PCSK9-Targeted Therapy Market Size and Forecast 2025 to 2034

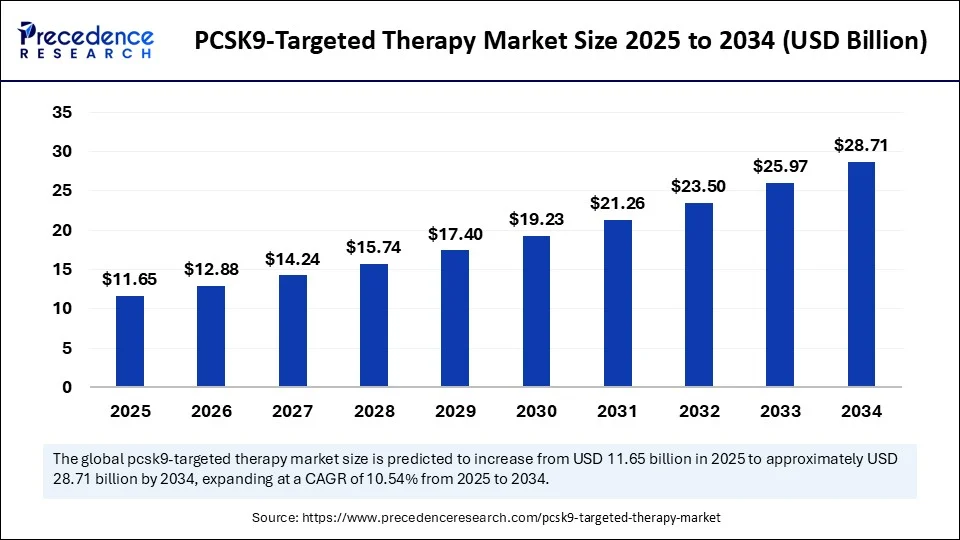

The global PCSK9-targeted therapy market size accounted for USD 10.54 billion in 2024 and is predicted to increase from USD 11.65 billion in 2025 to approximately USD 28.71 billion by 2034, expanding at a CAGR of 10.54% from 2025 to 2034. The prevalence of cardiovascular disease and hypercholesterolemia has increased, driving the growth of the PCSK9-targeted therapy market. The increasing demand for highly efficient and effective therapies to reduce LDL cholesterol levels contributes to market growth.

PCSK9-Targeted Therapy Market Key Takeaways

- In terms of revenue, the global PCSK9-targeted therapy market was valued at USD 10.54 billion in 2024.

- It is projected to reach USD 28.71 billion by 2034.

- The market is expected to grow at a CAGR of 10.54% from 2025 to 2034.

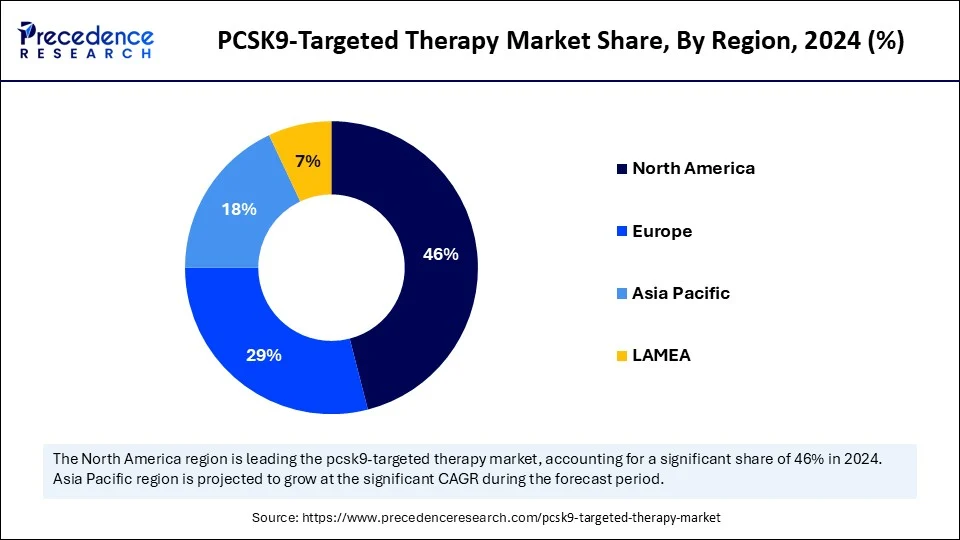

- North America dominated the global PCSK9-targeted therapy market with the largest market share of 46% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By drug type/modality, the monoclonal antibodies (mAbs) segment held a major market share in 2024.

- By drug type/modality, the siRNA-based therapies segment will grow at a CAGR between 2025 and 2034.

- By indication, the atherosclerotic cardiovascular disease (ASCVD) segment accounted for the biggest market share in 2024.

- By indication, the homozygous familial hypercholesterolemia (HoFH) segment will grow at a CAGR between 2025 and 2034.

- By patient type, the secondary prevention (with history of ASCVD) segment contributed the highest market share in 2024.

- By patient type, the statin-intolerant patients segment is expected to expand at a significant compound annual growth rate (CAGR) between 2025 and 2034.

- By route of administration, the subcutaneous injection segment held the major market share in 2024.

- By route of administration, the intravenous injection segment will grow at a CAGR between 2025 and 2034.

- By distribution channel, the hospital pharmacies segment contributed the largest market share in 2024.

- By distribution channel, the online pharmacies segment will grow at a CAGR between 2025 and 2034.

How is AI Impacting the PCSK9-Targeted Therapy Market?

Artificial Intelligence is poised to transform the PCSK9-targeted therapy market by enhancing drug discovery, optimizing clinical trials, and providing predictive analytics. AI has established its significant role in clinical trials by optimizing treatment strategies and enhancing overall patient outcomes. The discovery of novel PCSK9-targeted therapeutics has become easier and faster with the aid of AI, enabling the identification of potential candidates. Additionally, the ability of AI to analyze vast amounts of molecular information and genetics data makes it easier to identify novel targets for PCSK9 inhibitors. AI enables high success potential for emerging trends, such as base editing therapy, oral therapeutic strategies, and CRISPR-Cas9 gene editing, to enhance the efficiency, accuracy, and effectiveness of PCSK9 inhibitors.

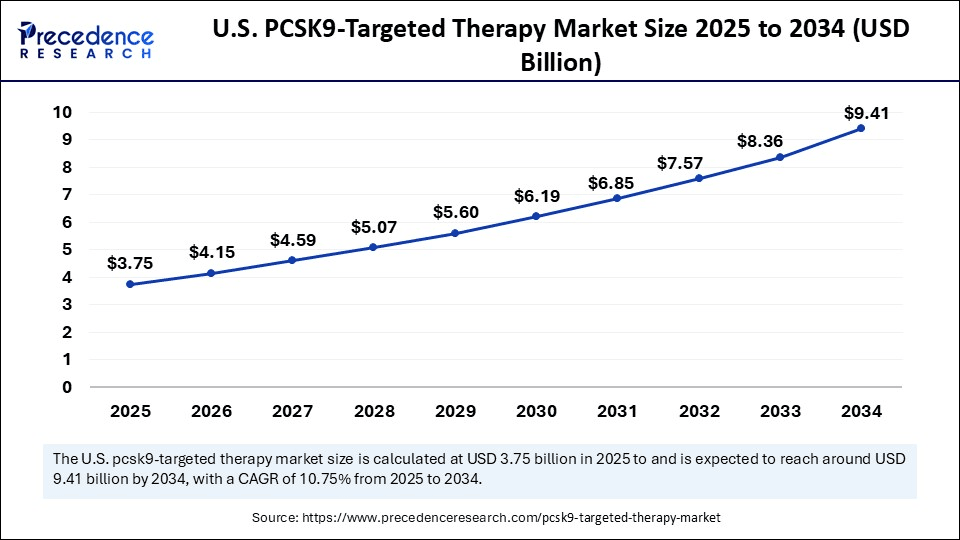

U.S. PCSK9-Targeted Therapy Market Size and Growth 2025 to 2034

The U.S. PCSK9-targeted therapy market size was exhibited at USD 3.39 billion in 2024 and is projected to be worth around USD 9.41 billion by 2034, growing at a CAGR of 10.75% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the PCSK9-Targeted Therapy Market?

North America dominated the global market for PCSK9-targeted therapies, capturing the largest share in 2024. This is primarily due to the increased prevalence of cardiovascular disease, advanced healthcare infrastructure, favorable reimbursement policies, strong investment in research and development, and the presence of key market vendors. North America has the highest patient population for cardiovascular diseases and hypercholesterolemia. Strong healthcare infrastructure and government funding for healthcare facilities are fostering market growth. The presence of major pharmaceutical companies and robust investment in research and development (R&D) is driving innovation in the market.

The U.S. is a major player in the regional market due to the high prevalence of cardiovascular disease and hypercholesterolemia, as well as innovations in novel therapies. The presence of favorable regulations and government policies, as well as R&D investments, is enabling the availability of novel treatment solutions in the market. An oral PCSK9 inhibitor, AstraZeneca's AZD0780, is demonstrating the potential opportunities and success of clinical trials, providing more convenient treatment solutions to patients.

Asia Pacific PCSK9-Targeted Therapy Market Trends

Asia Pacific is expected to grow at the fastest rate during the forecast period, driven by increasing cases of cardiovascular disease and high cholesterol levels. The expanding healthcare infrastructure and government initiatives, such as investments in R&D, awareness campaigns for cardiovascular risk management, and investments in local pharmaceutical companies, are contributing to market growth. The growth of medical tourism further supports the market's growth. The government's policies and efforts to increase awareness about the benefits of PCSK9 inhibitors among both physicians and patients for cardiovascular risk management and therapy adherence are fostering market growth. PCSK9 inhibitors, including evolocumab, alirocumab, and inclisiran, are the major inhibitors gaining popularity in the Asian healthcare infrastructure.

China is a major player in the regional market. The growing awareness of cardiovascular disease, increasing healthcare expenditure, and the introduction of novel therapies in China are contributing to market growth. The rising utilization of PCSK9 inhibitors for patients with familial hypercholesterolemia and high risk of cardiovascular events is shaping the market. Additionally, government investments in local pharmaceutical companies and R&D are driving innovations in the market.

- In May 2025, Shanghai Junshi Biosciences Co., Ltd received approval for two supplemental novel drug applications for ongericimabs injection from the National Medical Products Administration. This is China's first domestic PCSK9 inhibitor approval.

(Source: https://financialpost.com)

Europe PCSK9-Targeted Therapy Market Trends

Europe is expected to grow at a notable rate in the coming years. The growth of the market in the region is attributed to the increasing prevalence of cardiovascular diseases and the need for effective cholesterol-reducing treatments. Strong pharmaceutical companies, robust investments in R&D, favorable reimbursement regulations, and active approvals for novel therapies are contributing to market growth. Major pharmaceutical companies in Europe are collaborating on innovations and the development of novel therapeutics, and clinical trials for PCSK9 inhibitors are driving market growth.

Germany is a significant player in the market, contributing to growth due to the rising prevalence of cardiovascular disease in the country. Germany is a hub for several major pharmaceutical and chemical companies, as well as robust research and development firms. The market is witnessing rapid growth in the adoption of these therapies, particularly among patients with uncontrolled cholesterol levels and statin intolerance. The increasing demand for novel therapies and government investments in R&D are supporting the market growth.

Market Overview

The PCSK9-Targeted Therapy Market refers to pharmaceutical interventions aimed at inhibiting the activity of proprotein convertase subtilisin/kexin type 9 (PCSK9), a protein that plays a key role in regulating LDL cholesterol (LDL-C) levels. By inhibiting PCSK9, these therapies enhance the liver's ability to remove LDL-C from the bloodstream, significantly reducing cardiovascular risk. The market includes monoclonal antibodies, siRNA-based drugs, and gene editing technologies, primarily targeting patients with hypercholesterolemia, atherosclerotic cardiovascular disease (ASCVD), and familial hypercholesterolemia.

The market is driven by various factors, including increased awareness about cholesterol management and cardiovascular health, the growing prevalence of CVDs and hypercholesterolemia, the rising demand for cholesterol-reducing therapies, government policies that support novel drug innovations and developments, and ongoing advancements in biotechnology and genetic research. The rising surge in personalized medicines is fostering advancements in genetic research. Access to these therapies is widespread in hospital pharmacies, as well as in clinics.

What are the Key Factors of the PCSK9-Targeted Therapy Market?

- Prevalence of Cardiovascular Disease: The increasing prevalence of cardiovascular disease globally drives demand for PCSK9 inhibitors.

- Growing Geriatric Population: The growing aging population and rising prevalence of cardiovascular disease in aging populations have increased the need for effective cholesterol-reducing therapies, including PCSK9-targeted therapies.

- Healthcare Awareness: The awareness of healthcare, including cardiovascular health and the importance of cholesterol management, contributes to market growth.

- Research & Development: The ongoing research and development of innovative and new PCSK9 inhibitors are fueling pipelines in emerging markets.

- Demand for Personalized Medicines: The growing emphasis on personalized medicines is a major factor contributing to market competition, as it aims to meet individual patient needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.71 Billion |

| Market Size in 2025 | USD 11.65 Billion |

| Market Size in 2024 | USD 10.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type/Modality, Indication, Route of Administration, Distribution Channel, Patient Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Awareness of Cholesterol Management

The rising awareness about cholesterol management and access to effective therapies, such as PCSK9 inhibitors, are the major drivers of the market. This awareness has led to more diagnoses, increasing the need for effective PCSK9 inhibitor treatments. Moreover, the rising education about high cholesterol and cardiovascular disease among patients and healthcare professionals is fueling the increasing demand for effective treatments. Government initiatives, such as public health campaigns, are further contributing to enhanced awareness and education among patients, thereby supporting market growth.

Restraint

The Limited Patient Access

The limited access to effective PCSK9-targeted therapies for patients, driven by factors such as high costs, lack of awareness, prescribing restrictions, and reimbursement limitations, is a potential restraint for the global market. The restrictive prior authorization requirements are further limiting the adoption of these therapies among patients and healthcare providers. Additionally, current PCSK9 inhibitor treatments require subcutaneous administrations, which can be difficult for some patients, as they can refuse to take this injection, making the therapy more limited in access.

Opportunity

Supportive Government Policies

Supportive government policies, such as public health initiatives, research funding, collaborations, and regulatory approvals, are playing a crucial role in driving innovation in the market. Regulatory bodies are streamlining approval processes, resulting in the rapid entry of new PCSK9 inhibitors into the market. Ongoing collaborations among government, academics, healthcare providers, and research institutions are fostering innovation and the development of novel therapies. Additionally, government funding in the research sector on cardiovascular disease and clinical trials for novel drugs and treatment therapies is fostering market competition. Supportive government policies are increasing the accessibility of new therapies and improving healthcare outcomes.

Drug Type/Modality Insights

Which Drug Type Segment Dominate the PCSK9-Targeted Therapy Market in 2024?

The monoclonal antibodies (mAbs) segment dominated the market with the largest revenue share in 2024. This is mainly due to the increased prevalence of familial hypercholesterolemia and advancements in biotechnology. The increasing number of cases with high cholesterol levels is driving demand for monoclonal antibodies. Monoclonal antibodies have been studied for reducing major cardiovascular events. Monoclonal antibodies, including evolocumab and alirocumab, have gained significant popularity for effectively reducing LDL cholesterol levels. Additionally, the rapid adoption of monoclonal antibodies as alternative treatments for statin-intolerant patients is driving segment growth.

The siRNA-based therapies segment is expected to grow at the fastest rate over the forecast period due to its high usage as an alternative to traditional monoclonal antibodies. siRNA-based therapies are more convenient and effective compared to monoclonal antibodies. A GalNAc-conjugated siRNA, Inclisiran, has shown significant potential in LDL-C levels with dosing schedules twice a year, making it more convenient. Ongoing research and clinical trials of siRNA-based therapies are fostering the segment's growth.

Indication Insights

Why Did the Atherosclerotic Cardiovascular Disease (ASCVD) Segment Dominate the PCSK9-Targeted Therapy Market?

The atherosclerotic cardiovascular disease (ASCVD) segment dominated the market in 2024 due to the increased cases of mortality and morbidity. The need to reduce LDL-C levels is essential in high-risk patients with atherosclerotic cardiovascular disease (ASCVD). Clinical trials, such as ODYSSEY OUTCOMES and FOURIER, have showcased the potential of PCSK9 inhibitors in reducing cardiovascular events. The growing patient population with atherosclerotic cardiovascular disease is increasing the demand for PCSK9 inhibitors.

The homozygous familial hypercholesterolemia (HoFH) segment is the second-largest segment. The segment is expected to grow at the fastest rate in the upcoming period, driven by increased research and development of novel treatments. The variant effects of PCSK9 inhibitors for homozygous familial hypercholesterolemia (HoFH) drive the need for novel research. This variation leads to the demand for personalized medicine approaches. Additionally, the limited efficacy of traditional therapies is driving a shift toward novel therapy options, resulting in increased market competition.

Patient Type Insights

What Made Secondary Prevention the Dominant Segment in the PCSK9-Targeted Therapy Market in 2024?

The secondary prevention (with a history of ASCVD) segment dominated the market with a major share in 2024. This is primarily due to the high demand for PCSK9 inhibitors in reducing LDL-C levels. Patients with a history of ASCVD have a high risk of cardiovascular events, making it essential for secondary prevention in their disease management. The PCSK9 inhibitors are highly recommended in guidelines for the management of high-risk atherosclerotic cardiovascular disease with ASCVD, contributing to secondary prevention. Alirocumab and evolocumab are the primary PCSK9 inhibitors used to reduce LDL-C levels in patients with ASCVD.

The statin-intolerant patients segment is expected to grow at the highest CAGR during the projection period. The growth of the segment can be attributed to the rising use of PCSK9 inhibitors in lowering cholesterol and triglycerides in patients with statin intolerance. PCSK9 inhibitors offer effective and safe therapies for patients with a low tolerance to statins. The growing awareness and importance of therapy's benefits among patients and healthcare providers are driving the segment's growth.

Route of Administration Insights

How Does the Subcutaneous Injection Segment Lead the PCSK9-Targeted Therapy Market in 2024?

The subcutaneous injection segment led the market in 2024 due to its crucial role in delivering medication effectively. Subcutaneous injection is essential for monoclonal antibodies, such as alirocumab and evolocumab. The growing demand for self-administration is further driving the adoption of subcutaneous injection. These injections are less invasive and more convenient compared to other administration routes, helping to reduce the risk of complications and improve adherence and treatment outcomes.

The intravenous injection segment is expected to expand at the fastest rate in the coming years due to its wide use for rapid and more effective therapy delivery. Patients who require immediate lowering of LDL cholesterol are administered major intravenous injections. The ongoing research and innovations in gene-based therapies, such as CRISPR/CAS-based treatments for the long-term reduction of LDL cholesterol levels, are supporting segmental growth as these therapies are often delivered intravenously. The widespread use of this method in acute situations and for certain patients is contributing to the segment's growth.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Dominate the PCSK9-Targeted Therapy Market in 2024?

The hospital pharmacies segment dominated the market while holding the largest revenue share in 2024. This is mainly due to the increased hospital admission rate, driven by the increased prevalence of high cholesterol levels and cardiovascular disease. Hospital pharmacies are the primary distribution channel for dispensing and administering PCSK9 inhibitors, including evolocumab and alirocumab. Growing patient education about the proper administration of medications and the need for frequent follow-ups and monitoring has driven emphasis on hospital pharmacies. The prior authorization of these pharmacies is fostering the segment.

The online pharmacies segment is expected to grow at the fastest CAGR over the forecast period due to the wide accessibility of medications on online platforms. Online pharmacies offer competitive pricing of the medications, making them ideal for budget-conscious patients. Patients in remote areas and those with mobility issues are the major consumers of online pharmacies. Additionally, the growing collaborations of pharmacy retailers with online channels are driving the segment.

PCSK9-Targeted Therapy Market Companies

- Amgen Inc.

- Sanofi

- Regeneron Pharmaceuticals, Inc.

- Novartis AG

- Alnylam Pharmaceuticals

- The Medicines Company (acquired by Novartis)

- Eli Lilly and Company

- Arrowhead Pharmaceuticals

- Silence Therapeutics

- Verve Therapeutics

- Ionis Pharmaceuticals

- AstraZeneca plc

- Pfizer Inc.

- Roche Holding AG

- Cerenis Therapeutics

- Hansa Biopharma

- Sino Biopharmaceutical Limited

- Lexicon Pharmaceuticals

- MeiraGTx Holdings

- Beam Therapeutics

Recent Developments

- In March 2025, the FDA approved Verve's gene-editing trial for a cholesterol and heart disease treatment in the U.S. The treatment Verve is testing, dubbed VERVE-102, alters a single nucleotide, or base, in the PCSK9 gene, which produces a protein that regulates the uptake of cholesterol by liver cells from the blood.

(Source:https://www.biopharmadive.com)

- In February 2025, LIB Therapeutics Inc. (LIB), a U.S.-based biopharmaceutical company, announced that the U.S. FDA) accepted the company for review the Biologics License Application (BLA) of Lerodalcibep to reduce low-density lipoprotein cholesterol (LDL-C) for the treatment of patients with atherosclerotic cardiovascular disease (ASCVD), or very high or high risk of ASCVD, and primary hyperlipidemia, including heterozygous, and those 10 years or older with homozygous familial hypercholesterolemia (HeFH / HoFH). Lerodalcibep is a novel, adnectin-based, small protein-binding, third-generation PCSK9 inhibitor, with long-ambient stability, developed as a more patient-friendly, once-monthly, self-administered, single small-volume, subcutaneous injection alternative to approved PCSK9 inhibitors.

(Source:https://www.businesswire.com)

Segment Covered in the Report

By Drug Type / Modality

- Monoclonal Antibodies (mAbs)

- Alirocumab

- Evolocumab

- siRNA-based Therapies

- Inclisiran

- Gene Editing & Other Novel Modalities

- CRISPR-based approaches

- Antisense oligonucleotides (ASOs)

By Indication

- Heterozygous Familial Hypercholesterolemia (HeFH)

- Atherosclerotic Cardiovascular Disease (ASCVD)

- Homozygous Familial Hypercholesterolemia (HoFH)

- Hyperlipidemia (Non-FH)

By Route of Administration

- Subcutaneous Injection

- Intravenous Injection

- Oral (in pipeline)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Patient Type

- Primary Prevention (High Risk, No History of ASCVD)

- Secondary Prevention (With History of ASCVD)

- Statin-Intolerant Patients

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting