Cell Expansion Market Revenue, Top Companies, Report 2033

Cell Expansion Market Revenue and Opportunity

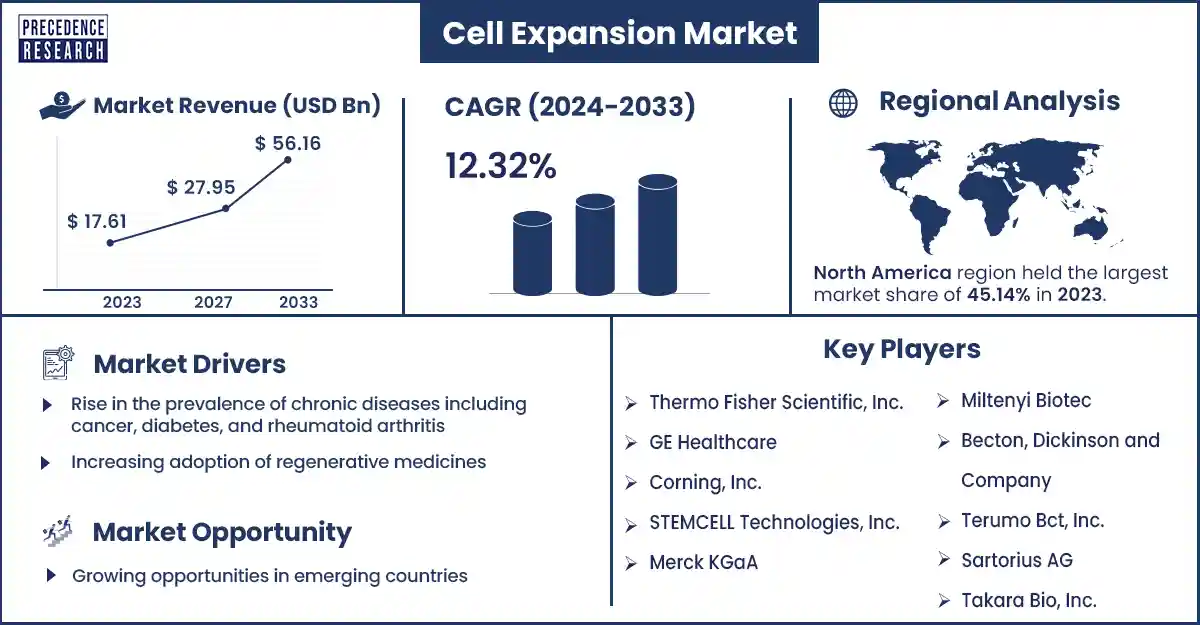

The global cell expansion market revenue was valued at USD 17.61 billion in 2023 and is poised to grow from USD 19.74 billion in 2024 to USD 56.16 billion by 2033, at a CAGR of 12.32% during the forecast period 2024 - 2033. The rising prevalence of chronic diseases such as osteoarthritis, diabetes, and cancer is attributed to the accelerating growth of the cell expansion market.

Market Overview

Cell expansion is the artificial production of large-scale daughter cells from an individual cell to support clinical research. Cell expansion controls the loosening of the wall and requires the synthesis of new cell wall material to enable it to increase and stretch in the area. Cell expansion is utilized in life science and is associated with drug development, drug screening, and research and development activities.

The rising research and development activities in the sector of cell biology, rising technological advancements, especially in the 3D bioprinting technology for cell expansion, and the utilization of automated systems are expected to drive the growth of the market. In addition, the increasing number of over-aged, growing investment and financing in regenerative medicines, increasing demand for cell expansion technologies, and rising collaborations and alliances are expected to drive market growth. In addition, increasing government initiatives and support are further anticipated to accelerate the growth of the cell expansion market.

Rising technological advancements in bioprocessing to fuel market growth

Advanced technologies such as perfusion culture systems, microcarrier-based systems, and single-use bioreactors are playing an important role in surging the efficiency of cell growth processes and enabling the development of a large number of cells while retaining favorable features. Technological advancements in automation and bioprocessing are driving the market of cell expansion, with vital implications for regenerative medicine and cell therapy. In addition, the increasing investments for cell expansion development and research are critical to enhancing innovation, advancing regenerative medicine progress, and pushing advances in cell-based therapeutics. Furthermore, increasing government funding for technological advancements and research and development activities is helping to improve cell expansion. These are the major driving factors estimated to accelerate the growth of the cell expansion market during the forecast period.

However, ethical concerns related to cell biology may restrain the growth of the market. The use of embryonic stem cells is the major concern that creates ethical concerns about the disturbance of human embryos. This has led to challenges in using embryonic stem cells in various countries and restraining their availability for therapeutic and research. The sourcing of cells is another concern for Ethical. Adult stem cell extraction often includes invasive procedures and creates concerns about safety and patient consent due to offering an ethical alternative to embryonic stem cells. In addition, there are potential risks and ethical considerations to both the environment and the patients. Hence, ethical concerns related to cell biology impact the market negatively and challenge the growth of the cell expansion market.

Cell Expansion Market Report Scope

| Report Coverage | Details |

| Cell Expansion Market Revenue in 2024 | USD 19.74 Billion |

| Projected Forecast Revenue by 2033 | USD 56.16 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cell Expansion Market Top Companies

- Takara Bio, Inc.

- Amsbio

- Sartorius AG

- Terumo Bct, Inc.

- Becton, Dickinson, and Company

- Miltenyi Biotec

- Merck KGaA

- STEMCELL Technologies, Inc.

- Corning, Inc.

- GE Healthcare

- Thermo Fisher Scientific, Inc.

Recent Innovation in the Cell Expansion Market by Amsbio

- In April 2024, Amsbio, the biotechnology company, launched a developed GMP-complaint version of chemically defined and animal-origin-free StemFit iPSC expansion medium. This product is produced to improve the pluripotency and growth of induced stem cells. This product offered superior iPSC maintenance, expansion, and long-term genetic stability performance.

Recent Innovation in Cell Expansion Market by Thermo Fisher Scientific, Inc.

- In April 2024, the world leader in serving science, Thermo Fisher Scientific, Inc., launched a novel animal origin-free formulation, Gibco CTS OpTmizer One Serum-Free Medium. This formulation is specially designed for commercial and clinical cell therapy production to deliver an increased performance and scalability of T-cell expansion. Due to this, cell therapy producers can optimize CTS OpTmizer One SFM to help of get T cell therapies to patients faster.

Regional Insights

Asia Pacific is expected to grow fastest during the forecast period. The increasing efforts made by several local biotechnology and pharmaceutical companies to promote and develop their cellular therapies are expected to drive the growth of the cell expansion market in Asia Pacific. India, China, Japan, and South Korea are the major leading companies in the Asia Pacific region. In China, there is an increasing prevalence of chronic diseases such as diabetes, cancer, and other disorders. The use of CAR T-cell therapies has increased rapidly in China over the past few years. The increasing unique healthcare system, large patient demand, capital flow, strong government support, and the efforts of Chinese scientists and physicians are predicted to enhance the growth of the cell expansion market.

In India, various well-developed biotechnology companies are improving or developing cell expansion.

- For instance, in April 2024, India’s manufacturing company and Norway’s cleantech company collaborated for fuel cell expansion in other South Asian Association and India for Regional Cooperation (SAARC) countries. In addition, the joint venture received the exclusive rights to commercialize, manufacture, and develop TECO 2023 fuel cell expansion technology for SAARC countries and the Indian market.

North America dominated the cell expansion market in 2024. The increasing government investment initiatives that have enhanced the development of cellular therapy products and regenerative medicine, the production of stem cells in the region, and increasing significant spending on research and development activities are anticipated to enhance the growth of the market in North America, U.S., and Canada are the major countries in North America.

- For instance, in September 2023, in the U.S., a pharmaceutical company, Merck, launched its existing cell culture media production facility. This advanced facility was the largest center of excellence and dry powder cell culture media facility for Merck in North America. The expansion supported the company in addressing existing demand and ensuring a robust supply for future requirements.

Market Potential and Growth Opportunity

Growing opportunities in emerging countries

Developing economies such as India, China, the U.S., Canada, and Japan are estimated to show potential growth opportunities for market players operating in the market enhanced by factors such as rising government support, expansion of market key players, rising technological advancements, growing biopharmaceutical sector, expanding manufacturing capabilities and rising healthcare spendings. The major market players contribute to improving access to quality healthcare products and expanding their existence in developing countries across the world by adopting these opportunities. These are the major opportunities expected to accelerate the growth of the cell expansion market in the near future.

Cell Expansion Market News

- In January 2024, an Israel-based biotech company, Pluri, launched PluriCDMO, a new business division. This new division offered cell therapy manufacturing solutions as a manufacturing organization and contract development (CDMO). The advanced division involves a production facility of 47,000-ft2 good manufacturing practice cell therapy.

- In January 2024, in India, for the extensive network of Bone Marrow Transplant centers in Bangalore, Mumbai, Noida, Gurgaon, Delhi, and Mohali, a private health group, Fortis launched CAT-T cell therapy. This therapy is supported by a commercial partnership with ImmunoACT, commercially approved gene-modified cell therapy, and an IIT-Bombay spin-off.

Market Segmentation

By Product

- Consumables

- Reagents, Media, & Serum

- Other Consumables

- Culture Flasks and Accessories

- Tissue Culture Flasks

- Other Culture Flasks and Accessories

- Instruments

- Automated Cell Expansion Systems

- Bioreactors

- Other Instruments

By Cell Type

- Mammalian

- Human

- Animal

- Others

By Application

- Biopharmaceuticals

- Tissue Culture & Engineering

- Vaccine Production

- Drug Development

- Gene Therapy

- Cancer Research

- Stem Cell Research

- Others

By End-Use

- Biopharmaceutical & Biotechnology Companies

- Research Institutes

- Cell Banks

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2795

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308