What is Point-of-Care Glucose Testing Market Size?

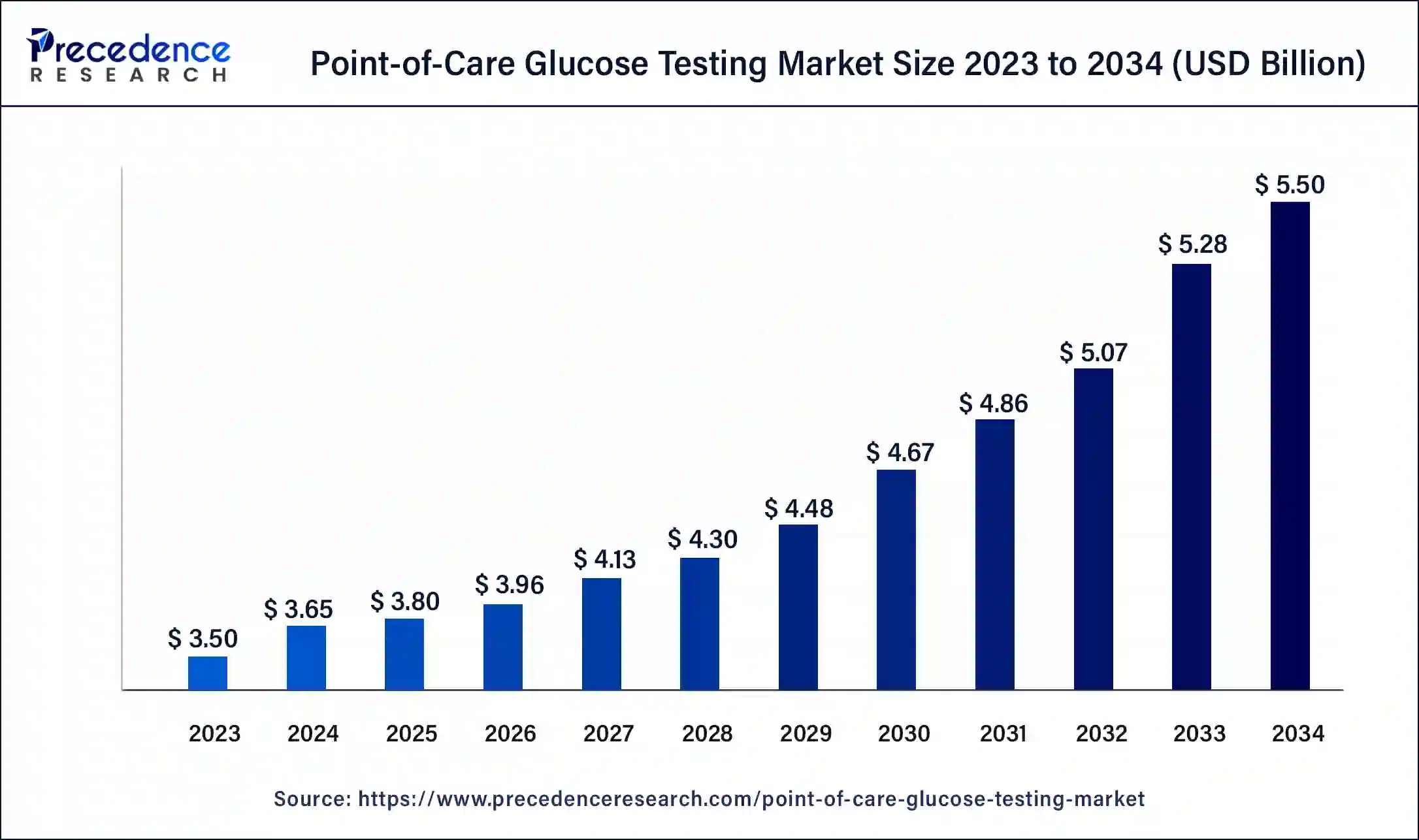

The global point-of-care glucose testing market size is accounted at USD 3.80 billion in 2025, and is expected to reach around USD 5.50 billion by 2034, expanding at a CAGR of 4.19% from 2025 to 2034. The North America point-of-care glucose testing market size reached USD 1.50 billion in 2024. The growing geriatric population and the ability of point-of-care diagnostic tests to deliver immediate results are among the major factors driving the growth of the point-of-care glucose testing market.

Market Highlights

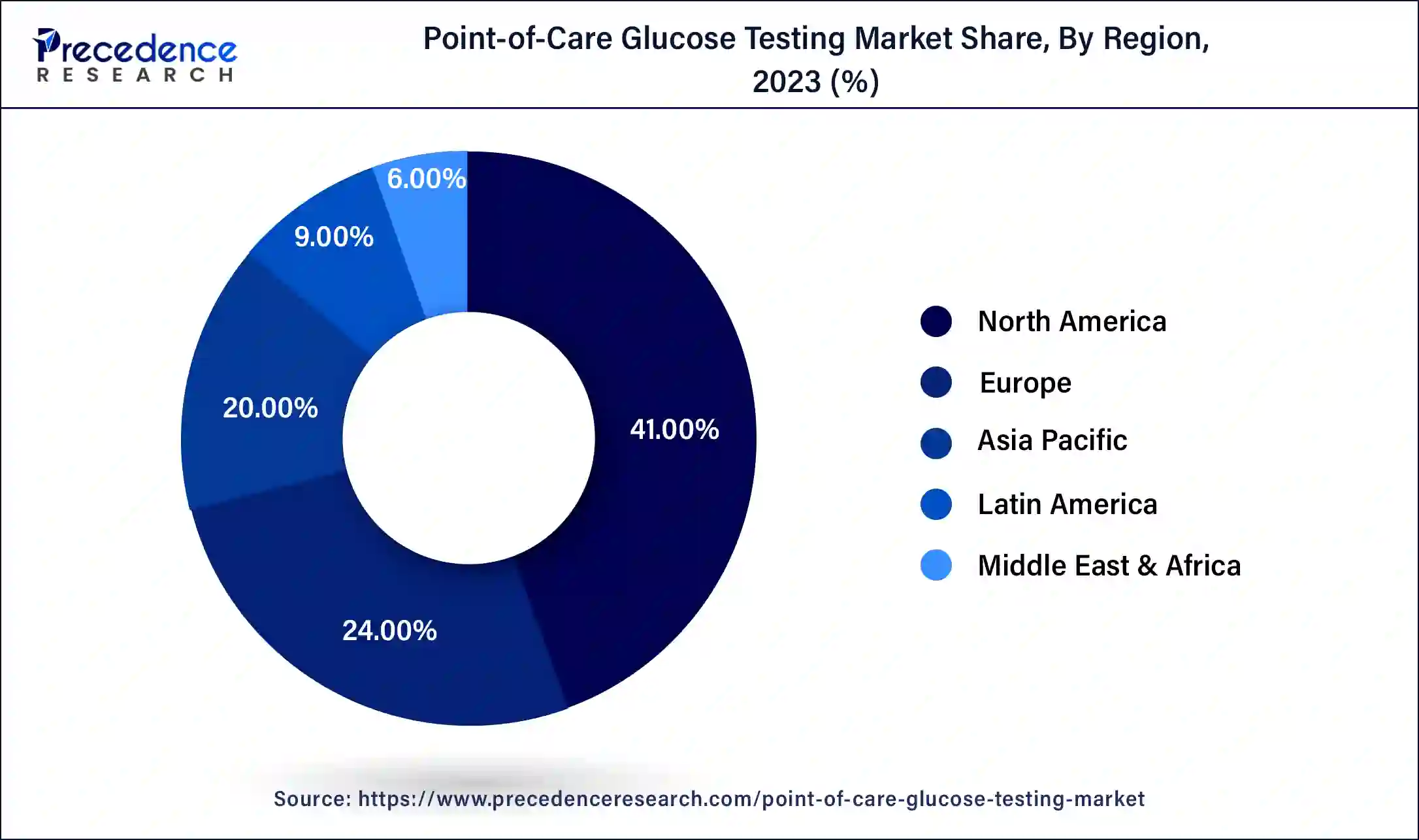

- North America dominated the global point-of-care glucose testing market in 2024 with a revenue share of 41%.

- Asia Pacific is witnessing significant growth in the point-of-care glucose testing market.

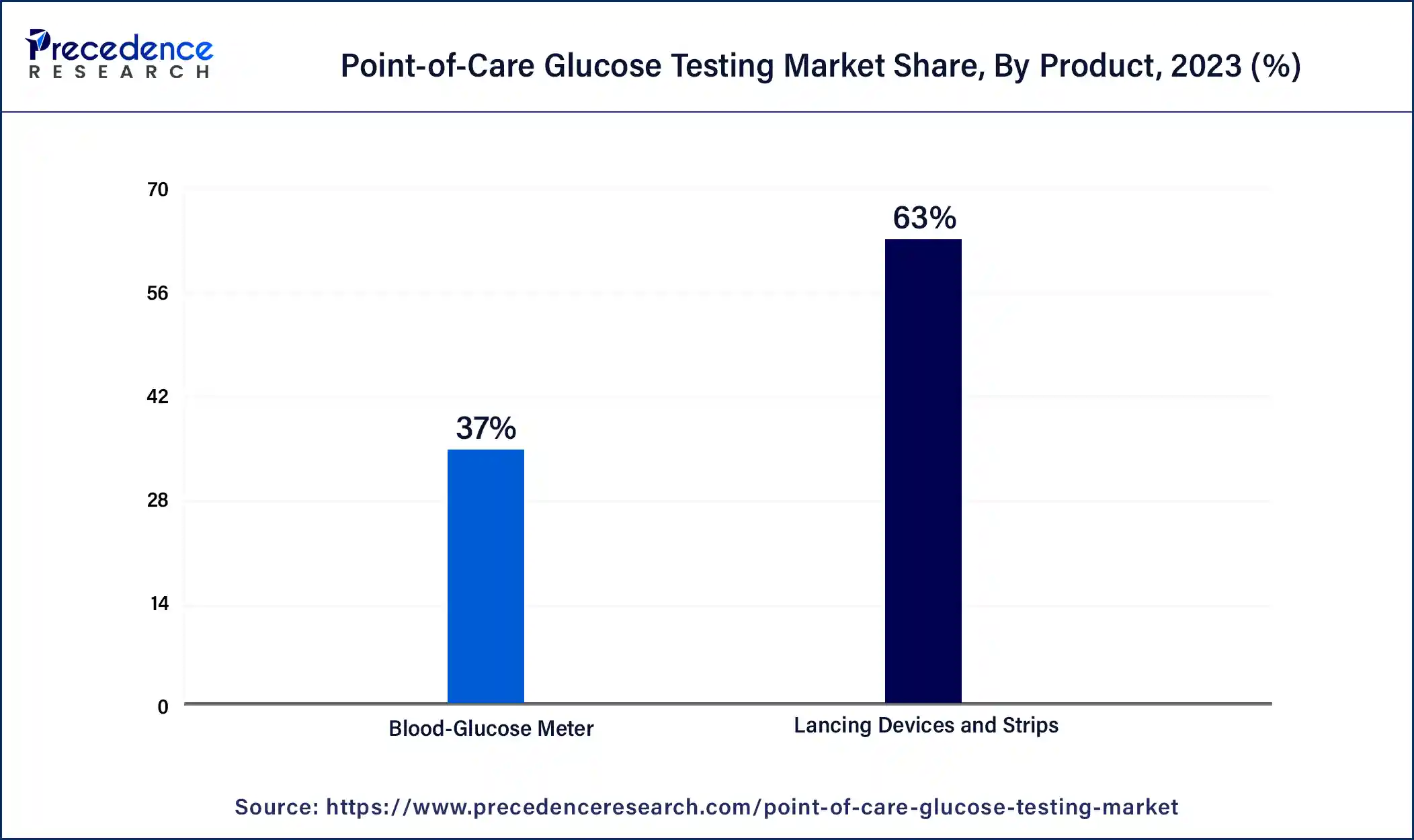

- By product, in 2023, the lancing devices and strips segment held the largest share of 63%.

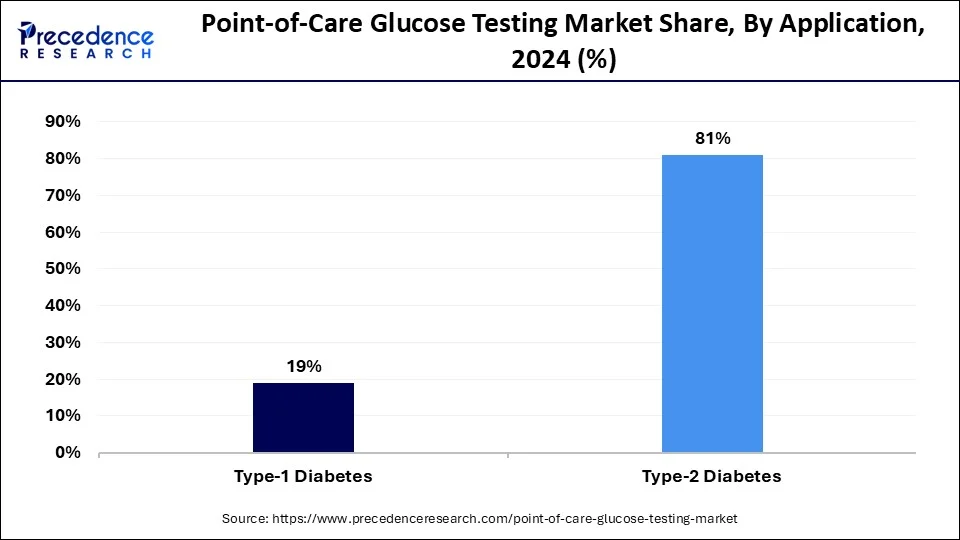

- By application, the type 2 diabetes segment dominated the market in 2024 with a revenue share of 81%.

- By end use, the home care setting segment has accounted revenue share of 62% in 2024.

Market Overview

Point-of-care glucose testing is a type of medical testing done right at the patient's bedside rather than sending samples to a lab. It's commonly used to manage diabetes, a condition where the body struggles to regulate blood sugar levels. This testing involves products like strips, lancets, and meters.Recent advancements have led to better connectivity for handheld devices. These devices are now essential in hospitals and clinics worldwide for quick glucose monitoring. They use whole blood for measurement, which simplifies bedside testing. Moreover, they empower patients to manage their health actively, increasing demand for patient engagement solutions. This trend is expected to continue, driving the growth of the market.

Point-of-care testing allows individuals to actively manage their health by offering real-time information for better glucose level control. It promotes early detection, monitoring, and intervention, aiming to improve patient outcomes and overall diabetes management. A significant driver in this market is the increasing global prevalence of diabetes.

Point-of-Care Glucose Testing Market Growth Factors

- The rise in the incidence of diabetes is one of the key factors driving the growth of the point-of-care glucose testing market.

- The growing geriatric population that is prone to diabetes can also fuel market growth shortly.

- Key market players like Abbot Laboratories, LifeScan, etc., are actively investing in these markets, which can further contribute to the market expansion.

- The launch of favorable regulatory policies to promote PoC glucose diagnostics is anticipated to boost the market's growth.

- Increasing awareness about this new set of treatments among most of the population is also helping the market expand over the forecast period.

Market Trends

- Connected and smart devices: Glucose meters are increasingly linked to apps and cloud platforms, allowing patients and healthcare providers to track data in real time.

- Continuous glucose monitors (CGMs) and wearables:CGMs and wearable patches are gaining popularity, reducing the need for frequent finger-prick tests.

- Non-invasive or minimally invasive testing: New technologies, such as optical sensors, sweat sensors, and skin patches, are making glucose monitoring more comfortable.

- Integration with telehealth: Devices are being integrated into telemedicine platforms, enabling remote monitoring and quicker interventions by doctors.

- Growth in homecare and self-monitoring: The demand for at-home glucose testing is rising, making it easier for patients to manage diabetes independently.

- Emerging market expansion: Asia-Pacific and other emerging regions are seeing faster adoption due to rising diabetes prevalence and improved healthcare access.

- Advanced analytics and AI integration: Some devices now include AI-powered insights, helping users and healthcare providers understand trends and make informed decisions.

- Focus on cost-effectiveness and accessibility: Manufacturers are developing affordable strips, sensors, and meters to reach a wider audience and increase routine monitoring compliance.

Market Outlook

- Industry Growth Overview: Due to the increasing incidence of diabetes and the demand for rapid on-the-spot monitoring, the market for point-of-care glucose testing is steadily growing. The growing use of home testing kits, remote care, and clinics seeking quicker results than traditional labs are the main drivers of growth. Demand is also being increased by home care adoption and emerging markets. The market is anticipated to expand at a consistent mid-single digit rate in the upcoming years, although cost and regulatory requirements continue to be factors.

- Sustainability Trends: Smarter more effective and patient friendly solutions are becoming more popular. Data tracking and remote monitoring and made possible by the growing number of devices connected through apps and cloud platforms. Convenience is increased by wearable technology and continues glucose monitors whcih eliminates the need for frequent finger prick tests. To make testing simpler and more comfortable, new less intrusive technologies are being developed such as sweat based monitor and optical sensors. Patients can now accurately track their blood sugar levels outside of clinics thanks to growing popularity of home care and remote monitoring systems.

- Major Investors: Businesses and investors are concentrating on consumer access, geographics expansion and product innovation. Instead of standalonn meters and strips, companies are creating connected, integrated devices. More money is being invested in manufacturing and distribution in emerging regions, particularly in the Middle East and Asia Pacific. There are opportunities for consumer focused.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.80 Billion |

| Market Size in 2026 | USD 3.96 Billion |

| Market Size by 2034 | USD 5.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of diabetes

The prevalence of diabetes has risen globally due to factors like an aging population, urbanization, unhealthy lifestyle choices, and increased obesity and physical inactivity. This rise is particularly pronounced in low- and middle-income countries where healthcare access is limited and awareness about regular glucose testing is low. To address this, there's been a notable increase in the use of portable point-of-care glucose testing market devices due to their affordability and ease of use.

Government initiatives in developing and underdeveloped countries are promoting effective monitoring and surveillance of diabetes and its complications. These efforts are expected to significantly contribute to the point-of-care glucose testing market's revenue growth in the future.

Restraint

Limited accuracy of point-of-care glucose testing devices

The accuracy of point-of-care glucose testing market devices has been a subject of ongoing debate. One of the challenges is determining which patients may be adversely affected by inaccurate results. False positive and false negative test results are common, leading to misdiagnosis in some cases. Many of these devices measure whole blood and hematocrit variations, which can introduce errors.

Organizations like the International Organization for Standardization and the Clinical and Laboratory Standards Institute have established new approval standards to address doubtful results. However, the low accuracy of these devices and the stringent regulatory approval processes may significantly hinder the growth of the point-of-care glucose testing market in the forecast period.

Opportunities

Development of advanced biosensor technologies

The development of highly advanced biosensor technologies, along with noninvasive glucose monitoring, grabs great potential for the market. Integration with electronic health records, telehealth services, and digital health platforms can further increase market opportunities. Moreover, the global point-of-care glucose testing market also provides efficient and immediate glucose monitoring for diabetes patients. These factors, along with the better disease management system, are expected to fuel market growth during the forecast period.

- In October 2023, the Canadian government approved Dexcom's next-generation Dexcom G7 Continuous Glucose Monitoring System for Canadian type-1 diabetes patients.

Innovations made by vendors

Vendors are striving to offer technologically advanced point-of-care glucose testing market products at competitive prices to gain an edge over their rivals. Among consumers, there's a preference for silk-based test strips due to their affordability compared to paper and plastic alternatives.

Silk strips only need a spray, as their coated threads can effectively conduct electrochemical signals, thereby reducing reliance on mechanical devices. By weaving enzyme-sprayed silk yarn together with electrodes, fabric sensors can independently conduct electrical charges. Also, the rising demand for cost-effective strips is expected to fuel growth in the point-of-care glucose testing market during the forecast period.

Technological advancements

Ongoing technological progress in glucose testing devices is fueling point-of-care glucose testing market expansion. Innovations like wireless connectivity, integration with smartphones, and cloud-based data management systems are improving the functionality and user-friendliness of point-of-care glucose testing devices. These advancements facilitate effortless data sharing, remote monitoring, and immediate insights for healthcare providers and patients alike.

Segment Insights

Product Insights

The lancing devices and strips segment held the largest share of the point-of-care glucose testing market in 2024 and is expected to maintain its position throughout the forecast period. This is mainly due to the increasing prevalence of diabetes and anemia, which drives the demand for lancets and lancing devices. The market is further boosted by the introduction of new lancing devices with features such as adjustable depth, vibration feedback, and pre-set depths.

The blood glucose meter segment is expected to grow significantly over the projected period. This growth is driven by the increasing cases of diabetes and the growing awareness about its diagnosis. A glucose meter, also known as a glucometer, is a small device used to measure the amount of sugar in a blood sample. Typically, a drop of blood obtained through a finger prick is placed on a test strip, which is then inserted into the meter for analysis. The finger prick can be done using a special needle called a lancet or a spring-loaded device that quickly pricks the fingertip.

- In February 2024, DexCom launched its real-time continuous glucose monitoring (CGM) system Dexcom ONE+ in Spain, Belgium, and Poland. The company also launched that same device on starting of 12 February. Dexcom said it will launch Dexcom ONE+ in the Middle East, Africa, and other European countries in the coming months.

Application Insights

The type 2 diabetes segment dominated the point-of-care glucose testing market in 2024and will continue to do so in the upcoming years. Factors such as the expansion of the healthcare sector and favorable government regulations are driving its global growth. Additionally, increasing government initiatives and favorable reimbursement policies are expected to further boost the growth of the type 2 diabetes segment in the future.

The same segment is estimated to experience substantial growth during the projected period. This is attributed to the increase in the number of type 2 diabetes cases worldwide and the increase in the research endogenous regarding type 2 diabetes.

End-user Insights

The home care setting segment has led the point-of-care glucose testing market in 2024 and will sustain its dominance in the foreseen future. This is attributed to the widespread use of point-of-care glucose testing devices in home care settings, where many diabetes patients monitor their glucose levels after meals. The segment's growth is also driven by an increase in the elderly population requiring medical care at home and rising awareness among people about using point-of-care glucose testing devices at home.

Regional Insights

U.S. Point-of-Care Glucose Testing Market Size and Growth 2025 to 2034

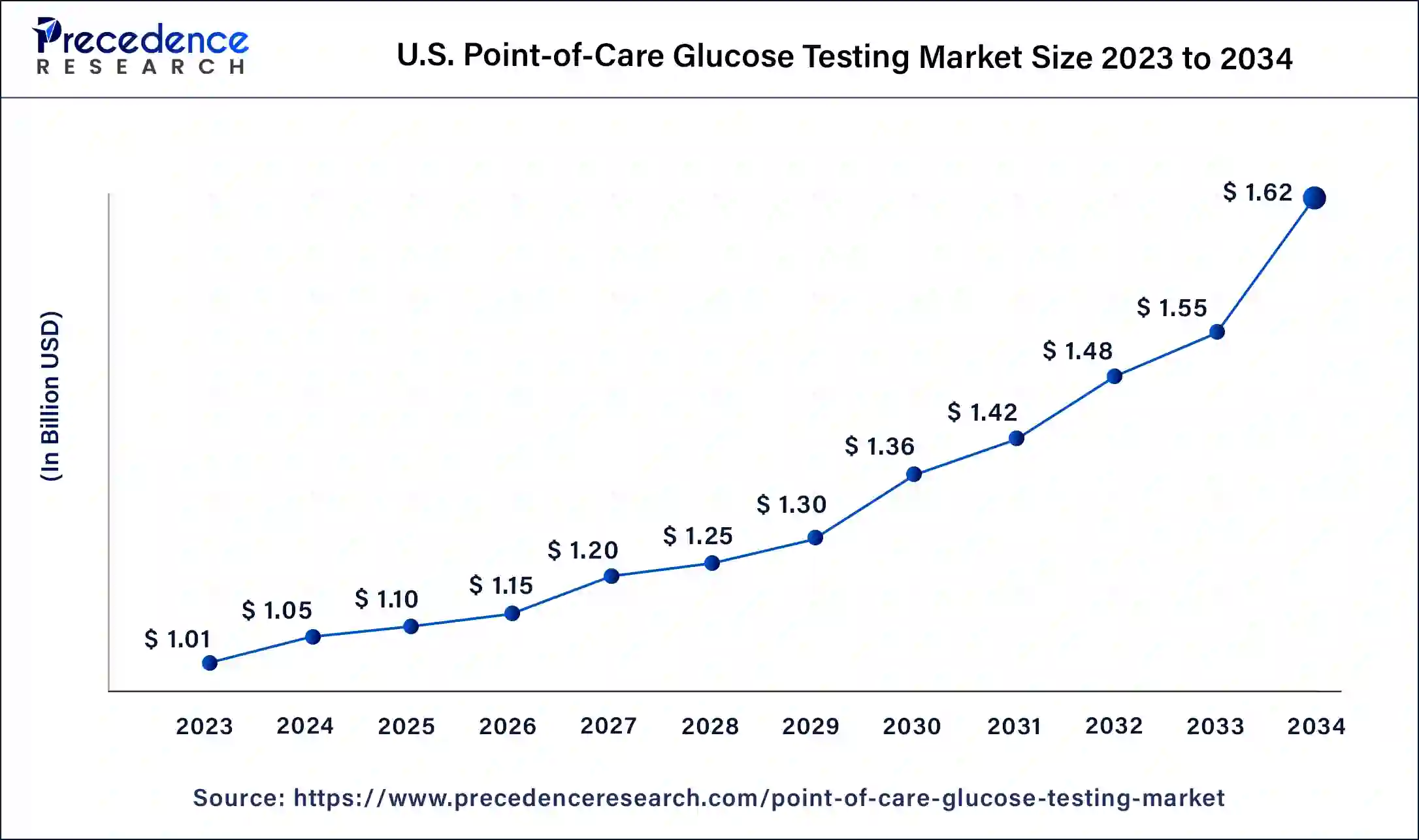

The U.S. point-of-care glucose testing market size is estimated at USD 1.10 billion in 2025 and is predicted to be worth around USD 1.62 billion by 2034, at a CAGR of 4.43% from 2025 to 2034.

North America dominates the global point-of-care glucose testing market.This can be attributed primarily to factors such as the region's high diabetes rates, advanced healthcare facilities, and supportive reimbursement policies. The presence of major industry players, along with continuous technological advancements in glucose testing devices, further strengthens North America's position. Moreover, increased awareness among healthcare providers and patients regarding the advantages of point-of-care glucose testing contributes to market expansion in the region.

- In January 2024, Amazon declared its intention to partner with digital health firms to offer virtual care benefits to customers, especially for managing chronic conditions such as diabetes and hypertension. Omada Health, a virtual-first chronic care provider, was revealed as Amazon's inaugural partner in this initiative.

Asia Pacific is expected to witness significant growth in the point-of-care glucose testing market. This growth is driven by factors such as the rising prevalence of diabetes, a large population, increasing healthcare spending, and growing awareness about the importance of glucose monitoring. Additionally, improving economic conditions and healthcare facilities in countries like China and India are key drivers of market expansion. The use of point-of-care glucose testing devices in home settings and the emphasis on preventive healthcare also contribute to market growth in the Asia Pacific region.

Point-of-Care Glucose Testing Market Companies

- Abbott (U.S.)

- Dexcom (U.S.)

- Roche (Switzerland)

- Ascensia Diabetes Care (Switzerland)

- LifeScan (U.S.)

- Medtronic (U.S.)

- Ypsomed (Switzerland)

- Animas (U.S.)

- Insulet (U.S.)

- Bayer (Germany)

- Nipro (Japan)

- Terumo (Japan)

- Arkray (Japan)

- Acon Laboratories (U.S.)

- Freestyle (U.S.)

- One Touch (U.S.)

- Accu-Chek (Germany)

- Dario (U.S.)

- iHealth (China)

- FreeStyle Libre (UK)

Recent Developments

- In July 2024, Insulet announced that it received CE-mark approval for its Omnipod 5 automated insulin delivery system to integrate with Abbott's FreeStyle Libre 2 Plus sensor, enabling seamless continuous glucose monitoring and insulin delivery in a tubeless pump system for users aged two years and above. This integration advances both companies' positions in the diabetes care ecosystem by combining wearable insulin delivery with real-time glucose data at the point of care.(Source: https://www.diabetesinfucare.com)

- In April 2025, Roche Diagnostics announced its plans to strengthen its near-patient glucose monitoring offering by launching a real-time continuous glucose monitoring (CGM) device under its Accu-Chek line, as detailed in its diagnostics-day strategy document, reinforcing its commitment to blended hospital-home glucose care and predictive algorithms to manage hypoglycemia. (Source: https://assets.roche.com)

- In February 2024,Trinity Biotech (TRIB) finalized a conclusive agreement to purchase the biosensor and Continuous Glucose Monitoring (CGM) assets from Waveform Technologies. This strategic acquisition, valued at $12.5 million in cash and 9 million American Depositary Shares (ADSs) of the company, alongside additional considerations, positions Trinity Biotech to innovate diabetes care and upgrade its presence in the biosensor market.

- In July 2023,Avricore Health and Ascensia Diabetes Care revealed a partnership to incorporate blood glucose monitoring into point-of-care testing. The collaboration seeks to integrate the Contour Next-Gen and Contour Next One BGM systems into Avricore's HealthTab PCOT platform.

- In June 2023,the initial locally produced continuous glucose monitoring device was approved by the South Korean Ministry of Food and Drug Safety. I-SENS, the manufacturer of blood glucose devices, introduced CareSens Air, which claimed to be the most compact and lightweight CGM device accessible in South Korea. It can be utilized continuously for 15 days and incorporates a calibration mechanism to enhance the accuracy of readings.

- In January 2022, Roche introduced the Cobas Pulse, a point-of-care blood glucose monitor meant for hospital personnel, along with a companion gadget structured like a touchscreen smartphone that will run its apps. The Cobas pulse will begin shipping to certain European countries with a CE mark.

Segments Covered in the Report

By Product

- Lancing Devices and Strips

- Blood-Glucose Meter

- Type

- Lifescan OneTouch Ultra and Lifescan OneTouch Verio

- Accu-Chek Aviva Plus and Accuchek

- Freestyle Lite and Freestyle Precission Neo

- Contour Next

- Others

- Type

By Application

- Type-1 Diabetes

- Type-2 Diabetes

By End User

- Hospitals and Clinics

- Home Care Settings

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content