Why is the Preclinical and Clinical Trials Market Expanding Rapidly?

The global preclinical and clinical trials market is expanding as pharmaceutical and biotech companies accelerate drug development and invest in advanced testing solutions.The market is expanding rapidly due to the impending threat of antibiotic-resistant pathogens, a rapid shift towards outsourcing, the active presence of biotechnology and pharmaceutical companies for R&D to develop new drugs, and supportive government regulations.

Market Highlights

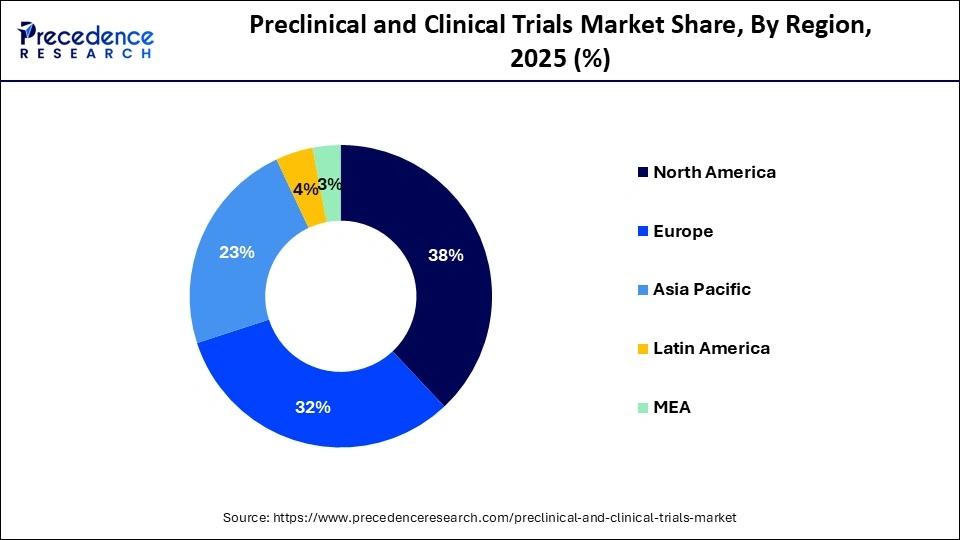

- North America held the largest market share of 38% in 2025.

- The Asia Pacific is projected to grow at a solid CAGR from 2026 to 2035.

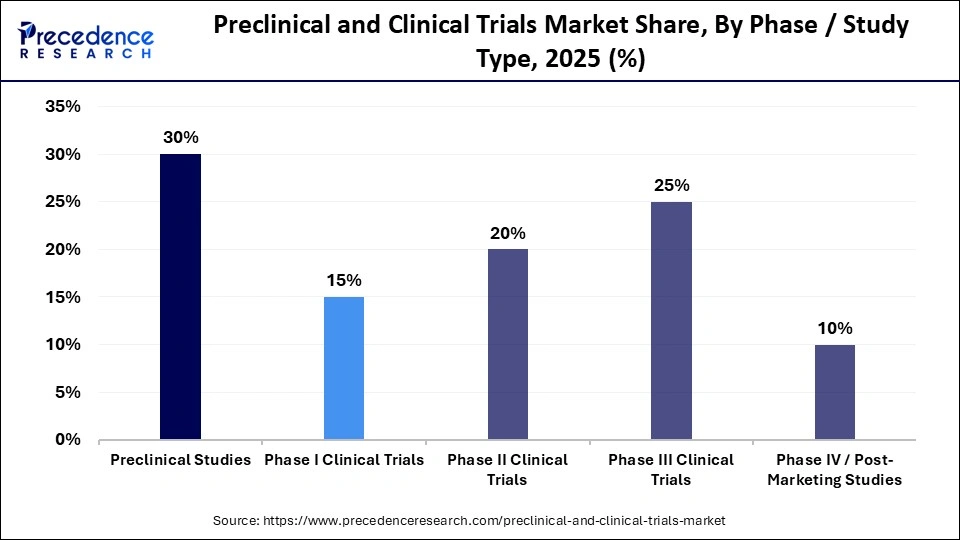

- By phase/study type, the preclinical studies segment held the largest market share of 30% in 2025.

- By phase/study type, the Phase II clinical trials segment is expected to grow at a notable CAGR from 2026 to 2035.

- By therapeutic area, the oncology segment contributed the biggest market share of 40% in 2025.

- By therapeutic area, the rare/orphan disease is expanding at a strong CAGR from 2026 to 2035.

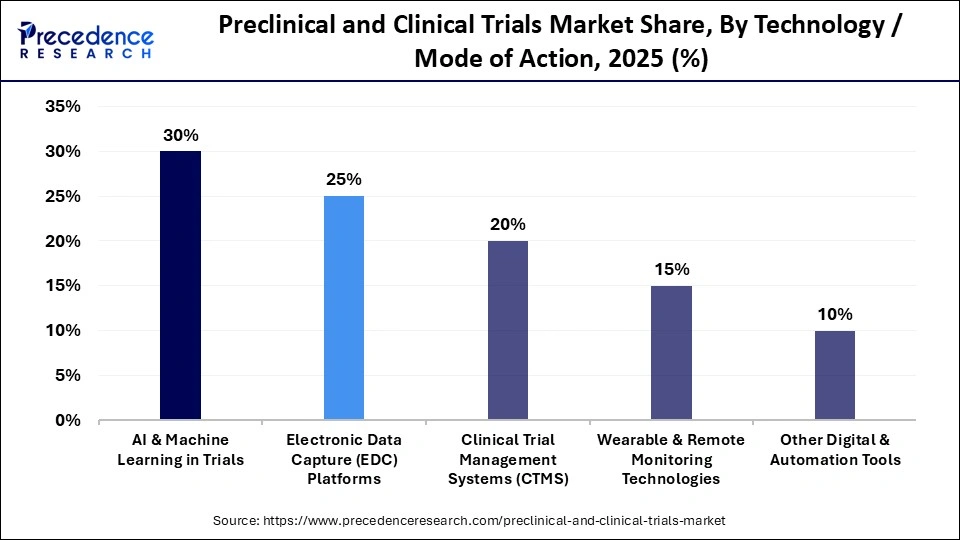

- By technology/mode of action, the electronic data capture platforms segment captured the highest market share of 25% in 2025.

- By technology/mode of action, the AI & machine learning in trials segment is growing at a CAGR of 30% from 2026 to 2035.

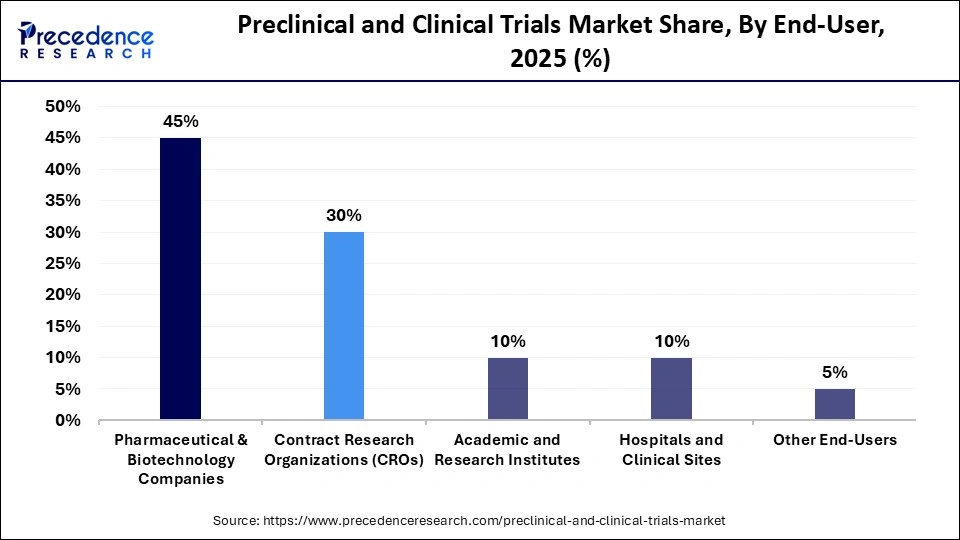

- By end-user, the pharmaceutical & biotechnology companies held the largest market share of 45% in 2025.

- By end-user, the contract research organization segment is poised to grow at a CAGR of 30% from 2026 to 2035.

Evolving Landscape of Preclinical and Clinical Trials

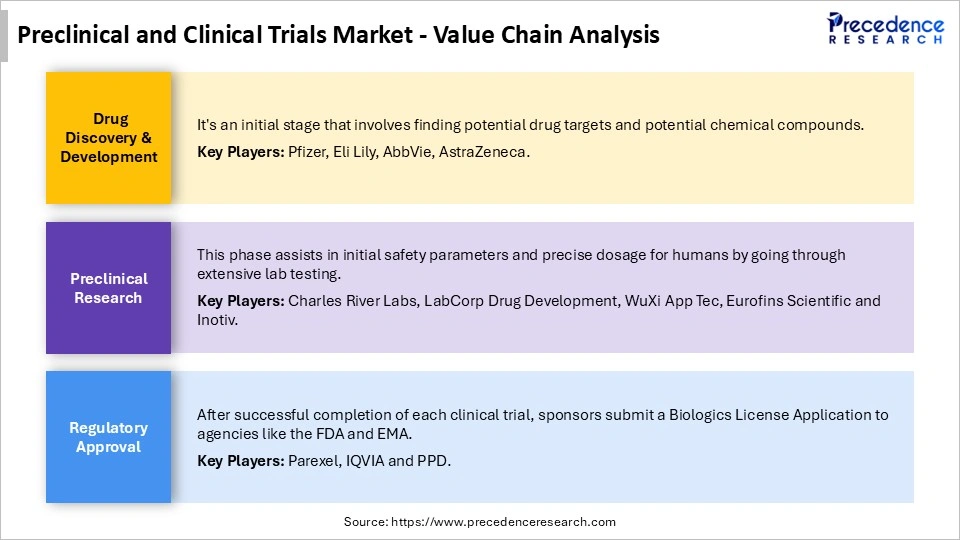

The preclinical and clinical trials market refers to the global industry that supports every stage of drug development, beginning with laboratory-based discovery studies and extending through phased human trials. The market includes a wide range of services and technologies used to evaluate safety, efficacy, dosing, and long-term performance of new therapeutics. Preclinical testing covers both in vitro and in vivo studies that examine toxicity, pharmacokinetics, target engagement, and disease model response. These studies generate the data packages required for regulatory submissions such as Investigational New Drug applications in the United States and Clinical Trial Applications in the European Union.

Clinical development spans Phase I to Phase IV trials. Phase I studies assess safety and tolerability in small groups of volunteers, while Phase II trials evaluate therapeutic activity and early efficacy signals. Large-scale Phase III trials confirm safety and efficacy in broader patient populations, and Phase IV post-marketing surveillance monitors long-term outcomes, rare adverse events, and real-world effectiveness.

The market also includes patient recruitment services, site management, trial monitoring, pharmacovigilance programs, and regulatory consulting to support compliance with agencies such as the FDA, EMA, and national drug authorities. Advanced digital platforms are now essential to this market. Electronic data capture systems, remote monitoring tools, electronic patient-reported outcome systems, and clinical trial management platforms support real-time data collection and centralized oversight.

AI Shifts in Preclinical and Clinical Trials Market

The integration of AI with the preclinical and clinical trials market is transforming the market on a large scale by speeding up drug discovery, making trials highly efficient, and focusing on developing more patient-centric solutions. Experts predict that the AI healthcare market will witness a huge growth of nearly 40% annually, along with clinical trials and AI integration.

A key benefit of AI in clinical trials includes accelerating drug development, reducing clinical trial costs, enhancing data quality, developing personalized treatments, and offering real-time expertise for smart trials. AI can handle time-consuming tasks like finding trial participants, safety data tracking and management of workflow which allows researchers to focus more on identifying new compounds quickly and planning maximum trial design within a shorter time frame.

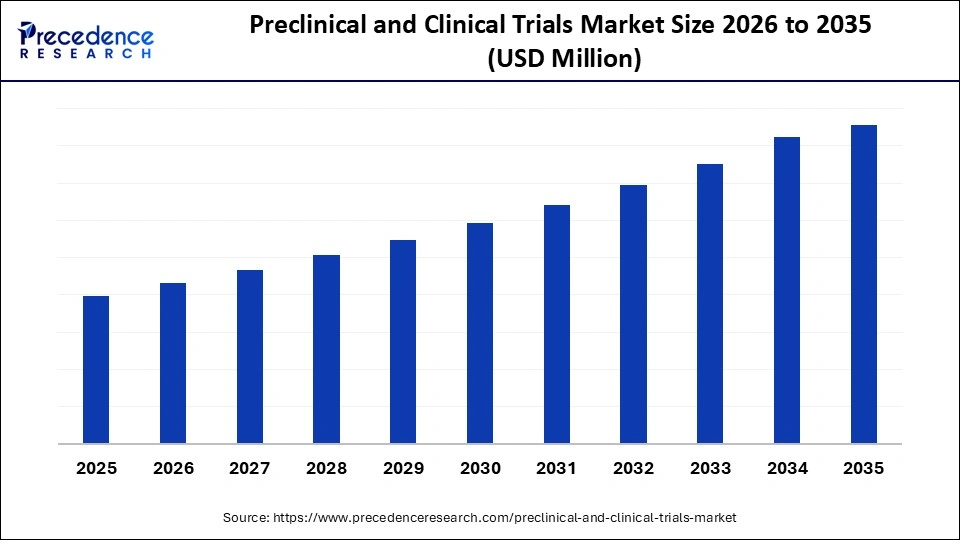

Preclinical and Clinical Trials Market Outlook

The preclinical and clinical trials market is growing due to the increasing need for new drug development to curb the increasing chronic diseases across the globe, and huge government funding for R&D in the life sciences sector. In the last few years, the future of clinical trials has been transforming rapidly due to trends like decentralized trials, real-world evidence, and technology integration, along with an emphasis on patient-centric methods for trials.

The sustainability trends include several factors, like sustainable manufacturing and green chemistry, energy-efficient facilities, proper waste management without toxic release, and climate risk management. Pharmaceutical manufacturing is resource-intensive and complex chemically as well. Hence, companies are adopting ‘green chemistry' where techniques are used to minimize toxic solvent use, support biodegradability, and completely eliminate toxic byproducts.

Major investors in the preclinical and clinical trials market encompass leading venture capital firms such as ARCH Venture Partners, Orbimed, and Third Rock Ventures, along with the pharmaceutical giants like Pfizer Ventures, NoVo Holding, and Sanofi Ventures. These firms are primarily focused on working on groundbreaking science and establishing start-ups to gain significant operational support from an early stage.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Phase/Study Type, Therapeutic Area, Technology/Mode of Action, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Preclinical and Clinical Trials Market Segmental Insights

Phase/Study Type Insights

Preclinical Studies: The preclinical studies segment held the largest market share of 30% in 2025. This dominance is driven by the foundational role preclinical research plays in every drug development program. Preclinical studies generate the first regulatory-required evidence on safety, toxicity, pharmacokinetics, and pharmacodynamics before a compound can progress to human testing. Regulatory agencies such as the U.S. FDA and the European Medicines Agency require a full package of data from in vitro and in vivo models before approving an Investigational New Drug submission or a Clinical Trial Application. These requirements make preclinical work one of the most resource-intensive and scientifically critical phases of development.

Phase II Clinical Trials: The Phase II clinical trials segment is projected to grow at a 20% CAGR over the foreseeable period. This growth reflects the rising investment in targeted and precision therapies, particularly in oncology, immunology, and rare diseases, where mechanism-specific candidates require detailed mid-stage efficacy evaluations. Phase II trials serve as the primary decision point for whether or not to progress a drug into larger scale, costlier Phase III studies. As a result of this, pharmaceutical and biotechnology companies allocate significant resources to Phase II program design, biomarker development, adaptive trial structures, and patient stratification strategies. The segment benefits from the high volume of drug candidates transitioning out of Phase I safety studies. Over the past decade, the number of oncology agents entering Phase II has increased steadily, supported by advances in genomic profiling and companion diagnostics that improve patient selection.

Therapeutic Area Insights

Oncology: The segment held the largest market share in 2025, at 40%. The segment is dominating due to the confluence of high disease burden, especially of cancer, unfulfilled demand for better treatment, extensive preclinical models like PDX and organs-on-a-chip, and regulatory incentives in the form of programs like therapy designation and orphan drug development. The possibility of a huge return on investment in successful drug development for cancer has made it a highly anticipated area for exploration.

Rare / Orphan Diseases: The rare and orphan disease segment is projected to grow at a 10% CAGR over the foreseeable period, driven by major advancements in genomics, molecular diagnostics, and precision medicine, which allow developers to identify disease-causing mutations and design highly targeted therapies. Next-generation sequencing technologies, widely adopted after 2010, have enabled rapid gene discovery and expanded the number of actionable targets across neuromuscular, metabolic, and immunological disorders. These tools support the development of gene therapies, antisense oligonucleotides, and other modality-specific treatments that are well-suited for small patient populations.

Technology Insights

Electronic Data Capture (EDC) Platforms: The electronic data capture platforms segment held the largest market share of 25% in 2025. The segment is dominating as the electronic data capture system has now become an integral part of the modern clinical trials, with global digitization and digitalization of patient records, doctors' notes, and online test results. It streamlines data gathering, improving trial quality while ensuring regulatory compliance. EDC platforms are highly valuable assets for transforming clinical trials through technologies such as AI, blockchain, and predictive analytics.

AI & Machine Learning in Trials: The AI and machine learning segment is projected to grow at the highest CAGR during the foreseeable period. Growth is driven by the acceleration of drug development workflows enabled by artificial intelligence and machine learning, which drastically shorten timelines, improve data quality, and increase the probability of clinical success. AI systems are now used across protocol design, patient stratification, site selection, safety signal detection, and adaptive trial decision making. These tools allow sponsors to analyse large volumes of clinical, genomic, imaging, and real-world data at speeds not achievable with conventional statistical methods.

End User Insights

Pharmaceutical & Biotechnology: The pharmaceutical & biotechnology companies held the largest share, 45%, of the preclinical and clinical trials market in 2025. The segment is dominating, as these sectors are vital to drug development and need to expedite breakthroughs through clinical trials to sustain in evolving areas of life science and the healthcare domain. The increasing demand for novel therapies to address unmet needs in the pharmaceutical sector, driven by the explosion of chronic diseases and cutting-edge biotechnology platforms such as mRNA, is a leading factor in market growth.

Contract Research Organizations (CROs): The contract research organization segment is projected to grow at a strong CAGR during the foreseeable period. The expansion is driven by the increasing reliance of pharmaceutical and biotechnology companies on CROs to manage preclinical studies, clinical trials, regulatory documentation, and global site operations. CROs can begin work immediately upon contract confirmation because they maintain pre-established infrastructure, trained staff, validated processes, and accredited laboratory systems. This operational readiness allows sponsors to accelerate early development timelines and avoid delays associated with building internal capacity.

Preclinical and Clinical Trials MarketRegional Insights

North America held the largest market share in 2025. The region is dominating due to the well-established infrastructure that supports advanced technological capacities for healthcare applications, a highly skilled workforce, and rapid adoption of new technologies in preclinical and clinical trials by recognizing its unmatched benefits. The region further emphasizes strong regulatory compliance while using cutting-edge technologies by focusing on efficiency and safety at the same time, and has further created a conducive environment for drug development.

Leading pharmaceutical and biotechnology companies are leveraging industry innovation aiming to shorten periods of clinical trials and improve trial outcomes. Patient recruitment, data management and trial roadmaps have been created with the help of technologies like AI/ML and blockchain are further changing the market's growth trajectory in the region.

The region is witnessing major trends for preclinical and clinical trials market that include pervasive AI integration for design, decentralized hybrid models, along with the patient's patient-centricity. Strict FDA rules with CROs handling early safety standards are a major driving factor for the region's growth. As per the sources, in 2023, the biopharmaceutical industry solely sponsored nearly 5,300 clinical trials of medicines in the U.S., along with 900,000 participants.

The Asia Pacific region is projected to grow at a CAGR of 30% during the foreseeable period. This rapid expansion reflects the region's position as one of the most active clinical trial hubs globally. Countries such as China, India, South Korea, Japan, Australia, and Singapore consistently register a high volume of clinical trials on platforms such as ClinicalTrials.gov and regional registries, indicating strong adoption rates across therapeutic areas.

China, for example, saw a surge in registered interventional studies after the National Medical Products Administration (NMPA) regulatory reforms in 2017, which streamlined approval timelines and encouraged foreign sponsors to initiate trials locally. India experienced similar momentum following updates to its New Drugs and Clinical Trials Rules in 2019, which simplified ethics committee operations and strengthened patient protections.

China Preclinical and Clinical Trials Market Analysis

China is witnessing a robust growth rate in the Preclinical and clinical trials market, owing to the explosive population with chronic disease burden and the government's supportive policies, positioning it as a global hub for drug discovery and development.

Additionally, domestic enterprises like Huahai and Zhejiang Hisun are actively working in preclinical trials. China has over 29,000 hospitals and 1 million plus independent clinics that offer various services like top academic medical centers.

The region is notably growing due to several leading factors like increasing research and development activities in Europe to ease the disease burden, which translates into the growing demand for an effective drug development process, along with the region's supportive pharmaceutical sector that is backed by government policies and regulatory frameworks supporting preclinical and clinical trials frequency in the region.

Moreover, the market's expansion is fueled by the growing rate of outsourcing of preclinical services, mainly by the biotechnology and pharmaceutical sectors, as many companies are looking for cost-effective solutions. Technological innovations like AI-powered research and highly advanced in vivo models are fueling the market's growth on a notable scale.

UK Preclinical and Clinical Trials Market Analysis

The UK region is mainly fueled by a strong pharmaceutical sector and government initiatives for innovation in the life science and biotechnology sectors. The country boasts an expertise in biomedical research, and well-developed regulatory bodies are attracting global investors. Strategic collaborations and partnerships between the academic sector and industry are further accelerating the market's growth in the UK.

The Middle East and Africa are notably growing in the preclinical and clinical trials market owing to rising research and development activity, increasing prevalence of chronic diseases, supportive regulatory reforms, and expanding collaboration between local companies and international pharmaceutical enterprises. Growth is strongest in GCC countries that have built structured research ecosystems and adopted modern regulatory pathways to attract global sponsors.

For example, the United Arab Emirates strengthened its clinical research capacity through the MOHAP Clinical Trials Guidelines issued in 2020, enabling faster approvals and clearer requirements for trial conduct. Abu Dhabi's Health Research and Technology Hub, launched in 2021 by the Department of Health, supports Phase I to Phase III studies across oncology, rare diseases, and metabolic disorders. Saudi Arabia is also emerging as a regional leader. The Saudi Food and Drug Authority (SFDA) implemented its Clinical Trials Regulation in 2019, which formalized oversight mechanisms and promoted local participation in multinational studies.

UAE Preclinical and Clinical Trials of Market Trends

The UAE is experiencing a notable growth rate in the preclinical and clinical trials market, supported by coordinated national strategies and expanding research infrastructure. A major driver is the National Strategy for Clinical Research, strengthened through directives issued by the UAE Ministry of Health and Prevention in 2020, which established standardized procedures for trial approval, ethics review, data governance, and international collaboration. These guidelines created a predictable regulatory environment that global sponsors recognize as suitable for Phase I to Phase III clinical development.

The region's rising burden of chronic diseases also contributes to increased trial activity. Cancer rates in the UAE have been rising steadily over the past decade, and oncology now accounts for a large share of trials conducted at major institutions such as Cleveland Clinic Abu Dhabi, Sheikh Shakhbout Medical City, and Tawam Hospital, all of which host early- and late-phase interventional studies linked to precision oncology initiatives.

Preclinical and Clinical Trials Market Value Chain

Top Companies in Preclinical and Clinical Trials Market & their Offerings

- IQVIA

- LabCorp Drug Development (Covance)

- Charles River Laboratories

- ICON plc

- Parexel International

- PPD, Inc. (Thermo Fisher)

- Syneos Health

- Medpace

- WuXi AppTec

- PRA Health Sciences

- Pharmaceutical Product Development, LLC

- SGS Life Sciences

- Eurofins Scientific

- Pharmaron

- Celerion

- Envigo

- BioReliance (Merck KGaA)

- KCR Group

- Frontage Laboratories

- Medpace Holdings

Recent Developments

- In April 2025, Atsena Therapeutics, a leading pharmaceutical company, well known for its working on gene therapies for inherited retinal diseases, secured a $150 million oversubscribed series of C financing. This therapy is currently in phase I/II clinical trials.(Source: https://www.fightingblindness.org)

- In November 2025, Oxford has joined a national initiative with funding of 15.9 million euros, aiming to transform through the development of highly advanced human tissue models, where the project will use samples of live human tumors to improve preclinical research and its precision.(Source: https://www.ox.ac.uk)

Preclinical and Clinical Trials MarketSegments Covered in the Report

By Phase/Study Type

- Preclinical Studies

- In vitro studies

- In vivo studies

- Phase I Clinical Trials

- Safety and dosage studies

- Pharmacokinetics/Pharmacodynamics

- Phase II Clinical Trials

- Efficacy studies

- Dose optimization

- Phase III Clinical Trials

- Large-scale efficacy studies

- Comparative studies

- Phase IV/Post-Marketing Studies

- Real-world evidence

- Long-term safety monitoring

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- Neurological Disorders

- Metabolic & Endocrine Disorders

- Rare/Orphan Diseases

- Other Therapeutic Areas

By Technology/Mode of Action

- AI & Machine Learning in Trials

- Electronic Data Capture (EDC) Platforms

- Clinical Trial Management Systems (CTMS)

- Wearable & Remote Monitoring Technologies

- Other Digital & Automation Tools

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Hospitals & Clinical Sites

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content