What is the Phase Change Materials (PCM) Market Size?

The global phase change materials (PCM) market size accounted for USD 767.55 million in 2025 and is predicted to increase from USD 903.33 million in 2026 to approximately USD 3,774.45 million by 2035, expanding at a CAGR of 17.27% from 2026 to 2035. The phase change materials market is driven by rising demand for energy-efficient buildings, improved thermal management needs, and broader adoption across electronics, packaging, and renewable energy solutions.

Market Highlights

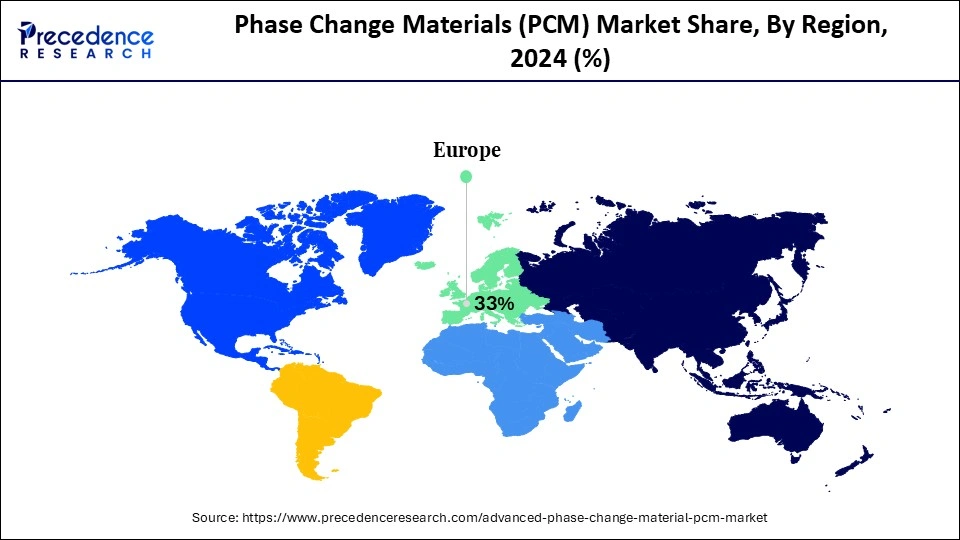

- Europe led the phase change materials (PCM) market with the highest share of 33% in 2025.

- The Asia Pacific is estimated to expand the fastest CAGR in the market between 2026 to 2035.

- By material/chemical type, the organic PCMs (paraffins, fatty acids, esters) segment held the largest market share of 44.2% in 2025.

- By material/chemical type, the bio-based PCMs segment is expected to expand at the highest CAGR from 2026 to 2035.

- By form/encapsulation, the macro-encapsulated PCMs segment contributed the biggest market share of 66% in 2025.

- By form/encapsulation, the micro-encapsulated PCMs segment is growing at a strong CAGR from 2026 to 2035.

- By application/end use, the building and construction segment held a dominant share of 39.7% in 2025.

- By application/end use, the thermal energy storage segment is expected to expand fastest in CAGR over the projected period.

- By temperature range, the medium-temperature PCMs (~0–200°C) segment captured the highest market share of 50% in 2025.

- By temperature range, the low-temperature PCMs (<0°C) segment is expanding at the fastest CAGR from 2026 to 2035.

What are the Phase Change Materials (PCM)?

Phase change materials (PCMs) are substances that can absorb and release heat during their solid–liquid transformation and thus help to maintain a steady temperature very effectively. Their use contributes to the energy efficiency of the system, the incorporation of renewable sources, and thermal management. The demand for them is increasing in buildings, cold storage, textiles, and electronics due to the use of sustainable design, encapsulation innovations, and environmentally friendly material developments.

Thermal Efficiency Boosting the Phase Change Materials (PCM) Market

The ever-growing focus on energy-efficient buildings and temperature-controlled logistics is driving demand for phase change materials (PCMs) as organizations seek cost-effective thermal management solutions.

The phase change materials (PCM) market focuses on materials that can absorb, store, and release thermal energy during phase transitions. Phase change materials enable temperature control. As a result, PCM systems are increasingly being incorporated into construction insulation, cold-chain packaging, electronics cooling, and textiles, primarily because they can stabilize temperature without a constant energy input. Organic, inorganic, and bio-based PCMs are being designed to improve their thermal reliability and cycling stability, thereby supporting their assimilation into modern energy-efficient systems. The requirements for sustainable building, the growth in the transport of temperature-sensitive pharmaceuticals, and the demand for efficient heat-managing materials are dynamically combining to make phase change materials a significant element for emerging thermal technologies.

AI-Driven Insights Powering Next-Gen Heat Transfer Analysis

Artificial intelligence is revolutionizing heat-transfer analysis using phase-change materials (PCMs) by delivering faster, deeper, and more accurate results. Neural networks replicate brain-like processing to facilitate the learning of complex thermal patterns, while deep learning uses layered relationships that traditional models often miss. Algorithms that are part of machine learning, supervised, unsupervised, and reinforcement learning, analyse large sets of experimental and simulation data to find hidden trends and optimize thermal behavior.

Furthermore, it allows us to optimize thermal storage; enhance energy efficiency, and temperature control or regulation systems. AI is particularly useful because it identifies, understands, and handles nonlinear, highly dynamic heat-transfer interactions. This will enable researchers to enhance phase change materials and develop more intelligent, efficient thermal management solutions for energy, cooling, and industrial applications.

Statistics of Phase Change Materials (PCM) Market

- Imported PCM boards to the globe were 96 shipments in the period of Apr 2024 to Mar 2025 TTM.

- Through these shipments, 30 exporters sold merchandise to 25 international buyers, and the growth in trade participation was high.

- The total imports have shown a steep increase of 317 percent over the past year.

- In March 2025, the global markets recorded 29 PCM board shipments, which are signs of increasing demand in the month. This showed an annual growth of 1350.0% as compared to the current import levels in Mar 2024.

- In a series, Mar 2025 import levels rose by 314 percent in relation to the shipment volumes of the same in February 2025.

- Vietnam, Hong Kong, and China became the major countries in the world where PCM board imports led.

- Vietnam topped the imports worldwide with 100 shipments then South Korea and the United States had the next best.

Phase Change Materials (PCM) Market Outlook

Phase change materials (PCM) are increasingly being adopted for use in the construction and operation of energy-efficient infrastructure and buildings, given the increased attention from government agencies. Further, the continued expansion of PCM product applications in temperature-controlled shipping and building systems solidifies PCMs role in regulated industrial uses.

Throughout the world, countries are adopting PCM faster because of outward pressures on energy franchising and sustainability, with several countries mandating stricter energy-efficiency and sustainable construction programs. Also, increasing demand for electric vehicle cooling batteries and thermal regulation in electronics infrastructure adds to the ongoing deployment of phase change materials in primary global markets.

Government-supported clean energy initiatives, such as the various Department of Energy initiatives for thermal storage implementation in the United States, and the various EU Horizon funding opportunities for research in order to develop safer, longer-lasting, and bio-based formulation of PCM, product improvements are being routinely advanced in thermal stability and performance.

With a strong mandate from sustainability agendas, institutional, national, and global goals, PCM use is being pursued in green buildings, low-carbon logistics, and recyclable cold-chaining systems. Increasing corporate commitment to ESG and national climate agendas is leading industries to pivot toward phase change materials solutions to reduce energy use, demand, and greenhouse gas emissions.

The Energy Performance of Buildings Directive in the EU, as well as other federally driven US efficiency standards, national regulatory standards, and global compliance carbon regulatory standards, are rapidly supporting PCM development as the mandates for meeting continued improvement of thermal performance and energy savings to commercial landscapes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 767.55 Million |

| Market Size in 2026 | USD 903.33 Million |

| Market Size by 2035 | USD 3,774.45Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.27% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material/Chemical Type, Form/Encapsulation, Application/End-use, Temperature Range, End User/Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Phase Change Materials (PCM) Market Segment Insights

Material / Chemical Type Insights

Organic PCMs: This segment is the most dominant in the phase change materials (PCM) market, accounting for ~44.2% in 2024, due to their thermal stability, low corrosiveness, and compatibility with building materials and textiles. Their reliable melting/freezing behavior for passive thermal control makes it a significant source of passive thermal management. The strong embrace of organic phase change materials in the building envelope, cold-chains, and consumer markets is also contributing to its leadership position in temperature-sensitive industries.

Bio-Based PCMs: The segment is set to be the fastest-growing in the phase change materials (PCM) market, as the PCMs derived from plant and animal-based fatty acids are emerging rapidly as an inevitable shift for industries toward low-carbon, biodegradable thermal management solutions. Like organic phase change materials, bio-based PCMs exhibit melting points and are inherently safer from an environmental perspective, and therefore can be deployed for HVAC, packaging, and renewable-integrated storage systems. The shift towards bio-materials in regulatory standards is also bolstering their use and implementation in commercial and industrial thermal management applications.

Eutectic PCMs: This segment combines organic-organic or organic-inorganic mixtures and is gaining traction where an exact melting temperature is desired. Their crystalline-like phase-transition properties lend themselves to use in electronics cooling, specialty packaging, or laboratory storage. The ability to build custom thermal profiles expanded the opportunities for use in next-generation thermal control systems and in condensed energy density storage applications.

Form / Encapsulation Insights

Macro-encapsulated PCMs: This segment represents the majority of the phase change materials (PCM) market at approximately 66% in 2024 because they integrate easily with building materials like wallboards, ceiling tiles, flooring panels, and container-based thermal units. They represent the greatest volume of capsules, as they provide consistent thermal buffering, low installation complexity, and strong mechanical property stability. Macro-encapsulated phase change materials are widely implemented in construction, cold-storage modules, and thermal-comfort product markets. They leverage established manufacturing processes and the long service life of macro-encapsulated PCMs, which are highly durable through repetitive heating–cooling cycles.

Micro-encapsulated PCMs: This segment is growing the fastest due to the dispersion properties of the microcapsules within coatings, textiles, gypsum boards, composites, cellular packaging, and battery compartment components. Their small capsule dimensions facilitate a quicker thermal response to passive temperature changes and enable more precise temperature control within products while maintaining overall structural properties. The fastest growth of micro-encapsulated phase change materials is occurring in categories such as smart textiles, temperature-adaptive paints, advanced building materials, and thermal layers within EV batteries, in part due to advanced polymer shells for microcapsules and microcapsules with high cycling stability.

Application / End-use Insights

Building & Construction: This segment constituted ~39.7% of the phase change materials (PCM) market application as energy-efficient buildings become dependent on PCM-related insulation boards, PCM-related gypsum panels, and PCM-related floor/roof systems to maintain indoor thermal comfort. Such materials mitigate the cooling or heating load on HVAC systems, improve thermal comfort for occupants, and help drive lower-energy residential buildings, commercial spaces, and existing and green building retrofits through broad-scale adoption.

Thermal Energy Storage: This segment is the fastest-growing in the market as thermal applications are slowly transitioning, with district heating and demand-side response needing compact thermal storage or buffers. Phase change materials enable peak-shaving thermal storage, solar-thermal thermal storage, and short-duration grid storage, and are attractive to utilities, new industrial facilities, and new technology groups needing single-point or high-energy-density storage to mitigate temperature excursion events, especially at stable operating temperatures.

Electronics & Thermal Management: This segment is steadily growing across data centers, electric vehicle battery packs, consumer electronics, and power modules. The demand for reliable passive thermal management in cooling solutions is driven by the need to address thermal spikes, extend device component life, and dimensional design constraints. PCMs transient thermal load reduction, such as in high-performance computing, telecom, electric, and industrial maintenance-free electronics, is driving adoption.

Temperature Range Insights

Medium-temperature PCMs (0-200°C): This segment is the most dominant due to their alignment with the operating temperature ranges of most industry, building, and energy-storage applications. Their compatibility enables HVAC optimization, solar-thermal buffering, and temperature control at the equipment level. Furthermore, strong coupling with construction materials and building- or industrys heat-recovery and process-heat activities strengthens medium-temperature phase change materials as the leading temperature class in commercial and utility-scale applications.

Low-temperature PCMs (<0°C): This segment is poised for rapid growth driven by increased cold-chain logistics, growing demand for pharmaceutical shipping, and the need for temperature-sensitive food preservation solutions. Their ability to maintain sub-zero conditions without mechanical refrigeration is more energy efficient, and the expanding vaccine distribution network, e-commerce grocery delivery expansions, and demand for off-grid cooling solutions continue to push this temperature range into the commercial space.

High-temperature PCMs (>200°C): This segment is also growing rapidly as concentrated solar power plants, industrial waste-heat recovery, and next-generation thermal batteries are in high demand. High-temperature materials can store heat at higher temperatures and be integrated into grid balancing, heat processes, or time-shifting for renewable-energy applications. Lastly, as decarbonizing heavy industry becomes a focus, the long-duration, high-efficiency thermal storage space is another important area for high-temperature PCMs.

Phase Change Materials (PCM) Market Regional Insights

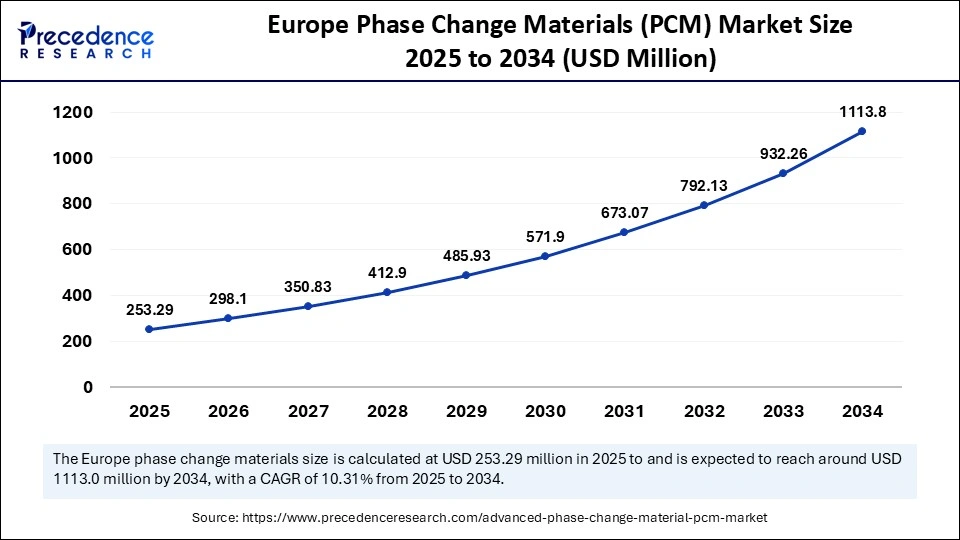

The Europe phase change materials market size has grown strongly in recent years. It will grow from USD 253.29 million in 2025 to USD 1,267.73 million in 2035, expanding at a compound annual growth rate (CAGR) of 17.47% between 2026 to 2035.

Why Is Europe Dominating the Phase Change Materials (PCM) Market?

Europe leads the market for phase change materials (PCMs) with a 33% share, driven by their association with building-energy innovation: research shows that PCMs integrated into facades, glazing, flooring, and insulation significantly buffer indoor temperatures and reduce heating and cooling loads. European policy frameworks are encouraging net-zero and more energy-efficient buildings, making phase change materials a favorable alternative for thermal mass. Furthermore, established R&D ecosystems have helped improve both encapsulation levels and phase stability of PCMs. Many local universities and construction labs are experimenting with macro- and micro-encapsulated PCMs to improve both comfort and buildings energy performance.

- In October 2024, Panasonic Marketing Europe GmbH, a unit of Japanese conglomerate Panasonic, and Innova are developing a multi-source heat pump compatible with PV (solar) systems, integrated with PCM to store thermal energy more efficiently and improve renewable-based heating/cooling.

Germany Phase Change Materials (PCM) Market Trends

Germany is a regional leader because of its strong building science sector, regulatory support for green buildings, and strong clusters of PCM materials. Some university studies conducted in Germany focus on PCM-enhanced wallboards and façade systems to flatten temperature swings and mitigate adverse effects on energy performance. Research groups at institutions such as Fraunhofer IBP, RWTH Aachen University, and the Technical University of Munich are actively testing the integration of phase change materials in residential and commercial buildings to support peak load reduction and thermal comfort improvements. In addition, Germanys strict building energy codes and incentives under programs like the KfW Efficiency House initiative are encouraging developers to adopt advanced thermal storage materials, reinforcing the countrys leadership in PCM innovation and deployment.

Over the Asia Pacific region, considerable urbanization, construction, and awareness of energy-efficient buildings are driving the uptake of condition-responsive PCM materials for buildings. In China, India, and other developing countries, PCM are being investigated in an effort to manage peak loads related to HVAC and stabilize indoor temperature variation. Research literature has found that PCM can be incorporated into building envelopes or building elements (such as bricks) to delay indoor peak temperature. At the same time, phase change materials are being deployed for solar-thermal or cold-chain applications, and particularly in warm climatic countries for passive latent-heat storage. A significant portion of academic work has also explored numerical modelling of the microcapsule distribution of phase change materials to adapt PCM properties to local climate conditions.

China Phase Change Materials (PCM) Market Trends

The reason for Chinas leadership in this field is the sheer scale of construction, the government-sponsored emphasis on sustainable urban infrastructure and strong connections between academia and industry. The academic literature generated by Chinese researchers is significant and includes experimental and numerical studies focused on phase change materials included in building elements, especially for retrofit construction and new low-carbon buildings.

Research institutes such as Tsinghua University, Southeast University and the Chinese Academy of Building Research are conducting large-scale investigations on PCM-enhanced concrete panels, PCM embedded floor systems and thermal energy storage composites designed for high-density urban climates. These studies are often linked to government programs promoting green building standards and smart city development, which accelerate testing and field deployment. The rapid expansion of residential, commercial and industrial construction across China provides ample pilot sites, allowing phase change materials technologies to transition from laboratory evaluation to real-world integration more quickly than in many other regions.

The use of PCMs is growing in North America, specifically in the U.S., due in part to buildings and high-tech industries. Academic studies indicate that, when used as part of a building envelope, PCMs can significantly reduce both peak thermal loads and indoor temperature fluctuations. In terms of technology, phase change materials microcapsules are already used in textiles, electronics, and device thermal management, which implies a range of applications. A well-known example is Outlast Technologies, based in the U.S., which develops clothing with microencapsulated PCMs embedded in fabrics to control body temperature. The combination of the development of novel phase change materials (PCMs) and the presence of building-science laboratories is stimulating regional growth in the use of PCMs.

The U.S. is a large market for phase change materials because of their diverse uses in building insulation, cold chain logistics, and thermal energy storage. The U.S. has focused on energy efficiency, green building, and renewable installations. Also, PCM formulation technology has advanced, allowing engineers to regulate temperature using PCMs more effectively. Government programs that support energy savings and green building performance improvements contribute to conditions that will make the U.S. a leading market for phase change materials use in North America.

The phase change materials (PCM) market in Latin America is significantly growing, with energy efficiency requirements in buildings, electronics, and cold chains as the main driver. The demand is leaning towards bio-based PCMs and the integration of smart buildings. Sustainability policies that support the region's green construction practices, along with increasing awareness about green building, are strengthening the long-term PCM market adoption in the region.

Mexico Phase Change Materials (PCM) Market Trends

The Mexican market is showing steady growth as demand rises for energy-efficient solutions in construction, cold chain logistics, and thermal energy storage. Increasing adoption of sustainable building practices is driving the use of PCMs in insulation, walls, and HVAC systems to reduce energy consumption.

Phase Change Materials (PCM) Value Chain

Phase Change Materials (PCM) Market Companies

Develops thermally conductive phase-change materials for electronics cooling, including PCM45F and PTM/LTM series pads and pastes. These TIMs enhance heat transfer in power devices, telecom hardware, and automotive electronics.

Produces Micronal microencapsulated paraffin PCMs designed for building materials such as gypsum boards and plasters. These phase change materials stabilize indoor temperatures and reduce energy consumption for heating and cooling.

Offers DuPont Energain PCM panels and sheets used in building envelopes to reduce HVAC load peaks. The materials increase thermal inertia, improving energy efficiency and occupant comfort.

Manufactures CrodaTherm bio-based phase-change materials used in textiles, refrigerated transport, and cold-chain systems. These sustainable PCMs support precise temperature regulation across diverse applications.

Supplies paraffin, salt-hydrate, and high-temperature PCMs under its RT, SP, and RTHC product families. The company serves thermal energy storage, HVAC, automotive, and industrial process markets.

Provides 100 percent bio-based PCMs under the PureTemp brand for packaging, apparel, medical transport, and renewable energy storage. The company specializes in environmentally friendly PCM formulations.

Offers Thermocules microencapsulated PCMs integrated into fibers, foams, and coatings for adaptive thermal-regulating textiles. Products are used in apparel, bedding, footwear, and protective gear.

Produces ClimSel PCM gels and pouches designed for pharmaceutical and food cold-chain logistics. Their reusable products maintain stable temperatures during transport and storage.

A UK-based supplier offering organic, salt-hydrate, and eutectic PCMs for thermal energy storage projects. The company also provides system-design services for engineered temperature-control solutions.

Provides reusable phase change materials refrigerants, gel packs, and temperature-controlled containers for pharmaceutical and biologics logistics. Their PCM solutions support validated cold-chain performance.

Recent Developments

- In April 2025, Wafr Technologies launched in Canada, aiming to build net-zero AI data centres using a proprietary PCM-based passive liquid cooling system, which reportedly offers over 80% energy savings by eliminating chillers and refrigerants.(Source: https://www.datacenterdynamics.com)

- In February 2025, Plaksha University and Tabreed India began a pilot project implementing PCM-thermal energy storage (TES) for sustainable night-cooling, storing cooling energy during the day and discharging at night to reduce grid dependence and emissions.(Source: https://themachinemaker.com)

- In August 2024, Phase Change Solutions and SCGC launched a decarbonization solution in Thailand, deploying PCM-based thermal energy storage to cut carbon emissions and enable sustainable cooling in industrial and commercial sectors.(Source: https://www.prweb.com)

- In February 2025, Plaksha University and Tabreed India began a pilot project implementing PCM-thermal energy storage (TES) for sustainable night-cooling, storing cooling energy during the day and discharging at night to reduce grid dependence and emissions.

Phase Change Materials (PCM) MarketSegments Covered in the Report

By Material/Chemical Type

- Organic PCMs (paraffins, fatty acids, esters)

- Inorganic PCMs (salt hydrates, metallics)

- Eutectic PCMs (organic–organic or organic–inorganic mixtures)

- Bio-based PCMs (fatty-acid derivatives from plant/animal oils)

By Form/Encapsulation

- Macro-encapsulated PCMs (sheets, panels, containers)

- Micro-encapsulated PCMs (microcapsules for paints, gypsum, textiles)

By Application/End-use

- Building & Construction

- HVAC & Thermal Comfort systems

- Thermal Energy Storage (including district/solar thermal storage

- Cold Chain & Packaging (phase-change cold packs, vaccine transport)

- Electronics & Thermal Management (data centers, power electronics, batteries)

- Textiles & Wearables (phase-change fibres/linings)

- Automotive (battery thermal management, cabin comfort)

- Refrigeration & Equipment

- Others (medical, aerospace, process industry)

By Temperature Range

- Low-temperature PCMs

- Medium-temperature PCMs

- High-temperature PCMs

By End User/Industry

- Construction & Building Materials

- Energy & Utilities (thermal energy storage)

- Cold-chain logistics & pharma packaging

- Electronics/Data centers/EV manufacturers

- Textiles & Personal Thermal Management

- Industrial process heating/cooling

- Aerospace & Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting