Peripheral Nerve Injury Market Size and Forecast 2025 to 2034

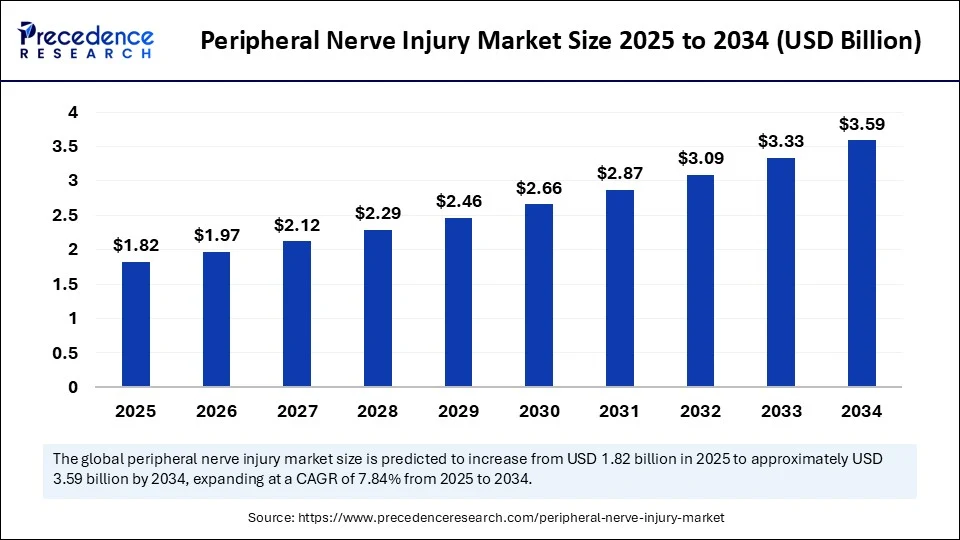

The global peripheral nerve injury market size accounted for USD 1.69 billion in 2024 and is predicted to increase from USD 1.82 billion in 2025 to approximately USD 3.59 billion by 2034, expanding at a CAGR of 7.84% from 2025 to 2034. The market is growing due to the rising incidence of traumatic injuries and increasing advancements in nerve repair and regeneration technologies.

Peripheral Nerve Injury Market Key Takeaways

- In terms of revenue, the global peripheral nerve injury market was valued at USD 1.69 billion in 2024.

- It is projected to reach USD 3.59 billion by 2034.

- The market is expected to grow at a CAGR of 7.84% from 2025 to 2034.

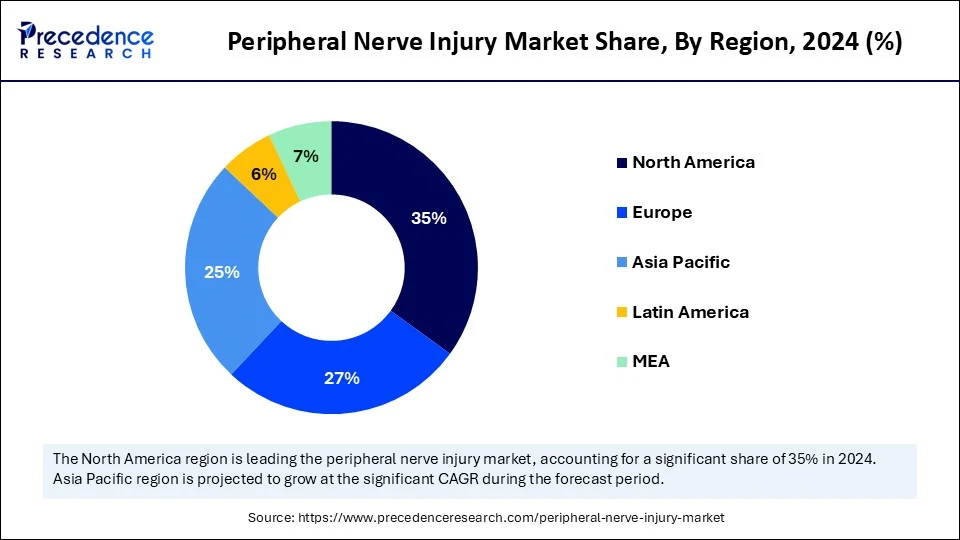

- North America dominated the peripheral nerve injury market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product type, the nerve conduits segment held the biggest market share of 64% in 2024.

- By product type, the nerve wraps segment is expected to grow at the fastest CAGR during the forecast period.

- By surgical technique, the direct nerve repair segment led the market in 2024.

- By surgical technique, the stem cell therapy segment is expected to grow at the fastest rate in the upcoming period.

- By treatment material, the autografts/allografts segment generated the major market share in 2024.

- By treatment material, the biomaterials segment is likely to grow at the fastest CAGR over the studied period.

- By application, the upper extremity segment captured the biggest market share in 2024.

- By application, the lower extremities segment is observed to grow at the fastest rate during the forecast period.

How is AI helping doctors diagnose peripheral nerve injuries more accurately?

Artificial Intelligence is helping doctors diagnose peripheral nerve injuries more accurately by analyzing complex medical data, such as MRI, CT, and EMG scans, more quickly and precisely than traditional methods. Machine learning algorithms can detect subtle patterns and abnormalities in nerve structures that the human eye may miss. AI also assists in classifying injury severity and predicting nerve recovery potential, enabling doctors to make more informed and timely treatment decisions. This results in earlier intervention, better outcomes, and reduced risk of long-term complications.

U.S. Peripheral Nerve Injury Market Size and Growth 2025 to 2034

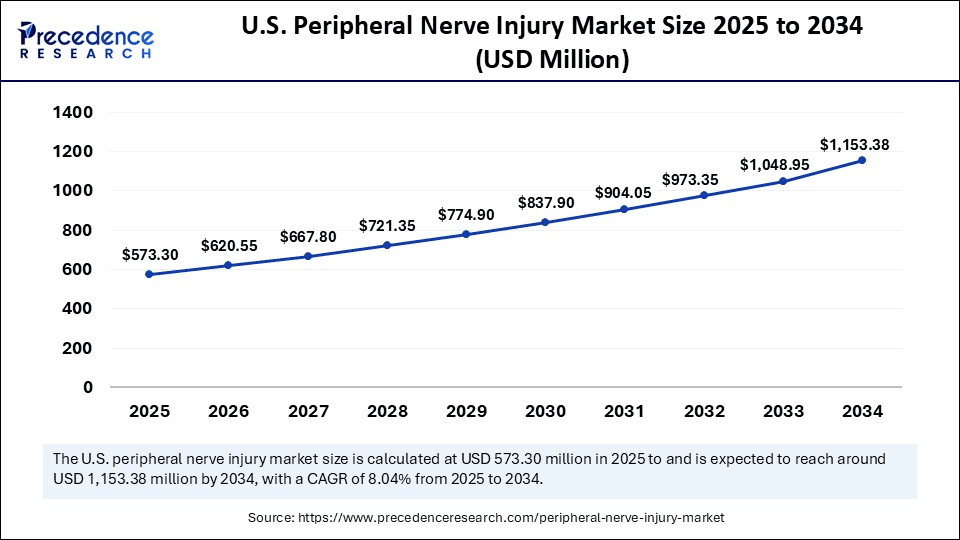

The U.S. peripheral nerve injury market size was exhibited at USD 532.35 million in 2024 and is projected to be worth around USD 1,153.38 million by 2034, growing at a CAGR of 8.04% from 2025 to 2034.

What Made North America the dominant region in the peripheral nerve injury market?

North America dominated the peripheral nerve injury market by holding the largest revenue share in 2024. This is mainly due to its early adoption of cutting-edge medical technologies, high incidence of trauma-related injuries, and sophisticated healthcare infrastructure. The region benefits from robust R&D initiatives, helpful reimbursement policies, and a reputable network of providers of specialized care. Furthermore, an aging population and increased knowledge of nerve repair options are likely to support the region's dominance. Clinical trials and a high volume of surgeries further solidify its position in the market.

Asia Pacific is expected to witness the fastest growth in the peripheral nerve injury market, supported by expanding access to contemporary treatment options, growing patient awareness, and quick advancements in healthcare systems. Aging populations and lifestyle-related factors are contributing to an increase in nerve-related conditions in the area. Government expenditures in medical technology and healthcare infrastructure are speeding up market expansion. The adoption of nerve repair solutions is also being aided by rising interest in cutting-edge surgeries and rehabilitation services. Moreover, the rising incidence of traffic accidents is expected to contribute to regional market growth.

Market Overview

The peripheral nerve injury (PNI) market comprises medical devices, biologics, grafts, and therapies designed to diagnose, repair, regenerate, or protect injured peripheral nerves caused by trauma, surgery, metabolic conditions, or chronic diseases. Solutions include nerve conduits, wraps, grafts, protective sleeves, surgical repair techniques, and regenerative treatments like stem cell and biomaterial therapies.

The rising number of traffic accidents and an aging population significantly impact the peripheral nerve injury market by increasing the number of patients needing treatment. Nerve damage is frequently the result of falls, sports injuries, and auto accidents, particularly in younger and more active users. However, as people age, their nervous systems naturally deteriorate, increasing their vulnerability to nerve-related illnesses and slowing their recovery. The market is expanding due to the rising demand for cutting-edge treatments, surgery, and regenerative solutions introduced by this patient-centered company.

Peripheral Nerve Injury Market Growth Factors

- Increasing Incidence of Trauma and Accidents: Road accidents, sports injuries, and falls are leading causes of peripheral nerve damage globally.

- Rising Geriatric Population: Older individuals are more prone to nerve injuries and degenerative disorders, increasing demand for treatments.

- Advancements in Nerve Repair Technologies: Innovations such as bioengineered nerve grafts and neurostimulation devices enhance treatment efficacy.

- Increased R&D Investment: Pharmaceutical and biotech companies are investing heavily in regenerative therapies for nerve repair.

- Favorable Reimbursement and Regulatory Support: Government policies and insurance coverage are making advanced treatments more accessible.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.59 Billion |

| Market Size in 2025 | USD 1.82 Billion |

| Market Size in 2024 | USD 1.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Surgical Technique, Application, Treatment Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Incidence of Trauma and Accidents

One of the major factors driving the growth of the peripheral nerve injury market is the rising incidence of trauma, which frequently happens because of falls, industrial accidents, traffic accidents, or sports-related incidents. Such injuries are becoming more common as a result of increased vehicle use and urbanization, particularly in developing countries. The risk of nerve damage from sports, especially contact sports and high-impact training, is rising. For a full recovery, these injuries frequently necessitate advanced therapies or surgery. This growing burden is greatly increasing the market's need for efficient diagnostic and therapeutic solutions.

Rising Demand for Minimally Invasive Procedures

Minimally invasive surgical methods are less risky, require less recovery time, and require fewer hospital stays. Patients and healthcare professionals are increasingly choosing them for nerve decompression and robotic microsurgery, two methods that are becoming more popular. These operations reduce the risk of infection or complications following surgery and inflict less damage on the surrounding tissues. Patients are more likely to choose treatment, particularly in outpatient settings, when there are better outcomes and shorter recovery times. This change is increasing demand for cutting-edge equipment and tools made for minimally invasive procedures.

Restraint

Limited Availability of Skilled Professionals

Repairing peripheral nerves involves the use of sophisticated robotic instruments or microsurgery, which requires a high level of surgical skill and precision. Neurosurgeons and specialists with the necessary training are in short supply, especially in rural or impoverished areas. The absence of training initiatives and exposure to emerging technologies exacerbates this disparity. Patients might thus not receive prompt or efficient treatment. This shortage of healthcare workers significantly hinders the widespread use of advanced therapies.

Complications and Low Success Rate in Serve Cases

Treatment success rates may be low in cases of severe or chronic nerve injury, particularly if the damage is extensive or has been present for a long time. Full function may not always be restored by surgery, and side effects like infections, graft rejection, or neuroma formation are possible. Patients' expectations might not be fulfilled in these situations, which would undermine their trust in nerve repair techniques. Both doctors and patients may be deterred from selecting surgical procedures by these risks. Despite advancements in technology, low efficacy can sometimes impede market expansion.

Opportunities

Advancements in Regenerative Medicine and Stem Cell Therapy

The development of regenerative medicine, particularly stem cell therapy, presents exciting new avenues for nerve regeneration and repair. Because stem cells can repair damaged tissues and encourage axonal growth, they may be able to restore nerve function. Additionally, research into 3D printing nerve scaffolds and tissue engineering is accelerating. These advancements have the potential to alter the course of treatment in the long term and provide biotech companies with new sources of revenue. These treatments might soon be incorporated into standard treatment regimens as clinical trials progress in the market.

Increasing Focus on Personalized Medicine

With the shift toward a personalized medicine approach, treatments for peripheral nerve injuries are becoming more patient-specific, improving success rates and patient satisfaction. Genetic profiling, AI-based decision tools, and customized nerve grafts enable tailored approaches to treatment. This trend supports the development of niche products and precision therapies. Companies investing in personalized solutions can differentiate themselves and capture premium market segments. The push for individualized care is expected to be a major driver in future innovation.

Product Type Insights

Why did the nerve conduits segment dominate the peripheral nerve injury market in 2024?

The nerve conduits segment dominated the market with the largest share in 2024. Since it has been demonstrated that nerve conduits can direct axonal regrowth across nerve gaps, they are frequently applied to injuries that cannot be repaired without tension. In gap management, clinical studies are the gold standard because they consistently produce positive results. Applying conduits is simple, and they are compatible with a variety of injury types. Surgeons and hospitals continue to trust them, as biodegradable and drug-releasing versions are being developed.

The nerve wraps segment is expected to grow at the fastest rate in the coming years, as nerve wraps are rapidly gaining popularity as a supplement to nerve repair, especially in operations where scarring or post-operative adhesion is a risk. By using them, the risk of compression neuropathies is decreased, and patient comfort is increased. They are becoming increasingly popular for protecting sensitive nerves due to advancements in bioresorbable materials. There is a particularly high demand for outpatient procedures and revision surgeries. Their use is anticipated to increase across several specialties as clinical awareness rises.

Surgical Technique Insights

How does the direct nerve repair segment dominate the peripheral nerve injury market in 2024?

The direct nerve repair segment dominated the market in 2024 as it remains the most performed technique due to its ease of use, affordability, and superior results in clean injuries with little gap. Under low tension, it facilitates natural healing. It is especially preferred in emergency rooms and trauma centers where prompt intervention is feasible. This technique is widely used, as surgeons are highly proficient in it worldwide. Its clinical relevance remains strong and reliable, despite the introduction of new technologies.

The stem cell therapy segment is expected to expand at the fastest rate over the forecast period due to the rising demand for personalized and targeted therapies. Stem cell therapy offers regenerative benefits that traditional surgery cannot. These cells can differentiate, secrete growth factors, and promote faster healing of complex nerve injuries. Clinical trials involving peripheral nerve repair with mesenchymal stem cells are yielding promising results. Stem cells are also being studied in combination with scaffolds and biomaterials for enhanced results. As safety and efficacy are validated, this method is poised for exponential growth.

Treatment Material Insights

What made autografts/allografts the dominant segment in the peripheral nerve injury market?

The autografts/allografts segment dominated the market with a major revenue share in 2024, as they are considered the clinical benchmark for large gap repairs. They are compatible with biology and can regenerate. With little immunological reaction, they offer a natural route for nerve regeneration. Even though autograft harvesting has drawbacks, such as donor site morbidity, the method is tried and true. Allografts, on the other hand, are more convenient because they do not require multiple surgical sites. In cases of trauma and complicated surgery, both materials are frequently utilized.

The biomaterials segment is likely to grow at the highest CAGR during the projection period. Biomaterials transform the nerve repair space by offering customizable, resorbable alternatives that support healing without the need for secondary surgeries. Synthetic polymers, collagen scaffolds, and fibrin matrices are among the substances that efficiently direct nerve regeneration. Research on smart biomaterials is broadening, including those that release growth factors. Both clinical and commercial innovation are focused on them due to their adaptability, biocompatibility, and capacity to integrate with drug delivery and cell therapies. The growing demand for next-generation solutions is driving market growth.

Application Insights

Why did the upper extremity nerve injuries segment dominate the market in 2024?

The upper extremity nerve injuries segment dominated the peripheral nerve injury market, holding the largest share in 2024, as these injuries are more prevalent, driven by the increased incidence of road and workplace accidents. A person's functional independence can be significantly impacted by injuries to their hands, wrists, and arms. Surgery is, therefore, given priority, and patients are more likely to seek early intervention. High treatment volumes can be attributed to the fact that these injuries are usually simpler to access and treat surgically. The most common nerve repair cases resulting from injuries to the upper extremities are reported by hospitals and trauma centers.

The lower extremities nerve injuries segment is expected to grow at the fastest CAGR in the coming years. The growth of the segment is attributed to the rising cases of sports injuries, diabetic neuropathy, and road trauma involving legs and feet. These injuries are often more complex due to deeper anatomical positioning and longer nerve pathways. Despite being more challenging to treat, advancements in imaging, microsurgery, and postoperative rehabilitation are improving outcomes. Rising awareness and better diagnosis are encouraging more patients to opt for treatment. Moreover, the growing diabetic population and focus on mobility restoration support segmental growth.

Peripheral Nerve Injury Market Companies

- AxoGen, Inc.

- Stryker Corporation

- Baxter International, Inc.

- Integra Lifesciences Corporation

- Polyganics BV

- Renerva, LLC

- Toyobo Co., Ltd.

- Newrotex

- Orthocell Ltd

- Medovent

- Auxilium Biotechnologies

- BioCircuit Technologies

- Isto Biologics

- Alafair Biosciences

- Fibrant

- Alafair Biosciences

- Orthocell Ltd

- Cleveland Clinic (research partner)

- University of Oxford (research collaborator)

- Medtronic (neurostimulation)

Recent Developments

- On 24 June 2025, Tissium announced FDA clearance of its sutureless polymer-based peripheral nerve repair device. This innovative bio-inspired device enables surgeons to perform nerve repairs without traditional sutures, aiming to simplify procedures and improve patient outcomes.

(Source:https://www.statnews.com)

- In May 2025, Auxilium Biotechnologies announced the enrollment of the first patient in its clinical trial evaluating the safety and efficacy of NeuroSpan Bridge. This innovative investigational device is designed to improve nerve regeneration. This trial represents a significant step forward in the company's mission to restore lost function for individuals suffering from debilitating nerve injuries to the extremities, including those resulting from trauma such as car accidents or work-related injuries.

(Source:https://www.businesswire.com)

Segments Covered in the Report

By Product Type

- Nerve Conduits

- Nerve Protectors / Wraps

- Nerve Connectors

- Nerve Grafts (Autograft, Allograft)

- Biologics (Stem Cells, Growth Factors)

- Others (Neurostimulation devices, scaffold systems)

By Surgical Technique

- Direct Nerve Repair

- Nerve Grafting

- Stem Cell Therapy

- Neurostimulation

- Others (Minimally invasive repair)

By Application

- Upper Extremities

- Lower Extremities

- Facial/Other

- Others (Spinal nerve roots)

By Treatment Material

- Biomaterials (collagen, hydrogels, synthetic polymers)

- Processed Nerve Allografts

- Autografts

- Others (Nanoparticle scaffolds, 3D-printed implants)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting