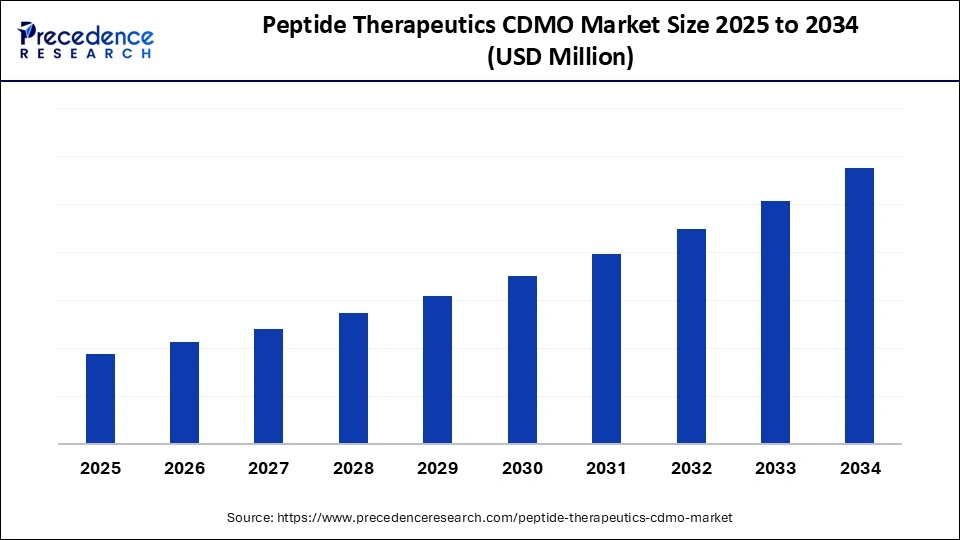

Peptide Therapeutics CDMO Market Size and Forecast 2025 to 2034

The global peptide therapeutics CDMO market continues to grow with increasing biologics R&D, strategic partnerships, and innovation in manufacturing processes. It's reshaping peptide drug development globally. The market growth is attributed to the rising demand for targeted and effective peptide-based therapies to treat chronic and complex diseases.

Peptide Therapeutics CDMO Market Key Takeaways

- North America dominated the global peptide therapeutics CDMO market with the largest share of 52% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By synthesis method, the solid-phase peptide synthesis (SPPS) segment held the major market share of 58% in 2024.

- By synthesis method, the hybrid/mixed-phase & recombinant production segment is projected to grow at a high CAGR between 2025 and 2034.

- By service type, the API development & manufacturing segment contributed the biggest market share of 42% in 2024.

- By service type, the formulation development & fill-finish services segment is expanding at a significant CAGR between 2025 and 2034.

- By peptide type, the generic & innovative peptides segment captured the highest market share of 66% in 2024.

- By peptide type, the peptide-drug conjugates & modified peptides segment is expected to grow at a significant CAGR over the projected period.

- By application area, oncology & diabetes treatment contributed the maximum market share of 35% in 2024.

- By application area, the center nervous system & autoimmune disorders segment is expected to grow at a notable CAGR from 2025 to 2034.

- By scale of operation, commercial scale manufacturing segment accounted for the significant market share of 38% in 2024.

- By scale of operations, clinical trial & pilot-scale production are expected to grow at a notable CAGR from 2024 to 2034.

- By end-user, the large pharmaceutical companies segment generated the major market share of 44% in 2024.

- By end-user, the biotechnology & specialty pharma companies segment is projected to grow at a CAGR between 2025 and 2034.

Market Overview

The rising frequency of unhealthy lifestyles around the use of tobacco, processed foods, sedentary jobs, high alcohol consumption, air pollution, stress, and genetic predispositions is leading to a spike in both infectious and chronic diseases, including cancer, diabetes, and metabolic disorders, which are major factors that contribute to the growth of the peptide therapeutics CDMO market. A 2025 WHO report states that the worldwide cancer burden is increasing steadily, and in 2020, 19.3 million new cancer cases and 10 million cancer deaths were estimated, which is why effective therapeutic interventions are highly required. Such an increase in the incidence of diseases has contributed to the increased pressure on using peptide-based treatments, which are characterized by selectivity and effectiveness.

Firms have added to their production capacity, opened new plants in China in Changzhou and Taixing to meet the increasing global demand for peptide therapeutics. Such technological advancements have increased the ability to fulfill the rising needs of peptide-based treatments. This regulatory assistance has created an atmosphere in which innovation and development in the peptide therapeutics industry have been encouraged. Furthermore, the continued attempts to treat chronic diseases using peptide-based therapies highlight the significance of contract development and manufacturing organisations in the healthcare environment throughout the world.

Impact of Artificial Intelligence on the Peptide Therapeutics CDMO Market

Artificial intelligence is having a significant impact on the peptide therapeutics CDMO market through speeding up drug discovery, changing production techniques and procedures, while ensuring quality compliance. Peptide drug development has been historically labor-intensive due to trial-and-error methodologies used to isolate stable sequences. Artificial intelligence is used to improve predictions for peptide structures, folding patterns through the use of advanced algorithms. This enables a reduction in both the cost and time required for the discovery stage, with ML models being deployed to identify new peptide configurations that are more stable, soluble, and accessible, resulting in improved therapeutic performance. In manufacturing, particularly, AI-optimized predictive analytics is used to design processes and create real-time feedback and response loops, with the help of computer vision and sensors.

- In November 2024, Asymchem announced the development of automated manufacturing for peptide production. The company optimized the suspension and mixing of reactants with the resins, deploying a special structural design with their synthesizers. Asymchem was also involved in the development of a host computer system that seamlessly interfaces with the control system, facilitating unmanned production across the entire solid-phase synthesis process.(Source: https://www.businesswire.com)

Peptide Therapeutics CDMO MarketGrowth Factors

- Rising Adoption of Connected Fitness Devices: Growing consumer preference for smart wearables and connected equipment is driving engagement and personalized workout experiences.

- Expansion of Virtual Training Platforms: Propelling demand, online and app-based fitness programs offer accessibility and flexibility for home workouts.

- Increasing Health Awareness Among Consumers: Boosting market growth, the rising focus on preventive healthcare and wellness is fueling participation in interactive fitness solutions.

- Integration of Gamification Features: Driving user motivation and retention, interactive workouts are increasingly incorporating gaming elements and challenges.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Synthesis Method, Service Type, Peptide Type, Application Area, Scale of Operation, End-User Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Are the Unique Advantages of Peptide Therapeutics Contributing to the Peptide Therapeutics CDMO Market?

Increasing demand for peptide-based drugs is expected to accelerate outsourcing activities to specialized CDMOs, which drives the expansion of the peptide therapeutics CDMO market. The oncology, metabolic, infectious, and cardiovascular drugs on which pharmaceutical and biotechnology companies seek peptides due to their high specificity and excellent safety. The increasing lists of peptide candidates burden developers with the need to engage a contract manufacturer with superior synthesis, purification, and scale-up capabilities.

- In December 2024, the U.S. FDA issued four warning letters regarding unapproved GLP-1 peptide drugs, demonstrating its aggressive enforcement of therapeutic quality standards. The overall rate of clinical trial activities increased in 2024, which also highlighted the urgency of developers to find trusted CDMO partners that can handle complex peptide workflows quickly. Developers in North America, Europe, and Asia are interested in CDMOs that provide operational responsiveness and regulatory conformity, which shortens development cycles and minimizes risk. Furthermore, the growing complexity of peptide molecules is anticipated to push pharmaceutical companies toward CDMOs with specialized technologies.(Source: https://www.fda.gov)

Restraint

Scalability Challenge in Complex Peptide Manufacturing Hindering Market Growth

Scalability challenges in complex peptide manufacturing are expected to slow expansion in outsourcing partnerships, thus hindering the market. Several therapeutic peptides are long chains and unnatural amino acids or structural alterations that form bottlenecks in the synthesis and purification processes. Furthermore, the high production and infrastructure costs are anticipated to impact affordability for smaller biotech firms outsourcing peptide development.

Opportunity

How Are Investments in Biologics Expected to Provide Opportunities for Peptide-Focused CDMOs?

Surging investment in biologics and precision medicine is projected to expand opportunities for new startups in the peptide therapeutics CDMO market. Solid-phase peptide synthesis is automated, and continuous-purification platforms are integrated to minimize cycle times and enhance batch-to-batch variability. This allows CDMOs to transition clinical supplies to IND/CTA phases faster.

- In the 2024 industry surveys and reports, digital transformation is accelerating throughout pharma facilities, with Pharma 4.0 adoption and process-analytical technology (PAT) integration topping the priorities of operations teams. Regulatory authorities are still supporting PAT frameworks and recommending manufacturers to show strong control measures. Thus, CDMOs that integrate advanced analytics and ongoing monitoring reinforced the customer confidence and regulatory congruency. Moreover, the rising prevalence of chronic and lifestyle-related diseases is anticipated to expand the need for peptide-based treatments and related outsourcing services.(Source: https://www.aspentech.com)

Synthesis Method Insights

Which Synthesis Method Dominated and Which Approach Is Set for High Growth in the Peptide Therapeutics CDMO Market?

The solid-phase peptide synthesis (SPSS) segment dominated the peptide therapeutics CDMO market in 2024, accounting for an estimated 58% share of the market, due to the unique advantages of SPSS, which are leading to high throughput and a wide range of peptide lengths and modifications.

Solid-phase synthesis of peptides is currently quite popular among pharmaceutical companies because it is scalable and compatible with automation, which reduces errors and increases efficiency. Additionally, the increased need to have chemically modified peptides, including PEGylated and lipidated forms, further strengthened SPPS as the choice of synthesis platform.

The hybrid/mixed-phase & recombinant production segment is expected to grow at the fastest rate in the coming years, as this approach combines solid-phase and liquid-phase approaches, and recombinant production platforms. Furthermore, the hybrid approaches were also popularized as they improved yield and shortened synthesis cycle times, making them very applicable to personalized peptide vaccines in the oncology pipeline.

Service Type Insights

Which Service Type Led Peptide Therapeutics CDMO Activities in 2024, and Which Service is Expected to Accelerate?

The API development & manufacturing segment held the largest revenue share in the peptide therapeutics CDMO market in 2024, accounting for 42% of the market share, due to the increasing demand for peptide-based therapeutics in oncology, metabolism, and hormone replacement therapies. Moreover, the growing number of new peptides in the pipeline continued to reinforce the dependency on API production services to perform high-quality, consistent production.(Source: https://www.nature.com)

The formulation development & fill-finish services segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing need for injectable peptide therapies, such as GLP-1 receptor agonists for diabetes and obesity.

- In May 2025, the Mounjaro and Zepbound production teams announced plans to scale up, thanks to Eli Lilly, which had invested USD 5.3 billion in a new manufacturing plant in Indiana in 2024 to address the soaring demand. Furthermore, the formulation development and API manufacturing integrated into CDMOs enhanced efficiency in operations and decreased time-to-clinic, facilitating the rapid commercialization of novel therapies.(Source: https://cen.acs.org)

Peptide Type Insights

Which Peptide Captured the Largest Share of CDMO Services, and Which Types Are Projected to Grow the Fastest?

The generic & innovative peptides segment captured the largest share of the peptide therapeutics CDMO market in 2024, which held a market share of about 66%, due to the increasing global need for peptide-based therapeutics in oncology, metabolic diseases, and hormone replacement therapies. Moreover, in 2024, the standardization and creation of innovative peptides were initiated by efforts from organizations such as the American Peptide Society (APS), the European Peptide Society (EPS), and the National Institutes of Health (NIH), driving up demand from contract development and manufacturing organizations worldwide.

Peptide-drug conjugates & modified peptides segment is expected to grow at the fastest rate in the coming years, owing to the development of molecules that overcome the shortcomings of traditional peptides by increasing the delivery, targeting, stability, and therapeutic efficacy. Furthermore, the global CDMOs were increasingly incorporating these capabilities to meet the growing market need for more sophisticated peptide therapeutics.

Application Area Insights

Which Application Areas Led the Peptide CDMO Market in 2024?

The oncology & diabetes treatment segment led the peptide therapeutics CDMO market in 2024, accounting for an estimated 35% share, due to the growing prevalence of cancer and diabetes globally, which creates a long-term interest in peptide-based therapeutics. The International Diabetes Federation estimates that by 2050, the world will see over 853 million diabetes patients.

Several global regulatory bodies have revised their guidelines regarding the characterization of peptides, impurity characterization, and stability testing, which emphasizes the need to have compliance-ready CDMOs. Moreover, the global partnerships between CDMOs and pharmaceutical firms were also extended to 2024, personalized oncology peptides and next-generation GLP-1 receptor agonists to treat diabetes and diabetes, thus further boosting the market. (Source:https://idf.org)

The central nervous system & autoimmune disorders segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in neurological and autoimmune disease burden and increased clinical trial activity, creating a need to develop targeted therapies. Furthermore, the CNS and autoimmune pipeline strategic alliances by international CDMOs make these organizations key facilitators of next-generation peptide therapeutic products.

Scale of Operation Insights

Which Scale of Operation Dominated Peptide Manufacturing Outsourcing and Which Scale is Expanding Quickly?

The commercial-scale manufacturing segment dominated the peptide therapeutics CDMO market in 2024, accounting for 38% of the market share, due to growing interest in peptide-based therapeutics for the management of chronic diseases, including oncology and diabetes. The scalability and efficiency of commercial-scale manufacturing platforms, such as solid-phase peptide synthesis (SPS) and liquid-phase peptide synthesis (LPPS), have played a central role in satisfying the growing production needs.

The technologies allow mass production of peptides of a uniform quality and quantity, which is in line with international regulations. In 2024, CordenPharma declared that it was investing more than EUR1 billion in peptide expansion, including a new greenfield facility near Basel of over 5,000 L SPPS capacity and the capacity to upgrade its Boulder, Colorado, facility. This program will fulfill the increasing peptide therapeutics demand by 2028. Additionally, such investments have an indicator of the industry working towards commercial-scale manufacturing capacity as an indication of the growing demand for peptide-based therapeutics.(Source: https://cordenpharma.com)

The clinical trial & pilot scale production segment is expected to grow at the fastest CAGR in the coming years, owing to the recent surge in peptide-based drugs in clinical trials has led to the need to develop scalable and flexible manufacturing solutions to sustain early-phase development. Moreover, the growing importance of personalized medicine and the necessity to obtain rapid clinical trial material also drive the demand for clinical trial and pilot-scale manufacturing services.

End-User Type Insights

Which End-User Segments Accounted for the Largest Outsourcing Demand in Peptide Therapeutics and Which Segments are Rising?

The large pharmaceutical companies segment held the largest revenue share in the peptide therapeutics CDMO market in 2024, which held a market share of about 44%, as they have made immense investments in research and development, have numerous clinical pipelines, and commercialized peptide-based therapies. Furthermore, government-enhanced efforts to develop biopharmaceutical manufacturing capacity allowed this sector to grow, and the U.S. Department of Health and Human Services (HHS) has identified peptide therapeutics as an area of innovation.

The biotechnology & specialty pharma companies segment is expected to grow at the fastest rate in the coming years. These organizations, in many cases targeting niche and orphan therapeutics, are progressively turning to CDMOs to specialize in the manufacture of their peptide drug candidates. Additionally, the growing emphasis on personalized medicine, such as targeted oncology and metabolic medicine, is likely to drive a further increase in CDMO demand among biotech and specialty pharma.

Regional Insights

Which Regions Led the Peptide Therapeutics CDMO Market and Which Regions are Projected to Experience the Fastest Growth?

North America led the peptide therapeutics CDMO market, capturing the largest revenue share in 2024, accounting for an estimated 52% share, due to the concentration of high-level pharmaceutical and biotechnology infrastructures in the U.S. and Canada 2024. The area is also characterized by a large number of peptide-related clinical trials with more than 380 current studies registered in ClinicalTrials.gov in 2024, involving oncology, diabetes, and metabolic diseases.

The intensified efforts by North American CDMOs, such as Bachem, CordenPharma, and PolyPeptide Group, to enhancing solid-phase and recombinant peptide manufacturing capacity. This is expected to meet the increased demand while maintaining compliance with good manufacturing practices (GMP) standards. Furthermore, the partnership of CDMOs with pharmaceutical innovators in the industry also facilitated the production of PEGylated and lipidated peptides, which widened the scope of superior therapies in the area.(Source: https://clinicaltrials.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increasing number of chronic diseases like diabetes, cancer, and metabolic disorders. There are several prominent CDMOs in the region, such as WuXi AppTec, Samsung Biologics, and Asymchem invested in the latest peptide synthesis equipment and site, enhanced production yield, ability, and purity of the final product in both clinical and commercial scale. Moreover, the growth of peptide manufacturing centres was also faster due to government activities to promote biotech infrastructure in South Korea, China, and India, making the region more strategic in the global peptide outsourcing networks.

Peptide Therapeutics CDMO Market Companies

- Almac Group

- AmbioPharm Inc.

- American Peptide Company

- Auspep Pty Ltd.

- Bachem AG

- BCN Peptides S.A.

- Chinese Peptide Company (CPC)

- CordenPharma International

- CPC Scientific Inc.

- Creative Peptides

- CSBio Co.

- GenScript Biotech Corporation

- Lonza Group Ltd.

- Peptide Institute Inc.

- Piramal Pharma Solutions

- PolyPeptide Group

- Sanofi (Zentiva)

- ScinoPharm Taiwan Ltd.

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

Recent Developments

- In March 2025, CordenPharma announced major progress in its growth strategy, committing more than €1 billion toward peptide development and manufacturing. The investment aims to propel the company's Peptide Platform business beyond the €1 billion sales milestone by 2028, reinforcing its leadership in providing integrated services from APIs to finished drug products for both injectable and oral peptides.(Source: https://cordenpharma.com)

- In July 2025, global CRDMO BioDuro announced a strategic partnership with Atombeat Inc., an AI-driven drug discovery specialist. The collaboration integrates Atombeat's proprietary Hermite software and RiDYMO platform with BioDuro's expertise in discovery chemistry, biology, and drug metabolism, creating an end-to-end AI-powered workflow.

- In March 2025, Shilpa Medicare unveiled a new full-service hybrid CDMO at DCAT 2025, catering to both small and large molecule therapeutics, including peptides. The model combines discovery, clinical, and commercial outsourcing services with ready-to-use, off-the-shelf formulations available for exclusive B2B licensing. By leveraging Shilpa's oncology expertise, this approach allows pharmaceutical companies to access novel therapeutics efficiently while mitigating development risks and shortening time-to-market.(Source: https://www.contractpharma.com)

- In June 2025, 1Elevan Biopharmaceuticals, a peptide therapeutics company based in California, announced plans to relocate and renovate its new headquarters in Fishers Life Sciences and Innovation Park, Indiana, investing $7 million in the facility. President and CEO Darrin Carrico emphasized that Fishers' supportive biotech ecosystem, collaborative environment, and focus on innovation made it an ideal location. The move positions 1Elevan to leverage a thriving hub for biopharmaceutical development, manufacturing, and distribution.(Source: https://econdev.fishersin.gov)

- In August 2025, Atombeat and BioDuro reaffirmed their collaboration by launching an AI-powered platform designed to accelerate the development of next-generation peptides. Combining Atombeat's in silico modeling expertise with BioDuro's discovery chemistry, biology, and DMPK capabilities, the initiative aims to streamline the identification of high-quality peptide candidates across diverse therapeutic areas. The platform is expected to significantly reduce development timelines while optimizing cost efficiency for peptide drug discovery.(Source: https://pharmasource.global)

Segments Covered in the Report

By Synthesis Method

- Solid-Phase Peptide Synthesis (SPPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid/Mixed-Phase Synthesis

- Recombinant Peptide Production

- Chemical Synthesis Methods

- Enzymatic Synthesis Approaches

- Fragment Condensation Techniques

- Convergent Synthesis Strategies

By Service Type

- API Development & Manufacturing

- Process Development & Optimization

- Analytical Method Development & Validation

- Regulatory Affairs & CMC Support

- Formulation Development

- Fill-Finish & Packaging Services

- Quality Control & Assurance

- Clinical Trial Material Manufacturing

- Commercial Manufacturing

- Technology Transfer Services

By Peptide Type

- Generic Peptides

- Innovative/Novel Peptides

- Modified Peptides (PEGylated, Lipidated)

- Cyclic Peptides

- Stapled Peptides

- Peptide-Drug Conjugates (PDCs)

- Antimicrobial Peptides

- Hormonal Peptides

- Therapeutic Proteins & Peptides

- Cosmetic & Nutraceutical Peptides

By Application Area

- Oncology & Cancer Treatment

- Diabetes & Metabolic Disorders

- Cardiovascular Diseases

- Central Nervous System Disorders

- Infectious Diseases

- Autoimmune & Inflammatory Conditions

- Hormonal Therapies

- Pain Management

- Dermatology & Cosmetics

- Gastrointestinal Disorders

By Scale of Operation

- Research & Development Scale

- Clinical Trial Manufacturing

- Pilot Scale Production

- Commercial Scale Manufacturing

- Large-Scale Industrial Production

- Custom Small Batch Production

By End-User Type

- Large Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutions

- Government Research Organizations

- Clinical Research Organizations (CROs)

- Specialty Pharmaceutical Companies

- Generic Drug Manufacturers

- Cosmetic & Nutraceutical Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting