Pain Relief Oil Market Size and Forecast 2025 to 2034

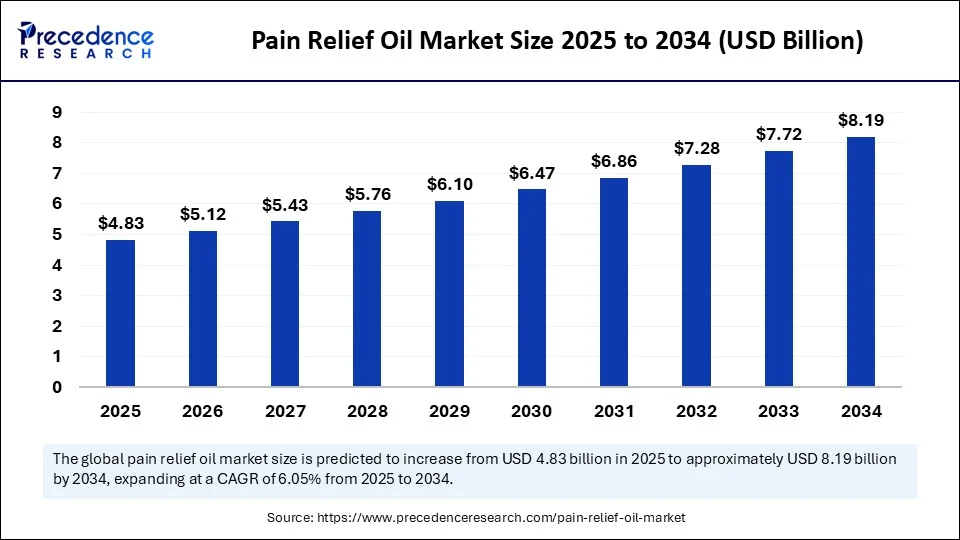

The global pain relief oil market size accounted for USD 4.55 billion in 2024 and is predicted to increase from USD 4.83 billion in 2025 to approximately USD 8.19 billion by 2034, expanding at a CAGR of 6.05% from 2025 to 2034.The market is driven by rising demand for natural and herbal remedies, increasing cases of chronic pain, and growing awareness of alternative therapies.

Pain Relief Oil MarketKey Takeaways

- In terms of revenue, the global pain relief oil market was valued at USD 4.55 billion in 2024.

- It is projected to reach USD 8.19 billion by 2034.

- The market is expected to grow at a CAGR of 6.05% from 2025 to 2034.

- North America dominated the pain relief oil market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- The European pain relief oil market is expected to account for a substantial market share.

- By product type, the herbal oil segment held a significant revenue share in 2024.

- By product type, the CBD-infused oil segment is anticipated to show considerable growth over the forecast period.

- By pain type treated, the joint pain segment led the market in 2024.

- By pain type treated, the arthritis pain segment is anticipated to show considerable growth over the forecast period.

- By formulation, the massage oil segment captured the biggest market share in 2024.

- By formulation, the oil-in-cream segment is anticipated to show considerable growth over the forecast period.

- By packaging type, the bottles (glass/plastic) segment captured the highest market share in 2024.

- By packaging type, the spray bottles segment is anticipated to show considerable growth over the forecast period.

- By application area, the joints (knees, elbows) segment generated the major market share of in 2024.

- By application area, the lower back segment is anticipated to show considerable growth over the forecast period.

- By end user, the adult segment accounted for the highest market share in 2024.

- By end user, the athletes & fitness enthusiasts segment is anticipated to show considerable growth over the forecast period.

- By distribution channel, the direct sales segment captured the maximum market share in 2024.

- By distribution channel, the e-commerce platforms segment is anticipated to show considerable growth over the forecast period.

How Is AI Integration Transforming the Pain Relief Oil Market?

The Artificial Intelligence integration is transforming the pain relief oil market by improving product design, customer and consumer interaction, and operational effectiveness. By examining consumer behaviour patterns, the preferences of the customers, and the health data, AI-driven algorithms will help to provide the most appropriate pain relief oils based on individual needs and maximize customer satisfaction and brand loyalty. Research and development are also boosted through AI by reducing development time and catalyzing the introduction of new and selective formulations. Moreover, AI-enabled chatbots and virtual assistants inside the online stores can maximize the customer experience with information, product usage advice, and post-purchase assistance in a real-time environment.

Market Overview

The pain relief oil market refers to the segment of the healthcare and wellness industry focused on topical oils formulated to relieve musculoskeletal pain, inflammation, and joint discomfort. These oils typically contain herbal extracts, essential oils, or synthetic ingredients that produce anti-inflammatory, analgesic, or soothing effects. The market serves both over-the-counter (OTC) and prescription-based consumers and is driven by demand from aging populations, sports injuries, and rising awareness of natural and alternative medicine.

The increasing instances of musculoskeletal disorders due to exercises and inactive lifestyles are fostering the development of the market. The natural and non-invasive curing of diseases is promising to patients, and they are gaining popularity in using herbal and ayurvedic oils. Increasing interest in self-care and wellness has also led to pain management becoming increasingly popular at home. The exposure of products via e-commerce websites has brought more opportunities to the consumer to compare brands and make their purchase from the comfort of their residence.

What Factors Are Fueling the Rapid Expansion of the Pain Relief Oil Market?

- Population Aging and Chronic Diseases: The increase in the number of aged people has increased the rate of chronic diseases such as arthritis, joint pains, and backache in the entire globe. Since pain relief oils provide an alternative, natural, safe option, which makes they popular among elderly people as an effective, non-invasive form of chronic pain management techniques.

- Explosion in Musculoskeletal Disorders: The newer pace of life, long hours at work, bad posture, and low physical exercise have seen a rise in the prevalence of musculoskeletal problems in the younger age groups. This has sparked the demand for convenient pain management alternatives in the form of oils that result in immediate and efficient pain-alleviating effects without any prescription or consultation at the clinic.

- E-Commerce and Digital Consciousness: The availability of pain relief oils has become a common household item, even in the remotest parts of the world, due to the existence of online retail stores. Consumers have been able to compare products and read about their products, and make informed buying decisions. The online advertisement, use of endorsements by influencers, as well as specific advertisements, have contributed to greater visibility.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.19 Billion |

| Market Size in 2025 | USD 4.83 Billion |

| Market Size in 2024 | USD 4.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Pain Type Treated, Formulation, Packaging Type, Application Area, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Lifestyle-Related Diseases

An increase in lifestyle-related diseases like arthritis, back pain, and sports injuries globally is one of the significant factors which members of the market share would boost pain relief oil. The tendency in sedentary jobs, more time in front of the screen, and physical inactivity have given rise to massive musculoskeletal problems even among the younger generations. These illnesses involve conditions that are commonly noted to need long-term non-invasive solutions to managing pain, thus increasing the need for topical oils. The rising trend of alternative and Ayurvedic medicine has contributed immensely to the spread of natural treatment that involves the use of oils. The awareness of the side effects of synthetic drugs continues to increase, and consequently, more people are moving toward plant-based remedies.

Restraint

Regulatory Hurdles and Consumer Perception

Herbal products and natural products face varying and often complicated regulations in different countries, and in many cases, high levels of testing, certification, and labeling requirements. These stringent requirements are likely to render the operations costly, time-consuming in terms of product update, and even exclude new or smaller businesses in the market. Moreover, the absence of standardized formulations used all over the world creates disparity in quality and performance; thus, consumers believe it is hard to rely on product performance across brands. The latter is also challenged by the cultural stigma that is still attached to herbal remedies in some parts. The older consumers or those who are medically conservative might find pharmaceutical choices more dependable, particularly because of the clinical support that is already available.

Opportunity

E-Commerce and Personalized Solutions

The emergence of e-commerce has opened a large potential for growth in the pain relief oil market. Brands can use online shops to target a larger and niche audience; they are convenient, and they have a wider range of products than local stores. The consumers are able to research, compare, and buy products catering to their focused needs, and it is the detailed description and peer reviews that influence them. Such a direct-to-consumer approach allows niche products visibility and brand loyalty. The other big opportunity is in the increasingly popular trend of personalized medicine. Premiumization can also be driven by innovation in terms of packaging, delivery mechanisms, and combinations of ingredients.

Product Type Insights

Why Does the Herbal Oil Segment Lead the Pain Relief Oil Market?

The herbal oil segment led the pain relief oil market and accounted for the largest revenue share in 2024 because there is a growing preference by global consumers to use natural, plant-based products. The ingredients used to formulate herbal oils in such a manner are time-proven, such as eucalyptus, peppermint, camphor, arnica, clove, and turmeric, which are found to be anti-inflammatory, analgesic, and calming. There is an increased perception that oils are safer products as compared to synthetic medicines with minimal side effects, and hence their effectiveness in long-term administration on ailments like arthritis, joint ache, and muscle stiffness, among others. The rising awareness of clean-labeled products and chemical-free health products heightens demand. Herbal oils have already been the most familiar brand in the market due to their presence through retail and online shops and the ongoing promotion by the wellness marketing specialist and holistic therapists.

The CBD-infused oil segment is expected to grow at a significant CAGR over the forecast period, caused by the growing awareness of the medicinal value of cannabidiol (CBD) for pain and inflammation management. CBD is non-psychoactive and is produced through the hemp plant; it has been embraced in the mainstream wellness market because it can reduce ailments such as chronic pain, arthritis, and even sports wounds. As cannabis stigma is declining, the population is also beginning to see CBD products based medicines as substitutes for pain medications currently available over the counter; they are often accompanied by the possibility of side effects or even developing an addiction. Innovation in formulation, such as fast-absorbing topical therapies, roll-on products, and transdermal patch formulations, is enhancing convenience and efficacy, and elevating the consumer desire to personalise wellness solutions products by upgrading to premium choices.

Pain Type Treated Insights

Why Did Joint Pain Contribute the Most Revenue in 2024?

The joint pain segment contributed the most revenue in 2024 because of the high level of joint-related complications, which are a higher figure in terms of the population demographic in different parts of the world, namely, the elderly, footballers, athletes, as well as people with physically strenuous lifestyles. Osteoarthritis, bursitis, and Age and stress-related wear-and-tear of joints through aging or a repetitive motion lifestyle are risk factors that contribute to the development of chronic joint discomfort. Pain-relieving oils are a common medicine on offer as a first resort, non-invasive therapy to relieve stiffness, inflammation, as well as sore muscles. Furthermore, heightened demands in the aging population, rising obesity, and sedentary behaviours will also contribute to the demands.

The arthritis pain segment is expected to grow substantially in the pain relief oil market. The conditions result in chronic inflammation, joint erosion, and decreased mobility, bringing the patients to request recurring and lasting relief. To treat arthritis, there is also the pain relief oil, which is an option because of its natural cleanliness; also, it has no side effects. Due to the increased awareness of alternative medicines, the use of therapeutic oils is being adopted by more consumers focused on relieving joint stiffness and enhancing mobility. Product innovation is also leading the segment as there are oils with better absorption effects, heat therapy effects, and infusions with CBD formulations, which are directly designed to overcome arthritis pain. There is an increasing trend in the burden of arthritis around the world. Effective, natural, and affordable solutions to pain relief are becoming a strong driver towards vigorous growth in this segment.

Formulation Insights

Why Did the Massage Oil Segment Lead the Pain Relief Oil Market in 2024?

The massage oil segment led the pain relief oil market as it has become widely used and has therapeutic advantages, along with high consumer preference when using traditional pain relief oil application methods. Massage oils are preferred because they can provide both immediate and sustained pain-relieving effects through increased blood flow, relaxation of muscles, and suppression of inflammation. They have found a wide application in hospitals, spas, physiotherapy clinics, and even at home as a part of the wellness routine. An increase in the popularity of self-care and holistic health has led to massage oil becoming an easy option among individuals living with manifestations of joint, muscle, and sports-related pain. These preparations frequently contain such familiar analgesics as eucalyptus, camphor, and menthol.

The oil-in-cream segment is expected to grow at a significant CAGR over the forecast period. Oil-in-cream products combine the benefits of traditional pain relief oils, along with being a little more familiar and having a more agreeable feel of creams offer faster absorption, lack of greasiness, spread to the consumer, and a more palatable user experience. Further, they typically consist of a regulated mixture of emollients and herbal extracts, which has a better effect on therapy and skin satisfaction. They are ideal to consume on the go and are also easily accessible as readily usable tubes or dispensers that are automatic. Fragrance-free or skin-soothing products are also experiencing an increase in usage by the sensitive-skin clientele. This has created a boom in the demand for oil-in-cream products because topical solutions remain popular in relieving pain, and the users also demand discreet solutions.

Packaging Type Insights

Which Packaging Type Led the Pain Relief Oil Market in 2024?

The bottles (glass/plastic) segment led the pain relief oil market and accounted for the largest revenue share in 2024. Some of the practical benefits of bottles are that they have a larger amount of capacity, a better storage facility, and they dispense controlled amounts. They are particularly favored with the massage oils in-home, wellness clinics, and physiotherapy clinics where it is needed to apply profusely and regularly. Glass offers a luxury status and a feel of chemical alone with high stability, whereas plastic is light, economical, strong, and can survive daily consumer productions. Also, bottles can offer a large surface area where a brand can be printed, instructions given to consumers, and regulatory information displayed to increase consumer confidence. This is also a packaging type that is conducive to dispensing through multiple options such as flip-top caps, pumps, or droppers, and is therefore, flexible in product lines.

The spray bottle segment is expected to grow at a significant CAGR over the forecast period. This is fueled by the increase in the demand for convenient, hygienic, and user-friendly packaging. Spray bottles give an advantage in that consumers do not need to touch to apply the pain relief oil, meaning that athletes, working professionals, and anyone who seeks a quick and no-mess remedy would find them extremely accommodating. The format is easily portable and allows dosage to be regulated and easily applied in difficult areas such as the back or shoulders. With wellness behavior becoming increasingly a part of everyday life, customers are demanding formats that are convenient as well as efficient, and this translates to the use of sprays in both therapeutic and cosmetic pain relief oils. Also, the fine-mist spray mechanisms and airless technology are developed to improve product delivery, retain formulation integrity, and minimize waste.

Application Area Insights

Why Did Joints Contribute the Most Revenue in 2024?

The joints (knees, elbows) segment contributed the most revenue in 2024 because there has been a high prevalence of joint-related diseases across the world, like osteoarthritis, rheumatoid arthritis, gout, and age-related wear and tear. Since joint pain relates to local treatment, pain relief oils have proven effective in relieving pain due to anti-inflammatory and pain relief features. Herbal preparations are also in use, which contain camphor, eucalyptus, and wintergreen oil among other ingredients, which are easy to provide immediate relief and have therapeutic effects. These are also perfect to use on a daily basis because of their capability to lessen stiffness, enhance flexibility, and favor mobility. The concurrence of chronic demand, aging population, and an overall move towards non-invasive pain management systems is the main reason why joint segments will continue being a major revenue generator in this market.

The lower back segment is expected to grow substantially in the pain relief oil market. Lack of activity, extended periods of desk jobs, improper sitting postures, and utilization of digital gadgets have led to a massive rise in back pain all over the world. Pain relief oils provide an affordable, non-pharmacological treatment of lower back pain. They are also easily applied and are useful because they offer immediate relief and, in most cases, warming or cooling effects, which relieve muscle tension. Formulation innovations, e.g., quick absorbing gels, roll-ons, enhanced absorption oil versions, are becoming more appealing toward treating large muscular sections of a body, such as the lower back.

End User Insights

Which End User Dominated the Pain Relief Oil Market in 2024?

The adult segment led the pain relief oil market and accounted for the largest revenue share in 2024. Musculoskeletal diseases, back pain, and joint rigidity present high possibilities among adults between 30 and 60 years of age because of sedentary lifestyles, work stress, and age-related syndromes. This age group mostly requires effective, non-invasive, and easy-to-use ways of dealing with chronic or repeated pain. Oils containing herbs and medicines are another convenient application of pain relievers with reduced side effects and more applicable in the long-term health perspective. Most people incorporate pain relief oils into their everyday lives by using them in massage therapy, reducing stress, and post-work rehabilitation. Also, the purchasing power of adults is usually higher and is more disposed towards conservative processes, especially where Ayurvedic or herbal remedies are considered culturally appropriate.

The athletes & fitness enthusiasts segment is expected to grow at a significant CAGR over the forecast period. Fuelled by the growing interest in sporting activities and fitness regimes, and active lifestyles. The greater the number of individuals indulging in exercises such as gym exercise, running, cycling, competitive sports, etc., the higher is the probability of occurrence of mutational strain, muscular soreness, and joint pains. Pain relief oils are extremely popular with this population due to their rapid onset and effectiveness, as well as the ease of their application after an exercise. The ingredients that provide a cooling or warming effect, deep tissue penetration, and rapid muscle recovery are desired by such users. The increased popularity of social media personalities, fitness video bloggers, and online fitness groups has also increased awareness and use of such products.

Distribution Channel Insights

Why Did Direct Sales Contribute the Most Revenue in 2024?

The direct sales segment contributed the most revenue in 2024 as a sizeable portion of the consumers, especially older groups and those suffering chronic pain, would be willing to purchase pain relief oils at a physical place where they can evaluate the product, confirm authenticity, and in some cases even achieve personalized consultation on the product with either a healthcare worker or a local vendor. Direct sales equally encourage great brand recognition and customer retention, with the existing players dealing in sample products, loyalty rewards, and promotional sales in the stores. Also, certain pain relief oil brands are operated through a relationship with physiotherapists, Ayurveda practitioners, and wellness centers, providing the right to customers.

The e-commerce platforms segment is expected to grow substantially in the pain relief oil market. The market is likely to experience an enormous growth in the e-commerce platforms segment because of the increasing digital use, convenience-related consumerism, and the emergence of online niche and premium products. As consumers get more digitally literate, particularly in the post-pandemic world, it is observed that there is increased customer movement towards buying health and wellness products via online stores such as Amazon, Flipkart, or store-specific websites. E-commerce allows its customers to have an extensive selection of products, the option of price comparison, reviews, and extensive product information from the convenience of their own homes. Increased online presence and reliability of consumers due to the emergence of influencer marketing, promo content on social media, and focused digital advertising of pain relief oils have improved visibility.

Regional Insights

Why Did North America Dominate the Pain Relief Oil Market in 2024?

North America held the dominating share of the pain relief oil market in 2024 as its population, specifically those who are aging adults and middle-aged people, experiences more chronic pain, arthritis, and musculoskeletal problems, which increases the demand for topical analgesics such as pain relief oils. The desire to find safer, non-invasive long-term options is one of the reasons that has led consumers to seek out plant-based and herbal formulations as well as CBD-infused products. The market has also grown due to the regulatory changes, especially the legalization and commercialization of cannabidiol (CBD) products in Canada and a few states within the United States. The region of North America has a developed retail network and healthy e-commerce penetration, so brands can efficiently target many clients.

The U.S. is the largest market in North America, which generates innovation and base consumer trends in the pain relief oil industry. The consumers are becoming more health-conscious in U.S. are embracing more clean-label, organic, and cruelty-free products. Their brands in the U.S. lead in the area of innovative product formulations with fast absorption properties and convenient features (e.g., sprays and roll-ons) and are customized to certain conditions like arthritis, sports injuries, and back pain. The effect of social media marketing, wellness influencers, and direct-to-consumer platforms has achieved a rate of product discovery and consumer trust.

Why Is the Asia Pacific Region Expected to Grow at the Fastest CAGR?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, fuelled by the presence of a traditional approach to medicine, the growth in understanding of health, and the growth in disposable incomes, especially in emerging economies such as India, China, Indonesia, and Vietnam. In the Asia Pacific, the interest in natural pain treatment topicals is on the increase, especially with an aging population and a changing lifestyle bringing on pain conditions related to arthritis, joint conditions, and muscular fatigue. The rise in organized retail outlets and online purchase sites has tremendously increased the availability of products at urban and rural locations. The other drivers of the market are increasing government interest in traditional medicine systems and the increasing impact of wellness tourism.

China is considered to be the key point in the Asia Pacific pain relief oil market as it is a key consumer and producer of the oil. The nation has a long history of Traditional Chinese Medicine (TCM) that involves the extensive application of herbal oils, topical analgesics, and balms in treating pain. The growth of urbanization and the level of stress, and the development of a sedentary working style have led to a booming market demand for convenient and natural pain relief methods.

What Factors Are Influencing Europe's Pain Relief Oil Market Share?

The European pain relief oil market is expected to account for a substantial share, owing to the growing trend of consumers to use organic and plant-extracted products in the health industry. European consumers with a relatively well-developed infrastructural healthcare system and an increase in the awareness of the dangers of long-term use of pharmaceutical painkillers are turning more towards natural and non-invasive treatments. This transformation is especially observable in terms of herbal pain relief oil use and CBD-infused oil being used to cure pain because it has low side effects and is an effective treatment. In an aging population in Europe, particularly Germany, Italy, and France, there has been a steady demand for products aimed at arthritis, stiff joints, and chronic back pain.

The U.K. has also experienced a significant rise in the demand for pain relief oils, particularly in adults who demand safer methods of pain relief, chronic pain, athletic injury, and postural pain through over-the-counter medicines. The consumers in the U.K. are also quite receptive towards clean-label, cruelty-free, and vegan-certified products, which makes brands pay attention to the areas of transparency and ethical sourcing. With a continued regulatory favor of product innovations and an increasing consumer confidence in natural solutions, the U.K. has the potential to play a central role in boosting the regional market share.

Pain Relief Oil Market Companies

- Emami Ltd.

- Himalaya Wellness Company

- Patanjali Ayurved

- Dabur India Ltd.

- Zandu Realty Ltd. (Zandu Balm)

- Sanofi (Volini)

- Reckitt Benckiser Group (Moov)

- Johnson & Johnson (BenGay)

- Dr. Ortho

- Amrutanjan Health Care Ltd.

- Biofreeze

- Tiger Balm (Haw Par Corporation)

- Vicco Laboratories

- Arlak Biotech

- Cipla Health (Omnigel)

- Relaxo Pain Relief

- SBL Pvt. Ltd.

- Mentholatum Company

- Green Cure Wellness

- Boiron Group

Recent Developments

- In August 2025, Saje Natural Wellness, North America's leader in 100 percent plant-powered essential-oil remedies, announced that Ulta Beauty will be the brand's first-ever national retailer. The collaboration will further establish the importance of continuing to invest in the wellness category as a key strategic focus of Ulta Beauty by presenting a natural alignment as the two brands introduce the functional, plant-based offerings of Saje Natural Wellness to millions of new guests across the U.S.(Source:https://www.prnewswire.com)

- In April 2024, Neet has also introduced two topicals: Neet Daily Joint and Neet Daily NeuPain Gone. They are new solutions that provide relief using Ayurveda therapeutic power and cannabinoid science. It is the ideal solution to the increasing interest in safe, effective, and natural pain relief, and at last, relief that feels good.

(Source: https://www.businesswireindia.com)

Segments Covered in the Report

By Product Type

- Herbal Oil

- Ayurvedic Oil

- Synthetic Oil

- Essential Oil Blends

- CBD-infused Oil

By Pain Type Treated

- Joint Pain

- Back Pain

- Muscle Pain

- Arthritis Pain

- Neuralgia and Nerve Pain

By Formulation

- Roll-on

- Spray

- Balm-based Oil

- Massage Oil

- Oil-in-Cream (Hybrid)

By Packaging Type

- Bottles (Glass/Plastic)

- Tubes

- Spray Bottles

- Roll-on Containers

- Pump Dispensers

By Application Area

- Neck and Shoulders

- Lower Back

- Joints (Knees, Elbows)

- Whole Body Massage

- Foot & Heel Pain

By End User

- Adults

- Geriatric Population

- Athletes & Fitness Enthusiasts

- Children (Pediatric Use)

By Distribution Channel

- Pharmacies/Drug Stores

- E-commerce Platforms

- Supermarkets/Hypermarkets

- Ayurvedic & Herbal Clinics

- Direct Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting