measure patient compliance. For example, in February 2025, Maxx Orthopedics, Inc. announced U.S. Food and Drug Administration (FDA) 510(k) clearance for 3D printed Porous Titanium Tibial Baseplate for Freedom Total Knee System. In another case, a U.S. clinical trial (NCT05222503) is exploring a smart knee brace with real‑time usage metrics for patients and therapists sent their mobile device. This type of innovation has the potential to increase adherence, promote personalized rehabilitation plans, and improve clinical outcomes. As healthcare systems seek accountability and implement digital health, compliance tracking and sensors provide growth opportunities in strategic direction for the future.

(Source:https://orthospinenews.com)

(Source: https://clinicaltrials.gov)

Product Type Insights

Why Did the Orthopedic Braces & Supports Segment Dominate the Market in 2024?

The orthopedic braces & supports segment dominated the orthopedic braces & support, casting & splints market, holding the largest share in 2024. This is mainly due to their widespread application in injury prevention, rehabilitation, and chronic orthopedic conditions. Braces and supports are often preferred because they are adjustable, comfortable, and offer a non-invasive approach to injury treatment in both sports medicine and general healthcare settings.

The casting supplies & equipment segment is expected to grow at the fastest CAGR during the forecast period, driven by rising trauma cases and demand for surgical interventions. Innovations in casting materials, such as lighter fiberglass and water-resistant options, lead to enhanced patient experience. The increasing demand for more efficient orthopedic immobilization further supports segmental growth.

Material Insights

What Made Metal the Dominant Segment in the Market in 2024?

The metal segment dominated the orthopedic braces & support, casting & splints market while holding a major share in 2024. The dominance of metal stems from its high usage, driven by its excellent strength, stability, and longevity. These attributes make it ideal for applications requiring long-term support. Devices made from metal are favored in complex orthopedic issues, requiring rigid structural support, or for post-surgical recovery, such as severe musculoskeletal issues.

The thermoplastic segment is expected to experience the fastest growth over the forecast period. The growth of this segment is attributed to the rising demand for lightweight, flexible, and moldable materials that improve comfort and enable the development of customized braces and splints. Overall, the adoption rate of thermoplastics is growing in modern orthopedic care, as they are user-friendly, adaptable materials, making them suitable for custom-fit braces and splints.

Application Insights

Which Application Segment Dominate the Market in 2024?

The fracture management segment accounted for the largest share of the orthopedic braces & support, casting & splints market in 2024. This segment's dominance stems from the high incidence of fractures caused by trauma, accidents, and sports injuries. Braces, splints, and casting materials are commonly used to stabilize and immobilize fractured bones, promoting faster healing and preventing additional damage during recovery.

The post-operative care segment is expected to expand at the fastest CAGR during the projection period. The growth of this segment is attributed to the increasing number of orthopedic surgeries, including joint replacements and ligament repairs, where braces and supports play a crucial role in rehabilitation. Rising awareness of structured post-surgical recovery is further accelerating the demand of braces and splints. The rising demand for customized braces in post-operative care contributes to segmental growth.

Distribution Channel Insights

How Does the Hospitals / Orthopedic Clinics Segment Dominate the Market in 2024?

The hospitals / orthopedic clinics segment held the largest share of the orthopedic braces & support, casting & splints market in 2024. This is due to the high patient volume in hospitals and clinics, driven by the ability to consult medical professionals as needed. The wide range of orthopedic products available for evaluation, treatment, and recovery encourages more patients to receive care from these settings. Hospitals and clinics also ensure products are fitted by trained professionals and provide supervised patient use, which can enhance treatment outcomes.

The online sales segment is likely to grow at the fastest rate in the coming years, driven by the increasing popularity of e-commerce platforms, which makes it easier for consumers to browse and purchase products from the comfort of their homes. This is further supported by the rise in digital health usage, with more people comfortable using online resources for healthcare needs. Additionally, online channels offer a wider selection of products and customization options, attracting a tech-savvy consumer base looking for tailored solutions.

Orthopedic Braces and Support, Casting and Splints Market Companies

- 3M Company

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Össur hf.

- DJO Global (including DonJoy)

- Bauerfeind AG

- Ottobock SE & Co. KGaA

- BSN Medical GmbH

- DeRoyal Industries, Inc.

- Spencer Italia S.r.l.

- Prime Medical, Inc.

- Becker Orthopedic

- Orfit Industries N.V.

- Medi GmbH & Co. KG

- Dynasplint Systems (dynamic splints)

- Revra DePuy / DePuy (Johnson & Johnson origin)

- Other notable global brands like Aircast, Valeo Medical, Bauer offers

- Additional specialty firms (e.g. Tynor Orthotics in India)

- Local/regional manufacturers (e.g. Prime Medical, Orfit)

- Innovators in lightweight and digital braces

Recent Developments

- In January 2025, Aspen Medical Products acquired Advanced Orthopaedics to promote its offerings of spinal and orthopedic bracing products. In addition to advancing Aspen's distribution capabilities, the acquisition will help Aspen branch into new orthopedic care markets throughout the United States.

(Source: https://www.prnewswire.com) - In June 2025, Dimension Ortho, along with Rothman Orthopaedics, announced a partnership to improve orthotic care through 3D printing orthopedic solutions. These two industry leaders aim to have custom-fit braces that lead to improved patient comfort and healing outcomes while modernizing the way orthopedics has traditionally treated patients.(Source: https://3dprintingindustry.com)

- In January 2025, Enovis launched the DonJoy ROAM OA knee brace in the U.S. for patients with osteoarthritis. The brace contains two new telescoping hinges and magnetic buckles to improve patient mobility or comfort by offloading pressure from the knee joint that commonly causes pain for patients. (Source:https://ir.enovis.com)

- In May 2024, DentalMonitoring received De Novo FDA clearance for its AI-based orthodontic remote-monitoring software, which will allow someone to more closely monitor their oral health in real time through smartphone scans, improve the efficiency of treatment and decrease the number of visits to clinics and break new ground in AI-based digital orthodontic care.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Product Type

- Orthopedic Braces & Supports

- Upper Extremity (neck, shoulder, elbow, wrist, spinal)

- Lower Extremity (knee, ankle, hip)

- Casting Supplies & Equipment

- Plaster casts, fiberglass casting tapes, cast cutters, accessories

- Splinting Supplies & Equipment

- Fiberglass splints, plaster splints, dynamic splints, tools & accessories

- Others

By Material

- Metal

- Fabric

- Thermoplastic

- Others (fiberglass/polyester casting tape)

By Application

- Fracture Management

- Ligament Injury Support

- Osteoarthritis Aid

- Post-operative Care

- Others (e.g. kyphosis, scoliosis)

By Distribution Channel

- Hospitals / Orthopedic Clinics

- Over the Counter (OTC retail)

- E commerce / Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting