What is the Postmenopausal Osteoporosis Treatment Market Size?

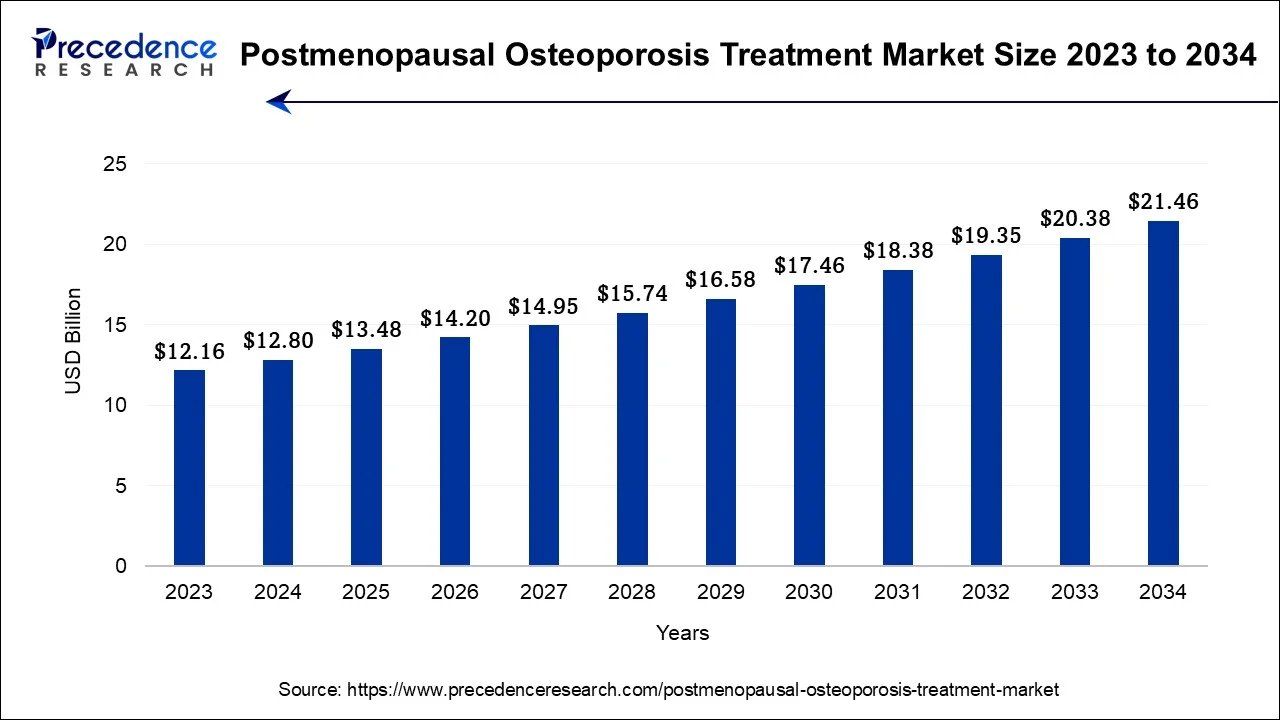

The global postmenopausal osteoporosis treatmentmarket size is calculated at USD 13.48 billion in 2025 and is predicted to increase from USD 14.20 billion in 2026 to approximately USD 21.46 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034.

Postmenopausal Osteoporosis Treatment Market Key Takeaways

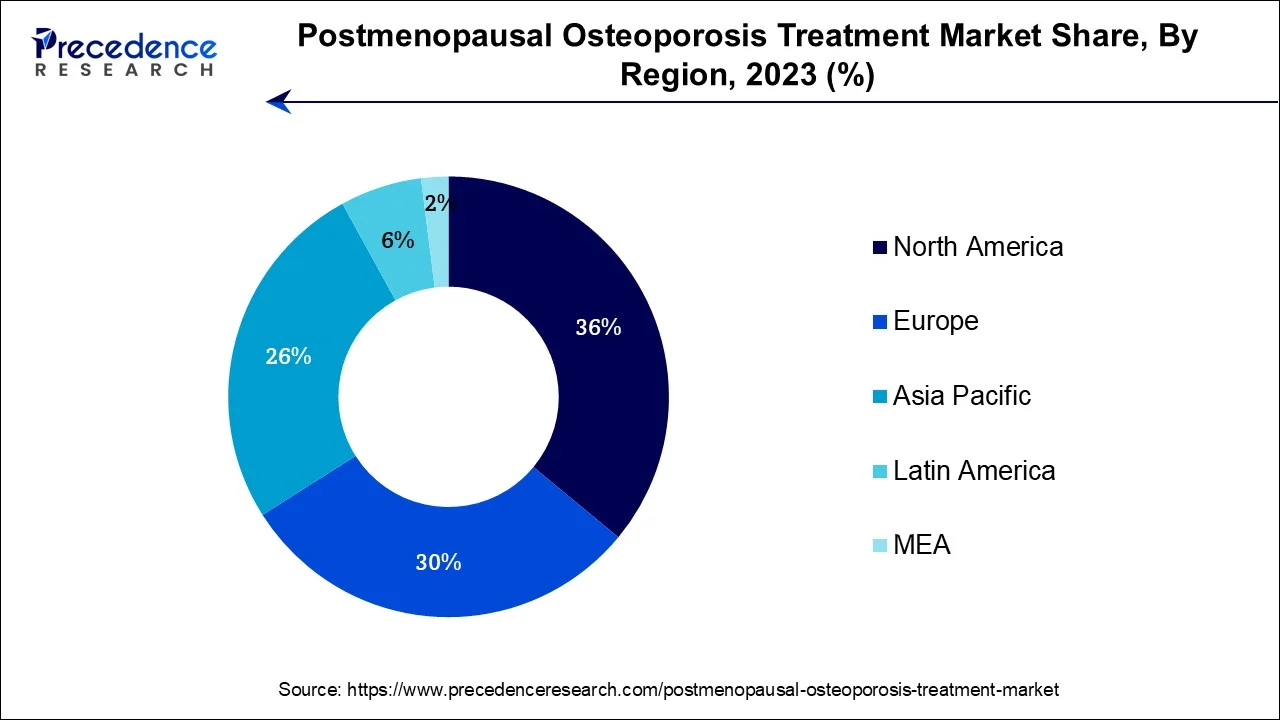

- North America generated more than 36% of revenue share in 2023.

- Asia-Pacific region is expected to expand at the fastest CAGR during the forecast period.

- By Drug Type, the bisphosphonates segment has held the highest market share of 39% in 2023.

- By Drug Type, the hormone replacement therapy (HRT) segment is expected to expand at the fastest CAGR of 8.1% between 2024 and 2034

- By Distribution Channel, the retail pharmacy segment captured more than 39% of revenue share in 2023.

- By Distribution Channel, the hospital pharmacy segment is projected to grow at the fastest CAGR over the projected period.

Market Overview

- The postmenopausal osteoporosis treatment market pertains to the healthcare industry dedicated to offering therapeutic solutions for women who have entered menopause and face the risk of developing fragile bones (osteoporosis). This market encompasses pharmaceuticals, biopharmaceuticals, and medical devices designed to prevent fractures and uphold bone health in postmenopausal women.

- Its essence lies in its increasing demand, propelled by an aging demographic, advancements in treatment techniques, and continuous research endeavors aimed at creating more efficient and precise therapies tailored to this specific patient demographic. Specifically, bisphosphonates, monoclonal antibodies, and hormone replacement therapies are garnering increased attention in the treatment of postmenopausal osteoporosis.

Postmenopausal Osteoporosis Treatment Market Outlook

- Industry Growth Overview:Between 2025 and 2034, the postmenopausal osteoporosis treatment market is set to grow rapidly, driven by healthcare systems' increasing focus on fracture prevention and long-term chronic disease management. Aging populations in regions such as the U.S., Japan, China, and Europe are boosting demand for bone-strengthening treatments, while the rising burden of fragility fractures is placing significant cost pressures on healthcare systems. Additionally, Fracture Liaison Services (FLS) are being integrated into hospitals and specialty clinics, contributing to higher therapy initiation rates and improved patient follow-up, thereby further driving treatment adoption.

- Therapeutic Innovation Trends:Innovation in the market is accelerating as research focuses on molecular-level control of bone metabolism, including pathways like RANKL inhibition, sclerostin suppression, and osteoblast activation. Leading companies such as Amgen and Eli Lilly are developing next-generation biologics that offer less frequent administration, improved safety profiles, and more predictable improvements in bone density. Renowned clinical centers like Mayo Clinic, Cleveland Clinic, and the Karolinska Institute are generating high-quality real-world data that help optimize patient selection and therapy sequencing for anabolic and antiresorptive treatments.

- Global Expansion:The market is expanding globally due to the rising prevalence of osteoporosis in aging populations, increased awareness of fracture prevention, and advancements in biologic therapies that offer more effective and convenient treatment options. Emerging regions, particularly in Asia-Pacific and Latin America, present significant opportunities as healthcare infrastructure improves, aging populations grow, and demand for innovative, accessible treatments to manage osteoporosis and prevent fractures rises.

- Major Investors:Major pharmaceutical companies and institutional investors are increasingly focusing on women's health and musculoskeletal disorders due to the high unmet clinical needs and the reliable long-term revenue potential in these areas. Biologic therapies, with their large-scale and periodic demand, are attracting the strategic interest of industry leaders like Amgen, Sanofi, Johnson & Johnson, Eli Lilly, and Roche, while chronic-care treatment models offer stable returns, sparking private equity interest in expanding manufacturing capacity, biosimilar production, and specialty injectable capabilities.

- Startup & Biotech Ecosystem:The startup and biotech ecosystem supporting osteoporosis treatment is evolving rapidly, driven by innovations in biomaterials, bone biology, peptide engineering, and precision diagnostics. Early-stage companies are exploring novel therapeutic pathways beyond traditional antiresorptive treatments, including biologics that stimulate bone regeneration or target new hormone interactions post-menopause. This expanding innovation ecosystem is not only broadening the range of available treatments but also accelerating translational research aimed at improving women's bone health.

Postmenopausal Osteoporosis Treatment Market Growth Factors

- The postmenopausal osteoporosis treatment market is driven by the aging population, particularly in developed nations. As women advance in age, their susceptibility to osteoporosis rises, resulting in a significant patient base. Furthermore, the increase in healthcare spending and enhanced healthcare accessibility are facilitating early detection and treatment. Additionally, collaborative efforts between pharmaceutical firms and research institutions are reinforcing the market by fostering the creation of innovative treatment approaches.

- One key industry trend involves the rising utilization of biopharmaceuticals and advanced treatment methods. Additionally, technological advancements in diagnostic tools, such as bone density scanning, are aiding in early diagnosis and treatment. Growing investments in research and development for novel therapies and the emergence of precision medicine approaches are also driving market growth.

- Despite the growth prospects, the postmenopausal osteoporosis treatment market faces certain challenges. Patent expirations for some existing medications have led to generic competition, affecting the revenues of pharmaceutical companies. Adherence to treatment regimens remains a challenge for patients, as long-term therapy is often required. Additionally, stringent regulatory requirements and the high cost of developing new drugs pose obstacles to market players.

- There are notable business opportunities within this market. Manufacturers can explore partnerships and collaborations to develop combination therapies or personalized medicine approaches. Targeting emerging markets with unmet medical needs is another avenue for growth. Furthermore, investing in patient education programs to improve treatment adherence can enhance brand loyalty and market share.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.3% |

| Market Size in 2025 | USD 13.48 Billion |

| Market Size in 2026 | USD 14.20 Billion |

| Market Size by 2034 | USD 21.46 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in biopharmaceuticals and combination therapies

The ascent of biopharmaceuticals has notably increased demand in the postmenopausal osteoporosis treatment market through the introduction of innovative, precision therapies. Monoclonal antibodies and other biological agents demonstrate heightened effectiveness and fewer side effects when contrasted with conventional treatments, alluring both patients and healthcare providers to this evolving landscape.

Moreover, combination therapies in the postmenopausal osteoporosis treatment market are driving increased demand by offering a more comprehensive and effective approach to managing the condition. These therapies amalgamate various medications with complementary modes of action, elevating treatment effectiveness while diminishing fracture risks. Both patients and healthcare providers are increasingly acknowledging the advantages of these integrated treatments, resulting in heightened market demand. This surge is propelled by the potential to achieve superior outcomes, mitigate adverse effects, and ultimately enhance the well-being of postmenopausal women vulnerable to complications associated with osteoporosis.

Patient education and adherence initiatives play a pivotal role in boosting market demand for postmenopausal osteoporosis treatment. Increasing awareness about the seriousness of the disease and the importance of timely treatment encourages more patients to seek medical care. This increased demand for treatment, driven by patient education and adherence, enhances the market's growth potential as healthcare providers and pharmaceutical companies prioritize comprehensive patient support programs.

Restraints

Generic competition and limited treatment options

Generic competition can significantly restrain the market demand for postmenopausal osteoporosis treatment. When patents for existing medications expire, generic versions become available at lower prices, reducing the revenues of pharmaceutical companies. This can discourage innovation and investment in new treatments. Patients and healthcare providers may opt for more cost-effective generic options, limiting the market potential for newer, potentially more effective therapies. As a result, the competitive landscape can lead to pricing pressures and slower market growth in the postmenopausal osteoporosis treatment sector.

Moreover, Limited treatment options in the postmenopausal osteoporosis treatment market can restrain market demand by failing to meet the diverse needs of patients. With a one-size-fits-all approach, some individuals may not respond well to available therapies, leading to dissatisfaction and reduced treatment adherence. This limitation underscores the urgent need for more innovative and personalized treatment options to address varying patient profiles effectively. Insufficient treatment choices can result in unmet medical needs and hinder the market's potential for growth and expansion.

Opportunities

Global aging population and collaborative research

The increasing global aging population significantly drives market demand for postmenopausal osteoporosis treatment. As more individuals enter the postmenopausal stage, the prevalence of osteoporosis rises, creating a substantial patient pool. This demographic shift fuels the demand for effective treatments to prevent fractures and maintain bone health. Healthcare providers and pharmaceutical companies are well-positioned to benefit from this expanding market by catering to the distinctive healthcare requirements of the elderly.

Collaborative research initiatives in the postmenopausal osteoporosis treatment market can significantly boost market demand. By bringing together pharmaceutical companies and research institutions, these collaborations accelerate the development of innovative therapies, potentially leading to breakthrough treatments. This fosters competition, increases treatment options, and enhances overall patient care, creating greater demand as patients and healthcare providers seek access to cutting-edge solutions. Additionally, collaborative research can expedite regulatory approvals, ensuring quicker market entry for novel treatments, further stimulating demand in a dynamic and evolving healthcare landscape.

Impact of COVID-19

The COVID-19 pandemic has had a multifaceted impact on the postmenopausal osteoporosis treatment market. Initially, the market faced disruptions as healthcare resources were diverted toward pandemic management, delaying diagnosis and treatment for many osteoporosis patients. Social distancing measures also hindered patient access to healthcare facilities, including bone density scans and consultations, potentially leading to underdiagnosis.

On the supply side, pharmaceutical companies experienced disruptions in production and supply chains, which affected drug availability. These disruptions also impacted clinical trials and research efforts focused on developing new osteoporosis treatments. Healthcare providers and patients have adapted to remote consultations and monitoring, potentially expanding the market's reach and driving demand for innovative therapies.

Segment Insights

Drug Type Insights

According to the drug type, the bisphosphonates segment has held 39% revenue share in 2023. Bisphosphonates, a category of medications employed in treating postmenopausal osteoporosis, work by suppressing bone resorption, ultimately boosting bone density. While bisphosphonates have historically been a fundamental element of osteoporosis treatment, current trends suggest a transition towards more contemporary biopharmaceuticals and precision-targeted therapies. While bisphosphonates remain widely prescribed due to their established efficacy, market trends reveal an increasing preference for innovative treatments with potentially fewer side effects and improved patient outcomes. This shift reflects the ongoing pursuit of more tailored and advanced solutions for postmenopausal osteoporosis.

The hormone replacement therapy (HRT) segment is anticipated to expand at a significantly CAGR of 8.1% during the projected period. This therapy is a pharmaceutical approach employed in the treatment of postmenopausal osteoporosis. It encompasses the introduction of hormones, predominantly estrogen, either alone or in combination with progestin. This therapy serves the purpose of replenishing the hormonal levels that naturally decrease during the menopausal phase. HRT aims to alleviate symptoms like hot flashes and vaginal dryness, as well as to prevent bone loss associated with postmenopausal osteoporosis.

In recent trends, HRT has experienced shifts in usage due to evolving medical guidelines and safety concerns. While it was once commonly prescribed to manage postmenopausal symptoms and prevent osteoporosis, its use has become more selective. The focus is now on personalized medicine, where HRT is considered for those with severe symptoms or high fracture risk. Research continues to refine the dosage and duration of HRT to maximize benefits while minimizing potential risks like breast cancer and cardiovascular issues, reflecting the dynamic landscape of postmenopausal osteoporosis treatment.

Distribution Channel Insights

The retail pharmacy segment held the largest market share of 39% in 2023. Retail pharmacies in the postmenopausal osteoporosis treatment market serve as essential distribution channels, offering patients convenient access to prescribed medications and related products while also playing an increasingly pivotal role in healthcare.

Recent trends in retail pharmacy include a shift towards patient-centric care, integration of e-commerce platforms for online access, the rise of telepharmacy services for virtual consultations, personalized medication packaging for improved adherence, expanded offerings encompassing health and wellness products, close collaboration with healthcare providers to ensure coordinated care, integration of digital health tools for monitoring and support, and the stocking of over-the-counter (OTC) options to provide patients with a wider range of choices for managing osteoporosis. These evolving trends reflect retail pharmacies' commitment to meeting diverse patient needs in the evolving healthcare landscape.

On the other hand, the hospital pharmacy sector is projected to grow at the fastest rate over the projected period. Hospital pharmacies, within the context of the postmenopausal osteoporosis treatment market, serve as integral distribution channels. These pharmacies are healthcare facilities situated within hospitals, responsible for the procurement, storage, and dispensation of osteoporosis medications to both inpatients and outpatients.

Notable trends in hospital pharmacies encompass the establishment of specialized bone clinics for comprehensive osteoporosis management, the integration of clinical decision support systems to optimize medication choices, increased pharmacist involvement in bone health assessments and patient counseling, a focus on medication reconciliation to ensure smooth transitions in care, quality assurance measures to enhance medication safety, the adoption of tele pharmacy services for extended patient access, collaboration with outpatient providers to ensure continuity of care, and the integration of electronic health records to facilitate seamless data sharing and care coordination, collectively contributing to more effective postmenopausal osteoporosis treatment within the hospital setting.

Regional Insights

North America held the largest revenue share 36% in 2023

In North America, the postmenopausal osteoporosis treatment market is characterized by robust research and development efforts, leading to the introduction of advanced therapies. Increasing awareness about bone health, a growing aging population, and improved healthcare infrastructure are driving market growth. Telehealth and digital health solutions are also gaining prominence, facilitating patient access to treatment and monitoring, while ensuring more comprehensive care for postmenopausal osteoporosis.

U.S. Postmenopausal Osteoporosis Treatment Market Analysis

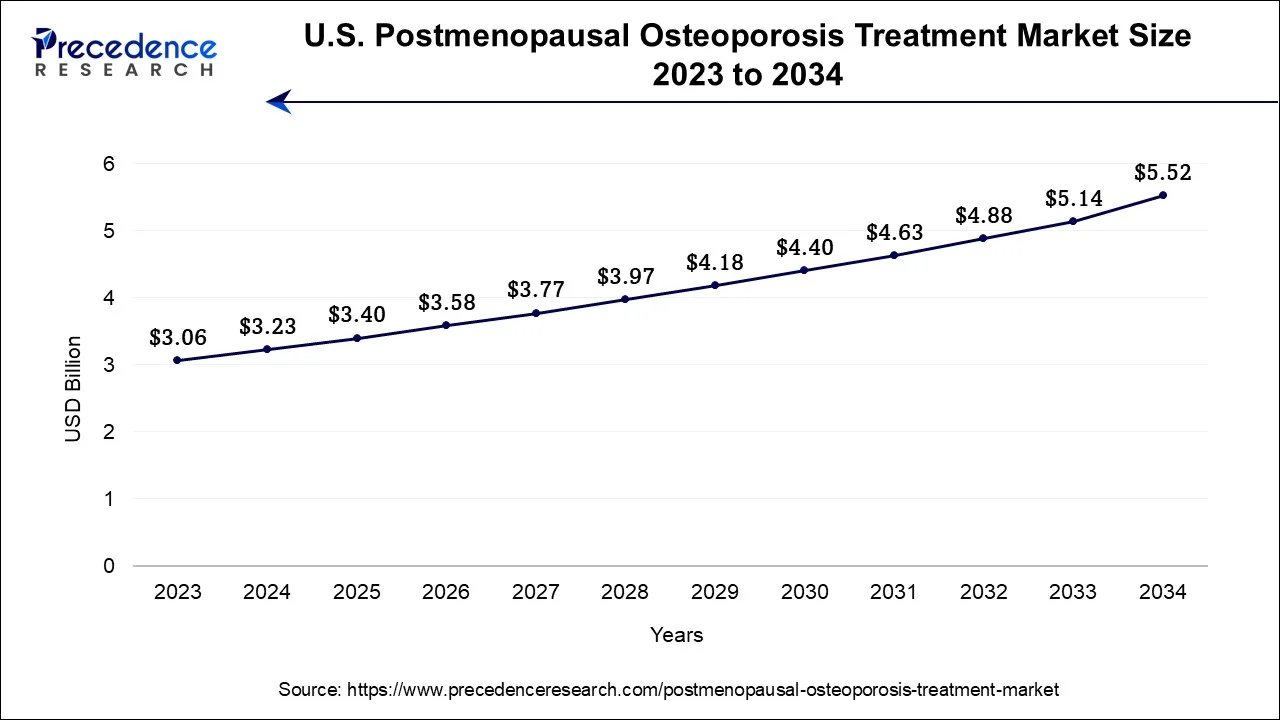

The U.S. postmenopausal osteoporosis treatment market size accounted USD 3.40 billion in 2025 and is estimated to reach around USD 5.52 billion by 2034, growing at a CAGR of 5.50% from 2024 to 2034.The U.S. plays a major role in the North American market due to strong clinical adoption of biologics, widespread availability of DXA screening, and insurance systems that support managing chronic osteoporosis. National organizations like ASBMR, AACE, and NOF provide authoritative guidelines.

This is likely to strengthen the proper sequencing of therapy for high-risk postmenopausal women. Pharmaceutical companies such as Amgen, Eli Lilly, and Pfizer are expected to grow their leadership by investing in new injectables, patient support programs, and education for specialists.

What Makes Asia Pacific the Fastest-Growing Region?

In the Asia-Pacific region, the postmenopausal osteoporosis treatment market is experiencing robust growth driven by the aging population, particularly in countries like Japan and China. Rising healthcare awareness, increased access to medical services, and adoption of advanced therapies are notable trends. Additionally, pharmaceutical companies are focusing on tailored approaches to address genetic and lifestyle factors unique to the region, reflecting a shift towardspersonalized medicine in osteoporosis management.

Japan Postmenopausal Osteoporosis Treatment Market Analysis

Japan is a major contributor to the market in Asia Pacific due to its rapidly aging population, which has led to an increased prevalence of osteoporosis and fragility fractures. The country has a well-developed healthcare system and strong clinical research infrastructure, facilitating access to advanced treatment options and the integration of innovative therapies. Furthermore, Japan's high demand for effective, long-term osteoporosis management, combined with government support for healthcare initiatives, positions it as a key player in the region's growing market.

Why is Europe Considered a Notably Growing Area in the Postmenopausal Osteoporosis Treatment Market?

Europe is expected to experience notable growth in the market due to well-established national osteoporosis programs and high physician adherence to ECTS and IOF clinical guidelines. Germany, France, and the UK are likely to increase their use of biologics and biosimilars as demographic shifts have raised the incidence of patient fractures and hospitalizations. Novartis, Sanofi, Roche, and GSK are expanding their presence through increased distribution and clinical education, contributing to market growth.

Germany Postmenopausal Osteoporosis Treatment Market Analysis

Germany is a major contributor to the market due to its strong healthcare infrastructure, leading pharmaceutical companies, and high level of medical research in bone health. The country's aging population, coupled with its well-established clinical practices and advanced diagnostic tools, drives significant demand for osteoporosis treatments. Additionally, Germany's leadership in medical innovation, including the development of biologic therapies and osteoporosis management programs, positions it as a key player in shaping treatment trends across Europe.

What Potentiates the Growth of the Latin American Postmenopausal Osteoporosis Treatment Market?

The market in Latin America is driven by improved reimbursement structures and growing specialist training in osteoporosis management. It is estimated that medical societies in the region facilitate the dissemination of clinical guidelines, thereby increasing physicians' confidence in using injectable biologics. The growing engagement of academic hospitals with international pharmaceutical firms likely supports high-quality clinical education programs.

Brazil Postmenopausal Osteoporosis Treatment Market Analysis

Brazil leads the market in Latin America due to its large and aging population, which increases the prevalence of osteoporosis and related fractures. The country's growing healthcare infrastructure, rising awareness of bone health, and increasing government and private-sector investments in medical treatments drive demand for osteoporosis therapies. Additionally, Brazil's role as a regional hub for clinical research and pharmaceutical distribution strengthens its position in the Latin American market, offering access to both innovative therapies and broader treatment options.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant opportunities in the market due to healthcare modernization in Gulf countries, increasing access to screening, and a growing focus on managing women's chronic diseases. The countries within the Gulf Cooperation Council (GCC) are expected to see higher treatment adoption as hospitals incorporate specialty endocrinology departments with access to high-quality biologics. Additionally, South Africa and Egypt are expanding the use of DXA scans, enabling earlier detection of severe bone density loss in postmenopausal women.

Saudi Arabia Postmenopausal Osteoporosis Treatment Market Analysis

In Saudi Arabia, the market is growing due to its rapidly aging population and increasing awareness of bone health, which is driving demand for osteoporosis treatments. The country's robust healthcare system, significant government investments in healthcare infrastructure, and growing focus on chronic disease management further bolster the adoption of osteoporosis therapies. Additionally, Saudi Arabia's strategic position as a regional medical hub, combined with its expanding network of specialized clinics and hospitals, enhances accessibility to advanced osteoporosis treatments in the MEA region.

Postmenopausal Osteoporosis Treatment Market Value Chain Analysis

- R&D & Drug Discovery

The value chain begins with intensive clinical research focused on understanding bone-mineral density loss, hormonal changes after menopause, and molecular targets involved in bone formation and resorption.

Key Players: Amgen Inc., Eli Lilly and Company, Novartis International AG, Roche Holding AG. - Active Pharmaceutical Ingredient (API) Development

Biologics, peptides, anabolic agents, bisphosphonates, and monoclonal antibodies are synthesized or cultured under high-purity pharmaceutical standards to ensure efficacy and safety.

Key Players: Teva Pharmaceutical Industries Ltd., Accord Healthcare, Mylan (Viatris), Sun Pharmaceutical Industries Ltd. - Formulation & Drug Manufacturing

APIs are processed into final dosage forms, including injectables, oral tablets, prefilled syringes, and infusion-based therapies, in compliance with global GMP requirements.

Key Players: Pfizer Inc., Johnson & Johnson, Sanofi S.A., GlaxoSmithKline plc. - Packaging & Quality Assurance

Drugs undergo stringent batch testing for potency, sterility, stability, and cold-chain requirements (especially for biologics) before final packaging and labeling.

Key Players: Merck & Co., Inc., Novartis (Sandoz division), Amgen Inc. - Regulatory Approval & Compliance

Companies navigate strict regulatory pathways involving large-scale clinical trials, safety reviews, and post-marketing surveillance for chronic therapies.

Key Bodies (non-market research): FDA, EMA, PMDA, Health Canada.

Industry Players: Roche, Eli Lilly, Amgen, Sanofi. - Distribution & Supply Chain Management

Manufactured treatments are supplied to wholesalers, hospital procurement systems, specialty pharmacies, and global distributors to ensure availability in chronic-care settings.

Key Players: Johnson & Johnson, Pfizer Inc., Teva Pharmaceuticals, Viatris. - Healthcare Provider Administration

Endocrinologists, rheumatologists, gynecologists, and primary-care providers evaluate fracture risk, diagnose osteoporosis, and administer approved treatments.

Key Participants: Mayo Clinic, Cleveland Clinic, Johns Hopkins, and leading hospital networks. - Patient Access, Support & Pharmacovigilance

Manufacturers run adherence programs, patient-support initiatives, insurance coordination, and continuous safety monitoring to ensure long-term treatment outcomes.

Key Players: Amgen (Prolia patient program), Eli Lilly patient support services, Sanofi, and Pfizer pharmacovigilance teams.

Top Companies in the Postmenopausal Osteoporosis Treatment Market & Their Core Offerings

- Amgen Inc.

Amgen remains a dominant force with denosumab-based therapies that target bone resorption and deliver strong fracture-risk reduction supported by extensive clinical evidence. - Eli Lilly and Company

Eli Lilly offers leading anabolic osteoporosis treatments that stimulate new bone formation and are widely used for high-risk postmenopausal women. - Novartis International AG

Novartis contributes to the market through its bisphosphonate heritage and continued development of bone-health therapies via its Sandoz generics and biosimilars division. - Gilead Sciences, Inc.

Gilead supports bone-health research through antiviral therapy safety initiatives, contributing data on bone density management in women with chronic conditions. - Teva Pharmaceutical Industries Ltd.

Teva remains a key supplier of cost-effective osteoporosis generics, particularly bisphosphonates, to improve treatment accessibility in global markets. - Merck & Co., Inc.

Merck maintains a strong footprint with historically significant bisphosphonate innovations and ongoing research in bone-metabolism therapeutics. - Pfizer Inc.

Pfizer strengthens the market with hormone-related and musculoskeletal-focused treatments, plus continued clinical research in women's bone health. - GlaxoSmithKline plc (GSK)

GSK contributes through women's health therapies and long-term clinical data that support bone-density preservation in complex patient populations. - Roche Holding AG

Roche advances the field through biologics and precision-medicine research that intersect oncology, endocrinology, and bone-metabolism pathways. - Johnson & Johnson

Johnson & Johnson influences the space through orthopedic innovation and clinical research that supports fracture healing and skeletal regeneration. - Sanofi S.A.

Sanofi drives progress with metabolic-disease therapeutics and biologic research that align with osteoporosis prevention and chronic disease management. - Actavis Pharma, Inc. (now part of Teva Pharmaceuticals)

Actavis, through Teva, expands global access to affordable osteoporosis generics that support broad adoption in emerging and developed markets. - Sun Pharmaceutical Industries Ltd.

Sun Pharma offers accessible generic bisphosphonates and bone-health medications widely used across Asia, Europe, and North America. - Mylan N.V. (now part of Viatris Inc.)

Viatris delivers a large portfolio of osteoporosis generics and biosimilars that help address treatment affordability and global therapy availability. - Accord Healthcare Limited

Accord Healthcare is a major provider of generic osteoporosis medications, supplying cost-effective bisphosphonates and hormone-related therapies to international markets.

Recent Developments

- In 2022, Chugai Pharmaceutical Co., Ltd., launched Edirol (eldecalcitol) in China after obtaining approval from the China National Medical Products Administration (NMPA) for the treatment of postmenopausal osteoporosis.

- In 2021, The Asia Pacific Consortium on Osteoporosis (APCO) introduced comprehensive pan-Asia Pacific clinical practice standards aimed at screening, diagnosing, and managing osteoporosis. These standards focus on addressing a wide array of high-risk groups within the region.

Segments Covered in the Report:

By Drug Type

- Bisphosphonates

- Vitamin D3

- Estrogen Agonist/Antagonist

- Hormone Replacement Therapy

- Parathyroid Hormone Therapy

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting