Cell ExpansionMarket Size and Forecast 2025 to 2034

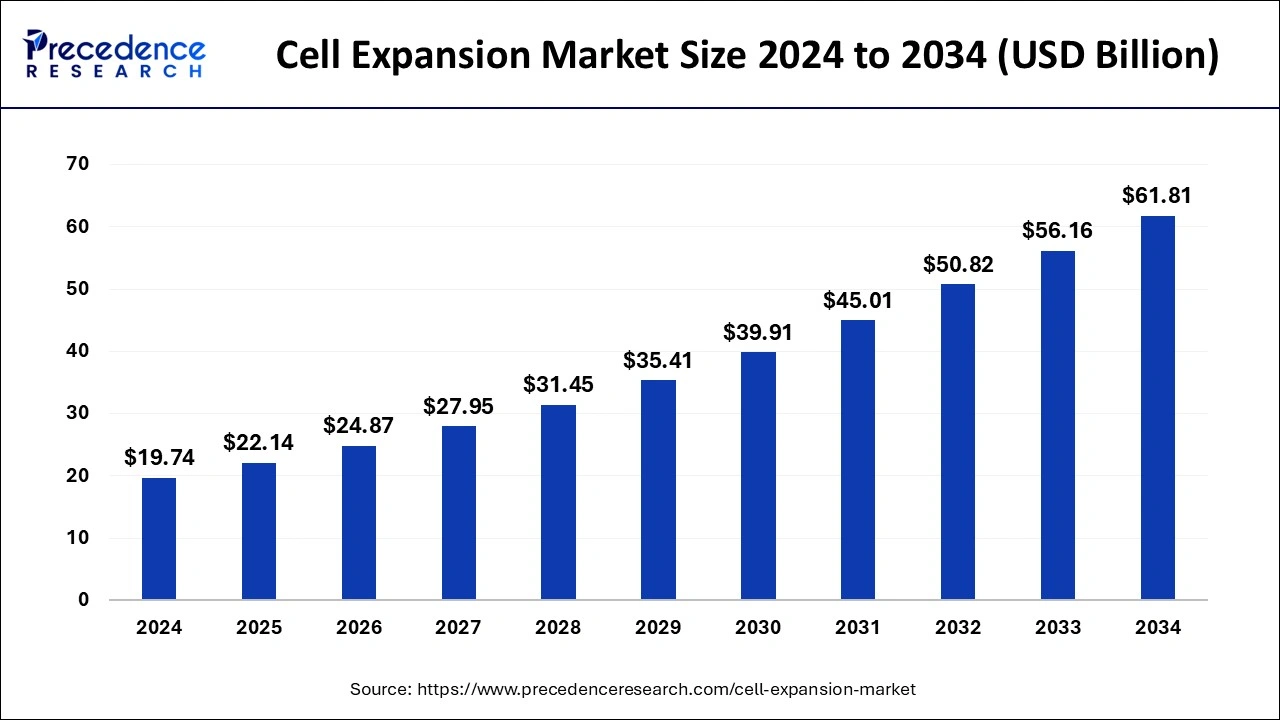

The global cell expansion market size was calculated for USD 19.74 billion in 2024 and is expected to exceed around USD 61.81 billion by 2034, growing at a CAGR of 12.09% from 2025 to 2034. The cell expansion market growth is driven by the basic need of a living organism to grow, develop and reproduce. This offers to repair the damaged cells for a better living.

Cell Expansion Market Key Takeaways

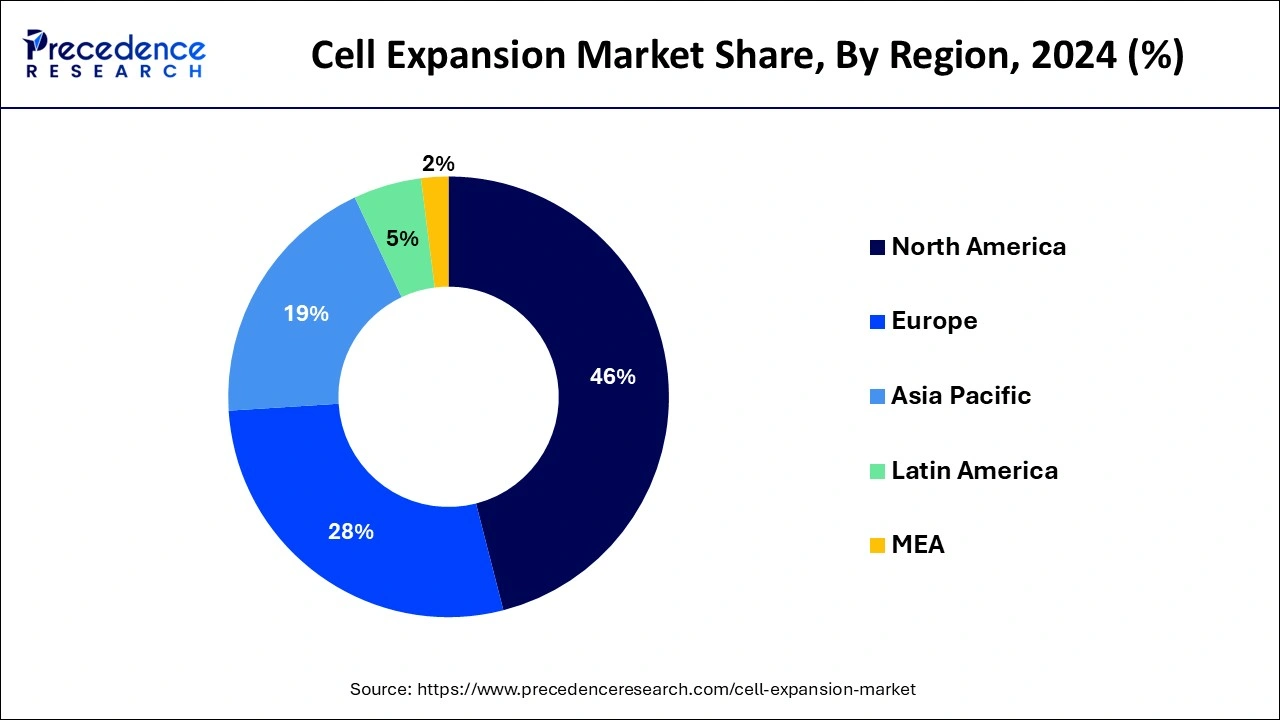

- North America region generated the largest market share of around 45.14% in 2024.

- By Product, the consumables segment captured the largest revenue share in 2024.

- By Product, the mammalian cells type segment contributed to the maximum revenue share in 2024.

- By Application, the biopharmaceutical segment recorded the greatest revenue share in 2024.

- By End-use, the biopharmaceutical and biotechnology companies segment generated the biggest share of around 52% in 2024.

How is Artificial Intelligence (AI) Changing the Cell Expansion Market?

Integration of artificial intelligence into cell expansion offers identifying and counting divided cells or mitotic figures, in order to help assess cancer and other medical conditions. Scientists are constantly developing cutting-edge artificial intelligence tools tailored to help grade cancer by analysing cell division. An AI tool enhances the current established standard of care for grading various cancers by identifying dividing cancer cells. An elevated count of divided cells is a clear indication of a highly aggressive tumour. Incorporation of tools such as MitPro, a next-generation AI solution is capable of counting these dividing cells accurately which helps in patient care and management.

- In January 2025, Illumina and Nvidia launched an AI-based genomics Partnership. Next-generation sequencing leader joins micro processing giant to apply genomics and AI technologies toward drug discovery, clinical research, and human health. Illumina will offer its DRAGEN analysis software on Nvidia's accelerated computing platforms.

U.S. Cell Expansion Market Market Size and Growth 2025 to 2034

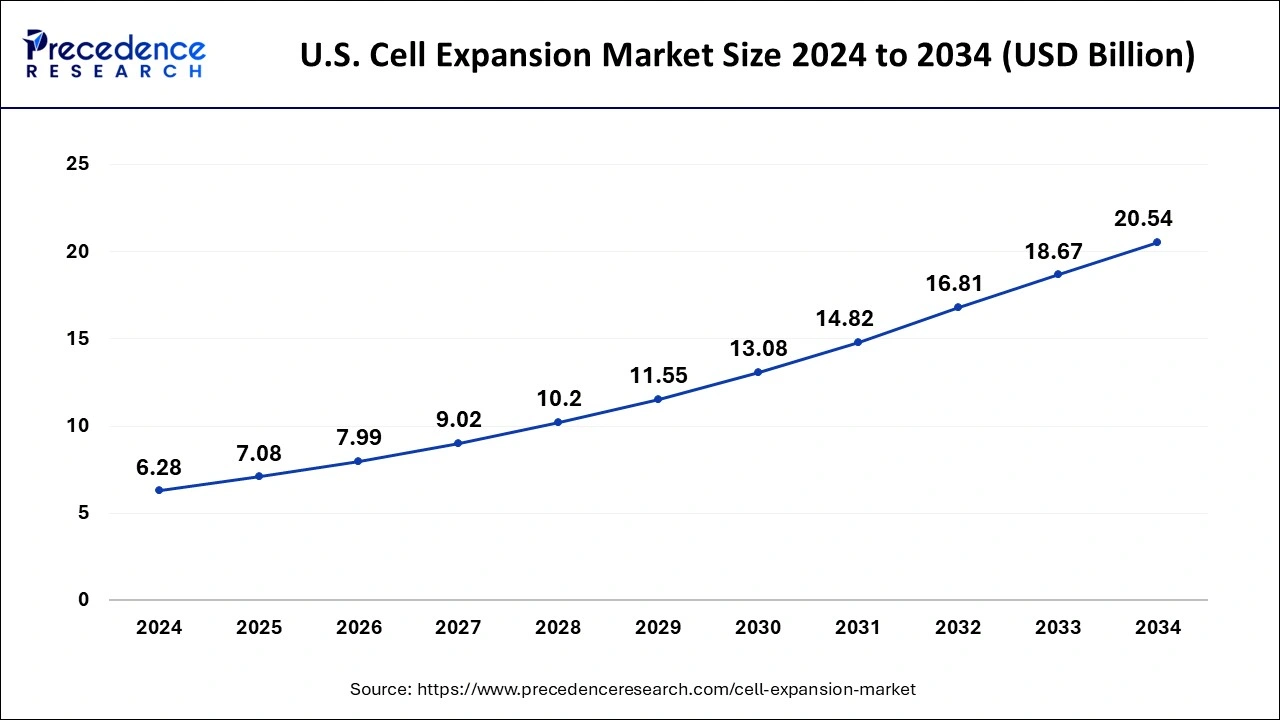

The U.S. cell expansion market size was exhibited at USD 6.28 billion in 2024 and is projected to be worth around USD 20.54 billion by 2034, growing at a CAGR of 12.58% from 2025 to 2034.

North America had the largest share in 2024 due to increased government funding initiatives that have accelerated the production of stem cells and the development of regenerative medicine and cellular therapy products, the region will continue to hold the top spot in the coming years. This drives up demand for cell expansion platforms even more in this region. For instance, the FDA and the Medical Technologies Enterprise Consortium (MTEC) provided USD 5.3 million in funding to the Southwest Research Institute (SwRI) in October 2019. (U.S.). The SwRI used these funds to spread cells for the development of personalised regenerative medicine.

Asia Pacific is predicted to see the fastest growth over the course of the forecast periodas a result of increased efforts made by various local pharmaceutical and biotechnology companies to develop and promote their cellular therapies. In July 2019, the Indian company Stempeutics Research Pvt. Ltd. partnered with the British pharmaceutical company Kemwell Biopharma to market the stem cell-based drug Stempeucel. These relationships may result in higher product sales for small and midsized firms.

- In March 2025, Bharat Biotech entered the cell and gene therapy market with a USD 75 million production investment. The move by Bharat represents its foray from vaccines into cutting-edge regenerative and personalized therapies.

Market Overview

For stem cells or fully differentiated cell populations to be truly favourable or effective as drug screening tools or even for fundamental research reasons, cell expansion is a requirement. In order for the cell wall to expand and develop in the region, cell expansion requires the incorporation of new cell wall material and regulated loosening of the wall. The expansion family of cell-wall-associated proteins plays a crucial role in this process. Cell culturing in bioreactors is a controlled method that necessitates the regulation of environmental parameters, such as pH, ambient temperature, regulated gas concentration for the cells' elongation, and controlled flow of cells.

A range of tasks, such as process development, clinical research, and translational research, can be accomplished using cell expansion bioreactors. Cell expansion bioreactors function well and do not need much sanitizing or cleaning. At pharmaceutical, biotechnology, or research institutes, cell expansion systems have the advantage of being extremely safe and guaranteeing that the mixing and aeration of cell culture are proper.

Cell Expansion Market Growth Factors

- Cytidine triphosphate (CTP) is a crucial molecule in cell proliferation and expansion. The industry leaders are emphasizing CTP developing as it addresses the significant rise in global demand for therapy products.

- A revolutionary change in Single-use systems (SUS) is used in cell expansion and other stages of biomanufacturing and is proven to improve the quality and safety of cell therapy products.

- Cellular therapies are gaining popularity in the field of life science. The significant rise in funding from government and private organizations encourages the development of cellular therapies which is boosting the cell expansion market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.14 Billion |

| Market Size by 2034 | USD 61.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.09% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Cell Type, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing incidence of chronic diseases

Cell expansion is used to create novel drugs to treat illnesses. It is used to make vaccinations, medications, therapies, and antibiotics. Due to the rising incidence of diseases like cancer and diabetes, there is an urgent need for in-depth research to produce novel treatment options. By 2045, the number of individuals with diabetes is expected to increase from an estimated 425 million in 2017 to 629 million, according to the International Diabetes Federation (IDF).

In 2018, there were 9.6 million cancer-related deaths worldwide, surpassing all other causes of death. According to GLOBOCAN, there will be over 30 million additional cases of cancer by 2040, up from 18 million in 2018. Cell expansion is a crucial component of this research because the prevalence of these diseases is on the rise, necessitating the performance of large studies for their diagnosis and treatment.

Restraint

Ethical concerns regarding research in cell biology

Since human and animal cells are employed in gene therapy trials involving gene recombination and stem cell therapies, both species must be used in cell biology research. These cells are also used to test the toxicity and pharmacokinetics of medicines that might be harmful to people and animals when administered in vivo. Human embryos are regularly murdered in stem cell research projects that employ them for medical purposes. Strict restrictions have been established by ethical authorities worldwide to control these activities.

The Human Tissue Authority (HTA), Human Fertilization and Embryology Authority (HFEA), Medicines and Healthcare Products Regulatory Agency (MHRA), and Central Ethics Committee for Stem Cell Research (ZES), among other organizations, have put strict regulations into place that apply to cell biology research. Because of these ethical concerns and restrictions on the use of cells for research, cell biology research is severely hampered in many countries throughout the world. It is anticipated that this will have the effect of restricting the growth of the cell expansion market.

Opportunity

Emerging markets

Most emerging markets are predicted to have growth in the cell expansion industry. In recent years, countries like India, Brazil, and China have experienced significant expansion in the biotechnology and pharmaceutical industries. This pattern is anticipated to persist within the forecasted time frame. According to the India Brand Equity Foundation, the biotechnology industry in India is predicted to increase from USD 11 billion in 2016 to USD 100 billion by 2025, at a rate of 30.46 percent (IBEF).

The same source projects a USD 55 billion pharmaceutical market in India by 2020, up from USD 36.7 billion in 2016. Brazil's pharmaceutical market is predicted to grow from USD 25.3 billion in 2016 to USD 29.9 billion in 2021. As the biotechnology and pharmaceutical industries in these countries develop, it is predicted that there will be an increase in the need for cell expansion products for R&D and pharmaceutical product manufacture.

- In March 2025, ENCell Co., Ltd., a South Korean biotech specializing in innovative biopharmaceutical contract development and manufacturing organizations (CDMO) and novel drug development, signed an MOU for collaboration in the field of CGT with Cell Resources Corporation (CRC).

Product Insights

Based on product insights, consumables led the product segment in 2024 and accounted for the largest revenue share. Throughout the forecast years, it is expected to continue to hold a strong position. The substantial revenue share of this category is attributed to the availability of a broad selection of commercial media and reagent items that are tailored to particular types of cells. These goods are also readily available, ready to use, and come in formulas without serum.

Due to automation in bioreactors and other expansion platforms to increase the efficiency of culturing activities, the instruments segment is anticipated to experience the quickest growth throughout the projection period. The introduction of automated platforms standardizes the procedure, makes process tracking easier, and cuts down on hands-on time, allowing trained workers to use their time more efficiently. Revenue generation in the instruments area is also fueled by ongoing commercialization and the introduction of automated culturing equipment.

For instance, Hitachi, Ltd. began selling its automated cell mass culture equipment in Japan in March 2019. Its commercialization made it possible to produce induced pluripotent stem cells for use in regenerative medicine. These initiatives should hasten the revenue generation for instruments.

Cell Type Insights

Based on cell type insights, the mammalian cells segment, which had the biggest revenue share in 2023, will continue to dominate during the projected period. This is because post-translational alterations in humans are relevant to these systems both pharmacokinetically and functionally. As a result, these culture systems are used to create the majority of biopharmaceuticals, such as monoclonal antibodies, certain interferons, thrombolytics, and other therapeutic enzymes.

As differentiated human cells serve a specific purpose in the body, they contributed significantly to revenue share. Differentiated cells, like fibroblasts, have become extremely important in the healing of cutaneous wounds and in skin bioengineering, which supports segment growth. Evaluation of 3D Gingival Fibroblast (GF) toroids as a workable and basic in vitro assay is also important.

Application Insights

Based on application, the biopharmaceutical segment had the greatest revenue share in 2024due to an increase in the number of biopharmaceutical medicines being approved over the past few years. The development of biopharmaceuticals is further fueled by the entry of new biopharmaceutical businesses and the spread of bioprocessing technology, which in turn stimulates the methods used during bioproduction to expand. Moreover, single-use technologies are quickly taking over the commercial manufacture of cellular therapies.

Various methods of planar cell expansion, such as tiny multi-layer bioreactors, have been developed over time. This satisfied the requirements for closed systems, which limit contamination risks while maintaining control over a significant upstream production and unit production. Due to the development of cell-based vaccine production in recent years, the vaccine production segment is estimated to see the quickest growth rate during the forecast period. The development of these vaccines offers a workable production alternative while shortening the development period.

End-Use Insights

Based on end-use insights, the segment for companies that produce biotechnology and biopharmaceuticals had the biggest share in 2024 and it will keep growing significantly. The expanding potential of cell-based medications in the healthcare industry is one of the primary reasons for the large proportion of biopharmaceutical enterprises. For instance, cellular-based therapies have seen a significant rise in popularity in regenerative medicine due to continuous developments in injectable cell delivery systems for a number of therapeutic applications.

In order to diversify their product offers, businesses in the pharmaceutical and biopharmaceutical sectors are increasingly buying other businesses. For instance, Sartorius AG and Biological Industries, an Israeli manufacturer of cell culture media, agreed to split 50% of the company's equity in December 2019. Sartorius' collection of cell culture media was widened by this acquisition, improving it particularly for cellular and gene therapies and regenerative medicine.

Cell Expansion Market Companies

- Thermo Fisher Scientific, Inc.

- GE Healthcare

- Corning, Inc.

- STEMCELL Technologies, Inc.

- Merck KGaA

- Miltenyi Biotec

- Becton, Dickinson and Company

- Terumo Bct, Inc.

- Sartorius AG

- Takara Bio, Inc.

Recent Developments

- In June 2024, Cytiva launched its Sefia next-generation manufacturing platform, with the goal of helping drug developers and larger healthcare providers accelerate their production of chimeric antigen receptor T (CAR T) cell therapies and other cell-based treatments at a lower cost.

- In July 2024, Calidi Biotherapeutics, Inc. a clinical-stage biotechnology company developing a new generation of targeted antitumor virotherapies, announced a USD 2 million strategic investment by Dr. Ronald Rigor into its new subsidiary, Nova Cell, Inc. (“Nova Cell”), to advance Calidi's Adult Adipose Allogeneic (AAA) stem cell innovative programs.

- In May 2023, panCELLa and BioCentriq signed a research agreement to study natural Killer cell expansion technology from stem cells. The agreement meant to evaluate panCELLa feeder cells, genetically engineered to affect expansion number, yield all and potential NK cells that have been well created.

- In September 2023, Amgen announced the acquisition of a biomanufacturing company to increase its capacity for cell expansion technologies. The market is expected to grow due to advancements in cell-based therapies and regenerative medicine, which enhance the need for efficient cell culture and expansion methodologies.

- In September 2024, PHC Corporation's Biomedical Division launched LiCellMo at the commercial level. This is a love cell metabolic analyzer which allows researchers to visualize metabolic changes in cell culture which later can be utilized in cell and gene therapies (CGT). LiCellMo is equipped with high-precision In-Line monitoring technology, which offers continuous measurement of cellular metabolites in a culture medium.

- In March 2024, Bristol Myers Squibb, a clinical development program for Breyanzi, declared the U.S. Food and Drug Administration (FDA) has approved Breyanzi, a CD19-directed chimeric antigen receptor (CAR) T cell therapy.

Segments Covered in the Report

By Product

- Consumables

- Reagents, Media, & Serum

- Other Consumables

- Culture Flasks and Accessories

- Tissue Culture Flasks

- Other Culture Flasks and Accessories

- Instruments

- Automated Cell Expansion Systems

- Bioreactors

- Other Instruments

By Cell Type

- Mammalian

- Human

- Animal

- Others

By Application

- Biopharmaceuticals

- Tissue Culture and Engineering

- Vaccine Production

- Drug Development

- Gene Therapy

- Cancer Research

- Stem Cell Research

- Others

By End-Use

- Biopharmaceutical and Biotechnology Companies

- Research Institutes

- Cell Banks

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content